Traczen Profile

- 1. 1 Profile

- 2. 2 About Traczen Led by a team of professionals who bring in not only rich experience in their respective fields but also passion to nurture and sustain long standing relationships with clients and people. Traczen was started in August 2013 with a vision is to provide one-stop solution to clients for their business, finance and tax related needs. Traczen currently has a team strength of 25 highly motivated professionals. We wish to partner with our clients in their growth by continuously adding value and being their trusted advisor of choice

- 3. 3 Our Service Offerings • Corporate Tax • Indirect Taxes • Corporate Laws • FEMA / FDI regulations • SEZ and FTP • Business, IP and Share valuation • Project Finance • M&A advisory • Restructuring advisory • Fund structuring • Cross border tax advisory • Risk Advisory Services • Global F & A out- sourcing • Domestic F &A outsourcing • Leverage technology to streamline processes Finance and Accounts outsourcing Business advisory and consulting Finance and Tax due diligence, Tax and regulatory services Valuation and Project finance

- 4. 4 Core Team

- 5. 5 Archana Korlimarla Mobile: +91 9901360000 Archana@traczen.com Archana Korlimarla – Finance, Accounts and Payroll outsourcing, Corporate tax and Regulatory services Archana is an Associate Member of the Institute of Chartered Accountants of India with over 14 years experience Professional experience Archana has over 12 years of experience managing outsourced processes relating to Finance, Corporate tax, International tax, Accounting, payroll processing and mortgage banking. Archana specialises in virtual CFO services involving building of sustainable business model, robust financial processes & control, providing tax efficient solutions, ensuring statutory and regulatory compliances, audit support etc for small and medium enterprises. Prior to founding Traczen Consulting LLP, Archana was with PwC as part of the Corporate tax and Regulatory practise dealing with Corporate International taxation and Foreign exchange management Laws . In PwC, Archana also managed the outsourced F&A practise which was part of Corporate tax and focused on bringing operational efficiencies by developing effective processes for accounting, payroll and tax functions and scaling up the value chain. Prior to PwC, she was involved in a diverse range of mortgage banking operations at Ocwen Financial Solutions.

- 6. 6 Hanish S Mobile: +91 9916836166 Hanish.s@hsadvisors.in Hanish S – Indirect tax Hanish is an Associate Member of the Institute of Chartered Accountants of India with over 7 years experience and also holds Bachelor’s degree in commerce and Law from Bangalore University. Hanish provides specialised services in the areas of Indirect Taxation. In a short span of time, he has been able to reach many medium and large scale entities engaged in diverse business sectors. Hanish has also been engaged in providing representation services at CESTAT and KAT including drafting of responses to orders / notices issued by departmental authorities . He actively conducts training programs for our clients covering topics like GST, implications of Budget, Overview of indirect taxes, CENVAT credit Rules Hanish is also part of the GST research Committee constituted by Institute of Chartered Accountants to understand the transition issues which will arise once the GST the introduced and provide suggestions on these issues – Published by ICAI in November 2015 Prior to starting his own practise, Hanish completed his internship with M/s JCSS, Chartered Accountants and worked with the indirect tax team of M/s BMR Advisors Private Limited. Hanish is vvisiting faculty at a leading CA Coaching Centre in Bangalore for accounts, costing, indirect taxes and international financial management. He is also a founder member of an NGO – CAPS foundation and Member of C3 – forum for knowledge sharing between Chartered Accountants

- 7. 7 Sriramya Garakahalli Mobile: +91 9611131978 sriramya27@yahoo.com Sriramya Garakahalli – Transfer pricing Sriramya is a Chartered Accountant and CPA from Denver, Colorado with service industry experience of over 14 years. Specialist in International tax, transfer pricing, cross-border structures and tax compliances Sriramya specializes in advising small and medium businesses on International Taxation, transfer price determination and studies. Her rich experience in cross border structures and tax compliances thereon, enables clients to effectively plan, implement and manage complex global organization structures. Prior to starting own practise, Sriramya’s role in the International tax division at Edwards Life Sciences included transfer pricing and compliance in over 40 countries across the globe. Sriramya started her career in International tax consulting at RSM & Co. (acquired by PWC) and had a brief stint at GE.

- 8. 8 CS Prakash M Mobile: ++91 9900943754 Mprakash.cs@gmail.com Prakash M – Corporate secretarial services Prakash is an Associate Member of the Institute of Company Secretaries of India with over 4 years of experience. Has been in practice for over 4 years in the field of Corporate Law Compliance and FEMA Compliances. Offers a wide range of corporate, secretarial, drafting and managerial consultancy services to clients from spectrum of industries ranging from real estate, IT companies, Apparel Industries, manufacturers, Service providers and BPO Services, to name a few. Apart from being a member of ICSI, Prakash has a Bachelor’s degree in Business Management from Mangalore University.

- 9. 9 Krishna Sudheendra Mobile: +91 9901360019 Krishna.sudheendra@gmail.com Krishna Sudheendra – Corporate Finance Krishna is a Chartered Accountant and CPA with service industry experience of over 20 years. Krishna has been the CFO and key management member of IT services company which grew from USD 20M to USD 400M in 8 years. Krishna was responsible for investor relations, corporate governance and ensuring a balance between growth, profitability and long-term shareholder value. He focuses on range from strengthening compliance and processes in line with Sarbanes Oxley, adapting corporate governance practices, implementing enterprise-wide value based accounting, rolling out a global employee stock option program to evaluating large deals, joint ventures and mergers and acquisitions. He has more than 15 years in financial management and has spent most of his career in services outsourcing. Spearheaded finance function in small, medium and large corporations with focus on operations/strategy, M&A, fund raising – debt & equity, Governance, Risk and Compliance (GRC) , Global corporate re/structuring, Executive performance management & total rewards, Global treasury & tax.

- 10. 10 Our Services

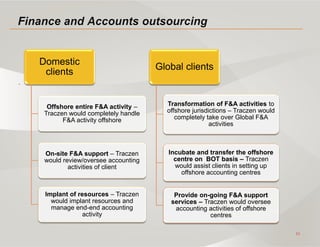

- 11. 11 . Domestic clients Offshore entire F&A activity – Traczen would completely handle F&A activity offshore On-site F&A support – Traczen would review/oversee accounting activities of client Implant of resources – Traczen would implant resources and manage end-end accounting activity Global clients Transformation of F&A activities to offshore jurisdictions – Traczen would completely take over Global F&A activities Incubate and transfer the offshore centre on BOT basis – Traczen would assist clients in setting up offshore accounting centres Provide on-going F&A support services – Traczen would oversee accounting activities of offshore centres

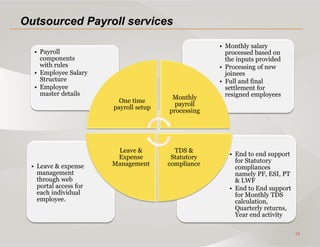

- 12. 12 Outsourced Payroll services • End to end support for Statutory compliances namely PF, ESI, PT & LWF • End to End support for Monthly TDS calculation, Quarterly returns, Year end activity • Leave & expense management through web portal access for each individual employee. • Monthly salary processed based on the inputs provided • Processing of new joinees • Full and final settlement for resigned employees • Payroll components with rules • Employee Salary Structure • Employee master details One time payroll setup Monthly payroll processing TDS & Statutory compliance Leave & Expense Management

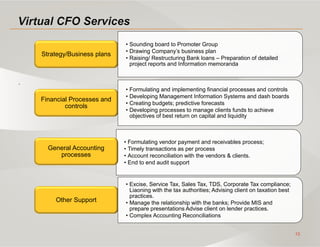

- 13. 13 . • Sounding board to Promoter Group • Drawing Company’s business plan • Raising/ Restructuring Bank loans – Preparation of detailed project reports and Information memoranda Strategy/Business plans • Formulating and implementing financial processes and controls • Developing Management Information Systems and dash boards • Creating budgets; predictive forecasts • Developing processes to manage clients funds to achieve objectives of best return on capital and liquidity Financial Processes and controls • Formulating vendor payment and receivables process; • Timely transactions as per process • Account reconciliation with the vendors & clients. • End to end audit support General Accounting processes • Excise, Service Tax, Sales Tax, TDS, Corporate Tax compliance; Liaoning with the tax authorities; Advising client on taxation best practices. • Manage the relationship with the banks; Provide MIS and prepare presentations Advise client on lender practices. • Complex Accounting Reconciliations Other Support

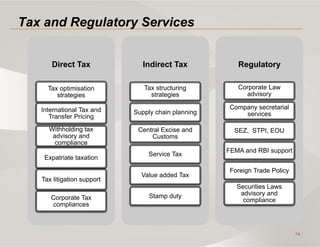

- 14. 14 Tax and Regulatory Services Direct Tax Tax optimisation strategies International Tax and Transfer Pricing Withholding tax advisory and compliance Expatriate taxation Tax litigation support Corporate Tax compliances Indirect Tax Tax structuring strategies Supply chain planning Central Excise and Customs Service Tax Value added Tax Stamp duty Regulatory Corporate Law advisory Company secretarial services SEZ, STPI, EOU FEMA and RBI support Foreign Trade Policy Securities Laws advisory and compliance

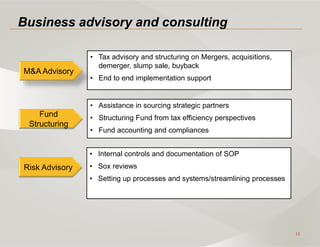

- 15. 15 Business advisory and consulting • Tax advisory and structuring on Mergers, acquisitions, demerger, slump sale, buyback • End to end implementation support • Assistance in sourcing strategic partners • Structuring Fund from tax efficiency perspectives • Fund accounting and compliances • Internal controls and documentation of SOP • Sox reviews • Setting up processes and systems/streamlining processes

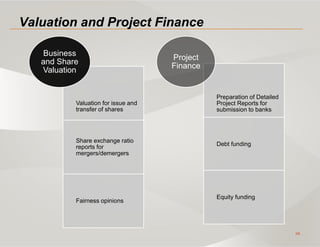

- 16. 16 Valuation and Project Finance Valuation for issue and transfer of shares Share exchange ratio reports for mergers/demergers Fairness opinions Business and Share Valuation Preparation of Detailed Project Reports for submission to banks Debt funding Equity funding Project Finance

- 18. 18 Accounting, payroll and audit support

- 21. 21 Business Advisory Services and Valuation

- 22. Traczen 4th Floor, # 600, Anand Surya Building, Above IndusInd Bank, JP Nagar VI phase, Bangalore – 560078, Karnataka, India. Tel: +080 26653009 Mobile No: - +91 9901360000 Email : - archana@traczen.com