income tax

Download as PPTX, PDF2 likes574 views

This document defines and explains different types of taxes. It begins by defining tax as a financial charge imposed by a state on taxpayers to fund government expenditures. It then distinguishes between direct and indirect taxes. Direct taxes are paid directly by individuals or organizations to the government, such as income tax and wealth tax, while indirect taxes increase the price of goods so consumers pay the tax. The document provides examples of indirect taxes like excise duty, VAT, sales tax, and service tax. It also defines key tax-related terms like assessment year, previous year, and person.

1 of 22

Download to read offline

Recommended

Income tax basics

Income tax basicsCA Deepali Gupta

Ėý

Income tax is a tax paid to the government on income. There are different types of taxes including direct taxes like income tax paid directly by taxpayers. Income tax is assessed based on an individual's gross total income, which is the aggregate income from five heads - salaries, house property, business/profession, capital gains, and other sources. Key concepts include taxable income, tax exemption limits, tax rates, residential status, tax deductions, and different types of income like casual income, capital gains income etc.Income tax

Income tax faysalsalekin

Ėý

This document summarizes key aspects of the Income Tax Ordinance 1984 of Bangladesh. It has 23 chapters and 187 sections that outline the procedural aspects of income tax law. Some key points include:

- It establishes different classes of income tax authorities like the National Board of Revenue, Commissioners of Taxes, Deputy Commissioners of Taxes, and Inspectors of Taxes.

- It covers the computation of income from various sources like wages, salaries, dividends, interest and rents.

- Other chapters address tax assessment, penalties, appeals, recovery of unpaid taxes, and provisions for double taxation relief and tax refunds.

- Schedules provide more details on assessment procedures, penalties that can be imposedIncome tax

Income taxV.V.Vanniaperumal College for Women

Ėý

Income tax is imposed on individuals according to their income level through a progressive tax system. The assessment year is the financial year during which a person's income from the previous year is assessed for taxation. Various types of incomes are categorized under different heads and then aggregated to determine the gross total income, from which deductions can be claimed to arrive at the total taxable income. An individual's residential status determines whether their global income is taxable in India.Income tax

Income taxVIVEK GILL

Ėý

This document provides information about income tax in India. It discusses the history of income tax dating back over 3,000 years to ancient Egypt and Greece. It was first introduced in India in 1860. The document outlines the various income tax authorities in India and provides definitions of key terms like assessee, person, assessment year, and previous year. It also describes the different types of income tax return forms (ITR) individuals and organizations can file. Other sections cover interest charges, advance tax payment due dates, and details of the Income Disclosure Scheme of 2016 for declaring undisclosed income and paying tax at concessional rates.Classification of taxes ppt doms

Classification of taxes ppt domsBabasab Patil

Ėý

The document discusses various types of taxes in India including direct taxes like income tax and indirect taxes like sales tax. It explains the key concepts related to income tax like previous year, assessment year, residential status, total income and tax slabs. Residential status is determined based on the number of days spent in India and can be resident, non-resident or resident but not ordinarily resident. Total income includes income from various heads like salary, house property, business, capital gains and other sources after exemptions. Tax is calculated by applying the appropriate tax rates to the net taxable income.Income Tax

Income TaxDayasagar S

Ėý

The document defines key terms related to income tax in India such as assessee, person, assessment year, previous year, types of income, and tax rates. It discusses how taxable income is calculated based on income from different sources such as salary, house property, business, capital gains, and other sources. It also outlines the incidence of tax for residents and non-residents depending on where the income is earned and received.In Come Tax Law Of India

In Come Tax Law Of IndiaDr. Trilok Kumar Jain

Ėý

come and join afterschoool and spread management education to common people so that they may become entrepreneurs. spread knowledge about business, entrepreneurship and commerce.General presentation on Income Tax in Bangladesh

General presentation on Income Tax in BangladeshBarrister Mutasim Billah Faruqui

Ėý

This document provides an overview of income tax returns in Bangladesh. It discusses key topics like the jurisdiction of different tax authorities, guidelines for filling out the income tax return form, calculating tax liabilities and credits, supporting documents required, and common errors. The return form has 8 pages collecting information on personal details, income sources, assets, liabilities, and expenditures. Examples are provided for correctly filling out sections on salaries, house rental income, interest from securities, agricultural income, and business income.Income tax-ppt

Income tax-pptlkiju

Ėý

The document discusses various aspects of income tax in India such as residential status, types of income, tax rates, deductions, and allowances. It provides definitions for key terms, outlines the process for determining residential status, and specifies tax treatment and exemptions for different types of income like salary, gratuity, pension, and perquisites. The document also details income tax slabs and surcharge rates for individuals, HUFs, firms, and companies.Income tax assessment year 2018 19

Income tax assessment year 2018 19Subramanya Bhat

Ėý

- Income Tax Return (ITR) is a document filed with the Indian Income Tax Department by taxpayers annually detailing their earnings and taxes paid for the year. It must be filed by all Indian citizens earning a taxable income.

- The due date for individual ITR filing for financial year 2018-2019 was July 31, 2018. The date is extended for individuals requiring tax audit. Late filers may face penalties.

- The Indian income tax system levies tax on both earned and unearned incomes based on multiple tax slabs ranging from 0-30% depending on the amount of total annual income. Tax rates are lower for senior citizens.Income Tax

Income TaxBandS

Ėý

The document provides an overview of key provisions under the Indian Income Tax Act. It discusses various heads of income like salary, house property, capital gains, and business income. It summarizes important points around deductions available for HRA, interest on housing loans, losses from house property rental, and capital gains from sale of art. The document also discusses key compliance requirements like TDS, advance tax payments, and income tax return filing due dates. It summarizes special provisions for new units in SEZs, additional depreciation, and deductions available for undertakings located in certain states.Unit 1-tk-ppt

Unit 1-tk-pptMadanapalle Institute of Technology & Science

Ėý

The basic concepts in Income tax such as assesse, assessment year previous year, etc are defined besides discussing the brief history of Income Tax....By...Dr. Thulasi Krishna. KChapter 1

Chapter 1Anita Tongli

Ėý

The document provides definitions and concepts related to income tax in India. It defines key terms like assessee, assessment, person, income, direct tax, indirect tax. It explains the types of taxes and why taxes are levied. It describes the procedure for computing total income which involves determining residential status, classifying income under different heads, setting off losses, deductions and arriving at tax payable. Taxation laws

Taxation lawsSRI GANESH

Ėý

Here are the key points regarding liability to pay excise duty:

- The manufacturer of excisable goods is primarily liable to pay excise duty.

- The owner of the factory or premises where manufacture takes place is also liable if the duty cannot be recovered from the manufacturer.

- Every person who produces or manufactures excisable goods or stores such goods in a warehouse is liable to pay excise duty.

- Duty is payable on removal of goods from the place of manufacture or warehouse. No excisable goods can be removed without payment of applicable duty, unless otherwise provided.

- Liability arises when goods are removed from the place of manufacture or warehouse for home consumption or sale. The dutyIncome tax A.Y 2014-2015

Income tax A.Y 2014-2015Sshailesh L. Prajapati

Ėý

This presentation has Income Tax Notes as per AY 2014-2015.

This is only for eduction purpose and not inteded to any action without a proper advise.income tax

income taxGorani & Associates

Ėý

The document provides an overview of the Income Tax Act of 1961 in India. It discusses key concepts such as the definition of an assessee, types of income, taxable income, residential status, exempted incomes, heads of income including salary, house property, capital gains, and other sources. It also summarizes provisions related to computation of profits from business or profession, capital gains, deductions allowed, and scope of total income under the act.Basics- Income tax basic info.

Basics- Income tax basic info.CA Bala Yadav

Ėý

This document discusses various topics related to direct taxes in India including definitions, types of taxes, key terms, and assessments. It defines tax as a financial charge imposed by the state on taxpayers that is punishable by law. It notes direct taxes are paid directly by individuals/organizations to the government, while indirect taxes increase good prices so consumers pay the tax. The document outlines that in India, the assessment year is the year in which income from the previous financial year is assessed for tax purposes. It also provides exceptions for when income may be taxed in the year it is earned rather than the following assessment year.Income Tax Fundamental Concepts

Income Tax Fundamental ConceptsRAJESH JAIN

Ėý

Under Fundamental Concepts of Income Tax Presentation, Important Definitions under Income Tax Act, Residential Status of the assesses & its tax incidence is covered.Income tax introduction

Income tax introductionChitraChellam

Ėý

The document provides a history of income tax law in India and definitions of key concepts in income tax. It discusses how income tax was first introduced in 1860 and the various acts passed until the current Income Tax Act of 1961. It defines important terms like assessee, person, income, agricultural income, assessment year, and previous year. It also outlines what constitutes taxable income and exemptions under the law.Income Tax Overview

Income Tax OverviewKenya Revenue Authority

Ėý

Income tax in Kenya is governed by the Income Tax Act and charges tax on various types of income earned by individuals and corporations. There are several methods of collecting income tax, including: Pay As You Earn (PAYE) for employed individuals; Corporation Tax for companies; Installment Tax for those with tax liability over Kshs. 40,000; Withholding Tax deducted at source; Advance Tax paid before vehicle licensing; Turnover Tax on business with annual sales over Kshs. 1 million; Residential Rental Income Tax; and Capital Gains Tax on property transfers. income Tax on various entity

income Tax on various entityVED MITTAL

Ėý

The document outlines the various tax rates applicable to different entities in India for the fiscal year 2017-18, including individuals, HUFs, partnership firms, companies, LLPs, AOPs, BOIs, cooperative societies, and local authorities. It provides the basic exemption limits and tax slabs for individuals of different ages. It also summarizes the steps to compute taxable income and tax liability for these different entities. Key tax rates mentioned include 30% for firms/LLPs, 25-40% for domestic and foreign companies depending on income level, and 10-30% for cooperative societies based on taxable income.Tax computation

Tax computationghanchifarhan

Ėý

This document provides information on various aspects of income tax in India including different types of income and applicable tax rates, common deductions and exemptions available, procedures for tax filing and payment, due dates and forms for tax returns. Key points covered include income from salary and applicable tax deductions, capital gains tax rates, section 80C deductions, filing tax returns online or physically and related timelines.Income Tax Management

Income Tax ManagementVijay Zanzrukiya

Ėý

This document provides guidelines on income tax management and reimbursement processes. It outlines Indian income tax slabs and various deductions available under sections such as 80C, 80D, 80DD, 80E, and 80U. It discusses deductions based on salary structure such as HRA, children education allowance, medical reimbursement, LTA reimbursement, and more. The document also details reimbursement and payroll schedules that must be followed, including deadlines for submitting reimbursement statements, obtaining approvals, passing journals, verifying documents, and processing payments.Introduction to Income Tax

Introduction to Income TaxAshutosh Mittal

Ėý

The document provides an overview of basic concepts related to income tax in India, including definitions of key terms like tax, direct tax, indirect tax, income, assessee, capital/revenue receipts and expenditures. It explains that the Income Tax Act of 1961 governs income tax and its provisions for determining taxable income and tax liability. Income includes various sources like profits, dividends, capital gains, interest etc. Computation of taxable income involves calculating income under different heads, applying deductions and exemptions, and determining the final tax liability.Income Tax Introduction

Income Tax Introductionneelima kogta

Ėý

The document provides an overview of key concepts in India's Income Tax Act of 1961, including that it extends to all of India and sets tax rates annually. It defines income broadly to include various sources like salary, business profits, capital gains, and more. An assessee is anyone liable to pay tax, including individuals, HUFs, companies, and firms. The previous year refers to the year income is earned and taxed the following assessment year. Exceptions apply for some incomes taxed in the year before the normal assessment year. Returns must be filed by certain categories and assessments include reassessments.Income presentation

Income presentationHelena Smith

Ėý

This document provides an overview of income calculations for determining eligibility. It discusses the purpose of income calculations, different pay frequencies, countable vs. non-countable income, determining monthly income amounts, income source codes, and exercises for calculating income. The objectives are to understand income verification, identify pay frequencies, determine countable monthly income, know income codes, and practice income calculations and data entry. Pay periods include weekly, bi-weekly, twice monthly, and monthly. Countable income includes earnings and benefits while non-countable includes loans, refunds, and SSI. Calculations convert pay to a monthly amount using multiplication factors.Income Tax(law and practice) (INDIA)

Income Tax(law and practice) (INDIA)Parminder Kaur

Ėý

This document provides an overview of income tax law and practice in India. It begins with a brief history of income tax in India and then defines key terms like assessment year, previous year, person, assessee, and income. It outlines the components that make up India's income tax law and discusses the basis of charging income tax. It also defines gross total income and total income. The document concludes by summarizing the general income tax rates for the assessment year 2013-2014 and providing details about what constitutes agricultural income and income that is exempt from taxation.Important topics of taxation

Important topics of taxation Marria Pirwani

Ėý

Income from other sources is a residual category that includes any income not covered under other heads. Key types of income covered are dividends, interest, lottery winnings, and cash gifts over Rs. 50,000 (except from relatives). Deductions for expenses incurred to earn such income are allowed under section 57, while section 58 disallows some expenses. Certain income chargeable under this head may instead be charged under business income depending on circumstances. The tax treatment of different types of other income like dividends and lottery winnings is also specified.Introduction to Income Tax-I

Introduction to Income Tax-ILAKSHMI V

Ėý

The document provides an overview of the history and framework of income tax in India. It discusses key definitions such as assessment year, previous year, assessee, person, income types. It outlines the principles (canons) of taxation including equality, certainty, convenience, economy, productivity, elasticity, simplicity and diversity. The document also describes the different tax authorities in India and their roles. It provides details on calculating agricultural income and the tax schemes for individual, firms, companies and local authorities for the assessment year 2020-21. Finally, it discusses the differences between capital vs revenue receipts/expenditure/losses.Income tax introduction and basic concepts

Income tax introduction and basic conceptsDr.Sangeetha R

Ėý

The document provides an introduction to income tax concepts including:

1) It defines income tax as a tax imposed by governments on the income generated by individuals and businesses within their jurisdiction, with taxpayers required to file annual returns.

2) It distinguishes between direct taxes, where the tax burden falls directly on the taxpayer, and indirect taxes, where the burden is passed on to consumers. Income tax is an example of a direct tax.

3) It outlines key income tax terms - the assessment year is the year income is taxed, the previous year is when the income was earned, and an assessee is anyone subject to income tax rules.More Related Content

What's hot (20)

Income tax-ppt

Income tax-pptlkiju

Ėý

The document discusses various aspects of income tax in India such as residential status, types of income, tax rates, deductions, and allowances. It provides definitions for key terms, outlines the process for determining residential status, and specifies tax treatment and exemptions for different types of income like salary, gratuity, pension, and perquisites. The document also details income tax slabs and surcharge rates for individuals, HUFs, firms, and companies.Income tax assessment year 2018 19

Income tax assessment year 2018 19Subramanya Bhat

Ėý

- Income Tax Return (ITR) is a document filed with the Indian Income Tax Department by taxpayers annually detailing their earnings and taxes paid for the year. It must be filed by all Indian citizens earning a taxable income.

- The due date for individual ITR filing for financial year 2018-2019 was July 31, 2018. The date is extended for individuals requiring tax audit. Late filers may face penalties.

- The Indian income tax system levies tax on both earned and unearned incomes based on multiple tax slabs ranging from 0-30% depending on the amount of total annual income. Tax rates are lower for senior citizens.Income Tax

Income TaxBandS

Ėý

The document provides an overview of key provisions under the Indian Income Tax Act. It discusses various heads of income like salary, house property, capital gains, and business income. It summarizes important points around deductions available for HRA, interest on housing loans, losses from house property rental, and capital gains from sale of art. The document also discusses key compliance requirements like TDS, advance tax payments, and income tax return filing due dates. It summarizes special provisions for new units in SEZs, additional depreciation, and deductions available for undertakings located in certain states.Unit 1-tk-ppt

Unit 1-tk-pptMadanapalle Institute of Technology & Science

Ėý

The basic concepts in Income tax such as assesse, assessment year previous year, etc are defined besides discussing the brief history of Income Tax....By...Dr. Thulasi Krishna. KChapter 1

Chapter 1Anita Tongli

Ėý

The document provides definitions and concepts related to income tax in India. It defines key terms like assessee, assessment, person, income, direct tax, indirect tax. It explains the types of taxes and why taxes are levied. It describes the procedure for computing total income which involves determining residential status, classifying income under different heads, setting off losses, deductions and arriving at tax payable. Taxation laws

Taxation lawsSRI GANESH

Ėý

Here are the key points regarding liability to pay excise duty:

- The manufacturer of excisable goods is primarily liable to pay excise duty.

- The owner of the factory or premises where manufacture takes place is also liable if the duty cannot be recovered from the manufacturer.

- Every person who produces or manufactures excisable goods or stores such goods in a warehouse is liable to pay excise duty.

- Duty is payable on removal of goods from the place of manufacture or warehouse. No excisable goods can be removed without payment of applicable duty, unless otherwise provided.

- Liability arises when goods are removed from the place of manufacture or warehouse for home consumption or sale. The dutyIncome tax A.Y 2014-2015

Income tax A.Y 2014-2015Sshailesh L. Prajapati

Ėý

This presentation has Income Tax Notes as per AY 2014-2015.

This is only for eduction purpose and not inteded to any action without a proper advise.income tax

income taxGorani & Associates

Ėý

The document provides an overview of the Income Tax Act of 1961 in India. It discusses key concepts such as the definition of an assessee, types of income, taxable income, residential status, exempted incomes, heads of income including salary, house property, capital gains, and other sources. It also summarizes provisions related to computation of profits from business or profession, capital gains, deductions allowed, and scope of total income under the act.Basics- Income tax basic info.

Basics- Income tax basic info.CA Bala Yadav

Ėý

This document discusses various topics related to direct taxes in India including definitions, types of taxes, key terms, and assessments. It defines tax as a financial charge imposed by the state on taxpayers that is punishable by law. It notes direct taxes are paid directly by individuals/organizations to the government, while indirect taxes increase good prices so consumers pay the tax. The document outlines that in India, the assessment year is the year in which income from the previous financial year is assessed for tax purposes. It also provides exceptions for when income may be taxed in the year it is earned rather than the following assessment year.Income Tax Fundamental Concepts

Income Tax Fundamental ConceptsRAJESH JAIN

Ėý

Under Fundamental Concepts of Income Tax Presentation, Important Definitions under Income Tax Act, Residential Status of the assesses & its tax incidence is covered.Income tax introduction

Income tax introductionChitraChellam

Ėý

The document provides a history of income tax law in India and definitions of key concepts in income tax. It discusses how income tax was first introduced in 1860 and the various acts passed until the current Income Tax Act of 1961. It defines important terms like assessee, person, income, agricultural income, assessment year, and previous year. It also outlines what constitutes taxable income and exemptions under the law.Income Tax Overview

Income Tax OverviewKenya Revenue Authority

Ėý

Income tax in Kenya is governed by the Income Tax Act and charges tax on various types of income earned by individuals and corporations. There are several methods of collecting income tax, including: Pay As You Earn (PAYE) for employed individuals; Corporation Tax for companies; Installment Tax for those with tax liability over Kshs. 40,000; Withholding Tax deducted at source; Advance Tax paid before vehicle licensing; Turnover Tax on business with annual sales over Kshs. 1 million; Residential Rental Income Tax; and Capital Gains Tax on property transfers. income Tax on various entity

income Tax on various entityVED MITTAL

Ėý

The document outlines the various tax rates applicable to different entities in India for the fiscal year 2017-18, including individuals, HUFs, partnership firms, companies, LLPs, AOPs, BOIs, cooperative societies, and local authorities. It provides the basic exemption limits and tax slabs for individuals of different ages. It also summarizes the steps to compute taxable income and tax liability for these different entities. Key tax rates mentioned include 30% for firms/LLPs, 25-40% for domestic and foreign companies depending on income level, and 10-30% for cooperative societies based on taxable income.Tax computation

Tax computationghanchifarhan

Ėý

This document provides information on various aspects of income tax in India including different types of income and applicable tax rates, common deductions and exemptions available, procedures for tax filing and payment, due dates and forms for tax returns. Key points covered include income from salary and applicable tax deductions, capital gains tax rates, section 80C deductions, filing tax returns online or physically and related timelines.Income Tax Management

Income Tax ManagementVijay Zanzrukiya

Ėý

This document provides guidelines on income tax management and reimbursement processes. It outlines Indian income tax slabs and various deductions available under sections such as 80C, 80D, 80DD, 80E, and 80U. It discusses deductions based on salary structure such as HRA, children education allowance, medical reimbursement, LTA reimbursement, and more. The document also details reimbursement and payroll schedules that must be followed, including deadlines for submitting reimbursement statements, obtaining approvals, passing journals, verifying documents, and processing payments.Introduction to Income Tax

Introduction to Income TaxAshutosh Mittal

Ėý

The document provides an overview of basic concepts related to income tax in India, including definitions of key terms like tax, direct tax, indirect tax, income, assessee, capital/revenue receipts and expenditures. It explains that the Income Tax Act of 1961 governs income tax and its provisions for determining taxable income and tax liability. Income includes various sources like profits, dividends, capital gains, interest etc. Computation of taxable income involves calculating income under different heads, applying deductions and exemptions, and determining the final tax liability.Income Tax Introduction

Income Tax Introductionneelima kogta

Ėý

The document provides an overview of key concepts in India's Income Tax Act of 1961, including that it extends to all of India and sets tax rates annually. It defines income broadly to include various sources like salary, business profits, capital gains, and more. An assessee is anyone liable to pay tax, including individuals, HUFs, companies, and firms. The previous year refers to the year income is earned and taxed the following assessment year. Exceptions apply for some incomes taxed in the year before the normal assessment year. Returns must be filed by certain categories and assessments include reassessments.Income presentation

Income presentationHelena Smith

Ėý

This document provides an overview of income calculations for determining eligibility. It discusses the purpose of income calculations, different pay frequencies, countable vs. non-countable income, determining monthly income amounts, income source codes, and exercises for calculating income. The objectives are to understand income verification, identify pay frequencies, determine countable monthly income, know income codes, and practice income calculations and data entry. Pay periods include weekly, bi-weekly, twice monthly, and monthly. Countable income includes earnings and benefits while non-countable includes loans, refunds, and SSI. Calculations convert pay to a monthly amount using multiplication factors.Income Tax(law and practice) (INDIA)

Income Tax(law and practice) (INDIA)Parminder Kaur

Ėý

This document provides an overview of income tax law and practice in India. It begins with a brief history of income tax in India and then defines key terms like assessment year, previous year, person, assessee, and income. It outlines the components that make up India's income tax law and discusses the basis of charging income tax. It also defines gross total income and total income. The document concludes by summarizing the general income tax rates for the assessment year 2013-2014 and providing details about what constitutes agricultural income and income that is exempt from taxation.Important topics of taxation

Important topics of taxation Marria Pirwani

Ėý

Income from other sources is a residual category that includes any income not covered under other heads. Key types of income covered are dividends, interest, lottery winnings, and cash gifts over Rs. 50,000 (except from relatives). Deductions for expenses incurred to earn such income are allowed under section 57, while section 58 disallows some expenses. Certain income chargeable under this head may instead be charged under business income depending on circumstances. The tax treatment of different types of other income like dividends and lottery winnings is also specified.Similar to income tax (20)

Introduction to Income Tax-I

Introduction to Income Tax-ILAKSHMI V

Ėý

The document provides an overview of the history and framework of income tax in India. It discusses key definitions such as assessment year, previous year, assessee, person, income types. It outlines the principles (canons) of taxation including equality, certainty, convenience, economy, productivity, elasticity, simplicity and diversity. The document also describes the different tax authorities in India and their roles. It provides details on calculating agricultural income and the tax schemes for individual, firms, companies and local authorities for the assessment year 2020-21. Finally, it discusses the differences between capital vs revenue receipts/expenditure/losses.Income tax introduction and basic concepts

Income tax introduction and basic conceptsDr.Sangeetha R

Ėý

The document provides an introduction to income tax concepts including:

1) It defines income tax as a tax imposed by governments on the income generated by individuals and businesses within their jurisdiction, with taxpayers required to file annual returns.

2) It distinguishes between direct taxes, where the tax burden falls directly on the taxpayer, and indirect taxes, where the burden is passed on to consumers. Income tax is an example of a direct tax.

3) It outlines key income tax terms - the assessment year is the year income is taxed, the previous year is when the income was earned, and an assessee is anyone subject to income tax rules.Direct tax ppt.pptx

Direct tax ppt.pptxjaiaditya2010

Ėý

This document defines key terms related to taxation in India. It discusses direct and indirect taxes, with direct taxes imposed directly on individuals and organizations, and indirect taxes imposed on goods and services where the burden is transferred to consumers. It also defines important tax-related terms like assessee, residential status, income tax return, tax deduction at source, and the different heads of income including salary, house property, business, capital gains, and other sources.Basics of income tax

Basics of income taxAanchal Singhal

Ėý

The document discusses the basics of income tax in India. It defines income tax as a direct tax levied by the government on its citizens' incomes. It notes that income includes salary as well as income from other sources like property, business, capital gains, and other sources. Certain incomes are exempt from taxation, like agricultural income. The document also discusses key income tax concepts like assessee, previous year, assessment year, types of persons under the Income Tax Act, canons of taxation, and different sources of income.Basic concepts of income tax

Basic concepts of income taxDR ANNIE STEPHEN

Ėý

The document defines key concepts related to income tax assessment in India. It explains that an assessee is a person liable to pay tax and includes those against whom proceedings have been initiated. It also defines person, assessment year, previous year, and financial year. It notes that gross total income includes all income earned under different heads and must be calculated before deductions. Total income is gross total income minus allowed deductions under tax saving sections.IMPORTANT TERMS USED IN INCOME TAX

IMPORTANT TERMS USED IN INCOME TAXDR ANNIE STEPHEN

Ėý

The document defines important terms used in income tax including assessee, assessment year, previous year, and person. It explains that an assessee is anyone liable to pay tax, interest, or penalties under the Income Tax Act and includes normal assessees, representative assessees, deemed assessees, and assessees in default. The assessment year is the 12 month period from April 1st in which the income of the previous financial year is assessed. The previous year refers to the financial year immediately preceding the assessment year. A person according to the Income Tax Act includes individuals, HUFs, companies, firms, associations of persons, local authorities, and artificial juridical persons.Income tax UGC NET Commerce

Income tax UGC NET CommerceUmakantAnnand

Ėý

Income tax is generally considered as Complicated subjects, so in this HAND BOOK we covered entire syllabus in such a manner in easiest language that student find it intresting.BASIC-CONCEPTS.ppt

BASIC-CONCEPTS.pptPankajVajpayee1

Ėý

The document provides an introduction to basic concepts in India's income tax law. It defines what a tax is, the types of taxes, and why taxes are levied. It then gives an overview of India's income tax law, including the key components like the Income Tax Act, Finance Acts, rules, circulars, and case laws. It explains the concepts of income, residential status, heads of income, computation of total income, tax rates, and filing a return of income.Basic concepts

Basic conceptsDelhi Institute of Advanced Studies

Ėý

This document provides an introduction to basic concepts in India's income tax law. It defines what a tax is, explaining direct and indirect taxes. Taxes are levied by the government to fund expenses like defense, education, healthcare and infrastructure. The income tax law in India consists of the Income Tax Act of 1961, annual Finance Acts, Income Tax Rules, circulars/notifications, and legal decisions from courts. Income tax is levied on a person's total income in the previous year as classified under various heads like salaries, house property, business/profession, capital gains, and other sources. Deductions are made to arrive at the total taxable income and applicable tax amount.Income%20tax%20ppt%2023.01.2024.pdf Income tax

Income%20tax%20ppt%2023.01.2024.pdf Income taxSaniyaSultana9

Ėý

This document provides an introduction and overview of key concepts related to income tax in India. It defines income tax and when it came into effect. It describes the different types of assessees (ordinary, deemed, in default) and explains exemption limits and slabs. It also defines key terms like person and assessment year. It distinguishes between direct and indirect taxes and components of each. Goods and Services Tax (GST) and its components are explained. Finally, the five heads of income under which a person's income is classified for tax purposes are outlined as salary, house property, business/profession, capital gains, and other sources.Basic concepts

Basic conceptsManish Singh

Ėý

This document provides an introduction to basic concepts in India's income tax law. It defines what a tax is, explaining direct and indirect taxes. Taxes are levied by the government to fund expenses like defense, education, healthcare and infrastructure. The income tax law in India consists of the Income Tax Act, annual Finance Acts, Income Tax Rules, circulars/notifications, and legal decisions from courts. Income tax is levied on a person's total income in the previous year as classified under various heads like salaries, house property, business/profession, capital gains, and other sources. Deductions are applied to arrive at the total taxable income and applicable tax rate.Income tax.ppt

Income tax.pptMaluSaji

Ėý

The basic fundamental concept of income tax is discussed here.

The important terms, years and definitions are also mentioned. Basic concepts of Tax

Basic concepts of TaxP.Ravichandran Chandran

Ėý

1. The document discusses various key concepts related to taxation in India such as direct taxes, indirect taxes, types of taxes including income tax, duty, cess, and surcharge. It provides definitions and explanations of these tax terms.

2. The key highlights are that direct taxes are imposed directly on income and wealth while indirect taxes are imposed on goods and services. Income tax is governed by the Income Tax Act of 1961 which is amended every year by the Finance Act.

3. The document also explains the difference between direct and indirect taxes, taxation system in India, types of taxation including progressive, regressive and proportional, and income tax computation process.Assessee.docxQ. 1. Discuss briefly the historical background of law of Negoti...

Assessee.docxQ. 1. Discuss briefly the historical background of law of Negoti...DineshPhogat5

Ėý

In ancient times, the routes along which vast commerce was carried on were insecure, and merchants carrying coins were usually robbed of their wealth by roving pirates of sea, and by marauding robbers on land. In the course of some centuries there came into existence an idea of exchange, whereby Letters of Credit, generally called Bills of Exchange from a merchant of one country to his debtor who is a merchant of another country, were issued, requiring the debt to be paid to a third person who carried the letter of credit to the place where the debtor resided.

A bill of exchange was thus originally an order to pay a trade-debt, and a system of such bills afforded a convenient and facile way for the payments of debts in one country due to a person in another, without the danger of encumbrance of carrying money from one place to another.

BASIC CONCEPTS.pptx

BASIC CONCEPTS.pptxCMAAshithaSherif

Ėý

This document provides an overview of direct tax laws and practices in India. It defines what a tax is, describing direct and indirect taxes. Income tax is identified as the most significant direct tax in India. The key laws and rules governing income tax are outlined, including the Income Tax Act of 1961, annual Finance Acts, Income Tax Rules of 1962, circulars and notifications, and legal decisions from courts. Total income is computed in several steps, including determining residential status, classifying and computing income under different heads, making adjustments, and applying tax rates along with surcharges and cesses to determine the final tax payable.Income tax theory for the ay 12 13

Income tax theory for the ay 12 13Libu Thomas

Ėý

This document provides definitions and explanations of key terms related to direct taxes, specifically income tax, in India. It discusses the differences between direct and indirect taxes, the meaning of income tax, the evolution of income tax law in India, the key laws related to income tax, and defines important terms like assessee, deemed assessee, total income, and agricultural income. The document also outlines the tax rates for the assessment year 2012-2013 in India.INCOME TAX BASIC CONCEPT

INCOME TAX BASIC CONCEPTParamSuraj

Ėý

This document provides an overview of key concepts in the Income Tax Act of 1961 in India. It discusses that the Act applies to all of India and was introduced on April 1, 1962. It defines important terms like gross total income, previous year, assessment year, person, assessee, and ordinary assessee. Gross total income is the aggregate of income under various heads like salary, house property, business or profession. The previous year refers to the financial year preceding the assessment year when taxes are paid.Financing the government

Financing the governmentesample458

Ėý

This document discusses how governments collect and use tax revenue. It explains that governments need income to pay expenses like public employees and services like defense, education, and health services. Taxes provide most government revenue and are collected from individuals and businesses. The main types of taxes discussed are income tax, property tax, sales tax, and social security tax. It also explains the differences between progressive and regressive taxes.income tax law- basic concepts.pptx

income tax law- basic concepts.pptxArvinderpal Kaur

Ėý

This document provides an overview of income tax law and practice in India. It defines key concepts like what a tax is, the types of taxes, and why taxes are levied by governments. It describes the major components that make up India's income tax law, including the Income Tax Act of 1961, annual Finance Acts, Income Tax Rules of 1962, circulars and notifications, and legal decisions from courts. It also defines important terms used in income tax like gross total income, person, assessee, assessment year, previous year, and explains the process for computing total income and tax payable in India.Tax planning and management

Tax planning and managementParitosh chaudhary

Ėý

The document discusses various topics related to taxation in India including:

1. Types of taxes such as direct taxes (income tax, corporate tax, wealth tax, etc.) and indirect taxes (excise duty, sales tax, customs duty, etc.).

2. Key concepts in taxation like assessee, person, previous year, exempted incomes.

3. Important principles of taxation known as canons of taxation including equality, certainty, convenience, economy, simplicity, diversity and flexibility.

4. The definition of assessee and exceptions to the general rule that income is taxable in the year following its accrual (previous year rule).Recently uploaded (20)

NUTRITIONAL ASSESSMENT AND EDUCATION - 5TH SEM.pdf

NUTRITIONAL ASSESSMENT AND EDUCATION - 5TH SEM.pdfDolisha Warbi

Ėý

NUTRITIONAL ASSESSMENT AND EDUCATION, Introduction, definition, types - macronutrient and micronutrient, food pyramid, meal planning, nutritional assessment of individual, family and community by using appropriate method, nutrition education, nutritional rehabilitation, nutritional deficiency disorder, law/policies regarding nutrition in India, food hygiene, food fortification, food handling and storage, food preservation, food preparation, food purchase, food consumption, food borne diseases, food poisoningIntellectual Honesty & Research Integrity.pptx

Intellectual Honesty & Research Integrity.pptxNidhiSharma495177

Ėý

Research Publication & Ethics contains a chapter on Intellectual Honesty and Research Integrity.

Different case studies of intellectual dishonesty and integrity were discussed.Dot NET Core Interview Questions PDF By ScholarHat

Dot NET Core Interview Questions PDF By ScholarHatScholarhat

Ėý

Dot NET Core Interview Questions PDF By ScholarHatMastering Soft Tissue Therapy & Sports Taping

Mastering Soft Tissue Therapy & Sports TapingKusal Goonewardena

Ėý

Mastering Soft Tissue Therapy & Sports Taping: Pathway to Sports Medicine Excellence

This presentation was delivered in Colombo, Sri Lanka, at the Institute of Sports Medicine to an audience of sports physiotherapists, exercise scientists, athletic trainers, and healthcare professionals. Led by Kusal Goonewardena (PhD Candidate - Muscle Fatigue, APA Titled Sports & Exercise Physiotherapist) and Gayath Jayasinghe (Sports Scientist), the session provided comprehensive training on soft tissue assessment, treatment techniques, and essential sports taping methods.

Key topics covered:

â

Soft Tissue Therapy â The science behind muscle, fascia, and joint assessment for optimal treatment outcomes.

â

Sports Taping Techniques â Practical applications for injury prevention and rehabilitation, including ankle, knee, shoulder, thoracic, and cervical spine taping.

â

Sports Trainer Level 1 Course by Sports Medicine Australia â A gateway to professional development, career opportunities, and working in Australia.

This training mirrors the Elite Akademy Sports Medicine standards, ensuring evidence-based approaches to injury management and athlete care.

If you are a sports professional looking to enhance your clinical skills and open doors to global opportunities, this presentation is for you.Báŧ TEST KIáŧM TRA GIáŧŪA KÃ 2 - TIášūNG ANH 10,11,12 - CHUášĻN FORM 2025 - GLOBAL SU...

Báŧ TEST KIáŧM TRA GIáŧŪA KÃ 2 - TIášūNG ANH 10,11,12 - CHUášĻN FORM 2025 - GLOBAL SU...Nguyen Thanh Tu Collection

Ėý

https://app.box.com/s/ij1ty3vm7el9i4qfrr41o756xycbahmgYear 10 The Senior Phase Session 3 Term 1.pptx

Year 10 The Senior Phase Session 3 Term 1.pptxmansk2

Ėý

Year 10 The Senior Phase Session 3 Term 1.pptxComprehensive Guide to Antibiotics & Beta-Lactam Antibiotics.pptx

Comprehensive Guide to Antibiotics & Beta-Lactam Antibiotics.pptxSamruddhi Khonde

Ėý

ðĒ Comprehensive Guide to Antibiotics & Beta-Lactam Antibiotics

ðŽ Antibiotics have revolutionized medicine, playing a crucial role in combating bacterial infections. Among them, Beta-Lactam antibiotics remain the most widely used class due to their effectiveness against Gram-positive and Gram-negative bacteria. This guide provides a detailed overview of their history, classification, chemical structures, mode of action, resistance mechanisms, SAR, and clinical applications.

ð What Youâll Learn in This Presentation

â

History & Evolution of Antibiotics

â

Cell Wall Structure of Gram-Positive & Gram-Negative Bacteria

â

Beta-Lactam Antibiotics: Classification & Subtypes

â

Penicillins, Cephalosporins, Carbapenems & Monobactams

â

Mode of Action (MOA) & Structure-Activity Relationship (SAR)

â

Beta-Lactamase Inhibitors & Resistance Mechanisms

â

Clinical Applications & Challenges.

ð Why You Should Check This Out?

Essential for pharmacy, medical & life sciences students.

Provides insights into antibiotic resistance & pharmaceutical trends.

Useful for healthcare professionals & researchers in drug discovery.

ð Swipe through & explore the world of antibiotics today!

ð Like, Share & Follow for more in-depth pharma insights!Functional Muscle Testing of Facial Muscles.pdf

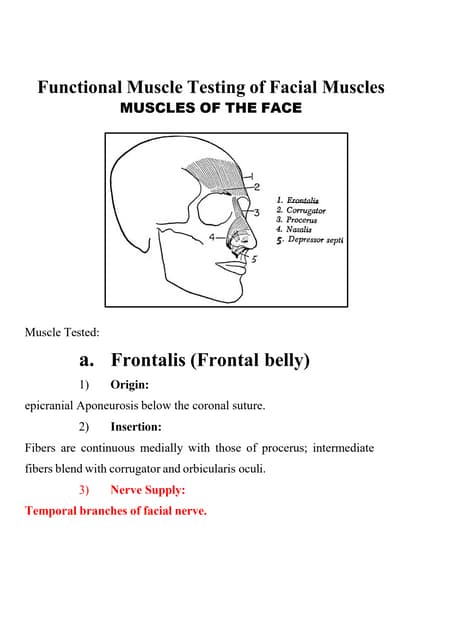

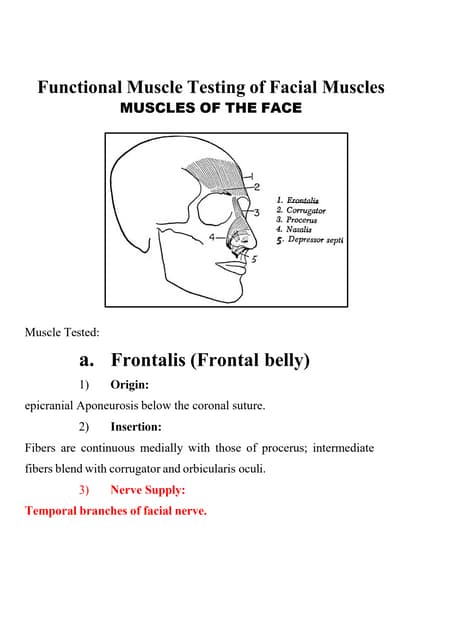

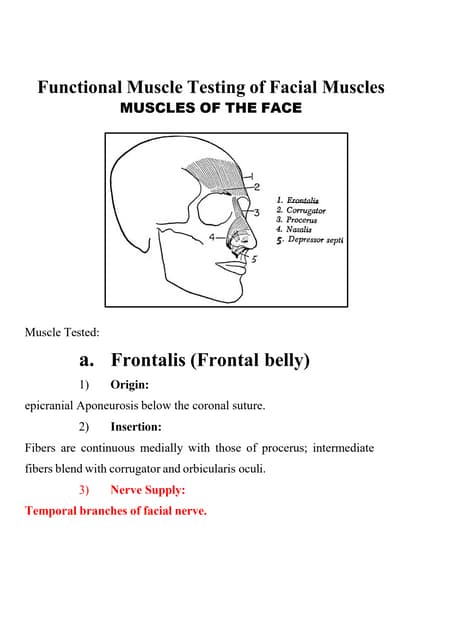

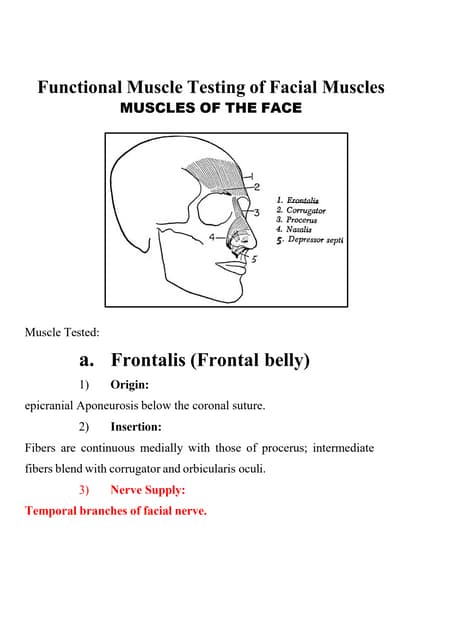

Functional Muscle Testing of Facial Muscles.pdfSamarHosni3

Ėý

Functional Muscle Testing of Facial Muscles.pdfUnit 1 Computer Hardware for Educational Computing.pptx

Unit 1 Computer Hardware for Educational Computing.pptxRomaSmart1

Ėý

Computers have revolutionized various sectors, including education, by enhancing learning experiences and making information more accessible. This presentation, "Computer Hardware for Educational Computing," introduces the fundamental aspects of computers, including their definition, characteristics, classification, and significance in the educational domain. Understanding these concepts helps educators and students leverage technology for more effective learning.Full-Stack .NET Developer Interview Questions PDF By ScholarHat

Full-Stack .NET Developer Interview Questions PDF By ScholarHatScholarhat

Ėý

Full-Stack .NET Developer Interview Questions PDF By ScholarHatBlind spots in AI and Formulation Science, IFPAC 2025.pdf

Blind spots in AI and Formulation Science, IFPAC 2025.pdfAjaz Hussain

Ėý

The intersection of AI and pharmaceutical formulation science highlights significant blind spotsâsystemic gaps in pharmaceutical development, regulatory oversight, quality assurance, and the ethical use of AIâthat could jeopardize patient safety and undermine public trust. To move forward effectively, we must address these normalized blind spots, which may arise from outdated assumptions, errors, gaps in previous knowledge, and biases in language or regulatory inertia. This is essential to ensure that AI and formulation science are developed as tools for patient-centered and ethical healthcare.ASP.NET Web API Interview Questions By Scholarhat

ASP.NET Web API Interview Questions By ScholarhatScholarhat

Ėý

ASP.NET Web API Interview Questions By ScholarhatBáŧ TEST KIáŧM TRA GIáŧŪA KÃ 2 - TIášūNG ANH 10,11,12 - CHUášĻN FORM 2025 - GLOBAL SU...

Báŧ TEST KIáŧM TRA GIáŧŪA KÃ 2 - TIášūNG ANH 10,11,12 - CHUášĻN FORM 2025 - GLOBAL SU...Nguyen Thanh Tu Collection

Ėý

income tax

- 1. Direct Tax BY CA BALA YADAV

- 2. TAX?

- 3. TAX Latin-Word-TAXO-Means-RATE ïķFinancial Charge/other levy ïķImposed upon a tax payer (tax payer may a individual or legal entity) ïķBy the state or the functional equivalent of a state ïķThat failure to pay or evasion of or resistance ïķIs punishable by law. Our tax system is based on our "ability to pay." The more money we earn, the more taxes we pay. And the opposite is also true. If we earn a small income, we pay less taxes.

- 4. A means by which governments finance their expenditure by imposing charges on citizens and corporate entities. Governments use taxation to encourage or discourage certain economic decisions. For example, reduction in taxable personal (or household) income by the amount paid as interest on home mortgage loans results in greater construction activity, and generates more jobs.

- 5. TYPE OF TAXES DIRECT TAXES âĒ A tax that is paid directly by an individual or organization to the imposing entity. âĒ e.g income tax, wealth tax etc. Burden of tax borne by the person himself. INDIRECT TAXES âĒ A tax that increases the price of a good so that consumers are actually paying the tax by paying more for the products. âĒ e.g excise duty, vat, sales tax, Service tax etc. Burden of tax shifted to another person

- 6. Income Tax Law The Income Tax Act, 1961 The Income Tax Rules, 1962 Circulars, Clarifications from CBDT Time to time Judicial Decision

- 7. CY FY AYPY

- 8. AY-Assessment Year- Section 2 (9) of Income Tax Act, 1961 A year in which income of an assessee of the previous year/last year needed to be assessed. It is called as âtax yearâ in some of the countries. Assessment Year (AY) is a period of twelve months starting from April 1st and ending on March 31st. PY-Previous Year- Section 3 of Income Tax Act, 1961 A year in which income is earned to be taxed exactly in the immediately next/following assessment year. It is also known as âincome yearâ in some of the countries.

- 9. For Example â The income accrued in FY 2013-2014 its Assessment Year (AY) is 2014-2015. So, Financial Year (FY) is the Previous Year (PY) while Assessment Year (AY) is the Current Year (CY) in which the income is being assessed earned in Previous Year (PY). In the Assessment Year (AY) your total tax liability for the income earned in the previous financial year is evaluated and computed. Therefore, tax for the income earned in the Previous Year (PY) is paid in the Current Year (CY). Previous Year in case of Newly Setup Business/Profession First Previous Year Second & Subsequent Previous Year Starting Point It Commences on the date of setting date up of the B/P or on the date when the new source of income comes into existence. April 1 Ending point Immediately following march 31 March 31st of the following year Duration of Previous Year 12 months or less 12 months

- 10. Income of the Previous Year is not Taxable in the immediate Assessment year i.e. Exceptions There are 5 cases in which income of previous year is not taxable in immediate assessment year. Means Income is Taxable in the Previous Year in which such Income is earned.

- 12. Section 174 Income of a person leaving India either permanently or for a period of time

- 13. Section 174A Association of person or body of individual, formed or established for a particular event and purpose and likely to be dissolved in the same year in which the same was established.

- 14. Section 175 Person likely to transfer property to avoid tax

- 16. Some Important Terms & Definitions Under INCOME TAX ACT, 1961 âĒ Section 2(7) Section 2(8) âĒ Section 2(22) Section 2 (24) âĒ Section 2(25A) Section 2(26A) âĒ Section 2(26B) Section 2(29BA) Section 2(31)

- 17. PERSON u/s 2(31) INDIVIDUAL AOP/BOI ARTIFICIAL JURIDICIAL PERSON

- 18. A natural human being i.e. male, female, person of sound and unsound mind It also includes minor child. However income of minor child included in the income of a parent. AN INDIVIDUAL

- 19. â â AS per Hindu Law, HUF means a family which consists of all the persons lineally descended from a common ancestors including their wives and unmarried daughters. HUF is not defined under tax laws. FIRM as defined under Indian Partnership Act, 1932 and shall includes LLPâs. defined under Limited Liability Partnership Act 2008

- 20. AOP/BOI AOP âĒ As name suggest, two or more persons âĒ Join for a common purpose âĒ With a view to earn income. âĒ In AOP two or more persons joined hand in income producing activity only. âĒ Companies, Individual , firm , HUF can be a AOP Member. âĒ AOP have common design or will. BOI âĒ As name suggest, consist of individuals only for income earning activity. âĒ Companies , firm , HUF cannot be a member of BOI. âĒ BOI may or may not have such common design or will.

- 21. LOCAL AUTHORITY Artificial Judicial Persons âĒ It is the rest category for the purpose of income tax act. âĒ It includes entities which are not natural person and act as separate entity in the eyes of law. âĒ Artificial person with a juristic personality fall under this category. Panchayat Municipality Municipal Committee District Board Cantonment Board

- 22. Thank You