Gursale sir final accounts adjustment

- 1. BOOK KEEPING & ACCOUNTANCY PARTNERSHIP FINAL ACCOUNTS (Adjustments & their effects) Ajay Janardan Gursale. ( M.Com.B.Ed.) 1

- 2. 1. CLOSING STOCK DR. Trading A/c Particulars Amt Cr. Particulars By Closing Stock Amt. **** Balance sheet Liabilities Amt. Assets Closing Stock Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. **** 2

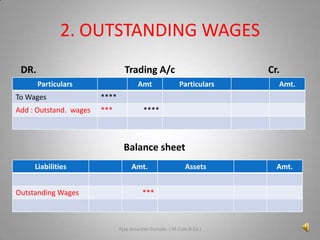

- 3. 2. OUTSTANDING WAGES DR. Trading A/c Particulars Amt To Wages *** Particulars Amt. **** Add : Outstand. wages Cr. **** Balance sheet Liabilities Outstanding Wages Amt. Assets Amt. *** Ajay Janardan Gursale. ( M.Com.B.Ed.) 3

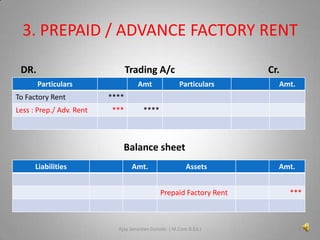

- 4. 3. PREPAID / ADVANCE FACTORY RENT DR. Trading A/c Particulars To Factory Rent Less : Prep./ Adv. Rent Amt Cr. Particulars Amt. **** *** **** Balance sheet Liabilities Amt. Assets Prepaid Factory Rent Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. *** 4

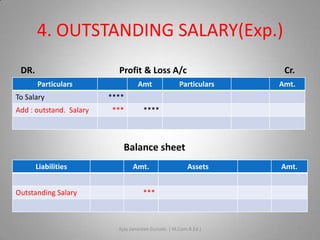

- 5. 4. OUTSTANDING SALARY(Exp.) DR. Profit & Loss A/c Particulars To Salary Add : outstand. Salary Amt Cr. Particulars Amt. **** *** **** Balance sheet Liabilities Outstanding Salary Amt. Assets Amt. *** Ajay Janardan Gursale. ( M.Com.B.Ed.) 5

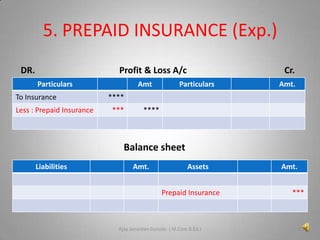

- 6. 5. PREPAID INSURANCE (Exp.) DR. Profit & Loss A/c Particulars To Insurance Less : Prepaid Insurance Amt Cr. Particulars Amt. **** *** **** Balance sheet Liabilities Amt. Assets Prepaid Insurance Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. *** 6

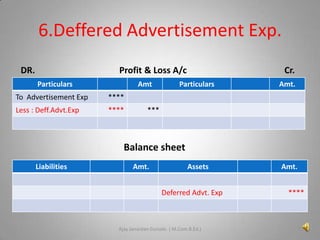

- 7. 6.Deffered Advertisement Exp. DR. Profit & Loss A/c Particulars Amt To Advertisement Exp **** Particulars Amt. **** Less : Deff.Advt.Exp Cr. *** Balance sheet Liabilities Amt. Assets Deferred Advt. Exp Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. **** 7

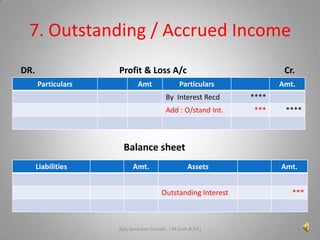

- 8. 7. Outstanding / Accrued Income DR. Profit & Loss A/c Particulars Amt Cr. Particulars Amt. By Interest Recd **** Add : O/stand Int. *** **** Balance sheet Liabilities Amt. Assets Outstanding Interest Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. *** 8

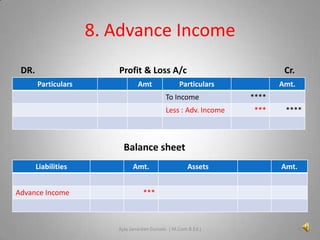

- 9. 8. Advance Income DR. Profit & Loss A/c Particulars Amt Cr. Particulars To Income Less : Adv. Income Amt. **** *** **** Balance sheet Liabilities Advance Income Amt. Assets Amt. *** Ajay Janardan Gursale. ( M.Com.B.Ed.) 9

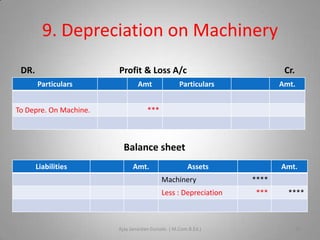

- 10. 9. Depreciation on Machinery DR. Profit & Loss A/c Particulars To Depre. On Machine. Amt Cr. Particulars Amt. *** Balance sheet Liabilities Amt. Assets Machinery Less : Depreciation Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. **** *** **** 10

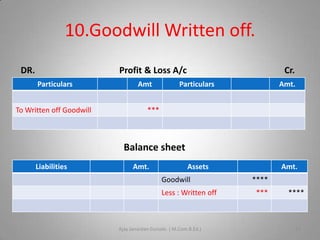

- 11. 10.Goodwill Written off. DR. Profit & Loss A/c Particulars To Written off Goodwill Amt Cr. Particulars Amt. *** Balance sheet Liabilities Amt. Assets Goodwill Less : Written off Ajay Janardan Gursale. ( M.Com.B.Ed.) Amt. **** *** **** 11

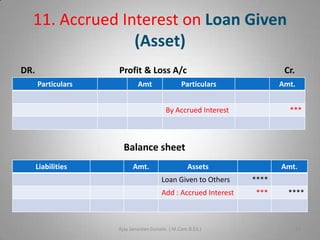

- 12. 11. Accrued Interest on Loan Given (Asset) DR. Profit & Loss A/c Particulars Amt Cr. Particulars Amt. By Accrued Interest *** Balance sheet Liabilities Amt. Assets Amt. Loan Given to Others **** Add : Accrued Interest *** Ajay Janardan Gursale. ( M.Com.B.Ed.) **** 12

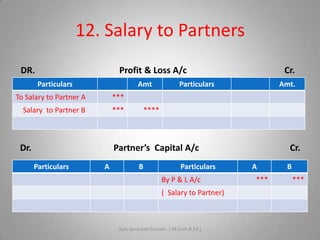

- 13. 12. Salary to Partners DR. Profit & Loss A/c Particulars Amt To Salary to Partner A *** Particulars Amt. *** Salary to Partner B Cr. Dr. **** Partnerâs Capital A/c Particulars A B Particulars By P & L A/c Cr. A *** B *** ( Salary to Partner) Ajay Janardan Gursale. ( M.Com.B.Ed.) 13

- 14. 13.Interest on Capital (Expenses of Business) DR. Profit & Loss A/c Particulars Amt To Interest on Capital A *** Particulars Amt. *** Interest on Capital B Cr. Dr. Particulars **** Partnerâs Capital A/c A B Particulars By P & L A/c Cr. A *** B *** ( Interest on Capital to Partner) Ajay Janardan Gursale. ( M.Com.B.Ed.) 14

- 15. 14. Drawing of Partners DR. Trading A/c Particulars Amt Cr. Particulars Amt. By Goods withdrawn by *** Partners A & B Dr. Particulars To Drawing a/c *** Partnerâs Capital A/c A B *** Particulars **** Cr. A B *** Ajay Janardan Gursale. ( M.Com.B.Ed.) 15

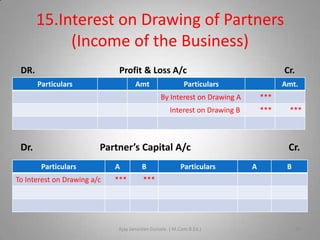

- 16. 15.Interest on Drawing of Partners (Income of the Business) DR. Profit & Loss A/c Particulars Amt Cr. Particulars Amt. By Interest on Drawing A Interest on Drawing B Dr. *** *** Partnerâs Capital A/c Particulars To Interest on Drawing a/c A B *** Particulars *** Cr. *** Ajay Janardan Gursale. ( M.Com.B.Ed.) A B 16