Grid Product Presentation

- 1. Executive Summary September 27, 2010

- 2. Platform Components Grid Financial Services, Inc. is a Business Process Outsource firm located in Raleigh, NC. Grid Financial has a national footprint servicing 25+ banks, private equity firms, mortgage origination platforms, and servicing companies. On the loan origination side of our business, Grid Financial provides outsourced loan processing, underwriting and closing services. In addition, Grid Financial is your outsourced default services department, providing full Home Affordable Modification Program (HAMP) and non-HAMP modifications, short sales, deeds-in-lieu and all manner of default services. Origination Fulfillment On the mortgage fulfillment side, Grid Financial’s services include a mortgage origination fulfillment platform with staff processors, underwriters and closers, which allows us to offer complete front end services ranging from file audit, document collection, processing with complete customer/client interaction, file underwriting to include Direct Endorsement and LAPP , complete closing services, post closing audits, trailing document management and direct investor shipping. These services can be retained as a complete solution or on a customized level of service. By choosing Grid Financial, you are able to access any piece or an entire custom solution to meet your needs. With the availability of short term engagements, your turn times should always stay where you want them. Why risk the additional hedge and lost revenue exposure of a 60 to 90 day lock period, when you can have expert plug-n-play support on very short notice? Grid Financial gives you elasticity to your front end sales functions which allows you to concentrate on your customer’s needs. Grid Financial allows you to avoid the tremendous expense and reputational damage associated with big fluctuations in headcount. Always enjoy a modest and predictable cost to originate. The economies of scale become your ally when we add staff to your dedicated team as needed. The ability to move floaters on and off your team allows us to keep your requirements met and you avoid fulltime staff expenses and training.

- 3. Platform Components (cont.) Loan Modification/ Loss Mitigation/Default Services Grid Financial offers a complete loss mitigation/default services process that allows a client to assign any loan that is currently 31 days delinquent or greater to Grid Financial and the borrower will be put into our aggressive program take the borrower through the entire loss mitigation waterfall all the way through to REO liquidation, if needed. We specialize in HAMP and non-HAMP modifications, short sales (HAFA or non HAFA), deeds-in-lieu, cash for keys, foreclosure filings and reporting, bankruptcy reporting, portfolio risk analytics and property valuations. With our management’s deep experience across the entire loss mitigation/ risk management spectrum, we consult regularly with our clients on overall strategies. Our loss mitigation platform provides an aggressive customer (right party) contact program that involves mail, express mail, phone calls (after hours and weekends) to field services. Our program provides for real time updates on the occupancy and condition of your property. We provide property pictures on every visit. Grid Financial will evaluate delinquent and Imminent Default borrowers for HAMP and complete the entire modification process for you, including all requisite reporting. We can even take care of the monthly reporting requirements after final modifications are completed. For borrowers who not qualify for HAMP, we will process them for alternative modifications, short sales, deeds-in-lieu (HAFA or non-HAFA) and will even facilitate the foreclosure process on your behalf. Our property preservation group will give you peace of mind, knowing that your property is not suffering needless price decay due to neglect. We will keep your vacant properties code compliant based on each MSA. We provide a consolidated billing structure that is itemized by time and service provided. So if you need the landscaping taken care of on a jumbo property, locks changed, windows boarded up in a code compliant manner, please inquire today.

- 4. Platform Components (cont.) Loan Modification/ Loss Mitigation/Default Services (cont.) Our HVCC compliant appraisal/valuation department allows for fast and accurate valuation of assets all over the country. Our services are full appraisals, government appraisals, BPOs, and commercial/project valuations. Not only are our process flows customized to meet your needs, so is our reporting capability. We can deliver scheduled reporting on everything from EDR reporting, right party contact attempts, times dialed, talk times, conversion rates and file status reports.

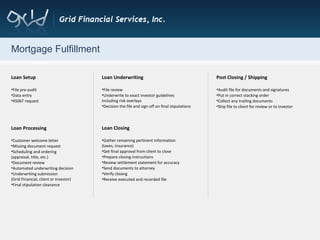

- 5. Mortgage Fulfillment Loan Setup File pre-audit Data entry 4506T request Loan Processing Customer welcome letter Missing document request Scheduling and ordering (appraisal, title, etc.) Document review Automated underwriting decision Underwriting submission (Grid Financial, client or investor) Final stipulation clearance Loan Underwriting File review Underwrite to exact investor guidelines including risk overlays Decision the file and sign off on final stipulations Loan Closing Gather remaining pertinent information (taxes, insurance) Get final approval from client to close Prepare closing instructions Review settlement statement for accuracy Send documents to attorney Verify closing Receive executed and recorded file Post Closing / Shipping Audit file for documents and signatures Put in correct stacking order Collect any trailing documents Ship file to client for review or to investor

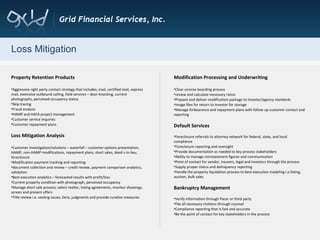

- 6. Loss Mitigation Property Retention Products Aggressive right party contact strategy that includes; mail, certified mail, express mail, extensive outbound calling, field services – door knocking, current photographs, perceived occupancy status Skip tracing Fraud analysis HAMP and HAFA project management Customer service inquiries Customer repayment plans Loss Mitigation Analysis Customer investigation/solutions – waterfall – customer options presentation, HAMP, non-HAMP modifications, repayment plans, short sales, deed s-in-lieu, foreclosure Modification payment tracking and reporting document collection and review – credit review, payment comparison analytics, validation Best execution analytics – forecasted results with profit/loss Current property condition with photograph, perceived occupancy Manage short sale process; select realtor, listing agreements, monitor showings, screen and present offers Title review i.e. vesting issues, liens, judgments and provide curative measures Modification Processing and Underwriting Clear concise boarding process review and calculate necessary ratios Prepare and deliver modification package to investor/agency standards Image files for return to investor for storage Manage forbearance and repayment plans with follow up customer contact and reporting Default Services Foreclosure referrals to attorney network for federal, state, and local compliance Foreclosure reporting and oversight Provide documentation as needed to key process stakeholders Ability to manage reinstatement figures and communication Point of contact for vendor, insurers, legal and investors through the process Supply proper status and delinquency reporting Handle the property liquidation process to best execution modeling i.e.listing, auction, bulk sales Bankruptcy Management Verify information through Pacer or third party File all necessary motions through counsel Compliance reporting that is fast and accurate Be the point of contact for key stakeholders in the process

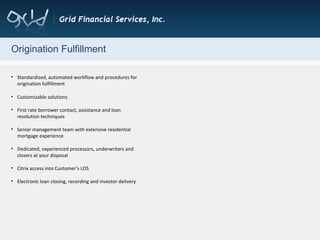

- 7. Origination Fulfillment Standardized, automated workflow and procedures for origination fulfillment Customizable solutions First rate borrower contact, assistance and loan resolution techniques Senior management team with extensive residential mortgage experience Dedicated, experienced processors, underwriters and closers at your disposal Citrix access into Customer’s LOS Electronic loan closing, recording and investor delivery

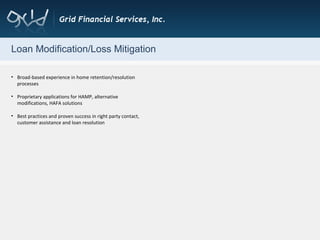

- 8. Loan Modification/Loss Mitigation Broad-based experience in home retention/resolution processes Proprietary applications for HAMP, alternative modifications, HAFA solutions Best practices and proven success in right party contact, customer assistance and loan resolution

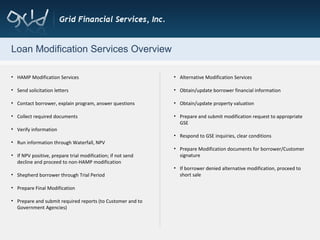

- 9. Loan Modification Services Overview HAMP Modification Services Send solicitation letters Contact borrower, explain program, answer questions Collect required documents Verify information Run information through Waterfall, NPV If NPV positive, prepare trial modification; if not send decline and proceed to non-HAMP modification Shepherd borrower through Trial Period Prepare Final Modification Prepare and submit required reports (to Customer and to Government Agencies) Alternative Modification Services Obtain/update borrower financial information Obtain/update property valuation Prepare and submit modification request to appropriate GSE Respond to GSE inquiries, clear conditions Prepare Modification documents for borrower/Customer signature If borrower denied alternative modification, proceed to short sale

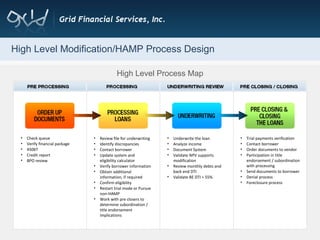

- 10. High Level Modification/HAMP Process Design Check queue Verify financial package 4506T Credit report BPO review Review file for underwriting Identify discrepancies Contact borrower Update system and eligibility calculator Verify borrower information Obtain additional information, if required Confirm eligibility Restart trial mode or Pursue non-HAMP Work with pre closers to determine subordination / title endorsement implications Underwrite the loan Analyze income Document System Validate NPV supports modification Review monthly debts and back end DTI Validate BE DTI > 55% High Level Process Map Trial payments verification Contact borrower Order documents to vendor Participation in title endorsement / subordination with processing Send documents to borrower Denial process Foreclosure process

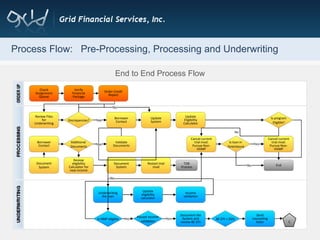

- 11. Process Flow: Pre-Processing, Processing and Underwriting End to End Process Flow Check Assignment Queue Verify Financial Package Order Credit Report Review Files for Underwriting Update Eligibility Calculator Discrepancies? Update System Additional Documents Document System Borrower Contact Review eligibility Calculator for new income Document System Restart trial mod TDB Process Validate Documents Cancel current trial mod: Pursue Non-HAMP Is loan in foreclosure Cancel current trial mod: Pursue Non-HAMP Borrower Contact Is program Eligible? End Yes No Yes No Yes No Underwriting the loan Update eligibility calculator Income validation Is HMP eligible Passed income validation Document the System and review BE DTI BE DTI > 55% Send counseling letter C No Yes Yes

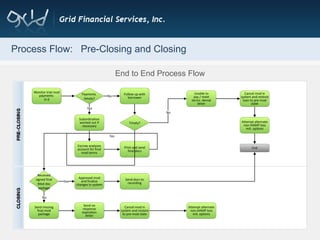

- 12. Process Flow: Pre-Closing and Closing End to End Process Flow Follow up with borrower Subordination worked out if necessary Payments timely? Monitor trial mod payments 2+3 Escrow analyzes account for final mod terms Timely? Print and send final docs Unable to pay / meet terms -denial letter Cancel mod in system and restore loan to pre-mod state Attempt alternate non-HAMP loss mit. options End Received signed final Mod doc package Send missing final mod package Approved mod and finalize changes in system Send docs to recording Send no response expiration letter Cancel mod in system and restore to pre-mod state Attempt alternate non-HAMP loss mit. options No Yes No Yes No Yes