INCENTIVE COMPENSATION/human resource.pptx

- 2. What are incentives? ´âÿare rewards given to employees performing beyond the standard requirements. ´âÿAlso referred to as variable pay

- 3. ´éù Factors to consider in establishing and maintaining incentive systems ´éù They must be tied to performance. Efforts and rewards must be directly related to each other. It must be fair and desirable. ´éù They must be designed to cater to individuals who have different needs. This means that there must be a variety of incentives to make sure that a certain type of incentive matches the unique and particular needs of any employee.

- 4. ´éù They must consider the specific environment and limitations of the organization. ´éù They must be reviewed periodically to find out if they are still effective. Changes are necessary if the incentive system is not encouraging employees to perform as expected.

- 5. Types of Incentives ´éù Individual incentive plan ´éù Group incentive plan ´éù Organizational incentive plan

- 6. INDIVIDUAL INCENTIVE PLANS ´âÿare those designed to motivate the individual employees to perform beyond standard requirements. Requisite: ´éù Individual contribution must be the emphasis of the organization. ´éù The job must be designed to allow the individual employees to work independently and with autonomy and discretion.

- 7. Individual incentive plans may be classified into the following: 1.Piece rate system ´éù pays individual employees based on the number of units produced by each. It is either straight or differential. ´éù Straight piece rate plan pays employees a certain rate for each unit produced. ´éù Differential piece rate plan, two rates are established: one for production within standard and another one for production above standard.

- 8. 2.Commissions ´éù is a form of incentive usually paid to sales employees. It is based on a percentage of sales in units or pesos. ´éù it is maybe paid using any of the two arrangements: Ôùª straight commission ÔÇô the employee receives as an incentive the total amount of sales made times his rate. Ôùª A small salary plus a commission ÔÇô when the employee exceeds the budgeted sales goal.

- 9. 3.Bonuses - an extra pay payment given to employees for good performance. 4.Merit pay ÔÇô as individual pay increases based on the rated performance of individual employees in a previous time period.

- 10. GROUP INCENTIVE PLANS ´éù are those designed to reward work teams, project members, or departments. Instead of individual output, the emphasis of group incentive is on group output. ´éù Teamwork is encouraged and poor performers are under pressure from other group members.

- 11. ORGANIZATIONAL INCENTIVE PLANS ´éù are rewards designed to cover all employees in an organization. Organization ÔÇô wide incentive plan consist of gain sharing, profit sharing, and employee stock ownership.

- 12. GAIN SHARING PLANS ÔÇô these are company wide group incentive plans that provide additional pay to employees based on group performance. ´éù the objective of this is to motivate the employees to increase production or reduce costs.

- 13. ´éù PROFIT SHARING PLANS - are those that reward employees using the profits of the enterprise as basis. Just like gain sharing plans, groups rather than individuals are rewarded.

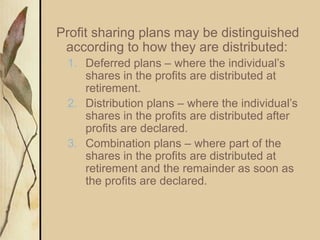

- 14. Profit sharing plans may be distinguished according to how they are distributed: 1. Deferred plans ÔÇô where the individualÔÇÖs shares in the profits are distributed at retirement. 2. Distribution plans ÔÇô where the individualÔÇÖs shares in the profits are distributed after profits are declared. 3. Combination plans ÔÇô where part of the shares in the profits are distributed at retirement and the remainder as soon as the profits are declared.

- 15. ´éù EMPLOYEE STOCK OWNERSHIP PLAN ÔÇô offer company stocks as an incentive to employees for good performance.

- 16. INCENTIVES FOR PROFESSIONALS INCENTIVES FOR EXECUTIVES ´éù the ability of executives to influence employees to perform provides sufficient reason to consider carefully the kinds of incentives they deserve. ´éù The following are the basic components of executive compensation:

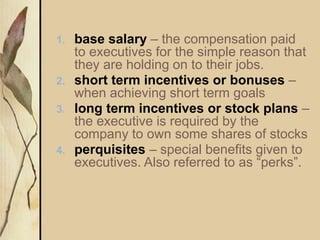

- 17. 1. base salary ÔÇô the compensation paid to executives for the simple reason that they are holding on to their jobs. 2. short term incentives or bonuses ÔÇô when achieving short term goals 3. long term incentives or stock plans ÔÇô the executive is required by the company to own some shares of stocks 4. perquisites ÔÇô special benefits given to executives. Also referred to as ÔÇ£perksÔÇØ.