Bail Out Final Pro Copy

- 1. Whoâs Going to Bail Me Out? Navigating Todayâs Market Conditions

- 2. Headlines ContinueâĶ IndyMac Bank Fails Freddie Mac & Fannie Mae in Trouble Lehman Brothers Goes Bankrupt Merrill Lynch Looking for Help Fed Loans AIG $85 Billion Whatâs Next?

- 3. $700 Billion Bail Out

- 5. How did we get into this mess? They believed housing prices would continue to rise and they would be able to re-finance at a more favorable rate in the future Banks realized they could charge much higher origination fees for sub-prime loans and so encouraged people without adequate education to apply for a sub-prime loan Everyone got a little greedy.

- 6. Let's break it up to explainâĶ A Security An instrument of financial value; stocks and bonds are securities. A Mortgage Backed Security Is where a bunch of mortgage loans are grouped together to create a large pool of debt. this debt is then sold to investors the same way a bond is; you buy it at a discount and rely on the mortgage payments for the payout. Because some of these mortgages were structured so that people ended up paying MORE than they were borrowing, it sounded like a great deal.

- 7. Gems arenât always what they seem to be! Corporate and institutional investors and investment banks like Bear Stearns bought mortgage-backed securities in droves during the height of the real estate boom, often touting them as âundiscovered gemsâ. - Schaeffersâs Investment Research

- 8. What does this mean to me? BANKS BAILOUT SUBPRIME RISK

- 9. How many more banks are at risk of failure? The FDIC has identified over 100 banks as "problem institutions" that where at risk of failure for the first quarter of 2008. That number will go up but historically, only about 13 percent of banks on the list typically fail, says the FDIC. The FDIC doesnât name the banks specifically for fear customers will rapidly pull their money out.

- 10. A look at Insurance Who is AIG? American International Group is the worldâs largest insurerâĶat the moment Fortune 500 company Itâs stock is tracked within the S&P 500

- 11. âĶ What Happened? As a company gets bigger, it gains tougher competition and lower margins. Making it harder to put up consistent profits. So in order to make more profits, they take on more risk and more ventures AIG was very heavily involved in the fast-growing market for a kind of derivative called a credit default swap .

- 12. /Credit Default Swap? Much like an insurance contract. AIG Financial Products (AIG FP) In a market where companies donât default, it was much like selling car insurance in a world that didnât have car accidents. The opposite when there is a market that is crashingâĶ.

- 13. and Rating Agencies Why are Ratings so important? When an insurance company has great ratings, they donât have to have as much collateral. Works much like your credit score.

- 14. and the Government Why the Government wonât let AIG fail AIG was deemed too huge (its assets toped $1 trillion), too global, and too interconnected to fail. Could, and probably would, put the credit market on its tail, making it hard for the common consumer to get credit The particular risks that brought the company to the brink of bankruptcy seem to lie not with its core insurance businesses but with AIG FP. They believe that AIGâs insurance businesses make so much money that hey could conceivably pay off the cost of the bailout within a few years!

- 15. Bailout? What is the bailout? The Fed authorized the Fed. Reserve Bank of New York to Lend AIG up to $85 billion. In return, the federal government will receive a 79.9% stake in the company. The line of credit, which is available for two years, is designed to help AIG meet its obligations. Fed says that taxpayers will be protected because the loan is backed by the assets of AIG and its subsidiaries.

- 16. Whatâs this Bailout all about? $700 BILLION!

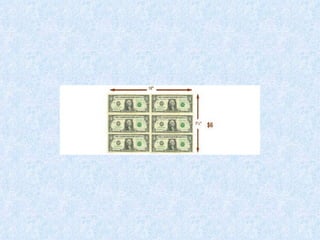

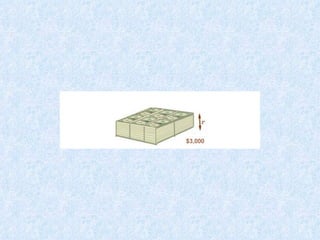

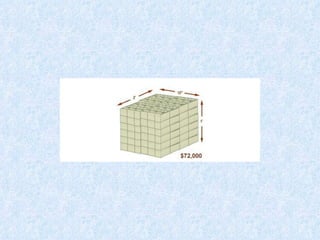

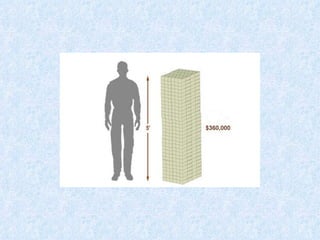

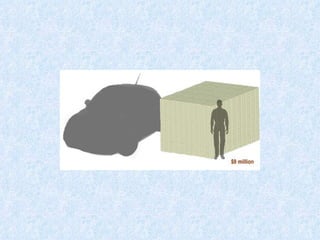

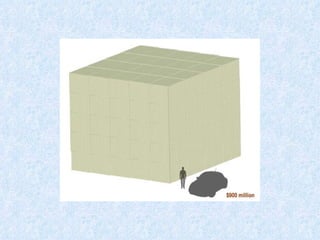

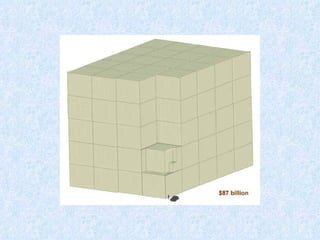

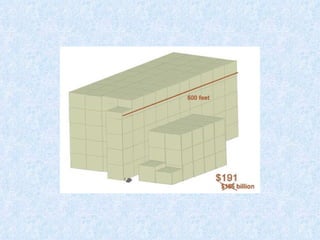

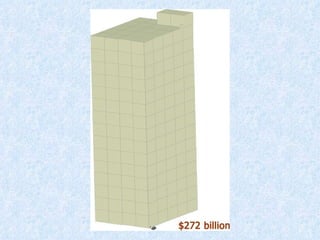

- 17. What $700,000,000,000.00 (seven hundred billion) looks like: It's hard to imagine what the USA bailout would look like in hard cash.

- 18. Ėý

- 19. Ėý

- 20. Ėý

- 21. Ėý

- 22. Ėý

- 23. Ėý

- 24. Ėý

- 25. Ėý

- 26. Ėý

- 27. Ėý

- 28. Ėý

- 29. Ėý

- 30. Ėý

- 31. Now double that. And add $170 Billion. That's the price tag of the bailout...

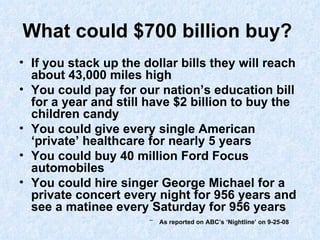

- 32. What could $700 billion buy? If you stack up the dollar bills they will reach about 43,000 miles high You could pay for our nationâs education bill for a year and still have $2 billion to buy the children candy You could give every single American âprivateâ healthcare for nearly 5 years You could buy 40 million Ford Focus automobiles You could hire singer George Michael for a private concert every night for 956 years and see a matinee every Saturday for 956 years As reported on ABCâs âNightlineâ on 9-25-08

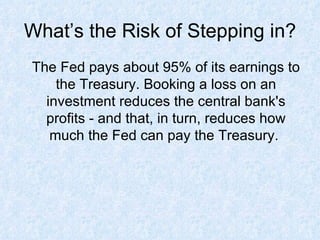

- 33. Whatâs the Risk of Stepping in? The Fed pays about 95% of its earnings to the Treasury. Booking a loss on an investment reduces the central bank's profits - and that, in turn, reduces how much the Fed can pay the Treasury.

- 34. Whatâs the Risk of Not Stepping In? The government stepped in to help Fannie, Freddie and AIG on the premise that their demise would cripple the economy. One concern was that if they fell, the noose on lending would tighten further. The last thing we want is to have the banks cut back on lending But the knock-on effects could be more widespread. If Fannie and Freddie went under, for instance, the housing industry could seize up, causing the loss of millions of jobs.

- 35. Even if the bailout gets approvedâĶ Will it get worse before it gets better? Who remembers the RTC or Resolution Trust Corporation in 1989?

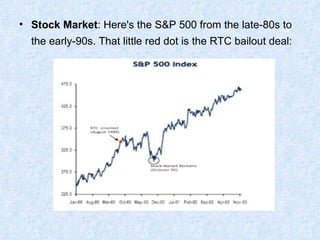

- 36. Stock Market : Here's the S&P 500 from the late-80s to the early-90s. That little red dot is the RTC bailout deal:

- 37. Economy: Here's GDP. Again, that dot is the bailout.

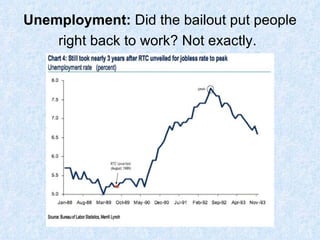

- 38. Unemployment: Did the bailout put people right back to work? Not exactly.

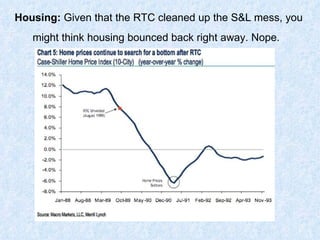

- 39. Housing: Given that the RTC cleaned up the S&L mess, you might think housing bounced back right away. Nope.

- 40. So Who Will Bail You Out? Ultimately youâĶbut youâll need an advisor on your team

- 41. Donât Panic! Much of whatâs happening is out of your control

- 42. Focus on what you can control! Pay attention to your risk level Find out what exposure your insurance carriers have Audit your bank accounts for proper FDIC Coverage Be aware of bad advice or bad advisers

- 43. Key areas to watch Income-producing investments How safe are they? What is Withdrawal Risk? Getting out at the wrong time What are your time horizons? How much risk should I take? Is it too late to protect my investments? Timing of withdrawals Structure a plan Stick to the plan