Time Financial Presentation To HR Directors

- 2. About time A trading style of PFP Founded in 2000 Over 30 IFAŌĆÖs One of the largest IFAŌĆÖs in the UK Over 10 years experience providing across the UK advice to business Over 100 corporate Advice to Companies clients ranging from Advice to Directors SMEŌĆÖs to Multi-national businesses Advice to Employees www.timefinancial.co.uk www.pfpifa.co.uk TIME is a trading style of Premier Financial Protection Ltd, which is authorised and regulated by the Financial Services Authority and is entered on the FSA register under reference number 226676

- 3. The big picture When pensions were introduced in the early 1900s there were 22 people of working age in Britain for every retired person. In 2024 there will be less than three. (Source: Office of National Statistics) British State pensions as a percentage of wages are the lowest of all of the G7 countries (Source: Phil Mullan, The Imaginary Timebomb)

- 4. The Response? Pension Auto-enrolment

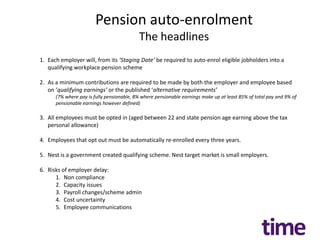

- 5. Pension auto-enrolment The headlines 1. Each employer will, from its ŌĆśStaging DateŌĆÖ be required to auto-enrol eligible jobholders into a qualifying workplace pension scheme 2. As a minimum contributions are required to be made by both the employer and employee based on ŌĆśqualifying earningsŌĆÖ or the published ŌĆśalternative requirementsŌĆÖ (7% where pay is fully pensionable, 8% where pensionable earnings make up at least 85% of total pay and 9% of pensionable earnings however defined) 3. All employees must be opted in (aged between 22 and state pension age earning above the tax personal allowance) 4. Employees that opt out must be automatically re-enrolled every three years. 5. Nest is a government created qualifying scheme. Nest target market is small employers. 6. Risks of employer delay: 1. Non compliance 2. Capacity issues 3. Payroll changes/scheme admin 4. Cost uncertainty 5. Employee communications

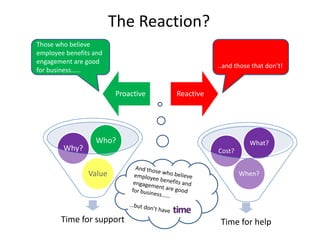

- 6. The Reaction? Those who believe employee benefits and engagement are good ..and those that donŌĆÖt! for businessŌĆ”ŌĆ” Proactive Reactive Who? What? Why? Cost? Value When? Time for support Time for help

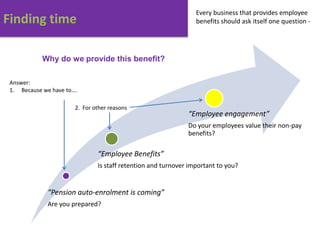

- 7. Every business that provides employee Finding time benefits should ask itself one question - Why do we provide this benefit? Answer: 1. Because we have toŌĆ”. 2. For other reasons ŌĆ£Employee engagementŌĆØ Do your employees value their non-pay benefits? ŌĆ£Employee BenefitsŌĆØ Is staff retention and turnover important to you? ŌĆ£Pension auto-enrolment is comingŌĆØ Are you prepared?

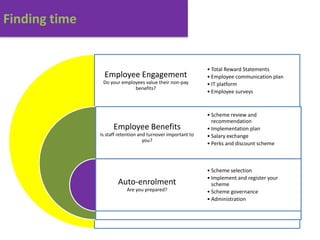

- 8. Finding time ŌĆó Total Reward Statements Employee Engagement ŌĆó Employee communication plan Do your employees value their non-pay ŌĆó IT platform benefits? ŌĆó Employee surveys ŌĆó Scheme review and recommendation Employee Benefits ŌĆó Implementation plan Is staff retention and turnover important to ŌĆó Salary exchange you? ŌĆó Perks and discount scheme ŌĆó Scheme selection ŌĆó Implement and register your Auto-enrolment scheme Are you prepared? ŌĆó Scheme governance ŌĆó Administration

- 10. Growth Opportunity to grow Opportunity to develop Us At work do my opinions seem to count? Are my co-workers committed to doing quality work? Me Is it clear what is expected of me? Understanding how my job contributes to helping the companyŌĆÖs success Is there someone at work who encourages my development? Foundation WhatŌĆÖs the deal? WhatŌĆÖs the environment?

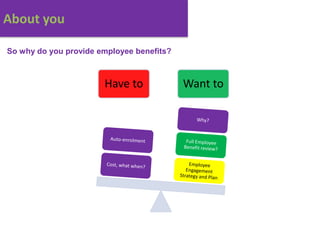

- 11. About you So why do you provide employee benefits? Have to Want to