Volker Bromund ECA case study USD 10 2016

1 like187 views

The document discusses buyer financing through export credit agencies. It provides an example of a German exporter providing goods to an Indonesian importer, with the import financing backed by a 95% loan from the importer's bank. The bank loan is insured by the export credit agency. Key benefits for importers include more favorable financing terms than local options, with longer tenors of 5-10 years and lower interest rates. Requirements for the importer include a minimum credit rating and financial profile.

1 of 9

Download to read offline

Recommended

Real estate principles_powerpoint_for_chapter_12

Real estate principles_powerpoint_for_chapter_12Morten Andersen

╠²

The document discusses consumer loan regulations and requirements in the United States. It outlines that the Truth-in-Lending Act and its related Regulation Z require lenders to disclose loan costs and terms to borrowers, including the annual percentage rate (APR), amount financed, payment schedule, and total payments. It also describes borrowers' right to rescind a loan within three days and restrictions against discriminatory lending practices like redlining.BG/SBLC AVAILABLE FOR LEASE

BG/SBLC AVAILABLE FOR LEASEkumar soni

╠²

Dear sir,

We are project funder with our cutting edge and group capital fund we can finance your signatory projects and help you to enhance your business plan, our financial instrument can be used for purchase of good from any manufacturer irrespective of location. We specialized in BG, SBLC, MTN, CD,LC , Non collateral loan, confirmable Bank Draft and other financial assistance from AAA rated bank (Prime Bank). The financial instrument can be invested into High Yield Trading Program or Private Placement Programme (PPP). Please see our instrument description and leasing procedure as follow.DESCRIPTION OF INSTRUMENT:

1. Instrument: Bank Guarantee {BG}/StandBy Letter of Credit{SBLC}(Appendix A)

2. Total Face Value: Eur/USD 1M{Minimum} to Eur/USD 10B{Maximum}

3. Issuing Bank: AAA Rated Bank (Prime Bank)

4. Age: One Year and One Day

5. Leasing Price: 5.0%+1%=6%

6. Delivery: S.W.I.F.T MT-760

7. Payment: MT103 (TT/WT)

8. Hard Copy: Bonded Courier Service We specialize in Bank Guarantee lease and sales, there are two types of bank guarantee which are Direct Bank Guarantee and Indirect Bank Guarantee. Its used as Bid Bond, Payment Guarantees, Letter of Indemnity, Guarantee Securing Credit Line, Advance Payment Guarantees, Performance Bond Guarantee E.T.C.Intermediaries/Consultant ts/Brokers are welcome to bring their clients and are 100% protected. In complete confidence, we will work together for the benefits of all parties involved.

For further inquiries contact

sonilease@gmail.com

Skype ID: soniklease1

Thank youBG/SBLC AVAILABLE FOR LEASE

BG/SBLC AVAILABLE FOR LEASEkumar soni

╠²

Dear sir,

We are project funder with our cutting edge and group capital fund we can finance your signatory projects and help you to enhance your business plan, our financial instrument can be used for purchase of good from any manufacturer irrespective of location. We specialized in BG, SBLC, MTN, CD,LC , Non collateral loan, confirmable Bank Draft and other financial assistance from AAA rated bank (Prime Bank). The financial instrument can be invested into High Yield Trading Program or Private Placement Programme (PPP). Please see our instrument description and leasing procedure as follow.DESCRIPTION OF INSTRUMENT:

1. Instrument: Bank Guarantee {BG}/StandBy Letter of Credit{SBLC}(Appendix A)

2. Total Face Value: Eur/USD 1M{Minimum} to Eur/USD 10B{Maximum}

3. Issuing Bank: AAA Rated Bank (Prime Bank)

4. Age: One Year and One Day

5. Leasing Price: 5.0%+1%=6%

6. Delivery: S.W.I.F.T MT-760

7. Payment: MT103 (TT/WT)

8. Hard Copy: Bonded Courier Service We specialize in Bank Guarantee lease and sales, there are two types of bank guarantee which are Direct Bank Guarantee and Indirect Bank Guarantee. Its used as Bid Bond, Payment Guarantees, Letter of Indemnity, Guarantee Securing Credit Line, Advance Payment Guarantees, Performance Bond Guarantee E.T.C.Intermediaries/Consultant ts/Brokers are welcome to bring their clients and are 100% protected. In complete confidence, we will work together for the benefits of all parties involved.

For further inquiries contact

sonilease@gmail.com

Skype ID: soniklease1

Thank youFormat

Formatkumar soni

╠²

This document describes financial instruments that can be used to fund projects or enhance business plans, including bank guarantees, standby letters of credit, and other banking instruments. It provides details on the types of instruments available such as face value ranging from 1 million to 10 billion Euros/USD, issuance from AAA rated prime banks, and a leasing price of 5%+1% of the face value. Inquiries can be directed to the contact provided for further discussion on acquiring these instruments.Kumar sonik

Kumar sonikkumar soni

╠²

We specialize in Bank Guarantee lease, there are two types of bank guarantee which are Direct Bank Guarantee and Indirect Bank Guarantee. Its used as Bid Bond, Payment Guarantees, Letter of Indemnity, Guarantee Securing Credit Line, Advance Payment Guarantees, Performance Bond Guarantee E.T.C.

Intermediaries/Consultants/Brokers are welcome to bring their clients and are 100% protected. In complete confidence, we will work together for the benefits of all parties involved.

Thank you

Email: sonilease@gmail.com

Skype: soniklease1

▒╩░∙▒▓§▒▓į│┘▓╣│”Š▒├│▓į1Anabel Belandria

╠²

Trajes de ba├▒os Hawaii mar fashion se estableci├│ en Caracas, Venezuela para brindar un buen servicio a nivel nacional e internacional con trabajadores calificados. La compa├▒├Ła se enfoca en ropa deportiva y de playa y busca satisfacer las necesidades del mercado. Pr├│ximamente ofrecer├Īn blusas, vestidos, monos deportivos y m├Īs prendas.Presentation1

Presentation1oyepeju

╠²

ECA is a proposed laptop rental business targeting Rutgers Newark students. It will rent Dell laptops on flexible terms including semester, month, week, and day rates. Based on a survey, 55% of students prefer semester rentals. Dell was the preferred brand. The business will operate out of the campus center and use low-cost promotions like flyers and campus newspaper ads. It projects breaking even with 100 laptops rented at projected utilization and rental rates.

Gerencia de proyectoscadavidsalome

╠²

La gerencia de proyectos es un ├Īrea de conocimiento que se encarga de planificar, organizar y dirigir los recursos para alcanzar los objetivos de un proyecto. El mapa conceptual presenta los conceptos clave de la gerencia de proyectos como el alcance, tiempo, costo y calidad, as├Ł como las herramientas para su gesti├│n como el cronograma de actividades, el presupuesto y los informes de avance. El documento fue elaborado por Margarita Gaviria en junio de 2013 como una gu├Ła sobre los principios b├Īsicos de la gerencia deBachir el nakib comparison between international payments

Bachir el nakib comparison between international payments Bachir El-Nakib, CAMS

╠²

The document compares the risks for exporters and importers between international payments and documentary trade finance. International payments like open accounts, collections, and letters of credit each allocate risk differently between exporters and importers. Trade finance tools from organizations like the SBA and Export-Import Bank can help exporters obtain financing to fulfill export orders or insure against risks like buyer default. Various trade finance products provide options to support international trade on different payment terms.Trade Finance Basics

Trade Finance Basicsmaheshpadwal

╠²

The document discusses various types of trade finance instruments including letters of credit, bills of exchange, and guarantees. It provides details on how letters of credit work, involving an importer, exporter, issuing bank, advising bank, and reimbursing bank. The key parties and processes are defined. It also explains the different types of guarantees commonly used in international trade, including bid guarantees, advance payment guarantees, and performance guarantees. The mechanics of how a transaction involving a guarantee is processed between the applicant, issuing bank, advising bank, and beneficiary are outlined.HERMES Export Credit Finance Case Study Indonesia Volker Bromund

HERMES Export Credit Finance Case Study Indonesia Volker BromundVolker Bromund

╠²

The document summarizes an Export Credit Agency (ECA) buyer financing program with HERMES coverage offered by Landesbank Baden-W├╝rttemberg (LBBW). The program provides long-term financing for capital goods and services exported from Germany, with a minimum loan amount of $2 million. LBBW reimburses the importer after payment is made to the German exporter under a letter of credit. The financing covers up to 85% of the contract value, has terms of 5-10 years, and offers competitive interest rates without requiring collateral from the creditworthy importer.Factoring

FactoringUjjwal 'Shanu'

╠²

This document provides information on factoring and forfaiting. It defines factoring as the purchase of accounts receivables by a factoring company, which provides financing, debt collection services, and protects against bad debts. Forfaiting involves the outright sale of receivables to a forfaiter at a discounted price without recourse to the seller. The key differences between the two are that factoring is for ongoing arrangements, provides various services, and has no minimum transaction size, while forfaiting is for single transactions over $250k and only provides discounted financing without recourse.Factoring & forfaiting

Factoring & forfaitingTanuj Poddar

╠²

This document provides information on factoring and forfaiting. It defines factoring as the purchase of accounts receivables by a factoring company, which provides financing, debt collection services, and protects against bad debts. Forfaiting involves the outright sale of receivables to a forfaiter at a discounted price without recourse to the seller. The key differences between the two are that factoring is for ongoing arrangements, provides various services, and has no minimum transaction size, while forfaiting is for single transactions over $250k and only provides financing without recourse.Eca case study euro HERMES Indonesia volker bromund 01 2016

Eca case study euro HERMES Indonesia volker bromund 01 2016Volker Bromund

╠²

The document summarizes an export credit agency (ECA) buyer financing program with HERMES coverage. It provides an example of a 5 million euro contract between a German exporter and Indonesian importer financed through an 85% loan from LBBW. Key terms included a 5-year tenor, 2.5% interest rate, and semi-annual principal and interest payments. Requirements for importers included minimum annual revenue of 20 million euros and asset value over 15 million euros. The financing allowed importers to access funds at attractive rates without using credit lines.Post shipment finance

Post shipment financevijay101

╠²

Post shipment finance is extended by banks after goods are shipped to bridge the financial gap since exporters only receive 60-80% at the pre-shipment stage. It can include negotiation of documents under LCs, purchasing documents without LCs which risks the bank, or advancing against documents sent on collection when limits are exceeded. Advances are also given against retention money withheld until performance is proven, or undrawn balances paid later based on testing. Post shipment finance is extended up to 100% of invoice value against proof of shipment, to finance export receivables and proceeds. Rates are PLR - 2.5% for up to 90 days, PLR - 0.5% for 91-180 days,14 factoring & forfeiting

14 factoring & forfeitingparth2402

╠²

Factoring and forfeiting are mechanisms that provide liquidity to exporters and traders by purchasing their receivables. Factoring involves a financial institution called a factor purchasing a firm's invoices and undertaking the responsibility of collecting payments from customers. Forfeiting specifically deals with receivables from deferred payment exports where the right to payment is purchased without recourse to the exporter. Both mechanisms convert future expected cash flows into immediate liquidity. They allow firms to better manage their working capital needs and cash flows.Collateral loan info pdf

Collateral loan info pdfM. Azizi A. Rahim

╠²

The document describes a collateral loan program that provides loans of $10 million or more, backed by collateral from a third party rather than the client. Key aspects include:

- Loans can be used for any project type worldwide and are paid back over 10 years with no prepayment penalty. Interest rates are variable between 0-3% plus Libor (around 6.5% on average).

- The program offers a 1-3 year deferral period where the borrower does not have to pay interest or make minimum payments, even if the project could repay the loan earlier.

- It involves multiple participants including the client, collateral provider, depositor who provides the collateral, purchaser who buys the interest in theFactoring

Factoring Murali Raj

╠²

This document discusses factoring, which is a financial transaction where a business sells its accounts receivable to a third party called a factor in exchange for immediate cash. There are several types of factoring described, including domestic, international, recourse, non-recourse, maturity, and invoice factoring. The key differences between factoring and a bank loan are also outlined. A case study is then provided showing how a company used export factoring and purchase order financing to fulfill several contracts requiring upfront capital.Buyers credit pdf

Buyers credit pdfSaveDesk

╠²

Buyer's credit is extended by an overseas financial institutions to the importer to make purchases against large imports. This is a unique credit facility that aids the importer to access the international trade transactions at cheaper rates as they are quoted close to LIBOR rates.Caiibfmwctlmoduled contd1 (1)

Caiibfmwctlmoduled contd1 (1)summi gupta

╠²

Factoring and forfaiting are both forms of invoice financing for businesses. Factoring involves the purchase of accounts receivable by a factoring company, which then takes on the responsibility of collecting payments from customers. It is usually used for domestic and export receivables with credit periods under 180 days. Forfaiting specifically refers to the forfeiting of rights to future export receivables in exchange for an upfront discounted payment. It is used for longer term export receivables over 180 days and provides financing without recourse for the exporter. The key differences between the two are the parties involved, eligible receivables and credit periods, and level of services provided.FINANCE IN BANKING

FINANCE IN BANKING TARUN VERMA

╠²

In this ppt. I mentioned what are the sources of finance in working capital of an organisation or a business.Factoring ppt

Factoring pptKapil Chhabra

╠²

Bill discounting allows banks to purchase bills or notes from customers before their maturity and credit the discounted value to the customer's account. It provides working capital financing to the customer. Factoring involves the ongoing assignment of accounts receivable invoices from a client to a factoring company, which provides working capital financing, invoice collection services, and accounts receivable management. Forfaiting involves the discounted purchase of medium-term bills of exchange associated with international trade transactions by a forfaiter, typically with tenors of 6 months to 10 years.Supply_Chain_Finance.pptx

Supply_Chain_Finance.pptxAvirupDas30

╠²

This document discusses supply chain finance concepts like bill discounting and purchase order financing. It defines supply chain and supply chain finance, explaining how bill discounting and purchase order financing work by outlining the key parties involved and cash flow. Bill discounting involves a bank paying a seller early by deducting interest from an invoice amount, which the bank then collects from the buyer on the due date. Purchase order financing provides working capital to a seller by financing a portion of a purchase order upfront. The document also discusses how banks earn interest from these arrangements and provides screenshots of the M1 Exchange platform for facilitating supply chain finance transactions digitally.Powerpoint presentation on Loan Financing, Trade Loan Products and detailed n...

Powerpoint presentation on Loan Financing, Trade Loan Products and detailed n...akmkayesmahmud

╠²

Trade Loan Details6 New Loan Facility Variations

6 New Loan Facility Variations2ndHomes International

╠²

This document outlines 6 new funding options from 2ndHomesFinance.com, including equity funds, joint venture funds, loan funds, and options using bank guarantees. The equity fund provides up to 100% financing with no interest required in exchange for equity in the applicant's project. The joint venture fund also provides up to 85% financing and requires the lender take an equity position of up to 50% in the project. A loan fund option provides up to 100% financing at interest rates from 2-4.5% depending on the applicant's equity contribution. A convertible soft loan offers near-zero interest financing using monetary collateral equal to the project costs. Global project funding of up to 100% of costs is alsoChapter 5

Chapter 5sriram

╠²

The document summarizes Export Credit Guarantee Corporation of India Ltd.'s (ECGC) new non-recourse maturity export factoring scheme. Key points:

1) The scheme provides exporters with pre-finance on receivables for working capital through maturity factoring with unique features that give full factoring services benefits.

2) It offers 100% credit guarantee protection against bad debts, sales register maintenance, and monitoring of outstanding credits.

3) The scheme aims to facilitate bank financing to exporters by making advances against ECGC-factored receivables an attractive low-risk portfolio for banks.Advantages of letter of credit | Bandenia Challenger Finance

Advantages of letter of credit | Bandenia Challenger FinanceBandenia Challenger Bank

╠²

Establishing a new business connection is not easy. It is difficult to find a new buyer who is ready to make an advance payment to an untested exporter. By offering a letter of credit, the exporter can increase the chance of securing the order.

More Related Content

Similar to Volker Bromund ECA case study USD 10 2016 (20)

Bachir el nakib comparison between international payments

Bachir el nakib comparison between international payments Bachir El-Nakib, CAMS

╠²

The document compares the risks for exporters and importers between international payments and documentary trade finance. International payments like open accounts, collections, and letters of credit each allocate risk differently between exporters and importers. Trade finance tools from organizations like the SBA and Export-Import Bank can help exporters obtain financing to fulfill export orders or insure against risks like buyer default. Various trade finance products provide options to support international trade on different payment terms.Trade Finance Basics

Trade Finance Basicsmaheshpadwal

╠²

The document discusses various types of trade finance instruments including letters of credit, bills of exchange, and guarantees. It provides details on how letters of credit work, involving an importer, exporter, issuing bank, advising bank, and reimbursing bank. The key parties and processes are defined. It also explains the different types of guarantees commonly used in international trade, including bid guarantees, advance payment guarantees, and performance guarantees. The mechanics of how a transaction involving a guarantee is processed between the applicant, issuing bank, advising bank, and beneficiary are outlined.HERMES Export Credit Finance Case Study Indonesia Volker Bromund

HERMES Export Credit Finance Case Study Indonesia Volker BromundVolker Bromund

╠²

The document summarizes an Export Credit Agency (ECA) buyer financing program with HERMES coverage offered by Landesbank Baden-W├╝rttemberg (LBBW). The program provides long-term financing for capital goods and services exported from Germany, with a minimum loan amount of $2 million. LBBW reimburses the importer after payment is made to the German exporter under a letter of credit. The financing covers up to 85% of the contract value, has terms of 5-10 years, and offers competitive interest rates without requiring collateral from the creditworthy importer.Factoring

FactoringUjjwal 'Shanu'

╠²

This document provides information on factoring and forfaiting. It defines factoring as the purchase of accounts receivables by a factoring company, which provides financing, debt collection services, and protects against bad debts. Forfaiting involves the outright sale of receivables to a forfaiter at a discounted price without recourse to the seller. The key differences between the two are that factoring is for ongoing arrangements, provides various services, and has no minimum transaction size, while forfaiting is for single transactions over $250k and only provides discounted financing without recourse.Factoring & forfaiting

Factoring & forfaitingTanuj Poddar

╠²

This document provides information on factoring and forfaiting. It defines factoring as the purchase of accounts receivables by a factoring company, which provides financing, debt collection services, and protects against bad debts. Forfaiting involves the outright sale of receivables to a forfaiter at a discounted price without recourse to the seller. The key differences between the two are that factoring is for ongoing arrangements, provides various services, and has no minimum transaction size, while forfaiting is for single transactions over $250k and only provides financing without recourse.Eca case study euro HERMES Indonesia volker bromund 01 2016

Eca case study euro HERMES Indonesia volker bromund 01 2016Volker Bromund

╠²

The document summarizes an export credit agency (ECA) buyer financing program with HERMES coverage. It provides an example of a 5 million euro contract between a German exporter and Indonesian importer financed through an 85% loan from LBBW. Key terms included a 5-year tenor, 2.5% interest rate, and semi-annual principal and interest payments. Requirements for importers included minimum annual revenue of 20 million euros and asset value over 15 million euros. The financing allowed importers to access funds at attractive rates without using credit lines.Post shipment finance

Post shipment financevijay101

╠²

Post shipment finance is extended by banks after goods are shipped to bridge the financial gap since exporters only receive 60-80% at the pre-shipment stage. It can include negotiation of documents under LCs, purchasing documents without LCs which risks the bank, or advancing against documents sent on collection when limits are exceeded. Advances are also given against retention money withheld until performance is proven, or undrawn balances paid later based on testing. Post shipment finance is extended up to 100% of invoice value against proof of shipment, to finance export receivables and proceeds. Rates are PLR - 2.5% for up to 90 days, PLR - 0.5% for 91-180 days,14 factoring & forfeiting

14 factoring & forfeitingparth2402

╠²

Factoring and forfeiting are mechanisms that provide liquidity to exporters and traders by purchasing their receivables. Factoring involves a financial institution called a factor purchasing a firm's invoices and undertaking the responsibility of collecting payments from customers. Forfeiting specifically deals with receivables from deferred payment exports where the right to payment is purchased without recourse to the exporter. Both mechanisms convert future expected cash flows into immediate liquidity. They allow firms to better manage their working capital needs and cash flows.Collateral loan info pdf

Collateral loan info pdfM. Azizi A. Rahim

╠²

The document describes a collateral loan program that provides loans of $10 million or more, backed by collateral from a third party rather than the client. Key aspects include:

- Loans can be used for any project type worldwide and are paid back over 10 years with no prepayment penalty. Interest rates are variable between 0-3% plus Libor (around 6.5% on average).

- The program offers a 1-3 year deferral period where the borrower does not have to pay interest or make minimum payments, even if the project could repay the loan earlier.

- It involves multiple participants including the client, collateral provider, depositor who provides the collateral, purchaser who buys the interest in theFactoring

Factoring Murali Raj

╠²

This document discusses factoring, which is a financial transaction where a business sells its accounts receivable to a third party called a factor in exchange for immediate cash. There are several types of factoring described, including domestic, international, recourse, non-recourse, maturity, and invoice factoring. The key differences between factoring and a bank loan are also outlined. A case study is then provided showing how a company used export factoring and purchase order financing to fulfill several contracts requiring upfront capital.Buyers credit pdf

Buyers credit pdfSaveDesk

╠²

Buyer's credit is extended by an overseas financial institutions to the importer to make purchases against large imports. This is a unique credit facility that aids the importer to access the international trade transactions at cheaper rates as they are quoted close to LIBOR rates.Caiibfmwctlmoduled contd1 (1)

Caiibfmwctlmoduled contd1 (1)summi gupta

╠²

Factoring and forfaiting are both forms of invoice financing for businesses. Factoring involves the purchase of accounts receivable by a factoring company, which then takes on the responsibility of collecting payments from customers. It is usually used for domestic and export receivables with credit periods under 180 days. Forfaiting specifically refers to the forfeiting of rights to future export receivables in exchange for an upfront discounted payment. It is used for longer term export receivables over 180 days and provides financing without recourse for the exporter. The key differences between the two are the parties involved, eligible receivables and credit periods, and level of services provided.FINANCE IN BANKING

FINANCE IN BANKING TARUN VERMA

╠²

In this ppt. I mentioned what are the sources of finance in working capital of an organisation or a business.Factoring ppt

Factoring pptKapil Chhabra

╠²

Bill discounting allows banks to purchase bills or notes from customers before their maturity and credit the discounted value to the customer's account. It provides working capital financing to the customer. Factoring involves the ongoing assignment of accounts receivable invoices from a client to a factoring company, which provides working capital financing, invoice collection services, and accounts receivable management. Forfaiting involves the discounted purchase of medium-term bills of exchange associated with international trade transactions by a forfaiter, typically with tenors of 6 months to 10 years.Supply_Chain_Finance.pptx

Supply_Chain_Finance.pptxAvirupDas30

╠²

This document discusses supply chain finance concepts like bill discounting and purchase order financing. It defines supply chain and supply chain finance, explaining how bill discounting and purchase order financing work by outlining the key parties involved and cash flow. Bill discounting involves a bank paying a seller early by deducting interest from an invoice amount, which the bank then collects from the buyer on the due date. Purchase order financing provides working capital to a seller by financing a portion of a purchase order upfront. The document also discusses how banks earn interest from these arrangements and provides screenshots of the M1 Exchange platform for facilitating supply chain finance transactions digitally.Powerpoint presentation on Loan Financing, Trade Loan Products and detailed n...

Powerpoint presentation on Loan Financing, Trade Loan Products and detailed n...akmkayesmahmud

╠²

Trade Loan Details6 New Loan Facility Variations

6 New Loan Facility Variations2ndHomes International

╠²

This document outlines 6 new funding options from 2ndHomesFinance.com, including equity funds, joint venture funds, loan funds, and options using bank guarantees. The equity fund provides up to 100% financing with no interest required in exchange for equity in the applicant's project. The joint venture fund also provides up to 85% financing and requires the lender take an equity position of up to 50% in the project. A loan fund option provides up to 100% financing at interest rates from 2-4.5% depending on the applicant's equity contribution. A convertible soft loan offers near-zero interest financing using monetary collateral equal to the project costs. Global project funding of up to 100% of costs is alsoChapter 5

Chapter 5sriram

╠²

The document summarizes Export Credit Guarantee Corporation of India Ltd.'s (ECGC) new non-recourse maturity export factoring scheme. Key points:

1) The scheme provides exporters with pre-finance on receivables for working capital through maturity factoring with unique features that give full factoring services benefits.

2) It offers 100% credit guarantee protection against bad debts, sales register maintenance, and monitoring of outstanding credits.

3) The scheme aims to facilitate bank financing to exporters by making advances against ECGC-factored receivables an attractive low-risk portfolio for banks.Advantages of letter of credit | Bandenia Challenger Finance

Advantages of letter of credit | Bandenia Challenger FinanceBandenia Challenger Bank

╠²

Establishing a new business connection is not easy. It is difficult to find a new buyer who is ready to make an advance payment to an untested exporter. By offering a letter of credit, the exporter can increase the chance of securing the order.

Volker Bromund ECA case study USD 10 2016

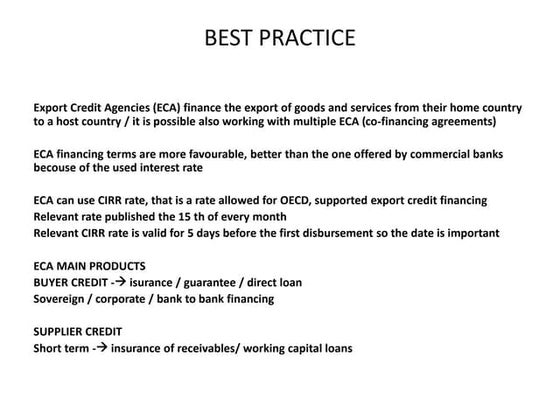

- 1. Volker Bromund, PT PRIME Consultancy, www.prime-consultancy.com Buyer Financing with Export Credit Agency (ECA) coverage ŌĆō case study - Volker Bromund PT PRIME Consultancy Jakarta, October 2016

- 2. Volker Bromund, PT PRIME Consultancy, www.prime-consultancy.com Indonesian Importer Comercial Contract Insures 95% of the loan amount Financing Agreement between Importer and Bank Reimbursement of LC after payment to Exporter BuyerŌĆÖs Credit ŌĆō example German Exporter Import financing Importer opens LC German Manufacturer / Exporter Bank

- 3. General Description ŌĆó Credit for long term financing of capital goods and services based on the ECA cover ŌĆó Usually reimbursement to Importer who pays under LC to the Manufacturer, structures without LC can also be supported ŌĆó Minimum amount: US$ 2.0 mio BuyerŌĆÖs Credit.

- 4. Advantages for the Importer/ Buyer: ’āś No charge to the importerŌĆÖs credit lines ’ā© Financing ŌĆ×on topŌĆ£ ’āś More cost efficient than local financing ’āś Low and attractive interest rates ’āś Typically no collateral, based on the credit standing of the borrower ’āś Tenor: from 5 up to 10 years depending on the value of the contract BuyerŌĆÖs credit

- 5. Borrower Companies with good credit ratings Lender Any bank which accepts the proposal ŌĆō typically offshore bank Loan Amount max. 85 % of contract value (min. US$ 2 mio) Goods according to the Export Contract Capital goods (Country of origin from Germany, Austria or other country). Inclusion of supplies from third countries Besides, it is possible to a certain extent to include goods which originate not in Germany (so-called foreign content). The percentage which these supplies may reach depends on the country from which they originate. In principle supplies of goods worth up to 30 % of the contract value are permissible (indication only ŌĆō depends on the Export Credit Agency). Higher amounts may also be feasible and can be discussed. General Description Buyers Credit

- 6. Financing through a bank covered ECA loan ’āś 85 % of the contract value ’āś At least 15 % down-payment to be paid before delivery, if higher DP ŌĆ£reimbursementŌĆØ with the loan ’āś ECA premium can be financed up to 100 % ’āś Tenor 5 - 10 years - depending on the contract value ’āś Payment in semi-annual installments, the first falls due 6 months after commissioning / COD (ŌĆ£starting pointŌĆØ) ’āś Loan disbursement to the importer after the exporter has confirmed that he has received the payment under the LC ECA Financing: BuyerŌĆÖs Credit

- 7. ’āś Purchase Order: US$ 5,000,000 ’āś Tenor: 6 years ’āś Financing amount: US$ 4,250,000 (85% of the contract amount) ’āś ECA fee: approx. US$ 242,0000 (will be included in the financing amount) ’āś Total Loan Amount: US$ 4,492,000 ’āś Interest rate: 6 month LIBOR (presently 1%) plus a margin of 2.5% p.a. (currently total interest 3.5%) ’āś Commitment Fee: 1% p.a. (unutilized portion of the loan amount) ’āś Management Fee: 1,5 % flat ’āś Repayment: semi-annually, here 12 instalments ’āś Interest payment: semi-annually ’āś Governing Law: to be agreed on with the lender Case study ŌĆō Example Terms & Conditions for indication only!

- 8. Major pre-requisites for credit assessment on ŌĆ×Corporate RiskŌĆ£ ’āś Annual and interim reports ’āś Annual revenue more than EUR 20 million ’āś Assets above EUR 15 million ’āś Equity to be compatible with the contract value Additional information: ’āś Commercial and bank references ’āś Received foreign credits ’āś Credit history ’āś Description of export activities/ FX income BuyerŌĆÖs credit: Pre-requisites.

- 9. Contact Details: Volker Bromund PT PRIME Consultancy Alamanda Tower 23rd Floor, Unit B, Jl. TB Simatupang Kav 23-24 12430 Jakarta, Indonesia Phone: +62 21 2276 7137 Mobile: +62 811 952651 volker.bromund@prime-consultancy.com www.prime-consultancy.com