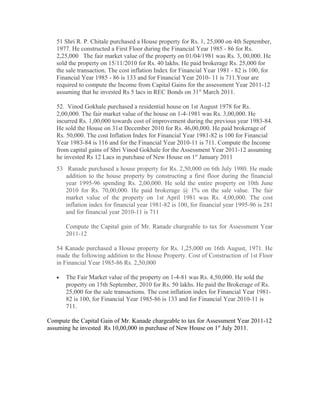

Sums on capital gains

- 1. 51 Shri R. P. Chitale purchased a House property for Rs. 1, 25,000 on 4th September, 1977. He constructed a First Floor during the Financial Year 1985 - 86 for Rs. 2,25,000 The fair market value of the property on 01/04/1981 was Rs. 3, 00,000. He sold the property on 15/11/2010 for Rs. 40 lakhs. He paid brokerage Rs. 25,000 for the sale transaction. The cost inflation Index for Financial Year 1981 - 82 is 100, for Financial Year 1985 - 86 is 133 and for Financial Year 2010- 11 is 711.Your are required to compute the Income from Capital Gains for the assessment Year 2011-12 assuming that he invested Rs 5 lacs in REC Bonds on 31st March 2011. 52. Vinod Gokhale purchased a residential house on 1st August 1978 for Rs. 2,00,000. The fair market value of the house on 1-4-1981 was Rs. 3,00,000. He incurred Rs. 1,00,000 towards cost of improvement during the previous year 1983-84. He sold the House on 31st December 2010 for Rs. 46,00,000. He paid brokerage of Rs. 50,000. The cost Inflation Index for Financial Year 1981-82 is 100 for Financial Year 1983-84 is 116 and for the Financial Year 2010-11 is 711. Compute the Income from capital gains of Shri Vinod Gokhale for the Assessment Year 2011-12 assuming he invested Rs 12 Lacs in purchase of New House on 1st January 2011 53 Ranade purchased a house property for Rs. 2,50,000 on 6th July 1980. He made addition to the house property by constructing a first floor during the financial year 1995-96 spending Rs. 2,00,000. He sold the entire property on 10th June 2010 for Rs. 70,00,000. He paid brokerage @ 1% on the sale value. The fair market value of the property on 1st April 1981 was Rs. 4,00,000. The cost inflation index for financial year 1981-82 is 100, for financial year 1995-96 is 281 and for financial year 2010-11 is 711 Compute the Capital gain of Mr. Ranade chargeable to tax for Assessment Year 2011-12 54 Kanade purchased a House property for Rs. 1,25,000 on 16th August, 1971. He made the following addition to the House Property. Cost of Construction of 1st Floor in Financial Year 1985-86 Rs. 2,50,000 · The Fair Market value of the property on 1-4-81 was Rs. 4,50,000. He sold the property on 15th September, 2010 for Rs. 50 lakhs. He paid the Brokerage of Rs. 25,000 for the sale transactions. The cost inflation index for Financial Year 1981- 82 is 100, for Financial Year 1985-86 is 133 and for Financial Year 2010-11 is 711. Compute the Capital Gain of Mr. Kanade chargeable to tax for Assessment Year 2011-12 assuming he invested Rs 10,00,000 in purchase of New House on 1st July 2011.

- 2. 55 Mr. Parag purchased a residential flat on 02/05/2008 for Rs. 10,00,000. He paid on the same day the stamp duty and registration charges of Rs. 48,750 on purchase of flat. He sold the said flat on 17/07/2011 for Rs. 30,00,000. Brokerage on the sale transaction was 2 %. The cost Inflation Index for F.Y. 2008-09 is 582 and for F.Y. 2011-12 is 711. Compute his Capital Gain Chargeable to tax for assessment year 2009-2010. He invested Rs 4,00,000 in REC Bonds on 25/05/2010 and Rs 8,00,000 for purchase of new House on 25/06/2010. 56 Kamlesh purchased a house property for Rs. 1, 00,000 on 27th August, 1978. He made the following additions/alterations to the house property. Cost of construction of 1st floor in Financial Year 1983-84 Rs. 3, 00,000. Cost of construction of 2nd floor in Financial Year 1990-91 Rs. 4, 00,000.Fair Market Value of the property on 01/4/1981 was Rs. 5, 00,000. He sold the property on 20th October, 2010 for Rs. 75, 00,000.He paid the brokerage of Rs. 75,000 for the sale transaction. The Cost Inflation Index for Financial Year 1981-82 is 100, for Financial Year 1983-84 is 116, for Financial Year 1990-91 is 182 and for Financial Year 2009-10 is 711.Compute the Capital gain of Mr. Kamlesh chargeable to tax for Assessment Year 2011-12 he invested Rs 10,00,000 in REC Bonds on 1st June 2011