About SSI, Inc.

Download as PPTX, PDF0 likes789 views

Enjoy! We appreciate your business. Cordially, James Crow, CGI. Division Manager Investigative Services PDC002371 1255 Lakes Parkway, Ste. 380 Lawrenceville, GA 30043 Ph (770) 339-2035 Fax (770) 339-2025 Cell (770) 313-8280 www.ssiglobalinc.com

1 of 35

Download to read offline

Recommended

Website

Websitemtgna

Ã˝

This document summarizes the home buying process sponsored by a company. It discusses prequalification, qualification, credit checks, loan programs, processing, underwriting, closing and funding. Attendees are encouraged to ask questions of the mortgage professionals in attendance to discuss their home buying goals and get prequalified for a loan in a risk-free and confidential manner.Trust Mortgage Lending Presentation

Trust Mortgage Lending PresentationScott Pfaff

Ã˝

The document outlines the mission, vision, values and programs of Trust Lending Mortgage, which aims to be the best place for employees to work and customers to work with, while helping customers fulfill their dreams of homeownership through a variety of loan programs. It also describes Trust Lending's partnership with AllRegs to provide online training courses to employees through a Branded University program in order to stay up to date on regulations and compliance in the changing mortgage industry.Guardian Lender Care

Guardian Lender CareGuardian Lender care

Ã˝

This document describes the SBA loan packaging and servicing services provided by GLC. GLC performs pre-screening of SBA loan applications to determine eligibility and structuring. They collect documentation and conduct a comprehensive credit review and analysis for compliance. GLC also organizes loan packages, assists with closing, handles secondary market sales, and provides staff training on SBA regulations and requirements. Their goal is to help banks and borrowers efficiently obtain SBA loans and guarantees.RachelResume1[22]![RachelResume1[22]](https://cdn.slidesharecdn.com/ss_thumbnails/c2c7ff2d-8540-42b4-b906-0e9fc9cc45bf-150903165202-lva1-app6891-thumbnail.jpg?width=560&fit=bounds)

![RachelResume1[22]](https://cdn.slidesharecdn.com/ss_thumbnails/c2c7ff2d-8540-42b4-b906-0e9fc9cc45bf-150903165202-lva1-app6891-thumbnail.jpg?width=560&fit=bounds)

![RachelResume1[22]](https://cdn.slidesharecdn.com/ss_thumbnails/c2c7ff2d-8540-42b4-b906-0e9fc9cc45bf-150903165202-lva1-app6891-thumbnail.jpg?width=560&fit=bounds)

![RachelResume1[22]](https://cdn.slidesharecdn.com/ss_thumbnails/c2c7ff2d-8540-42b4-b906-0e9fc9cc45bf-150903165202-lva1-app6891-thumbnail.jpg?width=560&fit=bounds)

RachelResume1[22]Rachel Reynoso

Ã˝

Rachel Reynoso has over 15 years of experience in loan processing, underwriting, and quality control. She has worked for several large financial institutions including USAA, CitiMortgage, Bank of America, and EMC Mortgage. She has a proven track record of exceeding goals and metrics. Reynoso received her Paralegal Certificate in 2015 and B.S. in Marketing from the University of North Texas in 2007.Equity Solutions - Our promise

Equity Solutions - Our promiseBill Cannova

Ã˝

ESUSA is an appraisal management company that aims to provide unparalleled customer service and industry expertise to banking and mortgage industries. They are committed to integrity, quality, accountability, and responding to client needs in a timely manner. Their knowledgeable team and appraisal partners work to identify appropriate solutions and provide access to industry-leading technology platforms. They believe in quality relationships through effective communication, quality service through understanding client needs, and quality products by selecting the best appraiser for each assignment and ensuring regulatory compliance.Thea's Master Resume

Thea's Master ResumeThea M Lazenby

Ã˝

Thea Lazenby has over 15 years of experience in administrative and loan servicing roles. She currently works as the Office Manager and Loan Servicer at Georgia Certified Development Corporation, where she assists the CEO, manages files, and processes loan documents. Previously, she was an SBA Loan Operations Specialist at Cornerstone Bank and a Bankruptcy Specialist at Lendmark Financial Services, where she handled loan servicing tasks like payments, disbursements, and addressing customer issues. She also has experience as a Loan Processor and Mortgage Loan Secretary. Thea holds a certificate from Ncino University and diploma from Kirkman Technical High School.Mela Capital Group, Llc ∫›∫›fl£ Show

Mela Capital Group, Llc ∫›∫›fl£ ShowCindi Dixon

Ã˝

Cindi Dixon has audited of over $5 Billion dollars of mortgage loan products, created and enforced underwriting policy for over two decades, and continues to provide expert witness testimony and consumer advocacy and mortgage fraud training nationwide. Mela Capital Group provides forensic financial audits and reporting for Attorneys and law enforcement throughout the U.S.

www.MelaCapitalGroup.com2015 ResumeA

2015 ResumeACarla D Krider

Ã˝

Carla D. Krider has over 30 years of experience in banking and financial consulting. She has held positions such as Loan Operations Manager and Vice President, where she oversaw loan departments and ensured compliance with regulations. Currently, as the owner of CDK Consulting, she provides regulatory compliance audits and risk assessments, internal control reviews, and training to financial institutions. Her qualifications include various banking certifications and extensive experience in loan and deposit compliance, auditing, and operations management.Flinks' Mortgage Package #fintech

Flinks' Mortgage Package #fintechCendrineIppersiel

Ã˝

You can use financial data to power your digital mortgage experience — and dramatically reduce delays and friction for hopeful homebuyers.

Check the link in the comments to find how you can enhance your client experience with our Mortgage Package.

#openbanking

American Street Capital CRE Overview

American Street Capital CRE OverviewAlexander Rek

Ã˝

The document discusses the fundamentals of commercial lending. It provides an overview of various commercial lending sources such as commercial banks, government agencies, life companies, and private lenders. It then compares these sources across key decision variables such as leverage, interest rates, terms, transaction times, transaction types, and recourse. The document also outlines ideal borrower and property type characteristics and concludes with an overview of the commercial lending process.Daisy Watson Paralegal Resume

Daisy Watson Paralegal ResumeDaisy Watson

Ã˝

Daisy Watson seeks a paralegal internship specializing in areas such as real estate law, family law, civil litigation, criminal law, or wills and trusts. She has skills in legal research databases and software. She is currently studying to become a paralegal at Atlanta Technical College and has work experience in real estate sales, loan servicing, and legal document review. Her resume demonstrates strong communication skills, legal research abilities, and experience assisting clients in areas such as loan modifications, short sales, and bankruptcy.Eugenia resume (1)

Eugenia resume (1)Eugenia Little

Ã˝

Eugenia Little has 10 years of experience conducting research and risk analysis. She currently works as an Operational Risk Analyst for Citibank performing know your customer and anti-money laundering research. Previously she has held roles at Bank of America, US Bank, and Jackson Hewitt conducting loan reviews, customer service, and tax preparation. She has strong research, problem solving, and communication skills.Grid Origination Services Presentation update 7 17 14

Grid Origination Services Presentation update 7 17 14Paul Hindman

Ã˝

Grid Origination Services delivers effective mortgage processing solutions through a unique delivery model combining domain expertise, market knowledge, and customer focus. They provide streamlined operations, reduced costs and turnaround times, improved productivity and quality, and enhanced responsiveness to meet service level commitments. Testimonials from banking executives praise Grid's experience, customer service, and ability to improve efficiencies and competitiveness while maintaining quality standards.Resume Dec2014

Resume Dec2014Melissa Grimsley

Ã˝

This document provides a summary and work history for Melissa Grimsley, a mortgage professional with over 17 years of experience in various roles in the lending and title industries. She has expertise in processing different types of loans, including FHA, VA, USDA, construction, and HELOC loans. Her experience includes senior processor roles at Guardian Mortgage, Cobalt Mortgage, and a staffing service, where she performed tasks like reviewing loans, ordering appraisals, and ensuring compliance. She also held compliance and closing specialist roles at Texas Lending.com and ViewPoint Bankers Mortgage. Earlier in her career, she worked as a senior loan processor and escrow assistant for FieldStone Mortgage and Centex Group.Port mgr 2015new

Port mgr 2015newAntoinette M. Allia

Ã˝

This document provides a summary of skills and work experience for a candidate named A Constace. Allia. It outlines her proficiency with software like Microsoft Office and banking programs, as well as her experience as a portfolio manager, credit analyst, and group leader for closing departments at various banks. She has over 15 years of experience in banking and currently works as a senior credit analyst and realtor associate.Law Firm Payments Masterclass with LawPay

Law Firm Payments Masterclass with LawPayClio - Cloud-Based Legal Technology

Ã˝

You already know how important it is to your clients that you accept online payments. But are you getting the most from your payments provider?

Join two industry experts to go beyond the basics and learn how online payments can accelerate your law firm's growth.

In this webinar, you’ll learn:

Advanced Clio Payments features that provide an end-to-end invoicing and payments solution, without having to switch tools, powered by LawPay

Proven, data-driven ways to increase firm revenue

LawPay's advanced protection services for law firms

How online payments changed one law firm's fortunes completely

https://landing.clio.com/law-firm-payments-masterclass.htmlBaker Hill Origination Suite Overview

Baker Hill Origination Suite OverviewBaker Hill

Ã˝

A look into Baker Hill's Origination suite, a customizable line of products that streamlines the lending process.Choose credit report repair

Choose credit report repairfowlerandfowler

Ã˝

Fowler and Fowler has been a leader in the credit repair industry for over a decade. Here you can find highly experienced Credit Repair Specialist who can solve your bad credit issue and assist you as per your requirements. Accounts Payables Specialist

Accounts Payables SpecialistAngela Denese Stephens

Ã˝

• Accounts Payables invoice processor utilizing Quickbooks Accounting Software.

• Member Services: Answers inbound calls from members, takes control of each call and by identifying the nature of the call, performs research, and places outbound calls to vendors to obtain necessary information to resolves members issue.

• Master’s proficiency and demonstrates a capacity for intense multi-tasking while answering member/vendor calls, placing outbound calls to resolve the nature of the calls, answering emails in Microsoft Outlook, and processes Purchase orders in Quickbooks, when needed.

• Resolves order shipping errors by clarifying the member’s complaint and determining course of action. Reports error to vendor and requests RMA for incorrect item to be returned and correct item to be shipped. Explains the best solution to solve member’s problem. Expedites correction or adjustment and follows up to ensure resolution.

• Processes up to 100 invoices on a daily basis for Accounts Payables. Maintains accuracy.

• Maintains invoice filing and prepares for shipment to warehouse for storage.

Preliminary Information AA

Preliminary Information AAmeir gaon

Ã˝

This document contains a preliminary information and KYC (Know Your Customer) form for a funding request. It requests basic contact and background information about the applicant, including the name of the main shareholder and borrower, management experience, length of time seeking capital for the current project, type of business, address, credit score, funding amount requested, repayment period, collateral available, purpose of funding, asset description if applicable, and historical and projected financial performance. The applicant must sign and attach financial statements and an asset/liability statement for the request to be considered.Marny Joy Abbott resume 2015.5

Marny Joy Abbott resume 2015.5Marny Abbott

Ã˝

Marny Abbott is an experienced transactional and litigation attorney with a focus on banking, financial services, and real estate. She has over 15 years of experience managing complex legal challenges and guiding clients through changing regulations. Her experience includes roles as a director managing over 75 attorneys, an independent litigation consultant reviewing large document productions, and managing foreclosure and bankruptcy departments. She is licensed to practice law in Illinois and Arizona.American Banker Article 5-10-11

American Banker Article 5-10-11Noel Watts

Ã˝

M&I Bank upgraded its mortgage origination technology over two years in order to streamline the loan process and allow loan officers to focus on sales. The upgrades included implementing a point of sale system, consumer web portal, paperless imaging, and outsourcing some functions like title work. This reduced the time to close loans from 45-60 days to an average of 28 days. The technology changes eliminated over 3,000 hours of non-sales work for loan officers each year. The bank has seen increased loan volume and prospects as a result of the upgrades.Resume Dec2014

Resume Dec2014Melissa Grimsley

Ã˝

Melissa Grimsley has over 20 years of experience in the mortgage and title industries. She has held various roles including senior processor, team lead, compliance specialist, and escrow assistant. Her expertise includes processing different types of loans and reviewing title work and surveys to ensure accurate closing documents and clear title.Resume- 2016

Resume- 2016Angy Gray

Ã˝

An experienced customer service professional seeking a position where they can utilize their expertise in relationship building, problem solving, and client satisfaction. They have over 8 years of experience at Bank of America handling wires, account management, and client services for both personal and commercial accounts. They are skilled in multiple bank systems, treasury products, team leadership, and resolving client issues.7

7rovijunepabular

Ã˝

Easy quick cash loans can be obtained instantly by filling out a simple online application form. These loans do not require faxing documents or a credit check. The loan amount is deposited directly into the borrower's bank account within 24 hours. An advantage is that these short term loans do not require collateral. They are suitable for people with bad credit histories or who need emergency cash quickly.ACCION USA Partner Training

ACCION USA Partner TrainingACCION East

Ã˝

ACCION USA provides microloans and business counseling to low- and moderate-income entrepreneurs, especially minorities and women. It is the largest microlender network in the US, having served over 20,000 clients and lent over $210 million. Loans range from $7,000 on average up to $50,000 for established businesses. Requirements include a minimum credit score, no bankruptcies in the last year, complete documentation, and a co-signer or second income source for startups. The application process involves applying online or with paper forms, then providing documents for underwriting before potential approval.my new resume uls

my new resume ulsnatalie lee

Ã˝

Natalie N Lee has over 15 years of experience in customer service, quality control review, and loan processing. She is currently an Appraisal Quality Control Analyst at United Lender Services where she completes written reviews and analysis on appraisal reporting discrepancies. Previously she was a Mortgage Loan Processor at PNC Mortgage and a QC Reviewer and Client Service Rep at Equifax Settlement Services where she reviewed appraisal documents for accuracy and compliance.Queshaylon Walker resume 2015

Queshaylon Walker resume 2015Queshaylon Walker

Ã˝

This document is a resume for Queshaylon Walker summarizing their experience working in financial services and mortgage processing over the past 10+ years. They have held roles in default processing, quality control, document support, and as a notary. Key experiences include processing national mortgage settlements, conducting quality control audits, drafting MERS documents, and implementing new processes. Technical skills include proficiency in various software programs used in mortgage processing like FileNet, CitiLink, and Outlook.I F F004 Chris Sommers91807

I F F004 Chris Sommers91807Dreamforce07

Ã˝

Dan Lawson of Lawson & Associates and Basil Fedynyshyn of Wells Fargo discussed how Salesforce helped their organizations improve productivity and business results. Both saw increases in sales volume and reductions in costs. Key benefits included centralized client information, remote access, automated workflows, and real-time dashboards for tracking performance. Salesforce provided an integrated platform to manage leads, opportunities, and customer relationships from first contact through the entire lending lifecycle.Cfs Roadshow Linked In (2)

Cfs Roadshow Linked In (2)Tim

Ã˝

An objective and comprehensive approach to evaluating the variety of strategic options available to lenders with a decision making construct for action.More Related Content

What's hot (20)

Flinks' Mortgage Package #fintech

Flinks' Mortgage Package #fintechCendrineIppersiel

Ã˝

You can use financial data to power your digital mortgage experience — and dramatically reduce delays and friction for hopeful homebuyers.

Check the link in the comments to find how you can enhance your client experience with our Mortgage Package.

#openbanking

American Street Capital CRE Overview

American Street Capital CRE OverviewAlexander Rek

Ã˝

The document discusses the fundamentals of commercial lending. It provides an overview of various commercial lending sources such as commercial banks, government agencies, life companies, and private lenders. It then compares these sources across key decision variables such as leverage, interest rates, terms, transaction times, transaction types, and recourse. The document also outlines ideal borrower and property type characteristics and concludes with an overview of the commercial lending process.Daisy Watson Paralegal Resume

Daisy Watson Paralegal ResumeDaisy Watson

Ã˝

Daisy Watson seeks a paralegal internship specializing in areas such as real estate law, family law, civil litigation, criminal law, or wills and trusts. She has skills in legal research databases and software. She is currently studying to become a paralegal at Atlanta Technical College and has work experience in real estate sales, loan servicing, and legal document review. Her resume demonstrates strong communication skills, legal research abilities, and experience assisting clients in areas such as loan modifications, short sales, and bankruptcy.Eugenia resume (1)

Eugenia resume (1)Eugenia Little

Ã˝

Eugenia Little has 10 years of experience conducting research and risk analysis. She currently works as an Operational Risk Analyst for Citibank performing know your customer and anti-money laundering research. Previously she has held roles at Bank of America, US Bank, and Jackson Hewitt conducting loan reviews, customer service, and tax preparation. She has strong research, problem solving, and communication skills.Grid Origination Services Presentation update 7 17 14

Grid Origination Services Presentation update 7 17 14Paul Hindman

Ã˝

Grid Origination Services delivers effective mortgage processing solutions through a unique delivery model combining domain expertise, market knowledge, and customer focus. They provide streamlined operations, reduced costs and turnaround times, improved productivity and quality, and enhanced responsiveness to meet service level commitments. Testimonials from banking executives praise Grid's experience, customer service, and ability to improve efficiencies and competitiveness while maintaining quality standards.Resume Dec2014

Resume Dec2014Melissa Grimsley

Ã˝

This document provides a summary and work history for Melissa Grimsley, a mortgage professional with over 17 years of experience in various roles in the lending and title industries. She has expertise in processing different types of loans, including FHA, VA, USDA, construction, and HELOC loans. Her experience includes senior processor roles at Guardian Mortgage, Cobalt Mortgage, and a staffing service, where she performed tasks like reviewing loans, ordering appraisals, and ensuring compliance. She also held compliance and closing specialist roles at Texas Lending.com and ViewPoint Bankers Mortgage. Earlier in her career, she worked as a senior loan processor and escrow assistant for FieldStone Mortgage and Centex Group.Port mgr 2015new

Port mgr 2015newAntoinette M. Allia

Ã˝

This document provides a summary of skills and work experience for a candidate named A Constace. Allia. It outlines her proficiency with software like Microsoft Office and banking programs, as well as her experience as a portfolio manager, credit analyst, and group leader for closing departments at various banks. She has over 15 years of experience in banking and currently works as a senior credit analyst and realtor associate.Law Firm Payments Masterclass with LawPay

Law Firm Payments Masterclass with LawPayClio - Cloud-Based Legal Technology

Ã˝

You already know how important it is to your clients that you accept online payments. But are you getting the most from your payments provider?

Join two industry experts to go beyond the basics and learn how online payments can accelerate your law firm's growth.

In this webinar, you’ll learn:

Advanced Clio Payments features that provide an end-to-end invoicing and payments solution, without having to switch tools, powered by LawPay

Proven, data-driven ways to increase firm revenue

LawPay's advanced protection services for law firms

How online payments changed one law firm's fortunes completely

https://landing.clio.com/law-firm-payments-masterclass.htmlBaker Hill Origination Suite Overview

Baker Hill Origination Suite OverviewBaker Hill

Ã˝

A look into Baker Hill's Origination suite, a customizable line of products that streamlines the lending process.Choose credit report repair

Choose credit report repairfowlerandfowler

Ã˝

Fowler and Fowler has been a leader in the credit repair industry for over a decade. Here you can find highly experienced Credit Repair Specialist who can solve your bad credit issue and assist you as per your requirements. Accounts Payables Specialist

Accounts Payables SpecialistAngela Denese Stephens

Ã˝

• Accounts Payables invoice processor utilizing Quickbooks Accounting Software.

• Member Services: Answers inbound calls from members, takes control of each call and by identifying the nature of the call, performs research, and places outbound calls to vendors to obtain necessary information to resolves members issue.

• Master’s proficiency and demonstrates a capacity for intense multi-tasking while answering member/vendor calls, placing outbound calls to resolve the nature of the calls, answering emails in Microsoft Outlook, and processes Purchase orders in Quickbooks, when needed.

• Resolves order shipping errors by clarifying the member’s complaint and determining course of action. Reports error to vendor and requests RMA for incorrect item to be returned and correct item to be shipped. Explains the best solution to solve member’s problem. Expedites correction or adjustment and follows up to ensure resolution.

• Processes up to 100 invoices on a daily basis for Accounts Payables. Maintains accuracy.

• Maintains invoice filing and prepares for shipment to warehouse for storage.

Preliminary Information AA

Preliminary Information AAmeir gaon

Ã˝

This document contains a preliminary information and KYC (Know Your Customer) form for a funding request. It requests basic contact and background information about the applicant, including the name of the main shareholder and borrower, management experience, length of time seeking capital for the current project, type of business, address, credit score, funding amount requested, repayment period, collateral available, purpose of funding, asset description if applicable, and historical and projected financial performance. The applicant must sign and attach financial statements and an asset/liability statement for the request to be considered.Marny Joy Abbott resume 2015.5

Marny Joy Abbott resume 2015.5Marny Abbott

Ã˝

Marny Abbott is an experienced transactional and litigation attorney with a focus on banking, financial services, and real estate. She has over 15 years of experience managing complex legal challenges and guiding clients through changing regulations. Her experience includes roles as a director managing over 75 attorneys, an independent litigation consultant reviewing large document productions, and managing foreclosure and bankruptcy departments. She is licensed to practice law in Illinois and Arizona.American Banker Article 5-10-11

American Banker Article 5-10-11Noel Watts

Ã˝

M&I Bank upgraded its mortgage origination technology over two years in order to streamline the loan process and allow loan officers to focus on sales. The upgrades included implementing a point of sale system, consumer web portal, paperless imaging, and outsourcing some functions like title work. This reduced the time to close loans from 45-60 days to an average of 28 days. The technology changes eliminated over 3,000 hours of non-sales work for loan officers each year. The bank has seen increased loan volume and prospects as a result of the upgrades.Resume Dec2014

Resume Dec2014Melissa Grimsley

Ã˝

Melissa Grimsley has over 20 years of experience in the mortgage and title industries. She has held various roles including senior processor, team lead, compliance specialist, and escrow assistant. Her expertise includes processing different types of loans and reviewing title work and surveys to ensure accurate closing documents and clear title.Resume- 2016

Resume- 2016Angy Gray

Ã˝

An experienced customer service professional seeking a position where they can utilize their expertise in relationship building, problem solving, and client satisfaction. They have over 8 years of experience at Bank of America handling wires, account management, and client services for both personal and commercial accounts. They are skilled in multiple bank systems, treasury products, team leadership, and resolving client issues.7

7rovijunepabular

Ã˝

Easy quick cash loans can be obtained instantly by filling out a simple online application form. These loans do not require faxing documents or a credit check. The loan amount is deposited directly into the borrower's bank account within 24 hours. An advantage is that these short term loans do not require collateral. They are suitable for people with bad credit histories or who need emergency cash quickly.ACCION USA Partner Training

ACCION USA Partner TrainingACCION East

Ã˝

ACCION USA provides microloans and business counseling to low- and moderate-income entrepreneurs, especially minorities and women. It is the largest microlender network in the US, having served over 20,000 clients and lent over $210 million. Loans range from $7,000 on average up to $50,000 for established businesses. Requirements include a minimum credit score, no bankruptcies in the last year, complete documentation, and a co-signer or second income source for startups. The application process involves applying online or with paper forms, then providing documents for underwriting before potential approval.my new resume uls

my new resume ulsnatalie lee

Ã˝

Natalie N Lee has over 15 years of experience in customer service, quality control review, and loan processing. She is currently an Appraisal Quality Control Analyst at United Lender Services where she completes written reviews and analysis on appraisal reporting discrepancies. Previously she was a Mortgage Loan Processor at PNC Mortgage and a QC Reviewer and Client Service Rep at Equifax Settlement Services where she reviewed appraisal documents for accuracy and compliance.Queshaylon Walker resume 2015

Queshaylon Walker resume 2015Queshaylon Walker

Ã˝

This document is a resume for Queshaylon Walker summarizing their experience working in financial services and mortgage processing over the past 10+ years. They have held roles in default processing, quality control, document support, and as a notary. Key experiences include processing national mortgage settlements, conducting quality control audits, drafting MERS documents, and implementing new processes. Technical skills include proficiency in various software programs used in mortgage processing like FileNet, CitiLink, and Outlook.Similar to About SSI, Inc. (20)

I F F004 Chris Sommers91807

I F F004 Chris Sommers91807Dreamforce07

Ã˝

Dan Lawson of Lawson & Associates and Basil Fedynyshyn of Wells Fargo discussed how Salesforce helped their organizations improve productivity and business results. Both saw increases in sales volume and reductions in costs. Key benefits included centralized client information, remote access, automated workflows, and real-time dashboards for tracking performance. Salesforce provided an integrated platform to manage leads, opportunities, and customer relationships from first contact through the entire lending lifecycle.Cfs Roadshow Linked In (2)

Cfs Roadshow Linked In (2)Tim

Ã˝

An objective and comprehensive approach to evaluating the variety of strategic options available to lenders with a decision making construct for action.Revolutionizing lending in today's digital world

Revolutionizing lending in today's digital worldExperian

Ã˝

Imagine a world where the lending journey is streamlined and aligned with today's innovative technologies. A world where income and asset verification happen real-time. No need to return to your customers and request even more paperwork to support their ability to pay. This presentation dives into how lenders can now bring financial data aggregation into the mainstream. With a simple interface, lenders can verify income and assets in minutes vs. days, leading to reduced processing times, improved revenue streams and higher customer satisfaction.Flatworld mortgage services overview rob porges

Flatworld mortgage services overview rob porgesRobPorges

Ã˝

Flatworld provides mortgage and financial services outsourcing to clients in the US, Canada, Europe, Australia, and other regions. It has delivery centers in India, Philippines, and other locations. Services include loan origination, underwriting, processing, and servicing. The document discusses Flatworld's vision, global delivery network, services offered, outsourcing considerations, and case studies of clients who achieved benefits like reduced costs, quicker turnaround times, and increased capacity through outsourcing to Flatworld.Next Generation Legal Staffing

Next Generation Legal StaffingHire An Esquire

Ã˝

We reinvented legal staffing with a proprietary online platform that analyzes a candidate’s experience and expertise to best match them with contract and permanent positions at law firms and legal departments of all sizes - the first system of its kind. The result is efficient and flexible legal staffing, built for a modern workforce.Bank business development officer resource

Bank business development officer resourcecinergy

Ã˝

How can commercial bank lending officers add value for their clients? Contact Cinergy Commercial Capital. D&B onboard.pdf

D&B onboard.pdfWilson Kao

Ã˝

This document provides an overview of Dun & Bradstreet's Compliance capabilities and solutions. It discusses how regulatory compliance is largely about managing data related to customers, suppliers, and third parties. It notes the increasing complexity of the global regulatory landscape. The document then outlines the high costs organizations face due to bad data, such as duplicate suppliers and poor quality customer data. It introduces D&B's tools and datasets that help organizations reduce costs, mitigate risk, and ensure regulatory compliance through features like entity resolution, ownership data, screening against watchlists, and monitoring capabilities. In summary, the document promotes D&B's compliance solutions for managing third-party risk, customer due diligence, and overall regulatory compliance through leveraging its global datasetsGrid presentation 3 13-13

Grid presentation 3 13-13Ruth Cowan

Ã˝

Grid Financial Services provides mortgage fulfillment solutions including processing, underwriting, closing, and post-closing services. They help lenders streamline operations, reduce costs, increase productivity and improve quality. Testimonials from lenders praise Grid for their expertise, customer service, and ability to scale with business needs.Grid presentation 3 13-13

Grid presentation 3 13-13Paul Hindman

Ã˝

Grid Financial Services is a mortgage process outsource firm located in Raleigh, NC. We currently provide services to clients ranging from top ten banks to community banks and mortgage lenders. Grid presentation 3 13-13

Grid presentation 3 13-13Julee Ashburn

Ã˝

Grid Financial Services provides mortgage fulfillment solutions including processing, underwriting, closing, and post-closing services. They help lenders streamline operations, reduce costs, increase productivity and improve quality. Testimonials from lenders praise Grid for their expertise, customer service, and ability to scale with business needs.Grid Product Presentation

Grid Product Presentationedenschris

Ã˝

The document provides an overview of the services offered by Grid Financial Services, including mortgage origination fulfillment, loan modification/loss mitigation services, and default services. Grid Financial offers outsourced processing, underwriting, closing, and default resolution services to banks, private equity firms, and mortgage companies. Their platform provides customizable solutions for origination, modifications, short sales, and other default services.Grid Presentation

Grid PresentationCastle Auction Group

Ã˝

The document provides an overview of the services offered by Grid Financial Services, including mortgage origination fulfillment, loan modification/loss mitigation services, and default services. Grid Financial offers outsourced processing, underwriting, closing, and default resolution services to banks, private equity firms, and mortgage companies. Their platform provides customizable solutions for origination, modifications, short sales, and other default services.Rainmaker Genome Results

Rainmaker Genome ResultsKarenFreeman23

Ã˝

What makes for a successful business developer in professional services? This large research study investigated the rainmaker 'genome' and found actionable differences between the most and least successful.Qc 10 08 2008 Final Final

Qc 10 08 2008 Final FinalTim

Ã˝

The document discusses Capital Financial Solutions' (CFS) expertise that could help Freddie Mac address quality control issues. CFS offers strategic consulting services utilizing decades of mortgage industry experience. CFS experts can perform quality control file reviews, loss mitigation programs, and technology solutions to help optimize Freddie Mac's operations and minimize losses. The document also provides an example model for how CFS could help triage and resolve issues with Freddie Mac servicers.Real estate risk advisory brochure 2013

Real estate risk advisory brochure 2013Rahul Bhan (CA, CIA, MBA)

Ã˝

Riskpro is an organization providing risk management consulting services across India through offices in major cities. It is managed by experienced professionals with over 200 years of cumulative experience. Riskpro aims to provide integrated risk management solutions to mid-large sized companies and financial institutions. It offers quality advisory services at affordable rates compared to large consulting firms. Riskpro's main focus and differentiators include risk management expertise, hybrid delivery model, and commitment to client service.Real estate risk advisory brochure 2013

Real estate risk advisory brochure 2013Nidhi Gupta

Ã˝

Riskpro is an organization of risk management consulting firms in India with over 200 years of cumulative experience. It provides integrated risk management services to mid-large corporations and financial institutions. Riskpro aims to be the preferred provider of governance, risk, and compliance solutions. It offers quality advisory services at affordable rates compared to large consulting firms. Riskpro has expertise in areas such as credit risk, market risk, operational risk, IT risk, and regulatory compliance.Real estate risk advisory brochure 2013

Real estate risk advisory brochure 2013Nidhi Gupta

Ã˝

Riskpro India is a specialized Risk Management Consulting firm providing risk management advisory, risk trainings, internal audits, forensic accounting, investigations, fraud prevention, process reviews services etc.

Real estate services involves the purchase, ownership, management, rental and/or sale of real estate for profit. Improvement of realty property as part of a real estate investment strategy is generally considered to be a sub-specialty of real estate investing called real estate development. Real estate is an asset form with limited liquidity relative to other investments. Management and evaluation of risk is a major part of any successful real estate investment strategy where risk occurs in many different ways at every stage of the investment process from sale, purchase, tenancy to market and environmental conditions where one needs a prudent approach for mitigating potential risks in this business for investors, buyers, sellers and vendors.

Basis above backdrop we’re pleased to launch our comprehensive Real estate Risk advisory services in addition to our existing bouquet of Risk advisory, Consulting, Training & Human Capital Services. Our services are offered through our multi location delivery centres in major metros with total presence in 11 Indian cities network.

“We are quoted in recent Economic Times news as among fastest growing risk consulting firms in India.”

A 100% Digital Bank: Using Real-time Data to Enable a New Digital Banking Exp...

A 100% Digital Bank: Using Real-time Data to Enable a New Digital Banking Exp...confluent

Ã˝

This document discusses Alex Bank, a 100% digital bank that uses real-time data to enable a new digital banking experience. It outlines how Alex Bank has achieved rapid growth through its niche focus and proprietary technology that enables straight-through processing. The benefits of Alex Bank's real-time digital banking model include fast and simple customer experiences with applications approved in hours. However, the reality is increased expectations around data security, fraud prevention and maintaining regulatory compliance when dealing with high volumes of real-time customer data across multiple channels.Wfcs Corporate Presentation

Wfcs Corporate PresentationWCFS

Ã˝

WCFS is a financial advisory firm that offers tailored solutions across financial engineering, capital sourcing, and wealth management. It aims to be a one-stop provider for all financial needs through efficient processes. The firm has over 30 years of collective experience in areas like equity and debt placement, M&A, and structuring creative transactions. It identifies investment opportunities through background checks and due diligence and specializes in sectors like infrastructure, power, real estate, and pharmaceuticals.Greentree Associates

Greentree Associatestinabobena27

Ã˝

Greentree & Associates is a debt collection agency based in California that has over 30 years of experience. They aim to recover funds for clients through excellent customer service, timely communication, and creative solutions. The company is led by President Dan Rountree, who has extensive experience in the collection industry. Greentree utilizes trained collectors and various technology tools like automated dialing and skip tracing to efficiently manage debtor accounts and maximize recoveries for clients.About SSI, Inc.

- 2. Mortgage Insurance IndustryDifficult EnvironmentCosts way up – profits way downCOSTSInvestment portfolio losses in the market downturnIncreased claims due to high foreclosure rateCredit rating downgrade or watchPROFITS

- 3. Sins of the Past“Unfortunately, the lending practices of the past have dramatically increased the volume of claims tainted by fraud filed with Mortgage Insurers.”David M. McGrawCEO – SSI, Inc.

- 4. Unique dual servicing delivery platformInternal team capabilities and mortgage experienceExternal team that possesses professionalism, and long term investigative experienceAdvanced Technology with integration capabilitiesFocused services provided in addition to optional services as requested or needed by clientCompliant policies and procedures regarding proprietary informationLongevity and Consistency WHAT MAKES US DIFFERENT

- 5. Provide our customers with both seasoned mortgage professionals as well as vetted and licensed private investigatorsManage scheduling and billing hours for our clients with respect to outside private investigatorsReduce collateral clutter by managing report information and maintaining complete reports in houseUnique Dual Servicing Platform

- 6. Over 207 years of mortgage underwriting and risk management experienceThe ability to spot irregularities quicklyAdept at quickly reviewing loan packagesComprehensive and concise reportingMulti-lingual StaffManagement of individual private investigators scheduling, and billable hoursOur Internal Team

- 7. Over 500 FBI, Sheriffs, and law enforcement professionals, ready to serve our clients needsAll vetted and properly licensed within their state requirementsSSI, Inc. is creating and launching webinar, power point, and awareness and sensitivity training for our private investigators to better serve our clientsOur External Team

- 8. Retooled our delivery system for best integration possibleWorks directly with our clients documentmanagement systemDirect login to clients secure networkAuto notices of file transmittalPaperlessTechnology

- 9. Re-verification of loan documents such as income, employment, assets and HUD-1 Settlement statementsDatabase searches of undisclosed propertiesReasonableness of incomeFace to face or phone interviews with borrowers as required by clientOur Service to YOU

- 10. Initial desk review to include “red flag” analysis as well as risk based borrower scoring systemLoan portfolio sampling, random or stratified samplesValue Added Services

- 11. Over 25 years in the business of investigating mortgage fraudLongevity and Consistency

- 12. Unique dual servicing delivery platformInternal Team capabilities and mortgage experienceExternal Teamthat possesses professionalism, and long term investigative experienceAdvanced Technology with integration capabilitiesFocused services provided in addition to optional services as requested or needed by clientCompliant policies and procedures regarding proprietary informationLongevity and Consistency Our differences that MAKE the difference

- 13. David McGrawCEO/Chairman14 Years as CEO/President of privately held companies

- 14. Carlton CardenVice President Corporate DevelopmentSuccessful technology entrepreneur28 years experience in business & corporate developmentGeorgia Tech & Stanford Business School graduate

- 15. Marie Summers20 Years Mortgage Industry Experience15 years Regional Manager2 years OPS Manager3 years Account ExecutiveRegional Manager of the Year 2006AE of the Year 1997

- 16. Susan Blair25 Years in the Mortgage Industry17 Years Operations Manager5 Years District Credit Manager Underwriter2 Years Producing Branch Manager6 years Processing Manager

- 17. Natasha Graves9 Years in the Mortgage IndustryOffice Manager

- 18. Adriane Harden5 years Mortgage Origination6 years Loan Processor1 YearCloser

- 19. Melinda Castro10 YearsSr. Loan Processor2 yearsCloser

- 20. Amanda Guerrero12 Years in Mortgage Industry2 years bi-lingual loan originator2 years Loan Processor5 yearsWarehouse line Analyst

- 21. Barbara Wood22 Years in the Mortgage Industry15 years Underwriting7 YearsProcessing/Operations

- 22. Cathy Steenwyk13 Years in the Mortgage Industry7 years Quality control Review3 years Loan Shipping and sales3 years Final Documents Control

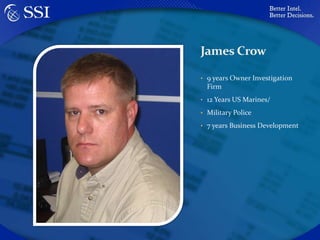

- 23. James Crow9 years Owner Investigation Firm12 Years US Marines/Military Police7 years Business Development

- 24. Jerri Haas16 Years in Banking, Taxes, Stockbroker6 yearsMortgage Loan Originator

- 25. Kyra Adams5 YearsMortgage Loan Processor

- 26. Matt Mitchell10 years in the Mortgage Industry5 years Loan Processing2 years Underwriting3 Years Compliance

- 27. Rhonda Padgett10 Years Mortgage Loan Processor

- 28. Rori Smith9 Years Customer Service

- 29. Shirley Goicochea12 Years in the Mortgage Industry6 years Commercial Lending6 years Residential and Consumer Lending

- 30. Whitney Moore5 Years Mortgage Loan Processor

- 31. Susan Yang13 Years Mortgage Industry Experience5 years processing5 years post closing3 years Wholesale Underwriter

- 32. Bonita Fontenot16 years Mortgage Experience2 years Mortgage Underwriter14 years Sales Management

- 33. Nicki WynnÃ˝Mortgage Industry 13 years4 yrs as a processor1 yr as an underwriter3 years as a pipeline manager5 years as an originator

- 34. Kristen BelcherMortgage industry 12 years11 yrs Ã˝Sr. Processor1 year junior processor

- 35. Our Private InvestigatorsFaces blurred to protect their identity