Your First Home: A Comprehensive Guide for First-Time Buyers

- 1. HereŌĆÖs 5 things to consider when choosing a home as a first-time homebuyer. Choosing Your First Home? Todd Headrick (605) 359 - 5581 todd@headrickteam.com

- 2. Preparation is Everything! #01 Buying a home is one of the most important decisions a family can make. It has serious financial and emotional implications. Buying your first home requires planning and saving. As you consider different homes, evaluate each based on values, needs, wants and financial constraints. Be flexible, realistic and responsible ŌĆö Your first home will most likely not be your dream home. Prepare a checklist to help you shop for a home. Can you and your family be happy living in this home? Prequalify for a mortgage to see how much you can afford. There are several government programs for first-time & low- to moderate- income home buyers. HereŌĆÖs our Advice:

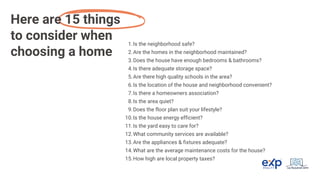

- 3. Is the neighborhood safe? 1. Are the homes in the neighborhood maintained? 2. Does the house have enough bedrooms & bathrooms? 3. Is there adequate storage space? 4. Are there high quality schools in the area? 5. Is the location of the house and neighborhood convenient? 6. Is there a homeowners association? 7. Is the area quiet? 8. Does the floor plan suit your lifestyle? 9. Is the house energy efficient? 10. Is the yard easy to care for? 11. What community services are available? 12. Are the appliances & fixtures adequate? 13. What are the average maintenance costs for the house? 14. How high are local property taxes? 15. Here are 15 things to consider when choosing a home

- 4. Steps involved in Buying a House Interview Process - We get together and determine if I can provide you with the level of service you require and you can give me the most accurate information to provide you with the best support. Pre-Loan Approval ŌĆō Ensures we are looking for homes in the correct price range, saving everyone involved time and money and to get the best house you can afford. Sellers are also more likely to accept an offer from a pre-approved buyer. Determine your lifestyle and needs ŌĆō I will help you find the areas and homes that best fit your needs. Together we will create a list of what you absolutely have to have in a home and whatŌĆÖs most important to you. (Schools, neighborhood, etc.). Sign agreement and acknowledgements ŌĆō People usually feel overwhelmed with all the contracts. Most of the time itŌĆÖs because they donŌĆÖt understand what they are signing and why. I will break it down for you! #02

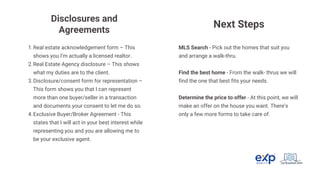

- 5. Real estate acknowledgement form ŌĆō This shows you IŌĆÖm actually a licensed realtor. 1. Real Estate Agency disclosure ŌĆō This shows what my duties are to the client. 2. Disclosure/consent form for representation ŌĆō This form shows you that I can represent more than one buyer/seller in a transaction and documents your consent to let me do so. 3. Exclusive Buyer/Broker Agreement - This states that I will act in your best interest while representing you and you are allowing me to be your exclusive agent. 4. Disclosures and Agreements Next Steps MLS Search - Pick out the homes that suit you and arrange a walk-thru. Find the best home - From the walk- thrus we will find the one that best fits your needs. Determine the price to offer - At this point, we will make an offer on the house you want. ThereŌĆÖs only a few more forms to take care of.

- 6. The ŌĆ£OfferŌĆØ to purchase 1. BuyerŌĆÖs advisory ŌĆō This says the price could change depending on contingencies. 2. APA form ŌĆō This lets you know if the other party is a licensed real estate agent and also lets you know if anyone in the transaction is related. 3. Local Area disclosure ŌĆō This says you have been notified of any out of the ordinary circumstances in the area youŌĆÖre moving to. 4. Forms may vary depending on the type and condition of the property. Furthermore, IŌĆÖll negotiate terms and conditions in your best interest and ensure you are prepared for closing day, when you will receive the keys to your new home! This includes: Managing the process of the transaction - Title, inspections, contingencies, deposits, loan funding, escrow, timelines and communicating this with you through the process. Coordinating the closing of sale/escrow. Coordinating your move date, transfer of keys, utilities, etc. Final Forms

- 7. OPENING ESCROW The first step taken in processing a sale is to "open" escrow. This simply means that the terms of the agreement of sale, or deposit receipt, which specifies the conditions to which both parties have agreed, is communicated to the escrow company or broker and that the check offered to bind the agreement is delivered to escrow. The money is deposited in a trust account and is part of the down payment. The escrow officer then writes the escrow instructions. The instructions are nothing more than a formal recital of the terms of the sale with additional conditions and instructions included by escrow as necessary to ensure both buyer and seller have a clean understanding of the process. Copies are mailed to all of the concerned parties. If all parties agree to the terms as stated, the instructions are signed and returned to the escrow officer. If changes are required, the instructions are amended until all parties are in agreement. Note: it is very important that the instructions are reviewed, signed, and returned as soon as possible to avoid delay in meeting the scheduled closing date. Key Terms and Explanations

- 8. LOAN DOCUMENTS The lender will draw up loan documents which will give the specific details of the loan you are obtaining- the amount, interest rate, term in years, due date, etc. LOAN APPLICATION Concurrent with the preparation of the instructions, the buyer usually will be processing a loan application. This application should be very carefully and accurately completed immediately as the lender's processing is quite time consuming. As soon as the loan application is received, an appraisal is ordered. It is conducted by the lender to insure that the property is worth the negotiated sales price. This is done to protect their investment in the property. It can be conducted by an independent appraiser or by an in-house appraiser. The buyer is usually charged a fee for this up front when filling out the loan application. HOMEOWNERS INSURANCE Although it is not required by law, your bank or mortgage company will most likely require you to get homeowners insurance coverage. ThatŌĆÖs because lenders need to protect their investment. In the unfortunate event your house burns down or is badly damaged by a hurricane, tornado or other disaster, homeowners insurance safeguards them (as well as you) against financial loss.

- 9. HOME WARRANTY Home Warranty programs are contractual guarantees that certain systems of a property are free from specified defects, and if such defects appear, those systems will be repaired or replaced, after payment of a deductible. Home warranties cover undisclosed defects caused by normal usage or lack of preventive maintenance by the previous owner. A home warranty program can be purchased by either the buyer or the seller. The price of the program can be included in the purchase price or be treated as part of the closing costs. DOWN PAYMENT BALANCE Approximately 3 days before the closing, the balance of the funds due on the down payment, the insurance premium and the escrow charges must be brought to escrow. Funds may be wired to the escrow trust account from an out-of-state bank. RECORDING OF THE DEED AND TRANSFER OF TITLE The recording and transfer usually occurs at 8:00 a.m. on the specified date, at which time the buyer has bought and the seller has sold the house. However, actual possession should be agreed upon in advance. It is awkward and costly to have two moving vans at the front door at the same time. The sales agent will provide a key.

- 10. CLOSING COSTS Separate forms are available which illustrate the elements of buyer's and seller's closing costs. Such forms can be completed by your sales agent prior to or at the time the purchase agreement is completed. While the various pro-rations, insurance premiums, etc. are not known at the time, and thus the costs cannot be exact, they will be sufficiently accurate to eliminate any "surprises" at closing time. The term "closing costs" is another misnomer, in that all of the elements are not actually associated with the purchase of the home. For example, if the seller has paid the taxes in advance, that money is refunded to him through escrow, and he is charged only for the actual time that he has lived in the house during the tax period. Prepaid interest is another item or "closing cost". This is interest that is pre-paid by the buyer to cover the time from the close of escrow until the regular monthly payment begins. There may be added pro-rations that will require cash in escrow in addition to the down payment. START OF INTEREST CHARGES The interest on the loan generally begins the day before closing, concurrent with the funding of the loan.

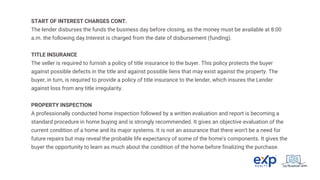

- 11. START OF INTEREST CHARGES CONT. The lender disburses the funds the business day before closing, as the money must be available at 8:00 a.m. the following day.Interest is charged from the date of disbursement (funding). TITLE INSURANCE The seller is required to furnish a policy of title insurance to the buyer. This policy protects the buyer against possible defects in the title and against possible liens that may exist against the property. The buyer, in turn, is required to provide a policy of title insurance to the lender, which insures the Lender against loss from any title irregularity. PROPERTY INSPECTION A professionally conducted home inspection followed by a written evaluation and report is becoming a standard procedure in home buying and is strongly recommended. It gives an objective evaluation of the current condition of a home and its major systems. It is not an assurance that there won't be a need for future repairs but may reveal the probable life expectancy of some of the home's components. It gives the buyer the opportunity to learn as much about the condition of the home before finalizing the purchase.

- 12. The 90 Ways I Assist Buyers 1. Schedule Time To Meet Buyers 2. Prepare Buyers Guide & Presentation 3. Meet Buyers and Discuss Their Goals 4. Explain Buyer & Seller Agency Relationships 5. Discuss Different Types of Financing Options 6. Help Buyers Find a Mortgage Lender 7. Obtain Pre-Approval Letter from Their Lender 8. Explain What You Do For Buyers As A Realtor 9. Provide Overview of Current Market Conditions 10. Explain Your CompanyŌĆÖs Value to Buyers 11. Discuss Earnest Money Deposits 12. Explain Home Inspection Process 13. Educate Buyers About Local Neighborhoods 14. Discuss Foreclosures & Short Sales 15. Gather Needs & Wants Of Their Next Home 16. Explain School Districts Effect on Home Values 17. Explain Recording Devices During Showings 18. Learn All Buyer Goals & Make A Plan 19. Create Internal File for Buyers Records 20. Send Buyers Homes Within Their Criteria 21. Start Showing Buyers Home That They Request 22. Schedule & Organize All Showings 23. Gather Showing Instructions for Each Listing 24. Send Showing Schedule to Buyers 25. Show Up Early and Prepare First Showing 26. Look For Possible Repair Issues While Showing 27. Gather Buyer Feedback After Each Showing 28. Update Buyers When New Homes Hit the Market 29. Share Knowledge & Insight About Homes 30. Guide Buyers Through Their Emotional Journey 31. Listen & Learn From Buyers At Each Showing 32. Keep Records of All Showings 33. Update Listing Agents with BuyerŌĆÖs Feedback 34. Discuss Home OwnerŌĆÖs Associations 35. Estimate Expected Utility Usage Costs 36. Confirm Water Source and Status 37. Discuss Transferable Warranties 38. Explain Property Appraisal Process 39. Discuss Multiple Offer Situations 40. Create Practice Offer To Help Buyers Prepare 41. Provide Updated Housing Market Data to Buyers 42. Inform Buyers of Their Showing Activity Weekly 43. Update Buyers On Any Price Drops 44. Discuss MLS Data With Buyers At Showings 45. Find the Right Home for Buyers 46. Determine Property Inclusions & Exclusions 47. Prepare Sales Contract When Buyers are Ready 48. Educate BuyerŌĆÖs On Sales Contract Options 49. Determine Need for Lead-Based Paint Disclosure 50. Explain Home Warranty Options #03

- 13. The 90 Ways I Assist Buyers 51. Update BuyerŌĆÖs Pre-Approval Letter 52. Discuss Loan Objection Deadlines 53. Choose a Closing Date 54. Verify Listing Data Is Correct 55. Review Comps With Buyers To Determine Value 56. Prepare & Submit BuyerŌĆÖs Offer to Listing Agent 57. Negotiate Buyers Offer With Listing Agent 58. Execute A Sales Contract & Disclosures 59. Once Under Contract, Send to Title Company 60. Coordinate Earnest Money Drop Off 61. Deliver Copies to Mortgage Lender 62. Obtain Copy of Sellers Disclosure for Buyers 63. Deliver Copies of Contract/Addendum to Buyers 64. Obtain A Copy of HOA Bylaws 65. Keep Track of Copies for Office File 66. Coordinate Inspections with Buyers 67. Meet Inspector At The Property 68. Review Home Inspection with Buyers 69. Negotiate Inspection Objections 70. Get All Agreed Upon Repair Items in Writing 71. Verify any Existing Lease Agreements 72. Check In With Lender To Verify Loan Status 73. Check on the Appraisal Date 74. Negotiate Any Unsatisfactory Appraisals 75. Coordinate Closing Times & Location 76. Make Sure All Documents Are Fully Signed 77. Verify Title Company Has Everything Needed 78. Remind Buyers to Schedule Utilities 79. Make Sure All Parties Are Notified of Closing Time 80. Solve Any Title Problems Before Closing 81. Receive and Review Closing Documents 82. Review Closing Figures With Buyers 83. Confirm Repairs Have Been Made By Sellers 84. Perform Final Walk-Through with Buyers 85. Resolve Any Last Minute Issues 86. Get CDA Signed By Brokerage 87. Attend Closing with Buyers 88. Provide Home Warranty Paperwork 89. Give Keys and Accessories to Buyers 90. Close Out BuyerŌĆÖs File Brokerage

- 14. Off Market Real Estate Property Searching Strategies I go beyond just looking at the MLS to find the home for you. I employ multiply strategies to make sure every property, whether on or off the market, is considered for your needs 1. FSBO (for sale by owner) OPPORTUNITIES Zillow Craigslist FB Marketplace Local FB groups Signs outside houses in the neighborhood Word of mouth 2. AGENT OPPORTUNITIES Asking listing agents what is in their pipeline New Construction ŌĆō asking the builders what is in their pipeline? Buyer leads that need to sell in order to buy Leads that will not list with us but will sign an ATS (authorization to show)

- 15. Off Market Real Estate Property Searching Strategies Continued 2. AGENT OPPORTUNITIES When making contact with an agent (setting up showings, inspections, FWT and communication), asking them if they have anything coming up that they can share with me Asking agents in my brokerage what they have coming up FB groups (my brokerageŌĆÖs internal group, and local MLS group) ŌĆō I can post what a client is looking for or look for agents posting their coming soon listings. Contact agents that represent New Construction Builders Contacting agents in my brokerage/internal brokerage FB Group if any closings may be falling through 3. PROSPECTING OPPORTUNITIES Reaching out to clients with pending listings Call pending listings on MLS ŌĆō are they through all contingencies?

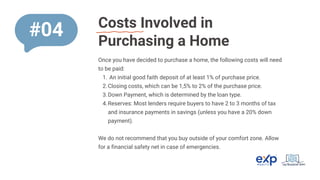

- 16. Costs Involved in Purchasing a Home Once you have decided to purchase a home, the following costs will need to be paid: An initial good faith deposit of at least 1% of purchase price. 1. Closing costs, which can be 1,5% to 2% of the purchase price. 2. Down Payment, which is determined by the loan type. 3. Reserves: Most lenders require buyers to have 2 to 3 months of tax and insurance payments in savings (unless you have a 20% down payment). 4. We do not recommend that you buy outside of your comfort zone. Allow for a financial safety net in case of emergencies. #04

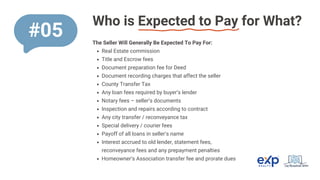

- 17. Who is Expected to Pay for What? The Seller Will Generally Be Expected To Pay For: Real Estate commission Title and Escrow fees Document preparation fee for Deed Document recording charges that affect the seller County Transfer Tax Any loan fees required by buyerŌĆÖs lender Notary fees ŌĆō sellerŌĆÖs documents Inspection and repairs according to contract Any city transfer / reconveyance tax Special delivery / courier fees Payoff of all loans in sellerŌĆÖs name Interest accrued to old lender, statement fees, reconveyance fees and any prepayment penalties HomeownerŌĆÖs Association transfer fee and prorate dues #05

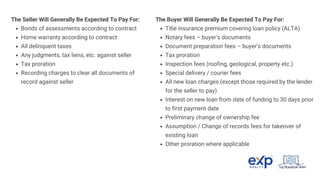

- 18. The Seller Will Generally Be Expected To Pay For: Bonds of assessments according to contract Home warranty according to contract All delinquent taxes Any judgments, tax liens, etc. against seller Tax proration Recording charges to clear all documents of record against seller The Buyer Will Generally Be Expected To Pay For: Title insurance premium covering loan policy (ALTA) Notary fees ŌĆō buyerŌĆÖs documents Document preparation fees ŌĆō buyerŌĆÖs documents Tax proration Inspection fees (roofing, geological, property etc.) Special delivery / courier fees All new loan charges (except those required by the lender for the seller to pay) Interest on new loan from date of funding to 30 days prior to first payment date Preliminary change of ownership fee Assumption / Change of records fees for takeover of existing loan Other proration where applicable

- 19. Please feel free to contact me to start your journey to homeownership. Let us help you find and make your dream home a reality! Congratulations! You're one step closer to finding your dream home! (605) 359 - 5581 todd@headrickteam.com dakotahomesonline.com Todd Headrick REALTOR┬« IŌĆÖll be waiting to hear from you!