X-FACTOR

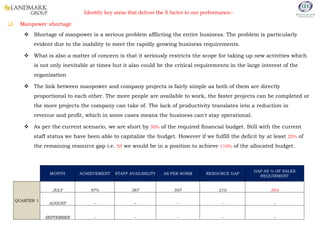

- 1. Identify key areas that deliver the X factor to our performance:- ïą Manpower shortage ïķ Shortage of manpower is a serious problem afflicting the entire business. The problem is particularly evident due to the inability to meet the rapidly growing business requirements. ïķ What is also a matter of concern is that it seriously restricts the scope for taking up new activities which is not only inevitable at times but it also could be the critical requirements in the large interest of the organization ïķ The link between manpower and company projects is fairly simple as both of them are directly proportional to each other. The more people are available to work, the faster projects can be completed or the more projects the company can take of. The lack of productivity translates into a reduction in revenue and profit, which in some cases means the business can't stay operational. ïķ As per the current scenario, we are short by 35% of the required financial budget. Still with the current staff status we have been able to capitalize the budget. However if we fulfill the deficit by at least 25% of the remaining resource gap i.e. 53 we would be in a position to achieve 110% of the allocated budget. MONTH ACHIEVEMENT STAFF AVAILIBILITY AS PER NORM RESOURCE GAP GAP AS % OF SALES REQUIRMENT QUARTER 1 JULY 97% 387 597 210 35% AUGUST - - - - - SEPTEMBER - - - - -

- 2. STORES GRAD E AREA (SQ FT) AVAILABL E STAFFS OPTIMUM REQUIRM NETS AS PER AREA RESOURC ES GAP GAP AS % OF AREA REQUIRMEN T JULY BUDGET YEARLY BUDGET SALES PER DAY OPTIMUM REQUIRMN ETS AS PER SALES RESOURC ES GAP GAP AS % OF SALES REQUIRMEN T CP - Takasusi A+ 21,447 15 29 14 48% 100% 27,821,601 77,068 26 11 42% CP - Alqassim A+ 10,770 10 14 4 30% 94% 15,230,091 42,189 14 4 29% CP - King Abdulla St A+ 20,251 22 27 5 19% 91% 54,256,026 150,294 50 28 56% CP - Tabuk A+ 12,722 12 17 5 29% 93% 20,886,951 57,859 19 7 38% CP - Abha A+ 17,221 15 23 8 35% 86% 25,708,954 71,216 24 9 37% CP - Hail A+ 12,313 11 16 5 33% 95% 17,958,527 49,747 17 6 34% CP - Exit 9 A+ 19,865 22 26 4 17% 95% 59,714,293 165,414 55 33 60% CP - Khurais Road A+ 18,367 16 24 8 35% 99% 36,067,026 99,909 33 17 52% CP - Mansoora A+ 19,324 17 26 9 34% 110% 22,283,150 61,726 21 4 17% CP - Al Kharj A+ 14,058 12 19 7 36% 97% 17,826,069 49,380 16 4 27% CP - Buraida A+ 12,648 13 17 4 23% 91% 30,605,673 84,780 28 15 54% CP - Badiya A+ 19,929 19 27 8 28% 106% 24,834,189 68,793 23 4 17% CP - Rabuwa A+ 17,731 16 24 8 32% 91% 27,754,099 76,881 26 10 38% CP - Jizan A+ 18,054 14 24 10 42% 92% 25,538,350 70,743 24 10 41% CP - Gallery A+ 18,417 20 25 5 19% 98% 33,147,536 91,821 31 11 35% Total 253,117 234 337 103 31% 96% 439,632,536 1,217,819 406 172 42% Babyshop âAâ Grade Stores

- 3. Babyshop âBâ Grade Stores Available staff, Optimum staff and Resources Gap STORES GRAD E AREA (SQ FT) AVAILABLE STAFFS OPTIMUM REQUIRMNET S AS PER AREA RESOUR CES GAP GAP AS % OF AREA REQUIRMENT JULY BUDGET YEARLY BUDGET SALES PER DAY OPTIMUM REQUIRMNET S AS PER SALES RESOURCE S GAP GAP AS % OF SALES REQUIRME NT CP - Exit - 17 B+ 18,156 12 24 12 50% 102% 17,160,653 47,536 16 4 24% CP - Salaam Mall B+ 10,462 11 14 3 21% 91% 17,613,459 48,791 16 5 32% CP - Al Jouf B+ 7,701 11 10 -1 -7% 99% 12,121,743 33,578 11 0 2% CP - Othaim Khurais B+ 9,432 11 13 2 13% 104% 19,311,756 53,495 18 7 38% CP - Al Qasr Mall B+ 15,640 15 21 6 28% 87% 21,177,251 58,663 20 5 23% CP - Tabuk-2 B+ 11,109 11 15 4 26% 112% 13,474,408 37,325 12 1 12% CP - Dawadmi B+ 6,985 7 9 2 25% 125% 8,080,538 22,384 7 0 6% BS - Najran B+ 8,706 9 12 3 22% 116% 11,149,723 30,886 10 1 13% BS- Garden Mall-Hail B+ 5,369 4 7 3 44% 78% 8,059,225 22,325 7 3 46% BS - Pada Mall-Buraida B+ 8,812 5 12 7 57% 87% 6,428,605 17,808 6 1 16% Total 102,373 96 136 40 30% 100% 134,577,361 372,790 124 28 23%

- 4. Babyshop âCâ Grade Stores Available staff, Optimum staff and Resources Gap STORES GRAD E AREA (SQ FT) AVAILABL E STAFFS OPTIMUM REQUIRM NETS AS PER AREA RESOURC ES GAP GAP AS % OF AREA REQUIRME NT JULY BUDGET YEARLY BUDGET SALES PER DAY OPTIMUM REQUIRM NETS AS PER SALES RESOURC ES GAP GAP AS % OF SALES REQUIRMENT BS - Majardah C+ 4,315 3 6 3 48% 123% 4,726,310 13,092 4 1 31% BS- Unaiza C+ 3,217 3 4 1 30% 87% 5,641,973 15,629 5 2 42% BS - Citymall Shifa C+ 5,457 4 7 3 45% 99% 8,739,106 24,208 8 4 50% BS - Al Rass C+ 7,215 4 10 6 58% 104% 7,077,439 19,605 7 3 39% BS - Abu Arish C+ 5,977 6 8 2 25% 103% 6,186,382 17,137 6 (0) -5% BS - Khamis Avenue C+ 5,622 6 7 1 20% 103% 8,259,259 22,879 8 2 21% BS- Rose Mall Najran C+ 8,070 6 11 5 44% 141% 5,208,715 14,429 5 (1) -25% BS- Dowma C+ 6,456 3 9 6 65% 85% 3,764,087 10,427 3 0 14% CP - Sharorah C+ 7,102 6 9 3 37% 57% 7,181,421 19,893 7 1 10% BS - Rehana C+ 8,425 7 11 4 38% 94% 7,927,182 21,959 7 0 4% BS- Zulfi C+ 6,843 9 9 0 1% 120% 7,177,347 19,882 7 (2) -36% Total 68,699 57 92 35 38% 101% 71,889,222 199,139 66 9 14% NOTE: No doubt the fact that the present staff strength is not sufficient enough to carry out the routine statistical functions at satisfactory level and also to undertake the statistical activities in new areas.

- 5. Identify key areas that deliver the X factor to our performance:- ïą Stock Replenishment ïķ The stock replenishment provides a powerful tool and a unique competitive advantage to our organization. First the forecasting can help predict what customers will buy, reducing inventory carrying cost of unwanted goods while ensuring the customers that we carry the items as per there demand ïķ Two much stocks can result in lower margins, high inventory cost and excess damage as stocks remain in house too long. However shortage can be even worst as customers who canât get an item in a reasonable time may call the competitor. This is a loss opportunity for the business. ïķ To overcome such issues in future we need to accurately forecast demand for inventory items and adjust the calculation by warehouse, customer, season, product group or an individual item ïķ Maximize the revenue and customer satisfaction by minimizing the chance of stock outs. Simultaneously reducing the inventory carrying cost by accurately stocking the warehouse. The bottom line is that the inventory fulfillment increases sales, margin and cash flow and lower the cost. ïķ As per the current scenario the buying stock is not sufficient enough to fulfill the gap. We require 15% extra stocks prior to the commencement of winter season to meet the requirement of achieving 110% ïą Customer service ïķ Changing economic dynamics, diverse choices in product and services, numerous shopping formats and unparallel access to information has empowered the customer to expect more from there retail experience. ïķ The customer interacts the retailer multiple time before during and after the purchase. So, it is important for us to provide complete and consistent customer experience across these channels.

- 6. Identify key areas that deliver the X factor to our performance:- ïŪ In the purchase phase, the customer takes the buying decision on the product and pays for it. Various touch points in this phase include the web, the physical store sales associates, assortments, layouts, etc.In the service phase, the customer service and loyalty programmes are the key touch points that the retailer has with the customer. After sales customer service includes installation of an appliance or return and exchange of merchandise. ïŪ In the service phase, the customer service and the loyalty programme are the key touch points that we need to have with the customer. Today the consumers are looking for a personalized, seamless and distinctive experience from us. Keeping fashions exciting helps engage and retain customers, results in sales, generates repeat traffic etc. ïŪ It is important to stay connected with the customers to remain the top of the mind recall when they shop. Since the store staff members act as a brand ambassador for the stores. They are in direct contact with the customers at various touch points and deliver the experience. So, continuous investment is required in the training and coaching of staff to deliver on customer expectation. ïŪ The consumer wants sharply priced, fashionable apparel to expand their wardrobe both at the workplace and at home. They no longer want to dress up just for work, they also want to look good implying access to choice and range. From the time the customer enters the store to when he/she leaves the store, he/she must have good experience across several touch points that includes interacting with staff, after sales experience, billing at the POS and the store ambience. ïŪ Keeping the above factors into consideration and to reach the target of 110% we will try to focus upon sales per hour, average sales, items per sale, conversion rate and wages to sales ratio.

- 7. Identify key areas that deliver the X factor to our performance:- NOTE:- ïķ Sales per hr- Statically will try to compare one sales person with the other and try to determine who is efficient in selling and attending the customer ïķ Average sale- Statically will try to compare the average selling price of a salesperson. The higher statistics will show that the person has a wide knowledge on the product and the less statistics reveals that he lacks the product knowledge or effective description ïķ Wages to sales ratio- This will give us a graph comparing the hourly wages of a sales person to hourly sales they have made . It will help us to determine their performance level and how effective they are. ïą We need to build a sustainable business model given that the gestation period for success in the retail sector is long. Sustainable product pricing , offering products that imply longevity, expanding operations in a calibrated but determined manner , are some of the ways in which we can convey our commitment to building a long term presence.