working capital mgmt

- 2. ŌĆó Working capital typically means the firmŌĆÖs holding of current or short-term assets such as cash, receivables, inventory and marketable securities. ŌĆó Working Capital refers to that part of the firmŌĆÖs capital, which is required for financing short-term or current assets. ŌĆó These items are also referred to as circulating capital. Working capital: Concept

- 3. ’üĮ There are two possible interpretations of working capital concept: 1. Balance sheet concept 2. Operating cycle concept Balance sheet concept: There are two interpretations of working capital under the balance sheet concept. a. Excess of current assets over current liabilities b. Gross or total current assets. Excess of current assets over current liabilities are called the net working capital or net current assets. Concept of working capital

- 4. Operating cycle concept ŌĆó A companyŌĆÖs operating cycle typically consists of three primary activities: ŌĆō Purchasing resources, ŌĆō Producing the product and ŌĆō Distributing (selling) the product. These activities create funds flows that are both unsynchronized and uncertain. Unsynchronized because cash disbursements usually take place before cash receipts. Uncertain because future sales and costs cannot be forecasted with complete accuracy.

- 5. ŌĆó The firm has to maintain cash balance to pay the bills as they come due. ŌĆó In addition, the company must invest in inventories to fill customer orders promptly. ŌĆó And finally, the company invests in accounts receivable to extend credit to customers. ŌĆó Operating cycle is equal to the length of inventory and receivable conversion periods. Operating cycle concept

- 6. Operating cycle of a typical company Payable Deferral period Inventory conversion period Cash conversion cycle Operating cycle Pay for Resources purchases Receive CashPurchase resources Sell Product On credit Receivable Conversion period

- 7. THE WORKING CAPITAL CYCLE (OPERATING CYCLE) Accounts Payable Cash Raw Materials W I P Finished Goods Value Addition Accounts Receivable SALES

- 8. If you Then ...... Collect receivables (debtors) faster You release cash from the cycle Collect receivables (debtors) slower Your receivables soak up cash Get better credit (in terms of duration or amount) from suppliers You increase your cash resources Shift inventory (stocks) faster You free up cash Move inventory (stocks) slower You consume more cash

- 9. ŌĆó Raw material storage peiod: = Average stock of raw material Cost of raw material consumed/365 ŌĆó WIP holding period: Average WIP inventory/ Cost of production/365 ŌĆó Finished goods storage period: Average stock of finished goods/Cost of goods sold/365 ŌĆó Inventory conversion period: Avg. inventory/ Cost of sales/365 ŌĆó Receivable conversion period:Accounts receivable/Annual credit sales/365 ŌĆó Payables deferral period: Accounts payable/(Credit purchases)/365 Operating cycle: Inventory conversion period + receivable conversion period. Cash conversion cycle = operating cycle ŌĆō payables deferral period.

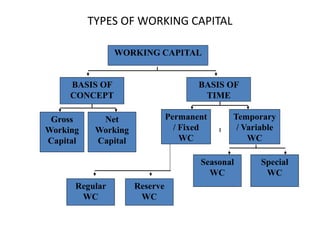

- 10. TYPES OF WORKING CAPITAL WORKING CAPITAL BASIS OF CONCEPT BASIS OF TIME Gross Working Capital Net Working Capital Permanent / Fixed WC Temporary / Variable WC Regular WC Reserve WC Special WC Seasonal WC

- 11. ŌĆó The size and nature of investment in current assets is a function of different factors such as ŌĆō Type of products manufactured, ŌĆō Length of operating cycle, ŌĆō Sales level, ŌĆō Inventory policies, ŌĆō Unexpected demand and ŌĆō Unanticipated delays in obtaining new inventories, ŌĆō Credit policies and ŌĆō Current assets. Working capital investment

- 12. Difference between permanent & temporary working capital Amount Variable Working Capital of Working Capital Permanent Working Capital Time

- 13. Variable Working Capital Amount of Working Capital Permanent Working Capital Time

- 14. Matching approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time Rs Short-term Debt Long-term Debt + Equity Capital

- 15. Conservative approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time Rs Short-term Debt Long-term Debt + Equity capital

- 16. Aggressive approach to asset financing Fixed Assets Permanent Current Assets Total Assets Fluctuating Current Assets Time RS Short-term Debt Long-term Debt + Equity capital

- 17. FACTORS DETERMINING WORKING CAPITAL 1. Nature of the Industry 2. Demand of Industry 3. Cash requirements 4. Nature of the Business 5. Manufacturing time 6. Volume of Sales 7. Terms of Purchase and Sales 8. Inventory Turnover 9. Business Turnover 10. Business Cycle 11. Current Assets requirements 12. Production Cycle

- 19. Satyam Ltd profit and loss A/c and balance sheet for the year ended 31.12.15 are given below. You required to calculate the working capital requirement under operating cycle method: Opening stock Raw material 10,000 WIP 30,000 Finished goods 5,000 Credit purchase 35,000 Manufacturing expn 15,000 Gross profit 55,000 150,000 Administration expn 15,000 Selling &distrbtn expn 10,000 Net profit 30,000 55,000 Credit sales 1,00,000 Closing stock Raw material 11,000 WIP 30,500 Finished goods 8,500 150,000 Gross profit 55,000 . 55,000

- 20. Liabilities Equities (16,000@Rs.10) 160,000 Net Profit 30,000 Creditors 10,000 2,00,000 Assets Fixed Assets 1,00,000 Debtors 30,500 Cash and Bank 19,500 Closing stock Raw material 11,000 WIP 30,500 Finished goods 8,500 2,00,000 Opening debtors (excluding profit) and opening creditor were Rs.6,500 and Rs.5,000 respectively

- 21. Calculation of operating cycle Raw material Average raw material /Raw material consumed per day =10,500/34,000/365 = Work in progress Average WIP /Total cost of production per day =30,250/48500/365 =

- 22. Calculation of operating cycle Finished goods Average stock/ Total cost of goods sold per day =6750/45,000/365 = Debtors Average Debtors/ credit sales per day =18,500/ 100,000/365 =

- 23. Calculation of operating cycle Creditor Average creditor/credit purchases per day =7500/35,000/365 Net Operating Cycle is Total days ŌĆō Credit allowed by creditors =

- 24. Estimation of Net Working capital requirement for Exl Ltd from the data given below Cost of production (per unit) Amount(per unit ) Raw materials 100 Direct labour 40 Overheads 80 220 The following are the additional information: Selling price per unit Rs.240 Level of activity 1,04,000 units p.a Raw material in stock Average 4 weeks Work In Progress (Assume 100% stage of completion of materials and 50 percent for labor and overheads) Average 2 weeks Finished goods in stock Average 4 weeks Credit allowed by supplier Average 4 weeks Credit allowed by debtors Average 8 weeks Lag in payment of wages Average 1.50 weeks Cash at bank is expected to Rs.25,000. Production is sustained during 52 weeks of year

- 25. Statement of Working Capital Requirement Particulars Amount Raw materials 2,000 x 4 x 100 8,00,000 WIP ŌĆóRaw materials 2,000 x 2 x 100 4,00,000 ŌĆóWages (2,000 x 2 x 40)50% 80,000 ŌĆóOverheads (2,000 x 2 x 80) 50% 1,60,000 6,40,000 Finished stock 2,000 x 4 x 220 17,60,000 Debtors 2,000 x 8 x 220 35,20,000 Cash 25,000 Total Current Assets 67,45,000 Creditors 2,000 x 4 x 100 8,00,000 Outstanding wages 2,000 x 4 x 1.5 1,20,000 Total current liabilities 9,20,000 Net working capital (TCA - TCL) 58,25,000

- 26. INVENTORY ’āśMEANING ŌĆó Held for SALE ŌĆó Consumed in the PRODUCTION of goods and services ’āś Forms of Inventory for Manufacturing firm. ’āśRaw materials, ’āśWork in process, ’āśFinished goods and stores & spares.

- 27. Inventory Management- objectives ’āśMinimize investments in inventory ’āśMeet the demand for products by efficiently organizing the production & sales operations.

- 28. RISK OF HOLDING INVENTORY ŌĆó Price decline ŌĆó Product Deterioration ŌĆó Product Obsolescence

- 29. COSTS OF HOLDING INVENTORIES ŌĆó Ordering costs ŌĆó Inventory Carrying/storage costs ŌĆó Opportunity costs of funds blocked ŌĆó Shortage

- 30. TOOLS & TECHNIQUES OF INVENTORY MANAGEMENT/ CONTROL ŌĆó ABC Analysis ŌĆó Economic Ordering Quantity (EOQ) ŌĆó Order Point Problem

- 31. ABC analysis ŌĆó ABC analysis is an inventory categorization method which consists in dividing items into three categories, A, B and C: ŌĆō A being the most valuable items, ŌĆō C being the least valuable ones. ŌĆó This method aims to draw managersŌĆÖ attention on the critical few (A-items) and not on the minor many (C-items).

- 32. ABC Analysis CATEGORY NO. OF ITEMS(%) ITEM VALUE(%) MANAGEMENT CONTROL A 15 70 (HIGHEST) MAXIMUM B 30 20(MODERATE) MODERATE C 55 10(LEAST) MINIMUM TOTAL 100 100

- 33. Example ABC Analysis Stock Number Annual Volume Percent of Annual Volume J24 12,500 46.2 R26 9,000 33.3 L02 3,200 11.8 M12 1,550 5.8 P33 620 2.3 T72 65 0.2 S67 53 0.2 Q47 32 0.1 V20 30 0.1 Total = 100.0

- 34. Solution ABC Groups Class Items Annual Volume Percent of Volume A J24, R26 21,500 79.5 B L02, M12 4,750 17.6 C P33, T72, S67, Q47, V20 800 2.9 S = 100.0

- 35. Economic Ordering Quantity (EOQ) ŌĆó Level of Inventory at which ŌĆó Total Cost* of Inventory is MINIMUM *(Ordering and Carrying Cost)

- 36. EOQ MODEL 2AO Q = S Q = Economic Order Quantity A = Annual usage/demand O= Cost of Placing an order S = Storage cost per unit per order * Where Storage cost is given in % , it is always calculated by multiplying the % with the purchase price of raw material per unit, i.e Storage cost = % X Purchase price of raw material

- 37. BEHAVIOR OF INVENTORY RELATED COSTS Costs Total costs Carrying costs Ordering costs Quantity ordered

- 38. BEHAVIOUR OF INVENTORY RELATED COSTS ŌĆó Total cost of Inventory = Ordering cost + Holding cost ŌĆō Ordering cost = Annual Demand*Ordering cost/Q ŌĆō Holding cost = Q*Holding cost /2

- 39. EOQ- Example ŌĆó A firmŌĆÖs annual inventory is 1,600 units. ŌĆó The cost of placing an order is Rs 50, purchase price of raw material/unit is Rs.10 and the carrying costs is expected to be 10% per unit p.a. ŌĆó Calculate EOQ? A=1600, O= Rs. 50, S= .10 x Rs.10=Rs.1 EOQ = 2 x 1600 x 50 1 = 400 units

- 40. Order Point Problem ŌĆó The re-order point is that level of inventory when a fresh order should be placed with suppliers. It is that inventory level which is equal to the consumption during the lead time or procurement time. ŌĆó Re-order level = (Daily usage ├Ś Lead time) + Safety stock. ŌĆó Safety stock is minimum level of inventory that a firm keeps in hand. The firm reorders more inventory if the current inventory falls to safety level. ŌĆó Safety Stock = (Maximum Daily Usage ŌłÆ Average Daily Usage) ├Ś Lead Time

- 41. Example ŌĆó ABC Ltd. is engaged in production of tires. It purchases rims from DEL Ltd. an external supplier. DEL Ltd. takes 10 days in manufacturing and delivering an order. ŌĆó ABC's requires 10,000 units of rims per year. Its ordering cost is Rs.1,000 per order and its carrying costs are Rs.3 per unit per year. ŌĆó The maximum usage per day could be 50 per day. Calculate economic order quantity, total cost of inventory, reorder level and safety stock.

- 42. Solution ŌĆó EOQ, (Q) = (2*Annual Demand*Ordering Cost Per Unit / Carrying Cost Per Unit)^1/2 ŌĆó Q = (2*10,000*1,000/3)^1/2 = 2582 ŌĆó Total cost of Inventory = Ordering cost + Holding cost ŌĆō Ordering cost = Annual Demand*Ordering cost/Q = 10,000*1,000/2582 ŌĆō Holding cost = Q*Holding cost /2 ŌĆō =

- 43. Reorder point ŌĆó Safety Stock = (Maximum Daily Usage ŌłÆ Average Daily Usage) ├Ś Lead Time ŌĆó Reorder Level = Safety Stock + Average Daily Usage ├Ś Lead Time

- 44. Example Assume you have a product with the following parameters: Annual Demand: 360; Holding cost per unit: Rs.1; Cost per order: Rs.100 The maximum daily demand is 3 units per day 1. What is the EOQ? 2. Given the data, and assuming a 300-day work year; how many orders should be processed per year? What is the expected time between orders? 3. What is the total cost for the inventory policy used ? 4. Assume that the demand was actually higher than estimated (i.e., 500 units instead of 360 units). What will be the actual annual total cost?

- 45. Solution EOQ Demand Order cost Holding cost items’ĆĮ ’ĆĮ ’ĆĮ ’ĆĮ 2 2 360 100 1 72000 268 * * * * N Demand Q orders per year’ĆĮ ’ĆĮ ’ĆĮ 360 268 134. T Working days Expected number of orders days between orders’ĆĮ ’ĆĮ ’ĆĮ300 134 224/ .

- 46. ŌĆó Total cost of Inventory = Ordering cost + Holding cost ŌĆó Ordering cost = Annual Demand *Ordering cost/Q = 360* 100/268 = 134 ŌĆó Holding cost = Q*Holding cost /2 = 268*1/2 = ŌĆó Total Cost of inventory =

- 47. JUST-IN-TIME (JIT) INVENTORY CONTROL ŌĆó The JIT control system implies that the firm should maintain a minimal level of inventory and rely on suppliers to provide parts and components ŌĆśjust-in-timeŌĆÖ to meet its assembly requirements. ŌĆó JIT also known as Zero Inventory Production Systems(ZIPS), Zero Inventories(ZIN), Materials as Needed(MAN), or Neck of Time(N0T)

- 48. Cash Management

- 49. Definition Cash Management refers to management of cash & bank balance and also includes the management of short term deposits.

- 50. Motives of cash management ŌĆó Transaction motive: Business firm keep cash to meet their demand for cash arising from day to day transactions. ŌĆó Precautionary motive: Maintenance of cash balance to act as buffer against unexpected events. ŌĆó Speculative motive: Cash balance to take advantage of potential profit making situations that may occur in future.

- 51. Optimum Cash Balance ŌĆó BaumolŌĆÖs model ŌĆó Miller-orr model

- 52. BaumolŌĆÖs model ŌĆó Suggested by William J. Baumol (1952) ŌĆó The model attempts to balance the income foregone on cash held by the firm against the transaction cost of converting cash into marketable securities or vice versa. ŌĆó This model can be presented on assumption as follows: ŌĆō Fixed Cash flow : The BaumolŌĆÖs model assumes that the firm uses cash at an already known rate per period and that this rate of use is constant. ŌĆō Holding cost: The holding cost is the opportunity cost in terms of interest foregone on investment in cash. ŌĆō Transaction cost: whenever cash is invested in marketable securities, there is cost involved like brokerage or commission.

- 54. Illustration ŌĆó The annual cash requirement of A Ltd. is Rs 10 lakhs. The company has marketable securities in lot sizes of Rs 50,000, Rs 1, 00,000, Rs 2, 00,000, Rs 2, 50,000 and Rs 5, 00,000. ŌĆó Cost of conversion of marketable securities per lot is Rs.1,000. The company can earn 5% annual yield on its securities. ŌĆó You are required to prepare a table indicating which lot size will have to be sold by the company. Also estimate the economic lot size can be obtained by the Baumol Model.

- 55. Baumol model C= 2A*F/O Where A= Annual requirement = 10 lakh F = Fixed conversion charges = 1000 O = opportunity 5% C = 2*10,00,000*1000/0.05 = 2,00,000

- 56. Table indicating lot size S. No Particulars Situation 1 Situtation2 Situation 3 A Annual cash requirement (Given) 10,00,000 10,00,000 10,00,000 B Lot size of securities (Given) 50,000 1, 00,000 2,00,000 C No. of lot sizes (A/B) 20 10 5 D Average holding OF CASH (B/2) 25,000 50,000 1,00,000 E Opportunity cost of holding cash (D x 0.05) 1250 2500 5000 F Fixed conversion cost (given) 1000 1000 1000 G Total conversion cost (C x F) 20,000 10,000 5,000 H Total cost (E+G) 21,250 12,500 10,000 The above illustration shown that the minimum cost is Rs.10,000 when the lot size is 2,00,000

- 57. Miller and Orr model ŌĆó BaumolŌĆÖs model is based on the basic assumption that the size and timing of cash flows are known with certainty. Whereas, in real situation, the cash flows of a firm are neither uniform nor certain. ŌĆó M.H. Miller and Daniel Orr (A Model of the Demand for Money) expanded on the Baumol model and developed Stochastic Model for firms with uncertain cash inflows and cash outflows.

- 58. The Miller and Orr (MO) model provides two control limits-the upper control limit and the lower control limit along-with a return point as shown in the figure below:

- 59. Miller and Orr model ŌĆó If the cash balance touches the upper control limit (H), marketable securities are purchased to the extent of (H-Z) to return back to the normal cash balance of Z. ŌĆó If the cash balance touches lower control limit (O), the firm will sell the marketable securities to the extent of O-Z to again return to the normal cash balance. ŌĆó The spread between the upper and lower cash balance limits (called Z) can be computed using Miller-Orr model as below:

- 60. Receivables Management ŌĆó Accounts receivables for the selling firm is same as an account payable for the purchaser. ŌĆó The purpose of credit analysis is to assess the credit worthiness of potential customers and the corresponding risk of late payments or default.

- 61. Receivables Management ŌĆó Credit analysis consists of: 1. Gathering information about the potential customer 2. Analyzing the information to derive a credit decision about the payment terms and amount of trade credit granted Credit agencies provide credit ratings and reports on companies.

- 62. STEPS IN CREDIT ANALYSIS The 5 CŌĆÖs of Credit Analysis ŌĆó Character - Reputation, Track Record ŌĆó Capacity - Ability to repay. ŌĆó Capital - Financial Position of the co. ŌĆó Collateral - The type and kind of assets pledged ŌĆó Conditions - Economic conditions & competitive factors that may affect the profitability of the customer.

- 63. Credit planning Aspects of credit planning ŌĆó Credit policy ŌĆó Credit standards ŌĆó Credit terms

- 64. Credit policy A company's policy related to trading off the profit on additional sales that arises due to credit sales and the cost of carrying those debtors and probable bad debts.

- 65. Credit standards ŌĆó The guidelines issued by a company that are used to determine if a potential borrower is creditworthy. ŌĆó Credit standards are often created after careful analysis of past borrowers and market conditions, and are designed to limit the risk of a borrower not making credit payments or defaulting on loaned money.

- 66. Credit terms ŌĆó The terms which indicate when payment is due for sales made on account (or credit). ŌĆō Credit period ŌĆō Discount period ŌĆō Discount rate ŌĆó The general credit terms are expressed as 2/10, net 30. This means the amount is due in 30 days; however, if the amount is paid in 10 days a discount of 2% will be permitted.

- 67. Calculation of annualized return ŌĆó If credit term is expressed as a/b,net c then; ŌĆó Annualized return = a/(1-a) * 360/(c-b) Which of the below terms have lower cost to company? 1. 2/10, net 30 2. 5/10, net 60

Editor's Notes

- #22: Total cost of production: = Opn WIP + Raw material consumed + Manufacturing expn ŌĆō Cls. WIP 30,000 + (10,000 +35000- 11,000)+ 15,000 ŌĆō 30,500 = 48,500

- #23: Cost of goods sold = Opn Finished Goods + Cost of production ŌĆō Cls Finished Goods= 5,000 + 48,500 ŌĆō 8,500 = 45,000 Average Debtors: (6500 + 30,500)/2 = 18,500

- #24: Average creditor = (5,000 + 10,000)/2 = 7,500

- #26: 1,04,000/52 = 2,000