Track Record | Updated 2019

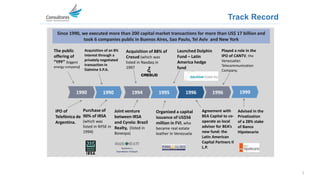

- 1. Joint venture between IRSA and Cyrela: Brazil Realty, (listed in Bovespa) 19961995199419901990 1996 IPO of Telefónica de Argentina. The public offering of “YPF” (biggest energy company) Acquisition of an 8% interest through a privately negotiated transaction in Dalmine S.P.A. Purchase of 90% of IRSA (which was listed in NYSE in 1994) Acquisition of 88% of Cresud (which was listed in Nasdaq in 1997 Launched Dolphin Fund – Latin America hedge fund Organized a capital issuance of US$56 million in FVI, who became real estate leather in Venezuela Played a role in the IPO of CANTV, the Venezuelan Telecommunication Company. Since 1990, we executed more than 200 capital market transactions for more than US$ 17 billion and took 6 companies public in Buenos Aires, Sao Paulo, Tel Aviv and New York 1999 Advised in the Privatization of a 28% stake of Banco Hipotecario Agreement with BEA Capital to co- operate as local advisor for BEA’s new fund: the Latin American Capital Partners II L.P. Track Record 1

- 2. 20092007200620032002 2008 Advised in the issuance of Convertible Notes for Entered the mining industry through Advised Banco Hipotecario in the successful restructuring of its US$ 1.2 billion debt Launched BrasilAgro, an agricultural company - Raised US$ 270 million. Launching of CAP Venture Holdings LP, a venture capital fund. Launching of (US Distressed RE market) Became main shareholder in US Hotel REIT HERSHA for over USD62 M Acquisition of Lipstick, an office building in Manhattan, NY for over USD140 Million Since 1990, we executed more than 200 capital market transactions for more than US$ 17 billion and took 6 companies public in Buenos Aires, Sao Paulo, Tel Aviv and New York 2001 Called a group of sophisticated investors to form IFIS Track Record 2010 Participated in the bidding process as finalist for Telecom (NYSE:TEO) Banco Hipotecario bids for local branch of Banca Nazionale del Lavoro for over USD 230 Million 2005 2

- 3. Acquisition of 183 Madison Ave., Manhattan, NYC for $100M 2011 Acquired aprox. 30% of Alto Palermo from Parque Arauco, increasing ownership to 95% 2012 Became main shareholder in US Hotel REIT Supertel for USD 30M 2013 Became largest shareholder 2014 Entered the Israeli market through the acquisition of IDB Since 1990, we executed more than 200 capital market transactions for more than US$ 17 billion and took 6 companies public in Buenos Aires, Sao Paulo, Tel Aviv and New York 2015 AGD initiated TSX-V listing process and business combination with ATX Became controlling shareholder of IDB Sold US Hotel REIT Hersha with a gain of +246% Sold 183 Madison Ave., Manhatta n, NYC 2017 DN acquired 100% of IDBD Launching of Pareto Digital 2018 Re-launching of Arg Capital Market with Cresud bond issuance(US$ 73 million) Track Record Launching of Elsztain Mining Opportunity Fund and CAM Argentina Opportunity Fund 3 2019 Acquired 8,1% of Wolox, software developme nt company Acquired 50% of SSV, argentine company which uses Israeli technology for public transport solutions