Capitalization method

Download as PPTX, PDF4 likes11,314 views

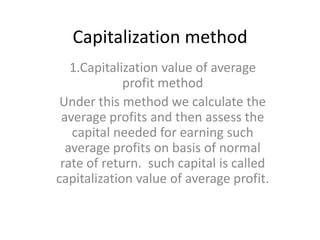

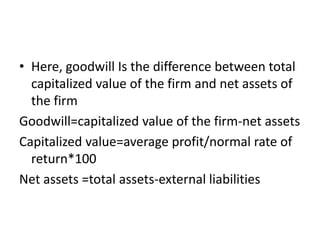

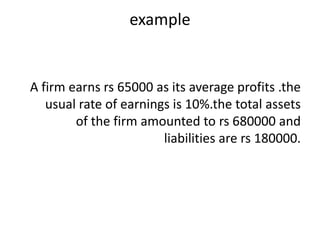

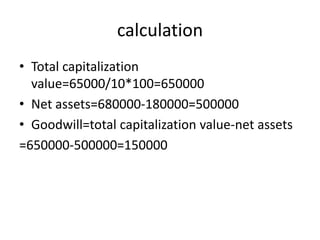

This document describes the capitalization method of valuing average profits to determine a firm's capitalization value and goodwill. The capitalization value is calculated by taking the average profits and dividing by the normal rate of return, then multiplying by 100. Goodwill is the difference between the total capitalized value and the net assets. An example is provided where a firm earns average profits of Rs. 65,000 at a 10% normal rate of return, with total assets of Rs. 680,000 and liabilities of Rs. 180,000, resulting in a capitalization value of Rs. 650,000 and goodwill of Rs. 150,000.

1 of 4

Downloaded 31 times

Recommended

Corporate valuation

Corporate valuationsavi_raina

╠²

This document discusses various methods for valuing a corporate business, including:

1. The discounted cash flow method, which values a business based on its future free cash flows discounted at the firm's weighted average cost of capital.

2. Relative valuation methods like comparable company analysis and comparable transaction analysis, which derive valuation multiples from similar public companies or M&A transactions.

3. Other methods like the net asset value approach and Tobin's Q, which value a business based on its asset book values.

The document provides steps and considerations for each method to determine a company's economic worth based on its financials, industry, and investment characteristics.Dividend Decisions

Dividend DecisionsKaushik Deb

╠²

All types of dividend decisions, theories of dividend decision are explained in a gist to help in presenting and learning purpose

Gaap (generally accepted accounting principles)

Gaap (generally accepted accounting principles)Muhammad Sher

╠²

The document discusses GAAP (Generally Accepted Accounting Principles). [1] GAAP are the common set of accounting standards, procedures and rules that govern financial accounting practices. [2] They provide guidelines for proper revenue recognition, balance sheet classifications, and share measurements to provide a fair representation of a company's financial status. [3] GAAP principles are divided into accounting concepts like the money measurement concept and dual aspect concept, and accounting conventions like full disclosure and materiality.Dividend Decisions

Dividend DecisionsGorani & Associates

╠²

This document discusses dividend policies, including the meaning of dividends, types of dividend policies, and factors that influence dividend decisions. It explains that dividends refer to the portion of company profits distributed to shareholders. The dividend policy determines how earnings are divided between payments to shareholders and retained earnings. Key factors that influence dividend decisions include stability of earnings, financing needs, liquidity, growth requirements, and legal obligations. The document also outlines different forms of dividends, including cash, stock, and scrip dividends.Joint product and by product costing

Joint product and by product costingMuhammad Usman

╠²

This chapter describes methods for allocating joint costs between joint products. Joint products are two or more products produced from the same raw materials, like petrol and diesel from crude oil. By-products have lower value. Methods for allocating joint costs include sale value at split-off point, reverse cost method, net realizable value method, physical unit method, and contribution margin method. The net realizable value method is often most suitable.Variance Analysis

Variance AnalysisDr. Rana Singh

╠²

The document defines various types of variances that can occur in cost accounting, including material, labor, and overhead variances. It provides formulas to calculate variance amounts and examples showing how to compute variances based on standard and actual costs. Variances are classified into price, usage/efficiency, and mix categories and can be favorable or unfavorable depending on whether actual costs are lower or higher than standards.Financial statement analysis

Financial statement analysisAnuj Bhatia

╠²

Financial statement analysis involves analyzing a company's financial statements to assess its performance and financial position. It is used to evaluate factors like profitability, solvency, liquidity, and efficiency. Key tools for financial statement analysis include financial ratios, common size analysis, trend analysis, and comparisons to industry standards and past performance. The purpose is to provide useful information to decision makers about a company's historical performance, current condition, and future prospects.CAPM

CAPMTixy Mariam Roy

╠²

CAPM model that describes the relationship between risk and expected return and that is used in the pricing of risky securities.

Leverage (Operating, financial & combined leverage)

Leverage (Operating, financial & combined leverage)Yamini Kahaliya

╠²

This PPT contains the full detail of topic leverage in financial management

it covers following topics :-

Meaning of Leverage

Types of Leverage

Operating Leverage

Financial Leverage

Difference between Operating & Financial Leverage

Combined Leverage

Illustrations

Exercise

Trade-off theory in capital structure

Trade-off theory in capital structureKashif Khans

╠²

This document provides an outline for a presentation on capital structure and the trade off theory. It introduces the presenters and outlines topics to be covered, including definitions of capital structure and firm value, the trade off theory, benefits and costs of leverage, and balancing costs and benefits to find an optimal capital structure. The trade off theory suggests there is an optimal mix of debt and equity that maximizes firm value by balancing the tax shield benefits of debt against the financial distress costs.Standard costing presentation

Standard costing presentationJay Singh

╠²

Standard costing is a technique that involves setting predetermined standards for costs and comparing them to actual costs. Standards are set for materials, labor, overhead and sales prices/margins. Variances between standards and actuals are analyzed to identify reasons for differences and take corrective actions. It helps management evaluate performance, control costs, set budgets and motivate staff. Some key advantages include cost control, delegation, efficiency improvements, and anticipating future costs and profits. Limitations include requiring technical skills and difficulty separating controllable vs. uncontrollable variances.Valuation of shares

Valuation of sharesHimanshu Arya

╠²

The document discusses various methods for valuing shares, including net asset value, dividend yield, earnings capitalization, and average methods. It outlines factors to consider under each method such as expected dividends, earnings rates, assets and liabilities. The purpose of share valuation is discussed for scenarios like mergers, reconstructions, and determining values for gifts or inheritance.Operating, financial and combined leverage

Operating, financial and combined leverageSimran Kaur

╠²

This document discusses different types of leverage used in business - operating, financial, and combined leverage. Operating leverage is related to fixed operating costs and how they magnify changes in sales on earnings. Financial leverage uses fixed financing costs to magnify the effect on earnings per share. Combined leverage is the product of operating and financial leverage. Degrees of leverage are defined to quantify the effects. Indifference points are discussed as the earnings level where leveraged vs unleveraged financing plans yield equal shareholder returns. Analysis of earnings-per-share for different financing options is based on expected earnings levels relative to the indifference point.Types of leverages

Types of leveragesAswathy_Jayan

╠²

This document discusses different types of leverage used in business. There are three main types: operating leverage, financial leverage, and combined leverage. Operating leverage measures how fixed costs affect operating profit with changes in sales. Financial leverage shows how interest expenses affect net income. Combined leverage considers both operating and financial leverage and their combined impact on earnings per share with sales changes. The degree of each type of leverage can be calculated to understand the risk involved at different levels.Liabilities of company auditor for auditing

Liabilities of company auditor for auditingPinkey Rana

╠²

This document discusses the various liabilities of a company auditor under Indian law. It outlines civil liabilities for negligence if the auditor fails to exercise reasonable skill and care, resulting in a client suffering loss. Auditors may also be liable for misstatements in prospectuses. Criminal liabilities are outlined under the Companies Act, Income Tax Act, and Chartered Accountants Act for offenses such as misfeasance. Auditors' liability to third parties is generally limited to cases of fraud, but they are not usually liable for negligence to non-clients. Throughout, the document provides details on the Indian legal statutes and sections that define an auditor's responsibilities and potential consequences for lapses.Cost of capital ppt

Cost of capital pptRICHA BHUSHAN

╠²

The document defines the cost of capital as the minimum required rate of return on invested funds. It discusses how the cost of capital is helpful for capital budgeting and structure decisions. It then outlines the different components of cost of capital - cost of debt, preferred shares, equity shares, and retained earnings. Various formulas are provided for calculating the costs of redeemable and irredeemable debt, preferred shares, and equity shares. The cost of retained earnings is said to equal the cost of equity shares.Management accounting

Management accountingpooja sonakiya

╠²

Management accounting provides accounting information to managers within organizations to help them make informed business decisions. It involves identifying, measuring, analyzing, and communicating financial and non-financial information. The key functions of management accounting are to modify raw accounting data, interpret financial analyses, and assist with management control through tools like budgeting and performance analysis to evaluate operations and fix issues. Management accounting differs from financial accounting in its focus on internal users, future orientation, and inclusion of both monetary and non-monetary information to support management planning, implementation, and decision-making.Cost of Retained Earnings

Cost of Retained EarningsMegha Anilkumar

╠²

This document discusses retained earnings and how to calculate the cost of retained earnings. It defines retained earnings as the portion of net profits not paid out as dividends, but instead retained by the company to reinvest. The cost of retained earnings must be at least equal to the rate of return shareholders expect to receive from reinvesting dividends. The cost can differ from the cost of equity if shareholders face flotation costs or personal taxes on reinvested dividends. Two formulas are provided to calculate the cost of retained earnings depending on whether flotation costs and taxes apply. An example calculation is also shown.Holding and subsidiary company

Holding and subsidiary companykaslinsas

╠²

Holding company first came into existence in the US. It was created to overcome the restrictions imposed by the Anti-trust legislation. They were formed because businessmen wanted to have concerns under common control and within the framework of law.

Under the companies Act, 1956, a holding company is any company which holds more than half of the equity share capital of other companies or controls the composition of the board of directors of other companies. Type of business organization that allows a firm (called parent) and its directors to control or influence other firms (called subsidiaries). This arrangement makes venturing outside one's core industry possible and, under certain conditions, to benefit from tax consolidation, sharing of operating losses, and ease of divestiture. The legal definition of a holding company varies with the legal system. Some require holding of a majority (80 percent) or the entire (100 percent) voting shares of the subsidiary whereas other require as little as five percent.

Functions of financial manager

Functions of financial managerShristi Giri

╠²

The functions of a financial manager include making investment, financing, and dividend decisions. A financial manager is responsible for the financial health of an organization by producing financial reports, directing investment activities, and developing long-term financial strategies and goals. Some of the primary roles of a financial manager are performing financial analysis and planning, deciding how to invest funds, determining the best sources of financing, and deciding how to distribute profits between shareholders and retained earnings. In addition to these core duties, a financial manager also forecasts future profits, allocates resources and funds, and represents the interests of shareholders.COST-VOLUME-PROFIT RELATIONSHIPS

COST-VOLUME-PROFIT RELATIONSHIPSMahmudul Hasan

╠²

This document presents information about cost-volume-profit (CVP) analysis for Racing Bicycle Company. It includes CVP graphs and equations, contribution margin calculations, and analyses of break-even points and margin of safety. Specifically, it shows that Racing Bicycle's break-even point is at 400 units of sales for $200,000 in revenue, and its margin of safety given actual sales of 500 units is $50,000 or 20% of sales.Factors affecting capital structure

Factors affecting capital structureSandeep Suresh

╠²

This document discusses factors that affect a company's capital structure. It defines capital structure as how a firm finances its operations through various sources of funds such as debt, equity, short-term debt, and other financing options. It then lists 14 factors that influence a company's capital structure decisions, including control interests of shareholders, risks, tax considerations, cost of capital, flexibility, investors' attitudes, legal provisions, growth rate, market conditions, profitability, floatation costs, cost of debt, cost of equity capital, and government policies. Maintaining an optimal capital structure is important for balancing business risks and maximizing shareholder value.Chapter 10 : Responsible Accounting

Chapter 10 : Responsible AccountingPeleZain

╠²

Responsibility accounting involves dividing an organization into responsibility centers and assigning costs and revenues to each center. The key types of responsibility centers are cost centers, which managers are responsible for costs, profit centers where managers are responsible for both costs and revenues, and investment centers where managers are responsible for costs, revenues, and capital employed. Effective responsibility accounting requires setting targets for each center, tracking actual performance against targets, reporting variances to management, and taking corrective actions. It aims to evaluate performance and provide feedback to improve future operations.Depository services

Depository servicesSangam├©sh Ks

╠²

This document discusses depository services in India. It explains that depository services allow for the electronic holding of securities and enable transactions to be processed via book entries. There are two main depositories - National Securities Depository Limited and Central Depository Services Limited - that interface with investors through depository participants like banks and stockbrokers. The depository system works similarly to the banking system, with a central authority and transactions occurring through associated participants rather than directly with the central authority.Working capital management

Working capital managementankita3590

╠²

The study analyzed the impact of working capital management on the profitability of 58 small manufacturing firms in Mauritius over the period of 1998-2003. The results showed that return on total assets, a measure of profitability, was positively correlated with measures of working capital management efficiency like accounts receivable days and cash conversion cycle. However, it was negatively correlated with accounts payable days. The paper concluded that synchronizing current assets and liabilities is important for small firm profitability and the paper industry showed best practices in working capital management.Transfer pricing

Transfer pricingReshma Gaikwad

╠²

This document discusses transfer pricing, which refers to the price at which divisions within a company transact with each other. It provides definitions of transfer pricing and outlines some key issues like how transfer prices impact revenue and influence whether managers prefer customers or suppliers that are internal or external to the company. The document then describes several methods that can be used to determine transfer prices, such as using market rates, negotiated prices, or cost-plus models. It provides an example of calculating an optimal transfer price between wood and paper divisions of a company. The summary concludes by noting how transfer prices can be manipulated for tax purposes in multinational companies.1. introduction to corporate finance

1. introduction to corporate financeirfan_1

╠²

This document provides an introduction to key concepts in corporate finance including what corporate finance is, its relationship to financial accounting and management accounting, the concepts of risk and return and time value of money. It discusses corporate structure including sole proprietorships, partnerships and corporations. It describes the finance function and role of the financial manager in raising, allocating and returning funds. It also covers separation of ownership and management and issues of agency theory and corporate governance.Goodwill & its valuation

Goodwill & its valuationrahul aggarwal

╠²

under this what do you mean by goodwill and what are the methods of goodwill , how to measure and why we need to measure?Goodwill

GoodwillPrateekshya Shakya

╠²

1. The document presents methods for calculating goodwill in a business. Goodwill represents the value of assets like brand name, customer base, supplier relationships, and workforce that are not separately recognized in a business acquisition.

2. There are three main methods discussed: average profits method, super profits method, and capitalization method. The average profits and super profits methods calculate goodwill as a multiple of average or excess profits. The capitalization method estimates goodwill as the difference between total capitalized value and net assets.

3. Examples are provided to demonstrate calculating goodwill under the super profits capitalization method. Goodwill is estimated as super profits multiplied by a capitalization rate based on normal returns.Valuation of Goodwill for class 12

Valuation of Goodwill for class 12shreyash Khandelwal

╠²

The document discusses the concept of goodwill in business valuation. It defines goodwill as the favorable reputation and brand name of a business that generates profits year after year. Factors that contribute to goodwill are good public relations, regular customers, quality maintenance, management skills, location, and employee relations. Methods discussed to value goodwill include the average profits method, super profits method, and capitalization method. The average profits and capitalization methods involve calculating average or super profits and capitalizing them based on a normal rate of return to determine goodwill value.More Related Content

What's hot (20)

Leverage (Operating, financial & combined leverage)

Leverage (Operating, financial & combined leverage)Yamini Kahaliya

╠²

This PPT contains the full detail of topic leverage in financial management

it covers following topics :-

Meaning of Leverage

Types of Leverage

Operating Leverage

Financial Leverage

Difference between Operating & Financial Leverage

Combined Leverage

Illustrations

Exercise

Trade-off theory in capital structure

Trade-off theory in capital structureKashif Khans

╠²

This document provides an outline for a presentation on capital structure and the trade off theory. It introduces the presenters and outlines topics to be covered, including definitions of capital structure and firm value, the trade off theory, benefits and costs of leverage, and balancing costs and benefits to find an optimal capital structure. The trade off theory suggests there is an optimal mix of debt and equity that maximizes firm value by balancing the tax shield benefits of debt against the financial distress costs.Standard costing presentation

Standard costing presentationJay Singh

╠²

Standard costing is a technique that involves setting predetermined standards for costs and comparing them to actual costs. Standards are set for materials, labor, overhead and sales prices/margins. Variances between standards and actuals are analyzed to identify reasons for differences and take corrective actions. It helps management evaluate performance, control costs, set budgets and motivate staff. Some key advantages include cost control, delegation, efficiency improvements, and anticipating future costs and profits. Limitations include requiring technical skills and difficulty separating controllable vs. uncontrollable variances.Valuation of shares

Valuation of sharesHimanshu Arya

╠²

The document discusses various methods for valuing shares, including net asset value, dividend yield, earnings capitalization, and average methods. It outlines factors to consider under each method such as expected dividends, earnings rates, assets and liabilities. The purpose of share valuation is discussed for scenarios like mergers, reconstructions, and determining values for gifts or inheritance.Operating, financial and combined leverage

Operating, financial and combined leverageSimran Kaur

╠²

This document discusses different types of leverage used in business - operating, financial, and combined leverage. Operating leverage is related to fixed operating costs and how they magnify changes in sales on earnings. Financial leverage uses fixed financing costs to magnify the effect on earnings per share. Combined leverage is the product of operating and financial leverage. Degrees of leverage are defined to quantify the effects. Indifference points are discussed as the earnings level where leveraged vs unleveraged financing plans yield equal shareholder returns. Analysis of earnings-per-share for different financing options is based on expected earnings levels relative to the indifference point.Types of leverages

Types of leveragesAswathy_Jayan

╠²

This document discusses different types of leverage used in business. There are three main types: operating leverage, financial leverage, and combined leverage. Operating leverage measures how fixed costs affect operating profit with changes in sales. Financial leverage shows how interest expenses affect net income. Combined leverage considers both operating and financial leverage and their combined impact on earnings per share with sales changes. The degree of each type of leverage can be calculated to understand the risk involved at different levels.Liabilities of company auditor for auditing

Liabilities of company auditor for auditingPinkey Rana

╠²

This document discusses the various liabilities of a company auditor under Indian law. It outlines civil liabilities for negligence if the auditor fails to exercise reasonable skill and care, resulting in a client suffering loss. Auditors may also be liable for misstatements in prospectuses. Criminal liabilities are outlined under the Companies Act, Income Tax Act, and Chartered Accountants Act for offenses such as misfeasance. Auditors' liability to third parties is generally limited to cases of fraud, but they are not usually liable for negligence to non-clients. Throughout, the document provides details on the Indian legal statutes and sections that define an auditor's responsibilities and potential consequences for lapses.Cost of capital ppt

Cost of capital pptRICHA BHUSHAN

╠²

The document defines the cost of capital as the minimum required rate of return on invested funds. It discusses how the cost of capital is helpful for capital budgeting and structure decisions. It then outlines the different components of cost of capital - cost of debt, preferred shares, equity shares, and retained earnings. Various formulas are provided for calculating the costs of redeemable and irredeemable debt, preferred shares, and equity shares. The cost of retained earnings is said to equal the cost of equity shares.Management accounting

Management accountingpooja sonakiya

╠²

Management accounting provides accounting information to managers within organizations to help them make informed business decisions. It involves identifying, measuring, analyzing, and communicating financial and non-financial information. The key functions of management accounting are to modify raw accounting data, interpret financial analyses, and assist with management control through tools like budgeting and performance analysis to evaluate operations and fix issues. Management accounting differs from financial accounting in its focus on internal users, future orientation, and inclusion of both monetary and non-monetary information to support management planning, implementation, and decision-making.Cost of Retained Earnings

Cost of Retained EarningsMegha Anilkumar

╠²

This document discusses retained earnings and how to calculate the cost of retained earnings. It defines retained earnings as the portion of net profits not paid out as dividends, but instead retained by the company to reinvest. The cost of retained earnings must be at least equal to the rate of return shareholders expect to receive from reinvesting dividends. The cost can differ from the cost of equity if shareholders face flotation costs or personal taxes on reinvested dividends. Two formulas are provided to calculate the cost of retained earnings depending on whether flotation costs and taxes apply. An example calculation is also shown.Holding and subsidiary company

Holding and subsidiary companykaslinsas

╠²

Holding company first came into existence in the US. It was created to overcome the restrictions imposed by the Anti-trust legislation. They were formed because businessmen wanted to have concerns under common control and within the framework of law.

Under the companies Act, 1956, a holding company is any company which holds more than half of the equity share capital of other companies or controls the composition of the board of directors of other companies. Type of business organization that allows a firm (called parent) and its directors to control or influence other firms (called subsidiaries). This arrangement makes venturing outside one's core industry possible and, under certain conditions, to benefit from tax consolidation, sharing of operating losses, and ease of divestiture. The legal definition of a holding company varies with the legal system. Some require holding of a majority (80 percent) or the entire (100 percent) voting shares of the subsidiary whereas other require as little as five percent.

Functions of financial manager

Functions of financial managerShristi Giri

╠²

The functions of a financial manager include making investment, financing, and dividend decisions. A financial manager is responsible for the financial health of an organization by producing financial reports, directing investment activities, and developing long-term financial strategies and goals. Some of the primary roles of a financial manager are performing financial analysis and planning, deciding how to invest funds, determining the best sources of financing, and deciding how to distribute profits between shareholders and retained earnings. In addition to these core duties, a financial manager also forecasts future profits, allocates resources and funds, and represents the interests of shareholders.COST-VOLUME-PROFIT RELATIONSHIPS

COST-VOLUME-PROFIT RELATIONSHIPSMahmudul Hasan

╠²

This document presents information about cost-volume-profit (CVP) analysis for Racing Bicycle Company. It includes CVP graphs and equations, contribution margin calculations, and analyses of break-even points and margin of safety. Specifically, it shows that Racing Bicycle's break-even point is at 400 units of sales for $200,000 in revenue, and its margin of safety given actual sales of 500 units is $50,000 or 20% of sales.Factors affecting capital structure

Factors affecting capital structureSandeep Suresh

╠²

This document discusses factors that affect a company's capital structure. It defines capital structure as how a firm finances its operations through various sources of funds such as debt, equity, short-term debt, and other financing options. It then lists 14 factors that influence a company's capital structure decisions, including control interests of shareholders, risks, tax considerations, cost of capital, flexibility, investors' attitudes, legal provisions, growth rate, market conditions, profitability, floatation costs, cost of debt, cost of equity capital, and government policies. Maintaining an optimal capital structure is important for balancing business risks and maximizing shareholder value.Chapter 10 : Responsible Accounting

Chapter 10 : Responsible AccountingPeleZain

╠²

Responsibility accounting involves dividing an organization into responsibility centers and assigning costs and revenues to each center. The key types of responsibility centers are cost centers, which managers are responsible for costs, profit centers where managers are responsible for both costs and revenues, and investment centers where managers are responsible for costs, revenues, and capital employed. Effective responsibility accounting requires setting targets for each center, tracking actual performance against targets, reporting variances to management, and taking corrective actions. It aims to evaluate performance and provide feedback to improve future operations.Depository services

Depository servicesSangam├©sh Ks

╠²

This document discusses depository services in India. It explains that depository services allow for the electronic holding of securities and enable transactions to be processed via book entries. There are two main depositories - National Securities Depository Limited and Central Depository Services Limited - that interface with investors through depository participants like banks and stockbrokers. The depository system works similarly to the banking system, with a central authority and transactions occurring through associated participants rather than directly with the central authority.Working capital management

Working capital managementankita3590

╠²

The study analyzed the impact of working capital management on the profitability of 58 small manufacturing firms in Mauritius over the period of 1998-2003. The results showed that return on total assets, a measure of profitability, was positively correlated with measures of working capital management efficiency like accounts receivable days and cash conversion cycle. However, it was negatively correlated with accounts payable days. The paper concluded that synchronizing current assets and liabilities is important for small firm profitability and the paper industry showed best practices in working capital management.Transfer pricing

Transfer pricingReshma Gaikwad

╠²

This document discusses transfer pricing, which refers to the price at which divisions within a company transact with each other. It provides definitions of transfer pricing and outlines some key issues like how transfer prices impact revenue and influence whether managers prefer customers or suppliers that are internal or external to the company. The document then describes several methods that can be used to determine transfer prices, such as using market rates, negotiated prices, or cost-plus models. It provides an example of calculating an optimal transfer price between wood and paper divisions of a company. The summary concludes by noting how transfer prices can be manipulated for tax purposes in multinational companies.1. introduction to corporate finance

1. introduction to corporate financeirfan_1

╠²

This document provides an introduction to key concepts in corporate finance including what corporate finance is, its relationship to financial accounting and management accounting, the concepts of risk and return and time value of money. It discusses corporate structure including sole proprietorships, partnerships and corporations. It describes the finance function and role of the financial manager in raising, allocating and returning funds. It also covers separation of ownership and management and issues of agency theory and corporate governance.Goodwill & its valuation

Goodwill & its valuationrahul aggarwal

╠²

under this what do you mean by goodwill and what are the methods of goodwill , how to measure and why we need to measure?Similar to Capitalization method (20)

Goodwill

GoodwillPrateekshya Shakya

╠²

1. The document presents methods for calculating goodwill in a business. Goodwill represents the value of assets like brand name, customer base, supplier relationships, and workforce that are not separately recognized in a business acquisition.

2. There are three main methods discussed: average profits method, super profits method, and capitalization method. The average profits and super profits methods calculate goodwill as a multiple of average or excess profits. The capitalization method estimates goodwill as the difference between total capitalized value and net assets.

3. Examples are provided to demonstrate calculating goodwill under the super profits capitalization method. Goodwill is estimated as super profits multiplied by a capitalization rate based on normal returns.Valuation of Goodwill for class 12

Valuation of Goodwill for class 12shreyash Khandelwal

╠²

The document discusses the concept of goodwill in business valuation. It defines goodwill as the favorable reputation and brand name of a business that generates profits year after year. Factors that contribute to goodwill are good public relations, regular customers, quality maintenance, management skills, location, and employee relations. Methods discussed to value goodwill include the average profits method, super profits method, and capitalization method. The average profits and capitalization methods involve calculating average or super profits and capitalizing them based on a normal rate of return to determine goodwill value.Goodwill by capitalisation of super profit method

Goodwill by capitalisation of super profit methodRaj Narayan Yadav

╠²

This document discusses methods for calculating goodwill, specifically the capitalization of super profit method. It provides the formulas for calculating goodwill using this method, where goodwill equals super profit multiplied by the normal rate of return. Super profit is defined as the actual/average profit minus the normal profit. Two examples are provided to illustrate how to use the capitalization of super profit method to calculate goodwill based on given financial information.Calculation of goodwill

Calculation of goodwillPRASANTH VENPAKAL

╠²

This document discusses methods for valuing goodwill of a business. It defines goodwill as the value of a firm's reputation that generates profits above normal levels, known as super profits. The value of goodwill is affected by factors like location, nature of business, management efficiency, time in business, market situation, and special advantages. Goodwill needs to be valued when partners join, retire, die, or the business dissolves. Common valuation methods include average profits, weighted average profits, super profits, capitalization of average/super profits, and present value of super profits. Illustrative examples are provided for each method.ValuationofGoodwill(Krish Dhall).pptx

ValuationofGoodwill(Krish Dhall).pptxKrishDhall

╠²

This document discusses different methods for valuing goodwill, which is the value of a business beyond its tangible assets. It defines goodwill and lists factors that affect its valuation. The key methods covered are:

1. Simple average profit method, which calculates goodwill as the average profit over several years multiplied by the number of purchase years.

2. Super profit method, which determines goodwill based on "super profits" above a normal rate of return on capital employed.

3. Weighted average profit method, a modified version of the simple average method that weights different years' profits.

4. Capitalization methods, which calculate goodwill as average or super profits divided by a normal rate of returnCapitalisation Solved Question Papers (KSAWU)- 2017

Capitalisation Solved Question Papers (KSAWU)- 2017uma reur

╠²

This document discusses the capitalization status of Apoorva Ltd. based on different earnings levels. It provides the balance sheet of the company and calculates the book value and real value of equity shares. When earnings are Rs. 50,000, the real value is Rs. 125 per share, less than the book value of Rs. 150, so the company is over-capitalized. When earnings increase to Rs. 60,000, the real value and book value are both Rs. 150 per share, so the company is fairly capitalized. The document uses calculations of net assets, book value, and capitalized value based on earnings to determine the capitalization status.Capital structure.pptx

Capital structure.pptxmanidevnathani2

╠²

The document discusses various aspects of capital structure including:

1) Capital structure refers to the combination of debt and equity used to finance a company's operations and growth. The capital structure decision considers factors like control, risk, and cost.

2) Several capital structure theories are described including the net income approach, traditional approach, and Modigliani-Miller approach. The net income approach suggests maximizing debt to minimize costs while the traditional approach finds an optimal debt level.

3) Worked examples demonstrate calculating a firm's value, cost of equity, and weighted average cost of capital under different capital structure assumptions.Financial Management - Capitalisation Problems

Financial Management - Capitalisation Problemsuma reur

╠²

This document discusses capitalization and provides examples of calculating capitalized value from estimated earnings. It includes 15 practice problems related to calculating capitalized value, capitalization rate, book value per share, and amount of capitalization given annual earnings and rate of return. The problems cover concepts like capitalized value, book value, capitalization status, and real value of shares. Solutions to the problems apply the formula that capitalized value equals expected earnings multiplied by 100 divided by the rate of return.Dividend policy and firm value with theories

Dividend policy and firm value with theoriessupport346674

╠²

Dividend policy and firm value with theories Valuation of goodwill

Valuation of goodwill Govt. P. G. College, Maldevta (Raipur), Dehradun

╠²

This document discusses various methods for valuing goodwill, including the years' purchase of average profit method, years' purchase of weighted average method, capitalization method, super profit method, and annuity method. It provides examples and calculations to demonstrate how each method is applied in practice. The key information is that goodwill valuation is important for sole proprietorships, partnerships, and companies in various scenarios like sales, mergers, and changes in ownership or profit sharing. Multiple accepted approaches exist to determine the monetary value of goodwill for accounting purposes.Financing Decisions and Capital Structure.pptx

Financing Decisions and Capital Structure.pptxAbhilash731327

╠²

Capital Structure and Financial Decision MakingValuation methods used in mergers and acquisitions

Valuation methods used in mergers and acquisitionsanvi sharma

╠²

This document discusses various valuation methods used in mergers and acquisitions, including asset-based valuation, earnings-based valuation using capitalization of earnings and PE ratios, dividend-based valuation using growth models, CAPM-based valuation, and free cash flow valuation. It emphasizes that the fair value of a company is typically determined by averaging the results of two or more methods to account for different factors and avoid reliance on a single approach.Traditional theory of capital structure

Traditional theory of capital structuredeeksha qanoungo

╠²

The document discusses capital structure, which refers to the composition of a company's long-term capital from sources like loans, reserves, shares, and bonds. It also discusses capitalization, which is the total amount of securities issued, and financial structure, which includes all short-term and long-term financial resources. Different approaches to capital structure are described, including the net income approach, which argues the optimal structure is maximum debt financing to reduce costs. The net operating income approach argues structure does not impact value or costs. The traditional approach finds an optimal debt ratio that balances lower debt costs and higher equity costs.Lecture 19 capital structure

Lecture 19 capital structureKritika Jain

╠²

1. The net income approach suggests that a firm can minimize its weighted average cost of capital and maximize shareholder value by using as much debt financing as possible, as long as the cost of debt is less than the cost of equity and risk is unchanged.

2. The net operating income approach, proposed by Durand, argues that a company's total market value and overall cost of capital remain constant regardless of its debt-equity ratio, so every capital structure is optimal.

3. The document provides examples to illustrate how to calculate a firm's value and capitalization rates under each approach, assuming no corporate taxes.Meeting 3 - Profitability Ratios (Financial Reporting and Analysis)

Meeting 3 - Profitability Ratios (Financial Reporting and Analysis)Albina Gaisina

╠²

The document discusses various profitability ratios used to analyze a company's financial performance, including:

1. Gross profit margin - Measures profitability after direct costs are subtracted from revenue.

2. Operating profit margin - Accounts for indirect costs in addition to direct costs.

3. Net profit margin - Shows profitability after all expenses including interest and taxes.

4. Return on assets - Measures how efficiently a company uses its assets to generate earnings.

5. Return on equity - Assesses how efficiently a company generates profit relative to shareholders' equity.Major decisions of a financial manager

Major decisions of a financial managerSweetp999

╠²

The document discusses financial planning and capitalization. It covers estimating capital requirements, theories of capitalization, and determining if a company is under or over capitalized. The key points are:

- Companies must estimate fixed and working capital needs. The cost and earnings theories of capitalization are used to determine how much funding is required.

- Under or over capitalization can be identified by comparing a company's book value per share to its real value, calculated using earnings and industry capitalization rate.

- If book value is greater than real value, the company is over capitalized. If book value is less than real value, the company is under capitalized. Book value equal to real value means proper capitalizationValuation methods used in mergers & acquisitions

Valuation methods used in mergers & acquisitionsRS P

╠²

The document discusses various valuation methods used in mergers and acquisitions, including:

1) Asset-based valuation which values a company based on the book value of its assets and liabilities.

2) Earnings-based valuation which values a company based on capitalizing its earnings or using its price-earnings ratio.

3) Discounted cash flow valuation which values a company based on the present value of its future free cash flows.

The document recommends using multiple valuation methods and averaging the results to determine a company's fair value for an acquisition.Valuation methods used in mergers & acquisitions

Valuation methods used in mergers & acquisitionsRS P

╠²

The document discusses various valuation methods used in mergers and acquisitions, including:

1) Asset-based valuation which values a company based on the book value of its assets and liabilities.

2) Earnings-based valuation which values a company based on capitalizing its earnings or using its price-earnings ratio.

3) Discounted cash flow valuation which values a company based on the present value of its future free cash flows.

The document recommends using multiple valuation methods and averaging the results to determine a company's fair value for an acquisition.Recently uploaded (20)

BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAH

BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAHcoacharyasetiyaki

╠²

BISNIS BERKAH BERANGKAT KE MEKKAH ISTIKMAL SYARIAHChapter 2. Strategic Management: Corporate Governance.pdf

Chapter 2. Strategic Management: Corporate Governance.pdfRommel Regala

╠²

This course provides students with a comprehensive understanding of strategic management principles, frameworks, and applications in business. It explores strategic planning, environmental analysis, corporate governance, business ethics, and sustainability. The course integrates Sustainable Development Goals (SDGs) to enhance global and ethical perspectives in decision-making.RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper (MMV Exam MCQ)

RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper (MMV Exam MCQ)SONU HEETSON

╠²

RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper. MMV MCQ PDF Free Download for Railway Assistant Loco Pilot Exam.Azure Data Engineer Interview Questions By ScholarHat

Azure Data Engineer Interview Questions By ScholarHatScholarhat

╠²

Azure Data Engineer Interview Questions By ScholarHatYear 10 The Senior Phase Session 3 Term 1.pptx

Year 10 The Senior Phase Session 3 Term 1.pptxmansk2

╠²

Year 10 The Senior Phase Session 3 Term 1.pptxUnit 1 Computer Hardware for Educational Computing.pptx

Unit 1 Computer Hardware for Educational Computing.pptxRomaSmart1

╠²

Computers have revolutionized various sectors, including education, by enhancing learning experiences and making information more accessible. This presentation, "Computer Hardware for Educational Computing," introduces the fundamental aspects of computers, including their definition, characteristics, classification, and significance in the educational domain. Understanding these concepts helps educators and students leverage technology for more effective learning.Mastering Soft Tissue Therapy & Sports Taping

Mastering Soft Tissue Therapy & Sports TapingKusal Goonewardena

╠²

Mastering Soft Tissue Therapy & Sports Taping: Pathway to Sports Medicine Excellence

This presentation was delivered in Colombo, Sri Lanka, at the Institute of Sports Medicine to an audience of sports physiotherapists, exercise scientists, athletic trainers, and healthcare professionals. Led by Kusal Goonewardena (PhD Candidate - Muscle Fatigue, APA Titled Sports & Exercise Physiotherapist) and Gayath Jayasinghe (Sports Scientist), the session provided comprehensive training on soft tissue assessment, treatment techniques, and essential sports taping methods.

Key topics covered:

Ō£ģ Soft Tissue Therapy ŌĆō The science behind muscle, fascia, and joint assessment for optimal treatment outcomes.

Ō£ģ Sports Taping Techniques ŌĆō Practical applications for injury prevention and rehabilitation, including ankle, knee, shoulder, thoracic, and cervical spine taping.

Ō£ģ Sports Trainer Level 1 Course by Sports Medicine Australia ŌĆō A gateway to professional development, career opportunities, and working in Australia.

This training mirrors the Elite Akademy Sports Medicine standards, ensuring evidence-based approaches to injury management and athlete care.

If you are a sports professional looking to enhance your clinical skills and open doors to global opportunities, this presentation is for you.Odoo 18 Accounting Access Rights - Odoo 18 ║▌║▌▀Żs

Odoo 18 Accounting Access Rights - Odoo 18 ║▌║▌▀ŻsCeline George

╠²

In this slide, weŌĆÖll discuss on accounting access rights in odoo 18. To ensure data security and maintain confidentiality, Odoo provides a robust access rights system that allows administrators to control who can access and modify accounting data. Azure Administrator Interview Questions By ScholarHat

Azure Administrator Interview Questions By ScholarHatScholarhat

╠²

Azure Administrator Interview Questions By ScholarHatASP.NET Interview Questions PDF By ScholarHat

ASP.NET Interview Questions PDF By ScholarHatScholarhat

╠²

ASP.NET Interview Questions PDF By ScholarHatInventory Reporting in Odoo 17 - Odoo 17 Inventory App

Inventory Reporting in Odoo 17 - Odoo 17 Inventory AppCeline George

╠²

This slide will helps us to efficiently create detailed reports of different records defined in its modules, both analytical and quantitative, with Odoo 17 ERP.How to Configure Deliver Content by Email in Odoo 18 Sales

How to Configure Deliver Content by Email in Odoo 18 SalesCeline George

╠²

In this slide, weŌĆÖll discuss on how to configure proforma invoice in Odoo 18 Sales module. A proforma invoice is a preliminary invoice that serves as a commercial document issued by a seller to a buyer.Functional Muscle Testing of Facial Muscles.pdf

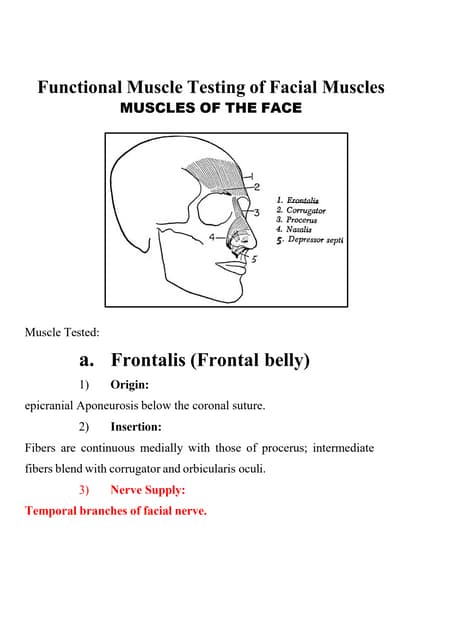

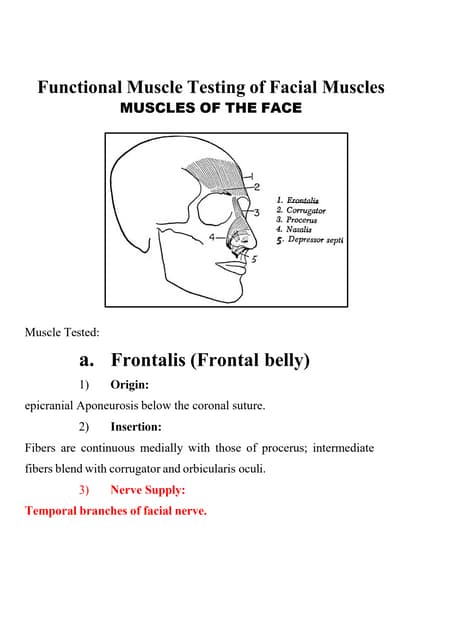

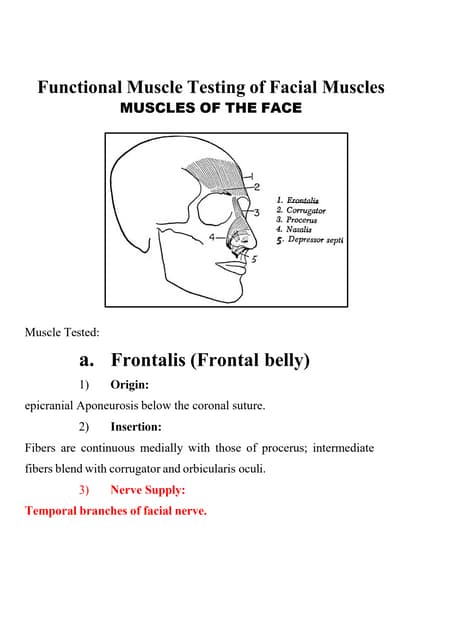

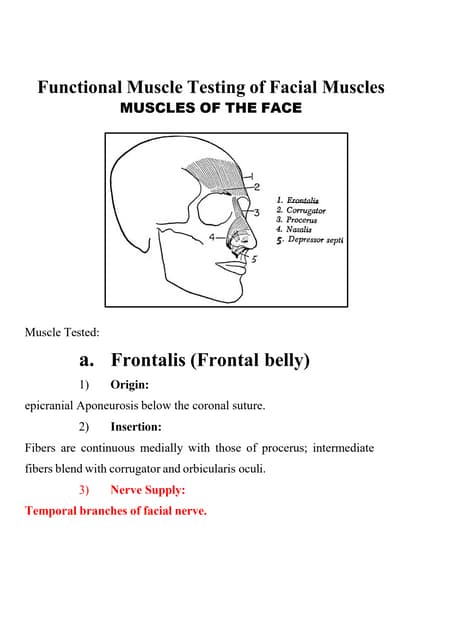

Functional Muscle Testing of Facial Muscles.pdfSamarHosni3

╠²

Functional Muscle Testing of Facial Muscles.pdfNUTRITIONAL ASSESSMENT AND EDUCATION - 5TH SEM.pdf

NUTRITIONAL ASSESSMENT AND EDUCATION - 5TH SEM.pdfDolisha Warbi

╠²

NUTRITIONAL ASSESSMENT AND EDUCATION, Introduction, definition, types - macronutrient and micronutrient, food pyramid, meal planning, nutritional assessment of individual, family and community by using appropriate method, nutrition education, nutritional rehabilitation, nutritional deficiency disorder, law/policies regarding nutrition in India, food hygiene, food fortification, food handling and storage, food preservation, food preparation, food purchase, food consumption, food borne diseases, food poisoningBß╗ś TEST KIß╗éM TRA GIß╗«A K├ī 2 - TIß║ŠNG ANH 10,11,12 - CHUß║©N FORM 2025 - GLOBAL SU...

Bß╗ś TEST KIß╗éM TRA GIß╗«A K├ī 2 - TIß║ŠNG ANH 10,11,12 - CHUß║©N FORM 2025 - GLOBAL SU...Nguyen Thanh Tu Collection

╠²

https://app.box.com/s/ij1ty3vm7el9i4qfrr41o756xycbahmgOne Click RFQ Cancellation in Odoo 18 - Odoo ║▌║▌▀Żs

One Click RFQ Cancellation in Odoo 18 - Odoo ║▌║▌▀ŻsCeline George

╠²

In this slide, weŌĆÖll discuss the one click RFQ Cancellation in odoo 18. One-Click RFQ Cancellation in Odoo 18 is a feature that allows users to quickly and easily cancel Request for Quotations (RFQs) with a single click.Full-Stack .NET Developer Interview Questions PDF By ScholarHat

Full-Stack .NET Developer Interview Questions PDF By ScholarHatScholarhat

╠²

Full-Stack .NET Developer Interview Questions PDF By ScholarHatBß╗ś TEST KIß╗éM TRA GIß╗«A K├ī 2 - TIß║ŠNG ANH 10,11,12 - CHUß║©N FORM 2025 - GLOBAL SU...

Bß╗ś TEST KIß╗éM TRA GIß╗«A K├ī 2 - TIß║ŠNG ANH 10,11,12 - CHUß║©N FORM 2025 - GLOBAL SU...Nguyen Thanh Tu Collection

╠²

Capitalization method

- 1. Capitalization method 1.Capitalization value of average profit method Under this method we calculate the average profits and then assess the capital needed for earning such average profits on basis of normal rate of return. such capital is called capitalization value of average profit.

- 2. ŌĆó Here, goodwill Is the difference between total capitalized value of the firm and net assets of the firm Goodwill=capitalized value of the firm-net assets Capitalized value=average profit/normal rate of return*100 Net assets =total assets-external liabilities

- 3. example A firm earns rs 65000 as its average profits .the usual rate of earnings is 10%.the total assets of the firm amounted to rs 680000 and liabilities are rs 180000.

- 4. calculation ŌĆó Total capitalization value=65000/10*100=650000 ŌĆó Net assets=680000-180000=500000 ŌĆó Goodwill=total capitalization value-net assets =650000-500000=150000