Trial Balance

- 1. By, Prof. P. B. Patil H.R. Patel Institute of Pharmacy, Shirpur

- 2. ’é× Before preparing the final account, it is necessary to test the accuracy of the individual posting in the ledger. ’é× Under the double entry book keeping system the two aspect viz debit and credit of each transaction must be recorded. ’é× An entry which is recorded on the debit site of one account is also recorded on the credit side of some other amount. ’é× Hence, the amount on the debit side must be equal to the amount on the credit side

- 3. ’é× Trial Balance is a statement prepared to check the arithmetical accuracy of the book keeping entries up to the date stated at the head of the trial balance. ’é× Trial balance ensure that both the aspect of each transaction have been duly recorded.

- 4. ’é× To ascertain the arithmetical accuracy of the ledger account ’é× To help in locating errors ’é× To help in preparation of final account

- 5. ’é× To ascertain the arithmetical accuracy of the ledger account: - As has been stated earlier, if the sum of the debit and credit columns of the trial balance tally. - Individual ledger accounts are also accurate since the following errors in the ledger account are not reveled by the trial balance:

- 6. -- Posting of transaction in in wrong column. -- Posting of correct amount but to wrong account. -- Wrong entry in the ledger. -- Omission of an entry in the ledger. Such errors can be avoided only by exercising due to care and caution while recording of transaction.

- 7. ’é× To help in locating errors: When there are a large no. of posting in ledger and the trial balance dies not tally the following steps are required: - To recheck the tally of debits and credits - To recheck of the trial balance item with the ledger - Rechecking the total of ledger accounts and their balancing - Find out the difference may be due to omission of an entry ether an debit and credit side

- 8. ’é× To helps in the preparation of final account: - The trial balance contain the list of all ledger accounts with their debit and credit balance. - So while preparing the financial statement (Final Account) there is no need to refer to the ledger. - Financial statement can be easily prepared from a tallied trial balance. - Trading account, Profit and loss account can also be prepared form revenue and expense account appearing in the trial balance.

- 9. ’é× Preparation of Trial Balance: Trial Balance is prepared by one of the following one method - Balance Method - Total Amount Method

- 10. ’é× Balance Method: - In this method all the ledger accounts are first balanced. This is done immediately after posting of original entry to the ledger. - The debit and credit sides of each ledger account is totaled. - The balance are then recoded on the credit or debit side of the trial balance.

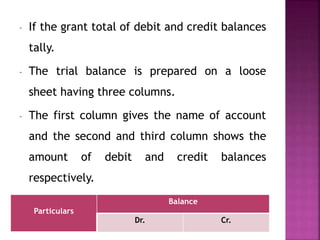

- 11. - If the grant total of debit and credit balances tally. - The trial balance is prepared on a loose sheet having three columns. - The first column gives the name of account and the second and third column shows the amount of debit and credit balances respectively. Particulars Balance Dr. Cr.

- 12. ’é× Total Amount Method: - In this method the total on debit side of every ledger account is entered under the debit column of the trial balance and the total on the credit side of each ledger account is recorded under the credit column of the trial balance. - A grant total of both debit and credit side is then taken. - In case the grant totals on both sides tall, it indicates arithmetical accuracy.

- 13. ’é× Accounting Errors: Following types errors are reflect on the Trial Balance: - Errors of Commission - Errors of Omission - Errors of Principle - Errors of Posting - Compensating Errors