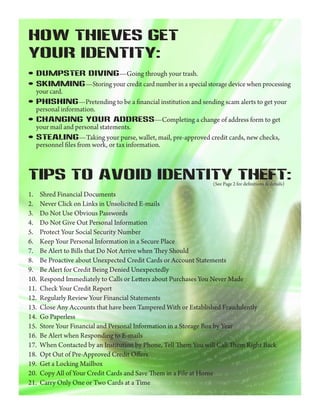

Identity Theft Tips

- 1. HOW THIEVES GET YOUR IDENTITY: ŌĆó Dumpster DivingŌĆöGoing through your trash. ŌĆó SkimmingŌĆöStoring your credit card number in a special storage device when processing your card. ŌĆó PhishingŌĆöPretending to be a financial institution and sending scam alerts to get your personal information. ŌĆó Changing Your AddressŌĆöCompleting a change of address form to get your mail and personal statements. ŌĆó StealingŌĆöTaking your purse, wallet, mail, pre-approved credit cards, new checks, personnel files from work, or tax information. TIPS TO AVOID IDENTITY THEFT: (See Page 2 for definitions & details) 1. Shred Financial Documents 2. Never Click on Links in Unsolicited E-mails 3. Do Not Use Obvious Passwords 4. Do Not Give Out Personal Information 5. Protect Your Social Security Number 6. Keep Your Personal Information in a Secure Place 7. Be Alert to Bills that Do Not Arrive when They Should 8. Be Proactive about Unexpected Credit Cards or Account Statements 9. Be Alert for Credit Being Denied Unexpectedly 10. Respond Immediately to Calls or Letters about Purchases You Never Made 11. Check Your Credit Report 12. Regularly Review Your Financial Statements 13. Close Any Accounts that have been Tampered With or Established Fraudulently 14. Go Paperless 15. Store Your Financial and Personal Information in a Storage Box by Year 16. Be Alert when Responding to E-mails 17. When Contacted by an Institution by Phone, Tell Them You will Call Them Right Back 18. Opt Out of Pre-Approved Credit Offers 19. Get a Locking Mailbox 20. Copy All of Your Credit Cards and Save Them in a File at Home 21. Carry Only One or Two Cards at a Time

- 2. TIPS TO AVOID often denied for a variety of reasons, one of it came directly from a financial institution. which is when too much credit is opened in a If you respond to the e-mail, you encour- IDENTITY THEFT: short period of time. Being denied credit may age them to continue trying to get personal mean that someone else has opened accounts information from you. Simply add the address 1. SHRED FINANCIAL in your name. to your spam list to keep them from contact- DOCUMENTS: Any paperwork with ing you in the future. Visit the addresses you personal information should be put through a 10. RESPOND IMMEDIATELY TO know if you are concerned the notice is valid. shredder before being thrown away. CALLS OR LETTERS ABOUT PUR- CHASES MADE: Credit card companies 17. WHEN CONTACTED BY AN 2. NEVER CLICK ON LINKS IN create a profile of their clients detailing out INSTITUTION BY PHONE, TELL UNSOLICITED E-MAILS: Since the most common places a customer shops THEM YOU WILL CALL THEM ŌĆ£phishingŌĆØ is becoming a common problem, and the items that they frequently buy. If RIGHT BACK: Let them give you their use up-to-date firewalls, anti-spyware, and something is purchased that does not suit name and number, but do not call that num- anti-virus software to protect your home your profile, they will contact you for verifica- ber back. Instead, call the number on the back computer. Good anti-spam software is a must. tion. Respond to the notice right away to head of your card and ask to speak to a representa- Plus, never click on links in e-mails. Instead, off potential theft and damage to your credit. tive about your account. Let them know that open a new window and go to the website you were contacted and ask them to verify any address you know in order to enter informa- 11. CHECK YOUR CREDIT problems. All account managers have access tion. (Fake PayPal e-mails are becoming more REPORT: Any credit opened in your name to the same information, so they will be able common, so be extra wary when dealing with will show up on your credit report. By staying to see if there is a problem with your account these.) You might also want to avoid e-mail on top of this, you will be able to stop identity or not. archiving in the event that someone hacks theft before too much damage occurs. into your account. 18. OPT OUT OF PRE-APPROVED 12. REGULARLY REVIEW YOUR CREDIT OFFERS: Although I do not 3. DO NOT USE OBVIOUS FINANCIAL STATEMENTS: Look for personally believe that people can get your PASSWORDS: These include your birth any charges that you did not make. Also not identity through pre-approved credit card date, motherŌĆÖs maiden name, or the last four that consumers usually have only 30 days to applications without your social security digits of your Social Security number. dispute items they did not authorize. information, it never hurts to opt-out of 13. CLOSE ANY ACCOUNTS THAT credit card offers. By doing so, you lessen the 4. DO NOT GIVE OUT PERSONAL amount of mail that comes to your mailbox, INFORMATION: Whether over the HAVE BEEN TAMPERED WITH OR and you will still be able to apply for credit phone, through the mail, or over the Internet, ESTABLISHED FRAUDULENTLY: online. Check out the FTCŌĆÖs Consumer Alert donŌĆÖt share your information unless you know Get a new card with a new number and close webpage to see all the ways you can opt out. who you are dealing with. the old card, since this alone may stop a thief in possession of your information. 19. GET A LOCKING MAILBOX: 5. PROTECT YOUR SOCIAL This is an especially good idea for anyone in SECURITY NUMBER: Never carry your 14. GO PAPERLESS: You can receive a nice area. The nicer the area you live in, the social security number in your wallet or write many of your bills through your e-mail/on- more ideal a target you make to an identity your social security number on a check. line banking instead of having them mailed. thief because they assume you have more By requesting this benefit, you keep account money for them to steal. 6. KEEP YOUR PERSONAL IN- numbers and personal information private. FORMATION IN A SECURE PLACE: You are also able to save hard copies directly 20. COPY ALL OF YOUR CREDIT This is especially important with roommates, to your hard drive, which allows you to find CARDS AND SAVE THEM IN A FILE outside help, or if you are having work done the information quickly and easily when AT HOME: By having a copy of the card in your home. needed. (front and back) in a locked filing cabinet or 7. BE ALERT TO BILLS THAT 15. STORE YOUR FINANCIAL AND other safe place, you will be able to quickly DO NOT ARRIVE WHEN THEY and easily contact your creditors should your PERSONAL INFORMATION IN purse or wallet ever be stolen. SHOULD: If they do not arrive, they may A STORAGE BOX BY YEAR: This is have been routed somewhere else. especially important when dealing with taxes 21. CARRY ONLY ONE OR TWO since the IRS can demand to see evidential CARDS AT A TIME: Lock away all the 8. BE PROACTIVE ABOUT UN proof of deductions for as long as eleven other cards in a safe place and carry as few EXPECTED CREDIT CARDS OR years after you file. By keeping it in a storage cards as possible. This way, if someone ever ACCOUNT STATEMENTS: If an box, you can shred the contents when the gets into your wallet or purse, you will notice account or credit card arrives that you did time period is up. Note: this does not include immediately if a card is stolen and be able to not open/activate, someone else did. Call social security numbers. report it right away. the company immediately and have it closed/ canceled. 16. BE ALERT WHEN RESPONDING TO E-MAILS: E-mails are now commonly 9. BE ALERT FOR CREDIT BEING used to steal or ŌĆ£phishŌĆØ information out of DENIED UNEXPECTEDLY: Credit is consumers by making the e-mail look as if