All About TDS Return Filing Online 2024.pptx

Download as PPTX, PDF0 likes1,100 views

TDS i.e. Tax Deducted at Source, is the tax that has been deducted by the Government of India at the time of payments of some specific transactions including rent, commission, professional fees, salary, interest etc. TDS Return is the quarterly statement or summary of all the transactions related to the TDS made in the specific quarter.

1 of 11

Download to read offline

Recommended

E way bill under GST

E way bill under GSTmmdaga

╠²

The document provides information about e-way bills in India. It discusses the objective and need for e-way bills, provisions under law, the e-way bill generation process which involves filling Part A and Part B, validity periods, extensions, cancellations, exceptions and verification process. E-way bills are required for inter-state movement of goods of over Rs. 50,000 in value and aim to facilitate seamless movement of goods and prevent tax evasion. Registered persons need to generate e-way bills on the common portal prior to movement of goods, listing key details of the consignment, supplier and recipient.Tds

TdsAltacit Global

╠²

The document provides information about Tax Deducted at Source (TDS) in India, including:

1. TDS is a certain percentage deducted from various payments like salary, commission, rent, interest, and dividends that is remitted to the government and can be adjusted against tax due.

2. The concept of TDS aims for "pay as you earn" taxation where tax is deducted at the time of payment.

3. A deductor is the person/company liable to deduct tax from payments made, while a deductee is the person from whom tax is deducted. Tax invoice , credit ntote and debit note

Tax invoice , credit ntote and debit noteDr. A. Anis Akthar Sulthana Banu

╠²

This document discusses various GST concepts related to invoicing such as tax invoices, debit notes, credit notes, and bills of supply. It provides details on:

- When tax invoices must be issued for goods and services, including for continuous supplies.

- The mandatory contents of tax invoices and bills of supply.

- How invoices must be issued, including requirements for original, duplicate, and triplicate copies.

- Situations where delivery challans can be issued instead of invoices when transporting goods.

- What debit notes and credit notes are used for and examples of when they would be issued to increase or decrease the tax amount on a previous invoice.GSTR-1 PPT Filling Step by Step

GSTR-1 PPT Filling Step by Step Hina juyal

╠²

The PPT about GSTR-1 , How to filling GSTRR-1 Step by Step all Details here by CA Sanjiv Nanda. .

Mostly people is confused how to file GSTR-1 so this PPT help That people . S 8- Payment of GST

S 8- Payment of GST Team Asija

╠²

1. There are three key electronic ledgers under GST law - the electronic cash ledger, credit ledger, and liability register.

2. The cash ledger reflects all tax deposits made while the credit ledger contains input tax credits.

3. The liability register shows a taxpayer's total tax liability for a period which is paid by adjusting credits in the ledger or making deposits shown in the cash ledger.Decoding GSTR-1 and GSTR-3B

Decoding GSTR-1 and GSTR-3BDVSResearchFoundatio

╠²

OBJECTIVE

Goods and Services Tax (GST) is the Indirect Tax levied in India introduced in July 2017 which was one of the most important reforms in the Indian Economy. There are various periodic compliance requirements and filings under GST. In this webinar, we shall analyse and understand the forms GSTR-1 and GSTR-3B.GSTR 3B Guide - ClearTax

GSTR 3B Guide - ClearTaxMASOOM SEKHAR SAHOO

╠²

The GST Council has relaxed filing rules for the first two months post implementation. Here's how to file your returns for these months using form GSTR 3B. To know more about GSTR 3B, visit our page https://cleartax.in/s/gstr-3bIncome from business or profession

Income from business or professionP.Ravichandran Chandran

╠²

The document discusses key aspects of income from business and profession under the Income Tax Act in India. It defines business, profession, and vocation. It outlines essential features of a business like regular transactions, profit motive, use of labor and skill. It also discusses what constitutes a business under section 2(13) and explains concepts like trade, commerce, and manufacture. The document then covers important points about income from business like the business must be carried out by the assessee during the previous year, and income includes losses. It also discusses the cash and mercantile systems of accounting and conditions for claiming depreciation.All about Permanent Account Number (PAN)

All about Permanent Account Number (PAN)Manaan Choksi

╠²

The document provides information about Permanent Account Numbers (PAN) in India. It discusses that PAN is a 10-digit alphanumeric number issued by the Income Tax department to identify taxpayers. The fourth character of the PAN denotes the taxpayer type such as individual, company, HUF, etc. and the fifth character denotes the first letter of the name. Instructions are provided on how to apply for a PAN, required documents, fees, and tracking application status.Clubbing of income

Clubbing of incomeShakti Yadav

╠²

Clubbing of income provisions allow the income of certain taxpayers to be included in the taxable income of another person under specific circumstances outlined in sections 60-64 of the Income Tax Act. This includes income transferred without asset transfer, income from revocable transfers of assets, income of a spouse from a business in which the other spouse has substantial interest without qualifications, income from assets transferred to a spouse or son's wife without adequate consideration, and income of a minor child. The purpose is to prevent tax avoidance by attributing income to the person who effectively controls or benefits from the income.Tax deduction at source

Tax deduction at sourcecaacgangji

╠²

This document outlines the tax deduction at source (TDS) compliance process in India. It applies to all corporate and government deductors who are required to get their accounts audited. The key steps are: 1) apply for and obtain a TAN number; 2) deduct tax from applicable payments like salaries, interest, rent, etc. at the time of payment or credit; 3) deposit the deducted tax with the government treasury by the due dates; 4) file quarterly electronic TDS returns; and 5) issue TDS certificates to deductees. Failure to comply can result in penalties like interest charges, fines, and in severe cases, imprisonment.TDS 194C & 194I

TDS 194C & 194IEsha Nevse

╠²

TDS is required to be deducted from payments made to resident contractors or sub-contractors under section 194C of the Income Tax Act if the aggregate amount exceeds Rs. 75,000 in a financial year. TDS of 1% or 2% depending on the recipient must be deducted unless the PAN is not quoted, in which case the rate is 20%. The deducted TDS must be deposited with the government within 7 days of the end of the month in which the deduction was made.Permanent Account Number (PAN)

Permanent Account Number (PAN)basiljoe010

╠²

The Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by the Income Tax Department to individuals and entities. It is a unique identifier that links all financial transactions of the person or entity to the department. It is compulsory for all individuals and entities who file an income tax return or are liable to pay taxes. PAN must be quoted for various financial transactions above a certain value as well as for tax-related documents and communications. Penalties may be imposed for failing to apply for a PAN or quote it as required without reasonable cause.TDS and TCS under GST

TDS and TCS under GSTMuskanGarg66

╠²

this presentation consists of the information abou TDS ans TCS and their implications under GST. It also includes the differnce between both the terms.GST RETURN FILING

GST RETURN FILING Manjunath Raibagi

╠²

The document discusses Goods and Services Tax (GST) returns that businesses in India are required to file. It states that under GST, businesses must file three monthly returns (GSTR-1, GSTR-2, GSTR-3) and one annual return each year, totaling 37 returns. GSTR-1 contains outward supply/sales details. GSTR-2 contains purchase/input tax credit details. GSTR-3 is a summarized return generated from GSTR-1 and GSTR-2 with tax liability details. Failure to file returns on time results in late fees.Tds edited

Tds editedDinesh Choudhari

╠²

The document discusses the provisions for tax deducted at source (TDS) in India. It provides details on the types of payments that are covered under TDS, including salary, interest, dividends, rent, professional fees, etc. It explains the rate of tax deduction for different payments and the requirements for deductors to obtain a Tax Deduction Account Number (TAN) and file quarterly returns. The purpose of TDS is to collect tax on income at the time it accrues to avoid tax evasion.Understanding the GST

Understanding the GSTGeeta Bansal

╠²

The document provides an overview of the Goods and Services Tax (GST) system in India. Some key points:

- GST is a consumption-based tax levied on the supply of goods and services. It comprises Central GST, State GST, and Integrated GST.

- Many existing taxes at the central and state level will be subsumed under GST including excise duty, VAT, service tax, etc.

- GST will have multiple tax slabs of 0%, 5%, 12%, 18%, 28% and a cess on luxury and 'sin' goods. Composition scheme available for small businesses.

- Input tax credit mechanism allows set-off of taxes paidRegistration under GST Law

Registration under GST LawDVSResearchFoundatio

╠²

This document summarizes key aspects of registration under the Goods and Services Tax (GST) law in India, including:

1. Registration is required for any supplier whose aggregate turnover exceeds Rs. 20 lakhs or Rs. 10 lakhs in certain states. It authorizes the supplier to collect taxes and claim input tax credits.

2. Suppliers must register in each state where they conduct business operations. The registration process involves filing Form GST REG-01 along with required documents.

3. Other persons required to compulsory register include casual taxable persons, suppliers of online/electronic services, and those liable to pay tax under reverse charge.Types of returns under gst

Types of returns under gstfinancialhospital

╠²

The document summarizes the various types of returns required to be filed under the Goods and Services Tax (GST) regime in India. It discusses 18 different return forms including monthly, quarterly, annual returns to be filed by regular taxpayers, compounding taxpayers, Input Service Distributors, e-commerce operators, non-resident taxpayers, and others. The returns require reporting of outward and inward supplies, input tax credit claimed, tax payable, payments made, and other details. The returns are largely auto-populated based on information filed in other returns, and allow for modifications and corrections.PPT on TDS in Very Simple Language

PPT on TDS in Very Simple LanguageNishank Garg

╠²

This document summarizes tax deduction at source requirements in India. It states that any person responsible for making income payments covered by the tax scheme must deduct tax at prescribed rates and deposit the amounts by the 7th of the following month. It also outlines requirements for obtaining a TAN number, issuing TDS certificates, submitting quarterly statements, and penalties for non-compliance. Various sections are cited that specify TDS rates for different types of payments like salary, rent, interest, dividends, and commission.Input tax credit

Input tax creditSundar B N

╠²

Meaning of Input tax credit

How to claim input tax credit

Conditions to claim ITC

In eligibility of ITC

Requirements for ITC under GST

Problem

Tds provisions [income tax act, 1961]![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

Tds provisions [income tax act, 1961]anmolgoyal1304

╠²

A presentation describing definition, applicability and other TDS related provisions laid down in the Income Tax Act, 1961.Invoicing under GST

Invoicing under GSTgst-trichy

╠²

This document provides information on invoicing requirements under the Goods and Services Tax (GST) in India. It discusses what documents (tax invoices or bills of supply) must be issued, when they must be issued, and what information they must contain. Key points include:

- Tax invoices must be issued for taxable supplies, while bills of supply are for exempt or composition supplies. Tax invoices allow input tax credit claims while bills of supply do not.

- Invoices must generally be issued before or at the time of supply, removal of goods, or payment due date for continuous supplies.

- Invoices must contain details like supplier/recipient names and GST numbers, item descriptions, quantities, valuesIncome tax return

Income tax returnKajal Bansal

╠²

- Individuals and companies with total income exceeding the maximum taxable limit must file an income tax return by the due date, which is July 31 for most assessees and September 30/November 30 for some.

- Those holding overseas assets or accounts must also file a return even if income is below the taxable limit. Late or revised returns can be filed within 1 year with penalties for failure to file on time.

- The return must be verified digitally in most cases. It must be signed by the individual, partner, director or other authorized person depending on the entity. Strict documentation and procedures must be followed for e-filing.Residential status

Residential statusDR ANNIE STEPHEN

╠²

- An individual's residential status in India for tax purposes depends on how many days they spent in India during the year, not their citizenship.

- Individuals are classified as resident, resident but not ordinarily resident (RNOR), or non-resident based on the number of days spent in India.

- To be a resident, an individual must spend 182 days or more in India during the year or 60 days and at least 365 days in the last 4 years.

- Exceptions apply for Indian citizens working abroad or visiting India temporarily.Tds Presentation as per Finance Act, 2014

Tds Presentation as per Finance Act, 2014Manu Katare

╠²

1) TDS refers to the deduction of tax at source on certain specified payments. Key provisions around TDS are covered under Chapter XVII-B of the Income Tax Act, 1961.

2) The document outlines various sections related to TDS such as 192 on salaries, 194 on dividends, 194A on interest, 194C on payments to contractors, and exceptions to these sections.

3) It also discusses the rates of TDS to be applied based on the nature of the deductee, including the applicability of surcharge and education cess in case of companies, foreign companies, and non-residents.TDS

TDSSakshi Saxena

╠²

TDS refers to tax deducted at source, which is a mechanism in India to collect income tax. It applies to various types of income such as salaries, business income, interest income, and capital gains. For salaries, the employer is responsible for deducting tax from an employee's salary and depositing it with the government. Interest income also faces TDS, where the payer of interest needs to deduct tax depending on the type of interest and exemption limits. Documents like TDS certificates and quarterly returns need to be issued to deductees and submitted to the tax department respectively.Clubbing of income

Clubbing of incomeVinor5

╠²

The document discusses the concept of clubbing of income under Section 64 of the Indian Income Tax Act. It specifies the persons and scenarios where income can be clubbed, such as transferring income without transferring the asset (Section 60), revocable transfers of assets (Section 61), income of a spouse or minor child, transfers of assets to a spouse, son's wife, or for their benefit without adequate consideration. The purpose is to prevent avoidance of tax liability by transferring income-generating assets to relatives.Simplifying TDS Returns: A Comprehensive Guide

Simplifying TDS Returns: A Comprehensive Guideconnect96

╠²

Filing TDS returns made easy! Explore our guide for clear instructions, important deadlines, and helpful tips to ensure you stay compliant.2. e-tds.ppt

2. e-tds.pptPrasadMolleti1

╠²

This document provides information about Tax Deduction at Source (TDS) in India. It discusses what TDS is, the TDS cycle, identifying transactions that are subject to TDS, deducting and remitting the tax, obtaining the Book Identification Number (BIN), preparing quarterly e-TDS returns, and consequences of failing to deduct or remit TDS. It also describes how to check TAN accuracy, make payments through challan or book adjustment, view Individual Tax Credit in Form 26AS, and download Form 16/16A. Key websites for TDS processes are also listed.More Related Content

What's hot (20)

All about Permanent Account Number (PAN)

All about Permanent Account Number (PAN)Manaan Choksi

╠²

The document provides information about Permanent Account Numbers (PAN) in India. It discusses that PAN is a 10-digit alphanumeric number issued by the Income Tax department to identify taxpayers. The fourth character of the PAN denotes the taxpayer type such as individual, company, HUF, etc. and the fifth character denotes the first letter of the name. Instructions are provided on how to apply for a PAN, required documents, fees, and tracking application status.Clubbing of income

Clubbing of incomeShakti Yadav

╠²

Clubbing of income provisions allow the income of certain taxpayers to be included in the taxable income of another person under specific circumstances outlined in sections 60-64 of the Income Tax Act. This includes income transferred without asset transfer, income from revocable transfers of assets, income of a spouse from a business in which the other spouse has substantial interest without qualifications, income from assets transferred to a spouse or son's wife without adequate consideration, and income of a minor child. The purpose is to prevent tax avoidance by attributing income to the person who effectively controls or benefits from the income.Tax deduction at source

Tax deduction at sourcecaacgangji

╠²

This document outlines the tax deduction at source (TDS) compliance process in India. It applies to all corporate and government deductors who are required to get their accounts audited. The key steps are: 1) apply for and obtain a TAN number; 2) deduct tax from applicable payments like salaries, interest, rent, etc. at the time of payment or credit; 3) deposit the deducted tax with the government treasury by the due dates; 4) file quarterly electronic TDS returns; and 5) issue TDS certificates to deductees. Failure to comply can result in penalties like interest charges, fines, and in severe cases, imprisonment.TDS 194C & 194I

TDS 194C & 194IEsha Nevse

╠²

TDS is required to be deducted from payments made to resident contractors or sub-contractors under section 194C of the Income Tax Act if the aggregate amount exceeds Rs. 75,000 in a financial year. TDS of 1% or 2% depending on the recipient must be deducted unless the PAN is not quoted, in which case the rate is 20%. The deducted TDS must be deposited with the government within 7 days of the end of the month in which the deduction was made.Permanent Account Number (PAN)

Permanent Account Number (PAN)basiljoe010

╠²

The Permanent Account Number (PAN) is a 10-digit alphanumeric number issued by the Income Tax Department to individuals and entities. It is a unique identifier that links all financial transactions of the person or entity to the department. It is compulsory for all individuals and entities who file an income tax return or are liable to pay taxes. PAN must be quoted for various financial transactions above a certain value as well as for tax-related documents and communications. Penalties may be imposed for failing to apply for a PAN or quote it as required without reasonable cause.TDS and TCS under GST

TDS and TCS under GSTMuskanGarg66

╠²

this presentation consists of the information abou TDS ans TCS and their implications under GST. It also includes the differnce between both the terms.GST RETURN FILING

GST RETURN FILING Manjunath Raibagi

╠²

The document discusses Goods and Services Tax (GST) returns that businesses in India are required to file. It states that under GST, businesses must file three monthly returns (GSTR-1, GSTR-2, GSTR-3) and one annual return each year, totaling 37 returns. GSTR-1 contains outward supply/sales details. GSTR-2 contains purchase/input tax credit details. GSTR-3 is a summarized return generated from GSTR-1 and GSTR-2 with tax liability details. Failure to file returns on time results in late fees.Tds edited

Tds editedDinesh Choudhari

╠²

The document discusses the provisions for tax deducted at source (TDS) in India. It provides details on the types of payments that are covered under TDS, including salary, interest, dividends, rent, professional fees, etc. It explains the rate of tax deduction for different payments and the requirements for deductors to obtain a Tax Deduction Account Number (TAN) and file quarterly returns. The purpose of TDS is to collect tax on income at the time it accrues to avoid tax evasion.Understanding the GST

Understanding the GSTGeeta Bansal

╠²

The document provides an overview of the Goods and Services Tax (GST) system in India. Some key points:

- GST is a consumption-based tax levied on the supply of goods and services. It comprises Central GST, State GST, and Integrated GST.

- Many existing taxes at the central and state level will be subsumed under GST including excise duty, VAT, service tax, etc.

- GST will have multiple tax slabs of 0%, 5%, 12%, 18%, 28% and a cess on luxury and 'sin' goods. Composition scheme available for small businesses.

- Input tax credit mechanism allows set-off of taxes paidRegistration under GST Law

Registration under GST LawDVSResearchFoundatio

╠²

This document summarizes key aspects of registration under the Goods and Services Tax (GST) law in India, including:

1. Registration is required for any supplier whose aggregate turnover exceeds Rs. 20 lakhs or Rs. 10 lakhs in certain states. It authorizes the supplier to collect taxes and claim input tax credits.

2. Suppliers must register in each state where they conduct business operations. The registration process involves filing Form GST REG-01 along with required documents.

3. Other persons required to compulsory register include casual taxable persons, suppliers of online/electronic services, and those liable to pay tax under reverse charge.Types of returns under gst

Types of returns under gstfinancialhospital

╠²

The document summarizes the various types of returns required to be filed under the Goods and Services Tax (GST) regime in India. It discusses 18 different return forms including monthly, quarterly, annual returns to be filed by regular taxpayers, compounding taxpayers, Input Service Distributors, e-commerce operators, non-resident taxpayers, and others. The returns require reporting of outward and inward supplies, input tax credit claimed, tax payable, payments made, and other details. The returns are largely auto-populated based on information filed in other returns, and allow for modifications and corrections.PPT on TDS in Very Simple Language

PPT on TDS in Very Simple LanguageNishank Garg

╠²

This document summarizes tax deduction at source requirements in India. It states that any person responsible for making income payments covered by the tax scheme must deduct tax at prescribed rates and deposit the amounts by the 7th of the following month. It also outlines requirements for obtaining a TAN number, issuing TDS certificates, submitting quarterly statements, and penalties for non-compliance. Various sections are cited that specify TDS rates for different types of payments like salary, rent, interest, dividends, and commission.Input tax credit

Input tax creditSundar B N

╠²

Meaning of Input tax credit

How to claim input tax credit

Conditions to claim ITC

In eligibility of ITC

Requirements for ITC under GST

Problem

Tds provisions [income tax act, 1961]![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

![Tds provisions [income tax act, 1961]](https://cdn.slidesharecdn.com/ss_thumbnails/tdsprovisionsincometaxact1961-140709044039-phpapp01-thumbnail.jpg?width=560&fit=bounds)

Tds provisions [income tax act, 1961]anmolgoyal1304

╠²

A presentation describing definition, applicability and other TDS related provisions laid down in the Income Tax Act, 1961.Invoicing under GST

Invoicing under GSTgst-trichy

╠²

This document provides information on invoicing requirements under the Goods and Services Tax (GST) in India. It discusses what documents (tax invoices or bills of supply) must be issued, when they must be issued, and what information they must contain. Key points include:

- Tax invoices must be issued for taxable supplies, while bills of supply are for exempt or composition supplies. Tax invoices allow input tax credit claims while bills of supply do not.

- Invoices must generally be issued before or at the time of supply, removal of goods, or payment due date for continuous supplies.

- Invoices must contain details like supplier/recipient names and GST numbers, item descriptions, quantities, valuesIncome tax return

Income tax returnKajal Bansal

╠²

- Individuals and companies with total income exceeding the maximum taxable limit must file an income tax return by the due date, which is July 31 for most assessees and September 30/November 30 for some.

- Those holding overseas assets or accounts must also file a return even if income is below the taxable limit. Late or revised returns can be filed within 1 year with penalties for failure to file on time.

- The return must be verified digitally in most cases. It must be signed by the individual, partner, director or other authorized person depending on the entity. Strict documentation and procedures must be followed for e-filing.Residential status

Residential statusDR ANNIE STEPHEN

╠²

- An individual's residential status in India for tax purposes depends on how many days they spent in India during the year, not their citizenship.

- Individuals are classified as resident, resident but not ordinarily resident (RNOR), or non-resident based on the number of days spent in India.

- To be a resident, an individual must spend 182 days or more in India during the year or 60 days and at least 365 days in the last 4 years.

- Exceptions apply for Indian citizens working abroad or visiting India temporarily.Tds Presentation as per Finance Act, 2014

Tds Presentation as per Finance Act, 2014Manu Katare

╠²

1) TDS refers to the deduction of tax at source on certain specified payments. Key provisions around TDS are covered under Chapter XVII-B of the Income Tax Act, 1961.

2) The document outlines various sections related to TDS such as 192 on salaries, 194 on dividends, 194A on interest, 194C on payments to contractors, and exceptions to these sections.

3) It also discusses the rates of TDS to be applied based on the nature of the deductee, including the applicability of surcharge and education cess in case of companies, foreign companies, and non-residents.TDS

TDSSakshi Saxena

╠²

TDS refers to tax deducted at source, which is a mechanism in India to collect income tax. It applies to various types of income such as salaries, business income, interest income, and capital gains. For salaries, the employer is responsible for deducting tax from an employee's salary and depositing it with the government. Interest income also faces TDS, where the payer of interest needs to deduct tax depending on the type of interest and exemption limits. Documents like TDS certificates and quarterly returns need to be issued to deductees and submitted to the tax department respectively.Clubbing of income

Clubbing of incomeVinor5

╠²

The document discusses the concept of clubbing of income under Section 64 of the Indian Income Tax Act. It specifies the persons and scenarios where income can be clubbed, such as transferring income without transferring the asset (Section 60), revocable transfers of assets (Section 61), income of a spouse or minor child, transfers of assets to a spouse, son's wife, or for their benefit without adequate consideration. The purpose is to prevent avoidance of tax liability by transferring income-generating assets to relatives.Similar to All About TDS Return Filing Online 2024.pptx (20)

Simplifying TDS Returns: A Comprehensive Guide

Simplifying TDS Returns: A Comprehensive Guideconnect96

╠²

Filing TDS returns made easy! Explore our guide for clear instructions, important deadlines, and helpful tips to ensure you stay compliant.2. e-tds.ppt

2. e-tds.pptPrasadMolleti1

╠²

This document provides information about Tax Deduction at Source (TDS) in India. It discusses what TDS is, the TDS cycle, identifying transactions that are subject to TDS, deducting and remitting the tax, obtaining the Book Identification Number (BIN), preparing quarterly e-TDS returns, and consequences of failing to deduct or remit TDS. It also describes how to check TAN accuracy, make payments through challan or book adjustment, view Individual Tax Credit in Form 26AS, and download Form 16/16A. Key websites for TDS processes are also listed.TDS filing, E-filling of returns

TDS filing, E-filling of returnsSankalpNautiyal

╠²

The document provides information about tax deducted at source (TDS) in India. Some key points:

1. TDS is a system where specified payments like salary, rent, professional fees etc are subject to tax deduction at source. The tax deducted is remitted to the government and the deductee gets credit for the tax paid.

2. Every deductor must obtain a Tax Deduction Account Number (TAN) to deduct taxes. TDS must be deducted as per prescribed rates depending on the nature of payment.

3. TDS certificates like Form 16 and Form 16A are issued to deductees stating the tax deducted. These can be used for claiming tax credits. TDS PPT.pptx

TDS PPT.pptxSirrTywin

╠²

The document discusses Tax Deduction at Source (TDS) under the Goods and Services Tax (GST) in India. It explains that TDS of 1% must be deducted by certain entities on payments exceeding Rs. 2.5 lakhs to suppliers for taxable goods and services. The deducted amount is deposited with the appropriate government and credited to the supplier's electronic cash ledger. Non-compliance with TDS provisions like short/non-deduction and payment attracts penalties between Rs. 10,000-5,000. The process of registration as a TDS deductor and generating challans for depositing the deducted tax is also summarized.18 tax deducted at source

18 tax deducted at sourceMD. Monzurul Karim Shanchay

╠²

Tax deducted at source (TDS) involves deducting income tax from certain types of payments and depositing this amount with the government. The document discusses TDS concepts like scope, applicable incomes, TDS rates, TAN registration, deductors, deductees, and configuring TDS in Tally ERP 9 software. It provides steps to enable TDS in a company, set up TDS statutory masters for nature of payments and deductee types, and create necessary expense and party ledgers for accounting TDS transactions.SIP Presentation Ujjwal.pdf

SIP Presentation Ujjwal.pdfRahulSharma665911

╠²

TDS is a percentage of various payments like salary, rent, interest, dividends that is deducted at source and deposited with the government. It is meant to implement the "pay as you earn" principle of taxation. The deductee is the person from whom tax is deducted, while the deductor is responsible for withholding the appropriate amount at source. TDS rates vary for different types of payments under different sections of the Income Tax Act, and deductors must obtain a Tax Deduction Number to file quarterly TDS returns and issue TDS certificates to deductees. The goal of TDS is to facilitate tax collection, ensure a regular inflow of funds, and prevent tax evasion.Form 24Q.pdf

Form 24Q.pdfNIKHIL96711

╠²

Form 24Q is the TDS return form that must be filed quarterly by employers to report tax deducted from employees' salaries under section 192. It contains details of tax deducted, employee names and PAN numbers, dates and amounts of salary payments, and tax deducted. Filing must be done online for employers above certain thresholds. The form has two annexures - Annexure I is filed for all quarters while Annexure II containing full-year salary details is only for the last quarter. Employers must provide a TDS certificate to all employees and meet filing deadlines to avoid penalties.Tax deducted at source

Tax deducted at source300544

╠²

TDS is a mechanism where a person deducts tax at the time of making certain specified payments to another person. Key persons responsible for deducting TDS (deductors) include company principals, DDOs in government offices, and those making payments of interest, dividends, contracts, lottery/game winnings, etc. Deductors must obtain a TAN, deduct tax at the correct rate, deposit the deducted amount timely, issue TDS certificates, and file quarterly TDS statements in the prescribed format and by the due dates. Maintaining compliance is important to ensure deductees get proper tax credit and deductors avoid penalties.TDS_RRSK_Feb23.pptx

TDS_RRSK_Feb23.pptxjuvvaharish

╠²

TDS related slides and how to file TDS returns and correction or modification on tds return. what is PAn what is TAN, issues faced during tds returing filling, corrections based on the notice received from income tax departments,

income tax payments, notices related to income tax and tds returnsE FORMS UNDER INCOME TAX(FORM 24q,26q,27q,27eq,16 and ITRs)

E FORMS UNDER INCOME TAX(FORM 24q,26q,27q,27eq,16 and ITRs)Aaditykale

╠²

This document provides information about TDS returns in India. It discusses that TDS refers to tax deducted at source on income. TDS returns are quarterly statements submitted by the deductor to report TDS transactions. The document outlines the different quarters and deadlines for filing TDS returns. It also describes the main TDS return forms like Form 24Q for TDS on salaries, Form 26Q for other payments, and Form 27Q for payments to NRIs. Form 16 and Part A/B are also summarized.Know About TDS and TCS Return Due Dates for the FY 2022ŌĆō2023 | Academy Tax4we...

Know About TDS and TCS Return Due Dates for the FY 2022ŌĆō2023 | Academy Tax4we...Academy Tax4wealth

╠²

Do you want to know about TDS and TCS Return Due Dates for the FY 2022ŌĆō2023? Check Late filing fees, Penalty, Interest Rate for Payment of TDS and TDS Return Forms. Join Academy Taax4wealth now, because this is the best e ŌĆō learning platform. Enroll now, and make your career.

For more information, you can visit us at:-

https://academy.tax4wealth.com/blog/due-dates-of-e-filing-of-tds-or-tcs-return

https://academy.tax4wealth.com/

TDS.pptx

TDS.pptxamitaYadav40

╠²

TDS or tax deducted at source is income tax deducted from specified payments such as rent, commission, professional fees, and salary. The recipient receives the net payment after TDS is deducted and will get credit for the TDS amount against their final tax liability. Any person or entity making specified payments must deduct TDS at the time of payment, unless they are an individual or HUF not required to get accounts audited. To deposit TDS, the payer must generate a TDS challan ITNS 281 online, enter payment details, and make the payment through net banking by the due date, which is typically the 7th of the following month.Tax deducted at source dr. p. pirakatheeswari

Tax deducted at source dr. p. pirakatheeswariDrPirakatheeswariP

╠²

GST - CGST, SGST, IGST, UTGST

Rate of TDS, Value of supply on which TDS shall be deducted

How can the Deductee claim the benefit of TDS?

Refund of the excess amount deductedTAN Registration.pdf

TAN Registration.pdfLegalMinions

╠²

TAN is a 10 digit number issued by the income tax department to those who file income tax and we have to register that TDS reimbursement process - VIVO

TDS reimbursement process - VIVOPaytm

╠²

1. The document discusses the Tax Deducted at Source (TDS) reimbursement process for merchants selling on Paytm Mall. It defines what TDS is and the applicable rates.

2. To raise a ticket for TDS reimbursement, merchants need to provide the Form 16A, commission invoice number, and calculate TDS amount paid against the taxable value.

3. Once submitted, Paytm Mall will validate the details and reimburse the TDS amount within 15 working days if correct, or update the merchant within days if there is any discrepancy.Annual Information Statement (AIS) - Extended version of From 26AS

Annual Information Statement (AIS) - Extended version of From 26ASManish Anil Gupta & Co. - A CA firm in Delhi, India

╠²

What is Annual Information Statement (AIS)? What information is shown in AIS? How AISis different from 26AS? How to access AIS? How to give feedback on AIS?All About ITR 2 for Income Tax Return.pptx

All About ITR 2 for Income Tax Return.pptxLegal Pillers

╠²

In India for Income Tax Return filing, ITR 2 is a crucial document in the context of the Indian tax system, serving as a comprehensive platform for individuals and Hindu Undivided Families (HUFs) to declare their income and tax liabilities to the Income Tax Department of India. The ITR-2 form is not just about income disclosure; it also serves as a tool for promoting transparency, accountability, and compliance within the taxation ecosystem, reinforcing the government's efforts to collect revenue, channelize resources for public welfare, and ensure a fair and equitable distribution of the tax burden among the citizenry.TDS Prentation By Vaibhav Singh

TDS Prentation By Vaibhav SinghVaibhav Singh

╠²

This document summarizes key provisions related to the Tax Deduction at Source (TDS) scheme in India. It discusses that every deductor must obtain a Tax Deduction Account Number (TAN) to be quoted in all TDS-related correspondence. It also outlines the forms, periodicity, and cut-off dates for filing TDS returns, as well as details about TDS rates, exemption limits, and procedures for obtaining a lower deduction certificate. The document concludes by summarizing provisions related to tax collection at source and penalties for non-compliance.Know About TDS and TCS Return Due Dates for the FY 2022ŌĆō2023 | Academy Tax4we...

Know About TDS and TCS Return Due Dates for the FY 2022ŌĆō2023 | Academy Tax4we...Academy Tax4wealth

╠²

Annual Information Statement (AIS) - Extended version of From 26AS

Annual Information Statement (AIS) - Extended version of From 26ASManish Anil Gupta & Co. - A CA firm in Delhi, India

╠²

Recently uploaded (20)

Vitaly Bondar: Are GANs dead or alive? (UA)

Vitaly Bondar: Are GANs dead or alive? (UA)Lviv Startup Club

╠²

Vitaly Bondar: Are GANs dead or alive? (UA)

Kyiv AI & BigData Day 2025

Website ŌĆō https://aiconf.com.ua/kyiv

Youtube ŌĆō https://www.youtube.com/startuplviv

FB ŌĆō https://www.facebook.com/aiconf2025-02 Design thinking presentation.pdf

2025-02 Design thinking presentation.pdfCambridge Product Management Network

╠²

║▌║▌▀Żs presented at the Cambridge Product Management Network meeting, 26 February 2025 Digital Marketing Roadmap - PPT Template and Guide

Digital Marketing Roadmap - PPT Template and GuideAurelien Domont, MBA

╠²

In the ever-evolving landscape of digital marketing, having a well-structured roadmap is essential for achieving success. HereŌĆÖs a comprehensive digital marketing roadmap that outlines key strategies and steps to take your marketing efforts to the next level. It includes 6 components:

1. Branding Guidelines Strategy

2. Website Design and Development

3. Search Engine Optimization (SEO)

4. Pay-Per-Click (PPC) Strategy

5. Social Media Strategy

6. Emailing Strategy

This PowerPoint presentation is only a small preview of our content. For more details, visit www.domontconsulting.com Oleksandr Krakovetskyi: ą×ą│ą╗čÅą┤ ą│ąĄąĮąĄčĆą░čéąĖą▓ąĮąĖčģ ą╝ąŠą┤ąĄą╗ąĄą╣ ąĘ ą╝č¢čĆą║čāą▓ą░ąĮąĮčÅą╝ (UA)

Oleksandr Krakovetskyi: ą×ą│ą╗čÅą┤ ą│ąĄąĮąĄčĆą░čéąĖą▓ąĮąĖčģ ą╝ąŠą┤ąĄą╗ąĄą╣ ąĘ ą╝č¢čĆą║čāą▓ą░ąĮąĮčÅą╝ (UA)Lviv Startup Club

╠²

Oleksandr Krakovetskyi: ą×ą│ą╗čÅą┤ ą│ąĄąĮąĄčĆą░čéąĖą▓ąĮąĖčģ ą╝ąŠą┤ąĄą╗ąĄą╣ ąĘ ą╝č¢čĆą║čāą▓ą░ąĮąĮčÅą╝ (UA)

Kyiv AI & BigData Day 2025

Website ŌĆō https://aiconf.com.ua/kyiv

Youtube ŌĆō https://www.youtube.com/startuplviv

FB ŌĆō https://www.facebook.com/aiconf Top Social Media Marketing Trends in 2025

Top Social Media Marketing Trends in 2025bulbulkanwar7070

╠²

Social media marketing trends is now being very crucial.Project Status Report - Powerpoint Template

Project Status Report - Powerpoint TemplateAurelien Domont, MBA

╠²

Project Status Report Template that our ex-McKinsey & Deloitte consultants like to use with their clients.

For more content, visit www.domontconsulting.com

In the fast-paced world of business, staying on top of key projects and initiatives is crucial for success. An initiative status report is a vital tool that provides transparency, accountability, and valuable insights to stakeholders. By outlining deadlines, costs, quality standards, and potential risks, these reports ensure that projects remain on track and aligned with organizational goals. In this article, we will delve into the essential components of an initiative status report, offering a comprehensive guide to creating effective and informative updates.Western Alaska Minerals Corporate Presentation Mar 2025.pdf

Western Alaska Minerals Corporate Presentation Mar 2025.pdfWestern Alaska Minerals Corp.

╠²

Advancing North America's Next Major Silver & Critical Minerals District

Western Alaska Minerals is unveiling a prolific 8-km mineral corridor with its two stand-alone deposits. Anchored by the high-grade silver deposit at Waterpump Creek and the historic Illinois Creek mine, our 100% owned carbonate replacement deposit reveals untapped potential across an expansive exploration landscape.

Waterpump Creek: 75 Moz @ 980 g/t AgEq (Inferred), open to the north and south.

Illinois Creek: 525 Koz AuEq - 373 Koz @ 1.3 g/t AuEq (Indicated), 152 Koz @ 1.44 g/t AuEq (Inferred).

2024 New Discovery at ŌĆ£Warm SpringsŌĆØ: First copper, gold, and Waterpump Creek-grade silver intercepts located 0.8 miles from Illinois Creek.

2025 plans: Drilling for more high-grade silver discoveries at the Waterpump Creek South target. Our 114.25m2 claim package located on mining-friendly state land also includes the promising Round Top copper and TG North CRD prospects, located 15 miles northeast of Illinois Creek.Transfer API | Transfer Booking Engine | Transfer API Integration

Transfer API | Transfer Booking Engine | Transfer API Integrationchethanaraj81

╠²

FlightsLogic is a leading╠²travel technology company╠²offering╠²Transfer API╠²and other services to the travel market. By integrating your travel website with our transfer API, you can take benefit of various international transfer services from airports, hotels, resorts, cars, etc. Our Transfer API comes with full documentation with technical support and it supports both B2C and B2B solutions. With the transfer API solution developed by FlightsLogic, the user can easily book their transport from the airport to the travel place. For more details, pls visit our website: https://www.flightslogic.com/transfer-api.php

CRED presentation in entrepreneurship management

CRED presentation in entrepreneurship managementkumarka087

╠²

CRED is an Indian fintech platform that primarily rewards users for making timely credit card payments.Creativity, AI, and Human-Centered Innovation

Creativity, AI, and Human-Centered InnovationRaj Lal

╠²

A 90-minute Design Workshop with David Moore, Lecturer at Stanford Design

Join us for an engaging session filled with actionable insights, dynamic conversations, and complimentary pizza and drinks to fuel your creativity.

Join us as a Volunteer.

Unlocking Creativity & Leadership: From Ideas to Impact

In todayŌĆÖs fast-paced world of design, innovation, and leadership, the ability to think creatively and strategically is essential for driving meaningful change. This workshop is designed for designers, product leaders, and entrepreneurs looking to break through creative barriers, adopt a user-centered mindset, and turn bold ideas into tangible success.

Join us for an engaging session where weŌĆÖll explore the intersection of creativity, leadership, and human-centered innovation. Through thought-provoking discussions, real-world case studies, and actionable strategies, youŌĆÖll gain the tools to navigate complex challenges, foster collaboration, and lead with purpose in an ever-evolving industry.

Key Takeaways:

¤ö╣ From Design Thinking to Design Doing ŌĆō Where are you in the creative process? The best work is multi-dimensional, engaging us on a deeper level. Unlock your natural creative abilities and move from ideation to execution.

¤ö╣ Reigniting Innovation: From Firefighting to Fire Starting ŌĆō WeŌĆÖve become so skilled at solving problems that weŌĆÖve forgotten how to spark new ideas. Learn how to cultivate a culture of communication, collaboration, and creative productivity to drive meaningful innovation.

¤ö╣ The Human Element of Innovation ŌĆō True creativity isnŌĆÖt just about ideasŌĆöitŌĆÖs about people. Understand how to nurture the deeper, often-overlooked aspects of your teamŌĆÖs potential to build an environment where innovation thrives.

¤ö╣ AI as Your Creative Partner, Not a Shortcut ŌĆō AI can be an incredible toolŌĆöbut only if you use it wisely. Learn when and how to integrate AI into your workflow, craft effective prompts, and avoid generic, uninspired results.

¤ö╣ Mastering Team Dynamics: Communication, Listening & Collaboration ŌĆō Teams are unpredictable, and clear communication isnŌĆÖt always as clear as we think. Discover strategies for building strong, high-performing teams that listen, collaborate, and innovate effectively. This session will equip you with the insights and techniques needed to lead with creativity, navigate challenges, and drive innovation with confidence.2025_Dominion Presentaci├│n_Corporativa_Larga (ENG)_web.pdf

2025_Dominion Presentaci├│n_Corporativa_Larga (ENG)_web.pdfdominionglobalanalyt

╠²

Presentaci├│n Corporativa en ingl├®s 2025Taylor Swift The Man Music Video Production

Taylor Swift The Man Music Video Productioneclark941

╠²

For my school project, I analyzed Taylor Swift's "The Man" music video. I explored how it critiques gender inequality by depicting Taylor Swift as a man to highlight the double standards and societal expectations placed on men and women. The video uses satire and symbolism to comment on issues of power and privilegeSiddhartha Bank Navigating_Nepals_Financial_Challenges.pptx

Siddhartha Bank Navigating_Nepals_Financial_Challenges.pptxSiddhartha Bank

╠²

This PowerPoint presentation provides an overview of NepalŌĆÖs current financial challenges and highlights how Siddhartha Bank supports individuals and businesses. It covers key issues such as inflation and limited credit access while showcasing the bankŌĆÖs solutions, including loan options, savings plans, digital banking services, and customer support. The slides are designed with concise points for clear and effective communication.Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)Lviv Startup Club

╠²

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Lemberg AIPM School 3.0

Website ŌĆō https://lembs.com/aipmschool

Youtube ŌĆō https://www.youtube.com/startuplviv

FB ŌĆō https://www.facebook.com/pmdayconference¤ö╣ SWOT Analysis: Boutique Consulting Firms in 2025 ¤ö╣

¤ö╣ SWOT Analysis: Boutique Consulting Firms in 2025 ¤ö╣Alexander Simon

╠²

In an era defined by Consulting 5.0, boutique consulting firmsŌĆöpositioned in the Blue OceanŌĆöface both unprecedented opportunities and critical challenges.

Their strengths lie in specialization, agility, and client-centricity, making them key players in delivering high-value, tailored insights. However, limited scale, regulatory constraints, and rising AI-driven competition present significant barriers to growth.

This SWOT analysis explores the internal and external forces shaping the future of boutique consultancies. Unlike Black Ocean firms, which grapple with the innovatorŌĆÖs dilemma, boutiques have the advantage of flexibility and speedŌĆöbut to fully harness Consulting 5.0, they must form strategic alliances with tech firms, PE-backed networks, and expert collectives.

Key Insights:

Ō£ģ Strengths: Agility, deep expertise, and productized offerings

ŌÜĀ’ĖÅ Weaknesses: Brand visibility, reliance on key personnel

¤ÜĆ Opportunities: AI, Web3, and strategic partnerships

Ōøö Threats: Automation, price competition, regulatory challenges

Strategic Imperatives for Boutique Firms:

¤ōī Leverage AI & emerging tech to augment consulting services

¤ōī Build strategic alliances to access resources & scale solutions

¤ōī Strengthen regulatory & compliance expertise to compete in high-value markets

¤ōī Shift from transactional to long-term partnerships for client retention

As Consulting 5.0 reshapes the industry, boutique consultancies must act now to differentiate themselves and secure their future in a rapidly evolving landscape.

¤ÆĪ What do you think? Can boutique firms unlock Consulting 5.0 before Black Ocean giants do?20250305_A. Stotz All Weather Strategy - Weights update & Performance review ...

20250305_A. Stotz All Weather Strategy - Weights update & Performance review ...FINNOMENAMarketing

╠²

A. Stotz All Weather Strategy - Weights update & Performance reviewTablePlus Crack with Free License Key Download

TablePlus Crack with Free License Key Downloadhilexalen1

╠²

Please copy the link and paste it into New Tab ¤æć

https://dr-up-community.info/

TablePlus is a cross-platform database management GUI tool designed to make managing databases easy and efficient. It supports a wide range of relational databases such as MySQL, PostgreSQL, SQLite, and more. Will-Skill Matrix PowerPoint Template and Guide

Will-Skill Matrix PowerPoint Template and GuideAurelien Domont, MBA

╠²

The Will-Skill Matrix is an essential framework for managers and consultants aiming to optimize team performance. This model divides employees into four quadrants based on their levels of motivation (Will) and competencies (Skill):

1.Contributors (Guide): High Will, Low Skill

2.High Performers (Challenge): High Will, High Skill

3.Low Performers (Direct): Low Will, Low Skill

4.Potential Detractors (Motivate): Low Will, High Skill

This PowerPoint presentation is only a small preview of our content. For more details, visit www.domontconsulting.com Oleksandr Krakovetskyi: ą×ą│ą╗čÅą┤ ą│ąĄąĮąĄčĆą░čéąĖą▓ąĮąĖčģ ą╝ąŠą┤ąĄą╗ąĄą╣ ąĘ ą╝č¢čĆą║čāą▓ą░ąĮąĮčÅą╝ (UA)

Oleksandr Krakovetskyi: ą×ą│ą╗čÅą┤ ą│ąĄąĮąĄčĆą░čéąĖą▓ąĮąĖčģ ą╝ąŠą┤ąĄą╗ąĄą╣ ąĘ ą╝č¢čĆą║čāą▓ą░ąĮąĮčÅą╝ (UA)Lviv Startup Club

╠²

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)Lviv Startup Club

╠²

20250305_A. Stotz All Weather Strategy - Weights update & Performance review ...

20250305_A. Stotz All Weather Strategy - Weights update & Performance review ...FINNOMENAMarketing

╠²

All About TDS Return Filing Online 2024.pptx

- 1. ’üČ Process ’üČ Benefits ’üČ Documents ’üČ Due Date

- 2. What is TDS Return Filing Online ’éŚ TDS i.e. Tax Deducted at Source, is the tax that has been deducted by the Government of India at the time of payments of some specific transactions including rent, commission, professional fees, salary, interest etc. ’éŚ TDS Return is the quarterly statement or summary of all the transactions related to the TDS made in the specific quarter. It includes the details of TDS that has been collected & deposited to the Income Tax Department by the deductor.

- 3. Who needs to file TDS Return? As per Income Tax Act, TDS return has been filed for the given types of payments: ’éŚ Salary income ’éŚ Income from securities ’éŚ Insurance commission ’éŚ Payments related to the NSC (National Savings Certificate) ’éŚ Earnings of winning horse races ’éŚ Earnings of winning lottery, puzzle, etc. ’éŚ Rent payment ’éŚ Sale or purchase of immovable property (house, shop etc.)

- 4. Benefits of Filing TDS Return ’éŚ Smaller payments: TDS has been deducted & paid as small amount in every three months so it will become easier to manage the finances. ’éŚ Regular Revenue: It ensures the stable flow of income for the government and supports the welfare initiatives. ’éŚ Tracking refund: By online filing, you can track your refund, and can claim any excess TDS that has been deducted. ’éŚ More convenient: Filing the TDS online can save your time & effort. ’éŚ Easy calculation of TDS: Online tools of calculating the TDS (like TDS calculator) helps you to calculate the TDS on your salary.

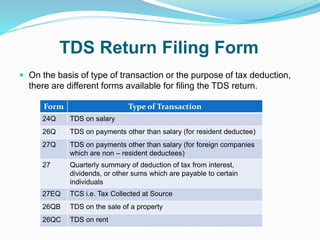

- 5. TDS Return Filing Form ’éŚ On the basis of type of transaction or the purpose of tax deduction, there are different forms available for filing the TDS return. Form Type of Transaction 24Q TDS on salary 26Q TDS on payments other than salary (for resident deductee) 27Q TDS on payments other than salary (for foreign companies which are non ŌĆō resident deductees) 27 Quarterly summary of deduction of tax from interest, dividends, or other sums which are payable to certain individuals 27EQ TCS i.e. Tax Collected at Source 26QB TDS on the sale of a property 26QC TDS on rent

- 6. TDS Return Filing Due Date ’éŚ The online TDS Return Filing Date for every quarter is as given below- Quarter Period of TDS Return Filing Due Date 1 st 1 st April to 30 th June 31 st July 2 nd 1 st July to 30 th September 31 st October 3 rd 1 st October to 31 st December 31 st January 4 th 1 st January to 31 st March 31 st May

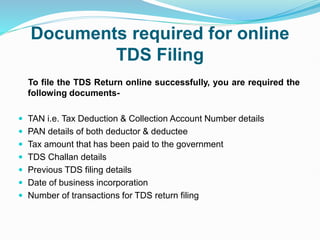

- 7. Documents required for online TDS Filing To file the TDS Return online successfully, you are required the following documents- ’éŚ TAN i.e. Tax Deduction & Collection Account Number details ’éŚ PAN details of both deductor & deductee ’éŚ Tax amount that has been paid to the government ’éŚ TDS Challan details ’éŚ Previous TDS filing details ’éŚ Date of business incorporation ’éŚ Number of transactions for TDS return filing

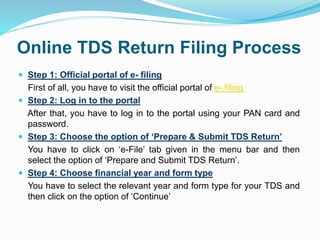

- 8. Online TDS Return Filing Process ’éŚ Step 1: Official portal of e- filing First of all, you have to visit the official portal of e- filing ’éŚ Step 2: Log in to the portal After that, you have to log in to the portal using your PAN card and password. ’éŚ Step 3: Choose the option of ŌĆśPrepare & Submit TDS ReturnŌĆÖ You have to click on ŌĆśe-FileŌĆÖ tab given in the menu bar and then select the option of ŌĆśPrepare and Submit TDS ReturnŌĆÖ. ’éŚ Step 4: Choose financial year and form type You have to select the relevant year and form type for your TDS and then click on the option of ŌĆśContinueŌĆÖ

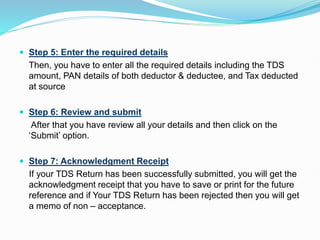

- 9. ’éŚ Step 5: Enter the required details Then, you have to enter all the required details including the TDS amount, PAN details of both deductor & deductee, and Tax deducted at source ’éŚ Step 6: Review and submit After that you have review all your details and then click on the ŌĆśSubmitŌĆÖ option. ’éŚ Step 7: Acknowledgment Receipt If your TDS Return has been successfully submitted, you will get the acknowledgment receipt that you have to save or print for the future reference and if Your TDS Return has been rejected then you will get a memo of non ŌĆō acceptance.

- 10. TDS Return late filing fees The individuals or entities who are filing TDS return after the due date have been liable to pay the penalty of Rs. 200 for per day until they file the TDS Return. In addition to this the assessing officer can impose a penalty of up to Rs. 10,000.

- 11. Conclusion Congratulations to you for entering the world online filing of TDS return. It is very important to control the tax deductions for doing the proper financial management. Understanding the process properly is the evidence of your dedication. Let LegalPillers be your guide to simplify the TDS Return Filing and donŌĆÖt let the complexities of the tax law distracts you from your core operations. Make sure that your business will stay on the right track by choosing the LegalPillers as your trusted partner in TDS Return filing.