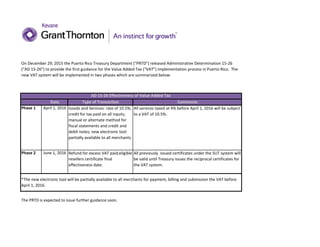

Vat effectiveness in Puerto Rico

- 1. Date Type of Transaction Phase 1 April 1, 2016 Phase 2 June 1, 2016 The PRTD is expected to issue further guidance soon. *The new electronic tool will be partially available to all merchants for payment, billing and submission the VAT before April 1, 2016. On December 29, 2015 the Puerto Rico Treasury Department ("PRTD") released Administrative Determination 15-26 (ŌĆ£AD 15-26ŌĆØ) to provide the first guidance for the Value Added Tax (ŌĆ£VATŌĆØ) implementation process in Puerto Rico. The new VAT system will be implemented in two phases which are summarized below: All previously issued certificates under the SUT system will be valid until Treasury issues the reciprocal certificates for the VAT system. AD 15-26 Effectiveness of Value Added Tax All services taxed at 4% before April 1, 2016 will be subject to a VAT of 10.5%. Comments Goods and Services: rate of 10.5%; credit for tax paid on all inputs; manual or alternate method for fiscal statements and credit and debit notes; new electronic tool partially available to all merchants. Refund for excess VAT paid;eligible resellers certificate final effectiveness date.