The_4_Sales_Reports_for_CEO

- 1. THE ONLY 4 SALES REPORTS A CEO NEEDS BASE getbase.com A Template of the Reports a CEO should get from their VP of Sales

- 2. BASE HOW TO USE THIS DECK The Only 4 Sales Reports a CEO Needs âĻ Ready or not, the future of sales is here and itâs driven by data. The purpose of this deck is to provide you with the ultimate sales reports your Head of Sales should produce for you on a weekly basis. Hereâs what we suggest you do: 1. Check out the 4 sales reports 2. Download the templates (Keynote or PowerPoint) 3. Create your own custom sales reports 2 1. TOTAL SALES How well is our business performing? 2. QUOTA ATTAINMENT How is our team performing over time? 3. SALES FORMULA How can we increase productivity to hit our revenue target? 4. LEAD YIELD Whatâs the ROI of a lead & how should we invest our money and time?Btwâ weâd love to help your Head of Sales put this report together. Just reply or email us at science@getbase.com

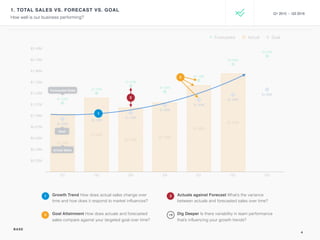

- 3. BASE 3 1. TOTAL SALES VS. FORECAST VS. GOAL $0.22M $0.44M $0.65M $0.87M $1.09M $1.31M $1.53M $1.75M $1.96M $2.18M $2.40M Q1 Q2 Q3 Q4 Q1 Q2 Q3 Forecasted Actual Goal $1.34M $1.53M $1.67M $1.56M $1.78M $2.09M $2.25M $1.60M $1.50M $1.40M $1.30M $1.15M $1.10M $1.03M $1.91M $1.68M $1.35M $1.25M $1.44M $1.13M $2.25M $2.09M $1.78M $1.56M $1.67M $1.53M $1.34M $1.03M $1.10M $1.15M $1.30M $1.40M $1.50M $1.60M How well is our business performing? EDITABLE TEMPLATE Goal Actual Sales Forecasted Sales Q1 2015 - Q3 2016

- 4. BASE 4 1. TOTAL SALES VS. FORECAST VS. GOAL $0.22M $0.44M $0.65M $0.87M $1.09M $1.31M $1.53M $1.75M $1.96M $2.18M $2.40M Q1 Q2 Q3 Q4 Q1 Q2 Q3 Forecasted Actual Goal $1.34M $1.53M $1.67M $1.56M $1.78M $2.09M $2.25M $1.60M $1.50M $1.40M $1.30M $1.15M $1.10M $1.03M $1.91M $1.68M $1.35M $1.25M $1.44M $1.13M $2.25M $2.09M $1.78M $1.56M $1.67M $1.53M $1.34M $1.03M $1.10M $1.15M $1.30M $1.40M $1.50M $1.60M How well is our business performing? Goal Actual Sales Forecasted Sales Q1 2015 - Q3 2016 1 2 3 1 2 3 Growth Trend How does actual sales change over time and how does it respond to market influences? Actuals against Forecast Whatâs the variance between actuals and forecasted sales over time? Goal Attainment How does actuals and forecasted sales compare against your targeted goal over time? Dig Deeper Is there variability in team performance thatâs influencing your growth trends?

- 5. BASE 5 2. QUOTA ATTAINMENT SOUTHWEST Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Grand Total Total Shared Quota $600,000 $600,000 $600,000 $800,000 $800,000 $800,000 $4,200,000 Actual Sales $503,405 $832,801 $642,030 $598,209 $739,023 $823,039 $4,138,507 Attainment % 83.9% 138.8% 107.0% 74.8% 92.4% 102.9% 98.5% MID-ATLANTIC Total Shared Quota $400,000 $400,000 $400,000 $500,000 $500,000 $500,000 $2,700,000 Actual Sales $490,195 $362,682 $398,021 $450,301 $602,996 $730,204 $3,034,399 Attainment % 122.5% 90.7% 99.5% 90.1% 120.6% 146.0% 112.4% NORTHEAST Total Shared Quota $300,000 $300,000 $300,000 $350,000 $350,000 $350,000 $1,950,000 Actual Sales $132,000 $245,234 $210,324 $302,466 $342,300 $353,217 $1,585,541 Attainment % 44.0% 81.7% 70.1% 86.4% 97.8% 100.9% 81.3% TOTAL BY QUARTER Total Shared Quota $1,300,000 $1,300,000 $1,300,000 $1,650,000 $1,650,000 $1,650,000 $8,850,000 Actual Sales $1,125,600 $1,440,717 $1,250,375 $1,350,976 $1,684,319 $1,906,460 $8,758,447 Attainment % 86.6% 110.8% 96.2% 81.9% 102.1% 115.5% 99.0% How are teams performing over time? EDITABLE TEMPLATE .7 1.5 Q1 2015 - Q2 2016

- 6. BASE 6 2. QUOTA ATTAINMENT SOUTHWEST Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Grand Total Total Shared Quota $600,000 $600,000 $600,000 $800,000 $800,000 $800,000 $4,200,000 Actual Sales $503,405 $832,801 $642,030 $598,209 $739,023 $823,039 $4,138,507 Attainment % 83.9% 138.8% 107.0% 74.8% 92.4% 102.9% 98.5% MID-ATLANTIC Total Shared Quota $400,000 $400,000 $400,000 $500,000 $500,000 $500,000 $2,700,000 Actual Sales $490,195 $362,682 $398,021 $450,301 $602,996 $730,204 $3,034,399 Attainment % 122.5% 90.7% 99.5% 90.1% 120.6% 146.0% 112.4% NORTHEAST Total Shared Quota $300,000 $300,000 $300,000 $350,000 $350,000 $350,000 $1,950,000 Actual Sales $132,000 $245,234 $210,324 $302,466 $342,300 $353,217 $1,585,541 Attainment % 44.0% 81.7% 70.1% 86.4% 97.8% 100.9% 81.3% TOTAL BY QUARTER Total Shared Quota $1,300,000 $1,300,000 $1,300,000 $1,650,000 $1,650,000 $1,650,000 $8,850,000 Actual Sales $1,125,600 $1,440,717 $1,250,375 $1,350,976 $1,684,319 $1,906,460 $8,758,447 Attainment % 86.6% 110.8% 96.2% 81.9% 102.1% 115.5% 99.0% How are teams performing over time? .7 1.5 2 1 1 2 Dig Deeper How can you influence key factors in your sales productivity to increase revenue? Q1 2015 - Q2 2016 Consistency over Time How predictable are teams at hitting their quota month over month? Variability across Teams Are there under-performing teams compared to others?

- 7. BASE 7 3. SALES FORMULA REPORT How can we increase productivity to hit our revenue target? A Sales Formula is used as a reliable and consistent way to measure your sales productivity over time. By focusing on the key metrics of turning a lead into revenue, the Sales Formula represents a standard measure by which you can derive and evaluate a sales process (or multiple processes), no matter how much your processes change over time. Leads Revenue f=revenue/lead # of Leads % of Leads Worked % of Leads Worked converted to Opportunities % of Opportunities worked % Win rate for worked opportunities Average Deal Size %Ow%LWCL %LW %WR Avg ($Deal)x x x x xSales Formula

- 8. BASE 8 3. SALES FORMULA REPORT Quarter Leads Leads Worked % Converted to Opportunities % Opportunities Worked % Opportunities Won Win Rate % Avg Deal Size Total Revenue Q1 21,203 17,839 84.1% 5,040 28.3% 4,605 91.4% 1,120 24.3% $1,005 $1,125,600 Q2 23,423 21,021 89.7% 5,304 25.2% 5,043 95.1% 1,689 33.5% $853 $1,440,717 Q3 25,958 22,204 85.5% 5,692 25.6% 5,103 89.7% 1,429 28.0% $875 $1,250,375 Q4 26,940 24,532 91.1% 6,940 28.3% 6,504 93.7% 1,672 25.7% $808 $1,350,976 2015 Total 97,524 85,596 87.8% 22,976 26.8% 21,255 92.5% 5,910 27.8% $874 $5,167,668 Q1 25,292 23,492 92.9% 7,149 30.4% 6,493 90.8% 1,561 24.0% $1,079 $1,684,319 Q2 25,869 22,852 88.3% 7,031 30.8% 6,692 95.2% 1,920 28.7% $992 $1,904,640 Q1, Q2 Total 51,161 46,344 90.6% 14,180 30.6% 13,185 93.0% 3,481 26.4% $1,031 $3,588,959 How can we increase productivity to hit our revenue target? %Ow%LWCL %LW %WR Avg ($Deal)x x x x x EDITABLE TEMPLATE Q1 2015 - Q2 2016

- 9. BASE 9 3. SALES FORMULA REPORT Quarter Leads Leads Worked % Converted to Opportunities % Opportunities Worked % Opportunities Won Win Rate % Avg Deal Size Total Revenue Q1 21,203 17,839 84.1% 5,040 28.3% 4,605 91.4% 1,120 24.3% $1,005 $1,125,600 Q2 23,423 21,021 89.7% 5,304 25.2% 5,043 95.1% 1,689 33.5% $853 $1,440,717 Q3 25,958 22,204 85.5% 5,692 25.6% 5,103 89.7% 1,429 28.0% $875 $1,250,375 Q4 26,940 24,532 91.1% 6,940 28.3% 6,504 93.7% 1,672 25.7% $808 $1,350,976 2015 Total 97,524 85,596 87.8% 22,976 26.8% 21,255 92.5% 5,910 27.8% $874 $5,167,668 Q1 25,292 23,492 92.9% 7,149 30.4% 6,493 90.8% 1,561 24.0% $1,079 $1,684,319 Q2 25,869 22,852 88.3% 7,031 30.8% 6,692 95.2% 1,920 28.7% $992 $1,904,640 Q1, Q2 Total 51,161 46,344 90.6% 14,180 30.6% 13,185 93.0% 3,481 26.4% $1,031 $3,588,959 How can we increase productivity to hit our revenue target? %Ow%LWCL %LW %WR Avg ($Deal)x x x x x Q1 2015 - Q2 2016 3 3 1 2 1 2 1 2 3 Capability Are there issues with your teamâs abilities to convert leads and win opportunities effectively? Predictability Is your teamâs performance predictable or highly variable month to month? Dig Deeper How can we better invest our time, effort and money to increase our sales revenue? Capacity & Prioritization Is your team operating at capacity or prioritizing high-value leads and opportunities effectively?

- 10. BASE 10 4. LEAD YIELD BY SOURCE Lead Source # of Leads Generated Total Sales Lead Yield % of Total Revenue Avg Sales Cycle Length (Days) Paid Search 36,279 $1,803,516 $49.71 34.9% 19 Organic Search 19,505 $1,018,031 $52.19 19.7% 27 Partners 9,167 $676,965 $73.85 13.1% 30 Walk On 12,776 $599,449 $46.92 11.6% 39 Outbound 11,995 $542,605 $45.24 10.5% 78 Referrals 5,071 $392,743 $77.45 7.6% 10 Media Campaign 2,731 $134,359 $49.20 2.6% 83 2015 Total 97,524 $5,167,668 $52.99 100% 40.9 What is the ROI of a lead and how should we invest our money and time? EDITABLE TEMPLATE Q1 2015 - Q4 2015

- 11. BASE 11 4. LEAD YIELD BY SOURCE Lead Source # of Leads Generated Total Sales Lead Yield % of Total Revenue Avg Sales Cycle Length (Days) Paid Search 36,279 $1,803,516 $49.71 34.9% 19 Organic Search 19,505 $1,018,031 $52.19 19.7% 27 Partners 9,167 $676,965 $73.85 13.1% 30 Walk On 12,776 $599,449 $46.92 11.6% 39 Outbound 11,995 $542,605 $45.24 10.5% 78 Referrals 5,071 $392,743 $77.45 7.6% 10 Media Campaign 2,731 $134,359 $49.20 2.6% 83 2015 Total 97,524 $5,167,668 $52.99 100% 40.9 What is the ROI of a lead and how should we invest our money and time? 1 2 3 Lead Yield Whatâs the value of a lead by source (based on total sales / # of leads generated)? Distribution How much of your total revenue does each lead source represent? Deal Velocity How much time does it take for a new lead to become a closed deal by source? Dig Deeper How should I balance my portfolio of investments (managing risk) to exceed my sales goal? 1 2 3 Q1 2015 - Q4 2015

- 12. BASE 12 4. LEAD YIELD BY SOURCE VISUALIZATION AvgLeadYield $27 $33 $40 $46 $53 $59 $66 $72 $79 $85 Avg Sales Cycle Length (days) 5 9 13 16 20 24 28 32 35 39 43 47 51 55 58 62 66 70 74 77 81 85 Partners 13.1% Media Campaign 2.6% Outbound 10.5% Walk On 11.6% Paid Search 34.9% Referrals 7.6% Organic Search 19.7% EDITABLE TEMPLATE What is the ROI of a lead and how should we invest our money and time? Circle size = % of total revenue Q1 2015 - Q4 2015

- 13. BASE 13 4. LEAD YIELD BY SOURCE VISUALIZATION AvgLeadYield $27 $33 $40 $46 $53 $59 $66 $72 $79 $85 Avg Sales Cycle Length (days) 5 9 13 16 20 24 28 32 35 39 43 47 51 55 58 62 66 70 74 77 81 85 Partners 13.1% Media Campaign 2.6% Outbound 10.5% Walk On 11.6% Paid Search 34.9% Referrals 7.6% Organic Search 19.7% EDITABLE TEMPLATE What is the ROI of a lead and how should we invest our money and time? Circle size = % of total revenue Q1 2015 - Q4 2015 % of Total Revenue Worth ($) Effort (Time)

- 14. 14 This template is available for download for both PowerPoint and Keynote file types. 1. Download the Template

- 15. 15 Weâll provide a free one hour consultation for your head of sales with a science of sales expert 2. Need Help? science@getbase.com Just reply or email us at

- 16. BASE BASE The All-In-One Sales Platform âĻ Base is the industryâs first all-in-one Sales Platform. Unlike legacy cloud CRM and Salesforce Automation systems, Base leverages big data, mobility and real- time computing to help sales teams increase win rates, while providing sales leaders with transformative big-data sales insights. Join the more than 7,000 Base customers using Base to accelerate their a data- driven sales team and sell more faster. 16 âThis startup just got another $30 million to take on Salesforce.â Read moreâĶ âBase is one of the only SFA vendors to put native predictive analytics in its solution.â Read moreâĶ Tanya Capital Stewart Gollmer, Managing Director âWe believe that Base is the future sales platform for data-driven sales teams.â Tanya Capital, RRE Ventures, Index Ventures, The Social+Capital Partnership, OCA Ventures, and I2A Founded in 2009 with Global Headquarters in Mountain View, California 7,000+ Happy Customers $53M Capital Raised The Company getbase.com

- 17. 850 N SHORELINE BLVD MOUNTAIN VIEW, CA 94304 (800) 940-9640 GETBASE.COM