The Road More Travelled New Maritime Silk Road For Gulf Airlines

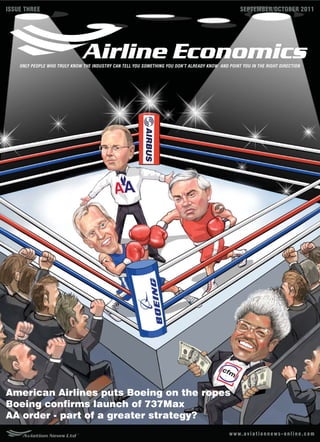

- 1. ISSUE THREE SEPTEMBER/OCTOBER 2011 ONLY PEOPLE WHO TRULY KNOW THE INDUSTRY CAN TELL YOU SOMETHING YOU DONŌĆÖT ALREADY KNOW AND POINT YOU IN THE RIGHT DIRECTION American Airlines puts Boeing on the ropes Boeing confirms launch of 737Max AA order - part of a greater strategy? w w w. a v i a t i o n n e w s - o n l i n e . c o m

- 2. EDITORŌĆÖS LETTER THE PACE OF CHANGE In has been a fast-moving couple of months over the long summer (in the northern hemisphere at least) when most people decamp to sunnier climes. However, the summer months are when airlines make their profit for the year, and as a result the rest of the aviation market can little afford to take time off. Boeing and Airbus have been particularly busy. It was always only a matter of time until Boeing was forced to make a decision between an all-new 737 aircraft or a re-engined version. The American Airlines order simply brought that decision forward by a few months. All credit to the US carrier for playing off the two airframe manufacturers to secure a bumper order at (allegedly of course) a discount price. See our cover feature (page 24), which digs a little deeper into the American Airlines order, while Charley Cleaver from Cabot Aviation draws his conclusions about the deal. The real winner in the ISSUE THREE, VOLUME ONE whole affair, aside from the airline, was CFM International, which masterly played its September/October 2011 hand to end up with a sole-source engine contract for the new 737Max family and EDITORIAL TEAM set itself well on the way to securing 50% market share in the re-engined narrowbody Victoria Tozer-Pennington market. This was not the situation a few short months ago, when the Pratt & Whitney victoria@aviationnews-online.com PW1000 Geared Turbo Fan was the clear preferred engine choice for airlines and Philip Tozer-Pennington lessors ordering the A320neo. David Cook at ASM consulting takes a closer look at philipt@aviationnews-online.com the two engines to help lessors and airlines decide which engine is the best option Kaleyesus Bekele for their business. kaleyesus@aviationnews-online.com BoeingŌĆÖs board of directors approved the 737Max family just one week before Air- SUBSCRIPTIONS Annual subscription: ┬Ż250 / Ōé¼250 / $300 line Economics went to press, but Randy Tinseth still found time in his busy schedule Subscription enquiries to: to take us through the alterations to the re-engined 737. He shares his thoughts about victoria@aviationnews-online.com the future of the aircraft and the narrowbody market. ADVERTISING SALES This issue of Airline Economics also contains excerpts from our sister publication John Pennington Aerospace Investment Journal, which sets out for readers in the investment commu- john@aviationnews-online.com nity why the aviation industry is such a good, long-term buy. InsightŌĆÖs Mike Pinggera Philip Tozer takes us through why he invested in the Doric Nimrod Air One and Two vehicles, while philipt@aviationnews-online.com Apollo AviationŌĆÖs David Treitel explains more about his fund, which invests in older PRODUCTION AND ONLINE aircraft both for leasing to customers and for parting out. Dino DŌĆÖAmore dino@aviationnews-online.com Our aim is to provide our readers with accurate and balanced articles, but that Kathy Alys, subeditor arenŌĆÖt afraid to put forward a point of view based on the extensive experience and knowledge of its editorial staff and reporters. Unlike some business magazines, we DIGITAL ISSUE donŌĆÖt write what our advertisers would like to hear, we report truthful facts that help Digital version production by our readers run their businesses better. To this end, we welcome all comments, sug- Symbian Print Intelligence gestions and thoughts from our readers to ensure we are achieving our aims. PUBLISHER Aviation News Ltd Best wishes, Suite 16745, Lower Ground Floor, 145-157 St John Street, London, EC1V 4PW Registered in England & Wales Company number: 7351543 Copyright 2011 Aviation News Ltd Victoria Tozer-Pennington Airline economics (Print) ISSN 2045-7154 Managing director Airline economics (Online) ISSN 2045-7162 Printed in England through Ben Chater Printing All rights reserved. No part of this publication may be reproduced by any means whatsoever without express permission of the Publisher. Although great care has been taken in the compilation of Airline Economics, Aviation News Ltd does not take any responsibility for the views expressed herein. www.airlineeconomics.co Airline Economics September/October 2011 1

- 3. MIDDLE EAST The road more travelled The strengthening of the trade routes between the Gulf and Asia is becoming known as the ŌĆśNew Maritime Silk RoadŌĆÖ. Monis Ahmed Hasan, an aviation strategy executive in Dubai, looks at how Middle Eastern airlines are taking advantage of this global shift. 52 Airline Economics September/October 2011 www.airlineeconomics.co

- 4. MIDDLE EAST he world is experiencing a T principal axis shift as the economic centres of the world move from America and Europe to Asia and the Middle East. The consen- sus emerging from experts is that the geopolitical and economic position in the twenty-first century will not be domi- nated by nations such as India, China and America but by global cities such as Mumbai, Shanghai, Dubai, Doha, Abu Dhabi and Jeddah. Cities are growing in sise so that they are beginning to merge both metaphori- cally and physically. A drive between Dubai and Abu Dhabi will show both cities are growing towards each other, with Jebel Ali emerging as a new dis- trict between them. Parag Khanna, New York-based director at the New Ameri- can Foundation and author of ŌĆśHow to run the world: charting a course to the next renaissanceŌĆÖ, calls this emerging global landscape the ŌĆśnew new world orderŌĆÖ, where cities are the dynamic drivers of growth and innovation, and the centre of political power and author- ity. Suddenly the world has multiple superpowers, and nations are not the only players in the world, but also cities, companies, non-governmental organi- sations, religious groups, universities and trade unions. This new new world order greatly resembles the Middle Ages a thousand years ago. Cities, not nations, domi- nated during that period and the trade routes they created resulted in the Great Silk Roads travelled by Ibn Battuta and Marco Polo. Fast-forward to today, and cities such as Doha and Dubai are our Medieval Venice, free zones that effi- ciently re-export the worldŌĆÖs goods, confidently sitting at the crossroads of Europe, Asia and Africa. This strength- ening of the trade routes between the Gulf and Asia is becoming known as the New Maritime Silk Road. And no matter which economies are up or down, these global cities retain the spoils from the continuing trade, even if it is among dif- ferent players. It is this strategic axis shift in trade routes that has fuelled the growth of air transportation in the Middle East, par- ticularly the Gulf countries. Whereas previously goods moved on camel www.airlineeconomics.co Airline Economics September/October 2011 53

- 5. MIDDLE EAST Qatar Airways and Etihad Airways com- reduces their supply chain costs com- bined being 70% of its size. Together pared with European, US or Asian these airlines operate a fleet of 303 air- airlines. Their young fleet age also helps craft (EK-155, QR-91, EY-57) and have keep their fuel costs down, as the lat- a further order book of 470 aircraft (EK- est generation aircraft burn fuel much 190, QR-182, EY-98). These airlines are more efficiently. Low labour costs exist, forecast to increase their capacity by as workers are sourced from the cheap more than 15% per year over the next labour markets of India, Pakistan, Sri five years. The Big Three have 57% Lanka, Bangladesh and Nepal. The more long-haul seat capacity on order management-friendly labour laws, with than the 35 member carriers of the trade unions and strikes being banned, across deserts and in Arabian dhows Association of European Airlines (AEA) has also helped keep the costs of across the Arabian Sea and Indian and 27% more than the 17 member air- skilled labour low. This has been a huge Ocean in the region, sophisticated com- lines of the Association of Asia Pacific advantage in running a labour-intensive mercial aircraft such as the Airbus A380 Airlines (AAPA). It is this increased operation such as the massive transit and Boeing 777 now haul such goods capacity on order that poses the major hubs at Dubai. as well as people around the world. threat to established European and Each airline has succeeded in ele- The aggressive emergence of the Asian airlines. vating their brand to an international Middle East airlines in the global aviation The Big Three airlines have specific level to stimulate customer demand in industry has been a notable develop- long-term strategies guiding their suc- line with their global aspirations. Emir- ment for many established players. cessful business models. They are ates, Etihad and Qatar Airways are all Emirates, Qatar Airways and Etihad Air- essentially network carriers that use a devoting a huge budget to their brand ways ŌĆō the ŌĆśBig ThreeŌĆÖ Gulf carriers ŌĆō are hub-and-spoke mechanism to collect awareness campaigns in a bid to posi- changing the dynamics of international short-haul traffic into long-haul opera- tion themselves as full-service carries aviation and have quickly emerged tions through their respective mega and generate sales throughout the as the new global challengers. The hubs. They offer one of the best in- world. Global advertising and sport regionŌĆÖs airports are being developed in flight products as full-service airlines to sponsorships are being used exten- tandem to handle the exponential traffic attract the high-yield customers. They sively by these carriers to carry their growth that is forecast. have continuously stimulated demand marketing message. Emirates has in The development of the New Mari- through continuous brand awareness particular been prolific in the range of time Silk Road has caused a major shift campaigns. And they have a much world sports it sponsors as a brand. It in the global air transport market as the lower cost structure due to labour would not be far from the truth to say it Middle East carriers, particularly the Big policies different from the West and an would like to become the Coca Cola of Three, have altered the way traffic flows abundance of labour from south Asia the airline world. have been routed. A paradigm shift and Arab countries outside the Gulf. It is not surprising that each of these has materialised that has transplanted The most significant strategy of these airlines is part of a broader city master European and Asian hubs to Gulf- carriers has been capitalising on their plan for growth in the world and reflects based hubs such as Dubai, Doha and strong hub-and-spoke network model the new new world order as well as the Abu Dhabi. These carriers are largely in a region with a geocentric potential New Maritime Silk Road. The airports in responsible for this growth and have of 4.5 billion people in an eight-hour Dubai, Doha and Abu Dhabi are play- capitalised on their geographical cen- flight radius. Emirates first displayed the ing a big role as prominent stops in tricity by cannibalising the traditional unique insight that it was theoretically international trade routes. And they are traffic flows between other hubs and possible to connect any two significant stimulating this through the growth of connecting secondary cities as a result cities on the planet with only one stop their airlines and respective hub airports. of exercising their sixth freedom traffic in Dubai. EmiratesŌĆÖ strategy is to pro- The Arabian Gulf countries had the rights using their hub-and-spoke net- vide connecting long-haul services via luxury of being able to start with a blank work. Approximately 4.5 billion people its hub in Dubai, connecting city pairs piece of paper to create the airline and reside within an eight-hour flight of the worldwide with only one stop in Dubai. the airport infrastructure model. In Middle East, providing a huge potential Both Qatar Airways and Etihad Airways preparing for the post-oil era by diversi- to connect that population to any city also follow this model. fying their industrial base, aviation was though a single stop. The competitive cost structure at an important sector. The development The Arab Air Carriers Organization these airlines also helps. Fuel and of the mega-hub airport is influencing lists 25 airlines at its members, covering labour cost are the two most significant the growth of cities through industrial the entire Arab world. Yet it is the rise of operating costs for any airline, but the development, relocation of corporate Emirates, Etihad Airways and Qatar Air- Gulf carriers enjoy advantageous posi- headquarters, light manufacturing, ways as the fastest growing full-service tions in both. Fuel is cheaper in the international conferences, trade shows, airlines that is the most spectacular. region due to its proximity to oil pro- sporting events, increased tourism and Emirates is the dominant carrier, with duction and refining facilities, which the growth of a logistics and distribu- 54 Airline Economics September/October 2011 www.airlineeconomics.co

- 6. MIDDLE EAST tion hub. By integrating these cities into global trade markets, their governments have positively affected their economic prosperity. Dubai was the pioneer of this model as its oil supplies dwindled and it raced to integrate itself into global trade markets before the oil ran dry. This is why it enjoys a lead over Doha and Abu Dhabi as an aviation hub. Another development has been the rise of low-cost carriers capturing the boom in point-to-point budget travel with the region. The success of Air Ara- bia, Fly Dubai, RAK Airways in UAE, Jazeera Airways in Kuwait, Bahrain Air in Bahrain and NAS Air in Saudi Arabia clearly shows that the market for air travel has grown to unprecedented lev- els. The low fares have prompted many people to fly that previously would not have flown at all or as frequently. The rise of these carriers has further given the region a stamp of approval as one of the leading air transportation markets in the world today. COMMERCIAL LEASING MARKET The concept of leasing commercial aircraft and engines is widely being used by airlines in the Middle East. Most commercial aircraft are financed through operating leases, through US Export-Import Bank guaranteed loans, European export credits, and Islamic and finance leases. Most of the major carriers have had success in getting their aircraft financed through various sources in the aviation finance market. Emirates has been an active user of operating leases, with 44% of its current fleet being financed that way. Several aerospace leasing com- panies have been established in the region. Mubadala Aerospace and Dubai Aerospace Enterprise-DAE are the two prominent companies. DAE Capital was the companyŌĆÖs aircraft finance division, which initially had plans to be the biggest leasing company in the Middle East. But financing from its parent company has been an issue for DAE, which subse- quently cancelled its entire order book of Airbus and Boeing aircraft in June and July this year except for a few Boeing 777 and 747-8F freighters, which it will lease to Emirates. Mubadala Aerospace has much stronger financing from the government of Abu Dhabi and is set to www.airlineeconomics.co Airline Economics September/October 2011 55

- 7. MIDDLE EAST become a global company by creating an aerospace industrial hub like Tou- louse but based in Abu Dhabi, UAE. Engine leasing is a newer concept in the region, as airlines usually have been owners of spare engines. These com- panies are providing financial options to airlines to lease spare engines for their fleet of aircraft. Engines are high-value assets that take up a companyŌĆÖs liq- uid resources. For many, leasing spare engines provides greater liquidity on their balance sheets. Engine lessors provide flexibility through short-, medium- and long-term solutions that appeal to air- lines in the region. Engine Lease Finance Company is the biggest engine leasing company in the world. It provides finan- cial services to airlines and maintenance, repair and overhaul (MRO) firms, and has about 240 engines in its portfolio. GE Capital Aviation services also offers simi- lar services to its clients worldwide. The regionŌĆÖs first engine leasing company was started by Mubadala Aerospace in Abu Dhabi under the name of Sanad. Sanad provides engine and component financing to its customers, which include Air Berlin and Etihad Airways. Monis Ahmed Hasan is an aviation strategy executive who was born and raised in Dubai, UAE. He helps avia- MAINTENANCE AND MRO ISSUES tion companies envision and execute their business vision and strategy in the booming Middle East region. Airlines in the Middle East have big fleets His life ambition is to play a leading role in shaping the future of the new Maritime Silk Road in the Gulf and and a surge of new aircraft deliveries are Indian subcontinent and have fun while doing it. coming in. This is keeping them focused He has previously worked as a business planning and development manager at Emirates Airlines and as on their main business of air transporta- a lecturer for business courses at Emirates Aviation College - aerospace and academic studies in Dubai. tion. They are using cost-saving measures His experience also includes working at SH&E, Simat, Helliesen & Eichner, an air transport consultancy in other areas such as engineering, out- based in New York, where he worked in the airline privatisation and aircraft asset management practices. He sourcing work to external parties. So they holds a bachelor of science in aviation business administration from Embry Riddle Aeronautical University are outsourcing contacts of maintenance in Florida. work to established MROs, which cre- Monis is currently based in Dubai, and can be contacted in connection with professional opportunities at ates more work potential in the Middle monis.hasan@gmail.com. East region. The trend is for these MROs to provide a package of customised ser- vices for airlines that addresses all their including air transport, military, busi- provider approved by original equip- line and base maintenance needs to win ness aviation and civil helicopters, is ment manufacturers to the region. their business. expected to grow. The total will increase Mubadala Aerospace is also creating TeamSAI is an aviation consulting from $7 billion in 2010 to $11.2 billion in a military MRO in Al Ain supported by firm providing strategic and tactical 2019, showing a 5.3% annual increase, Sikorsky called Ammroc Advanced solutions in MRO. During the MRO Mid- according to figures presented Aero- Military Maintenance Repair and Over- dle East exhibition earlier this year strategy. MROs and airline maintenance haul Center. The focus of companies in the company presented research that companies are therefore expanding in the region continues to be fleet perfor- showed profits have been pretty elusive preparation for such a high growth rate. mance of aircraft in operation. However, for aftermarket companies in the region Mubadala Aerospace in Abu Dhabi the Middle East can play a vital role as so far but a lot of positive developments is working in partnership, through its a hub for aircraft maintenance for the have taken place in preparation for the subsidiary Abu Dhabi Aircraft Technolo- region covering Africa, the Middle East coming growth in maintenance work. gies, with GE and the Engine Alliance on and Australasia. As the fastest growing In the next 10 years, the total after- engine maintenance, and SR Technics aviation region, this presents enormous market spend base in the Middle East, is bringing the first network overhaul economic potential. 56 Airline Economics September/October 2011 www.airlineeconomics.co