Caltrain tax legal opinion

0 likes473 views

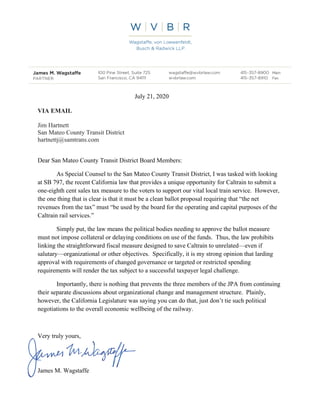

The letter discusses a recent California law, SB 797, that provides an opportunity for Caltrain to place a one-eighth cent sales tax measure on the ballot to support its rail services. The law requires that the net revenues from the tax must be used solely for Caltrain's operating and capital purposes. Specifically, any political body approving the ballot measure cannot impose additional conditions on the use of funds or link the fiscal measure to unrelated organizational objectives. Doing so could render the tax vulnerable to a legal challenge. Separate discussions about potential changes to Caltrain's governance or management structure can continue but should not be tied to approval of the economic measure.

1 of 1

Download to read offline

Ad

Recommended

Legislative Advocacy - What MACPA does for you that nobody else does

Legislative Advocacy - What MACPA does for you that nobody else doesTom Hood, CPA,CITP,CGMA

?

The document discusses the legislative advocacy efforts of the Maryland Association of CPAs (MACPA), which focuses on both proactive and defensive strategies to influence accounting laws and regulations. It highlights the importance of relationships with legislators and grassroots support to address challenges faced by the CPA profession. The MACPA encourages full membership and participation in events to strengthen its advocacy initiatives.Lottery Structure in Arkansas

Lottery Structure in ArkansasRobbie Wills

?

The document discusses key considerations for establishing the Arkansas Scholarship Lottery, including its organizational structure, how proceeds will fund scholarships, and best practices. It recommends operating the lottery as a state-owned corporation to balance business and regulatory needs. The corporation would license retailers to sell tickets, with profits funding scholarships while returning prizes to players and income to the state.Project Delivery Workshop # 2 狠狠撸s.pdf

Project Delivery Workshop # 2 狠狠撸s.pdfAdina Levin

?

This document discusses opportunities to improve major transportation projects in the Bay Area through two initiatives:

1. Transit 2050+, a connected network plan that would establish a long-term vision and priorities for regional transit to guide project selection.

2. The Major Project Advancement Policy (MAP) used by MTC to sequence funding for large projects. The MAP could be strengthened over time through progressive stage gates to better manage risks and ensure policy alignment as projects develop.

Regional planning efforts should focus first on developing a service-based vision through Transit 2050+ before prioritizing individual projects to deliver that vision. Close coordination is needed between Transit 2050+ and the MAP to advance the right projects. AdvocacySPUR + TransbayCoalition-Project Delivery Workshop 1 08.31.22.pdf

SPUR + TransbayCoalition-Project Delivery Workshop 1 08.31.22.pdfAdina Levin

?

The document addresses the challenges and solutions associated with transit megaprojects in the Bay Area, emphasizing the need for improved governance, better cost estimation, and enhanced procurement expertise. It outlines recommendations for regional planning and project delivery to expedite transit projects while managing costs effectively. Key initiatives include the establishment of Infrastructure Bay Area and a major project advancement policy aimed at reducing risks and improving project outcomes.megaprojects, SPUR 2022.pdf

megaprojects, SPUR 2022.pdfAdina Levin

?

This document explores the characteristics and challenges associated with transportation megaprojects, highlighting their tendency for cost overruns, incorrect usage forecasts, and complexity. Key traits, defined as the 7 'C's, include being colossal, costly, and controversial, while also illustrating significant issues such as transaction costs and path dependence. Recommendations for improvement focus on enhanced cost estimating, project management, and the need for transparent public engagement in decision-making processes.Southeast San Francisco New Caltrain Stations

Southeast San Francisco New Caltrain StationsAdina Levin

?

The document outlines planning for new Caltrain stations in Southeast San Francisco, highlighting various zones, vulnerability to sea level rise, and the environmental justice communities map. It includes discussions on station options, their pros and cons, as well as public feedback mechanisms. The planning is still in progress, with opportunities for public engagement and potential revisions based on new data.Regional options for caltrain governance

Regional options for caltrain governanceAdina Levin

?

This document discusses options for regional governance of Caltrain and transit connectivity in the Bay Area. It outlines Caltrain's evolution from standalone commuter rail to a vision of integrated, all-day regional service. A key part of this vision is improving connections to benefit equity. The region now has an opportunity to organize itself to deliver needed capital investments by considering a network manager approach. A network manager could coordinate functions like planning, funding, customer experience, and operations across transit agencies at various levels from light to strong coordination. The document closes by noting upcoming discussions and studies that could impact Caltrain governance and regional rail integration.SF resolution Caltrain sales tax

SF resolution Caltrain sales taxAdina Levin

?

The document is a resolution approving a one-eighth percent sales tax to support Caltrain services during the November 3, 2020 election, aimed at addressing operational and capital funding challenges faced by the Joint Powers Board (JPB). The tax will provide a dedicated funding source for maintaining and expanding service levels, including the electrification of the Caltrain system, and will be subject to specific governance and operational conditions. The resolution also outlines the necessary steps and approvals needed for the tax measure to be placed on the ballot and its implementation.Senator Hill letter SB797 Caltrain

Senator Hill letter SB797 CaltrainAdina Levin

?

Senator Jerry Hill urges the Santa Clara County Board of Supervisors to approve a clean Caltrain funding measure for the ballot, highlighting the urgent need for dedicated revenue to ensure the system's survival post-pandemic. He argues that attaching restrictions on the funds would undermine the intent of his legislation (SB 797) and could jeopardize the measure's viability and legality. Hill emphasizes that a clean measure has broad support and is crucial to prevent Caltrain's shutdown.West Bay Legislators support Caltrain ballot measure

West Bay Legislators support Caltrain ballot measureAdina Levin

?

The letter urges Caltrain and its member agencies to place a measure on the November 2020 ballot to secure a dedicated funding source, vital for Caltrain's survival amid ongoing COVID-19 challenges. It emphasizes the critical need for investment to modernize Caltrain's services, as well as the importance of identifying governance reforms for long-term resiliency. The signatories express their support and readiness to assist in this effort.Caltrain_Equity_522

Caltrain_Equity_522Adina Levin

?

Caltrain is undertaking an equity assessment to understand how to improve equity within the transit system as ridership grows. Feedback from stakeholders highlighted areas like improving off-peak and weekend service, providing more affordable fares for low-income riders, developing affordable housing near stations, and enhancing bike/pedestrian access and connecting bus services. An analysis found Caltrain ridership does not proportionally represent the diverse demographic groups within the corridor that parallel transit serves better through more frequent all-day service. Caltrain will explore scheduling changes, cost structures, and access/connectivity to increase ridership among marginalized communities.San Jose Transit first policy nomination

San Jose Transit first policy nominationAdina Levin

?

Develop a city-wide transit first policy framework to prioritize transit and make it faster, more useful, and a more viable option compared to driving. The policy would require considering transit improvements like bus-only lanes and signal priority on streets with high transit ridership or slow speeds. This is intended to increase transit speeds from the current 11.6 miles per hour to help more residents choose transit over driving, reduce costs for transit agencies, lower emissions, and expand access to opportunities in San José. The policy may require increased capital costs but could save on transit agency operating costs over time. City funding would likely be required.More Homes Less Driving TransForm 2-6-20

More Homes Less Driving TransForm 2-6-20Adina Levin

?

This document provides information on several topics related to green transportation and transit-oriented development certification including:

- GreenTRIP Certification which certifies developers

- Requirements for certification related to vehicle parking, traffic reduction strategies, vehicle miles traveled, and bicycle parking

- The GreenTRIP Connect tool which calculates reductions in parking demand, driving, and greenhouse gas emissions

- A parking database

- Policy adoptions by several California cities and agencies that utilize the GreenTRIP Certification and Connect toolMore Homes Less Driving Sares Regis 2-6-20

More Homes Less Driving Sares Regis 2-6-20Adina Levin

?

This developer has been based in San Mateo for 25 years and focuses on community, smart growth, sustainability, and building great places. They currently have over 3,000 homes under development across multiple cities in the Bay Area, as well as some commercial and office projects. Their core values include community focus, sustainability, relationships, discipline, and collaboration.More Homes Less Driving First Community Housing 2-6-20

More Homes Less Driving First Community Housing 2-6-20Adina Levin

?

FCH is a nonprofit housing organization that has built over 21 affordable housing properties serving over 4,000 residents over the past 30 years. They are redeveloping an existing 62-unit property called Orchard Gardens in Sunnyvale to add 115 units total, including supportive housing. They are also exploring alternative transportation options like smart passes, scooter discounts, and bike infrastructure to reduce costs and increase access for residents after housing expenses. Their newest project, Betty Ann Gardens, will include 76 affordable units and a mobility hub in San Jose's Berryessa district to further these transportation and sustainability goals.Fj pa-friendsof caltrain-levin-responseltr-10-09-2019 (1) (1)

Fj pa-friendsof caltrain-levin-responseltr-10-09-2019 (1) (1)Adina Levin

?

The letter responds to concerns raised by Friends of Caltrain about the relationship between the California High-Speed Rail project and other local planning efforts like the Caltrain Business Plan and Diridon Integrated Station Concept Plan. It explains that the High-Speed Rail project has been planned collaboratively with Caltrain since 2012 to develop a blended system, and that while the plans will be considered, they will require their own environmental clearances in the future. The letter also states that the High-Speed Rail project will not preclude the other plans from moving forward and that the agencies will continue to work together on long-term plans for the rail corridor.Caltrain 20190822 (1) (1)

Caltrain 20190822 (1) (1)Adina Levin

?

Caltrain letter to High Speed Rail regarding SF-SJ EIR preferred alternativeHigh speed rail eir preferred alternative sf-sj - fo c (1) (1)

High speed rail eir preferred alternative sf-sj - fo c (1) (1)Adina Levin

?

The document discusses two key areas where the High Speed Rail EIR's plans are out of sync with regional planning efforts: passing tracks on the Caltrain corridor and Diridon Station in San Jose. For passing tracks, the document notes that Caltrain plans to increase ridership by running more frequent trains, which will require additional passing tracks that are not included in the High Speed Rail EIR preferred alternative. It also notes that the Diridon Station plans in the EIR will likely be superseded by the Diridon Station Concept Plan. The document requests that High Speed Rail update its analysis to account for updated information and plans from Caltrain and the Diridon Station process.Dumbarton Crossbay

Dumbarton Crossbay Adina Levin

?

The document provides an overview of the Dumbarton Rail Corridor project including:

1) The roles and responsibilities of the key project partners - San Mateo County Transit District, Cross Bay Transit Partners (Facebook and Plenary Group), and regulatory agencies.

2) Updates on engineering and environmental work including potential station sites, alignment options, and key environmental topics.

3) Details on the public outreach process including recent introductory meetings and themes from community feedback.

4) The anticipated project schedule and timeline for environmental review and permitting, engineering, and construction.San Francisco Board of Supervisors Caltrain Governance Resolution

San Francisco Board of Supervisors Caltrain Governance ResolutionAdina Levin

?

The document is a resolution supporting the establishment of a strengthened independent agency to oversee the future development of Caltrain and high-speed rail projects between San Francisco and Gilroy. It highlights the growing ridership demand, the need for improved service, and the importance of modernizing the rail system while addressing financial challenges. The resolution aims to solidify Caltrain's role in promoting economic growth and reducing greenhouse gas emissions in the region.Connecting Communities Optimizing Highways Event April 18

Connecting Communities Optimizing Highways Event April 18Adina Levin

?

This document proposes how funds from a San Mateo County transportation expenditure plan should be allocated. It recommends that 60% of funds go to public transit and paratransit services, including more bus service and fare programs. An additional 10% each should go to expanding bike/pedestrian infrastructure and programs to reduce solo driving, such as subsidies for carpooling. The remaining funds would support local streets/roads projects, transit grade separations, intelligent transportation systems, and affordable housing near transit.Irfp 1819 07 dtx project delivery review services

Irfp 1819 07 dtx project delivery review servicesAdina Levin

?

1) The San Francisco County Transportation Authority is requesting proposals from qualified firms to provide governance, oversight, management, and project delivery consultant services to review the Downtown Extension rail project.

2) The project aims to extend Caltrain 1.3 miles into the new Transbay Transit Center. The estimated cost is $4 billion. Recent issues with cost overruns and delays on the transit center portion have raised concerns about oversight of the rail extension portion.

3) The consultant team will review international best practices, project delivery and funding strategies, and make recommendations to strengthen governance and oversight models, with the goal of ensuring the rail extension is delivered on time and on budget. The effort will include research, interviews, workshops, and2018 TIMMA toll policy recommendations final

2018 TIMMA toll policy recommendations finalAdina Levin

?

The document outlines recommendations for the Treasure Island Transit Pass, toll policy, and affordability program as part of the Treasure Island Transportation Implementation Plan. It details an integrated approach to managing travel demand and enhancing mobility on Treasure Island, including proposed transit pass options, toll pricing structures, and affordability measures for residents. The board's approval is sought to move forward with the design and implementation of these policies by December 2018.More Caltrain service to South San Jose and South Santa Clara County

More Caltrain service to South San Jose and South Santa Clara CountyAdina Levin

?

The document discusses plans to increase Caltrain service to South San Jose and South Santa Clara County. Currently there are 3 round trips south of the Diridon station, but funding from Measure B allows for potentially increasing service up to 5 round trips by 2020-2022. Future plans include electrified Caltrain service and integrating with high speed rail, which would require environmental review and agreements with Union Pacific. The document encourages public participation in the Caltrain business planning process to help shape decisions around increasing service in the south county area.VTA Rfp s18181 strategic plan for high capacity transit corridors final

VTA Rfp s18181 strategic plan for high capacity transit corridors finalAdina Levin

?

This document is a Request for Proposals from Santa Clara Valley Transportation Authority (VTA) seeking proposals from qualified consulting teams to conduct a planning study evaluating conceptual High Capacity Transit corridors in Santa Clara County. The study will examine the suitability of light rail transit, bus rapid transit, and other rapid transit options. Proposals are due by September 12, 2018. The RFP provides instructions to proposers, outlines proposer qualifications, evaluation criteria, proposal requirements, and the project scope of services.MTC RFQ Alameda County Rail Connections

MTC RFQ Alameda County Rail ConnectionsAdina Levin

?

The Metropolitan Transportation Commission (MTC) is soliciting Statements of Qualifications (SOQs) for the Southern Alameda County Integrated Rail Analysis, which aims to evaluate passenger rail needs in the region. Interested firms must submit proposals by 4:00 p.m. on October 18, 2018, with an estimated budget of $5.5 million and a project completion date of December 31, 2020. The chosen consultant will perform planning, feasibility analysis, and initial design work focused on improving rail connectivity and addressing operational issues in the area.5-23-18 - Means Based joint support letter

5-23-18 - Means Based joint support letter Adina Levin

?

The document expresses support for a proposed means-based transit fare discount pilot program, emphasizing the need for a focused initial rollout and independent evaluation. Key recommendations include user-centered design, deeper discounts, fare streamlining, and a roadmap for improvements based on evaluation outcomes. The goal is to achieve equitable access to transit while increasing ridership through collaboration among regional transit agencies.2016 11-03 ta bod highway-101-92 interchange

2016 11-03 ta bod highway-101-92 interchangeAdina Levin

?

This document summarizes the findings of a preliminary planning study for improvements to the US 101/SR 92 interchange in San Mateo County. It outlines the study process and presents alternatives that were developed and evaluated to address traffic congestion and safety issues. Short term and long term alternatives are proposed. Recommended alternatives include improvements to ramp configurations, added lanes, and new direct connectors. Next steps involve determining which alternatives to advance based on stakeholder input and funding availability.Trusted Site To Buy Verified Payoneer Accounts In This Time.pdf

Trusted Site To Buy Verified Payoneer Accounts In This Time.pdfhttps://top5starshop.com/product/buy-verified-cash-app-accounts/

?

? 24/7 Hours Reply/Contact ? Telegram: @Top5StarShop ? WhatsApp: +1 (470) 206-8684 ? Email: top5starshop99@gmail.comUN World Marine Fishery Health Situation Full Report 2025

UN World Marine Fishery Health Situation Full Report 2025Energy for One World

?

UN FAO report

June 2025

Nice UN Oceans ConferenceMore Related Content

More from Adina Levin (20)

Senator Hill letter SB797 Caltrain

Senator Hill letter SB797 CaltrainAdina Levin

?

Senator Jerry Hill urges the Santa Clara County Board of Supervisors to approve a clean Caltrain funding measure for the ballot, highlighting the urgent need for dedicated revenue to ensure the system's survival post-pandemic. He argues that attaching restrictions on the funds would undermine the intent of his legislation (SB 797) and could jeopardize the measure's viability and legality. Hill emphasizes that a clean measure has broad support and is crucial to prevent Caltrain's shutdown.West Bay Legislators support Caltrain ballot measure

West Bay Legislators support Caltrain ballot measureAdina Levin

?

The letter urges Caltrain and its member agencies to place a measure on the November 2020 ballot to secure a dedicated funding source, vital for Caltrain's survival amid ongoing COVID-19 challenges. It emphasizes the critical need for investment to modernize Caltrain's services, as well as the importance of identifying governance reforms for long-term resiliency. The signatories express their support and readiness to assist in this effort.Caltrain_Equity_522

Caltrain_Equity_522Adina Levin

?

Caltrain is undertaking an equity assessment to understand how to improve equity within the transit system as ridership grows. Feedback from stakeholders highlighted areas like improving off-peak and weekend service, providing more affordable fares for low-income riders, developing affordable housing near stations, and enhancing bike/pedestrian access and connecting bus services. An analysis found Caltrain ridership does not proportionally represent the diverse demographic groups within the corridor that parallel transit serves better through more frequent all-day service. Caltrain will explore scheduling changes, cost structures, and access/connectivity to increase ridership among marginalized communities.San Jose Transit first policy nomination

San Jose Transit first policy nominationAdina Levin

?

Develop a city-wide transit first policy framework to prioritize transit and make it faster, more useful, and a more viable option compared to driving. The policy would require considering transit improvements like bus-only lanes and signal priority on streets with high transit ridership or slow speeds. This is intended to increase transit speeds from the current 11.6 miles per hour to help more residents choose transit over driving, reduce costs for transit agencies, lower emissions, and expand access to opportunities in San José. The policy may require increased capital costs but could save on transit agency operating costs over time. City funding would likely be required.More Homes Less Driving TransForm 2-6-20

More Homes Less Driving TransForm 2-6-20Adina Levin

?

This document provides information on several topics related to green transportation and transit-oriented development certification including:

- GreenTRIP Certification which certifies developers

- Requirements for certification related to vehicle parking, traffic reduction strategies, vehicle miles traveled, and bicycle parking

- The GreenTRIP Connect tool which calculates reductions in parking demand, driving, and greenhouse gas emissions

- A parking database

- Policy adoptions by several California cities and agencies that utilize the GreenTRIP Certification and Connect toolMore Homes Less Driving Sares Regis 2-6-20

More Homes Less Driving Sares Regis 2-6-20Adina Levin

?

This developer has been based in San Mateo for 25 years and focuses on community, smart growth, sustainability, and building great places. They currently have over 3,000 homes under development across multiple cities in the Bay Area, as well as some commercial and office projects. Their core values include community focus, sustainability, relationships, discipline, and collaboration.More Homes Less Driving First Community Housing 2-6-20

More Homes Less Driving First Community Housing 2-6-20Adina Levin

?

FCH is a nonprofit housing organization that has built over 21 affordable housing properties serving over 4,000 residents over the past 30 years. They are redeveloping an existing 62-unit property called Orchard Gardens in Sunnyvale to add 115 units total, including supportive housing. They are also exploring alternative transportation options like smart passes, scooter discounts, and bike infrastructure to reduce costs and increase access for residents after housing expenses. Their newest project, Betty Ann Gardens, will include 76 affordable units and a mobility hub in San Jose's Berryessa district to further these transportation and sustainability goals.Fj pa-friendsof caltrain-levin-responseltr-10-09-2019 (1) (1)

Fj pa-friendsof caltrain-levin-responseltr-10-09-2019 (1) (1)Adina Levin

?

The letter responds to concerns raised by Friends of Caltrain about the relationship between the California High-Speed Rail project and other local planning efforts like the Caltrain Business Plan and Diridon Integrated Station Concept Plan. It explains that the High-Speed Rail project has been planned collaboratively with Caltrain since 2012 to develop a blended system, and that while the plans will be considered, they will require their own environmental clearances in the future. The letter also states that the High-Speed Rail project will not preclude the other plans from moving forward and that the agencies will continue to work together on long-term plans for the rail corridor.Caltrain 20190822 (1) (1)

Caltrain 20190822 (1) (1)Adina Levin

?

Caltrain letter to High Speed Rail regarding SF-SJ EIR preferred alternativeHigh speed rail eir preferred alternative sf-sj - fo c (1) (1)

High speed rail eir preferred alternative sf-sj - fo c (1) (1)Adina Levin

?

The document discusses two key areas where the High Speed Rail EIR's plans are out of sync with regional planning efforts: passing tracks on the Caltrain corridor and Diridon Station in San Jose. For passing tracks, the document notes that Caltrain plans to increase ridership by running more frequent trains, which will require additional passing tracks that are not included in the High Speed Rail EIR preferred alternative. It also notes that the Diridon Station plans in the EIR will likely be superseded by the Diridon Station Concept Plan. The document requests that High Speed Rail update its analysis to account for updated information and plans from Caltrain and the Diridon Station process.Dumbarton Crossbay

Dumbarton Crossbay Adina Levin

?

The document provides an overview of the Dumbarton Rail Corridor project including:

1) The roles and responsibilities of the key project partners - San Mateo County Transit District, Cross Bay Transit Partners (Facebook and Plenary Group), and regulatory agencies.

2) Updates on engineering and environmental work including potential station sites, alignment options, and key environmental topics.

3) Details on the public outreach process including recent introductory meetings and themes from community feedback.

4) The anticipated project schedule and timeline for environmental review and permitting, engineering, and construction.San Francisco Board of Supervisors Caltrain Governance Resolution

San Francisco Board of Supervisors Caltrain Governance ResolutionAdina Levin

?

The document is a resolution supporting the establishment of a strengthened independent agency to oversee the future development of Caltrain and high-speed rail projects between San Francisco and Gilroy. It highlights the growing ridership demand, the need for improved service, and the importance of modernizing the rail system while addressing financial challenges. The resolution aims to solidify Caltrain's role in promoting economic growth and reducing greenhouse gas emissions in the region.Connecting Communities Optimizing Highways Event April 18

Connecting Communities Optimizing Highways Event April 18Adina Levin

?

This document proposes how funds from a San Mateo County transportation expenditure plan should be allocated. It recommends that 60% of funds go to public transit and paratransit services, including more bus service and fare programs. An additional 10% each should go to expanding bike/pedestrian infrastructure and programs to reduce solo driving, such as subsidies for carpooling. The remaining funds would support local streets/roads projects, transit grade separations, intelligent transportation systems, and affordable housing near transit.Irfp 1819 07 dtx project delivery review services

Irfp 1819 07 dtx project delivery review servicesAdina Levin

?

1) The San Francisco County Transportation Authority is requesting proposals from qualified firms to provide governance, oversight, management, and project delivery consultant services to review the Downtown Extension rail project.

2) The project aims to extend Caltrain 1.3 miles into the new Transbay Transit Center. The estimated cost is $4 billion. Recent issues with cost overruns and delays on the transit center portion have raised concerns about oversight of the rail extension portion.

3) The consultant team will review international best practices, project delivery and funding strategies, and make recommendations to strengthen governance and oversight models, with the goal of ensuring the rail extension is delivered on time and on budget. The effort will include research, interviews, workshops, and2018 TIMMA toll policy recommendations final

2018 TIMMA toll policy recommendations finalAdina Levin

?

The document outlines recommendations for the Treasure Island Transit Pass, toll policy, and affordability program as part of the Treasure Island Transportation Implementation Plan. It details an integrated approach to managing travel demand and enhancing mobility on Treasure Island, including proposed transit pass options, toll pricing structures, and affordability measures for residents. The board's approval is sought to move forward with the design and implementation of these policies by December 2018.More Caltrain service to South San Jose and South Santa Clara County

More Caltrain service to South San Jose and South Santa Clara CountyAdina Levin

?

The document discusses plans to increase Caltrain service to South San Jose and South Santa Clara County. Currently there are 3 round trips south of the Diridon station, but funding from Measure B allows for potentially increasing service up to 5 round trips by 2020-2022. Future plans include electrified Caltrain service and integrating with high speed rail, which would require environmental review and agreements with Union Pacific. The document encourages public participation in the Caltrain business planning process to help shape decisions around increasing service in the south county area.VTA Rfp s18181 strategic plan for high capacity transit corridors final

VTA Rfp s18181 strategic plan for high capacity transit corridors finalAdina Levin

?

This document is a Request for Proposals from Santa Clara Valley Transportation Authority (VTA) seeking proposals from qualified consulting teams to conduct a planning study evaluating conceptual High Capacity Transit corridors in Santa Clara County. The study will examine the suitability of light rail transit, bus rapid transit, and other rapid transit options. Proposals are due by September 12, 2018. The RFP provides instructions to proposers, outlines proposer qualifications, evaluation criteria, proposal requirements, and the project scope of services.MTC RFQ Alameda County Rail Connections

MTC RFQ Alameda County Rail ConnectionsAdina Levin

?

The Metropolitan Transportation Commission (MTC) is soliciting Statements of Qualifications (SOQs) for the Southern Alameda County Integrated Rail Analysis, which aims to evaluate passenger rail needs in the region. Interested firms must submit proposals by 4:00 p.m. on October 18, 2018, with an estimated budget of $5.5 million and a project completion date of December 31, 2020. The chosen consultant will perform planning, feasibility analysis, and initial design work focused on improving rail connectivity and addressing operational issues in the area.5-23-18 - Means Based joint support letter

5-23-18 - Means Based joint support letter Adina Levin

?

The document expresses support for a proposed means-based transit fare discount pilot program, emphasizing the need for a focused initial rollout and independent evaluation. Key recommendations include user-centered design, deeper discounts, fare streamlining, and a roadmap for improvements based on evaluation outcomes. The goal is to achieve equitable access to transit while increasing ridership through collaboration among regional transit agencies.2016 11-03 ta bod highway-101-92 interchange

2016 11-03 ta bod highway-101-92 interchangeAdina Levin

?

This document summarizes the findings of a preliminary planning study for improvements to the US 101/SR 92 interchange in San Mateo County. It outlines the study process and presents alternatives that were developed and evaluated to address traffic congestion and safety issues. Short term and long term alternatives are proposed. Recommended alternatives include improvements to ramp configurations, added lanes, and new direct connectors. Next steps involve determining which alternatives to advance based on stakeholder input and funding availability.Recently uploaded (20)

Trusted Site To Buy Verified Payoneer Accounts In This Time.pdf

Trusted Site To Buy Verified Payoneer Accounts In This Time.pdfhttps://top5starshop.com/product/buy-verified-cash-app-accounts/

?

? 24/7 Hours Reply/Contact ? Telegram: @Top5StarShop ? WhatsApp: +1 (470) 206-8684 ? Email: top5starshop99@gmail.comUN World Marine Fishery Health Situation Full Report 2025

UN World Marine Fishery Health Situation Full Report 2025Energy for One World

?

UN FAO report

June 2025

Nice UN Oceans Conference“Strategic Evolution and Global Impact of BRICS: Trade, Governance & Future D...

“Strategic Evolution and Global Impact of BRICS: Trade, Governance & Future D...br3002611

?

Introduction to BRICS

BRICS, an acronym for Brazil, Russia, India, China, and South Africa, represents a coalition of emerging economies that have grown into a powerful voice in global economic and geopolitical affairs. Initially coined as “BRIC” by economist Jim O’Neill in 2001, this alliance gained institutional shape over the years and has evolved into a critical pillar of the multipolar world order. With the addition of South Africa in 2010 and subsequent expansions, BRICS now encompasses a significant portion of the world’s population, GDP, and trade capacity.

Historical Evolution and Foundation

The journey of BRICS began with informal ministerial meetings in 2006 and formalized in 2009 with the first summit. Since then, the alliance has held annual summits, collaborated on developmental banking, and continuously advocated for the reform of global financial governance institutions such as the IMF and World Bank.

South Africa’s inclusion was strategic, making BRICS more representative of the Global South. The establishment of the New Development Bank (NDB) in 2014 and the Contingent Reserve Arrangement (CRA) cemented BRICS' resolve to support sustainable development and provide alternatives to Western-dominated financial structures.

Current Membership and Expanding Influence

Initially comprising five countries, BRICS is expanding. As of the 16th Summit in Kazan, 2024, six more countries—Egypt, Ethiopia, Iran, UAE, Saudi Arabia, and Argentina—have either joined or shown interest, increasing the bloc’s relevance. This wider representation not only broadens market access but also strengthens BRICS as a strategic counterbalance to Western alliances like the G7 or NATO.

With the inclusion of new members, BRICS covers:

42% of global population

30% of global land area

23% of global GDP

44% of crude oil production

Objectives and Institutional Mechanisms

BRICS primarily aims to:

Reform global governance institutions for greater equity

Promote South-South cooperation

Encourage sustainable development

Reduce dependence on the U.S. dollar and Western-controlled systems

Key institutional mechanisms include:

Annual BRICS Summits

New Development Bank (NDB)

Contingent Reserve Arrangement (CRA)

BRICS Business Council

Think Tank Network for Finance

These structures foster deeper economic integration, financial autonomy, and policy collaboration across member states.

Key Themes from the 16th BRICS Summit (Kazan, Russia 2024)

The latest summit emphasized:

Expansion and inclusion of new members

Promotion of multilateralism and peaceful conflict resolution (Ukraine, West Asia)

Financial integration through non-dollar trade systems

Launch of the BRICS Grain Exchange

Wildlife conservation (Big Cats initiative)

India-China diplomatic reset on border issues

Strategic Benefits for Individual Members

Each member contributes uniquely:

Brazil: Agricultural powerhouse and energy exporter

Russia: Major energy supplier and strategic geopoliticalOutreach Proramme on Sensitizing the Diductor for Better TDS / TCS Compliance

Outreach Proramme on Sensitizing the Diductor for Better TDS / TCS ComplianceCOLOURIMPRESSION

?

Outreach Proramme on Sensitizing the Diductor for Better TDS / TCS Compliance

Org By : Treasury Banda一比一原版(贬诲惭毕业证)斯图加特媒体学院毕业证如何办理

一比一原版(贬诲惭毕业证)斯图加特媒体学院毕业证如何办理taqyed

?

HdM斯图加特媒体学院毕业证书多少钱【q薇1954292140】1:1原版斯图加特媒体学院毕业证+HdM成绩单【q薇1954292140】完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。

【主营项目】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理毕业证|办理文凭: 买大学毕业证|买大学文凭【q薇1954292140】学位证明书如何办理申请?

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理斯图加特媒体学院毕业证|HdM成绩单【q薇1954292140】国外大学毕业证, 文凭办理, 国外文凭办理, 留信网认证

三.材料咨询办理、认证咨询办理请加学历顾问【微信:1954292140】毕业证购买指大学文凭购买,毕业证办理和文凭办理。学院文凭定制,学校原版文凭补办,扫描件文凭定做,100%文凭复刻。DFARS Part 235 - Reseach And Development Contracts

DFARS Part 235 - Reseach And Development ContractsJSchaus & Associates

?

2025 - JSchaus & Associates in Washington DC present a complimentary webinar series covering The DFARS, Defense Federal Acquisition Regulation Supplement. Learn about US Federal Government Contracting with The Department of Defense, DoD. Defense Contracting. Defense Acquisition. Federal Contracting.

Link To Video:

https://www.youtube.com/watch?v=puBw_ehen7Y

Subscribe to Our YouTube Channel for complimentary access to US Federal Government Contracting videos:

https://www.youtube.com/@jenniferschaus/videosRs 50 Entry at Shivsrushti Ongoing Till July 15, Thanks to Abhay Bhutada Foun...

Rs 50 Entry at Shivsrushti Ongoing Till July 15, Thanks to Abhay Bhutada Foun...Swapnil Pednekar

?

Shivsrushti, Pune’s premier historical theme park, is offering discounted entry tickets thanks to the Abhay Bhutada Foundation. Discover the initiative’s educational purpose, featured exhibits, and limited-time availability through this detailed walkthrough.

最新版美国路易斯安那理工大学毕业证(尝补罢别肠丑毕业证书)原版定制

最新版美国路易斯安那理工大学毕业证(尝补罢别肠丑毕业证书)原版定制taqyea

?

一比一还原路易斯安那理工大学毕业证/LaTech毕业证书2025原版【q薇1954292140】我们专业办理澳洲大学毕业证成绩单,美国大学毕业证成绩单,英国大学毕业证成绩单,加拿大大学毕业证成绩单,新加坡大学毕业证成绩单,新西兰大学毕业证成绩单,韩国大学毕业证成绩单,日本大学毕业证成绩单。

【复刻一套路易斯安那理工大学毕业证成绩单信封等材料最强攻略,Buy Louisiana Tech University Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

路易斯安那理工大学成绩单能够体现您的的学习能力,包括路易斯安那理工大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!

我们承诺采用的是学校原版纸张(原版纸质、底色、纹路)我们工厂拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有成品以及工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!

【主营项目】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理毕业证|办理文凭: 买大学毕业证|买大学文凭【q薇1954292140】路易斯安那理工大学学位证明书如何办理申请?

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理美国成绩单路易斯安那理工大学毕业证【q薇1954292140】国外大学毕业证, 文凭办理, 国外文凭办理, 留信网认证

三.材料咨询办理、认证咨询办理请加学历顾问【微信:1954292140】路易斯安那理工大学毕业证购买指大学文凭购买,毕业证办理和文凭办理。学院文凭定制,学校原版文凭补办,扫描件文凭定做,100%文凭复刻。Texas Water Association: 89th Legislative Recap

Texas Water Association: 89th Legislative RecapTexas Water Association

?

Sarah Kirkle, TWA Director of Policy and Legislative Affairs加拿大爱德华王子岛大学成绩单范本调鲍笔贰滨毕业完成信鲍笔贰滨成绩单防伪皑100%复刻

加拿大爱德华王子岛大学成绩单范本调鲍笔贰滨毕业完成信鲍笔贰滨成绩单防伪皑100%复刻Taqyea

?

1:1原版爱德华王子岛大学毕业证+UPEI成绩单【Q微:1954 292 140】鉴于此,UPEIdiploma爱德华王子岛大学挂科处理解决方案UPEI毕业证成绩单专业服务学历认证【Q微:1954 292 140】办理教育部学历认证,留学回国证明,爱德华王子岛大学毕业证、爱德华王子岛大学成绩单、爱德华王子岛大学文凭(留信学历认证+永久存档查询)办理本科+硕士+博士毕业证成绩单学历认证,我们一直是留学生的首选,质量行业第一,诚信可靠。

【爱德华王子岛大学成绩单一站式办理专业技术完美呈现University of Prince Edward Island Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

爱德华王子岛大学成绩单能够体现您的的学习能力,包括爱德华王子岛大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!

【主营项目】

一.毕业证【q微1954292140】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)Competency of Interactive Diplomacy.pdf.pdf

Competency of Interactive Diplomacy.pdf.pdfgiselladarfian

?

Let’s talk about contemporary debates in IR and Diplomacy on Energy and Environment!The Data City, United Kingdom - Fatima Garcia

The Data City, United Kingdom - Fatima GarciaOECD CFE

?

Presentation by Fatima Garcia Elena (Consultant Data Scientist, The Data City, United Kingdom) at the OECD TPI Orkestra conference "From analysis to action: Harnessing local policies to boost productivity" held in Trento, Italy on 5-6 June 2025.

More info: https://oe.cd/5ZDWhen History Became Affordable: Abhay Bhutada Foundation and the Shivsrushti ...

When History Became Affordable: Abhay Bhutada Foundation and the Shivsrushti ...Lokesh Agrawal

?

The Abhay Bhutada Foundation has enabled reduced ticket pricing at Shivsrushti with a ?51 lakh donation. This limited-time offer enhances cultural access through immersive historical learning in Pune.How SafeLives Is Working to End Domestic Abuse

How SafeLives Is Working to End Domestic AbuseMark Lyttleton

?

The nationwide charity SafeLives is committed to ending domestic abuse for good. Last year, the charity trained over 11,500 first responders and professionals and reached nearly 100,000 child and 90,000 adult survivors via its programmes. Citizen Perception Survey (CPS) 2024 | Bangladesh Bureau of Statistics

Citizen Perception Survey (CPS) 2024 | Bangladesh Bureau of StatisticsRazin Mustafiz

?

Source: https://qci.qr-code.click/uploads/pdf/1750052592930_684faec2e2dca.pdfMiSST: Making Children’s Lives Better Through Classical Music

MiSST: Making Children’s Lives Better Through Classical MusicMark Lyttleton

?

MiSST (The Music in Secondary School Trust) was founded in 2013 and has now provided opportunities to more than 20,000 children, improving both social and educational outcomes through expert tuition and the provision of classical instruments. Strategic Planning for Grassroots Organizations 2025.pptx.pptx

Strategic Planning for Grassroots Organizations 2025.pptx.pptxJoyce Lewis-Andrews

?

Twenty-eight year nonprofit veteran, Joyce Lewis-Andrews’ strategic planning model provides a practical framework, relationship-building approach, and a focused process necessary to address four key goals of organizational sustainability.Government at a Glance 2025 Launch Presentation.pdf

Government at a Glance 2025 Launch Presentation.pdfOECD Governance

?

Published every two years, Government at a Glance provides reliable, internationally comparable indicators on government activities and their results in OECD Member countries and accession candidate countries.Trusted Site To Buy Verified Payoneer Accounts In This Time.pdf

Trusted Site To Buy Verified Payoneer Accounts In This Time.pdfhttps://top5starshop.com/product/buy-verified-cash-app-accounts/

?

Ad

Caltrain tax legal opinion

- 1. July 21, 2020 VIA EMAIL Jim Hartnett San Mateo County Transit District hartnettj@samtrans.com Dear San Mateo County Transit District Board Members: As Special Counsel to the San Mateo County Transit District, I was tasked with looking at SB 797, the recent California law that provides a unique opportunity for Caltrain to submit a one-eighth cent sales tax measure to the voters to support our vital local train service. However, the one thing that is clear is that it must be a clean ballot proposal requiring that “the net revenues from the tax” must “be used by the board for the operating and capital purposes of the Caltrain rail services.” Simply put, the law means the political bodies needing to approve the ballot measure must not impose collateral or delaying conditions on use of the funds. Thus, the law prohibits linking the straightforward fiscal measure designed to save Caltrain to unrelated—even if salutary—organizational or other objectives. Specifically, it is my strong opinion that larding approval with requirements of changed governance or targeted or restricted spending requirements will render the tax subject to a successful taxpayer legal challenge. Importantly, there is nothing that prevents the three members of the JPA from continuing their separate discussions about organizational change and management structure. Plainly, however, the California Legislature was saying you can do that, just don’t tie such political negotiations to the overall economic wellbeing of the railway. Very truly yours, James M. Wagstaffe