INNOCENT CV NEW

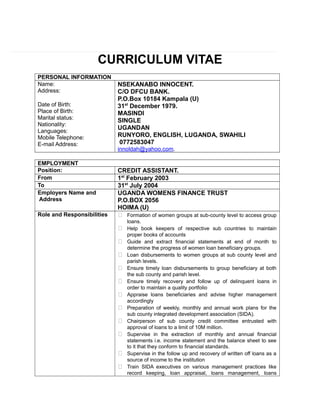

- 1. CURRICULUM VITAE PERSONAL INFORMATION Name: Address: Date of Birth: Place of Birth: Marital status: Nationality: Languages: Mobile Telephone: E-mail Address: NSEKANABO INNOCENT. C/O DFCU BANK. P.O.Box 10184 Kampala (U) 31st December 1979. MASINDI SINGLE UGANDAN RUNYORO, ENGLISH, LUGANDA, SWAHILI 0772583047 innoldah@yahoo.com. EMPLOYMENT Position: CREDIT ASSISTANT. From 1st February 2003 To 31st July 2004 Employers Name and Address UGANDA WOMENS FINANCE TRUST P.O.BOX 2056 HOIMA (U) Role and Responsibilities ď‚· Formation of women groups at sub-county level to access group loans. ď‚· Help book keepers of respective sub countries to maintain proper books of accounts ď‚· Guide and extract financial statements at end of month to determine the progress of women loan beneficiary groups. ď‚· Loan disbursements to women groups at sub county level and parish levels. ď‚· Ensure timely loan disbursements to group beneficiary at both the sub county and parish level. ď‚· Ensure timely recovery and follow up of delinquent loans in order to maintain a quality portfolio ď‚· Appraise loans beneficiaries and advise higher management accordingly ď‚· Preparation of weekly, monthly and annual work plans for the sub county integrated development association (SIDA). ď‚· Chairperson of sub county credit committee entrusted with approval of loans to a limit of 10M million. ď‚· Supervise in the extraction of monthly and annual financial statements i.e. income statement and the balance sheet to see to it that they conform to financial standards. ď‚· Supervise in the follow up and recovery of written off loans as a source of income to the institution ď‚· Train SIDA executives on various management practices like record keeping, loan appraisal, loans management, loans

- 2. delinquency. Position CREDIT ASSISTANT From 1ST AUGUST 2004 To 31st January 2006 Employers Name and Address BUNYORO TOORO RURAL DEVELOPMENT COMPANY P.O.BOX 1002. FORTPORTAL (U). Role and Responsibilities ď‚· Formation of women groups at sub county level to access group loans funded by the district development support programme ď‚· Help book keepers of respective sub countries to maintain proper books of accounts ď‚· Guide and extract financial statements at end of month to determine the progress of women loan beneficiaries. ď‚· Loan disbursements to women groups at sub county level and parish levels. ď‚· Ensure timely loan disbursements to group beneficiary at both the sub county and parish level. ď‚· Ensure timely recovery and follow up of delinquent loans in order to maintain a quality portfolio ď‚· Appraise loans beneficiaries and advise higher management accordingly ď‚· Preparation or weekly, monthly and annual work plans for the sub county integrated development association (SIDA). ď‚· Chairperson of sub county credit committee entrusted with approval of loans to a limit of three million. ď‚· Supervise in the extraction of monthly and annual financial statements i.e. income statement and the balance sheet to see to it that they conform to financial standards. ď‚· Supervise in the follow up and recovery of written off loans as a source of income to the institution. ď‚· Train SIDA executives on various management practices like record keeping, loans appraisal, loans management, loans delinquency Position FIELD OFFICER From 04TH APRIL 2007 To 31ST JUNE 2008 Employers Name and Address UGANDA MICRO FINANCE LIMITED P.O.BOX 10184 KAMPALA (U) Role and Responsibilities ď‚· Screening of would be loans beneficiaries basing on set loan policies and procedures and advise higher management accordingly ď‚· Appraising and determining the repayment capacities of clients and advising higher management accordingly

- 3.  Monitoring of loans disbursed to ensure a quality loan book is maintained at the required standards at all times.  A member of the Branch credit committee in taking credit decisions on loan files being presented.  Ensure that clients loan applications are worked on in time in order to meet customers’ requests  Delinquency management according to bank of Uganda rules and regulations on such loans.  Extraction of clients cash flows, turn over and present duly completed files for consideration in loan credit committees at branch level  Market the institution to would be customers, products and services offered. Position CREDIT OFFICER From 1ST JULY 2008 To 31st DEC 2011 Employers Name and Address EQUITY BANK UGANDA P.O.BOX 10814 KAMPALA, UGANDA Role and Responsibilities  Marketing of all loan products to existing and potential customers.  Conduct initial customer interview/visits for loan applications  Customer appraisal and preparation of loan documentation for presentation to the credit approval committee  Customer relationship management i.e. visit all borrowing customers at least once during the loan cycle  Responsible for the good performance and proper management of all the loan accounts booked under my portfolio.  Meet the set growth and quality targets for assigned portfolio segments.  Prompt follow up and proper recording (documentation) of all followed up activities for delinquent loans.  Ensure safety and proper maintenance of credit files for all the loans under my portfolio.  Cross selling of other bank products and services to existing and potential customers. POSITION  ACCOUNT ANALYST FROM  1ST JAN 2012 TO  PRESENT EMPLOYERS NAME AND  DEVELOPMENT FINANCE COMPANY OF

- 4. ADDRESS UGANDA (DFCU) BANK P. O BOX 70, KAMPALA UGANDA ROLE AND RESPONSIBILITIES ď‚· Appraise loan applications making sure that they meet the set standards and credit requirements using the prescribed score cards and return those that do not meet specifications to the front office desk for follow up. ď‚· Initiate credit applications for new and existing customers by completing the documentation with customers, completing the required financial analysis and submitting applications to Retail credit for approval. ď‚· Increase product penetration for the customers under management by reviewing their portfolio to determine potential cross sells and proactively recommend new products to customers. ď‚· Receive security documents from customers ensuring that they meet bank standards and any specific requirements depending on the facilities offered to the customer. Check all such documentation before submitting for processing. ď‚· Together with the Retail Credit Manager, conduct periodic reviews of existing facilities to check utilization and the continued health of the portfolio. ď‚· Follow up on all approved loans and ensure that customer information is correctly captured in the system i.e. standing orders, interest rates, repayment schedules, limits, review and expiry dates. ď‚· Follow up on irregular accounts and generate auctioned arrears report for submission to credit ď‚· Monitor the branch portfolio performance and ensure that PAR and NPA is kept within the acceptable limits to avoid losses.. Specific actions include going through the loan portfolio, checking the standing orders to ensure that they are going through. Where the standing orders have not gone through due to insufficient funds on the operation accounts, call the customers. ď‚· Process disbursement requests for all lending products in order to achieve the branch targets ď‚· Request and closely monitor TODs and other overdrafts in the branch portfolio and highlight those that are of concern to the Branch manager for action. ď‚· Ensure that all documentation and transactions are in line with local and regulatory anti-money laundering

- 5. and KYC requirements resulting into compliance with KYC, AML & suspicious transactions reporting EDUCATION AND QUALIFICATIONS  Pursuing a Bachelors of Science in Accounting and Finance. 2013 Kyambogo university  Uganda Diploma in Business Studies. Makerere university Business school, 2003  Uganda Advanced Certificate of Education. Masindi academy 1999  Uganda Certificate of Education Hoima high school 1997  Certificate in Information Technology.Ms.Dos, Ms Word, Excel, power point. PERSONAL SKILLS AND ABILITIES  Positive attitude and high level of integrity.  Self-motivated and self-driven  Work with minimal supervision..  Strong analytical and interpersonal skills. ON JOB TRAINING  Training of trainers in Micro finance best practices, conducted by Uganda women’s finance trust limited.  Agricultural lending and micro leasing tailor made for equity bank limited conducted by Uganda institute of bankers and funded by agricultural sector programme support, Danida, June 2008  Free to grow customer care training series, conducted by free to grow South Africa (pty) limited company Reg No. 2005/123598/07 July 2007.  Customer relationship management, conducted by Uganda microfinance training and consultancy trust limited  Micro credit course, conducted by Uganda micro finance limited, November 2007  First aid at work course conducted by the Uganda Red Cross society.  Accounting for community based Micro finance institutions conducted by the district development support programme in conjunction with Uganda women’s finance trust, October 2006.  Industrial fire safety, precaution intervention training conducted by Uganda police fire brigade headquarters Kampala.  Management of financial community based organisations conducted by microfinance competence centre, department of Uganda institute of bankers july 2005.  Training of trainer’s course conducted by the microfinance competence centre a department of Uganda institute of bankers November 2002.  Performance management-people plan, measure of

- 6. individual roles. HOBBIES ď‚· Researching ď‚· Reading books especially business oriented ď‚· Playing football ď‚· Enjoy deliberating on contentious issues with an open mind ď‚· Watching television and movies REFEREES 1. Mr. Thomas Kajoba Branch Manager DFCU Bank Uganda P.O.Box 70 Kampala (U) Mob; 0701230240 2. Karamagi Edison Parliament of Uganda P.O.Box, 7178, Kampala Uganda Mob. 0772322310, 0783673186 3. Mr. Jjagwe Livingstone Credit Manager Equity Bank Uganda Limited P.O.Box 10814, Kampala (U) Mob:0392964171 I NSEKANABO INNOCENT do hereby declare that to the best of my knowledge I that information given in this curriculum vitae is true and complete of me.

- 7. individual roles. HOBBIES ď‚· Researching ď‚· Reading books especially business oriented ď‚· Playing football ď‚· Enjoy deliberating on contentious issues with an open mind ď‚· Watching television and movies REFEREES 1. Mr. Thomas Kajoba Branch Manager DFCU Bank Uganda P.O.Box 70 Kampala (U) Mob; 0701230240 2. Karamagi Edison Parliament of Uganda P.O.Box, 7178, Kampala Uganda Mob. 0772322310, 0783673186 3. Mr. Jjagwe Livingstone Credit Manager Equity Bank Uganda Limited P.O.Box 10814, Kampala (U) Mob:0392964171 I NSEKANABO INNOCENT do hereby declare that to the best of my knowledge I that information given in this curriculum vitae is true and complete of me.