Free+Spreadsheet+Template

- 1. Budget Template Instructions Saint Louis University Office of Research Services March 19, 2008

- 2. About the Template • Although a detailed budget may not be required for submission with your proposal, the template will still be useful when completing the budget required to be submitted to ORS. • Many fields will fill-in automatically once base numbers are entered. • Different sheets are available based on number of years proposed. • One sheet is blank. No formulas are used, except for totals. Use this sheet if you need to make modifications to the formulas or want to enter numbers manually. • Extra sheets can be deleted to avoid confusion. If using the sheets with formulas, be sure not to delete the “Rates” tab.

- 3. Getting Started • Talk to the Business Manager or Proposal Helper in your department about your proposal. • Let your department’s ORS representative know that you are going to be submitting a proposal. • Gather current rates for all salaries to be included in budget. • Complete paperwork for Tuition Scholarships and Cost-Sharing, if needed.

- 4. Rates • Calculations on spreadsheets will be made using the “Rates” tab. • If your proposal does not start in the current fiscal year, you will need to make a few minor adjustments to this sheet. If your proposal does start during the current fiscal year, you will not need to make any changes to this page. • Check Research Services’ website periodically for new spreadsheets including updated rates.

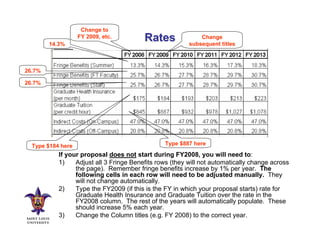

- 5. Change to 14.3% FY 2009, etc. Rates Change subsequent titles 26.7% 26.7% Type $184 here Type $887 here If your proposal does not start during FY2008, you will need to: 1) Adjust all 3 Fringe Benefits rows (they will not automatically change across the page). Remember fringe benefits increase by 1% per year. The following cells in each row will need to be adjusted manually. They will not change automatically. 2) Type the FY2009 (if this is the FY in which your proposal starts) rate for Graduate Health Insurance and Graduate Tuition over the rate in the FY2008 column. The rest of the years will automatically populate. These should increase 5% each year. 3) Change the Column titles (e.g. FY 2008) to the correct year.

- 6. 1 PI and Co-PI Salaries 2 3 4 5 6 7 1) Enter the Grant Period Dates 2) Enter your current contract amount (if you are not receiving salary from the grant, enter 0) 3) Enter the length of your contract (must ≠ 0) 4) Number of months per year the grant will pay your salary (can enter decimals for partial months) 5) Enter Co-PI’s current contract amount (if no Co-PIs are being paid, enter 0) 6) Enter the length of their contract (must ≠ 0) 7) Number of months per year the grant will pay their salary

- 7. Other Personnel Salary (Full-time) 1 1) Fill in the blanks. It will populate the table on the left, just as it did with PI and Co-PI salaries.

- 8. Other Personnel Salary (Full-time) 1 1) If you have more than one salary rate for Graduate Students, Staff, etc., you should overwrite the formula in the first year of the corresponding budget line with the total salaries for that type of personnel. Example: You need to budget 2 staff workers on the grant. Both are full- time, but have different duties. One makes $27,000 and the other makes $35,000. Therefore, you can overwrite the formula in cell B13 with 62,000. A 3% rate increase will be automatically calculated for the following years.

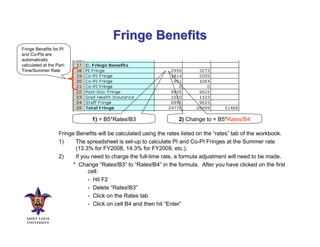

- 9. Fringe Benefits Fringe Benefits for PI and Co-PIs are automatically calculated at the Part- Time/Summer Rate 1) = B5*Rates!B3 2) Change to = B5*Rates!B4 Fringe Benefits will be calculated using the rates listed on the “rates” tab of the workbook. 1) The spreadsheet is set-up to calculate PI and Co-PI Fringes at the Summer rate (13.3% for FY2008, 14.3% for FY2009, etc.). 2) If you need to charge the full-time rate, a formula adjustment will need to be made. * Change “Rates!B3” to “Rates!B4” in the formula. After you have clicked on the first cell: - Hit F2 - Delete “Rates!B3” - Click on the Rates tab - Click on cell B4 and then hit “Enter”

- 10. Fringe Benefits + 1 2 1) In order to make the changes work in adjacent cells, move your mouse to the bottom right corner of the cell you just changed. It will turn into a “+”. 2) Press the left mouse button and drag the mouse to the right until you have highlighted the adjacent cells .

- 11. Total Salaries, Wages & Fringe Benefits • Totals will be automatically calculated.

- 12. Equipment, Travel and Participant Support Costs • Equipment (capital only)- Enter all equipment that is valued at $5,000+ per unit with a life expectancy of 2+ years and is non-expendable. (Capital equipment will be automatically removed from the indirect cost calculation.) • Feel free to change “Item 1”, etc. to the name of the item, so it will be easier to keep track of. • If you need more than 3 items of capital equipment: – Right click on line 33 – Click “Insert”. A new line will appear below “Item 3”. – Add the name of the item and enter the amount. • Participant Support costs will not automatically calculate; enter each amount separately (they will total in Row 45 and be included in Indirect Costs automatically).

- 13. Other Direct Costs 1 2 3 1) All subawards should be entered here. 2) Enter the number of Subawards that are >$25,000. (If not entered here, they will not be counted in the Indirect Cost calculation.) 3) If you can’t find another line on the budget for an item, it can be listed under number 6 of Other Direct Costs. Be sure to explain it in your budget justification.

- 14. Indirect Costs 1 2 Indirect Costs = Facilities and Administrative Costs (F&A) F&A Costs include, for example, use of space and equipment, depreciation on equipment and facilities, utility costs, financial accounting, departmental administrative costs, and numerous other support services. These costs cannot be easily attributed to individual sponsored research projects, therefore a rate has been calculated. 1) Total Direct Costs include all costs in lines A-G. 2) Indirect Cost Base automatically excludes Graduate Tuition, Capital Equipment and Subawards (see slide 16 for further info on subawards). – Indirect Costs are automatically calculated at the on-campus rate (47%).

- 15. Indirect Costs (Off Campus Rate) 1) = B58*Rates!B8 2) Change to = B58*Rates!B9 When work on a grant is being performed at an off-campus site, a different rate should be charged for Indirect Costs. 1) The spreadsheets are defaulted to charge the on-campus rate (47%). 2) If you need to charge the full-time rate, a formula adjustment will need to be made. * Change “Rates!B8” to “Rates!B9” in the formula. After you have clicked on the first cell: - Hit F2 - Delete “Rates!B8” - Click on the Rates tab - Click on cell B9 and then hit “Enter”

- 16. Indirect Costs on Subawards Example 1 =(B57-B54-B52- Example 2 =(B57-B54-B52- B33)+(H52*25000)+20000 B33)+(H52*25000)+5000 In order for Subawards, <$25,000, to have Indirect Costs charged to them, the formula in the first cell of “Indirect Cost Base” will need to include their total (only the first cell of “ICB” will need to change). Example 1: You have 2 subawards, one for $15,000 and the other for $5,000. Since neither of them are >$25,000, they will not be automatically calculated in the indirect costs. You will have to add $20,000 to the indirect cost base. - Add “+20000” to the end of the formula Example 2: You have 2 subawards, one for $50,000 and another for $5,000. You will only need to add $5,000 to the indirect cost base formula. As long as you have put a “1” in the box for the # of Subawards >$25,000, the indirect costs on the $50,000 subaward will automatically be calculated. - Add “+5000” to the end of the formula. - If you do not add 5000 to the end of the formula, no indirect costs will be charged to it.

- 17. Amount of Request and Cost Share Amount 1 2 (Example 1) $6,000 (Example 2) $7,000 1) Amount of Request is the total amount per year that you are requesting from the sponsor. 2) Enter any approved cost share dollars here. (They will not be included in any calculations.) Cost Share (Matching Funds) is the amount of money SLU will be spending to support this proposal. Example 1: Cost sharing is required by the sponsor. Your department head agrees to cost share $6,000 towards the purchase of a new computer needed to perform the research. You would include that $6,000 here. Example 2: The maximum amount allowed to request for the grant is $5,000. This will only cover the cost of supplies. You will be cost sharing your time on the project, because you will not be getting paid from the grant, but will be getting paid by the university to work on the grant. Your salary for this time is $7,000. This is the amount that the university is cost-sharing.

- 18. Example 1 • $250,000 maximum budget • Project Period 6/1/2008 – 5/31/2010 • PI Salary is $72,000. He has a 9 month contract and is requesting the sponsor pay for 2 summer months’ salary per year. • 2 Co-PIs will be getting paid. – #1- $60,000 salary, 9 month contract, 1 summer months/year – #2- $85,000 salary, 9 month contract, 2 summer months/year • 1 Graduate Student – Stipend = $16,000 per year – Will work 9 months/year – Needs 18 credit hours of tuition • 2 Undergraduate Students – 10 hours/week – 8 weeks – $9.00/hour • Microscope - $7,500 in Year 1 • Travel - $1,500 per year domestic • No Participant Support Costs • However much supplies money as they can get

- 19. Example 2 • Project Period 6/1/2008 – 5/31/2011 • PI Salary is $80,000. He has a 9 month contract and is requesting the sponsor pay for 2 summer months’ salary per year. • 2 Co-PIs will be getting paid. – #1- $60,000 salary, 9 month contract, 1 summer months/year – #2- $85,000 salary, 9 month contract, 2 summer months/year • 1 Graduate Student – Stipend = $16,000 per year – Will work 9 months/year – Needs 18 credit hours of tuition • 2 Undergraduate Students – 10 hours/week – 8 weeks – $9.00/hour • Spectrophotometer - $12,000 • Travel - $1,500 per year domestic – $4,000 per year foreign • No Participant Support Costs • However much supplies money as they can get • 2 Subawards – #1- $30,000 – #2- $10,000