Types of Retirement Accounts

- 2. TYPES OF RETIREMENT ACCOUNTS TYPES OF ACCOUNTS TO USE YOUR RETIREMENT TO INVEST IN REAL ESTATE  401(k)/Solo 401k  SEP  Traditional IRA  Roth IRA  Health Savings Account (HSA)  Coverdell Education Savings Account (ESA)  Inherited IRAs (Traditional and Roth)

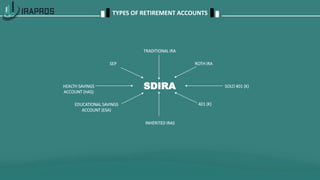

- 3. TRADITIONAL IRA ROTH IRASEP HEALTH SAVINGS ACCOUNT (HAS) SOLO 401 (K) 401 (K)EDUCATIONAL SAVINGS ACCOUNT (ESA) INHERITED IRAS SDIRA TYPES OF RETIREMENT ACCOUNTS

- 4. TYPES OF RETIREMENT ACCOUNTS

- 5. SOLO 401K https://www.irs.gov/retirement-plans/one-participant-401k-plans TYPES OF RETIREMENT ACCOUNTS

- 6. SOLO 401k CONTRIBUTIONS In 2020, as an employee, you can contribute up to $19,500 to your Solo 401k, and an additional $6,500 if you are at least age 50. You, as an employer, can also contribute to your Solo 401(k) up to 25% of your compensation. Total contributions (employee and employer, combined) to your Solo 401k cannot exceed $57,000, or $62,000 if you’re at least 50 years old in 2020. There are other factors; Quest can walk you through your options and what is best for you. https://www.irs.gov/retirement-plans/one-participant-401k-plans TYPES OF RETIREMENT ACCOUNTS

- 7.  Beth, age 51, earned $50,000 in W-2 wages from her S Corporation in 2020.  She deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401(k) plan.  Her business contributed 25% of her compensation to the plan, $12,500.  Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Beth for 2020. SOLO 401(K) EXAMPLE https://www.irs.gov/retirement-plans/one-participant-401k-plans TYPES OF RETIREMENT ACCOUNTS

- 8. Contributions an employer can make to an employee's SEP-IRA cannot exceed the lesser of:  25% of the employee's compensation, or  $57,000 for 2020 SIMPLIFIED EMPLOYMENT PLAN (SEP) https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep TYPES OF RETIREMENT ACCOUNTS

- 9. HEALTH SAVINGS ACCOUNT (HSA) An HSA is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. https://www.healthcare.gov/glossary/health-savings-account-hsa/ TYPES OF RETIREMENT ACCOUNTS

- 10. EDUCATION SAVINGS ACCOUNT (ESA) A Coverdell education savings account (Coverdell ESA) is a trust or custodial account set up solely for paying qualified education expenses for the designated beneficiary of the account. https://www.irs.gov/taxtopics/tc310 TYPES OF RETIREMENT ACCOUNTS

- 11. INHERITED IRAs Inherited IRAs, both Traditional and Roth, can be quite complicated and dealing with the specifics are well beyond the scope of this presentation. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary TYPES OF RETIREMENT ACCOUNTS

- 12. TRADITIONAL IRA ROTH IRASEP HEALTH SAVINGS ACCOUNT (HAS) SOLO 401 (K) 401 (K)EDUCATIONAL SAVINGS ACCOUNT (ESA) INHERITED IRAS SDIRA TYPES OF RETIREMENT ACCOUNTS

Editor's Notes

- #10: An HAS is a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in an HSA to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs. HSA funds generally may not be used to pay premiums. While you can use the funds in an HSA at any time to pay for qualified medical expenses, you may contribute to an HSA only if you have a High Deductible Health Plan (HDHP) — generally a health plan (including a Marketplace plan) that only covers preventive services before the deductible. For plan year 2020, the minimum deductible for an HDHP is $1,400 for an individual and $2,800 for a family. When you view plans in the Marketplace, you can see if they are "HSA-eligible.” For 2020, if you have an HDHP, you can contribute up to $3,550 for self-only coverage and up to $7,100 for family coverage into an HSA. HSA funds roll over year to year if you don't spend them. An HSA may earn interest or other earnings, which are not taxable.

- #11: This benefit applies not only to qualified higher education expenses, but also to qualified elementary and secondary education expenses. Contributions are not tax deductible. Total contributions on behalf of a beneficiary in any year can't exceed $2,000.

- #12: The important takeaway is if you find you have inherited an IRA, do not do anything with it until you consult with a licensed professional like Quest. HOWEVER, THERE ARE SOME GREAT STRATEGIES YOU CAN USE WITH AN INERHITED ROTH IRA. LOOK FOR AN UPCOMING SPECIFIC VIDEO ON THIS TOPIC AND HOW YOU CAN EXCELERATE YOUR RETIRTEMENT GROWTH TAX FREE.

- #13: SUMMARY AND CTA TO KEEP MOVING THROUGH THE TOPICS……ETC.