What is ATM

Download as DOCX, PDF0 likes171 views

An ATM allows customers to complete basic banking transactions without a teller. When a customer inserts their debit or credit card, the ATM reads the encoded information to access their bank account information through interbank networks. The ATM then prompts for the customer's PIN to verify their identity before allowing transactions like checking balances or withdrawing cash. Common card types used at ATMs include debit cards, which directly access funds from a linked checking account, and cash cards which can be used to withdraw preset amounts. ATMs also may charge fees like activity charges to cover transaction costs or service charges for using an ATM from a non-issuing bank.

1 of 8

Download to read offline

Recommended

ATM BANKING SYSTEM

ATM BANKING SYSTEMsathish sak

╠²

The money transaction most for used an ATMs and credit cards.

The authentication of these transactions are unsecure

Author proposes the idea of using fingerprints

customers as password in place of traditional pin number

A reference fingerprint of the nominee for close family member of the customer

Automated Teller Machine

Automated Teller MachineSowie Althea

╠²

Automated Teller Machines (ATMs) were invented in the 1960s and allowed customers to access cash without a bank teller. The first ATM was introduced in 1967 in London. There are several types of ATMs including online ATMs that are connected to the bank database and offline ATMs that have preset withdrawal limits. While ATMs provide convenience, criminals use various scams like attaching card skimmers to the outside of ATMs and installing fake ATMs solely to steal customer information. Common ATM scams involve stealing customer cards and PINs through hidden cameras or by tricking customers.ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURE

ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURERadhika Venkat

╠²

An ATM allows customers to access financial services without a human clerk. It uses a card with magnetic stripe or chip to identify the customer and a PIN for security. The first ATM was introduced in 1967 in London. An ATM has components like a card reader, keypad, display, printer and cash dispenser. It communicates with a host processor to approve transactions, transferring funds between accounts. ATMs are commonly placed in locations where many people gather for convenience.Atm

AtmAnurag Srivastava

╠²

This presentation summarizes an ATM system. It includes sections on introduction, software and hardware requirements, functions like cash withdrawal and deposits, state and user case diagrams, data flow diagram, class diagram, advantages like convenience and privacy, disadvantages like security risks, screen shots, future scopes such as biometric authentication and white label ATMs, conclusion that ATMs provide secure banking though require improving security, and references.Atm machine

Atm machineVarsha Pawar

╠²

This document discusses embedded systems and ATM machines. It defines an embedded system as a combination of hardware and software designed for a specific task. An ATM machine is then described as an embedded system that allows customers to perform basic banking functions even when the bank is closed. The major components of an ATM machine are identified as the card reader, host processor, keypad/touchpad, speaker, LCD/CRT screen, receipt printer, and cash dispenser. Their individual functions are explained. Advantages and disadvantages of ATM machines are also briefly mentioned.Atm (bm)

Atm (bm)Neha Patel

╠²

The document provides information about Automated Teller Machines (ATMs) in India, including their history, how they work, security measures, and benefits. It notes that ATMs were first introduced in 1967 in London and have since gained prominence as a delivery channel for banking in India. The number of ATMs in India has grown significantly in recent years and is expected to continue growing.Security features of atm

Security features of atmargoncillo

╠²

An ATM (automated teller machine) allows customers to withdraw cash, check balances, and complete other transactions without a human teller. The world's first ATM was installed in Enfield, London in 1967. ATMs are also known as cash machines, cash points, automated banking machines, and hole-in-the-wall. They provide access to financial services via a computer without needing a clerk or teller.Atm reconciliation manual

Atm reconciliation manualCharles Itsuokor

╠²

This document provides an overview of ATM reconciliation procedures. It describes the parties involved in ATM transactions, types of ATM transactions, accounting entries for different transaction types, basic message types, risks associated with ATM operations, and reconciliation processes. The reconciliation process involves daily matching of ATM cash GL transactions to the electronic journal to identify exceptions like un-dispensed cash, partial dispenses, or transactions not impacting the GL. Control procedures like dual custody of keys and weekly unloads are also outlined.Automated taller machine (atm)

Automated taller machine (atm)amanjit9306

╠²

ATMs allow bank account holders to access their accounts and perform transactions without interacting with bank staff. An ATM uses a customer's plastic card with a magnetic strip containing their account information to identify them. The first ATM was installed in London in 1967. There are now over 1.8 million ATMs globally. ATMs provide convenience for customers as they offer 24/7 access to accounts and can be found in many public locations. However, they also pose security risks if cards are stolen and fees are sometimes charged. An ATM consists of components like a CPU, magnetic card reader, display, function keys and vault to control transactions securely.4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etc

4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etcPratap Parab

╠²

4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etc for end to end settlement, chargeback, representment and incident cycleAtm-Automated Teller Machines prepared by Abhijith Rajasekharan

Atm-Automated Teller Machines prepared by Abhijith Rajasekharanabhijith rs

╠²

ATM Automated Teller Machines prepared by Abhijith Rajasekharan from Lourdes Matha College of Science and Technology (LMCST) Kuttichal Trivandrum, keralaATM

ATMDarani Daran

╠²

An automated teller machine (ATM) allows customers of financial institutions to access services such as withdrawing cash, checking balances, transferring funds, and paying bills without a human bank teller. ATMs use magnetic cards containing unique numbers and security PINs to identify customers. The first ATM was introduced in 1967 in London, and since then ATMs have provided 24/7 access to banking worldwide with features like deposits, bill payments, and international support.Presentation On ATM Technology

Presentation On ATM TechnologyVINOD KUMAR RAMKUMAR

╠²

Watch the presentation about Presentation On ATM Technology .I have explained the detail of ATM in a concise manner.For any doubts message us.

Best Wishes

#ATM #ATMTECHNOLOGY #AtmtechnologyPpt final

Ppt finaldikshagupta111

╠²

The document discusses the history and functions of automated teller machines (ATMs). It traces the development of ATMs from early prototypes in the 1930s to the first modern ATM introduced in the UK in 1972. It describes the basic components of an ATM and how they enable customers to perform transactions like withdrawing cash, checking balances, and transferring funds 24/7 without visiting a bank. Benefits include convenience and round-the-clock service for customers as well as reduced workload for bank staff. Potential disadvantages involve limited availability in remote areas and security issues if a card is stolen.Atm transaction

Atm transactionKeerthi Reddy

╠²

An ATM allows customers to access their bank accounts to withdraw cash, check balances, and perform other transactions without a bank teller. The customer inserts their card with a magnetic stripe or chip and enters a PIN for authentication. The ATM can provide cash withdrawals from linked accounts, deposits, money transfers between accounts, and balance inquiries. Security features include limiting total withdrawal amounts and printing receipts to later exchange for cash to reduce fraud.How an ATM transaction really works (and how testing fits in)

How an ATM transaction really works (and how testing fits in)Steve Lacourt

╠²

The document describes the components and process of an ATM transaction. It outlines the key components of an ATM including the card reader, keypad, receipt printer, cash dispenser, display, deposit slot, and QR code. It explains how the card reader retrieves customer account information from the chip card which is sent to the payment host for verification before cash is dispensed or deposits are accepted. It also mentions alternative mobile payment methods and how ATM software and hardware can be virtualized for testing.Cash deposit machine

Cash deposit machineBhavana Nandu

╠²

The document discusses cash deposit machines (CDMs), which allow users to deposit cash into their bank accounts without human assistance. CDMs can be used with a debit card by entering a PIN, or by entering a 15-digit account number. A maximum of Rs. 49,950 can be deposited in 200-400 notes at a time. The machine counts and sorts the cash, displays the amounts, and generates a receipt once complete. Funds are instantly credited to the user's account after deposit is confirmed.Atm machine

Atm machineRanjithMsc

╠²

The document discusses automated teller machines (ATMs). It describes how ATMs allow customers to access financial services without a human bank teller by using their ATM card and PIN. It provides details on the history and development of ATMs, including how the first ATM was installed in 1967 in London. It also outlines the main components of an ATM and describes the benefits and security tips for using ATMs.Atm security

Atm securityPushkar Dutt

╠²

Government Developed ATM Machine those people who do not a stand for a rank of row. Maximum People is attract this system because it is time consuming and user friendly. Government provide many security of that system like, ATM Card No., PIN NoAtm security

Atm securityLikan Patra

╠²

The document discusses the security features of ATM systems. It covers how ATMs work by connecting to a host computer for transaction authorization. Card readers, PIN entry, and crypto-processors securely authenticate users. Additional security measures include transaction limits, invalidating stolen cards, and encrypting transmitted data. Databases and network security aim to protect confidential user information and ensure integrity of financial transactions processed through the ATM network.ATM BANKING

ATM BANKINGAshish Saini

╠²

The document discusses ATM banking in India, including its history, growth, functions, problems, and factors for growth. It notes that ATMs were first introduced in India in 1987 and have since grown rapidly, reaching over 76,000 ATMs in India by 2010-2011. ATMs provide 24/7 banking access and allow customers to withdraw cash, check balances, pay bills and transfer funds. However, customers sometimes experience issues like not receiving cash or receipts. Banks also struggle with theft, fraud and system failures. Overall, ATMs have become an important part of modern banking by improving convenience and reducing costs compared to traditional teller services.Automated Teller Machine

Automated Teller MachineDiotima Gupta

╠²

The document provides an overview of automated teller machines (ATMs). It discusses what an ATM is, the history and growth of ATMs, their functions and structure. Key points covered include that an ATM allows customers to access financial transactions without a human clerk, the first ATM was installed in 1967 in London, and ATMs now number in the millions worldwide. Functions of ATMs include withdrawing cash, checking balances, paying bills and transferring funds. Common ATM components are also outlined such as card readers, displays, cash dispensers and receipt printers.Software for atm manufacturer

Software for atm manufacturerhandryjames

╠²

ATM stands for Automated Teller Machine and allows customers to access their bank accounts for cash withdrawals, check account balance and purchase pre paid mobile phone credit. It often provides one of the best possible official exchange rates for foreign travelers and also widely used for this purpose.Presentationonsecurityfeatureofatm2 130621034116-phpapp02

Presentationonsecurityfeatureofatm2 130621034116-phpapp02Divyaprathapraju Divyaprathapraju

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Atm

AtmSimardeep Kaur

╠²

one of the basic necessities in our life , i have prepared this to make it understandable for a layman to use it . i have also presented to a seminar that was quiet apprecaible , hope to get from you all also .THANK YOU :)Seminar on atm

Seminar on atmkhurda

╠²

An ATM, or automated teller machine, allows bank customers to access their accounts and perform transactions like withdrawing cash or checking balances without interacting with a human teller. The document provides a history of the first ATM, how ATMs work by connecting to bank networks, common security features of ATMs, and tips for safe ATM usage. Modern ATMs use encryption and other technologies to securely process transactions and protect customers' financial information.Atm

AtmVinoth Kumar

╠²

The document discusses the functions and evolution of automated teller machines (ATMs). It describes how ATMs allow customers to withdraw cash, check balances, make deposits, transfer funds between accounts, and complete other banking transactions. It also outlines some of the technical components of ATMs including hardware, software, and international usage statistics. The conclusion is that ATMs provide a convenient, reliable, and secure way for customers to complete banking transactions anytime.Presentation on security feature of atm (2)

Presentation on security feature of atm (2)Siya Agarwal

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Holisticmanagement of global recession dr. shriniwas kashalikar

Holisticmanagement of global recession dr. shriniwas kashalikarBadar Daimi

╠²

The document discusses holistic management of global recession through namasmarn, or remembering the name of God. It states that current individualistic and sectarian perspectives have led to cancerous growth and mutual antagonism. This causes economic booms and busts as consumer bases shrink due to widespread deprivation. It recommends 1) teaching children spiritual practices like prayer from a young age, 2) promoting productive sectors over wasteful activities, 3) incentivizing agriculture, and 4) reducing private vehicle production in favor of public transportation. Most importantly, it asserts that namasmarn is the "yoga of yogas" that can help billions spiritually reorient and establish inner connection, helping overcome sectarianism and manage global recession hol

ANADE Retos Telecom (2016)Carlos J. D├Łaz Sobrino

╠²

El documento describe los principales retos regulatorios y de cumplimiento que enfrentan las empresas de telecomunicaciones en M├®xico. Brevemente resume la reforma constitucional de 2013 que cre├│ la Comisi├│n Federal de Competencia Econ├│mica y el Instituto Federal de Telecomunicaciones como ├│rganos aut├│nomos. Explica los diferentes tipos de licencias para prestar servicios, sus requisitos y obligaciones regulatorias. Finalmente, destaca los retos en materia de protecci├│n al consumidor y protecci├│n de datos personales.More Related Content

What's hot (20)

Automated taller machine (atm)

Automated taller machine (atm)amanjit9306

╠²

ATMs allow bank account holders to access their accounts and perform transactions without interacting with bank staff. An ATM uses a customer's plastic card with a magnetic strip containing their account information to identify them. The first ATM was installed in London in 1967. There are now over 1.8 million ATMs globally. ATMs provide convenience for customers as they offer 24/7 access to accounts and can be found in many public locations. However, they also pose security risks if cards are stolen and fees are sometimes charged. An ATM consists of components like a CPU, magnetic card reader, display, function keys and vault to control transactions securely.4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etc

4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etcPratap Parab

╠²

4 way recon solution for ATM,POS,Recyclers,Mobile banking, Internet banking,etc for end to end settlement, chargeback, representment and incident cycleAtm-Automated Teller Machines prepared by Abhijith Rajasekharan

Atm-Automated Teller Machines prepared by Abhijith Rajasekharanabhijith rs

╠²

ATM Automated Teller Machines prepared by Abhijith Rajasekharan from Lourdes Matha College of Science and Technology (LMCST) Kuttichal Trivandrum, keralaATM

ATMDarani Daran

╠²

An automated teller machine (ATM) allows customers of financial institutions to access services such as withdrawing cash, checking balances, transferring funds, and paying bills without a human bank teller. ATMs use magnetic cards containing unique numbers and security PINs to identify customers. The first ATM was introduced in 1967 in London, and since then ATMs have provided 24/7 access to banking worldwide with features like deposits, bill payments, and international support.Presentation On ATM Technology

Presentation On ATM TechnologyVINOD KUMAR RAMKUMAR

╠²

Watch the presentation about Presentation On ATM Technology .I have explained the detail of ATM in a concise manner.For any doubts message us.

Best Wishes

#ATM #ATMTECHNOLOGY #AtmtechnologyPpt final

Ppt finaldikshagupta111

╠²

The document discusses the history and functions of automated teller machines (ATMs). It traces the development of ATMs from early prototypes in the 1930s to the first modern ATM introduced in the UK in 1972. It describes the basic components of an ATM and how they enable customers to perform transactions like withdrawing cash, checking balances, and transferring funds 24/7 without visiting a bank. Benefits include convenience and round-the-clock service for customers as well as reduced workload for bank staff. Potential disadvantages involve limited availability in remote areas and security issues if a card is stolen.Atm transaction

Atm transactionKeerthi Reddy

╠²

An ATM allows customers to access their bank accounts to withdraw cash, check balances, and perform other transactions without a bank teller. The customer inserts their card with a magnetic stripe or chip and enters a PIN for authentication. The ATM can provide cash withdrawals from linked accounts, deposits, money transfers between accounts, and balance inquiries. Security features include limiting total withdrawal amounts and printing receipts to later exchange for cash to reduce fraud.How an ATM transaction really works (and how testing fits in)

How an ATM transaction really works (and how testing fits in)Steve Lacourt

╠²

The document describes the components and process of an ATM transaction. It outlines the key components of an ATM including the card reader, keypad, receipt printer, cash dispenser, display, deposit slot, and QR code. It explains how the card reader retrieves customer account information from the chip card which is sent to the payment host for verification before cash is dispensed or deposits are accepted. It also mentions alternative mobile payment methods and how ATM software and hardware can be virtualized for testing.Cash deposit machine

Cash deposit machineBhavana Nandu

╠²

The document discusses cash deposit machines (CDMs), which allow users to deposit cash into their bank accounts without human assistance. CDMs can be used with a debit card by entering a PIN, or by entering a 15-digit account number. A maximum of Rs. 49,950 can be deposited in 200-400 notes at a time. The machine counts and sorts the cash, displays the amounts, and generates a receipt once complete. Funds are instantly credited to the user's account after deposit is confirmed.Atm machine

Atm machineRanjithMsc

╠²

The document discusses automated teller machines (ATMs). It describes how ATMs allow customers to access financial services without a human bank teller by using their ATM card and PIN. It provides details on the history and development of ATMs, including how the first ATM was installed in 1967 in London. It also outlines the main components of an ATM and describes the benefits and security tips for using ATMs.Atm security

Atm securityPushkar Dutt

╠²

Government Developed ATM Machine those people who do not a stand for a rank of row. Maximum People is attract this system because it is time consuming and user friendly. Government provide many security of that system like, ATM Card No., PIN NoAtm security

Atm securityLikan Patra

╠²

The document discusses the security features of ATM systems. It covers how ATMs work by connecting to a host computer for transaction authorization. Card readers, PIN entry, and crypto-processors securely authenticate users. Additional security measures include transaction limits, invalidating stolen cards, and encrypting transmitted data. Databases and network security aim to protect confidential user information and ensure integrity of financial transactions processed through the ATM network.ATM BANKING

ATM BANKINGAshish Saini

╠²

The document discusses ATM banking in India, including its history, growth, functions, problems, and factors for growth. It notes that ATMs were first introduced in India in 1987 and have since grown rapidly, reaching over 76,000 ATMs in India by 2010-2011. ATMs provide 24/7 banking access and allow customers to withdraw cash, check balances, pay bills and transfer funds. However, customers sometimes experience issues like not receiving cash or receipts. Banks also struggle with theft, fraud and system failures. Overall, ATMs have become an important part of modern banking by improving convenience and reducing costs compared to traditional teller services.Automated Teller Machine

Automated Teller MachineDiotima Gupta

╠²

The document provides an overview of automated teller machines (ATMs). It discusses what an ATM is, the history and growth of ATMs, their functions and structure. Key points covered include that an ATM allows customers to access financial transactions without a human clerk, the first ATM was installed in 1967 in London, and ATMs now number in the millions worldwide. Functions of ATMs include withdrawing cash, checking balances, paying bills and transferring funds. Common ATM components are also outlined such as card readers, displays, cash dispensers and receipt printers.Software for atm manufacturer

Software for atm manufacturerhandryjames

╠²

ATM stands for Automated Teller Machine and allows customers to access their bank accounts for cash withdrawals, check account balance and purchase pre paid mobile phone credit. It often provides one of the best possible official exchange rates for foreign travelers and also widely used for this purpose.Presentationonsecurityfeatureofatm2 130621034116-phpapp02

Presentationonsecurityfeatureofatm2 130621034116-phpapp02Divyaprathapraju Divyaprathapraju

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Atm

AtmSimardeep Kaur

╠²

one of the basic necessities in our life , i have prepared this to make it understandable for a layman to use it . i have also presented to a seminar that was quiet apprecaible , hope to get from you all also .THANK YOU :)Seminar on atm

Seminar on atmkhurda

╠²

An ATM, or automated teller machine, allows bank customers to access their accounts and perform transactions like withdrawing cash or checking balances without interacting with a human teller. The document provides a history of the first ATM, how ATMs work by connecting to bank networks, common security features of ATMs, and tips for safe ATM usage. Modern ATMs use encryption and other technologies to securely process transactions and protect customers' financial information.Atm

AtmVinoth Kumar

╠²

The document discusses the functions and evolution of automated teller machines (ATMs). It describes how ATMs allow customers to withdraw cash, check balances, make deposits, transfer funds between accounts, and complete other banking transactions. It also outlines some of the technical components of ATMs including hardware, software, and international usage statistics. The conclusion is that ATMs provide a convenient, reliable, and secure way for customers to complete banking transactions anytime.Presentation on security feature of atm (2)

Presentation on security feature of atm (2)Siya Agarwal

╠²

The document discusses the security features of ATM systems. It describes how ATMs work by having customers authenticate using cards and PINs. ATM security relies on crypto-processors, database security, and network security. It provides security through mechanisms like time-outs for invalid PIN entries and recognizing stolen cards. Additional security features include identity verification, data confidentiality, accountability, and audit capabilities. The document emphasizes the importance of keeping ATM cards and PINs secure and reporting any loss or theft.Viewers also liked (16)

Holisticmanagement of global recession dr. shriniwas kashalikar

Holisticmanagement of global recession dr. shriniwas kashalikarBadar Daimi

╠²

The document discusses holistic management of global recession through namasmarn, or remembering the name of God. It states that current individualistic and sectarian perspectives have led to cancerous growth and mutual antagonism. This causes economic booms and busts as consumer bases shrink due to widespread deprivation. It recommends 1) teaching children spiritual practices like prayer from a young age, 2) promoting productive sectors over wasteful activities, 3) incentivizing agriculture, and 4) reducing private vehicle production in favor of public transportation. Most importantly, it asserts that namasmarn is the "yoga of yogas" that can help billions spiritually reorient and establish inner connection, helping overcome sectarianism and manage global recession hol

ANADE Retos Telecom (2016)Carlos J. D├Łaz Sobrino

╠²

El documento describe los principales retos regulatorios y de cumplimiento que enfrentan las empresas de telecomunicaciones en M├®xico. Brevemente resume la reforma constitucional de 2013 que cre├│ la Comisi├│n Federal de Competencia Econ├│mica y el Instituto Federal de Telecomunicaciones como ├│rganos aut├│nomos. Explica los diferentes tipos de licencias para prestar servicios, sus requisitos y obligaciones regulatorias. Finalmente, destaca los retos en materia de protecci├│n al consumidor y protecci├│n de datos personales.

Pr├Īctico de tic.. PROFESORADO DE EDUCACI├ōN PRIMARIAGloria Noemi Ortiz

╠²

El documento presenta una recopilaci├│n de res├║menes de varios art├Łculos acad├®micos sobre el uso pedag├│gico de las tecnolog├Łas de la informaci├│n y la comunicaci├│n (TIC) en el aula. Los art├Łculos abordan temas como los desaf├Łos que enfrentan los docentes para incorporar las TIC de manera efectiva, los nuevos entornos de aprendizaje digital y sus implicancias, y los cambios en la evaluaci├│n del aprendizaje en la era de Internet. En general, se argumenta que si bien las TIC tienen potencial para enWelcome to www. Frank-Ruijgrok.com

Welcome to www. Frank-Ruijgrok.comFrank Ruijgrok

╠²

Specialist in Security, IT-Infrastructure and Telecom serviceswcs profile

wcs profileWISTRALEDGE CONSULTING SERVICES

╠²

Wistraledge Consulting provides management consulting, training, and advisory services. They help clients in diverse industries improve performance, transform operations, and stimulate growth. Their services include strategic planning, business intelligence, project management, IT, and human resources development. They also offer a variety of corporate training programs in areas like leadership, finance, sales, marketing, and personal development. Additionally, Wistraledge provides advisory services focused on business and financial matters, tax, corporate value, quality management, and health and safety. Their goal is to support clients' success through innovative solutions that address specific needs.Mohamed Hassan _ C V

Mohamed Hassan _ C V Mohamed Hassan

╠²

This document provides personal and career details for Mohamed Hassan Ali. It summarizes his educational background in electronics and communications engineering from Suez Canal University. It also outlines his extensive work experience over 10 years in roles such as team leader, RNE engineer, and consultant for various telecommunications companies in Egypt, UAE, and Qatar. His experience includes tasks like network optimization, drive testing, indoor site planning, and technical report writing.Frankly Speaking Dr. Shriniwas Kashalikar

Frankly Speaking Dr. Shriniwas KashalikarBadar Daimi

╠²

Life manifests through cells, organs, systems and organisms in various ways such as movements, emotions, thoughts and theories. It manifests through both tender love and brutal rage, as well as maniacal plans and melancholic deeds. Neither are humans completely right or wrong, but simply exist as life continues to manifest through them. The question is how to merge with the root of life itself, as this idea of merging also seems to have arisen from life. NAMASMARAN is proposed to solve the enigma of the root of ideas, and its validity may be able to be verified.

Planteamiento de un problema por Cecilia ChamgoChangoCecilia

╠²

Este documento presenta las etapas clave del proceso de investigaci├│n, incluyendo la apertura, el cuerpo y el cierre. En el cuerpo, se discuten temas como generar ideas, plantear un problema de manera cient├Łfica, y definir los objetivos y preguntas de investigaci├│n. El documento tambi├®n cubre las caracter├Łsticas de un buen problema de investigaci├│n y c├│mo justificar un estudio.Long_Chelsea_PPP

Long_Chelsea_PPPChelsea Long

╠²

The document introduces Chelsea Long and her background in game art and environment design. She has been interested in games since receiving her first game system at age 5 and took a month-long trip around the world that inspired her to pursue art. With over 5 years of experience in game design programs, Chelsea creates personal art that reflects her big kid nature and takes notes to constantly improve her skills. She is passionate about her work and invites the reader to go on a journey with her.siva green valley,amaravathi road,Gorantla,Guntur

siva green valley,amaravathi road,Gorantla,GunturNagarjuna Reddy Alla

╠²

siva green valley is the first gated community in guntur with all amenitiesNew Kerala September 9, 2009 Prospects Bright For Qualified Institutional Pla...

New Kerala September 9, 2009 Prospects Bright For Qualified Institutional Pla...Jagannadham Thunuguntla

╠²

ŌĆ£Unitech took a chance by going in for a QIP, when conditions were still uncertain. Since then, a lot of companies have found QIP to be the flavour of the season,ŌĆØ said Jagannadham Thunuguntla.How to choose a mobile marketing platform

How to choose a mobile marketing platformVizury - Growth Marketing Platform

╠²

A checklist of 10 questions to help you assess your current Mobile Marketing Platform5 Things Every Mobile App Marketer Should Know- Beyond Installs

5 Things Every Mobile App Marketer Should Know- Beyond InstallsVizury - Growth Marketing Platform

╠²

Here are 5 things that every mobile marketer should know. We have compiled a list from the awesome sessions at an event- Beyond Installs. Great app marketers have shared their tips. Check it out!

Libro de antologia de derecho penal iJoselito C├Īrdenas Guti├®rrez

╠²

Este documento presenta un resumen de la asignatura Derecho Penal I de la Licenciatura en Derecho en el Instituto Colimense de Estudios Superiores. Explica la importancia de distinguir entre conducta antisocial y delito, y define cuatro tipos de conducta: social, asocial, parasocial y antisocial. Tambi├®n distingue entre sujetos sociales, asociales, parasociales y antisociales dependiendo del tipo de conducta que predomine. El objetivo es proveer los conocimientos b├Īsicos sobre la evoluci├│n hist├│rica del derecho

Mindfulness definitivoenfermeriamentalizate

╠²

El documento define mindfulness como una forma de conciencia centrada en el presente no elaborativa y no juzgadora, en la que cada pensamiento, sentimiento o sensaci├│n es reconocida y aceptada tal como es. Ofrece varias definiciones de mindfulness de diferentes autores y explica elementos como centrarse en el momento presente, aceptaci├│n radical y renunciar al control de pensamientos. Tambi├®n describe beneficios como mejora de la regulaci├│n emocional, gesti├│n del estr├®s, bienestar personal y concentraci├│n.

New Kerala September 9, 2009 Prospects Bright For Qualified Institutional Pla...

New Kerala September 9, 2009 Prospects Bright For Qualified Institutional Pla...Jagannadham Thunuguntla

╠²

Similar to What is ATM (20)

Ppt on atm machine

Ppt on atm machinePrabhat Singh

╠²

The document provides information about ATM machines, including:

- It describes the basic functions of an ATM machine and how customers can access their bank accounts and perform transactions even when the bank is closed.

- It discusses the history and development of the first ATM machines in the late 1960s.

- It outlines the key components of an ATM machine, including the card reader, host processor, keypad/touchscreen, screen, receipt printer, cash dispenser, and their basic functions.

- It briefly explains how ATM machines connect to host processors and bank servers to authorize transactions and access customer account information.Out sources of atm

Out sources of atmDharmik

╠²

This document provides information about ATMs, including their history, structure, and uses. It discusses how ATMs work, allowing customers to access cash 24/7 without human intervention. The key components of an ATM are described as the processor, consumer interface panel, card reader, printers, dispenser, and depositor. Alternative uses of ATMs beyond cash withdrawal are also mentioned, such as depositing, checking balances, and transferring funds.Concepts of Digital Banking

Concepts of Digital BankingAbinayaS31

╠²

The document defines key terms related to digital banking such as digitization, digitalization, and digital transformation. It explains that digital banking utilizes digital technologies like analytics, social media, payments, and mobile to enhance traditional online and mobile banking services. The main channels of digital banking are described as ATMs, mobile/internet banking, cards, cash machines, and more. The document provides details on the input/output components of ATMs, how ATM networks function to process transactions, and the basic steps for withdrawing money from an ATM.13828523.ppt

13828523.pptPrashantmittal33

╠²

The document describes how ATM machines work by explaining the steps in an ATM transaction and identifying the main components of an ATM. It discusses how the ATM reads the magnetic strip on an ATM card to access account information. It then prompts the user for their PIN for authentication before allowing cash withdrawals, balance checks, or other transactions. Key components of the ATM include the card reader, keypad, screen, cash dispenser, and receipt printer.Mk seminar

Mk seminarHCL Technologies

╠²

This document provides an overview of ATMs including their history, how they work, security features, and tips for safe usage. It discusses that the first ATM was installed in 1967 in London. It describes the basic components and functions of an ATM including the card reader, keypad, display screen, receipt printer, and cash dispenser. It explains that ATMs connect to host processors to authorize transactions and facilitate electronic funds transfers. The document provides recommendations for choosing a PIN and cautions about protecting account information for security.Mk seminar

Mk seminarHCL Technologies

╠²

The document provides an overview of how ATMs work. It discusses the history of ATMs, beginning with the first one installed in 1967 in London. It describes the basic components and functions of an ATM, including how customers authenticate themselves using cards and PINs, how ATMs are connected to networks to allow withdrawals from other banks, and the basic process by which funds are withdrawn. It also covers reliability issues, security features, and innovations in ATM technology over time.Area of impact -banking and finance

Area of impact -banking and financeJia

╠²

EFT (Electronic Funds Transfer) allows transferring money between bank accounts electronically without paper money changing hands. It is used for payments, refunds, withdrawals, deposits and more. To perform EFT, one must have a bank account and register online for the service. Major banks provide EFT services for customers. Benefits include reduced transaction times and no paperwork, while disadvantages include potential for private information release and lack of human interaction. Security is ensured through unique login credentials and dedicated online gateways.Automated teller machine

Automated teller machineVidya Sagar

╠²

How does an atm work?.. why cant atms be robbed.??

why are atms operated only by atm cards ....why not by visting cards.??ATM / Electronic Clearing Service

ATM / Electronic Clearing ServiceANANDHU BALAN

╠²

An ATM, or automated teller machine, allows customers to access their bank accounts and perform transactions without a human bank teller. Customers insert their debit or credit card and enter their PIN to access their accounts. Using an ATM, customers can withdraw cash, check balances, transfer funds between accounts, and perform other banking tasks. ATMs are connected to financial networks so customers can access their funds from machines not owned by their bank. Estimates show there are over 2.2 million ATMs globally, providing convenient banking access.E Banking

E BankingDeep Das

╠²

This document provides an overview of e-banking in India, including definitions, forms of e-banking such as internet banking, ATMs, telebanking, smart cards, debit cards, and e-cheques. It discusses the global e-banking landscape and trends, focusing on experiences in Asia, the US, and Europe. For India specifically, it notes that e-banking is still nascent but growing in importance. Key challenges include security concerns and technological development, which Indian banks and regulators are working to address through guidelines and initiatives.ATM and E- Banking

ATM and E- BankingAniketPujari

╠²

The document discusses the history and features of automatic teller machines (ATMs). It begins by explaining how ATMs provide convenient banking access for customers 24/7. It then describes the basic functions of an ATM and how customers can deposit, withdraw, and check balances without bank employees. The document outlines the origins of the first ATM in the 1960s and its growth. It also covers the types of ATMs, how to use an ATM, the advantages and disadvantages, and newer technologies like biometric authentication and real-time gross settlement systems.ATM Banking

ATM BankingArnav Sameer

╠²

The document describes the requirements for an ATM network software system. It allows customers to complete banking transactions through off-premise ATMs. The software must interface with individual bank computers to process transactions. Key requirements include supporting account balance inquiries, withdrawals, and transfers according to each bank's business rules while ensuring security of customer authentication and funds. The system must also have high availability, safety protections, and handle concurrent access to accounts correctly.E banking

E bankingmaartinaa

╠²

The document discusses electronic banking or e-banking. It defines e-banking and provides examples of how it can be used, such as direct deposit, bill payment, and account balance checks. It then describes various forms of e-banking including internet banking, automated teller machines, telebanking, smart cards, debit cards, and e-checks. Benefits for both banks and customers are outlined, along with some concerns regarding e-banking. The document concludes with sections on the global perspective of e-banking, strategies, transactions, and trends.Wireless Serial Data Synchronization for Money Transaction Using Multi Accoun...

Wireless Serial Data Synchronization for Money Transaction Using Multi Accoun...IJSRED

╠²

This document summarizes a proposed system for a multi-account ATM card that allows users to access multiple bank accounts with one card. The system uses eye tracking and facial recognition to authenticate authorized users. For unauthorized users, it sends an OTP to the authorized user's phone that must be entered for access. This provides enhanced security while allowing the convenience of managing multiple accounts in one card. If eye tracking authenticates the user, they can select the bank account to use from a displayed list.Ijcsi 9-4-2-457-462

Ijcsi 9-4-2-457-462Hai Nguyen

╠²

This document discusses two-factor authentication in the banking sector, specifically evaluating its performance for automated teller machines (ATMs). It provides background on ATMs, including a brief history of their development from the late 1960s onward. It describes how two-factor authentication works for ATM transactions, requiring both the physical ATM card and a personal identification number (PIN). The document examines different factors of authentication and classifications of factors into things the user has, knows, and is (biometrics).An atm with an eye

An atm with an eyeChand Pasha

╠²

This document discusses adding facial recognition technology to ATMs. It proposes combining a physical access card, PIN, and facial recognition for added security. The main challenges are keeping verification time negligible, allowing for variation in a customer's face, and enabling credit card use without banks having customer photos. Facial recognition could match a live image to one stored in a bank database associated with the account, neutralizing stolen card and PIN fraud. With appropriate lighting and software, variations could be accounted for, and additional images stored over time to decrease false negatives. This added security could reduce theft by bank employees and the impact of stolen cards and PINs.E010313141

E010313141IOSR Journals

╠²

This document summarizes a research paper on developing a multi-account embedded ATM card with enhanced security. Key points include:

1) The proposed system would embed multiple bank accounts onto a single smart ATM card, allowing customers to access all accounts from any ATM without carrying multiple cards.

2) Security would be enhanced through fingerprint authentication instead of just a PIN. A fingerprint scanner would be integrated into the ATM to verify customers' identities.

3) This would provide more convenience for customers while reducing fraud risks compared to traditional single-account cards authenticated solely with PINs.Tellerpass -

Tellerpass - Yiannis Hatzopoulos

╠²

TellerPass is a SIM card applet that dynamically generates one-time passwords every 30 seconds to access bank accounts through ATMs, web banking, and phone banking. It runs autonomously on the SIM card without interacting with the banking server during use. This improves security over traditional hardware OTP generators by preventing man-in-the-middle attacks. TellerPass allows multiple applets from different banks to coexist securely on one SIM card.Ppt

PptShashank Bhat

╠²

Bank computerization in India increased after economic liberalization in 1991. The Reserve Bank of India set up committees in 1984 and 1988 to define banking technology standards and coordinate computerization efforts. The 1984 committee recommended introducing MICR technology and standardized cheque forms. The 1988 committee emphasized computerizing clearing house settlement operations and increasing branch connectivity through computers. Automated teller machines allow customers to perform basic transactions without a bank representative. Customers use an ATM card and PIN for authentication. ATMs make cash available 24/7 and are part of interbank networks. HSBC introduced the first ATM in India in 1987. Electronic clearing service is an electronic funds transfer between bank accounts, used for payments like salaries, dividends, and loanPayment gateway testing

Payment gateway testingAtul Pant

╠²

This document outlines steps to test payment gateway functionality, including:

1. Gathering test credit card numbers and sandbox accounts for testing.

2. Understanding integration between payment gateway and application and testing parameters passed between them.

3. Checking successful retrieval of payment data by the application and error handling.

4. Verifying database entries for transactions, amounts, and errors.

5. Ensuring security measures are in place for transactions.What is ATM

- 1. Assignment Personal development & Information Technology: Topic: ATM (Automated Teller Machine) NCBA & E

- 2. What is an ATM (Automated Teller Machine)? An automated teller machine (ATM) is an electronic banking outlet, which allows customers to complete basic transactions without the aid of a branch representative or teller. When you insert your debit or credit card into the ATM, it reads the information encoded on the magnetic strip on the back of the card. That black strip is encoded with your unique card number, expiration date and personal identification number (PIN). Your card is basically a hard copy of the access information to your account. The ATM then asks for your PIN to verify your authorization to access account funds and information. When you have verified your PIN, the ATM communicates with your bank to access your account information. It can then display your account balance or distribute cash to you from your bank account balance. The ATM is connected to a collection of massive interbank networks. The two largest interbank networks are Cirrus and Pulse, although there are many others. An ATM can only provide access to bank accounts that are enrolled in the interbank networks it has access to; these are usually listed on the side of the machine. These interbank networks use phone lines, internet access and central computers to distribute information among one another and facilitate financial transactions. Some cards and charges use in ATM:- ’éĘ Debit Card A payment card that deducts money directly from a consumerŌĆÖs checking account to pay for a purchase. Debit cards eliminate the need to carry cash or physical checks to make purchases. In addition, debit cards, also called check cards. ’éĘ Cash Card A cash card can be any card that you can insert into an ATM or other cash dispenser, or a pre-paid credit card or a card with a preset cash value from a particular store (Costco or Subway), which is read by a cash card reader and used to pay for products or services at that retailer.

- 3. ’éĘ Activity Charge A fee charged to cover the servicing costs of an account. An activity charge is triggered by an activity or event, and should follow a fee schedule outlined in the account contract. These fees can be based on teller and non-teller activities. ’éĘ Service Charge A service charge is a type of fee charged to cover services related to the primary product or service being purchased. ’āś For example, a concert venue may charge a service fee in addition to the initial price of a ticket in order to cover the cost of security or for allowing electronic purchases. ’āś Another example would be a fee for using the ATM of a competing bank. ’üČ Quite a few things take place when you insert the card into an ATM. First and foremost the ATM awakens. Most modern ATMs go into a power saving mode, but when the card is inserted, the ATM is now fully awake (from a power point of view). ATMs (or Automated Teller Machines) are known as Alternative Delivery Channels. ’éĘ Alternative, because they are alternative to the human teller. ’éĘ Delivery because they are programmed to deliver a specific set of services, and ’éĘ Channel because in the banking world, all delivery mechanisms need a channel via which the delivery would be made.

- 4. ’üČ ATMs or Auto Teller Machines follow a simple five step process: 1. Validate the card : if its really a debit/credit card that is acceptable in the machine 2. Read the account number : The account number of the card is coded on the black magnetic script on the back of the card. 3. Validate the user : The user or cardholder is validated generally by asking for a 4 digit pin code. 4. Connect to the network: All the above information (account number and pin code) is validated on the bank's network through a satellite network. ATMs generally have a dish antenna nearby them which are used for the communication with the bank's network through satellites. 5. Dispense the cash: The cash is dispensed from the trays inside the machine as requested by the user. After this a receipt is printed out and the transaction ends. The validation and account number reading is done through 2 sensors in the panel where you insert the card. The first sensor validates the card and second one reads the account number. The cash is stored in trays inside the machine. Different trays are used to store different denominations of bills. A single bill is taken out of each tray at a time to dispense. To validate the bills being issued, a sensor is placed on the conveyer that carries the bills, which measures the thickness of the bill. If the thickness is more than standard, there might be a possibility of more than one bill being issued. If the thickness is less, the bill might be fake. So, all such doubtful bills are separated and stored in a specified tray; these are sorted later manually. The ATM machine is an impregnable vault that can take a lot of pressure or powerful impact before breaking down to prevent the cash inside from being stolen. The trays have ink jets installed in them which make the cash worthless by spraying ink over the bills in case of any attempt to steal the cash.

- 5. ATM CONNECTIVITY To understand how the ATMs work, it is a good idea to know how they connect: Needless to say all ATMs connect to some server. This is called the Host Server or Host Switch (for the ATMs): These Host Servers may be of your own bank or another bank. Whatever the case maybe, their connectivity would usually look something like this:

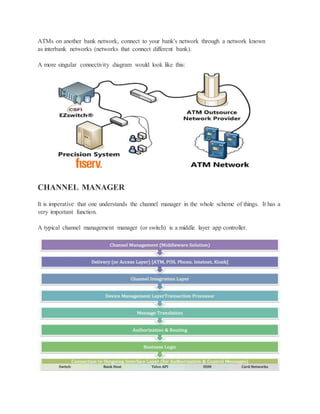

- 6. ATMs on another bank network, connect to your bank's network through a network known as interbank networks (networks that connect different bank). A more singular connectivity diagram would look like this: CHANNEL MANAGER It is imperative that one understands the channel manager in the whole scheme of things. It has a very important function. A typical channel management manager (or switch) is a middle layer app controller.

- 7. The above is what a multi-channel manger would look like. Again, this is nothing more than a software, middle-layer app server that is essentially doing a very crude form of financial routing. BASIC CHECKS when you insert a card into the ATM, the following (more or less) is checked for: In the channel manage diagram, you will see something called the HSM that is the Hardware Security Module. This is where the PIN is kept (encrypted) and from where the PIN is confirmed. Once the PIN is confirmed, the middle-layer will request access to the core-banking server and here (like with any transaction, the user's bank account would be locked, till such time the transaction is completed, so double-spend does not occur). If all the validation checks for you being able to withdraw money from your account are good, then the money will be dispensed by the ATM.