Demonetization: A Welcome or a Worry

- 1. DEMONETIZATION â A WELCOME OR A WORRY ? By CA Mehul R Shah

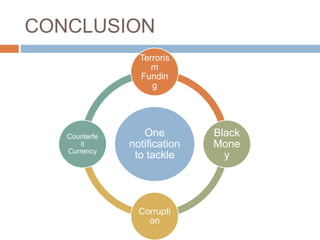

- 2. TABLE OF CONTENT ïĻ THE CURRENT POSITION ïĻ FUTHER DETAILS ïĻ THE NEXT STEP ïĻ ABOUT NEW NOTES ïĻ A PLANNED STEP TO CURB BLACK MONEY ïĻ WHY THE SUDDEN WITHDRAWAL ïĻ WHAT IF YOU ARE AN NRI/FOREIGN TOURIST?! ïĻ MISCELLANEOUS ïĻ CONCLUSION ïĻ THANK YOU

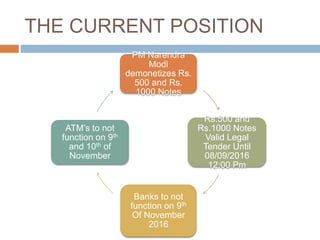

- 3. THE CURRENT POSITION PM Narendra Modi demonetizes Rs. 500 and Rs. 1000 Notes Rs.500 and Rs.1000 Notes Valid Legal Tender Until 08/09/2016 12:00 Pm Banks to not function on 9th Of November 2016 ATMâs to not function on 9th and 10th of November

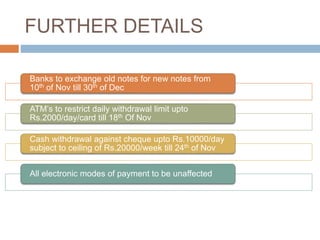

- 4. FURTHER DETAILS Banks to exchange old notes for new notes from 10th of Nov till 30th of Dec ATMâs to restrict daily withdrawal limit upto Rs.2000/day/card till 18th Of Nov Cash withdrawal against cheque upto Rs.10000/day subject to ceiling of Rs.20000/week till 24th of Nov All electronic modes of payment to be unaffected

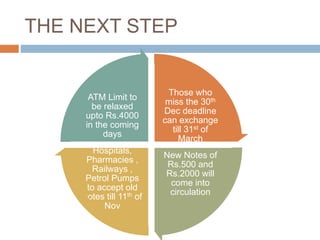

- 5. THE NEXT STEP Those who miss the 30th Dec deadline can exchange till 31st of March New Notes of Rs.500 and Rs.2000 will come into circulation Govt. Hospitals, Pharmacies , Railways , Petrol Pumps to accept old notes till 11th of Nov ATM Limit to be relaxed upto Rs.4000 in the coming days

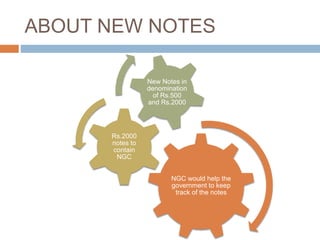

- 6. ABOUT NEW NOTES NGC would help the government to keep track of the notes Rs.2000 notes to contain NGC New Notes in denomination of Rs.500 and Rs.2000

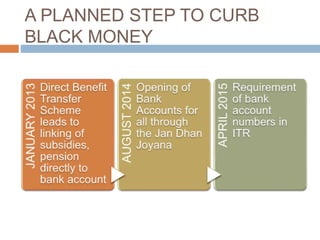

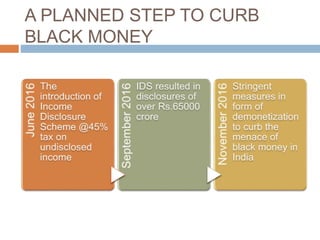

- 7. A PLANNED STEP TO CURB BLACK MONEY

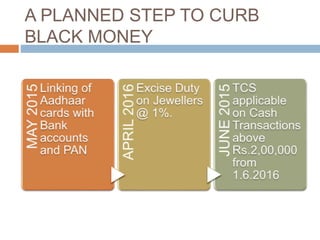

- 8. A PLANNED STEP TO CURB BLACK MONEY

- 9. A PLANNED STEP TO CURB BLACK MONEY

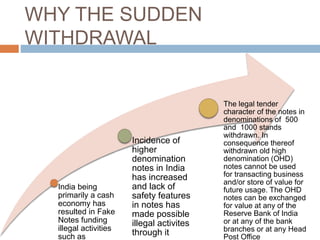

- 10. WHY THE SUDDEN WITHDRAWAL India being primarily a cash economy has resulted in Fake Notes funding illegal activities such as Incidence of higher denomination notes in India has increased and lack of safety features in notes has made possible illegal activites through it The legal tender character of the notes in denominations of 500 and 1000 stands withdrawn. In consequence thereof withdrawn old high denomination (OHD) notes cannot be used for transacting business and/or store of value for future usage. The OHD notes can be exchanged for value at any of the Reserve Bank of India or at any of the bank branches or at any Head Post Office

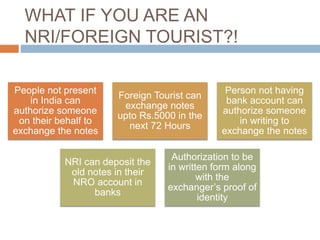

- 11. WHAT IF YOU ARE AN NRI/FOREIGN TOURIST?! People not present in India can authorize someone on their behalf to exchange the notes Foreign Tourist can exchange notes upto Rs.5000 in the next 72 Hours Person not having bank account can authorize someone in writing to exchange the notes NRI can deposit the old notes in their NRO account in banks Authorization to be in written form along with the exchangerâs proof of identity

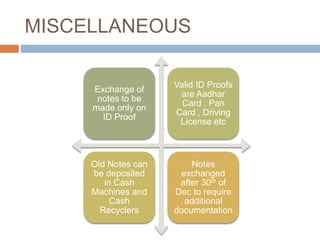

- 12. MISCELLANEOUS Exchange of notes to be made only on ID Proof Valid ID Proofs are Aadhar Card , Pan Card , Driving License etc Old Notes can be deposited in Cash Machines and Cash Recyclers Notes exchanged after 30th of Dec to require additional documentation

- 14. These are just my opinion. Opinion are like wrist watches. All show different times but all think that their time is correctâĶ

- 15. ABOUT THE AUTHOR Author, Mr. Mehul Rasesh Shah is a member of the ICAI. He has pursued certificate Course in International Taxation in the year 2012 conducted by the ICAI. He has also completed his Diploma in IFRS (ACCA, London) and Advanced Diploma in Management Accounting (CIMA, London) in the year 2013. Currently he is handling many Appellate proceedings including representation before the Tribunal and Settlement Commission.

- 16. About Tax Origin Tax Origin is a bunch of enthusiastic Chartered Accountants and Software Professionals, rendering services in the field of Web Application Development, with a distinct focus on Accounting, Taxation and Enterprise integration E-commerce Solutions. Tax Origin also conducts various seminars and publishes blogs on the content written by renowned professionals.

- 17. Thanks!Any questions? ïĻ Log-on to www.taxorigin.com and fill up the inquiry form OR ïĻ E-mail us at rsa.surat@gmail.com