Value of currency

- 2. Table of Contents Forex Market Factors / Affects Floating vs. Fixed (Int'l Pegs) China Euro EtcâĶ

- 3. Forex Market Largest market in the world Perfect competition $3.98 trillion traded daily 1.490 in spot transactions $475 billion in outright forwards 1.765 trillion in foreign exchange swaps $43 billion currency swaps 207 billion in options and other products

- 4. Where Global system, no central place where it is exchanged / clearing house $1.85 trillion (37%) of trades occur in London (IMF stats) New York City = 17.9% Tokyo = 6.2% Futures are traded on the Chicago Mercantile Exchange / (RMB) Korea, South Africa, India all have their currency traded on their own exchanges Banks will exchange currency for you

- 5. Who Inter-bank = 53% of all transactions Can see demand before others See next slide Central Banks Control supply Multi-National Corp's Hedge funds

- 6. Top 10 currency traders (% of overall volume, May, 2010) Deutsche Bank 18.06% UBS AG 11.30% Barclays Capital 11.08% Citi 7.69% Royal Bank of Scotland 6.50% JPMorgan Chase 6.35% HSBC 4.55% Creidt Suisse Goldman Sachs 4.28% Morgan Stanley 2.91%

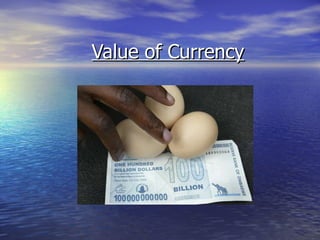

- 7. Factors Governance Economic policies Monetary policies Legal system Defense force Commercial policies Education Industrial policies Accounting principles Banking policies Law enforcement Transportation policies Agricultural policies Backed by the sum total of the underlying value systems in an economy

- 8. What affects a currency Basic Macroeconomic conditions Monetary flows caused by changes in GDP growth Inflation Interest rates Budget and trade deficits / surpluses Media

- 9. Fixed vs. Floating Reasons for fixing: Short-term economic stability Control Inflation Trade more predictable (small/export countries) Reasons for floating: Belief in free market policy Gives real time value of the system you are buying into

- 10. Who Pegs to Who? Dark green: USD / Light green: Currencies pegged to USD Dark Blue: Eurozone users / Light Blue: Currencies pegged to Euro

- 11. Countries who Peg their currency to the USD Hong Kong dollar (narrow band) Jordanian dinar Lebanese pound Maldivian rufiyaa Netherlands Antillean gulden Omani rial Panamanian balboa (at par) Qatari riyal Saudi riyal Trinidad and Tobago dollar United Arab Emirates dirham Venezuelan bolÃvar Aruban florin Bahamian dollar (at par) Bahraini dinar Barbadian dollar Belize dollar Bermudian dollar (at par) Cayman Islands dollar Cuban convertible peso Djiboutian franc East Caribbean dollar Eritrean nakfa

- 12. How they do it Buying and selling their own currency on an open market (why they maintain reserves) Make it illegal to trade = black market US Fed determines its interest rate & money supply

- 13. China: Basic Things to Know Renminbi & Chinese Yuan: Same as Sterling and Pound Yuan(CNY) is the unit of account (Pound) Renminbi(RMB) is the actual currency (Sterling) Futures are traded on the Chicago Mercantile Exchange (RMB)

- 14. USDCNY Peg was lifted Financial Crisis hit (Safe Haven)

- 15. China: Pegged to Basket Trade Surplus Receive interest payments in USD Managed float = Unknown Basket USD (mostly) Euro South Korean Won Japanese Yen

- 16. Euro 2 nd largest reserve currency 2 nd most traded currency in the world EURUSD 27% of Spot currency market PIIGS Short-term: Would be better off if they werenât on the Euro. Canât devalue currency to stimulate economy.

- 17. EtcâĶ Currency War = Same idea as price war between companies Purchasing power parity = balancing act between domestic and int'l needs