USDA Mortgage Presentation

- 1. USDA Rural Housing Mortgage Ed Gillespie, First Priority Financial (916) 849-9200

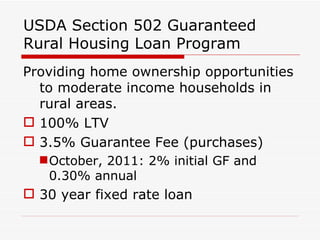

- 2. USDA Section 502 Guaranteed Rural Housing Loan Program Providing home ownership opportunities to moderate income households in rural areas. 100% LTV 3.5% Guarantee Fee (purchases) October, 2011: 2% initial GF and 0.30% annual 30 year fixed rate loan

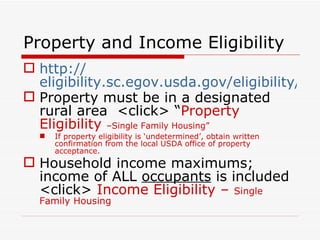

- 3. Property and Income Eligibility http:// eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do Property must be in a designated rural area <click> ŌĆ£ Property Eligibility ŌĆōSingle Family HousingŌĆØ If property eligibility is ŌĆśundeterminedŌĆÖ, obtain written confirmation from the local USDA office of property acceptance. Household income maximums; income of ALL occupants is included <click> Income Eligibility ŌĆō Single Family Housing

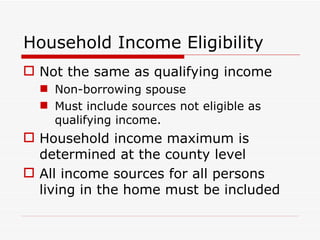

- 4. Household Income Eligibility Not the same as qualifying income Non-borrowing spouse Must include sources not eligible as qualifying income. Household income maximum is determined at the county level All income sources for all persons living in the home must be included

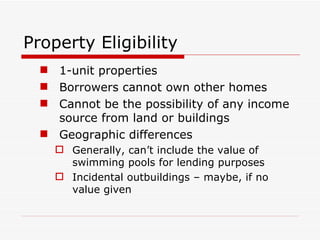

- 5. Property Eligibility 1-unit properties Borrowers cannot own other homes Cannot be the possibility of any income source from land or buildings Geographic differences Generally, canŌĆÖt include the value of swimming pools for lending purposes Incidental outbuildings ŌĆō maybe, if no value given

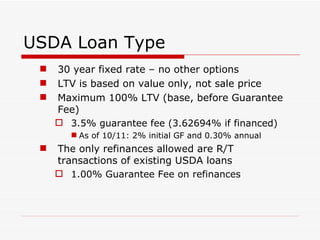

- 6. USDA Loan Type 30 year fixed rate ŌĆō no other options LTV is based on value only, not sale price Maximum 100% LTV (base, before Guarantee Fee) 3.5% guarantee fee (3.62694% if financed) As of 10/11: 2% initial GF and 0.30% annual The only refinances allowed are R/T transactions of existing USDA loans 1.00% Guarantee Fee on refinances

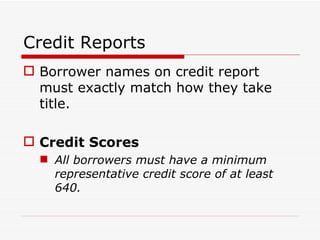

- 7. Credit Reports Borrower names on credit report must exactly match how they take title. Credit Scores All borrowers must have a minimum representative credit score of at least 640.

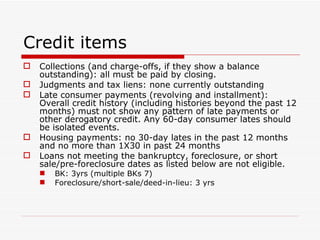

- 8. Credit items Collections (and charge-offs, if they show a balance outstanding): all must be paid by closing. Judgments and tax liens: none currently outstanding Late consumer payments (revolving and installment): Overall credit history (including histories beyond the past 12 months) must not show any pattern of late payments or other derogatory credit. Any 60-day consumer lates should be isolated events. Housing payments: no 30-day lates in the past 12 months and no more than 1X30 in past 24 months Loans not meeting the bankruptcy, foreclosure, or short sale/pre-foreclosure dates as listed below are not eligible. BK: 3yrs (multiple BKs 7) Foreclosure/short-sale/deed-in-lieu: 3 yrs

- 9. Questions? Assistance? Ed Gillespie, First Priority Financial (916) 849-9200