Enterprise Ireland- 3rdApril2013

- 1. Entrepreneurship How and when to approach Investors. George Kiely Enterprise Ireland UCD - Innovation Academy 3rd April 2013

- 2. Enterprise Ireland Enterprise Ireland is the Government agency in Ireland responsible for supporting Irish businesses in the manufacturing and internationally traded service sectors. Specifically, Enterprise Ireland helps businesses to start- up, innovate and ultimately, to achieve global success.

- 4. Introduction ’é¦ Working with entrepreneurs, EI and national programmes for entrepreneurship. ’é¦ View circa 1500 business propositions and business plans each year ’é¦ Meet with circa 500 entrepreneurs/ teams each year to evaluate, challenge and advise new start-up companies ’é¦ Design, deliver and manage Start-up programmes for High Potential Start-Ups ’é¦ Review wide range of business ideas of all shapes and sizes to make investor ready.

- 5. What I will cover ŌĆ” Enterprise Ireland and the types of Start-up businesses EI supports The importance of a Robust Investor Ready Business Plan Indicators for Success (what we are looking for) Common mistakes Raising Funding ŌĆō Sources of Funding for Start-Ups

- 6. Projects EI invests in Eligibility Criteria ’é¦ Manufacturing or internationally traded services ’é¦ Likely to achieve significant growth within 3 years ’āś Sales of Ōé¼1m per annum ’āś Employment of at least 10 people ’é¦ Export orientated ’é¦ Involving industry experienced team ’é¦ Irish owned or strategically controlled and located in Ireland ’é¦ High level of technical innovation

- 7. Projects EI cannot invest in NOT Eligible ’é¦ No export potential i.e. customers will be based in Ireland ’é¦ No growth potential ’é¦ The main promoters / strategic decision making is not based in Ireland ’é¦ IP is not registered with an Irish company ’é¦ Importing products to sell in Ireland ’é¦ Not innovative ŌĆō many competitors

- 8. Graduated EI assistance 1)┬ĀStarting a Business: Enterprise Start 1(ES1) 2)┬ĀValidating the Business Idea: ES2 or EI one to oneŌĆÖs. 3) Incubation and Interim Funding IOTŌĆÖs / New Frontiers Programme 4) Raising Substantial Investment : EI High Potential Start Up HPSU.

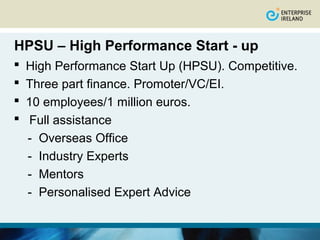

- 9. HPSU ŌĆō High Performance Start - up ’é¦ High Performance Start Up (HPSU). Competitive. ’é¦ Three part finance. Promoter/VC/EI. ’é¦ 10 employees/1 million euros. ’é¦ Full assistance - Overseas Office - Industry Experts - Mentors - Personalised Expert Advice

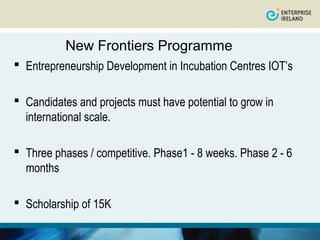

- 10. New Frontiers Programme ’é¦ Entrepreneurship Development in Incubation Centres IOTŌĆÖs ’é¦ Candidates and projects must have potential to grow in international scale. ’é¦ Three phases / competitive. Phase1 - 8 weeks. Phase 2 - 6 months ’é¦ Scholarship of 15K

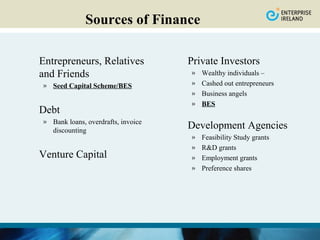

- 11. Sources of Finance Entrepreneurs, Relatives Private Investors and Friends ┬╗ Wealthy individuals ŌĆō ┬╗ Seed Capital Scheme/BES ┬╗ Cashed out entrepreneurs ┬╗ Business angels ┬╗ BES Debt ┬╗ Bank loans, overdrafts, invoice discounting Development Agencies ┬╗ Feasibility Study grants ┬╗ R&D grants Venture Capital ┬╗ Employment grants ┬╗ Preference shares

- 13. Innovation Voucher ’é¦ If you own or manage a small limited company with a company registration number and you have a business opportunity or problem that you want to explore - apply for an Innovation Voucher.

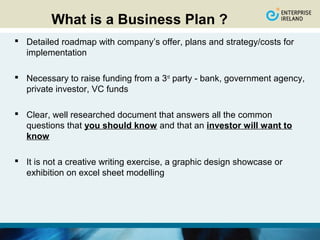

- 14. What is a Business Plan ? ’é¦ Detailed roadmap with companyŌĆÖs offer, plans and strategy/costs for implementation ’é¦ Necessary to raise funding from a 3rd party - bank, government agency, private investor, VC funds ’é¦ Clear, well researched document that answers all the common questions that you should know and that an investor will want to know ’é¦ It is not a creative writing exercise, a graphic design showcase or exhibition on excel sheet modelling

- 15. Who is the Business Plan For? ’é¦ You the entrepreneur ŌĆō plan the work and work the plan ’é¦ For potential investors (Public and Private) ’é¦ For your bank manager ’é¦ For your staff ŌĆō new members joining to company : Note All different Audiences ŌĆō may need different versions, may need NDA.

- 16. Investor Ready Business Plan ’é¦ A Business Plan but not an Investor Ready Business Plan ’é¦ We encourage entrepreneurs to think more about getting Investor ready ŌĆō i.e. ŌĆ£what information/evidence do I need to convince investors to part with their money ’é¦ If you can do this - finance will follow

- 17. Investor Ready Business Plan ŌĆō Content? Plans should give information and detail about the entrepreneur and the business that de-risks the business in the view of potential investors or more simply put - adds credible evidence as to the likely success of the business

- 18. Common mistakes ’üČ Value proposition is not clearly defined. Technically brilliant product but does it deliver VALUE to the customer? ’üČ Inability to identify and qualify the customer. ’üČ ŌĆ£Our product has no competitorsŌĆØ ! ’üČ Unbelievable numbers (revenue projections and costs). ’üČ Unrealistic expectations on raising cash (time needed and valuations). It will take 3-6 months. Plan conservatively. ’üČ Verbiage / inelegance

- 19. Common mistakes ’üČ Inability to identify clear ŌĆō and achievable ŌĆō milestones. ’üČ ŌĆśUnbalancedŌĆÖ Management team ŌĆō dominance commercially/technically? ’üČ Inability to plan for contingencies (they will happen !!).

- 20. Important considerations ’é¦ 1. Competition. Where are you in relation to your competition? ’é¦ 2. What is different about your product or service? ŌĆ£Uniqueness?ŌĆØ ’é¦ 3. Elevator pitch. 10 seconds. Brutal assessment. ’é¦ 4. Brand. Competitive matrix. ’é¦ 5. Who is selling it? Emotional intelligence supported by research. ’é¦ 6. Technology is a given unlessŌĆ”ŌĆ”.what is does for whom and better/ cheaper/ more effectively. ’é¦ 7. Innovation is not just technology but business model for example.

- 21. Commercial Environment - Interdisciplinary ’é¦ Best creative business people - classicists, natural scientists, philosophers. ’é¦ Most successful ICT entrepreneurs ŌĆō non technical. ’é¦ Successful businesses projects have valuable combinations of skills. ’é¦ Interdependence - the project itself - the promoter.

- 22. Impact ’é¦ Advice more important than Funding

- 23. County Enterprise Boards ’é¦ Throughout REGIONS and DUBLIN ’é¦ Businesses employing less than ten ’é¦ Transition to EI HPSU ’é¦ Close collaboration with EI ŌĆō incorporated within EI ’é¦ EI on boards ’é¦ ŌĆśOrganicŌĆÖ rather than ŌĆśscaleŌĆÖ growth

- 24. The Future ’é¦ Recessions ’é¦ Extraordinary talent. ’é¦ Non - economic factors ’é¦ Commercial significance of International Good Will.

- 25. Contact ’é¦ George Kiely ’é¦ george.kiely@enterprise-ireland.com ’é¦ 01 7272329

Editor's Notes

- #2: Types of Businesses EI supports What is not eligible Support available from EI