Understanding payments

- 1. - - Explained by OmVikramThapa

- 3. DISCLAIMER âTHIS SESSION IS NOT ABOUT HOW TO BUILD A PG BUT ABOUT HOW THE PG & ITS SURROUNDING SYSTEM WORKS!!â

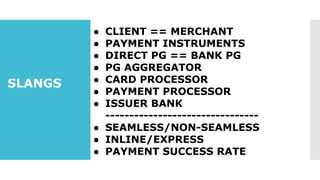

- 4. â CLIENT == MERCHANT â PAYMENT INSTRUMENTS â DIRECT PG == BANK PG â PG AGGREGATOR â CARD PROCESSOR â PAYMENT PROCESSOR â ISSUER BANK -------------------------------- â SEAMLESS/NON-SEAMLESS â INLINE/EXPRESS â PAYMENT SUCCESS RATE SLANGS

- 5. â MERCHANT ID â SALT OR CHECKSUM â ENCRYPTION LOGIC â REDIRECT URL â SURL â FURL â CURL â PAYMENT STATUS API â REFUND API â CALLBACK API â WHITELISTING SANDBOX

- 6. WHAT ARE THE MOST IMPORTANT THINGS A PAYMENT GATEWAY REQUIRES TO COMPLETE A PAYMENT FOR A PRODUCT? PAYMENT PAGE QUERY

- 7. THE ANSWER IS â ROTI == ORDER OBJECT â KAPDA == CUSTOMER OBJECT â MAKAAN == PAYMENT OBJECT

- 8. â CC â DC â NB â WALLET â UPI â PAY LATER - PRE-DECIDED PG IN BAKGROUND - SERVES BANK CODE FOR NB - SERVES BANK DOWNTIME NOTIFN. - CHECKS USER SAVED CARD INFO - CHECKS ELIGIBILITY CRITERIA 1 GET PAYMENT INSTRUMENTS

- 9. â CLIENT SIDE JUSPAY, BRAINTREE â SERVER SIDE PAYU, CCAVENUE, BILLDESK 2 INTEGRATE

- 12. EXAMPLES SHA(order_id|order_amount|customer_email|custome r_phone|.......|SALT) ==> HASH MD5(order_id~order_amount~customer_email~custo mer_phone~SALT~customer_phone~customer_email ~order_amount~order_id) ==> HASH OUTPUT = UNIQUETARGET URL

- 13. 3 PAYMENT GATEWAY CLIENT SIDE - FORM SUBMITTOTARGET URL (MERCHANT LOOSE CONTROL HERE) SERVER SIDE - FORM SUBMIT FROM SERVER SIDE - AUTH & CAPTURE APIs (MERCHANT HAS SOME CONTROL HERE)

- 16. 5 REVERSE U-TURN âŦ MERCHANT ORDER ID âŦ PGTXN ID âŦ BANK REFERENCE NO âŦ BANK REFERENCE NO âŦ PGTXN ID âŦ MERCHANT ORDER ID

- 17. 6 REDIRECTION

- 18. 7 SERVER SIDE VERIFY CALL MOST OFTHE PGs PROVIDETHIS S2S CALLTO CROSSVERIFY THE PAYMENT.THIS ISTO AVOID RISK & PASS UDFVALUES.