Unified Payments Interface (UPI) - Introduction

- 1. Unified Payments Interface (UPI)

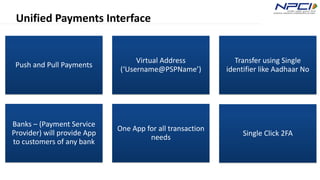

- 2. Push and Pull Payments Virtual Address (ŌĆśUsername@PSPNameŌĆÖ) Transfer using Single identifier like Aadhaar No Banks ŌĆō (Payment Service Provider) will provide App to customers of any bank One App for all transaction needs Single Click 2FA Unified Payments Interface

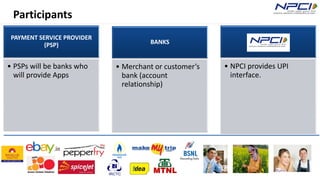

- 3. Participants PAYMENT SERVICE PROVIDER (PSP) ŌĆó PSPs will be banks who will provide Apps BANKS ŌĆó Merchant or customerŌĆÖs bank (account relationship) ŌĆó NPCI provides UPI interface.

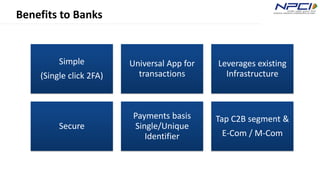

- 4. Benefits to Banks Simple (Single click 2FA) Universal App for transactions Leverages existing Infrastructure Secure Payments basis Single/Unique Identifier Tap C2B segment & E-Com / M-Com

- 5. Benefits to Merchants Seamless fund collection from customers - single identifiers No risk of storing customerŌĆÖs virtual address like in Cards Tap customers not having credit/debit cards Suitable for e-Com & m- Com/ Resolves the COD collection problem Single click 2FA facility to the customer - seamless Pull In-App Payments (IAP)

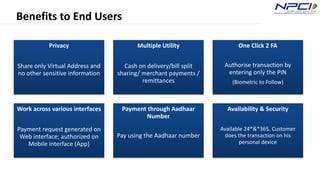

- 6. Benefits to End Users Privacy Share only Virtual Address and no other sensitive information Multiple Utility Cash on delivery/bill split sharing/ merchant payments / remittances One Click 2 FA Authorise transaction by entering only the PIN (Biometric to Follow) Work across various interfaces Payment request generated on Web interface; authorized on Mobile interface (App) Payment through Aadhaar Number Pay using the Aadhaar number Availability & Security Available 24*&*365. Customer does the transaction on his personal device

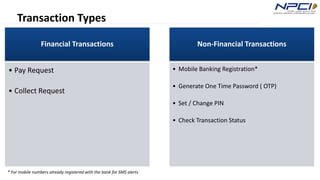

- 7. Transaction Types Financial Transactions ŌĆó Pay Request ŌĆó Collect Request Non-Financial Transactions ŌĆó Mobile Banking Registration* ŌĆó Generate One Time Password ( OTP) ŌĆó Set / Change PIN ŌĆó Check Transaction Status * For mobile numbers already registered with the bank for SMS alerts

- 8. Authentication Authentication First Txn Authorised by Subsequent Txn Authorised by 1st Factor Mobile Number (OTP) Issuer Device Finger print PSP 2nd Factor PIN or Biometrics Issuer PIN or Biometrics Issuer Single Click 2FA

- 9. Simple enabling Steps Step 1 ŌĆó Download PSP App and create Profile Step 2 ŌĆó Add Bank Account/s Step 3 ŌĆó Register for Mobile banking, if not already registered / Generate PIN for Transactions

- 10. Use Cases

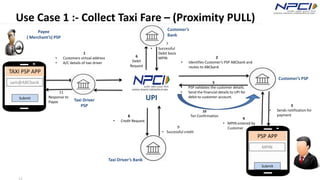

- 11. Use Case 1 :- Collect Taxi Fare ŌĆō (Proximity PULL) TAXI PSP APP sam@ABCbank Submit 1 ŌĆó Customers virtual address ŌĆó A/C details of taxi driver 2 ŌĆó Identifies CustomerŌĆÖs PSP ABCbank and routes to ABCbank Payee ( MerchantŌĆÖs) PSP 5 ŌĆó PSP validates the customer details. ŌĆó Send the financial details to UPI for debit to customer account. CustomerŌĆÖs PSP 4 ŌĆó MPIN entered by Customer9 ŌĆó Successful credit 8 ŌĆó Credit Request PSP APP MPIN Submit 3 ŌĆó Sends notification for payment 10 Txn Confirmation 6 Debit Request 7 ŌĆó Successful Debit basis MPIN CustomerŌĆÖs Bank Taxi DriverŌĆÖs Bank Taxi Driver PSP 11 Response to Payee UPI

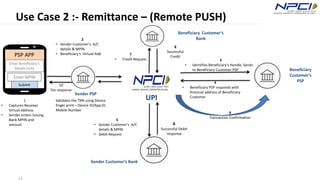

- 12. Use Case 2 :- Remittance ŌĆō (Remote PUSH) 13 PSP APP Enter MPIN Submit 1 ŌĆó Captures Receiver Virtual address. ŌĆó Sender enters Issuing Bank MPIN and amount 2 ŌĆó Sender CustomerŌĆÖs A/C details & MPIN ŌĆó BeneficiaryŌĆÖs Virtual Add 3 ŌĆó Identifies BeneficiaryŌĆÖs Handle. Sends to Beneficiary Customer PSP Beneficiary CustomerŌĆÖs PSP4 ŌĆó Beneficiary PSP responds with financial address of Beneficiary Customer Sender CustomerŌĆÖs Bank 5 ŌĆó Sender CustomerŌĆÖs A/C details & MPIN ŌĆó Debit Request 6 Successful Debit response 7 ŌĆó Credit Request 9 Transaction Confirmation 8 Successful Credit Enter BeneficiaryŌĆÖs Details (V.A) Validates the TXN using Device finger print ŌĆō Device ID/App ID, Mobile Number 10 Txn response Sender PSP Beneficiary CustomerŌĆÖs Bank UPI

- 13. Use Cases