22.5. Rakennusten energiatehokkuus muuttuvassa ilmastossa

- 1. Rakennusten energiatehokkuus muuttuvassa ilmastossa Energiatehokkuudesta liiketoimintaa Helsinki, 22.5.2012 Juha Jokisalo Erikoistutkija, TkT juha.jokisalo@aalto.fi Aalto yliopisto, energiatekniikan laitos, LVI-tekniikka

- 2. Taustaa • Frame-hankkeen tulosten laskennassa on käytetty Suomen nykyilmastoa kuvaavaa energialaskennan tunnittaista referenssivuotta (D3, 2012) sekä ilmatieteenlaitoksen vuosille 2050 ja 2100 laatimia tulevaisuuden tunnittaisia referenssivuosia, jotka pohjautuvat A2- päästöskenaarioon.

- 3. Laskentamenetelmä • Dynaaminen simulointiohjelma IDA-ICE 4: Lähde: http://www.equa.se/

- 4. Mallinnuskohteet • Tutkittavat talotyypit: – Pientalo • Huoneistoala 134m² – Kerrostalo • 3 asuinkerrosta + kellari • Huoneistoala 1627m² – Toimisto • Nettoala 5390m² – Atriumtila 526m² – Avokonttorit 4043m² – Neuvotteluhuoneet 178m² – Toimistohuoneet 643m²

- 5. Kuinka paljon vaipan lämmöneristämisellä voidaan parantaa rakennusten energiatehokkuutta nyt ja tulevaisuudessa?

- 6. Tavoite • Selvitetään rakennuksen vaipan osien: • Ulkoseinän (US) • Yläpohjan (YP) • Alapohjan (AP) lämmöneristystason vaikutus pientalon, kerrostalon ja toimiston lämmityksen ja jäähdytyksen ostoenergiankulutukseen.

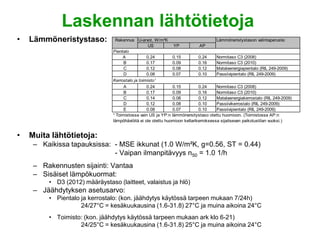

- 7. Laskennan lähtötietoja • Lämmöneristystaso: Rakennus U-arvot, W/m²K Lämmöneristystason valintaperuste: US YP AP Pientalo A 0.24 0.15 0.24 Normitaso C3 (2008) B 0.17 0.09 0.16 Normitaso C3 (2010) C 0.12 0.08 0.12 Matalaenergiapientalo (RIL 249-2009) D 0.08 0.07 0.10 Passiivipientalo (RIL 249-2009) Kerrostalo ja toimisto ¹ A 0.24 0.15 0.24 Normitaso C3 (2008) B 0.17 0.09 0.16 Normitaso C3 (2010) C 0.14 0.08 0.12 Matalaenergiakerrostalo (RIL 249-2009) D 0.12 0.08 0.10 Passiivikerrostalo (RIL 249-2009) E 0.08 0.07 0.10 Passiivipientalo (RIL 249-2009) ¹ Toimistossa vain US ja YP:n lämmönersitystaso otettu huomioon. (Toimistossa AP:n lämpöhäviöitä ei ole otettu huomioon kellarikerroksessa sijaitsevan paikotustilan vuoksi.) • Muita lähtötietoja: – Kaikissa tapauksissa: - MSE ikkunat (1.0 W/m²K, g=0.56, ST = 0.44) - Vaipan ilmanpitävyys n50 = 1.0 1/h – Rakennusten sijainti: Vantaa – Sisäiset lämpökuormat: • D3 (2012) määräystaso (laitteet, valaistus ja hlö) – Jäähdytyksen asetusarvo: • Pientalo ja kerrostalo: (kon. jäähdytys käytössä tarpeen mukaan 7/24h) 24/27°C = kesäkuukausina (1.6-31.8) 27°C ja muina aikoina 24°C • Toimisto: (kon. jäähdytys käytössä tarpeen mukaan ark klo 6-21) 24/25°C = kesäkuukausina (1.6-31.8) 25°C ja muina aikoina 24°C

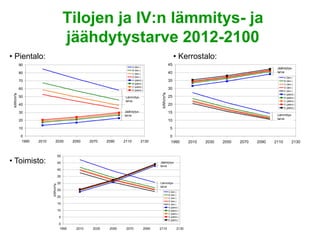

- 8. Tilojen ja IV:n lämmitys- ja jäähdytystarve 2012-2100 • Pientalo: • Kerrostalo: 90 45 A (läm.) Jäähdytys- B (läm.) 80 C (läm.) 40 tarve D (läm.) A (läm.) 70 A (jäähd.) 35 B (läm.) B (jäähd.) C (läm.) C (jäähd.) D (läm.) 60 D (jäähd.) 30 E (läm.) kWh/m²a kWh/m²a A (jäähd.) 50 Lämmitys- 25 B (jäähd.) tarve C (jäähd.) 40 20 D (jäähd.) E (jäähd.) 30 Jäähdytys- 15 tarve Lämmitys- tarve 20 10 10 5 0 0 1990 2010 2030 2050 2070 2090 2110 2130 1990 2010 2030 2050 2070 2090 2110 2130 50 • Toimisto: 45 Jäähdytys- tarve 40 35 30 Lämmitys- kWh/m²a tarve 25 A (läm.) B (läm.) 20 C (läm.) D (läm.) 15 E (läm.) A (jäähd.) 10 B (jäähd.) C (jäähd.) 5 D (jäähd.) E (jäähd.) 0 1990 2010 2030 2050 2070 2090 2110 2130

- 9. Valitut lämmitys- ja jäähdytysratkaisut Rakennus Lämmitys Jäähdytys I II III IV 2 4 4 Pientalo Sähkö Passiivinen + kon. jäähdytys Kon. jäähdytys - - MLP1 Passiivinen + MLP vapaajäähdytys MLP vapaajäähdytys 5 2 5 - - Kerrostalo Kaukolämpö Passiivinen2 + kon. jäähdytys 4 Kon. jäähdytys 4 - - MLP1 Passiivinen2 + MLP vapaajäähdytys 5 MLP vapaajäähdytys 5 - - Toimisto Kaukolämpö Passiivinen3 + kon. jäähdytys 6 Kon. jäähdytys 6 Passiivinen3 + kaukojäähdytys Kaukojäähdytys 1 3 5 5 MLP Passiivinen + MLP vapaajäähdytys MLP vapaajäähdytys - - 1 MLP = maalämpöpumppu (SPF-luku = 3.1) 2 Pientalon ja kerrostalon passiiviset jäähdytysratkaisut: Ikkunatuuletus + sälekaihtimet ulkoimmassa ikkunavälissä 3 Toimiston passiiviset jäähdytysratkaisut: Ulkopuoliset sälekaihtimet 4 Pientalon ja kerrostalon koneellinen jäähdytys split-laitteilla (vuotuinen kylmäkerroin 3) 5 Vapaajähdytys toteutettu MLP:n lämmönkeruupiirin avulla (vuotuinen kylmäkerroin = 30) 6 Toimistossa ilmalauhdutteinen kompressorikylmälaite + jäähdytyspalkit (vuotuinen kylmäkerroin 2.5)

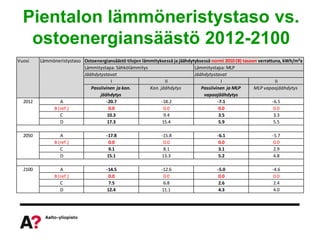

- 10. Pientalon lämmöneristystaso vs. ostoenergiansäästö 2012-2100 Vuosi Lämmöneristystaso Ostoenergiansäästö tilojen lämmityksessä ja jäähdytyksessä normi 2010 (B) tasoon verrattuna, kWh/m²a Lämmitystapa: Sähkölämmitys Lämmitystapa: MLP Jäähdytystavat Jäähdytystavat I II I II Passiivinen ja kon. Kon. jäähdytys Passiivinen ja MLP MLP vapaajäähdytys jäähdytys vapaajäähdytys 2012 A -20.7 -18.2 -7.1 -6.5 B (ref.) 0.0 0.0 0.0 0.0 C 10.3 9.4 3.5 3.3 D 17.3 15.4 5.9 5.5 2050 A -17.8 -15.8 -6.1 -5.7 B (ref.) 0.0 0.0 0.0 0.0 C 9.1 8.1 3.1 2.9 D 15.1 13.3 5.2 4.8 2100 A -14.5 -12.6 -5.0 -4.6 B (ref.) 0.0 0.0 0.0 0.0 C 7.5 6.8 2.6 2.4 D 12.4 11.1 4.3 4.0

- 11. Kerrostalon lämmöneristystaso vs. ostoenergiansäästö 2012-2100 Vuosi Lämmöneristystaso Ostoenergiansäästö tilojen lämmityksessä ja jäähdytyksessä normi 2010 (B) tasoon verrattuna, kWh/m²a Lämmitystapa: Kaukolämpö Lämmitystapa: MLP Jäähdytystavat Jäähdytystavat I II I II Passiivinen ja kon. Kon. jäähdytys Passiivinen ja MLP MLP vapaajäähdytys Jäähdytys vapaajäähdytys 2012 A -3.7 -3.2 -1.3 -1.2 B (ref.) 0.0 0.0 0.0 0.0 C 1.2 1.1 0.4 0.4 D 1.9 1.6 0.7 0.6 E 3.0 2.4 1.0 1.0 2050 A -2.9 -2.4 -1.0 -1.0 B (ref.) 0.0 0.0 0.0 0.0 C 0.9 0.8 0.3 0.3 D 1.4 1.2 0.5 0.5 E 2.2 1.7 0.8 0.7 2100 A -1.9 -1.5 -0.7 -0.6 B (ref.) 0.0 0.0 0.0 0.0 C 0.6 0.4 0.2 0.2 D 0.9 0.6 0.3 0.3 E 1.2 0.8 0.5 0.4

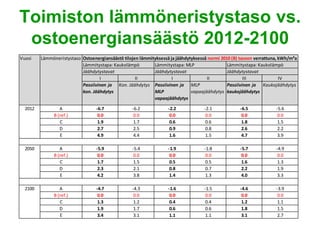

- 12. Toimiston lämmöneristystaso vs. ostoenergiansäästö 2012-2100 Vuosi Lämmöneristystaso Ostoenergiansäästö tilojen lämmityksessä ja jäähdytyksessä normi 2010 (B) tasoon verrattuna, kWh/m²a Lämmitystapa: Kaukolämpö Lämmitystapa: MLP Lämmitystapa: Kaukolämpö Jäähdytystavat Jäähdytystavat Jäähdytystavat I II I II III IV Passiivinen ja Kon. Jäähdytys Passiivinen ja MLP Passiivinen ja Kaukojäähdytys kon. Jäähdytys MLP vapaajäähdytys kaukojäähdytys vapaajäähdytys 2012 A -6.7 -6.2 -2.2 -2.1 -6.5 -5.6 B (ref.) 0.0 0.0 0.0 0.0 0.0 0.0 C 1.9 1.7 0.6 0.6 1.8 1.5 D 2.7 2.5 0.9 0.8 2.6 2.2 E 4.9 4.4 1.6 1.5 4.7 3.9 2050 A -5.9 -5.4 -1.9 -1.8 -5.7 -4.9 B (ref.) 0.0 0.0 0.0 0.0 0.0 0.0 C 1.7 1.5 0.5 0.5 1.6 1.3 D 2.3 2.1 0.8 0.7 2.2 1.9 E 4.2 3.8 1.4 1.3 4.0 3.3 2100 A -4.7 -4.3 -1.6 -1.5 -4.6 -3.9 B (ref.) 0.0 0.0 0.0 0.0 0.0 0.0 C 1.3 1.2 0.4 0.4 1.2 1.1 D 1.9 1.7 0.6 0.6 1.8 1.5 E 3.4 3.1 1.1 1.1 3.1 2.7

- 13. Kuinka paljon taloteknisillä järjestelmillä voidaan parantaa rakennusten energiatehokkuutta?

- 14. Laskentaesimerkki • Lähtötietoja: – Vuosi 2012 – Rakennusten sijainti: Vantaa – Vaipan lämmöneristystaso kaikilta osin normin C3 (2010) mukainen – Vaipan ilmanpitävyys n50 = 1.0 1/h – Lämmitystapa: Sähkö, MLP tai kaukolämpö – Jäähdytystapa: Koneellinen jäähdytys tai vapaajäähdytys MLP:n maapiirillä

- 15. Lämmitys- ja jäähdytysjärjestelmät vs. ostoenergiansäästö 2012 • Pientalo: Järjestelmä Ostoenergiankulutus, kWh/m²a Lämmitys Jäähdytys yht Tilat ja IV LKV Tilat Vesik. sähkölämmitys + kon. jäähdytys¹ 64.5 38.0 5.8 108.4 MLP-lämmitys +vapaajäähdytys² 21.9 16.5 0.6 39.0 Ostoenergiansäästö (I - II) 42.6 21.5 5.3 69.4 • Kerrostalo: Järjestelmä Ostoenergiankulutus, kWh/m²a Lämmitys Jäähdytys yht Tilat ja IV LKV Tilat Kaukolämpö + kon. jäähdytys¹ 19.7 36.1 11.2 66.9 MLP-lämmitys +vapaajäähdytys² 6.5 15.7 1.1 23.3 Ostoenergiansäästö (I - II) 13.2 20.4 10.0 43.6 • Toimisto: Järjestelmä Ostoenergiankulutus, kWh/m²a Lämmitys Jäähdytys yht Tilat ja IV LKV Tilat ja IV Kaukolämpö + kon. jäähdytys¹ 49.2 6.8 9.9 65.9 MLP-lämmitys + vapaajäähdytys² 15.9 3.0 0.8 19.7 Ostoenergiansäästö (I - II) 33.3 3.9 9.0 46.2 ¹ Ilmalauhdutteinen kompressorikylmälaite, jonka vuotuinen kylmäkerroin on 3.0 (pientalo ja kerrostalo) tai 2.5 (toimisto) ² Maalämpöpumpun SPF-luku (tilojen lämmitys = 3.1, LKV = 2.3), vapaajäähd. vuotuinen kylmäkerroin = 30

- 16. Yhteenveto • Rakennusten tilojen ja ilmanvaihdon lämmitystarve tulee vähenemään ilmastonmuutoksen vaikutuksesta vuoteen 2050 mennessä 15-25% ja vuoteen 2100 mennessä 30-50% rakennustyypistä riippuen. • Rakennusten tilojen ja ilmanvaihdon jäähdytystarve tulee kasvamaan vastaavasti vuoteen 2050 mennessä 10-30% ja vuoteen 2100 mennessä 20-75% rakennustyypistä riippuen. • Tutkittujen rakennuksen vaipan osien lämmöneristystason lisääminen 2008 normitasoa paremmaksi kasvattaa rakennuksen jäähdytystarvetta. • Rakennuksen jäähdytystarve tulee ensisijaisesti kattaa passiivisilla jäähdytysratkaisuilla ja vasta tarvittaessa koneellisilla jäähdytysratkaisuilla.

- 17. Yhteenveto • Tutkittujen vaipan osien lämmöneristystason kasvattaminen nykyistä normitasoa C3 (2010) paremmaksi: – Ei ole kerrostaloissa ja toimistoissa kannattavaa, vaikka tilojen jäähdytystarve katetaan ensisijaisesti passiivisilla ratkaisuilla, koska lisäeristämisen tuoma ostoenergiansäästö on marginaalinen. – Pientalossa lisäeristämisellä saavutetaan enemmän ostoenergiansäästöä kuin kerrostaloissa ja toimistoissa. Säästö on nykyilmastossa suurimmillaan 6-17kWh/m²a käytetyistä lämmitys- ja jäähdytystavoista riippuen. • Kerrostaloissa ja toimistorakennuksissa jo vuoden 2008 normitason lämmöneristystaso tutkittujen vaipan osien osalta olisi ollut energiansäästön kannalta varsin riittävä. • Lämmöneristystason lisäämisellä saavutettava energian- säästö tulee ilmastonmuutoksen myötä edelleen pienenemään. • Lämmitys- ja jäähdytysjärjestelmien valinnalla voidaan vaikuttaa rakennuksen energiatahokkuuteen huomattavasti enemmän kuin tutkituilla vaipan lämmöneristystasoilla.