Trade Ideas Data: Market Intelligence for the Financial Technology Industry

- 1. ? 2014 Trade Ideas LLC. All rights reserved. Real-time Market Intelligence ?

- 2. 2 ! ! ! We are a leading technology firm specializing in MARKET DATA ANALYTICS within the financial services space.

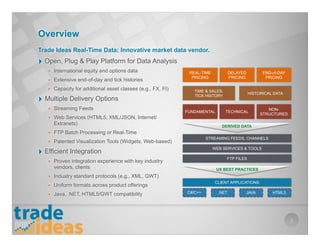

- 3. 3 Overview ! Trade Ideas Real-Time Data: Innovative market data vendor. ? Open, Plug & Play Platform for Data Analysis ? International equity and options data ? Extensive end-of-day and tick histories ? Capacity for additional asset classes (e.g., FX, FI) ? Multiple Delivery Options ? Streaming Feeds ? Web Services (HTML5, XML/JSON, Internet/ Extranets) ? FTP Batch Processing or Real-Time ? Patented Visualization Tools (Widgets, Web-based) ? Efficient Integration ? Proven integration experience with key industry vendors, clients ? Industry standard protocols (e.g., XML, GWT) ? Uniform formats across product offerings ? Java, .NET, HTML5/GWT compatibility REAL-TIME PRICING DELAYED PRICING END-of-DAY PRICING TIME & SALES, TICK HISTORY HISTORICAL DATA STREAMING FEEDS, CHANNELS WEB SERVICES & TOOLS FTP FILES DERIVED DATA CLIENT APPLICATIONS FUNDAMENTAL TECHNICAL NON- STRUCTURED C#/C++ .NET JAVA HTML5 UX BEST PRACTICES

- 4. 4 ! ! ! We apply our real-time analytics to structured and non-structured data - FROM MARKET EXCHANGES TO STOCK RELATED TWEETS.

- 5. 5 Our Clients ! Retail Brokers, Institutions: Buy-side, Sell-side. RETAIL BROKERAGE BROKER-DEALERS SOFTWARE VENDORS PROPRIETARY TRADING DESKS MEDIA PLATFORMS RIA, ASSET MANAGERS MARKET MAKERS, SALES DESKS MID RANGE HEDGE FUNDS EXCHANGES REDISTRIBUTORS { ? We service the need for market analytics of participants across the financial industry ? Complex Event Processing ? Big Data Visualization ? Trading & Backtesting, Research ? Risk Management, Portfolio Valuation ? 200 + institutional and ¡®instividual¡¯ clients located in 16 countries ? 30,000 + individual investors located in 29 countries on 5 continents

- 6. 6 ¡°Integrating Trade-Ideas into our trading platform . . . ? I can honestly say that this has been ONE OF THE SMOOTHEST AND MOST PLEASANT EXPERIENCES IN MY PROFESSIONAL CAREER. Very professional and responsive in addressing all of our business and technical concerns.¡± ! March 6, 2008, Ruben Guerrero, Product Manager

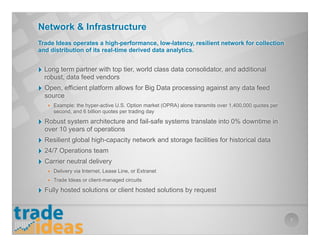

- 7. 7 Network & Infrastructure ! Trade Ideas operates a high-performance, low-latency, resilient network for collection and distribution of its real-time derived data analytics. ? Long term partner with top tier, world class data consolidator, and additional robust, data feed vendors ? Open, efficient platform allows for Big Data processing against any data feed source ? Example: the hyper-active U.S. Option market (OPRA) alone transmits over 1,400,000 quotes per second, and 6 billion quotes per trading day ? Robust system architecture and fail-safe systems translate into 0% downtime in over 10 years of operations ? Resilient global high-capacity network and storage facilities for historical data ? 24/7 Operations team ? Carrier neutral delivery ? Delivery via Internet, Lease Line, or Extranet ? Trade Ideas or client-managed circuits ? Fully hosted solutions or client hosted solutions by request

- 8. DEVELOPMENT STRATEGY: INNOVATION AT TRADE IDEAS 8

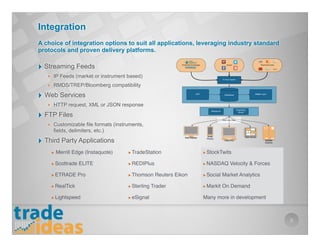

- 9. 9 Integration ! A choice of integration options to suit all applications, leveraging industry standard protocols and proven delivery platforms. ? Streaming Feeds ? IP Feeds (market or instrument based) ? RMDS/TREP/Bloomberg compatibility ? Web Services ? HTTP request, XML or JSON response ? FTP Files ? Customizable file formats (instruments, fields, delimiters, etc.) ? Third Party Applications ?? Merrill Edge (Instaquote) ?? TradeStation ?? StockTwits ?? Scottrade ELITE ?? REDIPlus ?? NASDAQ Velocity & Forces ?? ETRADE Pro ?? Thomson Reuters Eikon ?? Social Market Analytics ?? RealTick ?? Sterling Trader ?? Markit On Demand ?? Lightspeed ?? eSignal Many more in development

- 10. 10 Trade Ideas organizes ? Big Data and filters it to generate a new, derived, ¡®derived¡¯ stream that¡¯s condensed and relevant. Emerging Keys to Success: ? The ability to collect, store, organize, and filter data quickly and efficiently. ?

- 11. 11 Additional Content ! A diverse array of third party and Trade Ideas proprietary, derived content, also available through Trade Ideas Real-Time Data. ? Indices, ETFs, Industry, Sector, Sub Sector symbol lists ? U.S. Option Market pricing data (OPRA) ? Trade Ideas Equity Fundamentals (selected data points from TI¡¯s global equity database) ? Numerous Trade Ideas-calculated and layerable data points (Examples) ! ! ! ? Earnings reporting filters, calendar data ? News from Briefing.com ? Extensive histories ? Lifetime values ? Up to 10 years intraday derived data history ? Trade Ideas FX (over 1,000 currency pairs. In development) ?? Unusual social activity spike ?? Opening Range breakdown ?? Change since January 1 ?? Positive VWAP divergence ?? Relative Volume ?? Position in Consolidation ?? Crosses above resistance ?? Distance from Pivot Points ?? Range contraction

- 12. ¡°PRICE TO METADATA [DERIVED DATA] IS THE NEW P/E RATIO¡± 12 Source: Twitter, $TWTR, Lukasz Wrobel, @wrobelluk, November 7, 2013

- 13. 13 Web Services ! Trade Ideas provides fast integration of its real-time and historical derived data into applications using industry standard delivery and high performance development teams. ? Real-Time, Delayed and End-of-Day pricing data supported ? Extensive histories ? Lifetime values ? Up to 10 years intraday derived data history ? CSV, XML or JSON response format possibilities ? Optimized SaaS model with bandwidth efficient delivery ? Access controlled by IP address and username/password for added security ? Fail safe database architecture ensures no downtime outside of Exchange related outages ? FTP/SFTP delivery

- 14. 14 ¡°Trade-Ideas Pro is a sophisticated and highly customizable program for active day traders [ed: and others] WHO NEED MARKET INFORMATION IN TRULY REAL TIME.¡± ! June 2012, American Association of Individual Investors

- 15. 15 Benefits ? Reduced Total Cost of Ownership - lower implementation & maintenance costs ? High innovation cycles vs. fully utilized, in-house development teams ? Common data model across services with clearly documented feed specifications ? High Quality Support ? Consistent testimonials for high quality and timeliness of support ? Trusted Brand ? Established reputation for consistent uptime, partner dialog, and delivering best practices in UX, workflows ? Consistent ownership structure ? Continued investment in people, content, and technology ? Sustained growth over 10+ years ? Innovative Development Pipeline ? Motif based, market dashboards ? Auto generated content ? Post trade performance analysis: Trade Journal

- 16. ? 2014 Trade Ideas LLC. All rights reserved. ? Real-time Market Intelligence

![¡°PRICE TO METADATA

[DERIVED DATA] IS

THE NEW P/E RATIO¡±

12

Source: Twitter, $TWTR, Lukasz Wrobel, @wrobelluk, November 7, 2013](https://image.slidesharecdn.com/tradeideasmarketing2014lb-140521124501-phpapp02/85/Trade-Ideas-Data-Market-Intelligence-for-the-Financial-Technology-Industry-12-320.jpg)

![14

¡°Trade-Ideas Pro is a sophisticated and highly

customizable program for active day traders [ed: and

others] WHO NEED MARKET INFORMATION IN

TRULY REAL TIME.¡±

!

June 2012, American Association of Individual Investors](https://image.slidesharecdn.com/tradeideasmarketing2014lb-140521124501-phpapp02/85/Trade-Ideas-Data-Market-Intelligence-for-the-Financial-Technology-Industry-14-320.jpg)