Value chain Financing.pptxjfjffjfjcjfjfju

- 1. Introduction ŌĆó Some of the constraints related to product and financial markets that smallholders face can be mitigated using value chain approach. ŌĆó It brings chain actors including farmers, aggregators, traders, processors, and financial institutions together to gain control over the processes of production, marketing, processing, and distribution so as to reduce transaction costs and enhance competitiveness of the entire chain ŌĆó For financial institutions, value chains can serve an important entry point to enhance their outreach to chain actors, mainly small-scale producers and entrepreneurs, and to reduce transaction costs and risks associated with small-sized loans. ŌĆó Through value chain, a financial institution can obtain information on potential borrowers at a little or no cost

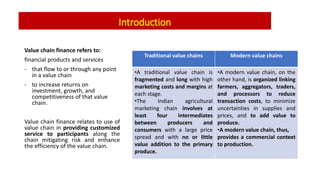

- 2. Introduction Value chain finance refers to: financial products and services - that flow to or through any point in a value chain - to increase returns on investment, growth, and competitiveness of that value chain. Value chain finance relates to use of value chain in providing customized service to participants along the chain mitigating risk and enhance the efficiency of the value chain. 4 htsxnrgjsfhmfbxgnxgfxhm Traditional value chains Modern value chains ŌĆóA traditional value chain is fragmented and long with high marketing costs and margins at each stage. ŌĆóThe Indian agricultural marketing chain involves at least four intermediates between producers and consumers with a large price spread and with no or little value addition to the primary produce. ŌĆóA modern value chain, on the other hand, is organized linking farmers, aggregators, traders, and processors to reduce transaction costs, to minimize uncertainties in supplies and prices, and to add value to produce. ŌĆóA modern value chain, thus, provides a commercial context to production.

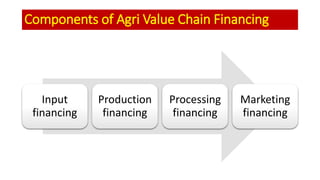

- 3. Components of Agri Value Chain Financing Input financing Production financing Processing financing Marketing financing 5 htsxnrgjsfhmfbxgnxgfxhm

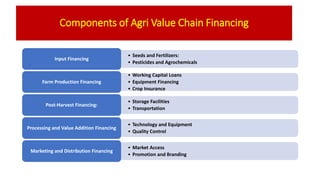

- 4. ŌĆó Seeds and Fertilizers: ŌĆó Pesticides and Agrochemicals Input Financing ŌĆó Working Capital Loans ŌĆó Equipment Financing ŌĆó Crop Insurance Farm Production Financing ŌĆó Storage Facilities ŌĆó Transportation Post-Harvest Financing: ŌĆó Technology and Equipment ŌĆó Quality Control Processing and Value Addition Financing ŌĆó Market Access ŌĆó Promotion and Branding Marketing and Distribution Financing Components of Agri Value Chain Financing

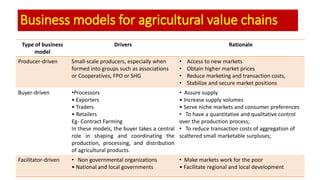

- 5. Business models for agricultural value chains Type of business model Drivers Rationale Producer-driven Small-scale producers, especially when formed into groups such as associations or Cooperatives, FPO or SHG ŌĆó Access to new markets ŌĆó Obtain higher market prices ŌĆó Reduce marketing and transaction costs, ŌĆó Stabilize and secure market positions Buyer-driven ŌĆóProcessors ŌĆó Exporters ŌĆó Traders ŌĆó Retailers Eg- Contract Farming In these models, the buyer takes a central role in shaping and coordinating the production, processing, and distribution of agricultural products. ŌĆó Assure supply ŌĆó Increase supply volumes ŌĆó Serve niche markets and consumer preferences ŌĆó To have a quantitative and qualitative control over the production process; ŌĆó To reduce transaction costs of aggregation of scattered small marketable surpluses; Facilitator-driven ŌĆó Non governmental organizations ŌĆó National and local governments ŌĆó Make markets work for the poor ŌĆó Facilitate regional and local development

- 6. Types of value chain finance Internal value chain finance: When a supplier gives credit to a farmer External value chain finance: When a bank gives a loan to a farmer based on a contract with a trusted buyer or a warehouse receipt from a recognized storage facility

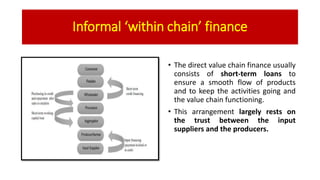

- 7. Informal ŌĆświthin chainŌĆÖ finance ŌĆó The direct value chain finance usually consists of short-term loans to ensure a smooth flow of products and to keep the activities going and the value chain functioning. ŌĆó This arrangement largely rests on the trust between the input suppliers and the producers.

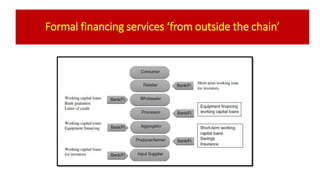

- 8. Formal financing services ŌĆśfrom outside the chainŌĆÖ

- 9. Value Chain Models and Financial Instruments 1. Product Financing (A)Aggregator Credit: Aggregator provides advance loans to producer and these loans are repaid just after the harvest. Under this kind of system, the aggregator provides insurance to producer that he will procure product by financing the production. Aggregators may be medium or large farmers or cooperatives or other farmer producer organization. (B) Input Supplier Credit: Input supplier credit is the primary source of credit to small and poor farmers. Under this system, input suppliers provide agricultural inputs such as chemicals, seeds, fertilizers and equipment as a loan to the producer, and this loan must be repaid by the producer just after the harvest or any other mutually decided time.

- 10. 2. LeadFirm Financing/Contract Farming ŌĆó In this system, a lead firm gives direct credit to foundation player in the chain including producers. ŌĆó In this the farmer produces crop under guaranteed buyback agreement and the lead firm finances all requirements at the production stage. The lead firm not only supplies inputs and working capital but also finances extension services, high-quality crop seeds, technology transfer, training and supervision of production. ŌĆó The lead firm plays a very crucial and central role in the production cycle

- 11. 3. Receivable Financing ŌĆó Receivables finance is generally used for immediate cash flow by businesses to convert sales on credit terms ŌĆó Receivable finance, also known as accounts receivable financing, is a financial arrangement where a business (such as a participant in the agricultural value chain) uses its outstanding receivables as collateral to secure financing.

- 12. 4. Physical-asset collateralization (A) Warehouse receipts: Farmers or other value chain enterprises receive a receipt from a certified warehouse that can be used as collateral to access a loan from third-party financial institutions against the security of goods in an independently controlled warehouse (B) Financial lease: The financier retains ownership of the goods until full payment is made, making it easy to recover goods if payment is not made, while allowing agribusinesses and farmers to use and purchase machinery, vehicles and other large-ticket items without requiring the collateral otherwise needed for such a purchase

- 13. 5. Risk Mitigation products (A) Insurance: Insurance products are used to reduce risks by pooling regular payments of many clients and paying out to those affected by losses (B)Forward contract: It is a contract between two parties to buy or sell goods/asset at a specified price on a future date. These are not traded on centralized exchanges. ( C) Futures: Futures are financial contracts between buyer and seller to buy or sell commodities/asset at a predetermined future date and price. Futures contract details specify quality and quantity of the commodities/asset and are standardized to facilitate trading on futures exchange.

- 14. 6. Financial enhancements ŌĆó (A) Loan guarantees: Third-party loan guarantees to agriculture loans by public or private organizations reduce lending risks to banks and other lending entities. This facilitates increased lending to agriculture sector ŌĆó (B) Joint-venture finance: Joint-venture finance is a form of shared-owner equity finance between private and/or public partners or shareholders. Joint-venture finance creates opportunities for shared ownership, returns and risks. Partners also often bring complementary technical expertise and natural, financial and market access resources

Editor's Notes

- #5: ┬® Copyright Showeet.com ŌĆō Free PowerPoint Templates

![Presentation1[1].pptx JHAKShsHHHHHHHHHHHHHHHHHHH](https://cdn.slidesharecdn.com/ss_thumbnails/presentation11-240616122800-7ad0e6ef-thumbnail.jpg?width=560&fit=bounds)