TZMI Oct 09 TiO2 Presentation Singapore

- 1. David McCoy Has the industry reached the bottom? TZMI Congress/ Asia in focus Singapore| 22-23 October 2009

- 2. Key points about the world yp Clear ŌĆ£VŌĆØ shaped downturn for the global market Emerging markets strongest growth in 2010 Destocking complete Pigment inventory levels recalibrated ŌĆō production trimmed Cost pressures throughout the supply chain ŌĆō TiO2 producers under severe stress TZMI Congress/ Asia in focus 4 Singapore| 22-23 October 2009

- 3. Changing markets for TiO2 g g 1980 1990 18% 46% 21% 36% 2000 42% 37% 26% 38% 36% Americas EMEA Asia-Pacific TZMI Congress/ Asia in focus 5 Singapore| 22-23 October 2009

- 4. Demand in 2008 4.72 million tonnes 5% 2% 1% 6% 3% 2% 3% 7% 9% 24% 23% 57% 23% 35% North America Western Europe Coatings Plastics Paper Specialties Asia Pacific Central Europe Inks Fibres Central & South America Middle East & Africa Rubber Food & Pharmaceuticals TZMI Congress/ Asia in focus 6 Singapore| 22-23 October 2009

- 5. TiO2 pigment supply changes pg pp y g 1998 4% 14% Chloride 60%, Sulfate 40% 4% 23% 3% Outlook for chloride grow at expense of sulfate 4% 5 largest produced 73.7% of global market 18% ISK produced 20% of Asia-Pacific market 11% 13% 9% China Chi produced 18% of Asia Pacific market d d f A i P ifi k DuPont Cristal Global Tronox Kronos Huntsman Tioxide Sachtleben Kemira 2008 Ishihara Sangyo Kaisha Chinese Others Chl id 57%, Sulfate 43% Chloride 57% S lf t 10% Sulfate the dominant growth platform, but 19% everyone still wants chloride technology 16% 5 largest produced 66.0% of global market 15% ISK produced 11% of Asia-Pacific market 4% 4% 12% China produced 52% of Asia Pacific market 9% 11% TZMI Congress/ Asia in focus 7 Singapore| 22-23 October 2009

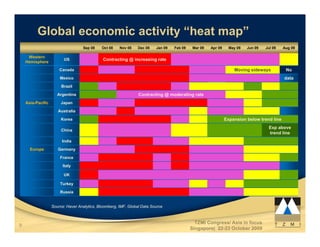

- 6. Global economic activity ŌĆ£heat mapŌĆØ Sep 08 Oct 08 Nov 08 Dec 08 Jan 09 Feb 09 Mar 09 Apr 09 May 09 Jun 09 Jul 09 Aug 09 Western US Contracting @ increasing rate Hemisphere Canada Moving sideways No Mexico M i data d t Brazil Argentina Contracting @ moderating rate Asia-Pacific Japan Australia Korea Expansion below trend line Exp above China trend line India Europe Germany France Italy UK Turkey Russia Source: Haver Analytics, Bloomberg, IMF, Global Data Source TZMI Congress/ Asia in focus 9 Singapore| 22-23 October 2009

- 7. IMF 2010 GDP forecasts Eurozone 0.3 -0.3 UK 0.9 09 0.2 US 1.5 0.8 Japan 1.7 1.7 17 India 6.4 6.5 China 9.0 8.5 Advanced Ad d 1.3 13 0.6 Emerging 5.1 4.7 World 3.1 2.5 -2 0 2 4 6 8 10 % change year-on-year Oct-09 Oct 09 Jul-09 Jul 09 TZMI Congress/ Asia in focus 10 Singapore| 22-23 October 2009

- 8. Emerging markets ŌĆō key for g g g y growth Mature Emerging Per Capita Per Capita Architectural < 2 litres 8 litres Paint Industrial and Special 13 litres < 6 litres Purpose Coatings Plastics ~100 kg ~20 kg Paper P ~170 k 170 kg ~25 kg Source: Food & Agriculture Organization of the UN, 2005 data for paper and paperboard; Plastic Europe Market Research Group (PEMRG) 2005 plastics data; Euromonitor 2007 coatings data; WorldBank population data TZMI Congress/ Asia in focus 12 Singapore| 22-23 October 2009

- 9. Coatings raw materials g 5% 12% Additives 27% 12% Solvents 32% 38% TiO2 / Pigments / Fillers 44% 31% Resins Volume Spend TZMI Congress/ Asia in focus 13 Singapore| 22-23 October 2009

- 10. Largest coatings companies - 2008 g g p Revenue US$ billions 16 14 12 10 8 6 4 2 0 Masco Kansai Valspar PPG Nobel SHW RPM BASF Nippon DuPont Akzo Source: Company reports, TZMI estimates TZMI Congress/ Asia in focus 14 Singapore| 22-23 October 2009

- 11. Revenue-based market share 2008 achtleben Huntsman Jinhong Billions DuPont Kronos omon ronox Cristal SK Lo Sa IS Tr 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% Masco Kansai Valspar PPG RPM Akz Nobel SHW BASF Nippon DuPont zo Source: Company reports, TZMI database TZMI Congress/ Asia in focus 15 Singapore| 22-23 October 2009

- 12. Long term TiO2 pigment demand growth g pg g ŌĆś000 tonnes 2,000 1,800 3.0% CAGR 1.7% CAGR 1,600 5.5% CAGR 1,400 1,200 1,000 800 600 400 200 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 EMEA Americas A i Asia-Pacific A i P ifi Source: TZMI Database TZMI Congress/ Asia in focus 16 Singapore| 22-23 October 2009

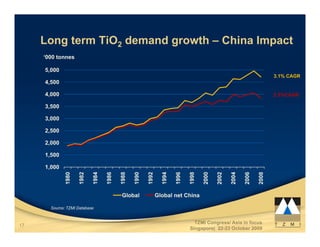

- 13. Long term TiO2 demand growth ŌĆō China Impact g g p ŌĆś000 tonnes 5,000 3.1% 3 1% CAGR 4,500 4,000 2.5%CAGR 3,500 3,000 2,500 2,000 1,500 1,000 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 Global Global net China Source: TZMI Database TZMI Congress/ Asia in focus 17 Singapore| 22-23 October 2009

- 14. Long term demand growth ŌĆō Looking forward g g g ŌĆś000 tonnes 6,000 3.2% 3 2% CAGR 5,500 5,000 4,500 1.8% CAGR 4,000 , 3,500 3,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009f 2010f 2012f 2013f 2014f 2015f 2011f Global Global net China 30 yr trendline Source: TZMI Database TZMI Congress/ Asia in focus 21 Singapore| 22-23 October 2009

- 15. China in the world: Demand Cumulative incremental demand (ŌĆś000 tonnes) 1,600 1 600 60% 1,400 53% 44% 1,200 45% 42% 38% 39% 41% 1,000 38% 800 32% 30% 600 23% % 400 15% 200 8% 0 0% 2009f 2010f 2011f 2012f 2013f 2014f 2015f ROW Chinese exports China domestic China % of world growth TZMI Congress/ Asia in focus 23 Singapore| 22-23 October 2009

- 16. * Greenfields including chloride conversions ** Excludes brownfields expansions and all Chinese plants 1. Osaka was re-opened in 1999, but completely closed in 2004 Major M j capacity changes** it h ** ŌĆś000 tonnes Price index 2008 real 200 180 more Sulfate Teluk Kalung, 150 Kua Yin 160 ┬®TZMI an te Kemerton, Botlek k Antwerp, Baltim Savannah Sulfat 100 140 Stallingborough Onsan Lehavre 50 120 0 100 Kwinana, Yanbu, Lake Charles Varennes Jurong Langerbrugge Osaka1 Antioch Akita -50 80 Tracey Burnie K -100 60 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Greenfields plants Closures TiO2 price Source: TZMI database TZMI Congress/ Asia in focus 26 Singapore| 22-23 October 2009

- 17. In summary y The worst is probably behind us, although the rebound in mature markets will take longer Economic outlook to 2010 is looking more positive with each forecast Restocking will drive Q1 demand and maybe some Q4 demand if price increases look to flow through in early 2010 Rebound in pricing to begin in early 2010 and continue through to 2012. TZMI Congress/ Asia in focus 28 Singapore| 22-23 October 2009

- 18. In summary y Consolidation in the pigment and coatings sector is likely to continue. No greenfields TiO2 plants outside of China for at 2-3 years. least 2 3 years ChinaŌĆÖs domestic market should not be underestimated ŌĆō two tier pricing structure to continue for several years. TZMI Congress/ Asia in focus 29 Singapore| 22-23 October 2009

- 19. Helping the global titanium and zircon industries to achieve maximum value from resources. TZMI Congress/ Asia in focus Singapore| 22-23 October 2009