Voluntary Benefits

Download as ppt, pdf0 likes240 views

This document discusses building a strong financial foundation through voluntary benefit programs that can help protect employees from life's uncertainties. It highlights the importance of having insurance such as disability, life, long-term care, and critical illness insurance. Specific types of insurance coverage being offered through the employer include universal life insurance with long-term care and other riders, short-term disability insurance, and group critical illness insurance. Employees are encouraged to review their needs and coverage with their spouse.

1 of 8

Download to read offline

Ad

Recommended

V

Vguest7e3a84e

╠²

The document discusses building a strong financial foundation through voluntary benefit programs offered by Slone & Associates to employees of Medicorp. It emphasizes the importance of having insurance such as life insurance, disability insurance, long-term care insurance, and critical illness insurance to protect against uncertainties. Specific insurance options being made available include universal life insurance with long-term care and other riders, short-term disability insurance, and group critical illness insurance. Employees are encouraged to review their needs and consult with spouses.Short and long term disability insurance

Short and long term disability insuranceemilyk655

╠²

Short and long term disability insurance is fully paid by IPMM and provides income replacement for employees unable to work due to accident or illness. Short term disability covers absences from work for medical reasons like illness or injury requiring time off, or for planned medical procedures, while long term disability provides continued income for those unable to work for extended periods. Both short and long term disability aim to financially protect employees' ability to earn income when unable to work.Disability Income Insurance

Disability Income Insurancejustinpartlow

╠²

The document discusses the importance of disability income insurance. It notes that the probability of becoming disabled before age 65 is quite high. It also discusses how most disabilities are caused by illness rather than accidents. The document emphasizes that disability insurance can help replace lost income that results from being unable to work due to injury or illness. It highlights some limitations of relying solely on savings, employer-provided insurance, Social Security, or workers compensation.Disability Insurance

Disability Insurancec683765

╠²

This document provides a 3-step guide to disability income protection: 1) Understand the need for income protection given disability statistics, 2) Protect your income through individual disability insurance to supplement employer policies, and 3) Regularly review your disability plan for changes in needs. It emphasizes the importance of disability coverage given the risk of becoming unable to work and the limited alternatives to replace lost income from savings or social security.Article 3

Article 3ronniecombs24

╠²

Critical illness insurance provides a lump sum payment if the policyholder is diagnosed with a serious illness covered by the policy, such as cancer, kidney failure, or AIDS. This payment can be used to cover bills, medical costs, or equipment to aid recovery. The cost of critical illness insurance depends on factors like the policyholder's age, health, habits, and occupation. It is meant to lessen the financial burden of critical illnesses and allow policyholders to focus on treatment without worrying about paying bills.9 Reasons People Buy Annuities For Retirement.

9 Reasons People Buy Annuities For Retirement.Shawn Plummer

╠²

Annuities offer tax-deferred growth, a guaranteed income for life, and protection from creditors and market volatility. They can also assist with long-term care expenses, provide higher interest rates than CDs without annual tax payments, and allow individuals to qualify for Medicaid while retaining some assets. These features make annuities a valuable financial product for retirement planning.THE WAY INSURANCE AGENCIES JUDGE RISKS & FIX PREMIUM ON HEALTH INSURANCE POLICY

THE WAY INSURANCE AGENCIES JUDGE RISKS & FIX PREMIUM ON HEALTH INSURANCE POLICYMandana Sharma

╠²

The document discusses how insurance agencies determine premiums for health insurance policies based on various factors such as age, gender, income, lifestyle, and health risks. It emphasizes the importance of health insurance as a safeguard during medical emergencies and the financial implications of health-related expenses. Additionally, it highlights the correlation between an individual's credit score and their risk assessment by insurers, suggesting that maintaining good health can lead to lower premiums.2016 Welcome to Medicare

2016 Welcome to MedicareLLoyd Lofton L.U.T.C.

╠²

The document outlines key aspects of Medicare coverage, including when it begins based on age, disability, or end-stage renal disease. It details the four components of original Medicare (Part A, B, C, and D), their corresponding costs, and services covered, particularly focusing on prescription drugs and immunosuppressants. Additionally, it discusses coordination of benefits, emphasizing primary and secondary payers based on employment status and eligibility criteria.Article 5

Article 5ShaundaGlover

╠²

Income protection insurance provides income payments to replace lost earnings if someone is unable to work due to an accident, injury, illness, or unemployment. There are different types of income protection insurance plans that vary in payment amounts, duration of payments, and definitions of disability. It is important to compare income protection insurance quotes and carefully review policy details and limitations to find the most suitable plan.income-protector benefits Brochure 2015

income-protector benefits Brochure 2015Sonette Willett

╠²

This document provides an overview of Liberty's Income Protector product, which offers comprehensive income protection against various risks. The Income Protector consists of three layers of benefits - a core layer including Absolute Income Protector, a comprehensive layer adding additional risks like retrenchment and critical illness, and an extended layer providing long-term coverage. The Absolute Income Protector pays out if you are temporarily or permanently disabled and unable to work, or permanently impaired. It covers up to 75% of your after-tax income for up to 24 months. Additional benefits like Child Illness Protector and Overhead Expenses Protector are also included.Estate Planning For Disability

Estate Planning For Disabilitywardwilsey

╠²

The document discusses the importance of disability planning, outlining methods such as living trusts and durable power of attorney to ensure proper care and management of assets during incapacity. It highlights the need to define disability, coordinate care for dependents, and address potential challenges faced by business owners during disability. Additionally, it emphasizes insurance considerations and health care decision-making as part of comprehensive disability planning.What College Graduates Should Know About Health Insurance

What College Graduates Should Know About Health InsuranceUniversity of New Hampshire Health Services

╠²

This document provides information for graduating college students about health insurance. It notes that large medical bills are a primary cause of bankruptcy and that even minor surgeries can cost thousands without insurance. It recommends obtaining a job with good health insurance coverage or affordable individual plans if unemployed. It offers tips for finding low-cost plans, like choosing higher deductibles and co-payments. It also lists nine important things to look for in a health insurance plan and provides resources for where to find plans in New Hampshire or other states.Can Your Insurance Do This???

Can Your Insurance Do This???D-BEST Health & Life Insurance Service Company

╠²

Aflac insurance policies offer several advantages including special payroll rates, pre-tax savings, portability, and guaranteed renewability. Aflac always pays cash benefits directly to the policyholder. The policies provide payment for accidents, sickness, maternity leave, short-term spouse disability from accidents, expenses for cancer, heart disease, hospital stays, and dental procedures. Aflac plans pay cash benefits for covered medical events or services that can be used for any expenses.Risk Insurance April 2010

Risk Insurance April 2010WealthEngine

╠²

This document discusses different types of personal risk insurance including life insurance, total and permanent disability insurance, income protection insurance, and trauma insurance. It provides statistics highlighting the need for insurance coverage and outlines the purpose and mechanics of each type of insurance. Key points covered include statistics on underinsurance in Australia, rules of thumb for determining appropriate life insurance coverage amounts, and how different insurance products can help cover expenses and support one's lifestyle in the event of death, disability, illness or injury.Cash is the best medicine

Cash is the best medicineAleksandr Sushko

╠²

This document summarizes a critical illness insurance policy from Assurity that provides a lump sum payment between $5,000-$500,000 upon the first diagnosis of a critical illness like a heart attack, cancer, or stroke. The payment can be used for expenses like a mortgage, loans, medical costs, or vacations. Interested individuals should contact their Assurity agent for more details on coverage, costs, limitations, and exclusions.A step by step guide to critical illness

A step by step guide to critical illnessKelly Shultis

╠²

Critical illness insurance provides a lump sum payment if the policyholder is diagnosed with a specified critical illness. It can help cover costs if the person is unable to work due to a serious illness like cancer, stroke, or heart attack. The payment is made as long as the policyholder survives more than a month after diagnosis. Policies vary by insurer but typically cover around 30 illnesses and can be purchased through an insurer or advisor. The cost of coverage depends on factors like age, health, smoking status, and amount of coverage. Claims require medical evidence and meeting the insurer's criteria for the illness.Disability choice powerpoint

Disability choice powerpointTim Barnes Clu

╠²

This document summarizes disability income insurance and promotes Mutual of Omaha's Disability Income Choice Portfolio. It notes that disability is more likely than death for working adults and can lead to loss of income. It outlines limitations of other potential sources of income replacement during disability, like employer policies, Social Security, workers compensation, and personal savings. The Disability Income Choice Portfolio offers different short- and long-term accident and sickness policies to help protect income in case of disability. Readers are encouraged to speak with an agent to learn more.The Taxing Of Social Security

The Taxing Of Social SecurityLLoyd Lofton L.U.T.C.

╠²

The document discusses how interest income from certain assets like CDs, bonds, and money market accounts can increase provisional income and cause Social Security benefits to become partially or fully taxable. It provides examples of how moving such assets to a deferred annuity, where interest accrues tax-deferred, can reduce provisional income and eliminate taxes on Social Security benefits. This can significantly increase total retirement income and net returns.Long-term Care Insurance: Basic Pricing Concepts

Long-term Care Insurance: Basic Pricing ConceptsLTCI Partners

╠²

Long-term care insurance provides daily or monthly benefits to policyholders who become disabled and require long-term care services such as assistance with activities of daily living. This document provides a basic explanation of long-term care insurance pricing, reserves, and premium rate increases. It uses an analogy of a savings account to illustrate how insurers set aside premium dollars in a reserve fund to pay future claims, which are expected to increase over time. Changes in economic conditions like lower interest rates and higher-than-expected claims have caused some reserves to be insufficient. Insurers may need to increase premium rates or use other funds to restore balance between expected premium income and benefit payouts.HealthCompare Insurance - Understanding other types of insurance

HealthCompare Insurance - Understanding other types of insuranceHealth Compare

╠²

The document provides an overview of various health insurance plans, including managed care, discount medical plans, short-term insurance, critical illness insurance, disability insurance, worker's compensation, and travel health insurance. It emphasizes the limitations of discount medical plans and explains the types of disability insurance available. Additionally, it introduces healthcompare.org as a platform for researching and comparing health insurance plans from multiple carriers.Does Medicare Pay for Long-Term Care in New York

Does Medicare Pay for Long-Term Care in New YorkMark Eghrari

╠²

Medicare does not pay for long-term custodial care like that received in nursing homes. Such care can cost over $160,000 per year in New York. While Medicare helps with medical costs, 7 in 10 seniors will require long-term care assistance that Medicare does not cover. Medicaid may pay for long-term care for those with limited assets who qualify through a spend-down process. Planning is needed to qualify for Medicaid assistance with long-term care costs that Medicare does not cover.Pet Insurance as an Employee Benefit

Pet Insurance as an Employee BenefitPets Best Insurance

╠²

Pet insurance provides financial relief for veterinary expenses due to unexpected injuries or illnesses in pets. Plans are available for dogs and cats starting from 7 weeks old, with various options ranging from accident-only to comprehensive coverage that includes routine care. The claims process is straightforward, with most claims reimbursed within five days, and no pre-existing conditions are covered.Critical illness insurance pros and cons

Critical illness insurance pros and consKelly Shultis

╠²

Critical illness insurance provides a tax-free lump sum payment if the policyholder is diagnosed with a specified critical illness. This can help cover costs and provide financial stability. While premiums may be higher than for life insurance, the payout is guaranteed and can give peace of mind. However, not all illnesses are covered, pre-existing conditions may impact premiums, and ongoing premium costs are incurred. On balance, for those with dependents, the benefits of critical illness insurance in planning for family needs are seen as outweighing the disadvantages.Final expense tips to increase your income

Final expense tips to increase your incomeSeward Life.

╠²

This document provides tips for increasing income as a final expense insurance agent. It discusses reducing chargebacks by building relationships with clients and providing additional value beyond just the policy. It suggests keeping lead costs below $1 per $10 return and provides strategies for reducing no-show appointments such as discussing value added services during scheduling. The tips include follow-up plans to save clients money on supplements or provide critical illness plans to increase client retention.Group Financially Focused

Group Financially FocusedCynthia Wilson

╠²

Long-term care insurance can help employees plan for future long-term care needs. Statistics show that 70% of people over 65 will likely need long-term care services. Currently, most people do not have a plan and rely on Medicaid for assistance, often depleting their savings. Long-term care insurance allows people to receive benefits for assistance with daily living before experiencing a major health event. Employers can offer group long-term care insurance plans to employees, which are more affordable than individual policies and provide peace of mind. The document discusses the need for long-term care planning and the advantages of employers providing group long-term care insurance options to their employees.0812 differencedisability

0812 differencedisabilityBetter Financial Education

╠²

Disability insurance covers lost wages due to an inability to work from illness or injury, while long-term care insurance covers medical costs from assistance with daily living in a home or facility. Disability insurance may cover short or long-term needs and pays a percentage of salary, while long-term care insurance covers costs of care regardless of wages. Experts recommend both because many become disabled before retirement and nursing home or assisted living costs are high.AIA LTC Presentation

AIA LTC PresentationAbacus Insurance Advisors

╠²

This document provides information about long-term care (LTC) insurance for producers. It discusses the history and market for LTC insurance, common misconceptions clients have about coverage, benefits of LTC policies, and tips for reducing policy costs. Sample policy comparisons and illustrations are also included to demonstrate how LTC insurance can help clients pay for long-term care needs and protect their assets.Demolition Projects

Demolition Projectsjohnnymack

╠²

This document discusses various demolition projects including demolishing an entire house, interior demolition, concrete demolition, demolition clean up, grading after demolition, and demolishing an NYC apartment. Demolition of buildings and structures is the focus of the topics covered.Awareness Short V2

Awareness Short V2Ivan Petrov

╠²

The document discusses brand awareness and models for measuring it in oligopoly markets. It defines brand awareness and factors that influence it, like advertising and word-of-mouth effects. It then describes limitations of old models for measuring awareness that ignored competition or lacked guidelines. A new oligopoly markets model is presented that tracks awareness data over time for multiple competing brands and allows estimating optimal advertising strategies and predicting market equilibrium states.More Related Content

What's hot (19)

Article 5

Article 5ShaundaGlover

╠²

Income protection insurance provides income payments to replace lost earnings if someone is unable to work due to an accident, injury, illness, or unemployment. There are different types of income protection insurance plans that vary in payment amounts, duration of payments, and definitions of disability. It is important to compare income protection insurance quotes and carefully review policy details and limitations to find the most suitable plan.income-protector benefits Brochure 2015

income-protector benefits Brochure 2015Sonette Willett

╠²

This document provides an overview of Liberty's Income Protector product, which offers comprehensive income protection against various risks. The Income Protector consists of three layers of benefits - a core layer including Absolute Income Protector, a comprehensive layer adding additional risks like retrenchment and critical illness, and an extended layer providing long-term coverage. The Absolute Income Protector pays out if you are temporarily or permanently disabled and unable to work, or permanently impaired. It covers up to 75% of your after-tax income for up to 24 months. Additional benefits like Child Illness Protector and Overhead Expenses Protector are also included.Estate Planning For Disability

Estate Planning For Disabilitywardwilsey

╠²

The document discusses the importance of disability planning, outlining methods such as living trusts and durable power of attorney to ensure proper care and management of assets during incapacity. It highlights the need to define disability, coordinate care for dependents, and address potential challenges faced by business owners during disability. Additionally, it emphasizes insurance considerations and health care decision-making as part of comprehensive disability planning.What College Graduates Should Know About Health Insurance

What College Graduates Should Know About Health InsuranceUniversity of New Hampshire Health Services

╠²

This document provides information for graduating college students about health insurance. It notes that large medical bills are a primary cause of bankruptcy and that even minor surgeries can cost thousands without insurance. It recommends obtaining a job with good health insurance coverage or affordable individual plans if unemployed. It offers tips for finding low-cost plans, like choosing higher deductibles and co-payments. It also lists nine important things to look for in a health insurance plan and provides resources for where to find plans in New Hampshire or other states.Can Your Insurance Do This???

Can Your Insurance Do This???D-BEST Health & Life Insurance Service Company

╠²

Aflac insurance policies offer several advantages including special payroll rates, pre-tax savings, portability, and guaranteed renewability. Aflac always pays cash benefits directly to the policyholder. The policies provide payment for accidents, sickness, maternity leave, short-term spouse disability from accidents, expenses for cancer, heart disease, hospital stays, and dental procedures. Aflac plans pay cash benefits for covered medical events or services that can be used for any expenses.Risk Insurance April 2010

Risk Insurance April 2010WealthEngine

╠²

This document discusses different types of personal risk insurance including life insurance, total and permanent disability insurance, income protection insurance, and trauma insurance. It provides statistics highlighting the need for insurance coverage and outlines the purpose and mechanics of each type of insurance. Key points covered include statistics on underinsurance in Australia, rules of thumb for determining appropriate life insurance coverage amounts, and how different insurance products can help cover expenses and support one's lifestyle in the event of death, disability, illness or injury.Cash is the best medicine

Cash is the best medicineAleksandr Sushko

╠²

This document summarizes a critical illness insurance policy from Assurity that provides a lump sum payment between $5,000-$500,000 upon the first diagnosis of a critical illness like a heart attack, cancer, or stroke. The payment can be used for expenses like a mortgage, loans, medical costs, or vacations. Interested individuals should contact their Assurity agent for more details on coverage, costs, limitations, and exclusions.A step by step guide to critical illness

A step by step guide to critical illnessKelly Shultis

╠²

Critical illness insurance provides a lump sum payment if the policyholder is diagnosed with a specified critical illness. It can help cover costs if the person is unable to work due to a serious illness like cancer, stroke, or heart attack. The payment is made as long as the policyholder survives more than a month after diagnosis. Policies vary by insurer but typically cover around 30 illnesses and can be purchased through an insurer or advisor. The cost of coverage depends on factors like age, health, smoking status, and amount of coverage. Claims require medical evidence and meeting the insurer's criteria for the illness.Disability choice powerpoint

Disability choice powerpointTim Barnes Clu

╠²

This document summarizes disability income insurance and promotes Mutual of Omaha's Disability Income Choice Portfolio. It notes that disability is more likely than death for working adults and can lead to loss of income. It outlines limitations of other potential sources of income replacement during disability, like employer policies, Social Security, workers compensation, and personal savings. The Disability Income Choice Portfolio offers different short- and long-term accident and sickness policies to help protect income in case of disability. Readers are encouraged to speak with an agent to learn more.The Taxing Of Social Security

The Taxing Of Social SecurityLLoyd Lofton L.U.T.C.

╠²

The document discusses how interest income from certain assets like CDs, bonds, and money market accounts can increase provisional income and cause Social Security benefits to become partially or fully taxable. It provides examples of how moving such assets to a deferred annuity, where interest accrues tax-deferred, can reduce provisional income and eliminate taxes on Social Security benefits. This can significantly increase total retirement income and net returns.Long-term Care Insurance: Basic Pricing Concepts

Long-term Care Insurance: Basic Pricing ConceptsLTCI Partners

╠²

Long-term care insurance provides daily or monthly benefits to policyholders who become disabled and require long-term care services such as assistance with activities of daily living. This document provides a basic explanation of long-term care insurance pricing, reserves, and premium rate increases. It uses an analogy of a savings account to illustrate how insurers set aside premium dollars in a reserve fund to pay future claims, which are expected to increase over time. Changes in economic conditions like lower interest rates and higher-than-expected claims have caused some reserves to be insufficient. Insurers may need to increase premium rates or use other funds to restore balance between expected premium income and benefit payouts.HealthCompare Insurance - Understanding other types of insurance

HealthCompare Insurance - Understanding other types of insuranceHealth Compare

╠²

The document provides an overview of various health insurance plans, including managed care, discount medical plans, short-term insurance, critical illness insurance, disability insurance, worker's compensation, and travel health insurance. It emphasizes the limitations of discount medical plans and explains the types of disability insurance available. Additionally, it introduces healthcompare.org as a platform for researching and comparing health insurance plans from multiple carriers.Does Medicare Pay for Long-Term Care in New York

Does Medicare Pay for Long-Term Care in New YorkMark Eghrari

╠²

Medicare does not pay for long-term custodial care like that received in nursing homes. Such care can cost over $160,000 per year in New York. While Medicare helps with medical costs, 7 in 10 seniors will require long-term care assistance that Medicare does not cover. Medicaid may pay for long-term care for those with limited assets who qualify through a spend-down process. Planning is needed to qualify for Medicaid assistance with long-term care costs that Medicare does not cover.Pet Insurance as an Employee Benefit

Pet Insurance as an Employee BenefitPets Best Insurance

╠²

Pet insurance provides financial relief for veterinary expenses due to unexpected injuries or illnesses in pets. Plans are available for dogs and cats starting from 7 weeks old, with various options ranging from accident-only to comprehensive coverage that includes routine care. The claims process is straightforward, with most claims reimbursed within five days, and no pre-existing conditions are covered.Critical illness insurance pros and cons

Critical illness insurance pros and consKelly Shultis

╠²

Critical illness insurance provides a tax-free lump sum payment if the policyholder is diagnosed with a specified critical illness. This can help cover costs and provide financial stability. While premiums may be higher than for life insurance, the payout is guaranteed and can give peace of mind. However, not all illnesses are covered, pre-existing conditions may impact premiums, and ongoing premium costs are incurred. On balance, for those with dependents, the benefits of critical illness insurance in planning for family needs are seen as outweighing the disadvantages.Final expense tips to increase your income

Final expense tips to increase your incomeSeward Life.

╠²

This document provides tips for increasing income as a final expense insurance agent. It discusses reducing chargebacks by building relationships with clients and providing additional value beyond just the policy. It suggests keeping lead costs below $1 per $10 return and provides strategies for reducing no-show appointments such as discussing value added services during scheduling. The tips include follow-up plans to save clients money on supplements or provide critical illness plans to increase client retention.Group Financially Focused

Group Financially FocusedCynthia Wilson

╠²

Long-term care insurance can help employees plan for future long-term care needs. Statistics show that 70% of people over 65 will likely need long-term care services. Currently, most people do not have a plan and rely on Medicaid for assistance, often depleting their savings. Long-term care insurance allows people to receive benefits for assistance with daily living before experiencing a major health event. Employers can offer group long-term care insurance plans to employees, which are more affordable than individual policies and provide peace of mind. The document discusses the need for long-term care planning and the advantages of employers providing group long-term care insurance options to their employees.0812 differencedisability

0812 differencedisabilityBetter Financial Education

╠²

Disability insurance covers lost wages due to an inability to work from illness or injury, while long-term care insurance covers medical costs from assistance with daily living in a home or facility. Disability insurance may cover short or long-term needs and pays a percentage of salary, while long-term care insurance covers costs of care regardless of wages. Experts recommend both because many become disabled before retirement and nursing home or assisted living costs are high.AIA LTC Presentation

AIA LTC PresentationAbacus Insurance Advisors

╠²

This document provides information about long-term care (LTC) insurance for producers. It discusses the history and market for LTC insurance, common misconceptions clients have about coverage, benefits of LTC policies, and tips for reducing policy costs. Sample policy comparisons and illustrations are also included to demonstrate how LTC insurance can help clients pay for long-term care needs and protect their assets.What College Graduates Should Know About Health Insurance

What College Graduates Should Know About Health InsuranceUniversity of New Hampshire Health Services

╠²

Viewers also liked (7)

Demolition Projects

Demolition Projectsjohnnymack

╠²

This document discusses various demolition projects including demolishing an entire house, interior demolition, concrete demolition, demolition clean up, grading after demolition, and demolishing an NYC apartment. Demolition of buildings and structures is the focus of the topics covered.Awareness Short V2

Awareness Short V2Ivan Petrov

╠²

The document discusses brand awareness and models for measuring it in oligopoly markets. It defines brand awareness and factors that influence it, like advertising and word-of-mouth effects. It then describes limitations of old models for measuring awareness that ignored competition or lacked guidelines. A new oligopoly markets model is presented that tracks awareness data over time for multiple competing brands and allows estimating optimal advertising strategies and predicting market equilibrium states.27[1].Noor

27[1].Noorguest647ee4

╠²

This document provides a literature review on Islamic perspectives on stock markets. It summarizes various classical and modern writings on the topic from traditional Islamic sources as well as modern Islamic finance. The review finds that while some scholars argue stock markets can comply with Shariah principles if structured properly, others note areas of non-compliance around issues like gharar (uncertainty) and speculation. The document aims to shed light on the validity of stock markets from an Islamic law perspective and how they should be structured if deemed valid.Life Is A Tug Of War

Life Is A Tug Of WarShaheen Mohammed

╠²

The document discusses the ups and downs of life and encourages taking life's challenges in stride. It notes that life can be both happy and sad, rewarding and difficult, but advises making the most of each day by maintaining a positive attitude, accepting what cannot be changed, and finding the beauty in small pleasures. The overall message is that life is a mix of good and bad experiences and we should do our best to meet challenges while appreciating life's simple joys.CSA Celebrity Speakers Brochure

CSA Celebrity Speakers BrochureIntellecta Srl

╠²

CSA Celebrity Speakers is a speakers bureau based in Bulgaria that can be contacted at +359 888 308180 or by email at christina.vlahova@intellectasrl.com. They have a website at www.speakersbulgaria.com where information about celebrity speakers that can be booked can be found.Ad

Similar to Voluntary Benefits (20)

Protection

Protectionsoccerba101

╠²

The document discusses the importance of having life and disability insurance. It notes that an emergency fund should be 3 to 6 months of total income and lists common monthly expenses families need to cover. The document then discusses different types of life insurance, who needs it, and how other sources of income may not be enough. It also discusses disability insurance, the importance of knowing your policy details, and how savings can be quickly wiped out without disability coverage. The overall message is the importance of planning and having insurance to protect your family's finances and standard of living.Kfs critical illness

Kfs critical illnessroowah1

╠²

This document provides an overview and review of critical illness insurance. It discusses how critical illnesses like cancer and heart disease can impact finances through lost income and medical costs. It then outlines sources of funds people may have like health insurance, disability insurance, and savings, but notes their limitations. The document proposes critical illness insurance as a potential solution, explaining that it pays a lump sum that can be used flexibly upon diagnosis of a covered critical illness. This allows focusing on treatment instead of finances. The document also clarifies what critical illness insurance is not, such as health care insurance.Di Needs Analysis

Di Needs AnalysisJerryTeixeira

╠²

The document provides an analysis of disability needs and risks. It discusses (1) the probability of occurrence of disability, with statistics showing nearly 1 in 5 people will become disabled before age 65; (2) assessing one's most valuable asset as their ability to earn an income; and (3) the magnitude of financial risks if disability prevents earning an income to cover monthly expenses. It outlines options to plan for potential problems from death, disability or retirement through insurance or savings.Insurance 101

Insurance 101Eric Krock

╠²

This document provides an overview of insurance concepts. It begins with legal disclaimers noting the author is not a certified financial advisor and discusses various types of insurance including health, auto, home, life, disability, and long-term care. It emphasizes the importance of having adequate insurance coverage, especially life insurance, before health issues arise. The document also touches on factors that impact insurance costs and strategies for building a diversified portfolio. Overall, the key messages are to protect yourself from risks through insurance and start planning for your financial goals and retirement as early as possible.Disability insurance

Disability insuranceLawrence Cole

╠²

Individual disability insurance can provide income replacement if you are unable to work due to disability. The document discusses how insuring your income through disability insurance is a fundamental part of financial planning, as your ability to earn an income may be your most valuable asset. It notes that over 25% of 30-year old males and over 20% of 30-year old females will become disabled for 90 days or more before age 65. The document emphasizes that if you become disabled, your savings and assets may not be enough to cover living expenses, making disability insurance crucial protection.Protection Strategies

Protection Strategiesjtarnofs

╠²

The document discusses the importance of protecting your family's financial security through life insurance, disability insurance, and long-term care insurance. It notes that your future earnings are typically your most valuable asset but can be at risk if you die prematurely, become disabled, or require long-term care. It highlights that many families are underinsured for these risks. The document urges planning now to choose appropriate insurance coverage to safeguard your loved ones' financial well-being and independence.Principal Di

Principal Diplangelier

╠²

This document provides an overview of disability income insurance and why it is important. It discusses how even with group long-term disability insurance and social security, many people would struggle financially if they became too sick or injured to work. Individual disability income insurance can help fill the gaps. The document recommends speaking to a financial professional to understand your risks and how much coverage you may need based on your individual situation. It profiles four example families - singles, young couples, up-and-comers, and 40-somethings - to show how disability insurance needs vary at different life stages.Disability Income Protection: A Step-by-Step Guide

Disability Income Protection: A Step-by-Step GuideDougIngram

╠²

This document provides an overview of disability income insurance. It discusses how disability is common and can last a long time, preventing many Americans from working and maintaining their standard of living without this type of insurance. It encourages readers to calculate their potential income over their career to understand their need to protect it with disability coverage.Guide To Disability Insurance

Guide To Disability Insurancelifeplanman

╠²

Individual disability insurance is important because most people's greatest asset is their ability to earn an income. Statistics show that about 1 in 3 women and 1 in 4 men will be disabled for 3 months or longer at some point in their career. Disability can jeopardize one's finances and quality of life. The key sources of disability income are employer-provided short-term and long-term disability insurance, Social Security, and individual disability insurance policies. It is important to understand the benefits and limitations of different policies to ensure adequate financial protection in the event of a disability.Kfs disability 2

Kfs disability 2roowah1

╠²

The document discusses the importance of disability income planning and insurance. It notes that most people do not realize how much income they are expected to earn over their careers. It then highlights the risks of disability and average durations. The rest of the document provides examples of sources of funds during a disability, and suggests that disability income insurance can help replace income and maintain lifestyle. It includes a checklist for evaluating disability income policy features and benefits. The final pages provide a disability income action plan.Is Your Retirement At Risk In Today's Economy?

Is Your Retirement At Risk In Today's Economy?Neal Mandelbaum

╠²

The document outlines three critical areas to secure retirement in today's economy: managing unforeseen healthcare costs, ensuring investments grow without risk of loss, and having a sustainable retirement plan. It highlights various risks retirees face, such as healthcare expenses, market volatility, and the need for long-term care insurance. It emphasizes strategies for capitalizing on market gains while minimizing risks and securing guaranteed income for life.Are Your Assets Protected Hany Salib

Are Your Assets Protected Hany Salibhsalib

╠²

The document discusses the importance of protecting one's assets and income through insurance policies. It notes that only about 10% of the working population has income protection and over a third of Australians risk becoming disabled for over 3 months before retirement. Various types of insurance like income protection, critical illness coverage, life insurance, and trauma insurance are presented as ways to financially protect oneself and one's family from risks relating to health issues, death, or disability. The document advocates lessening the financial impact of such risks through insurance rather than taking on the risks oneself.Planning for Unexpected Finances | Adam Tau

Planning for Unexpected Finances | Adam Tau Adam Tau

╠²

The document discusses planning for unexpected large financial risks such as market volatility, death, injury or illness, legal issues, outliving savings in retirement, and needing long-term care. It recommends diversifying investments, having life insurance to replace lost income from death, disability insurance to replace lost income from injury or illness, liability insurance for legal issues, annuities to guarantee retirement income, and long-term care insurance to cover expensive long-term care costs. Having insurance for these unexpected risks can provide financial protection and peace of mind.July 2017 newsletter

July 2017 newslettertoddrobison

╠²

The document discusses alternatives to long-term care insurance (LTCI) for covering long-term care costs, including self-insuring using personal savings and income, using life insurance policies that allow access to death benefits for long-term care costs, and applying for Medicaid assistance. It notes that while LTCI provides dedicated coverage for long-term care, it can be expensive with a risk of paying premiums without ever needing the insurance. The alternatives aim to use existing assets like life insurance or qualify for government aid through Medicaid to help pay for long-term care.Financial Management abd YOU

Financial Management abd YOUalstraub

╠²

The document outlines strategies for building financial security, emphasizing the importance of risk management, wealth accumulation, and wealth preservation at various life stages. It highlights the need for adequate insurance, investment plans, and retirement strategies, while addressing potential financial risks such as premature death and disability. Additionally, it stresses the significance of a personal needs analysis to tailor financial solutions that meet individual goals and circumstances.Insurance 101 risk mgmt workshop march 4

Insurance 101 risk mgmt workshop march 4cochranewealthmanagement

╠²

This document discusses various types of insurance and risk management strategies. It covers topics such as life insurance, term insurance, whole life insurance, universal life insurance, disability income protection, critical illness insurance, and long term care insurance. For each type of insurance, the document provides details on coverage options, premium costs, benefits, and common uses. It emphasizes the importance of insurance for individuals, families, and business owners to manage risks related to mortality, health issues, loss of income, and more.Wink Risk Management

Wink Risk ManagementPlace2Give Foundation/Karma & Cents Inc.

╠²

The document discusses various aspects of risk management, focusing on the importance of different types of insurance such as life, disability, and critical illness insurance, especially for women. It emphasizes the benefits and structures of insurance products, financial planning, and risk assessments tailored to individual circumstances. Additionally, the document highlights the significance of preparing for the financial implications of health challenges and the importance of strategic planning for financial independence and family legacies.Managing Finances

Managing FinancesGeoff Thompson

╠²

This document provides information to help individuals analyze their personal financial security needs and develop a plan to achieve their goals. It discusses factors such as protecting a family's future if income is lost, preparing for retirement, funding children's education, disability protection, paying off a mortgage, and estate planning. The document advocates using a four-step process of analyzing one's current situation, identifying and prioritizing goals, developing and implementing a plan, and regularly reviewing and updating the plan to achieve personal financial security.Kfs disability 1

Kfs disability 1roowah1

╠²

This document provides information about disability income insurance. It discusses the importance of having income replacement in the event of a disability, as other sources like savings may not be sufficient. It notes that disability is common and can lead to financial problems. The document provides a checklist for evaluating disability income policies and their benefits and features. It stresses the importance of purchasing adequate personally-owned disability income insurance to guarantee income if a disability prevents working.Kfs disability 1

Kfs disability 1roowah1

╠²

This document provides information about disability income insurance. It discusses the risks of disability and how disability can impact one's finances and ability to earn income. It then presents disability income insurance as a potential solution to replace income in the event of disability. The document provides checklists to help individuals estimate their needs for disability income, evaluate policy features, and take action to implement a disability income insurance plan.Ad

Voluntary Benefits

- 1. A solid financial foundation can keep your future from falling through the cracks. Slone & Associates, Inc. Building a Financial Investment PYRAMID Through Voluntary Benefit Programs

- 2. Why We Are Here? Most employees donŌĆÖt have the time, or donŌĆÖt have access to information to secure and maintain their financial future . We are taking voluntary benefits to the next level by helping your employees build a financial foundation.

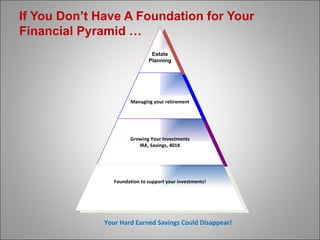

- 3. If You DonŌĆÖt Have A Foundation for Your Financial Pyramid ŌĆ” Your Hard Earned Savings Could Disappear! Estate Planning Managing your retirement Growing Your Investments IRA, Savings, 401K Foundation to support your investments!

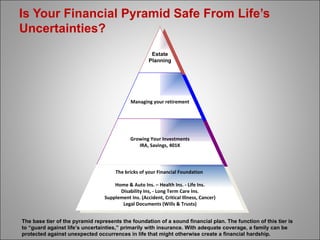

- 4. Is Your Financial Pyramid Safe From LifeŌĆÖs Uncertainties? The base tier of the pyramid represents the foundation of a sound financial plan. The function of this tier is to ŌĆ£guard against lifeŌĆÖs uncertainties,ŌĆØ primarily with insurance. With adequate coverage, a family can be protected against unexpected occurrences in life that might otherwise create a financial hardship. Estate Planning Managing your retirement Growing Your Investments IRA, Savings, 401K The bricks of your Financial Foundation Home & Auto Ins. ŌĆō Health Ins. - Life Ins. Disability Ins, - Long Term Care Ins. Supplement Ins. (Accident, Critical Illness, Cancer) Legal Documents (Wills & Trusts)

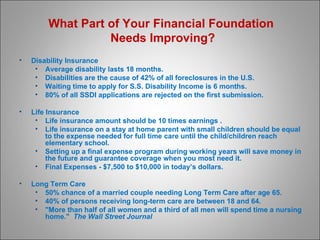

- 5. What Part of Your Financial Foundation Needs Improving? Disability Insurance Average disability lasts 18 months. Disabilities are the cause of 42% of all foreclosures in the U.S. Waiting time to apply for S.S. Disability Income is 6 months. 80% of all SSDI applications are rejected on the first submission. Life Insurance Life insurance amount should be 10 times earnings . Life insurance on a stay at home parent with small children should be equal to the expense needed for full time care until the child/children reach elementary school. Setting up a final expense program during working years will save money in the future and guarantee coverage when you most need it. Final Expenses - $7,500 to $10,000 in todayŌĆÖs dollars. Long Term Care 50% chance of a married couple needing Long Term Care after age 65. 40% of persons receiving long-term care are between 18 and 64. "More than half of all women and a third of all men will spend time a nursing home." The Wall Street Journal

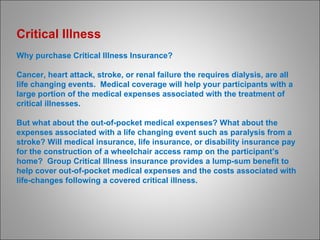

- 6. Critical Illness Why purchase Critical Illness Insurance? Cancer, heart attack, stroke, or renal failure the requires dialysis, are all life changing events. Medical coverage will help your participants with a large portion of the medical expenses associated with the treatment of critical illnesses. But what about the out-of-pocket medical expenses? What about the expenses associated with a life changing event such as paralysis from a stroke? Will medical insurance, life insurance, or disability insurance pay for the construction of a wheelchair access ramp on the participantŌĆÖs home? Group Critical Illness insurance provides a lump-sum benefit to help cover out-of-pocket medical expenses and the costs associated with life-changes following a covered critical illness.

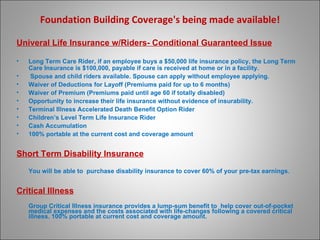

- 7. Foundation Building Coverage's being made available! Univeral Life Insurance w/Riders- Conditional Guaranteed Issue Long Term Care Rider, if an employee buys a $50,000 life insurance policy, the Long Term Care Insurance is $100,000, payable if care is received at home or in a facility. ╠² Spouse and child riders available. Spouse can apply without employee applying. Waiver of Deductions for Layoff (Premiums paid for up to 6 months) Waiver of Premium (Premiums paid until age 60 if totally disabled) Opportunity to increase their life insurance without evidence of insurability. Terminal Illness Accelerated Death Benefit Option Rider ChildrenŌĆÖs Level Term Life Insurance Rider Cash Accumulation 100% portable at the current cost and coverage amount Short Term Disability Insurance You will be able to purchase disability insurance to cover 60% of your pre-tax earnings. Critical Illness Group Critical Illness insurance provides a lump-sum benefit to help cover out-of-pocket medical expenses and the costs associated with life-changes following a covered critical illness. 100% portable at current cost and coverage amount.

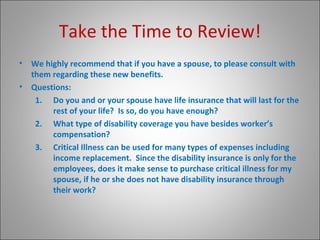

- 8. Take the Time to Review! We highly recommend that if you have a spouse, to please consult with them regarding these new benefits. Questions: Do you and or your spouse have life insurance that will last for the rest of your life? Is so, do you have enough? What type of disability coverage you have besides workerŌĆÖs compensation? Critical Illness can be used for many types of expenses including income replacement. Since the disability insurance is only for the employees, does it make sense to purchase critical illness for my spouse, if he or she does not have disability insurance through their work?