Boris Dragan Desancic

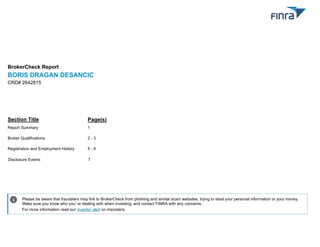

- 1. BrokerCheck Report BORIS DRAGAN DESANCIC Section Title Report Summary Broker Qualifications Registration and Employment History Disclosure Events CRD# 2642815 1 2 - 3 5 - 6 7 Page(s) Please be aware that fraudsters may link to BrokerCheck from phishing and similar scam websites, trying to steal your personal information or your money. Make sure you know who you’re dealing with when investing, and contact FINRA with any concerns. For more information read our investor alert on imposters. i

- 2. About BrokerCheck? BrokerCheck offers information on all current, and many former, registered securities brokers, and all current and former registered securities firms. FINRA strongly encourages investors to use BrokerCheck to check the background of securities brokers and brokerage firms before deciding to conduct, or continue to conduct, business with them. · What is included in a BrokerCheck report? · BrokerCheck reports for individual brokers include information such as employment history, professional qualifications, disciplinary actions, criminal convictions, civil judgments and arbitration awards. BrokerCheck reports for brokerage firms include information on a firm’s profile, history, and operations, as well as many of the same disclosure events mentioned above. · Please note that the information contained in a BrokerCheck report may include pending actions or allegations that may be contested, unresolved or unproven. In the end, these actions or allegations may be resolved in favor of the broker or brokerage firm, or concluded through a negotiated settlement with no admission or finding of wrongdoing. · Where did this information come from? · The information contained in BrokerCheck comes from FINRA’s Central Registration Depository, or CRD? and is a combination of: o information FINRA and/or the Securities and Exchange Commission (SEC) require brokers and brokerage firms to submit as part of the registration and licensing process, and o information that regulators report regarding disciplinary actions or allegations against firms or brokers. · How current is this information? · Generally, active brokerage firms and brokers are required to update their professional and disciplinary information in CRD within 30 days. Under most circumstances, information reported by brokerage firms, brokers and regulators is available in BrokerCheck the next business day. · What if I want to check the background of an investment adviser firm or investment adviser representative? · To check the background of an investment adviser firm or representative, you can search for the firm or individual in BrokerCheck. If your search is successful, click on the link provided to view the available licensing and registration information in the SEC's Investment Adviser Public Disclosure (IAPD) website at https://www.adviserinfo.sec.gov. In the alternative, you may search the IAPD website directly or contact your state securities regulator at http://www.finra.org/Investors/ToolsCalculators/BrokerCheck/P455414. · Are there other resources I can use to check the background of investment professionals? · FINRA recommends that you learn as much as possible about an investment professional before deciding to work with them. Your state securities regulator can help you research brokers and investment adviser representatives doing business in your state. · Thank you for using FINRA BrokerCheck. For more information about FINRA, visit www.finra.org. Using this site/information means that you accept the FINRA BrokerCheck Terms and Conditions. A complete list of Terms and Conditions can be found at For additional information about the contents of this report, please refer to the User Guidance or www.finra.org/brokercheck. It provides a glossary of terms and a list of frequently asked questions, as well as additional resources. brokercheck.finra.org

- 3. BORIS D. DESANCIC CRD# 2642815 This broker is not currently registered. Report Summary for this Broker This report summary provides an overview of the broker's professional background and conduct. Additional information can be found in the detailed report. Disclosure Events All individuals registered to sell securities or provide investment advice are required to disclose customer complaints and arbitrations, regulatory actions, employment terminations, bankruptcy filings, and criminal or civil judicial proceedings. Are there events disclosed about this broker? Yes The following types of disclosures have been reported: Type Count Regulatory Event 1 Investment Adviser Representative Information https://www.adviserinfo.sec.gov The information below represents the individual's record as a broker. For details on this individual's record as an investment adviser representative, visit the SEC's Investment Adviser Public Disclosure website at Broker Qualifications This broker is not currently registered. This broker has passed: 1 Principal/Supervisory Exam 3 General Industry/Product Exams 2 State Securities Law Exams Registration History This broker was previously registered with the following securities firm(s): WADDELL & REED CRD# 866 BELLEVUE, WA 01/2001 - 04/2019 B THE LEADERS GROUP, INC. CRD# 37157 LITTLETON, CO 09/2000 - 01/2001 B ASCEND FINANCIAL SERVICES, INC. CRD# 15296 ST. PAUL, MN 07/1997 - 08/2000 B www.finra.org/brokercheck User Guidance 1 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 4. www.finra.org/brokercheck User Guidance Broker Qualifications Registrations This section provides the self-regulatory organizations (SROs) and U.S. states/territories the broker is currently registered and licensed with, the category of each license, and the date on which it became effective. This section also provides, for every brokerage firm with which the broker is currently employed, the address of each branch where the broker works. This broker is not currently registered. 2 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 5. www.finra.org/brokercheck User Guidance Broker Qualifications Industry Exams this Broker has Passed This individual has passed 1 principal/supervisory exam, 3 general industry/product exams, and 2 state securities law exams. This section includes all securities industry exams that the broker has passed. Under limited circumstances, a broker may attain a registration after receiving an exam waiver based on exams the broker has passed and/or qualifying work experience. Any exam waivers that the broker has received are not included below. Exam Category Date Principal/Supervisory Exams General Securities Principal Examination 08/21/2001 Series 24 B Exam Category Date General Industry/Product Exams Securities Industry Essentials Examination 10/01/2018 SIE B General Securities Representative Examination 03/08/2001 Series 7 B Investment Company Products/Variable Contracts Representative Examination 08/23/1995 Series 6 B Exam Category Date State Securities Law Exams Uniform Investment Adviser Law Examination 11/02/1998 Series 65 IA Uniform Securities Agent State Law Examination 09/12/1995 Series 63 B Additional information about the above exams or other exams FINRA administers to brokers and other securities professionals can be found at www.finra.org/brokerqualifications/registeredrep/. 3 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 6. www.finra.org/brokercheck User Guidance Broker Qualifications Professional Designations This section details that the representative has reported 0 professional designation(s). No information reported. 4 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 7. www.finra.org/brokercheck User Guidance Registration and Employment History Registration History Registration Dates Firm Name CRD# Branch Location The broker previously was registered with the following firms: B 01/2001 - 04/2019 WADDELL & REED 866 BELLEVUE, WA B 09/2000 - 01/2001 THE LEADERS GROUP, INC. 37157 LITTLETON, CO B 07/1997 - 08/2000 ASCEND FINANCIAL SERVICES, INC. 15296 ST. PAUL, MN B 08/1995 - 06/1997 BMA FINANCIAL SERVICES, INC. 7943 KANSAS CITY, MO Employment History Employment Employer Name Investment Related Position Employer Location This section provides up to 10 years of an individual broker's employment history as reported by the individual broker on the most recently filed Form U4. Please note that the broker is required to provide this information only while registered with FINRA or a national securities exchange and the information is not updated via Form U4 after the broker ceases to be registered. Therefore, an employment end date of "Present" may not reflect the broker's current employment status. 09/2019 - Present CLEAR CREEK FINANCIAL MANAGEMENT, LLC Investment Advisor Representative Y SILVERDALE, WA, United States 05/2016 - Present REDEEMING SOLES BOARD MEMBER N SEATTLE, WA, United States 05/2019 - 08/2019 PCG Wealth Advisors, LLC Investment Advisor Representative Y Overland Park, KS, United States 09/2010 - 05/2019 RENTAL PROPERTY OWNER N SEATTLE, WA, United States 02/2001 - 04/2019 VARIOUS INSURANCE CARRIERS FOR W & R INSURANCE AGENCIES INSURANCE AGENT Y SEATTLE, WA, United States 01/2001 - 04/2019 WADDELL & REED, INC. ASSOCIATED PERSON Y SEATTLE, WA, United States Other Business Activities This section includes information, if any, as provided by the broker regarding other business activities the broker is currently engaged in either as a proprietor, partner, officer, director, employee, trustee, agent or otherwise. This section does not include non-investment related activity that is exclusively charitable, civic, religious or fraternal and is recognized as tax exempt. 1. REDEEMING SOLES 2. INVESTMENT RELATED: No 3. SEATTLE, WA 4. NON PROFIT 5. BOARD MEMBER 5 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 8. www.finra.org/brokercheck User Guidance Registration and Employment History Other Business Activities, continued 1. REDEEMING SOLES 2. INVESTMENT RELATED: No 3. SEATTLE, WA 4. NON PROFIT 5. BOARD MEMBER 6. 05/2016-PRESENT 7. 8 HRS/MO, 8. 0 SEC HRS. 9. Chairman of the board, not active employee 1. Boris Desancic Consulting 2. Non-investment related 3. 965 N Armstrong Drive, Coeur D Alene, ID 83814 4. Consulting Services 5. Position held: consultant 6. Start date: Sep 19th 7. 60 hours 8. 30 hours 9. Coach and mentor financial advisors toward having better and bigger practices 1. WestPac Wealth Partners, LLC/ Guardian Life Insurance Company 2. Non-investment related 3. 4275 Executive Square, Suite 800, La Jolla, CA 92037 4. Insurance Brokerage 5. Agent 6. Start Date May 8th 2019 7. 0 hours 8. 0 hours 9. I sell life and disability insurance The Grape Basket; Not investment related; Seattle, WA; Website for small wineries; Advisor to the business; Advisor; February 2021; 1 hour per day during trading hours; Advise the business operations 6 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 9. www.finra.org/brokercheck User Guidance Disclosure Events What you should know about reported disclosure events: 1. All individuals registered to sell securities or provide investment advice are required to disclose customer complaints and arbitrations, regulatory actions, employment terminations, bankruptcy filings, and criminal or civil judicial proceedings. 2. Certain thresholds must be met before an event is reported to CRD, for example: o A law enforcement agency must file formal charges before a broker is required to disclose a particular criminal event. o A customer dispute must involve allegations that a broker engaged in activity that violates certain rules or conduct governing the industry and that the activity resulted in damages of at least $5,000. o 3. Disclosure events in BrokerCheck reports come from different sources: o As mentioned at the beginning of this report, information contained in BrokerCheck comes from brokers, brokerage firms and regulators. When more than one of these sources reports information for the same disclosure event, all versions of the event will appear in the BrokerCheck report. The different versions will be separated by a solid line with the reporting source labeled. o 4. There are different statuses and dispositions for disclosure events: o A disclosure event may have a status of pending, on appeal, or final. § A "pending" event involves allegations that have not been proven or formally adjudicated. § An event that is "on appeal" involves allegations that have been adjudicated but are currently being appealed. § A "final" event has been concluded and its resolution is not subject to change. o A final event generally has a disposition of adjudicated, settled or otherwise resolved. § An "adjudicated" matter includes a disposition by (1) a court of law in a criminal or civil matter, or (2) an administrative panel in an action brought by a regulator that is contested by the party charged with some alleged wrongdoing. § A "settled" matter generally involves an agreement by the parties to resolve the matter. Please note that brokers and brokerage firms may choose to settle customer disputes or regulatory matters for business or other reasons. § A "resolved" matter usually involves no payment to the customer and no finding of wrongdoing on the part of the individual broker. Such matters generally involve customer disputes. For your convenience, below is a matrix of the number and status of disclosure events involving this broker. Further information regarding these events can be found in the subsequent pages of this report. You also may wish to contact the broker to obtain further information regarding these events. Final On Appeal Pending Regulatory Event 0 1 0 7 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 10. www.finra.org/brokercheck User Guidance Disclosure Event Details When evaluating this information, please keep in mind that a discloure event may be pending or involve allegations that are contested and have not been resolved or proven. The matter may, in the end, be withdrawn, dismissed, resolved in favor of the broker, or concluded through a negotiated settlement for certain business reasons (e.g., to maintain customer relationships or to limit the litigation costs associated with disputing the allegations) with no admission or finding of wrongdoing. This report provides the information exactly as it was reported to CRD and therefore some of the specific data fields contained in the report may be blank if the information was not provided to CRD. Regulatory - Final This type of disclosure event may involve (1) a final, formal proceeding initiated by a regulatory authority (e.g., a state securities agency, self- regulatory organization, federal regulatory such as the Securities and Exchange Commission, foreign financial regulatory body) for a violation of investment-related rules or regulations; or (2) a revocation or suspension of a broker's authority to act as an attorney, accountant, or federal contractor. Disclosure 1 of 1 Reporting Source: Regulator Regulatory Action Initiated By: Washington Sanction(s) Sought: Other: Heightened Supervision Plan Date Initiated: 09/17/2019 Docket/Case Number: S-19-2706-19-CO01 URL for Regulatory Action: Employing firm when activity occurred which led to the regulatory action: Product Type: No Product Allegations: On September 17, 2019, the Securities Division entered into a Consent Order S- 19-2706-19-CO01 with Boris Desancic (CRD 2642815) ("Consent Order"). The Consent Order states that Mr. Desancic was terminated as an investment adviser representative from his employing firm for violating the firm's policy on private securities transactions. In the Consent Order Mr. Desancic agreed that before an application for registration as an investment adviser representative for him is approved, his sponsoring firm must provide the Securities Division an acceptable plan of supervision. Respondent waived his right to judicial review of the matter. Current Status: Final Resolution: 8 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 11. www.finra.org/brokercheck User Guidance Resolution: Stipulation and Consent Resolution Date: 09/17/2019 Sanctions Ordered: Does the order constitute a final order based on violations of any laws or regulations that prohibit fraudulent, manipulative, or deceptive conduct? No Other: Heightened supervision plan i Reporting Source: Broker Regulatory Action Initiated By: State of Washington Department of Financial Institutions Securities Division Sanction(s) Sought: Other: Heightened supervision Date Initiated: 09/06/2019 Docket/Case Number: S-19-2706-19-CO01 Employing firm when activity occurred which led to the regulatory action: Waddell and Reed, Inc. Product Type: No Product Allegations: Respondent was alleged to failed to disclose to his firm the requested information and documents regarding the sales of securities of promissory notes issued by his wife's company, and for representing to his firm that his wife's company did not sell securities when the company had issued promissory notes to investors. Current Status: Final Resolution: Order Resolution Date: 09/06/2019 Does the order constitute a final order based on violations of any laws or regulations that prohibit fraudulent, manipulative, or deceptive conduct? Yes 9 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 12. www.finra.org/brokercheck User Guidance Sanctions Ordered: Other: Prior to registration as an investment advisor representative or securities salesperson is approved for Respondent, the state must approve a heightened supervision for two years. Respondent will not be a principal, owner, officer, or director of an investment advisor or broker dealer for two years. 10 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.

- 13. www.finra.org/brokercheck User Guidance End of Report This page is intentionally left blank. 11 ?2023 FINRA. All rights reserved. Report about BORIS D. DESANCIC.