Understanding Proof of Work (PoW) and Proof of Stake (PoS) Algorithms

- 1. Developer Weekly #2 LetsBuildEOS | Blockchain Developer Community Understanding Proof of Stake (PoS) Algorithm August 11, 2018 Gautam ANAND

- 2. About Gautam ANAND ŌŚÅ 5 Years of FullStack Software Development ŌŚÅ Software Architecture Design (Microservices) - Build & Scale ŌŚÅ JavaScript ES6 (Node.js), C++ (EOSIO Smart Contracts) and Python (Scikit-Learn & TensorFlow) ŌŚÅ DevOps (Docker/Kubernetes/Serverless) ŌŚÅ Databases (Mongo, Redis and PostgresQL) ŌŚÅ Machine Learning Models to Cloud Agnostic APIs ŌŚÅ Code Reviews ŌŚÅ 3X Blockchain Hackathons ŌŚÅ Building two EOSIO based projects (SmartCitySteriods & ReliefChain). ŌŚÅ Part of Global EOS Community

- 3. About Blockchain Technology How developers see it? ŌŚÅ Decentralised Database running on millions of computer ŌŚÅ Public chain (You donŌĆÖt the location); Private Chain (Your company datacenter) ŌŚÅ Data entry is one way i.e. NO UPDATE and NO Delete. Only Create and READ is allowed. ŌŚÅ Smart contracts are the actions on top of DATA entry, increasing functionality. In nutshell, 1. Data (Transactions) is immutable 2. Network as a secure model

- 4. Algorithms to validate transactions on the blockchain ŌŚÅ Proof of Work (PoW) ŌŚÅ Proof of Stake (PoS)

- 5. Proof of Work (PoW)

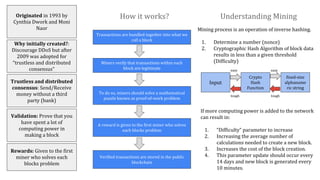

- 6. Originated in 1993 by Cynthia Dwork and Moni Naor Why initially created?: Discourage DDoS but after 2009 was adopted for ŌĆ£trustless and distributed consensusŌĆØ Trustless and distributed consensus: Send/Receive money without a third party (bank) Validation: Prove that you have spent a lot of computing power in making a block Rewards: Given to the first miner who solves each blocks problem How it works? Transactions are bundled together into what we call a block Miners verify that transactions within each block are legitimate To do so, miners should solve a mathematical puzzle known as proof-of-work problem A reward is given to the first miner who solves each blocks problem Verified transactions are stored in the public blockchain Understanding Mining Mining process is an operation of inverse hashing. 1. Determine a number (nonce) 2. Cryptographic Hash Algorithm of block data results in less than a given threshold (Difficulty) Input Crypto Hash Function fixed-size alphanume ric string easy easy tough tough If more computing power is added to the network can result in: 1. ŌĆ£DifficultyŌĆØ parameter to increase 2. Increasing the average number of calculations needed to create a new block. 3. Increases the cost of the block creation. 4. This parameter update should occur every 14 days and new block is generated every 10 minutes.

- 7. Breaking Point 1. Needs computing power i.e. high electricity usage: 2017, Bitcoin Energy Farms alone consumed 54 TWh (~5M US Households or power hungary/Ireland) 2. Higher Rewards are given to people with better and more equipments: Higher hashrate, Higher the reward. 3. Mining Pools make blockchain more centralised than decentralised: Miners create a mining pool to combine hashpower and share the profits evenly. Reference: https://www.theguardian.com/technology/2018/jan/17/bitcoin-electricity-usage-huge-climate-cryptocurrency

- 8. If three biggest mining pools combine they will take over the network and start approving fraudulent transactions. Concerns

- 9. Proof of Stake (PoS)

- 10. Originated in 2011 by Quantum Mechanic (Bitcointalk.org) Why initially created?: Letting everyone compete with each other for mining is wasteful (Proof of Work) Validation: Creator of a new block is chosen in a deterministic way, depending on its wealth, also defined as stake. Rewards: No block rewards, so the validators take the transaction fees. How it works? Transactions are bundled together into what we call a block Validators will stake (personal wealth as security deposit) to be randomly selected in a deterministic way Validators will mint/forge a new block. Validators take the transaction fees inside a block. They lose a part of stake if they verify fraud transactions. Verified transactions are stored in the public blockchain Block selection variants Selecting by account balance would result in (undesirable) centralization, so other ways are: 1. Randomized Block Selection: Look the lowest hash value in combination with the size of stake (NXT and BlackCoin). 2. Coin Age-based selection: A number derived from the product of the number of coins multiplied by the number of days the coins have been held (Peercoin). Stake and chance are linear Trustless and distributed consensus: Send/Receive money without a third party (bank)

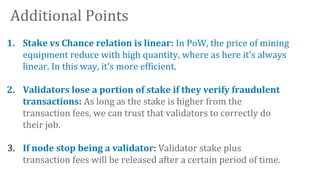

- 11. Additional Points 1. Stake vs Chance relation is linear: In PoW, the price of mining equipment reduce with high quantity, where as here it's always linear. In this way, it's more efficient. 2. Validators lose a portion of stake if they verify fraudulent transactions: As long as the stake is higher from the transaction fees, we can trust that validators to correctly do their job. 3. If node stop being a validator: Validator stake plus transaction fees will be released after a certain period of time.

- 12. The 51% Attack Scenario: If one can buy majority in the network, they can influence it. Proof of Work (BTC) Proof of Stake (BTC) Impractical as the attacker will need 79 Billion USD if BTC was to move to PoS from PoW.

- 13. Who uses it?

- 14. Thanks, Stay in touch! Telegram LinkedIN