What We Do

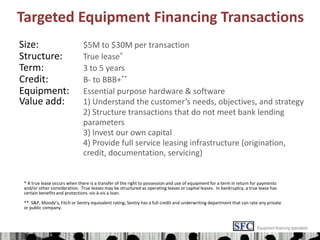

- 1. Targeted Equipment Financing TransactionsSize:$5M to $30M per transactionStructure:True lease*Term:3 to 5 yearsCredit: B- to BBB+**Equipment:Essential purpose hardware & softwareValue add:1) Understand the customer’s needs, objectives, and strategy 2) Structure transactions that do not meet bank lending parameters 3) Invest our own capital 4) Provide full service leasing infrastructure (origination, credit, documentation, servicing)* A true lease occurs when there is a transfer of the right to possession and use of equipment for a term in return for payments and/or other consideration. True leases may be structured as operating leases or capital leases. In bankruptcy, a true lease has certain benefits and protections vis-à -vis a loan.** S&P, Moody’s, Fitch or Sentry equivalent rating; Sentry has a full credit and underwriting department that can rate any private or public company.Equipment financing specialists

- 2. Targeted Vendor Financing EngagementsVendors:Manufacturers (U.S. or foreign) of capital equipment and softwareStructure:Lease line facility The vendor provides its targeted customers with a lease line facility that can be drawn down over a term typically from 6 to 12 monthsSize:$10M to $100M per customerTakedowns: Each takedown (funding) is structured as a true lease Each lease has a term from 3 to 5 years based on the equipment and credit of the lesseeEquipment: Hardware, software and services (total solution)Value add:Manufacturers are able to: 1) offer “one-stop shopping” 2) increase total solution sales 3) strengthen customer relationshipsEquipment financing specialists