Small Industries Development Bank of India SIDBI

17 likes6,348 views

SIDBI was established in 1989 to promote and finance small scale industries. It provides direct financing, refinancing, bill financing, and international financing. It also offers promotional services like entrepreneurship training. SIDBI operates schemes to support technology upgrades, provide venture capital and equity funding, and offers seed money for new entrepreneurs through DICs. It aims to empower small and medium enterprises through financial and developmental assistance.

1 of 16

Downloaded 233 times

Ad

Recommended

Export import bank of india(exim)

Export import bank of india(exim)Abhinav Kp

Ěý

The Export-Import Bank of India (EXIM Bank) is the leading institution for export finance in India, established in 1982 to enhance exports and integrate foreign trade with economic growth. It offers various financial services such as overseas investment finance, project finance, lines of credit, and corporate banking to support exporters and importers. The bank also provides marketing advisory and research services to assist Indian businesses in their globalization efforts.DEVELOPMENT BANKS

DEVELOPMENT BANKSAditya Kumar

Ěý

Development banks play an important role in promoting social and economic development. They provide loans and technical support for a variety of development activities aimed at improving people's lives and reducing poverty. The major development banks in India include IFCI, IDBI, ICICI, SIDBI, and NABARD. They work to fulfill objectives like promoting industries, meeting capital needs, and aiding small businesses and rural development through financial and promotional activities.Entrepreneurship devlopment

Entrepreneurship devlopmentDhina Karan

Ěý

The document discusses various topics related to entrepreneurship development and small businesses in India, including:

1. It describes entrepreneurship development programs that help individuals improve their skills and knowledge for starting a business.

2. A project report is summarized as providing necessary details for establishing a manufacturing or service business, including general information, project description, market potential, costs, financing, and economic and social considerations.

3. Several organizations that support small businesses in India are introduced, such as the District Industries Center, Small Industries Development Organization, State Industries Development Corporations, National Small Industries Corporation, and others. Their roles in offering services like credit, training, marketing assistance and industrial development are briefly outlined.Role and functions of sebi

Role and functions of sebiAnkur Yadav

Ěý

The document summarizes the roles and functions of the Securities and Exchange Board of India (SEBI). It discusses that SEBI was established in 1988 by the Government of India and was upgraded to a statutory board in 1992. It describes SEBI's objectives to protect investor interests and promote fair practices in securities markets. The document outlines SEBI's regulatory functions such as registration of intermediaries and prohibition of unfair trade practices. It also discusses SEBI's developmental functions like investor education and research. The powers and departments of SEBI are presented. Recent regulatory cases involving Vedanta-Cairn and Deccan Chronicle Holdings are also summarized.Export – import bank of india

Export – import bank of indiaMayuri Pujare

Ěý

The Export - Import Bank of India (EXIM Bank) was established in 1982 as a public sector financial institution to finance, facilitate, and promote foreign trade for India and other third world countries. EXIM Bank provides medium and long term loans to Indian exporters, guarantees for export contracts, advisory services on financing and trade, and collects/shares market and credit information to promote exports. It works to finance exports/imports, joint ventures abroad, R&D projects, and lending to commercial banks and overseas parties. The conclusion is that EXIM Bank was created to promote India's foreign trade through various financing functions and has been instrumental in supporting cross-border trade and investment.Loans and advances

Loans and advancesPankaj Baid

Ěý

The document outlines statutory and regulatory restrictions placed on Indian banks regarding loans and advances. It discusses guidelines around restricting loans to bank directors, loan amounts for individuals against shares, and prohibiting unethical lending practices. The purpose is to ensure sound risk management and prevent issues like speculative commodity holding or money laundering using bank funds.Schedule commercial bank ppt

Schedule commercial bank ppt UAS,GKVK,BENGALURU

Ěý

Scheduled commercial banks in India must meet certain criteria set by the Reserve Bank of India, such as maintaining a minimum paid capital and funds. These banks can access loans from the RBI and automatically become members of the clearing house. The main types of scheduled commercial banks are public sector banks, private sector banks, foreign banks, and regional rural banks. The key differences between scheduled commercial banks and regular commercial banks are that scheduled banks must meet RBI's criteria and enjoy special facilities, while commercial banks exist globally without these distinguishing Indian features.Merchant Banking

Merchant BankingBiswajit Palit

Ěý

Merchant banking provides a wide range of financial services including underwriting shares, portfolio management, project counseling, and more. They work with both equity and debt financing unlike commercial banks. Some key services include corporate counseling, project financing, managing public offerings, portfolio management, M&A advisory, offshore financing, and advising non-resident investors. Merchant banks must have expertise in financial analysis, market knowledge, and maintain high professional standards. The merchant banking industry in India has opportunities to grow with the increasing number of public offerings, foreign institutional investments, evolving debt markets, and corporate restructuring needs.Key terms done

Key terms donenileshsen

Ěý

This document provides definitions and explanations of key terms related to international banking and payments systems, including: correspondent banking, NOSTRO and VOSTRO accounts, SWIFT, CHIPS, CHAPS, FEDWIRE, and letters of credit. It describes how correspondent banking works and how NOSTRO and VOSTRO accounts are used in foreign exchange transactions. It also summarizes the purpose and operations of payment systems like SWIFT, CHIPS, CHAPS, and FEDWIRE which facilitate international funds transfers and settlements.Non Banking Financial Company (NBFC)

Non Banking Financial Company (NBFC)Vishak G

Ěý

L&T Finance Holdings Ltd is a large NBFC operating in finance sector in India. It provides various financial services including loans, insurance, factoring etc. The company follows frameworks like GRI, NVG, UNGC to report on economic, environmental and social performances. It ensures ethics and transparency in business operations and incorporates social/environmental factors. The company focuses on talent acquisition and development, transparency, learning and good governance in its HR policy.Venture capital

Venture capital Omkar More

Ěý

This document provides an overview of venture capital. It defines venture capital as long-term risk capital used to finance high-growth potential startups and small businesses. Key points include that venture capital investments are long-term, lack liquidity, and carry high risks but also high potential returns. The document discusses advantages like bringing capital and expertise to companies, as well as disadvantages such as loss of founder autonomy. Top cities attracting venture capital in India are listed as Mumbai, Bangalore, Delhi, Chennai, and Hyderabad. The information technology sector captures the largest share of venture capital funding in India.Presentation of banking & insurance

Presentation of banking & insuranceLavanya Dev

Ěý

Saraswat Co-Operative Bank has over 90 years of experience serving customers as a financial cooperative owned by its members. It has over 200 branches across India offering banking services like deposits, loans, debit cards, internet banking, and more. The bank aims to provide both the capabilities of large banks with the personalized service of small banks. It caters mainly to middle-class customers and has introduced many popular credit and deposit schemes at competitive rates.IDBI, Industrial Development Bank of India

IDBI, Industrial Development Bank of IndiaRani More

Ěý

The Industrial Development Bank of India (IDBI) was established in 1964 and is currently owned by the Government of India. It is the 10th largest development bank in the world and provides financing and development assistance to key industries in India. IDBI raises funds through share capital, government and RBI borrowings, market bonds, deposits, and foreign currency borrowings. It offers various refinancing schemes and development programs to support industries. IDBI has received several awards and recognitions for its performance and technology initiatives.UNIT TRUST OF INDIA

UNIT TRUST OF INDIAAmith Kumar

Ěý

The Unit Trust of India (UTI) was established in 1964 by the government of India to promote and pool savings from small investors and give them an opportunity to benefit. UTI was established with an initial capital of Rs. 5 crores contributed by several major banks and financial institutions. Its main functions are to encourage savings among lower and middle class people, sell units across India, convert small savings into industrial finance, and provide liquidity, advisory, and investment services. Over time UTI launched several unit schemes and funds for different objectives. It has progressed through different phases from 1964 to the present, and is now organized as the Specified Undertaking of UTI and UTI Mutual Fund Ltd.Types of mutual funds

Types of mutual fundsIndraja Modem

Ěý

This document discusses different types of mutual funds. It begins with an introduction to mutual funds, explaining that they allow investors to pool money for investment in a basket of assets managed by professionals at low cost. The document then outlines the main types of mutual funds:

On the basis of lock-in period, funds are either open-ended, allowing entry and exit at any time, or closed-ended, with a minimum three-year lock-in.

Based on investment, the main types are equity funds (investing in stocks), ELSS funds (for tax benefits), debt funds, balanced funds (mixing equity and debt), and sectoral funds (focusing on a single industry). Equity funds include largePpt on Small Industries Development Bank of India

Ppt on Small Industries Development Bank of IndiaSatakshi Kaushik

Ěý

1) Small Industries Development Bank of India (SIDBI) is a financial institution established in 1990 to aid the growth and development of micro, small and medium enterprises in India.

2) SIDBI aims to promote, finance, and develop small businesses through financing, promotion, development, and coordination activities. It provides loans for equipment, working capital, and work sheds.

3) SIDBI's mission is to facilitate and strengthen credit flow to small businesses and address financial and developmental gaps. Its vision is to be a single window for meeting small business needs and to enhance shareholder wealth through technology.agencies for policy formulation and implementation for promoting entrepreneur...

agencies for policy formulation and implementation for promoting entrepreneur...Megha Roy

Ěý

This document summarizes several key agencies involved in policy formulation and implementation related to entrepreneurship development and small businesses in India. It describes the District Industries Centre (DIC), which promotes small industries at the district level. It also outlines the Small Industries Service Institutes (SISI) that provide consultancy and training. Additionally, it discusses the National Institute of Entrepreneurship & Small Business Development (NIESBUD), the apex body coordinating entrepreneurship development agencies. The Entrepreneurship Development Institute of India (EDII) and National Entrepreneurship Development Board (NEDB) are also summarized as organizations that promote entrepreneurship and small businesses.Insurance companies

Insurance companiesDr. Jamal uddeen

Ěý

The document discusses the history and operations of Life Insurance Corporation (LIC) and General Insurance Corporation (GIC) in India.

It provides background on LIC, including that it was established in 1956 by merging 245 private insurance companies following nationalization. LIC is India's largest insurance company and is owned by the government. The document also outlines GIC's role in reinsuring policies and consolidating 107 private insurers after nationalization in 1972.

The roles of LIC and GIC include spreading insurance widely, maximizing savings mobilization, conducting business efficiently, and investing policyholder funds prudently and safely.IFCI

IFCInaveen99

Ěý

The Industrial Finance Corporation of India (IFCI) was established in 1948 as the first development financial institution in India to provide long-term financing to industrial sectors. IFCI's authorized capital was initially Rs. 10 crores but was later raised to Rs. 20 crores. IFCI engages in direct financing, incidental activities, and promotional activities to support industries, including providing rupee and foreign currency loans, loan guarantees, technical assistance, and merchant banking services. IFCI obtains its resources from sources such as the Reserve Bank of India, share capital, retained earnings, bond issues, government loans, and international sources.INSURANCE REGULATORY DEVELOPMENT AUTHORITY

INSURANCE REGULATORY DEVELOPMENT AUTHORITYBHANU DIXIT

Ěý

IRDA is the statutory, independent body that governs and supervises the insurance industry in India. It was established in 2000 by the Insurance Regulatory and Development Authority Act, 1999. IRDA regulates the insurance industry, issues licenses, protects policyholders, and promotes growth of the insurance sector. It aims to ensure speedy settlement of claims, prevent fraud and malpractices, and bring transparency to the insurance market. The organization is headed by a Chairman and has 10 members. IRDA seeks to balance effective regulation with ensuring the development of the insurance industry in India.MERCHANT BANKING SERVICES

MERCHANT BANKING SERVICESAMAR ID

Ěý

This document provides an overview of merchant banking services. It defines merchant banking and traces its origins in London financing foreign trade. Merchant banking services include project counseling, loan syndication, issue management, underwriting public issues, portfolio management, advising on NRI investment, mergers and acquisitions, and offshore finance. They help raise funds for projects, market corporate securities to the public, insure companies issuing public stock, manage investor portfolios, and facilitate foreign investment.Structure of Indian Banking System

Structure of Indian Banking SystemDr. S. Bulomine Regi

Ěý

The document summarizes the structure of the banking system in India. It outlines the different types of banks: scheduled banks and non-scheduled banks. It also discusses cooperative banks, including central cooperative banks, state cooperative banks, and district central cooperative banks. The document then covers commercial banks such as public sector banks, regional rural banks, private sector banks, and foreign banks. It provides brief descriptions of each type of bank and their roles within the Indian banking system.Indian Banking Structure

Indian Banking Structure Praveen Asokan

Ěý

The document outlines the structure and regulation of the banking system in India, which is governed by the Reserve Bank of India (RBI) and various banking acts. It categorizes banks into commercial, co-operative, and development banks, detailing their functions, products, and services, including the role of IT in modern banking. Additionally, it highlights the significance of e-banking, providing convenience and accessibility to customers.Chapter 10 banker- customer relationship

Chapter 10 banker- customer relationshipiipmff2

Ěý

The document discusses key definitions and concepts related to banking law in India. It defines terms like "banker" and "customer" and outlines how the legal relationship between them is established. It also examines the various roles and duties of a banker, including as a debtor, trustee, agent, and bailee. The document also discusses exceptions to the general duty of confidentiality bankers owe to customers, as well as how the banker-customer relationship can be terminated.Government securities

Government securitiesShubham Agrawal

Ěý

Government securities are debt instruments issued by the government to raise funds. They include treasury bills and bonds. Government securities are considered low-risk as they are backed by the government's taxing power. They are issued to fund government expenditures and control the money supply. Types of government securities include dated securities, zero-coupon bonds, floating rate bonds, and bonds with call/put options. While government securities offer assured returns, their returns are generally lower than other securities and investors may lose value if interest rates rise.Privatization of insurance

Privatization of insuranceISHA JAISWAL

Ěý

The document discusses the history and development of the insurance sector in India. It notes that insurance was initially nationalized and state-owned companies dominated the market. Liberalization in the 1990s allowed private companies to enter the sector. Now there are many private life, health, and general insurance companies operating alongside state-owned insurers, increasing competition and improving customer choice, services and products. However, some risks remain, such as companies prioritizing profits over customers.Exim Bank

Exim BankFortune Institute of International Business

Ěý

The Export-Import Bank of India was established in 1981 by the Indian parliament to provide financial assistance to Indian exporters and importers. It aims to promote India's international trade by functioning as the principal financial institution for organizations involved in financing exports and imports. Exim Bank provides a wide range of financing programs, advisory services, and research to support all types of exporters and importers in India.Venture capital

Venture capitalarathy V

Ěý

Venture capital refers to funds provided to startup companies and small businesses with growth potential. It involves long-term risk capital to finance high-risk technology projects. Venture capital is regulated in India by SEBI and involves investing in private companies, with at least 80% invested in venture capital firms. It provides benefits like large equity financing and expertise, but founders lose some autonomy and the application process is complex.Sidbi

Sidbinaveen99

Ěý

The Small Industries Development Bank of India (SIDBI) was established in 1989 as the principal financial institution for promoting, financing and developing small industries in India. SIDBI's mission is to empower micro, small and medium enterprises to make them strong, vibrant and globally competitive. Its key objectives are financing, promotion, development and coordination of small industries. SIDBI offers various direct financing, refinancing, bills financing and international financing schemes as well as promotional and developmental activities like entrepreneurship training to support small businesses.SIDBI

SIDBIYashika Parekh

Ěý

The Small Industries Development Bank of India (SIDBI), established in 1990, serves as the primary financial institution for promoting and developing the micro, small, and medium enterprises (MSME) sector in India. SIDBI provides various financial products and services, including direct finance, refinance, and support for technological upgradation, with a mission to empower MSMEs and enhance their global competitiveness. The bank has also successfully implemented several initiatives and schemes to ensure the growth and sustainability of small-scale industries, contributing significantly to the national economy.More Related Content

What's hot (20)

Key terms done

Key terms donenileshsen

Ěý

This document provides definitions and explanations of key terms related to international banking and payments systems, including: correspondent banking, NOSTRO and VOSTRO accounts, SWIFT, CHIPS, CHAPS, FEDWIRE, and letters of credit. It describes how correspondent banking works and how NOSTRO and VOSTRO accounts are used in foreign exchange transactions. It also summarizes the purpose and operations of payment systems like SWIFT, CHIPS, CHAPS, and FEDWIRE which facilitate international funds transfers and settlements.Non Banking Financial Company (NBFC)

Non Banking Financial Company (NBFC)Vishak G

Ěý

L&T Finance Holdings Ltd is a large NBFC operating in finance sector in India. It provides various financial services including loans, insurance, factoring etc. The company follows frameworks like GRI, NVG, UNGC to report on economic, environmental and social performances. It ensures ethics and transparency in business operations and incorporates social/environmental factors. The company focuses on talent acquisition and development, transparency, learning and good governance in its HR policy.Venture capital

Venture capital Omkar More

Ěý

This document provides an overview of venture capital. It defines venture capital as long-term risk capital used to finance high-growth potential startups and small businesses. Key points include that venture capital investments are long-term, lack liquidity, and carry high risks but also high potential returns. The document discusses advantages like bringing capital and expertise to companies, as well as disadvantages such as loss of founder autonomy. Top cities attracting venture capital in India are listed as Mumbai, Bangalore, Delhi, Chennai, and Hyderabad. The information technology sector captures the largest share of venture capital funding in India.Presentation of banking & insurance

Presentation of banking & insuranceLavanya Dev

Ěý

Saraswat Co-Operative Bank has over 90 years of experience serving customers as a financial cooperative owned by its members. It has over 200 branches across India offering banking services like deposits, loans, debit cards, internet banking, and more. The bank aims to provide both the capabilities of large banks with the personalized service of small banks. It caters mainly to middle-class customers and has introduced many popular credit and deposit schemes at competitive rates.IDBI, Industrial Development Bank of India

IDBI, Industrial Development Bank of IndiaRani More

Ěý

The Industrial Development Bank of India (IDBI) was established in 1964 and is currently owned by the Government of India. It is the 10th largest development bank in the world and provides financing and development assistance to key industries in India. IDBI raises funds through share capital, government and RBI borrowings, market bonds, deposits, and foreign currency borrowings. It offers various refinancing schemes and development programs to support industries. IDBI has received several awards and recognitions for its performance and technology initiatives.UNIT TRUST OF INDIA

UNIT TRUST OF INDIAAmith Kumar

Ěý

The Unit Trust of India (UTI) was established in 1964 by the government of India to promote and pool savings from small investors and give them an opportunity to benefit. UTI was established with an initial capital of Rs. 5 crores contributed by several major banks and financial institutions. Its main functions are to encourage savings among lower and middle class people, sell units across India, convert small savings into industrial finance, and provide liquidity, advisory, and investment services. Over time UTI launched several unit schemes and funds for different objectives. It has progressed through different phases from 1964 to the present, and is now organized as the Specified Undertaking of UTI and UTI Mutual Fund Ltd.Types of mutual funds

Types of mutual fundsIndraja Modem

Ěý

This document discusses different types of mutual funds. It begins with an introduction to mutual funds, explaining that they allow investors to pool money for investment in a basket of assets managed by professionals at low cost. The document then outlines the main types of mutual funds:

On the basis of lock-in period, funds are either open-ended, allowing entry and exit at any time, or closed-ended, with a minimum three-year lock-in.

Based on investment, the main types are equity funds (investing in stocks), ELSS funds (for tax benefits), debt funds, balanced funds (mixing equity and debt), and sectoral funds (focusing on a single industry). Equity funds include largePpt on Small Industries Development Bank of India

Ppt on Small Industries Development Bank of IndiaSatakshi Kaushik

Ěý

1) Small Industries Development Bank of India (SIDBI) is a financial institution established in 1990 to aid the growth and development of micro, small and medium enterprises in India.

2) SIDBI aims to promote, finance, and develop small businesses through financing, promotion, development, and coordination activities. It provides loans for equipment, working capital, and work sheds.

3) SIDBI's mission is to facilitate and strengthen credit flow to small businesses and address financial and developmental gaps. Its vision is to be a single window for meeting small business needs and to enhance shareholder wealth through technology.agencies for policy formulation and implementation for promoting entrepreneur...

agencies for policy formulation and implementation for promoting entrepreneur...Megha Roy

Ěý

This document summarizes several key agencies involved in policy formulation and implementation related to entrepreneurship development and small businesses in India. It describes the District Industries Centre (DIC), which promotes small industries at the district level. It also outlines the Small Industries Service Institutes (SISI) that provide consultancy and training. Additionally, it discusses the National Institute of Entrepreneurship & Small Business Development (NIESBUD), the apex body coordinating entrepreneurship development agencies. The Entrepreneurship Development Institute of India (EDII) and National Entrepreneurship Development Board (NEDB) are also summarized as organizations that promote entrepreneurship and small businesses.Insurance companies

Insurance companiesDr. Jamal uddeen

Ěý

The document discusses the history and operations of Life Insurance Corporation (LIC) and General Insurance Corporation (GIC) in India.

It provides background on LIC, including that it was established in 1956 by merging 245 private insurance companies following nationalization. LIC is India's largest insurance company and is owned by the government. The document also outlines GIC's role in reinsuring policies and consolidating 107 private insurers after nationalization in 1972.

The roles of LIC and GIC include spreading insurance widely, maximizing savings mobilization, conducting business efficiently, and investing policyholder funds prudently and safely.IFCI

IFCInaveen99

Ěý

The Industrial Finance Corporation of India (IFCI) was established in 1948 as the first development financial institution in India to provide long-term financing to industrial sectors. IFCI's authorized capital was initially Rs. 10 crores but was later raised to Rs. 20 crores. IFCI engages in direct financing, incidental activities, and promotional activities to support industries, including providing rupee and foreign currency loans, loan guarantees, technical assistance, and merchant banking services. IFCI obtains its resources from sources such as the Reserve Bank of India, share capital, retained earnings, bond issues, government loans, and international sources.INSURANCE REGULATORY DEVELOPMENT AUTHORITY

INSURANCE REGULATORY DEVELOPMENT AUTHORITYBHANU DIXIT

Ěý

IRDA is the statutory, independent body that governs and supervises the insurance industry in India. It was established in 2000 by the Insurance Regulatory and Development Authority Act, 1999. IRDA regulates the insurance industry, issues licenses, protects policyholders, and promotes growth of the insurance sector. It aims to ensure speedy settlement of claims, prevent fraud and malpractices, and bring transparency to the insurance market. The organization is headed by a Chairman and has 10 members. IRDA seeks to balance effective regulation with ensuring the development of the insurance industry in India.MERCHANT BANKING SERVICES

MERCHANT BANKING SERVICESAMAR ID

Ěý

This document provides an overview of merchant banking services. It defines merchant banking and traces its origins in London financing foreign trade. Merchant banking services include project counseling, loan syndication, issue management, underwriting public issues, portfolio management, advising on NRI investment, mergers and acquisitions, and offshore finance. They help raise funds for projects, market corporate securities to the public, insure companies issuing public stock, manage investor portfolios, and facilitate foreign investment.Structure of Indian Banking System

Structure of Indian Banking SystemDr. S. Bulomine Regi

Ěý

The document summarizes the structure of the banking system in India. It outlines the different types of banks: scheduled banks and non-scheduled banks. It also discusses cooperative banks, including central cooperative banks, state cooperative banks, and district central cooperative banks. The document then covers commercial banks such as public sector banks, regional rural banks, private sector banks, and foreign banks. It provides brief descriptions of each type of bank and their roles within the Indian banking system.Indian Banking Structure

Indian Banking Structure Praveen Asokan

Ěý

The document outlines the structure and regulation of the banking system in India, which is governed by the Reserve Bank of India (RBI) and various banking acts. It categorizes banks into commercial, co-operative, and development banks, detailing their functions, products, and services, including the role of IT in modern banking. Additionally, it highlights the significance of e-banking, providing convenience and accessibility to customers.Chapter 10 banker- customer relationship

Chapter 10 banker- customer relationshipiipmff2

Ěý

The document discusses key definitions and concepts related to banking law in India. It defines terms like "banker" and "customer" and outlines how the legal relationship between them is established. It also examines the various roles and duties of a banker, including as a debtor, trustee, agent, and bailee. The document also discusses exceptions to the general duty of confidentiality bankers owe to customers, as well as how the banker-customer relationship can be terminated.Government securities

Government securitiesShubham Agrawal

Ěý

Government securities are debt instruments issued by the government to raise funds. They include treasury bills and bonds. Government securities are considered low-risk as they are backed by the government's taxing power. They are issued to fund government expenditures and control the money supply. Types of government securities include dated securities, zero-coupon bonds, floating rate bonds, and bonds with call/put options. While government securities offer assured returns, their returns are generally lower than other securities and investors may lose value if interest rates rise.Privatization of insurance

Privatization of insuranceISHA JAISWAL

Ěý

The document discusses the history and development of the insurance sector in India. It notes that insurance was initially nationalized and state-owned companies dominated the market. Liberalization in the 1990s allowed private companies to enter the sector. Now there are many private life, health, and general insurance companies operating alongside state-owned insurers, increasing competition and improving customer choice, services and products. However, some risks remain, such as companies prioritizing profits over customers.Exim Bank

Exim BankFortune Institute of International Business

Ěý

The Export-Import Bank of India was established in 1981 by the Indian parliament to provide financial assistance to Indian exporters and importers. It aims to promote India's international trade by functioning as the principal financial institution for organizations involved in financing exports and imports. Exim Bank provides a wide range of financing programs, advisory services, and research to support all types of exporters and importers in India.Venture capital

Venture capitalarathy V

Ěý

Venture capital refers to funds provided to startup companies and small businesses with growth potential. It involves long-term risk capital to finance high-risk technology projects. Venture capital is regulated in India by SEBI and involves investing in private companies, with at least 80% invested in venture capital firms. It provides benefits like large equity financing and expertise, but founders lose some autonomy and the application process is complex.Similar to Small Industries Development Bank of India SIDBI (20)

Sidbi

Sidbinaveen99

Ěý

The Small Industries Development Bank of India (SIDBI) was established in 1989 as the principal financial institution for promoting, financing and developing small industries in India. SIDBI's mission is to empower micro, small and medium enterprises to make them strong, vibrant and globally competitive. Its key objectives are financing, promotion, development and coordination of small industries. SIDBI offers various direct financing, refinancing, bills financing and international financing schemes as well as promotional and developmental activities like entrepreneurship training to support small businesses.SIDBI

SIDBIYashika Parekh

Ěý

The Small Industries Development Bank of India (SIDBI), established in 1990, serves as the primary financial institution for promoting and developing the micro, small, and medium enterprises (MSME) sector in India. SIDBI provides various financial products and services, including direct finance, refinance, and support for technological upgradation, with a mission to empower MSMEs and enhance their global competitiveness. The bank has also successfully implemented several initiatives and schemes to ensure the growth and sustainability of small-scale industries, contributing significantly to the national economy.Sidbi msfc

Sidbi msfcmohit satodia

Ěý

SIDBI and MSFC play important roles in providing financial services to support small and medium enterprises in India. SIDBI was established by the government in 1989 as the apex institution to oversee financing for small and medium industries. It provides loans, refinancing, import/export support, and development programs. MSFC was established in 1962 and supports industries in Maharashtra, Goa, and Daman and Diu by providing term loans for assets, expansion, and modernization of small and medium businesses. Both organizations aim to promote industry and economic development in India.SIDBI

SIDBIRishebh Clement

Ěý

SIDBI is the principal financial institution for promotion, financing and development of MSMEs in India. It provides various financial services like direct financing, refinancing, bill financing, and international financing to MSMEs. It also engages in promotional activities like entrepreneurship training. Some key schemes include Technology Upgradation Fund Scheme, Venture Capital Fund Scheme, and National Equity Fund Scheme. SIDBI aims to empower and support the growth of MSMEs through its financial and developmental activities.Institutional support

Institutional supportManoj Reddy

Ěý

The document discusses various institutions that provide support to industries in Karnataka, including the Karnataka Industrial Areas Development Board (KIADB), Karnataka Small Scale Industries Development Corporation (KSSIDC), Karnataka State Industrial Investment and Development Corporation (KSIMC), National Small Industries Corporation (NSIC), District Industries Centres (DICs), and Small Industries Development Bank of India (SIDBI). It provides details on the functions and services provided by these institutions such as acquiring land for industrial areas, providing infrastructure, term loans, refinancing, entrepreneurship training, and more.Small industries development bank of india

Small industries development bank of indiaArushi Rajput

Ěý

The Small Industries Development Bank of India (SIDBI) was founded in 1990 as the principal financial institution to promote, finance, and develop micro, small and medium enterprises in India. It was established as a wholly owned subsidiary of IDBI Bank under an Act of the Indian Parliament. SIDBI provides financing support to MSMEs, which contribute significantly to the Indian economy through production, employment, and exports. In addition to direct financing, SIDBI also engages in promotion, development, and coordination activities to strengthen the MSME sector.Role of financial institutions in support of women entrepreneurial activities...

Role of financial institutions in support of women entrepreneurial activities...uma reur

Ěý

The document outlines the syllabus for the Women Entrepreneurship course in the 2nd semester of B.Com at Smt. V G Degree College for Women. It discusses 5 units that make up the course: 1) Introduction to women entrepreneurship, 2) Opportunities and challenges faced by women entrepreneurs, 3) Role of financial institutions in supporting women's entrepreneurial activities, 4) Government schemes for promoting women entrepreneurship, and 5) Project identification and formulation. Unit 3 specifically focuses on the role of organizations like SIDBI, DIC, CEDOK, and RUDSETI in providing long and short-term financing to support women entrepreneurs. The overall goal of the course is to familiarizeSIDBI, Banking in India, Amity University Jharkhand , Business Environment

SIDBI, Banking in India, Amity University Jharkhand , Business Environment AditiBhadani2

Ěý

SIDBI was established in 1988 as a wholly owned subsidiary of IDBI to promote and finance micro, small and medium enterprises in India. It is the principal financial institution for MSME sector development. SIDBI provides refinancing to loans given to small businesses, discounts bills of machinery sales/manufacturing, and facilitates credit flow for term loans and working capital. Its objectives include promoting marketing, upgrading technology, providing more financial assistance to ancillary and tiny sectors, encouraging employment, and coordinating other institutions involved in MSME promotion.Small industries devlopment bank of india (sidbi)1234

Small industries devlopment bank of india (sidbi)1234bhargavsojiya

Ěý

The Small Industries Development Bank of India (SIDBI) was established on April 2, 1990, to support the growth of micro, small, and medium enterprises (MSMEs) in India. It aims to facilitate credit flow, promote development, and enhance marketing capabilities for MSMEs while offering various financial products and services. SIDBI also manages venture capital funds to assist knowledge-based MSMEs and plays a significant role in fostering entrepreneurship in the small scale sector.Main schemes of sidbi

Main schemes of sidbiNazneen sheikh

Ěý

The document outlines various schemes provided by the Small Industries Development Bank of India (SIDBI) to support small and tiny enterprises, including financial aid for technology modernization, equity assistance, and rehabilitation of sick units. Key programs include the National Equity Fund, Mahila Udyam Nidhi for women entrepreneurs, and the Technology Development and Modernization Fund, each designed to enhance the capabilities and competitiveness of small industries. Additionally, assistance is available for disabled entrepreneurs through the National Handicapped Finance and Development Corporation to promote self-employment and income-generating activities.Financial Agencies

Financial AgenciesJacob John Panicker

Ěý

This document discusses various types of institutional finance available to entrepreneurs in India from government agencies, including equity capital, term loans, and working capital. It outlines several agencies that provide financing such as commercial banks, the Industrial Development Bank of India (IDBI), the Industrial Finance Corporation of India (IFCI), the Industrial Credit and Investment Corporation of India (ICICI), and the Small Industries Development Bank of India (SIDBI). Each agency offers different loan terms and interest rates targeted towards small businesses and entrepreneurs.Sidbi

Sidbiakhilmind

Ěý

SIDBI stands for Small Industries Development Bank of India. It is an independent financial institution aimed to aid the growth and development of micro, small and medium scale enterprises in India. It was set up in 1990 through an act of parliament as a wholly owned subsidiary of Industrial Development Bank of India. SIDBI's mission is to empower the Micro, Small and Medium Enterprises sector to contribute to economic growth, employment generation, and balanced regional development. It provides financial assistance to small scale industries, which contribute significantly to national production, employment, and exports.Financial and non financial assistance

Financial and non financial assistanceReenaRamachandran4

Ěý

The document discusses various institutions that provide financial and non-financial assistance to small scale enterprises in India. It describes the roles of state financial corporations, SIDBI, commercial banks, KSIIDC, IFCI, DIC, SISI, EDI, SIDO, AWAKE, TCOs, TECSOK, and KVIC in promoting and supporting small businesses. It also covers microfinance institutions like self-help groups and their role in providing financial services to unemployed or low-income individuals.Institutional support

Institutional supportSavita Makond

Ěý

There are two main types of institutions that provide support to small scale industries (SSI) in India - state level institutions and central government institutions. State level institutions include State Directorates of Industries, State Small Scale Industries Development Corporations, District Industries Centers, State Finance Corporations, and Technical Consultancy Organizations. Central government institutions that support SSI include the Department of Small Scale Industries, Small Scale Industries Board, Small Industries Development Organisation, National Small Industries Corporation, Industrial Credit and Investment Corporation of India, and Industrial Finance Corporation of India. These institutions provide various services like financing, training, marketing assistance, infrastructure development, and policy guidance to small businesses.B.B.A-SEM-2-GSI- Small scale n cottage industries

B.B.A-SEM-2-GSI- Small scale n cottage industriesKU Open Source Education

Ěý

The document discusses the classification and importance of small scale industries (SSI) and cottage industries in India, including their contributions to employment, output, and exports. It outlines various promotional measures, financial assistance, and challenges faced by these industries, along with the role of institutions such as SIDBI and NSIC in supporting them. The evolution of industrial policy since 1977 and the financial resources available for SSI development are also highlighted.Institutions supporting small and medium enterprises, sanjeev

Institutions supporting small and medium enterprises, sanjeevSanjeev Patel

Ěý

This document outlines the various institutions that support small and medium enterprises in India at the central and state level. At the central level, key institutions include the Small Scale Industries Board, Khadi and Village Industries Commission, Small Industries Development Organization, National Small Industries Corporation, and National Science and Technology Entrepreneurship Development Board. At the state level, supporting institutions include Directorates of Industries, District Industries Centers, State Financial Corporations, State Industrial Development Corporations, and State Small Industrial Development Corporations.NABARD in entrepreneurship

NABARD in entrepreneurship SachinJamakhandi

Ěý

1. NABARD provides short, medium, and long term credit for agriculture and rural development purposes through banks and financial institutions.

2. It also provides refinancing assistance for activities like cottage industries, artisans, and agriculture marketing.

3. SIDO works to promote small industries through various programs like entrepreneurship training and developing industrial clusters across India.Institutions supporting sm es, sanjeev patel

Institutions supporting sm es, sanjeev patelSanjeev Patel

Ěý

This document summarizes several organizations that support small and medium enterprises in India at both the central and state level. At the central level, organizations described include the Small Scale Industries Board, Khadi and Village Industries Commission, Small Industries Development Organization, National Small Industries Corporation, National Science and Technology Entrepreneurship Development Board, and National Institute for Small Industry Extension and Training. At the state level, organizations discussed are Directorates of Industries, District Industries Centers, State Financial Corporations, State Industrial Development/Investment Corporations, and State Small Industries Development Corporations. These organizations provide various services including finance, training, technology support, marketing assistance, and infrastructure development to small businesses.Ad

Recently uploaded (8)

Expert Industrial Machine Repair • CNC Servicing • Preventative Maintenance.pptx

Expert Industrial Machine Repair • CNC Servicing • Preventative Maintenance.pptxMachine Ethics

Ěý

Machine Ethics LLC is a Michigan-based industrial machine service company specializing in CNC repair, preventative maintenance, and equipment installations. With nearly 20 years of experience, we help manufacturers reduce downtime and extend equipment life—offering expert repairs, custom PM programs, and affordable alternatives to OEM service. From mechanical and electrical issues to full machine rebuilds, our skilled technicians deliver reliable, cost-effective solutions across Michigan and the Great Lakes region.

Why Outsourcing Web Development Matters for Non-Technical Founders 1.pdf

Why Outsourcing Web Development Matters for Non-Technical Founders 1.pdfInnvatonMServices

Ěý

Launching a web development project without deep technical expertise can be intimidating for many startup founders, CTOs, and IT consultants.Understanding Pay Per Call_ A Guide for Affiliates and Advertisers!.pdf

Understanding Pay Per Call_ A Guide for Affiliates and Advertisers!.pdfMutualCall

Ěý

MutualCall is a Premium Pay Per Call Affiliate Network, offering high-quality inbound & outbound calls and exceptional lead generation services. As experts in Pay Per Call and affiliate marketing, we drive business growth by delivering top-tier leads across multiple sectors. Our advanced call tracking system ensures that every campaign is optimized for maximum performance, giving you the competitive edge needed to succeed.Building Financial Resilience_ Why It’s More Important Than Ever

Building Financial Resilience_ Why It’s More Important Than EverMatt Dixon

Ěý

"Building Financial Resilience: Why It’s More Important Than Ever"** explores the critical need for individuals and families to strengthen their financial stability in an increasingly uncertain world. This piece highlights practical strategies for managing debt, saving effectively, and preparing for unexpected challenges—empowering readers to take control of their financial future with confidence.The Ultimate Guide to Local SEO Automation.pdf

The Ultimate Guide to Local SEO Automation.pdfKHM Anwar

Ěý

Are you exhausted by your rivals’ success in local search results? Local SEO Automation is changing digital marketing’s rules. Discover ten smart tools to dominate local SEO by 2025. These tools will simplify your processes and make it easy for customers to find you.

The game-changing applications worthy of being in your toolkit include Local SEO automation tools that simplify tasks such as optimizing Google Business Profiles, gathering customer reviews, and establishing consistent citations across the Internet.Mencari Ide Wirausaha Kreatif Inovatif dan digitalisasi.pptx

Mencari Ide Wirausaha Kreatif Inovatif dan digitalisasi.pptxInstitut Ilmu Hukum dan Ekonomi Lamaddukelleng

Ěý

Mencari Ide Wirausaha Kreatif Inovatif dan digitalisasiLocal SEO Guide 2025-12 Strategies Explained.pdf

Local SEO Guide 2025-12 Strategies Explained.pdfKHM Anwar

Ěý

Local SEO Guide: Why do some shops appear on Google Maps while others do not? This article will help you get your coffee shop at the top of local searches. Search engines reveal their new methods every few months. For instance, today, 55% of users search for information about people and places in their vicinity.

Simply having an online presence is no longer enough. You have to specialize in your area. If you deliver pizza or fix roofs next door, make your presence felt locally.

These Local SEO Guide-twelve tips will help create your local authority on search results pages in 2025. They are responsive to modern-day algorithms and build on what others say about you. You may now get noticed by those who live close by. Let us get started.Expert Industrial Machine Repair • CNC Servicing • Preventative Maintenance.pptx

Expert Industrial Machine Repair • CNC Servicing • Preventative Maintenance.pptxMachine Ethics

Ěý

Mencari Ide Wirausaha Kreatif Inovatif dan digitalisasi.pptx

Mencari Ide Wirausaha Kreatif Inovatif dan digitalisasi.pptxInstitut Ilmu Hukum dan Ekonomi Lamaddukelleng

Ěý

Ad

Small Industries Development Bank of India SIDBI

- 1. Special Guidance by : Mr. H. S. K. Tangirala Director, Udaybhansinhji Regional Institute of Cooperative Management (URICM) - Gandhinagar. Prepared by: Milan Dhaduk (1304) PGDM (ABM) – 2013-15 URICM - Gandhinagar.

- 2. Introduction • The Government of India set up the SIDBI under a special Act of the Parliament in October 1989. • SIDBI commenced its operations from April 2, 1990 with its head office in Lucknow. • SIDBI has been setup as a wholly owned subsidiary of IDBI. • Its authorised capital is Rs.250 cr. with an enabling provision to increase it to Rs.1000 cr. • It is the apex institution which oversees, co-ordinates & further strengthens various arrangements for providing financial and non- financial assistance to small-scale, tiny, and cottage industries.

- 3. Mission & Vision Mission: “ To empower the Micro, Small and Medium Enterprises (MSME) sector with a view to contributing to the process of economic growth, employment generation and balanced regional development” Vision: “ To emerge as a single window for meeting the financial and developmental needs of the MSME sector to make it strong, vibrant and globally competitive, to position SIDBI Brand as the preferred and customer - friendly institution and for enhancement of share - holder wealth and highest corporate values through modern technology platform”

- 4. Objectives • Four basic objectives are set out in the SIDBI Charter. They are: •Financing •Promotion •Development •Co-ordination • for orderly growth of industry in the small scale sector. The Charter has provided SIDBI considerable flexibility in adopting appropriate operational strategies to meet these objectives.

- 5. Products & Services • Direct finance. • Bills finance • Refinance • International finance • Promotional & Development activities. • Fixed deposit scheme • Technology Up-gradation & Modernisation Fund Scheme {TDMF} • Venture Capital Fund Scheme • Seed Money Schemes • National Equity Fund Scheme

- 6. Direct Finance • Since its beginning, SIDBI had been providing refinance to State Level Finance Corporations / State Industrial Development Corporations / Banks etc., against their loans granted to small scale units. • SIDBI’s direct finance schemes are: o Scheme for expansion / diversification of small scale units. o Scheme for specialised marketing agencies. o Scheme for ancilaring / subcontract units. o Scheme for existing Export Oriented Units(EOUs) to enable them to acquire ISO 9000 series certification.

- 7. Bills Finance Schemes • Bills Finance Scheme involves provision of medium and short-term finance for the benefit of the small-scale sector. • Bills Finance seeks to provide finance, to manufacturers of indigenous machinery, capital equipment, components sub-assemblies etc, based on compliance to the various eligibility criteria, norms etc as applicable to the respective schemes. • To be eligible under the various bills schemes, one of the parties to the transactions to the scheme has to be an industrial unit in the small-scale sector within the meaning of Section 2(h) of the SIDBI Act, 1989.

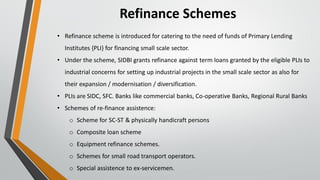

- 8. Refinance Schemes • Refinance scheme is introduced for catering to the need of funds of Primary Lending Institutes {PLI} for financing small scale sector. • Under the scheme, SIDBI grants refinance against term loans granted by the eligible PLIs to industrial concerns for setting up industrial projects in the small scale sector as also for their expansion / modernisation / diversification. • PLIs are SIDC, SFC. Banks like commercial banks, Co-operative Banks, Regional Rural Banks • Schemes of re-finance assistence: o Scheme for SC-ST & physically handicraft persons o Composite loan scheme o Equipment refinance schemes. o Schemes for small road transport operators. o Special assistence to ex-servicemen.

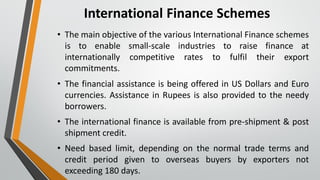

- 9. International Finance Schemes • The main objective of the various International Finance schemes is to enable small-scale industries to raise finance at internationally competitive rates to fulfil their export commitments. • The financial assistance is being offered in US Dollars and Euro currencies. Assistance in Rupees is also provided to the needy borrowers. • The international finance is available from pre-shipment & post shipment credit. • Need based limit, depending on the normal trade terms and credit period given to overseas buyers by exporters not exceeding 180 days.

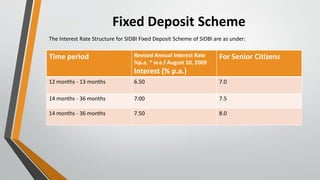

- 10. Fixed Deposit Scheme The Interest Rate Structure for SIDBI Fixed Deposit Scheme of SIDBI are as under: Time period Revised Annual Interest Rate %p.a. * w.e.f August 10, 2009 Interest (% p.a.) For Senior Citizens 12 months - 13 months 6.50 7.0 14 months - 36 months 7.00 7.5 14 months - 36 months 7.50 8.0

- 11. Promotional and Development Activities • As an apex financial institution for promotion, financing and development of industry in the small scale sector, SIDBI meets the varied developmental needs of the Indian SSI sector by its wide-ranging Promotional and Developmental (P&D) activities. • The activities are as follows: o Entrepreneurship Development Programmes. o Management Development Programmes. o Technology Up-gradation Programmes.

- 12. Technology Up-gradation & Modernisation Fund Scheme {TDMF} • This fund was setup in the year 1996 by the SIDBI with an initial capital of 200 cr. • It was setup for the purpose of encouraging the existing small scale industrial units to modernise production facilities and adopt improved and updated technology for strengthening export capabilities. • For availing benefits under this scheme the unit have to prepare an estimate for modernisation & submit it to SIDBI. • The sanction of funds is made depending upon the estimate submitted.

- 13. Venture Capital Fund Scheme • SIDBI is participating in the Venture capital fund set by public sector institutions as well as private companies to the extent of Rs,50,00,000 of total capital of the fund required. • The fund should be dedicated to financing small industry preferably the most risky one.

- 14. National Equity Fund Scheme • In order to provide equity type assistance, SIDBI is operation a National Equity Fund Scheme. • The equity capital loan to the extent of 2.5lakh is sanctioned to each project provided the prefect qualities under this scheme.

- 15. Seed Money Schemes • One of the constraints faced by Entrepreneurs is the lack of own resources to promote the minimum promoter contribution. • Hence, SIDBI introduced seed money scheme for the benefit of entrepreneurs. • Seed money is available through DIC { Direct Industry Centre } to those entrepreneur who are technically qualified but lack of own capital.