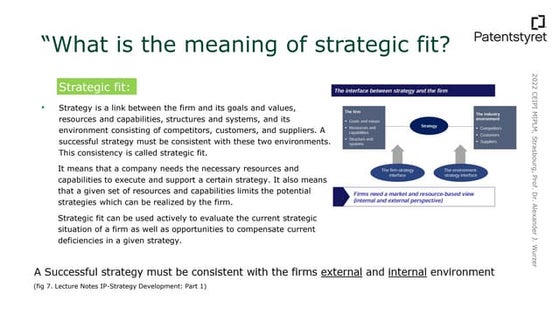

Usd 400 expenses

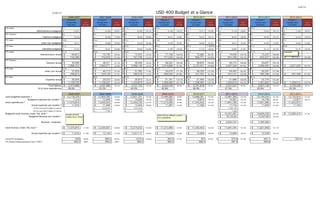

- 1. 5/6/14 4/30/14 USD 400 Budget at a Glance 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 Employee # Employee # Employee # Employee # Employee # Employee # Employee # Employee # Average Salary % of Average Salary % of Average Salary % of Average Salary % of Average Salary % of Average Salary % of Average Salary % of Average Salary % of Total Salary increase Total Salary increase Total Salary increase Total Salary increase Total Salary increase Total Salary increase Total Salary increase Total Salary increase FTE Admin 11 12.3 11.5 10.3 11.2 11.1 10.3 11.3 Administrators budgeted 65,007$ 64,586$ 99.4% 67,856$ 105.1% 72,395$ 106.7% 74,311$ 102.6% 74,130$ 99.8% 78,642$ 106.1% 77,656$ 98.7% FTE Teachers 63 64 65 62 64 60 61 59 Teachers budgeted 42,420$ 48,480$ 114.3% 48,846$ 100.8% 46,201$ 94.6% 46,237$ 100.1% 49,207$ 106.4% 49,791$ 101.2% 50,134$ 100.7% FTE other 12.8 14.4 19.2 13.8 7.6 9.8 9.7 7.6 other cert budgeted 40,611$ 40,806$ 100.5% 43,220$ 105.9% 41,563$ 96.2% 38,942$ 93.7% 38,015$ 97.6% 44,394$ 116.8% 59,402$ 133.8% FTE Class 41.2 42.7 42.8 39.3 40.3 1.0254 39 41.7 40.9 Classified budgeted 22,547$ 28,541$ 126.6% 29,940$ 104.9% 31,594$ 105.5% 31,723$ 100.4% 30,862$ 97.3% 33,114$ 107.3% 35,191$ 106.3% FTE Admin 11.3 10.6 10.6 10 11.1 11.1 11.3 Administrators actual 64,813$ 70,185$ 108.3% 72,425$ 103.2% 77,106$ 106.5% 72,682$ 94.3% 74,936$ 103.1% 75,525$ 100.8% 732,390$ 743,959$ 101.6% 767,709$ 103.2% 771,056$ 100.4% 806,771$ 104.6% 831,790$ 103.1% 853,427$ 102.6% 877,511$ 102.8% FTE Teachers 64 62 64 62 64 60 61 Teachers actual 45,098$ 48,311$ 107.1% 48,409$ 100.2% 48,563$ 100.3% 48,835$ 100.6% 49,125$ 100.6% 50,647$ 103.1% 2,886,253$ 2,995,271$ 103.8% 3,098,148$ 103.4% 3,010,888$ 97.2% 3,125,451$ 103.8% 2,947,520$ 94.3% 3,089,485$ 104.8% 2,957,929$ 95.7% FTE other 14.4 13.1 19.1 16.3 7.6 9.7 8.7 other cert actual 37,959$ 40,773$ 107.4% 31,383$ 77.0% 34,910$ 111.2% 46,205$ 132.4% 44,445$ 96.2% 56,597$ 127.3% 546,613$ 534,129$ 97.7% 599,419$ 112.2% 569,035$ 94.9% 351,161$ 61.7% 431,121$ 122.8% 492,396$ 114.2% 451,456$ 91.7% FET Class 42.7 39.5 41.9 40.7 40.9 41.9 41.5 Classified actual 26,926$ 29,325$ 108.9% 29,973$ 102.2% 31,191$ 104.1% 31,993$ 102.6% 31,996$ 100.0% 33,779$ 105.6% 1,149,730$ 1,158,321$ 100.7% 1,255,879$ 108.4% 1,269,480$ 101.1% 1,308,495$ 103.1% 1,340,616$ 102.5% 1,401,820$ 104.6% 1,439,313$ 102.7% Total Salaries 5,314,986$ 5,431,680$ 102.2% 5,721,155$ 105.3% 5,620,459$ 98.2% 5,591,878$ 99.5% 5,551,047$ 99.3% 5,837,128$ 105.2% 5,726,209$ 98.1% % of total expenditures 48.0% 45.2% 46.5% 49.8% 48.4% 47.5% 49.4% 49.3% 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 total budgeted expenses ^ 12,178,378$ 12,904,382$ 106.0% 13,921,701$ 107.9% 13,449,083$ 96.6% 13,668,361$ 101.6% 13,981,380$ 102.3% 14,144,550$ 101.2% 13,735,910$ 97.1% Budgeted expenses per student ^ 11,016$ 12,840$ 116.6% 14,059$ 109.5% 13,582$ 96.6% 13,874$ 102.1% 14,381$ 103.7% 14,146$ 98.4% 13,877$ 98.1% total expenditures * 11,070,816$ 12,020,023$ 108.6% 12,304,720$ 102.4% 11,275,090$ 91.6% 11,545,453$ 102.4% 11,691,180$ 101.3% 11,821,966$ 101.1% 11,622,972$ Actual expenses per student * 11,016$ 11,960$ 108.6% 12,426$ 103.9% 11,387$ 91.6% 11,566$ 101.6% 11,716$ 101.3% 11,944$ 101.9% 11,743$ #s from year before budget at a glance 12,020,651$ 12,214,252$ 11,691,181$ #s from year before budget at a glance 11,961$ 12,335$ 11,692$ Budgeted total revenue, state, fed, local * 14,341,287$ 14,604,250$ 101.8% 13,395,315$ 91.7% Budgeted Revenue per student * 14,725.63$ 15,501.80$ 105.3% Revenue - Expenses 2,650,107$ 2,782,284$ total revenue, state, fed, local * 11,070,816$ 111.6% 12,020,651$ 108.6% 12,214,252$ 101.6% 11,275,090$ 92.3% 11,545,452$ 102.4% 11,691,181$ 101.3% 11,821,966$ 101.1% Actual expenses per student * 11,016$ 111.8% 12,140$ 110.2% 12,017.17$ 99.0% 11,349$ 94.4% 12,064$ 106.3% 12,004$ 99.5% 12,549$ 104.5% Actual FTE enrollment 1005 99.8% 990.2 98.5% 1016.4 102.6% 993.5 97.7% 957 96.3% 0 973.9 101.8% # 942.1 96.7% 952.4 101.1% FTE Actual including preschool (form 1000) * 990.2 #REF! 990.2 #REF! 990.2 990.2 988.5 997.9 989.8 includes all funds (capital, bond, virtual) 2009-2010 has different numbers from republishing contracted

- 2. These numbers are taken from Budget at a Glance 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 total Budgeted Expenses total expenditure 12,178,378$ total Actual Expenses total expenditures 9,114,119$ 9,920,003$ 108.8% 11,070,816$ These numbers ar general fund budget general fund actuals contingency reserve July 1st Balance 240,662$ 391,552$ Actual sources of Revenue These numbers are taken from Smoky Valley (USD DO400) Mcpherson C State Aid 5,275,399$ 5,365,918$ 101.7% 5,827,921$ 108.6% 5,414,875$ 92.9% 5,922,546$ 109.4% 6,780,447$ 114.5% 7,764,679$ Federal Aid 163,029$ 164,369$ 100.8% 171,830$ 104.5% 178,186$ 103.7% 319,038$ 179.0% 313,373$ 98.2% 331,823$ Local Revenue 2,344,007$ 2,184,821$ 93.2% 2,194,057$ 100.4% 2,922,562$ 133.2% 2,872,535$ 98.3% 2,826,181$ 98.4% 2,974,314$ total revenue 7,782,435$ 7,715,108$ 99.1% 8,193,808$ 106.2% 8,515,623$ 103.9% 9,114,119$ 107.0% 9,920,001$ 108.8% 11,070,816$ State Aid per student 5,295$ 5,394$ 101.9% 6,205$ 115.0% 5,879$ 94.8% 6,234$ 106.0% 6,736$ 108.1% 7,726$ Federal Aid per student 164$ 165$ 101.0% 183$ 110.7% 193$ 105.8% 336$ 173.6% 311$ 92.7% 330$ Local Revenue per student 2,353$ 2,196$ 93.3% 2,336$ 106.4% 3,173$ 135.9% 3,023$ 95.3% 2,808$ 92.9% 2,960$ total spent per student 7,811$ 7,755$ 99.3% 8,723$ 112.5% 9,246$ 106.0% 9,593$ 103.8% 9,855$ 102.7% 11,016$ Enrollment (FTE)* for Budget Authority 996.3 0 994.8 99.8% 939.3 94.4% 921 98.1% 950.1 103.2% 1006.6 105.9% 1005 includes all funds (capital, bond, virtual) from 2008-2009 Budget at a Glace 10% of general fund budget is max tried to close MJH

- 3. 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 12,904,382$ 106.0% 13,921,701$ 107.9% 13,449,083$ 96.6% 13,668,361$ 101.6% 13,981,380$ 102.3% 14,144,550$ 101.2% 13,735,910$ 97.1% 111.6% 12,020,023$ 108.6% 12,304,720$ 102.4% 11,275,090$ 91.6% 11,545,453$ 102.4% 11,691,181$ 101.3% 11,821,966$ 101.1% 12,020,651$ 12,214,252$ Budgeted sources of Revenue State 7,336,879$ 7,288,960$ 99.3% 7,236,510$ 99.3% Federal 372,059$ 365,796$ 98.3% 280,632$ 76.7% Local 6,632,349$ 6,949,494$ 104.8% 5,878,173$ 84.6% total revenue 14,341,287$ 14,604,250$ 101.8% 13,395,315$ 91.7% 11,944$ budgeted rev-accual exp 2,650,106$ 2,782,284$ numbers are taken from the Budget USD#400 - Smoky Valley 6,949,999$ 6,742,567$ 6,862,232$ 6,775,221$ 6,695,860$ 7,969,019$ 7,954,329$ 6,840,633$ 6,749,650$ 7,050,483$ 6,853,681$ 411,220.86$ 6.0% 409,467$ 426,797$ 737,142$ 737,142$ 737,142$ 498,142$ 396,686$ cpherson County, KDOE website Last 13 year % increase 114.5% 8,433,477$ 108.6% 8,449,210$ 100.2% 6,852,467$ 81.1% 6,944,054$ 101.3% 7,336,879$ 105.7% 7,288,960$ 99.3% 138.2% 105.9% 254,341$ 76.6% 276,729$ 108.8% 876,230$ 316.6% 682,923$ 77.9% 372,059$ 54.5% 365,796$ 98.3% 224.4% 105.2% 3,332,833$ 112.1% 3,488,313$ 104.7% 3,546,393$ 101.7% 3,918,475$ 110.5% 3,982,243$ 101.6% 4,167,210$ 104.6% 177.8% 111.6% 12,020,651$ 108.6% 12,214,252$ 101.6% 11,275,090$ 92.3% 11,545,452$ 102.4% 11,691,181$ 101.3% 11,821,966$ 101.1% 151.9% 114.7% 8,517$ 110.2% 8,313$ 97.6% 6,897$ 83.0% 7,256$ 105.2% 7,534$ 103.8% 7,737$ 102.7% 146.1% 106.1% 257$ 77.8% 272$ 106.0% 882$ 323.9% 714$ 80.9% 382$ 53.5% 388$ 101.6% 237.3% 105.4% 3,366$ 113.7% 3,432$ 102.0% 3,570$ 104.0% 4,095$ 114.7% 4,089$ 99.9% 4,423$ 108.2% 188.0% 111.8% 12,140$ 110.2% 12,017$ 99.0% 11,349$ 94.4% 12,064$ 106.3% 12,004$ 99.5% 12,549$ 104.5% 160.6% 99.8% 990.2 98.5% 1016.4 102.6% 993.5 97.7% 957 96.3% 973.9 101.8% 942.1 96.7% 952.4 101.1% Budget at a Glance # 9 ace from 2009-2010 Budget at a Glance Verual School funding changed State Pre-K funded at this year and therafter 6% of general fund budget is maxMJH closed closed MES 4th grade Closed MES

- 4. USD 400 Enrollment FY01 FY02 FY03 FY04 FY05 FY06 FY07 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 FTE Enrollment from state work sheet 996.3 994.8 99.8% 939.3 94.4% 921 98.1% 950.1 103.2% 1006.6 105.9% 1005 99.8% From USD 400 996.3 994.8 99.8% 939.3 94.4% 921 98.1% 950.1 103.2% 1006.6 105.9% 1005 99.8% Enrollment (FTE)* Republished for Budget Authority 1464.3 1449.1 99.0% 1557.7 107.5% 1513.2 97.1% 1528 101.0% 1533 100.3% 1581.2 103.1% 2013-2014 Instruction Expen (1000) 2013-2014 Enrollment Information 2012-2013 Instruction Expen (1000) 2012-2013 Enrollment Information 2011-2012 Instruction Expen (1000) 2011-2012 Enrollment Information 2010-2011 Instruction Expen (1000) 2010-2011 Enrollment Information 1005 2009-2010 Instruction Expen (1000) 2009-2010 Enrollment Information 1006.6 1005 99.8% 2008-2009 Instruction Expen (1000) 1005 2008-2009 Enrollment Information 950.1 1006.6 105.9% 1005 99.8% 2007-2008 Instruction Expen (1000) 1006.6 1005 2007-200 Enrollment Information 921 950.1 103.2% 1006.6 105.9% 1005 99.8% 2006-2007 Instruction Expen (1000) 950.1 1006.6 1006.6 2006-2009 Enrollment Information 939.3 921 98.1% 950.1 103.2% 1006.6 105.9% 1006.6 100.0% 9/20/069/20/059/20/00 9/20/01 9/20/02 9/20/03 9/20/04

- 5. USD 400 Enrollment FY08 FY09 FY10 FY11 FY12 FY13 FY14 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 990.2 98.5% 1016.4 102.6% 993.5 97.7% 957 96.3% 973.9 101.8% 942.1 96.7% 990.2 98.5% 1016.4 102.6% 993.5 97.7% 957 96.3% 973.9 101.8% 942.1 96.7% 952.4 101.1% 1626.3 102.9% 1679.3 103.3% 1678.4 99.9% 1696.5 101.1% 1746.4 102.9% 1746.4 100.0% 1751.2 100.3% 997.9 989.8 989.8 954.7 914.8 95.8% 922.7 100.9% 861.7 93.4% 861.7 100.0% 988.5 999.9 999.9 938.8 954.7 101.7% 914.8 95.8% 922.7 100.9% 922.7 100.0% 1003.7 998.2 972.2 990.2 938.8 94.8% 954.7 101.7% 914.8 95.8% 897 98.1% 990.2 990.2 985.2 990.2 98.5% 938.8 94.8% 954.7 101.7% 954.7 100.0% 1005 990.2 990.2 990.2 98.5% 938.8 94.8% 938.8 100.0% 1005 990.2 990.2 98.5% 990.2 100.0% 1005 986.5 98.2% 9/20/11 9/20/12 9/20/139/20/07 9/20/08 9/20/09 9/20/10

- 6. USD 400 Enrollment enrollment FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 9/20/00 9/20/01 9/20/02 9/20/03 9/20/04 9/20/05 9/20/06 9/20/07 9/20/08 9/20/09 9/20/10 9/20/11 9/20/12 9/20/13 K .5 30 23.5 39.5 34 39.5 38 33.5 37 39.5 38.5 32 46.3 39.2 1st 70 59 56 75 64 77 77 58 68 57 66 50.6 73.2 2nd 73 61 59 63 80 60 69 74 62 69 65 68.8 59.4 3rd 66 67 64 71 66.1 75 58 70 74 62 63 60.2 63 4th 72 77 77 66.1 80 69 74 65.1 68 73.1 66 66 66.7 5th 76 75.1 78.2 83 73.2 77 70 83 75.1 70 75.1 69.2 75.4 6th 79 76 75.2 78 87 70.2 77 75 87.1 75.8 75 77.9 77.3 7th 71.3 76 77.1 81.1 86.8 88.1 73.5 83.1 78.6 82.4 82.1 68 69.8 8th 90.3 77 78.2 83 83.2 84 84.3 78.6 86.8 76 80 81 69.4 9th 76.4 69 75.4 77.4 90.6 85 82.9 96.1 74.9 84 82.6 84.1 90.8 10th 95 96 71 81 84.7 95 99.1 89.9 84.8 81.2 90 77.1 82.4 11th 100.8 79 88.5 73 90.7 87.7 94.2 97.6 87.5 84.5 81.9 83.5 76 12th 89.9 90 76.9 80.9 73.8 86.8 81.2 93 89.7 85.6 86.7 85.7 86.8 Pre school sp ed .5 2.5 3 2 2.5 5 3.5 5 5 4 3 8 2.5 2 Non-graded 4.1 10.7 3 1.1 2 8.7 11.5 0 1.5 2.9 8.5 9.2 9 total 996.3 994.8 939.3 921 950.1 1006.6 1005 990.2 1005.4 981.5 945 961.9 930.1 940.4 Less Virtual School -29.6 -30.2 -39.2 -68.4 -83.2 total USD 400 Enrollment 996.3 994.8 939.3 921 950.1 1006.6 1005 990.2 1005.4 951.9 914.8 922.7 861.7 857.2 State Pre-K 11 14 14 14 14 14 State Pre-K not funded -2 -2 -2 -2 -2 Grand total Enrollment 996.3 994.8 939.3 921 950.1 1006.6 1005 990.2 1016.4 993.5 957 973.9 942.1 952.4 Enrollment (FTE)* for Budget 1031 996.3 994.8 939.3 921 990 1006.6 1005 950.1 955.9 954.7 922.2 922.7 882 Enrollment (FTE)* Republished for Budget 1031 1007.4 994.8 951.7 950.1 1006.6 1006.6 1005 1005.4 961.2 954.7 930.7 922.7 880.5 Enrollment (FTE)* for Budget Authority 1466.1 1436.1 1563.5 1497.1 1491.7 1508.7 1573.4 1619.5 1680.3 1647.7 1680.6 1728.7 1765.5 1734.2 Enrollment (FTE)* Republished for Budget Authority 1464.3 1449.1 1557.7 1513.2 1528 1533 1581.2 1626.3 1679.3 1678.4 1696.5 1746.4 1746.4 1751.2

- 7. ╠²$-┬ŁŌĆÉ ╠² ╠² ╠² ╠²$2,000,000 ╠² ╠²$4,000,000 ╠² ╠²$6,000,000 ╠² ╠²$8,000,000 ╠² ╠²$10,000,000 ╠² ╠²$12,000,000 ╠² ╠²$14,000,000 ╠² 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 total ╠²revenue spent ╠²per ╠²student Enrollment ╠²(FTE)

- 8. 860 880 900 920 940 960 980 1000 1020 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Enrollment ╠²(FTE) Enrollment ╠²(FTE)

- 9. These numbers are taken from Budget at a Glance 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 total revenue 7,782,435$ 7,715,108$ 8,193,808$ 8,515,623$ 9,114,119$ 9,920,001$ 11,070,816$ 12,020,651$ 12,214,252$ 11,275,090$ 11,545,452$ 11,691,181$ 11,821,966$ 151.9% spent per student 7,811$ 7,755$ 8,723$ 9,246$ 9,593$ 9,855$ 11,016$ 12,140$ 12,017$ 11,349$ 12,064$ 12,004$ 12,549$ 160.6% Enrollment (FTE) 996.3 994.8 939.3 921 950.1 1006.6 1005 990.2 1016.4 993.5 957 973.9 942.1 952.4 total expenditure 12,178,378$ 12,904,382$ 13,921,701$ 13,449,083$ 13,668,361$ 13,981,380$ 14,144,550$ 13,735,910$ total expenditures 9,114,119$ 9,920,003$ 11,070,816$ 12,020,023$ 12,304,720$ 11,275,090$ 11,545,453$ 11,691,181$ 11,821,966$ 12,020,651$ 12,214,252$ Budgeted sources of Revenue 7,336,879$ 7,288,960$ 7,236,510$ 372,059$ 365,796$ 280,632$ 6,632,349$ 6,949,494$ 5,878,173$ 14,341,287$ 14,604,250$ 13,395,315$ 11,944$ 2,650,106$ 2,782,284$ These numbers are taken from the Budget USD#400 - Smoky Valley general fund budget 6,949,999$ 6,742,567$ 6,862,232$ 6,775,221$ 6,695,860$ general fund actuals 7,969,019$ 7,954,329$ 6,840,633$ 6,749,650$ 7,050,483$ 6,853,681$ 411,220.86$ contingency reserve July 1st Balance 240,662$ 391,552$ 409,467$ 426,797$ 737,142$ 737,142$ 737,142$ 498,142$ 396,686$ These numbers are taken from Smoky Valley (USD DO400) Mcpherson County, KDOE website Last 13 year % increase State Aid 5,275,399$ 5,365,918$ 5,827,921$ 5,414,875$ 5,922,546$ 6,780,447$ 7,764,679$ 8,433,477$ 8,449,210$ 6,852,467$ 6,944,054$ 7,336,879$ 7,288,960$ 138.2% Federal Aid 163,029$ 164,369$ 171,830$ 178,186$ 319,038$ 313,373$ 331,823$ 254,341$ 276,729$ 876,230$ 682,923$ 372,059$ 365,796$ 224.4% Local Revenue 2,344,007$ 2,184,821$ 2,194,057$ 2,922,562$ 2,872,535$ 2,826,181$ 2,974,314$ 3,332,833$ 3,488,313$ 3,546,393$ 3,918,475$ 3,982,243$ 4,167,210$ 177.8% State Aid per student 5,295$ 5,394$ 6,205$ 5,879$ 6,234$ 6,736$ 7,726$ 8,517$ 8,313$ 6,897$ 7,256$ 7,534$ 7,737$ 146.1% Federal Aid per student 164$ 165$ 183$ 193$ 336$ 311$ 330$ 257$ 272$ 882$ 714$ 382$ 388$ 237.3% Local Revenue per student 2,353$ 2,196$ 2,336$ 3,173$ 3,023$ 2,808$ 2,960$ 3,366$ 3,432$ 3,570$ 4,095$ 4,089$ 4,423$ 188.0% includes all funds (capital, bond, virtual) from 2008-2009 Budget at a Glace from 2009-2010 Budget at a Glance tried to close MJH Verual School funding changed

- 10. FY01 FY02 FY03 FY04 FY05 FY06 FY07 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 Actual Sept 20th enrolment Form 150 Estimated sept 20th at risk 4 yr olds Form 150 Estimated Sept 20th enrolment Form 150 Sept 20th enrolment Form 150 for Budgeting Enrollment (FTE)* for Budget Authority Enrollment (FTE)** preschool, headstart & ADK FTE on Sept 20th Actual including preschool 9/20/069/20/059/20/00 9/20/01 9/20/02 9/20/03 9/20/04 FY08 FY09 FY10 FY11 FY12 FY13 FY14 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 861.7 12 861.7 894 1045.4 ? 1024 ? 9/20/12 9/20/139/20/07 9/20/08 9/20/09 9/20/10 9/20/11

![Exploring the State of Facilities 2014 [Part 4]: Operations Effectiveness & E...](https://cdn.slidesharecdn.com/ss_thumbnails/2014stateoffacilitieswebinarpart4-pdf-141120131415-conversion-gate01-thumbnail.jpg?width=560&fit=bounds)