Environmental Due Diligence

- 1. Environmental Due Diligence: Phase I vs. Phase II Assessments Cassie Anderson April 12, 2012

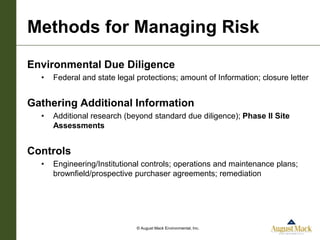

- 2. Methods for Managing Risk Environmental Due Diligence ŌĆó Federal and state legal protections; amount of Information; closure letter Gathering Additional Information ŌĆó Additional research (beyond standard due diligence); Phase II Site Assessments Controls ŌĆó Engineering/Institutional controls; operations and maintenance plans; brownfield/prospective purchaser agreements; remediation ┬® August Mack Environmental, Inc.

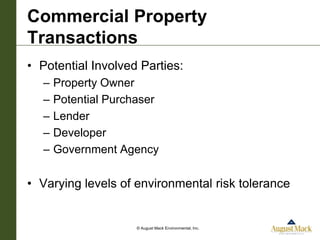

- 3. Commercial Property Transactions ŌĆó Potential Involved Parties: ŌĆō Property Owner ŌĆō Potential Purchaser ŌĆō Lender ŌĆō Developer ŌĆō Government Agency ŌĆó Varying levels of environmental risk tolerance ┬® August Mack Environmental, Inc.

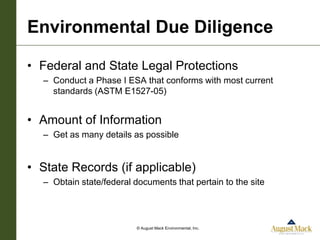

- 4. Environmental Due Diligence ŌĆó Federal and State Legal Protections ŌĆō Conduct a Phase I ESA that conforms with most current standards (ASTM E1527-05) ŌĆó Amount of Information ŌĆō Get as many details as possible ŌĆó State Records (if applicable) ŌĆō Obtain state/federal documents that pertain to the site ┬® August Mack Environmental, Inc.

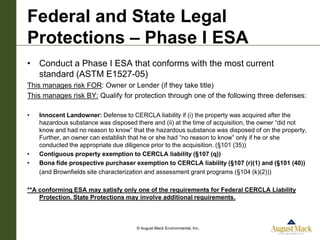

- 5. Federal and State Legal Protections ŌĆō Phase I ESA ŌĆó Conduct a Phase I ESA that conforms with the most current standard (ASTM E1527-05) This manages risk FOR: Owner or Lender (if they take title) This manages risk BY: Qualify for protection through one of the following three defenses: ŌĆó Innocent Landowner: Defense to CERCLA liability if (i) the property was acquired after the hazardous substance was disposed there and (ii) at the time of acquisition, the owner ŌĆ£did not know and had no reason to knowŌĆØ that the hazardous substance was disposed of on the property. Further, an owner can establish that he or she had ŌĆ£no reason to knowŌĆØ only if he or she conducted the appropriate due diligence prior to the acquisition. (┬¦101 (35)) ŌĆó Contiguous property exemption to CERCLA liability (┬¦107 (q)) ŌĆó Bona fide prospective purchaser exemption to CERCLA liability (┬¦107 (r)(1) and (┬¦101 (40)) (and Brownfields site characterization and assessment grant programs (┬¦104 (k)(2))) **A conforming ESA may satisfy only one of the requirements for Federal CERCLA Liability Protection. State Protections may involve additional requirements. ┬® August Mack Environmental, Inc.

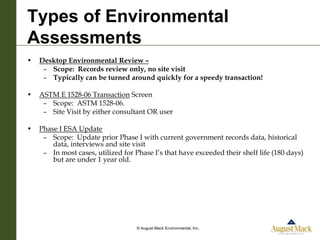

- 6. Types of Environmental Assessments ŌĆó Desktop Environmental Review ŌĆō ŌĆō Scope: Records review only, no site visit ŌĆō Typically can be turned around quickly for a speedy transaction! ŌĆó ASTM E 1528-06 Transaction Screen ŌĆō Scope: ASTM 1528-06. ŌĆō Site Visit by either consultant OR user ŌĆó Phase I ESA Update ŌĆō Scope: Update prior Phase I with current government records data, historical data, interviews and site visit ŌĆō In most cases, utilized for Phase IŌĆÖs that have exceeded their shelf life (180 days) but are under 1 year old. ┬® August Mack Environmental, Inc.

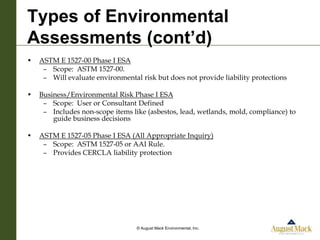

- 7. Types of Environmental Assessments (contŌĆÖd) ŌĆó ASTM E 1527-00 Phase I ESA ŌĆō Scope: ASTM 1527-00. ŌĆō Will evaluate environmental risk but does not provide liability protections ŌĆó Business/Environmental Risk Phase I ESA ŌĆō Scope: User or Consultant Defined ŌĆō Includes non-scope items like (asbestos, lead, wetlands, mold, compliance) to guide business decisions ŌĆó ASTM E 1527-05 Phase I ESA (All Appropriate Inquiry) ŌĆō Scope: ASTM 1527-05 or AAI Rule. ŌĆō Provides CERCLA liability protection ┬® August Mack Environmental, Inc.

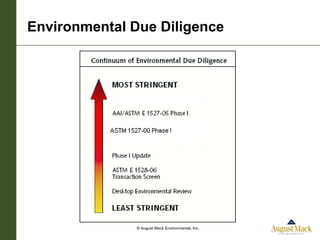

- 8. Environmental Due Diligence ┬® August Mack Environmental, Inc.

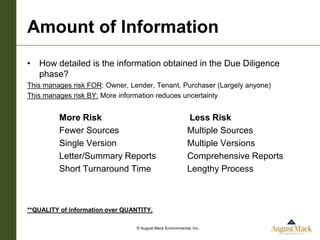

- 9. Amount of Information ŌĆó How detailed is the information obtained in the Due Diligence phase? This manages risk FOR: Owner, Lender, Tenant, Purchaser (Largely anyone) This manages risk BY: More information reduces uncertainty More Risk Less Risk Fewer Sources Multiple Sources Single Version Multiple Versions Letter/Summary Reports Comprehensive Reports Short Turnaround Time Lengthy Process **QUALITY of information over QUANTITY. ┬® August Mack Environmental, Inc.

- 10. Additional Research ŌĆó Reviewing additional sources (file review) This manages risk FOR: Lender or Owner This manages risk BY: Reducing discovered uncertainty in a Phase I ESA ┬® August Mack Environmental, Inc.

- 11. Data Gaps ŌĆó Identified during a Phase I (or similar) ŌĆó A lack of or inability to obtain information required by this practice despite good faith efforts by the environmental professional to gather such information. Data gaps may result from incompleteness in any of the activities required by this practice. ┬® August Mack Environmental, Inc.

- 12. Additional Information Additional Research ŌĆó Using non-conventional sources, above and beyond the standard scope for most Due Diligence projects Phase II ŌĆó Subsurface Investigation to determine presence/absence and possibly the extent of contamination ┬® August Mack Environmental, Inc.

- 13. Phase II ŌĆó Collecting soil and/or groundwater samples for laboratory analysis. ŌĆó Identifying contamination can evaluate the risk tolerance of a potential purchaser or lender, but can also determine the outcome and possibly the negotiation proceedings of a property transaction. ┬® August Mack Environmental, Inc.

- 14. Phase II ŌĆó Subsurface Investigation This manages risk FOR: Lender or Owner This manages risk BY: Understanding the absence, presence/nature/extent of contamination. ┬® August Mack Environmental, Inc.

- 15. Then What? ŌĆō Controls/Plans ŌĆó Nature and Extent ŌĆó Engineering or Institutional Controls (EC/IC) ŌĆō Putting an EC or IC in place ŌĆó Operations and Maintenance (O&M) Plans ŌĆō Asbestos or other O&M Plan ŌĆó Brownfield, Prospective Purchaser Agreements ŌĆō Small Business Liability Relief and Brownfields Revitalization Act ŌĆó Remediation ŌĆō Dig and haul, pump and treat ┬® August Mack Environmental, Inc.

- 16. Engineering or Institutional Controls ŌĆó Placing a physical barrier or land use restriction on a property This manages risk FOR: All involved (Tenants, Owners, Lenders) This manages risk BY: Putting a ŌĆ£barrierŌĆØ (either tangible or intangible) between people and pollution. EC Case Study: Contamination at a bulk fueling terminal is impossible to remediate using conventional methods. Difficulty in subsurface probing due to clearance issues around underground utilities/pipelines. Owner/operator elects to install concrete/asphalt cap over contamination to eliminate the exposure pathway. IC Case Study: A deed notice is associated with the bulk fueling terminal that indicates that all or a portion of the property is contaminated. Because it is associated with the deed, all future owners should be aware of impact during any property transfer. Additionally, a land use restriction is placed on the property. CAVEAT(S): These can be costly and require ŌĆścontinuing obligationsŌĆÖ or restrictions to property use that may impact the value of the property. ┬® August Mack Environmental, Inc.

- 17. Operations and Maintenance Plans Asbestos O&M Plan for a Building with known ACMs This manages risk FOR: Lender, Owner or Tenants This manages risk BY: Ensuring that on a routine schedule, known, potential environmental impact or health concerns are properly mitigated or eliminated. ┬® August Mack Environmental, Inc.

- 18. Brownfield, Prospective Purchaser Agreements ŌĆó Prospective Purchaser Agreement limits liability of seller. This manages risk FOR: Lender, Owner, Developer This manages risk BY: Knowing exactly what is required by all parties upon development and deed transfer. ┬® August Mack Environmental, Inc.

- 19. The Next Step: Remediation ŌĆó Reducing contamination in soil/groundwater to concentrations below applicable action levels This manages risk FOR: Lender or Owner This manages risk BY: Preventing further migration and exposure to environment or humans. Types of Remediation ŌĆó Pump and Treat ŌĆó Dig and Haul ŌĆó Dig and Treat (land farming) ŌĆó In-Situ ŌĆō Thermal ŌĆō Air ŌĆō Chemicals ŌĆō Bio-remediation ŌĆō Phyto-remediation ŌĆó Natural Attenuation ┬® August Mack Environmental, Inc.

- 20. Questions? Cassie Anderson Business Development canderson@augustmack.com 317.916.3151 ┬® August Mack Environmental, Inc.