Basel standards

- 1. Berat BAÅAT 1

- 2. ïBIS ïBasel Committee ïBASEL I ïBASEL II ïComparison of Basel I â Basel II ïBASEL III ïImplications on SMEâs 2

- 3. - To operate as the Central Bank of Europe, - To organize international payments system formed by central banks of countries. - The oldest international financial institution - Remains the principal center for international central bank cooperation. 3

- 4. Basel Committee Basel Committee on Banking Supervision - Founded in 1975 by the central bank governors of the Group of Ten countries Main Goals: - To improve the understanding of key challenges in supervision - To improve quality of banking supervision worldwide 4

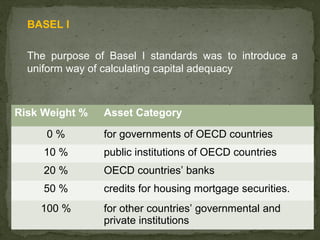

- 5. BASEL I The purpose of Basel I standards was to introduce a uniform way of calculating capital adequacy Risk Weight % Asset Category 0% for governments of OECD countries 10 % public institutions of OECD countries 20 % OECD countriesâ banks 50 % credits for housing mortgage securities. 100 % for other countriesâ governmental and private institutions 5

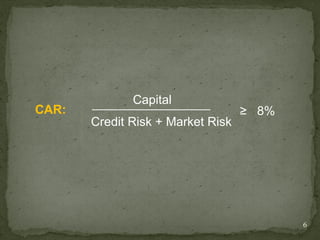

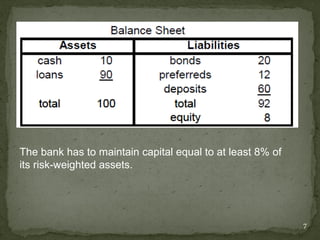

- 6. Capital CAR: âĨ 8% Credit Risk + Market Risk 6

- 7. The bank has to maintain capital equal to at least 8% of its risk-weighted assets. 7

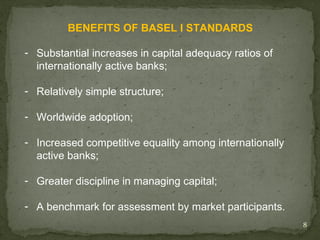

- 8. BENEFITS OF BASEL I STANDARDS - Substantial increases in capital adequacy ratios of internationally active banks; - Relatively simple structure; - Worldwide adoption; - Increased competitive equality among internationally active banks; - Greater discipline in managing capital; - A benchmark for assessment by market participants. 8

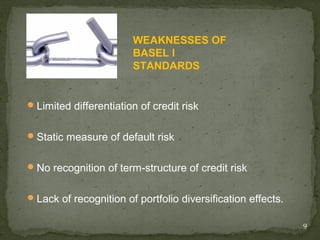

- 9. WEAKNESSES OF BASEL I STANDARDS ï Limited differentiation of credit risk ï Static measure of default risk ï No recognition of term-structure of credit risk ï Lack of recognition of portfolio diversification effects. 9

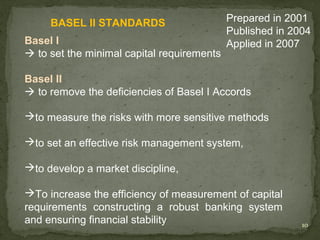

- 10. BASEL II STANDARDS Prepared in 2001 Published in 2004 Basel I Applied in 2007 ï to set the minimal capital requirements Basel II ï to remove the deficiencies of Basel I Accords ï to measure the risks with more sensitive methods ï to set an effective risk management system, ï to develop a market discipline, ï To increase the efficiency of measurement of capital requirements constructing a robust banking system and ensuring financial stability 10

- 11. 11

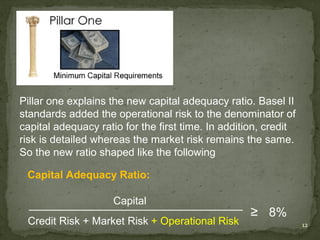

- 12. Pillar one explains the new capital adequacy ratio. Basel II standards added the operational risk to the denominator of capital adequacy ratio for the first time. In addition, credit risk is detailed whereas the market risk remains the same. So the new ratio shaped like the following Capital Adequacy Ratio: Capital âĨ 8% Credit Risk + Market Risk + Operational Risk 12

- 13. Pillar two basically focuses on the duty and responsibilities of the regulatory authorities According to the pillar two, banks need to construct more powerful risk management systems and increase the importance of internal control. Provides a framework for dealing with all the other risks a bank may face (such as systematic risk, liqudity risk) Recommends active interaction between banks and their supervisors 13

- 14. Basel II should maintain security and robustness in financial system therefore protect the capital at least in its current state. Aims to promote greater stability in the financial system. Encourages prudent management and transparency in financial reporting of banks. Focuses on effective disclosure of information and specifies the nature and type of information that should be reported to market participants. 14

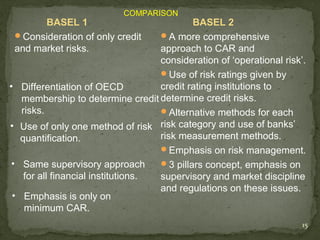

- 15. COMPARISON BASEL 1 BASEL 2 ïConsideration of only credit ïA more comprehensive and market risks. approach to CAR and consideration of âoperational riskâ. ïUse of risk ratings given by âĒ Differentiation of OECD credit rating institutions to membership to determine credit determine credit risks. risks. ïAlternative methods for each âĒ Use of only one method of risk risk category and use of banksâ quantification. risk measurement methods. ïEmphasis on risk management. âĒ Same supervisory approach ï3 pillars concept, emphasis on for all financial institutions. supervisory and market discipline and regulations on these issues. âĒ Emphasis is only on minimum CAR. 15

- 16. BASEL III Basel III is a new global regulatory standards on bank capital adequacy, leverage and liquidity to strenghten supervision and risk management of banking sector. Requires banks to hold more capital and higher quality of capital than Basel II requirements. 16

- 17. PROPOSED CHANGES 1 - The quality, consistency, and transparency of the new capital base will be raised. Tier1: Capital must be common shares and retained earnings. Tier2: Instruments will be harmonized. Tier3: Capital will be eliminated 2 - The risk coverage of the capital framework will be strengthened. 17

- 18. 3 - The committee will introduce a leverage ratio as a supplementary measure to the Basel II risk based framework 4 - The committee is reviewing the need for additional capital, liquidity or other supervisory measures to reduce the externalities created by systematically important situations. 18

- 19. IMPORTANCE OF SMEâs - SMEs tend to employ more labor-intensive production processes than large enterprises. Accordingly, they contribute significantly to the new employment opportunities, the generation of income and ultimately, the reduction of poverty. - SMEs are keys to the transition of agricultural to industrial economies as they provide simple opportunities for processing activities - SMEs are good examples for entrepreneurship development, innovation and risk taking behavior and the transition towards larger enterprises 19

- 20. SMEs support the building up of systemic productive capacities. help to absorb productive resources at all levels of the economy contribute to the creation of flexible economic systems in which small and large firms are interlinked. 20

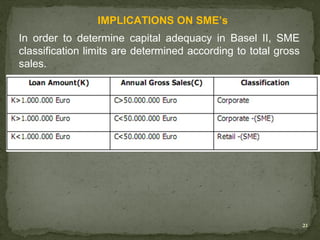

- 21. IMPLICATIONS ON SMEâs In order to determine capital adequacy in Basel II, SME classification limits are determined according to total gross sales. 21

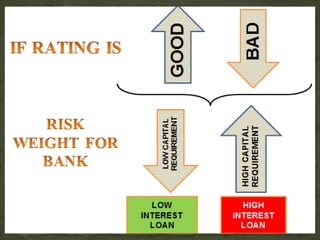

- 22. If banks do not use the advanced methodologies that Basel II proposes, their capital needs will increase and this will bring out the situation that they convey this extra cost to their credit packages. The consequence has noticeable implications on SMEs especially in developing countries. In contrast, if banks apply Basel II Standard and its total loan exceed one million Euros, it will be evaluated in the corporate portfolio and the risk rating note that is given by external rating agencies will be considered by the banks. This situation will inevitably affect the enterprises that use high amount of loans. 22

- 23. The percentage of SMEs out of the total number of firms in OECD countries is greater than 97 percent, generating over half of private sector employment. Their contribution to employment, adoptability to new developments due to their flexible nature, creation of product differentiation, provision of intermediate goods are considerable attribution for an economy. 23

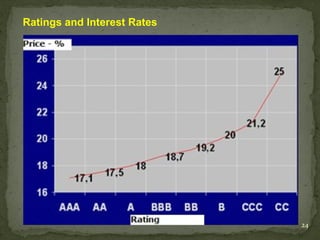

- 24. Ratings and Interest Rates 24

- 25. 25

- 26. - Definition of SMEs has been changed - Credit pricing will be made related to risk - SMEâs will have to take a degree from banks or rating agencies in order to determination of its credit risk - The assets that can be showed as a warranty has been redefined. -Registration and reporting of financial information and transparency has become much more important. -The SMEs will try to seek different sources of finances 26

- 27. 27