USA bond Presentation (Mr. Rierson)

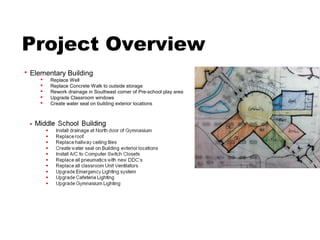

- 1. Project Overview  Elementary Building  Replace Well  Replace Concrete Walk to outside storage  Rework drainage in Southeast corner of Pre-school play area  Upgrade Classroom windows  Create water seal on building exterior locations

- 3. Bond Proposal Shall Unionville-Sebewaing Area Schools, Tuscola and Huron Counties Michigan, borrow the sum of not to exceed Five Million Eight Hundred Fifty Thousand Dollars ($5,850,000) and issue its general obligation unlimited tax bonds therefor, for the purpose of: Partially remodeling, furnishing and refurnishing, equipping and re-equipping facilities; acquiring, installing and equipping educational technology for school facilities; purchasing school buses; construction and equipping a new running track and developing and improving sites? The following is for informational purposes only: No millage will be levied for the proposed bonds in 2013, under current law. The maximum number of years the bonds may be outstanding, exclusive of any refunding, is fourteen (14) years. The estimated simple average annual millage anticipated to be required to retire this bond debt is 2.97 ($2.97 on each $1000.00 of taxable valuation) If the school district borrows from the State to pay debt service on the bonds, the school district may be required to continue to levy mills beyond the term of the bonds to repay the State. (Pursuant to State law, expenditure of bond proceeds must be audited, and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses.)

- 4. What are the additional costs? The state has determined your home or property’s taxable value growth to cap at either 5% or the rate of inflation, whichever is less per year. *The taxable value of your home is approximately one-half the market value of a home or property. See your most recent tax statement for the exact amount of your taxable value. Calculate your tax investment by diving the taxable value* of your home or property by 1000 and then multiply the results by the millage levy. NOTE: One mill = $1.00 per $1,000 of taxable value of a home or property. MILLAGE COST TO TAXPAYERS FOR Proposal One is $5,850,000 0 MILL LEVY INCREASE TAXABLE VALUE* COST/YEAR COST/MO. COST/DAY $ 25,000.00 $ - $ - $ - $ 40,000.00 $ - $ - $ - $ 50,000.00 $ - $ - $ - $ 75,000.00 $ - $ - $ - $ 100,000.00 $ - $ - $ -

- 5. After Additional Bonding Before Additional Bonding Tax Mills needed this Mills needed all Mills Levied Qual. Debt Tax Mills needed all Year issue qualified Debt Mills Levied Qual. Debt Year Debt 2012 2013 7.62 7.00 2012 2013 6.94 7.00 2013 2014 0.00 9.03 7.00 2013 2014 6.90 7.00 2014 2015 0.00 8.86 7.00 2014 2015 6.85 7.00 2015 2016 0.00 8.69 7.00 2015 2016 6.79 7.00 2016 2017 1.63 6.84 7.00 2016 2017 4.59 6.24 2017 2018 2.88 6.69 7.00 2017 2018 4.43 4.42 2018 2019 3.10 6.51 7.00 2018 2019 4.27 4.27 2019 2020 3.30 6.36 7.00 2019 2020 4.12 4.12 2020 2021 3.50 6.20 7.00 2020 2021 3.97 3.97 2021 2022 3.69 6.09 7.00 2021 2022 3.81 3.81 2022 2023 3.88 5.90 7.00 2022 2023 3.66 3.66 2023 2024 4.00 5.76 7.00 2023 2024 3.51 3.51 2024 2025 4.23 5.62 7.00 2024 2025 3.36 3.36 2025 2026 4.40 5.41 7.00 2025 2026 3.21 3.21 2026 2027 4.17 5.09 6.63 2026 2027 3.09 3.09

- 6. 20 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 12 -2 01 3 20 13 -2 01 4 Mills Required 20 14 -2 01 5 20 15 -2 01 6 20 16 -2 01 7 20 17 -2 01 8 20 18 -2 01 9 20 19 -2 Before Bond Issue 02 0 20 20 -2 02 1 20 21 -2 02 2 20 22 -2 02 3 20 After Bond Issue 23 -2 02 4 20 24 -2 02 5 20 25 -2 02 6 20 26 -2 02 7

- 7. 20 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 12 -2 01 3 20 13 -2 01 4 Mills Required 20 14 -2 01 5 20 15 -2 01 6 20 16 -2 01 7 20 17 -2 01 8 20 18 -2 01 9 20 19 -2 Before Bond Issue 02 0 20 20 -2 02 1 20 21 -2 02 2 20 22 -2 02 3 20 After Bond Issue 23 -2 02 4 20 24 -2 02 5 20 25 -2 02 6 20 26 -2 02 7