Tricumen JPM\'s CIO unit

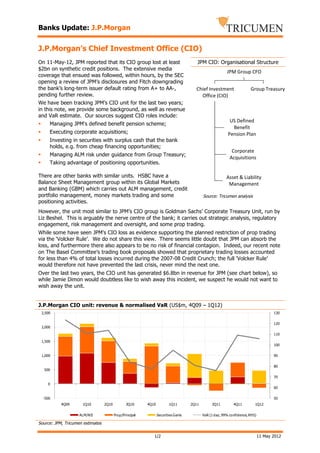

- 1. Banks Update: J.P.Morgan J.P.MorganˇŻs Chief Investment Office (CIO) On 11-May-12, JPM reported that its CIO group lost at least JPM CIO: Organisational Structure $2bn on synthetic credit positions. The extensive media JPM ?Group ?CFO coverage that ensued was followed, within hours, by the SEC opening a review of JPMˇŻs disclosures and Fitch downgrading the bankˇŻs long-term issuer default rating from A+ to AA-, Chief ?Investment Group Treasury pending further review. Office ?(CIO) We have been tracking JPMˇŻs CIO unit for the last two years; in this note, we provide some background, as well as revenue and VaR estimate. Our sources suggest CIO roles include: US ?Defined ˇě? Managing JPM's defined benefit pension scheme; Benefit ˇě? Executing corporate acquisitions; Pension Plan ˇě? Investing in securities with surplus cash that the bank holds, e.g. from cheap financing opportunities; Corporate ˇě? Managing ALM risk under guidance from Group Treasury; Acquisitions ˇě? Taking advantage of positioning opportunities. There are other banks with similar units. HSBC have a Asset ?& ?Liability Balance Sheet Management group within its Global Markets Management and Banking (GBM) which carries out ALM management, credit portfolio management, money markets trading and some Source: Tricumen analysis positioning activities. However, the unit most similar to JPMˇŻs CIO group is Goldman SachsˇŻ Corporate Treasury Unit, run by Liz Beshel. This is arguably the nerve centre of the bank; it carries out strategic analysis, regulatory engagement, risk management and oversight, and some prop trading. While some have seen JPM's CIO loss as evidence supporting the planned restriction of prop trading via the ˇ®Volcker RuleˇŻ. We do not share this view. There seems little doubt that JPM can absorb the loss, and furthermore there also appears to be no risk of financial contagion. Indeed, our recent note on The Basel CommitteeˇŻs trading book proposals showed that proprietary trading losses accounted for less than 4% of total losses incurred during the 2007-08 Credit Crunch; the full ˇ®Volcker RuleˇŻ would therefore not have prevented the last crisis, never mind the next one. Over the last two years, the CIO unit has generated $6.8bn in revenue for JPM (see chart below), so while Jamie Dimon would doubtless like to wish away this incident, we suspect he would not want to wish away the unit. J.P.Morgan CIO unit: revenue & normalised VaR (US$m, 4Q09 ¨C 1Q12) 2,500 130 120 2,000 110 1,500 100 1,000 90 80 500 70 0 60 -500 50 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 ALM/NII Prop/Principal Securities Gains VaR (1 day, 99% confidence, RHS) Source: JPM, Tricumen estimates 1/2 11 May 2012

- 2. Banks Update: J.P.Morgan Notes & Caveats Tricumen Limited has used all reasonable care in writing, editing and presenting the information found in this report. All reasonable effort has been made to ensure the information supplied is accurate and not misleading. For the purposes of cross- market comparison, all numerical data is normalised in accordance to TricumenˇŻs proprietary product classification and may contain +/-10% margin of error. The information and commentary provided in this report has been compiled for informational purposes only. We recommend that independent advice and enquiries should be sought before acting upon it. Readers should not rely on this information for legal, accounting, investment, or similar purposes. No part of this report constitutes investment advice, any form of recommendation, or a solicitation to buy or sell any instrument or to engage in any trading or investment activity or strategy. Tricumen does not provide investment advice or personal recommendation, nor will it be deemed to have done so. Tricumen Limited makes no representation, guarantee or warranty as to the suitability, accuracy or completeness of the report or the information therein. Tricumen Limited assumes no responsibility for information contained in this report and disclaims all liability arising from negligence or otherwise in respect of such information. Tricumen Limited is not liable for any damages arising in contract, tort or otherwise from the use of or inability to use this report or any material contained in it, or from any action or decision taken as a result of using the report. 2/2 11 May 2012