K1T_Aug_2016_Report_V1

Download as docx, pdf0 likes112 views

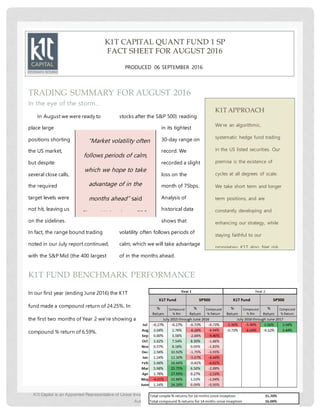

K1T Capital is an algorithmic hedge fund that trades US listed securities. In August 2016, the fund recorded a slight loss of 0.75% despite being positioned to short the US market. The fund has achieved a compound annual return of 24.25% in its first year. The document provides information on the fund's strategy, benchmark performance, management team, and Sharpe ratio as a measure of risk-adjusted return.

1 of 4

Download to read offline

Ad

Recommended

Pick of the Week: TATA CONSULTANCY SERVICES LTD.

Pick of the Week: TATA CONSULTANCY SERVICES LTD.choice broking

Ã˝

Tata Consultancy Services (TCS) is an Indian multinational IT services company headquartered in Mumbai. It is one of the largest Indian companies by market capitalization and India's largest IT services exporter. TCS provides a wide range of IT services and software products. It has over 335,000 employees worldwide and is one of India's largest private sector employers. The document recommends buying TCS based on a technical analysis indicating the stock price may rise further after recent consolidation.How To Start Your Own SPAC? by Sebastian Amieva

How To Start Your Own SPAC? by Sebastian AmievaSebastian Amieva

Ã˝

A SPAC, or special purpose acquisition company, is a shell company that raises money through an IPO to acquire a private company. SPACs must acquire a target within 2 years. They allow retail investors to invest in private equity deals. SPACs specify target industries and have simple capital structures with shares and warrants. Advantages are low costs and focus on tech/consumer sectors. Disadvantages include limited offerings and resale restrictions. Top SPACs include Virgin Galactic, DraftKings, and Nikola. The document recommends setting up a SPAC in Frankfurt or Stockholm for lower costs and flexibility.Are hedge funds obsolete

Are hedge funds obsoleteKobus Jansen van Vuuren

Ã˝

This document discusses the performance and relevance of South African hedge funds in the context of recent market trends, particularly the strong equity returns of 2017 driven by specific stock performance. It argues that while hedge funds may appear unnecessary due to last year’s low volatility, the changing macroeconomic environment suggests a need for diversification strategies offered by hedge funds going forward. The conclusion emphasizes that hedge funds retain long-term value and should be reconsidered in portfolio construction despite recent underperformance.Active vs. passive – practitioner perspectives

Active vs. passive – practitioner perspectivesLondon Business School

Ã˝

The document discusses the differences between active and passive investment strategies, emphasizing that investment is an addition to capital stock while speculation involves market psychology. It outlines the challenges faced by long-term investors, including the difficulty of forecasting compared to short-term strategies. The conclusion suggests that passive strategies can serve as a default approach, freeing resources for more intensive investment thinking.Prince Frog Oct 2013

Prince Frog Oct 2013asianextractor

Ã˝

1. An investigation was conducted into Prince Frog International Holdings, a Chinese producer of childcare products, after a blogger publicly questioned the accuracy of the company's reported sales figures.

2. The investigation found evidence from Nielsen retail sales data, a Chinese government consumer brand awareness survey, tax records, and customer regulatory filings that independently indicate the company's actual sales are less than 25% of the figures reported in public filings.

3. The research firm conducting the investigation concluded Prince Frog overstated its financials and business scale to investors and regulators in violation of Hong Kong securities laws, and valued the company's shares between HKD 0.74 to HKD 0.98 per share based on their analysis.Avasar partners presentation_aug_2019_p

Avasar partners presentation_aug_2019_pSidarth Kapoor, CFA

Ã˝

Avasar Hudson Partners LP is a long/short equity strategy fund focused on generating superior returns while minimizing losses through a concentrated portfolio and fundamental research. The investment team has over 15 years of experience and aims to leverage market opportunities with a strong risk management approach. Investments are speculative and subject to significant risks, inclusive of market volatility and high fees, necessitating thorough examination by potential investors.Minding your percents 30 june 2013 update

Minding your percents 30 june 2013 updateHans Goetze

Ã˝

Stocktakers Limited provides insights on investment strategies for small investors, emphasizing that traditional financial products often fail to yield real returns after fees and inflation. The document discusses their proprietary methods to identify 'likeable' equities, which have historically outperformed market indices, and outlines the performance of multiple investment portfolios, demonstrating gains even in fluctuating markets. The authors advocate for investor independence and offer guidance on managing portfolios effectively to protect wealth.The Great TFSA Race

The Great TFSA RaceShafik Hirani

Ã˝

This document describes the winners of MoneySense magazine's inaugural Great TFSA Race contest, which aimed to find Canadian investors who had grown their Tax-Free Savings Account (TFSA) balances the most since 2009. It profiles the top six winners, including a husband and wife team from Kelowna, BC who grew their investments to over $1 million by betting on a single penny stock. It also describes the varied investment strategies and stocks held by other winners, such as speculative bets on unlikely events by a Calgary investor and holdings in nano-cap stocks by a Montreal accountant seeking high returns.September 2018 Investment Commentary & Performance

September 2018 Investment Commentary & PerformanceAnthony A. Lombardi, CFA

Ã˝

The document provides commentary on investments for the third quarter of 2018. Key points include:

- Markets reached numerous highs in the quarter despite trade tensions and upcoming midterm elections.

- The portfolio manager made several changes to the portfolio, including selling two positions, adding two new positions, and adjusting target sector weightings and cash levels.

- The portfolio generated a return of 7.03% for the quarter, outperforming the benchmark. Performance was driven by security selection and modest allocation effects.Morning tea 22 12-2016

Morning tea 22 12-2016Choice Equity

Ã˝

The document summarizes key developments in US and Asian stock markets, Indian corporate actions and results calendar, and provides technical analysis recommendations for buying/selling two stocks - EDELWEISS and INFRATEL. US stocks fell on concerns about valuations following recent gains. Asian shares were mixed with Japan's Nikkei falling. The Indian market is expected to open flat to negative. Key corporate actions and an earnings announcement calendar are provided. Technical analysis indicates buying EDELWEISS with a target price of Rs. 99.50 and selling INFRATEL with a target price of Rs. 320.Pick of the Week: LIC Housing Finance Ltd.

Pick of the Week: LIC Housing Finance Ltd.choice broking

Ã˝

This document provides information on LIC Housing Finance Ltd (LICHF), including that it is one of the largest housing finance companies in India. It was incorporated in 1989 and went public in 1994. The main objective of LICHF is to provide long-term financing to individuals for housing and real estate purposes. The company has an extensive network across India and representative offices in Dubai and Kuwait to serve Non-Resident Indians. The document also provides a technical analysis of LICHF stock and recommends it as a buy, with a price target of Rs. 460 based on the analysis.Morning tea 13 01-2017

Morning tea 13 01-2017Choice Equity

Ã˝

The US and Asian stock markets closed lower as investors awaited corporate earnings reports and details on Trump's economic policies. In India, the equity market is expected to open flat to positive tracking Asian indices. Two stocks, Torntpower and Crompton Greaves, are recommended as buy opportunities based on technical analysis showing breakouts and rising momentum. The document also provides a corporate action calendar and details of bulk deals by various investors.Ladder Capital - Investor Presentation (November 2019)

Ladder Capital - Investor Presentation (November 2019)David Merkur

Ã˝

Ladder Capital Corp is a commercial mortgage REIT that invests in commercial real estate loans, securities, and equity. It has a $6.6 billion portfolio of CRE assets focused on the middle market. Ladder utilizes a fully integrated in-house team to originate, underwrite, and manage its primarily senior secured loan portfolio. The company has a consistent track record of profitability through multiple market cycles and maintains a conservative leverage profile and dividend payout.Ladder Capital - Investor Presentation (November 2019)

Ladder Capital - Investor Presentation (November 2019)David Merkur

Ã˝

Ladder Capital Corp is a leading commercial mortgage REIT with $6.6 billion in CRE debt and equity assets. It has a multi-cylinder platform focused on CRE credit underwriting and generates industry-leading returns through loans, securities, and equity investments, with 79% of assets in senior secured products. The company has a cycle-tested management team with a track record of profitability and strong shareholder alignment.Introduction to Mutual Funds

Introduction to Mutual FundsHarshit Goyal

Ã˝

Mutual funds allow investors to pool their money for professional management across various assets like stocks and bonds, making them accessible even for small investors. These funds operate under regulatory frameworks, primarily governed by India's Securities and Exchange Board (SEBI), which ensures transparency and protection for investors. Advantages include diversification, professional management, liquidity, and potential tax benefits, while disadvantages may involve management costs, lock-in periods, and risk of dilution.Introduction to Mutual Funds

Introduction to Mutual FundsHarshit Goyal

Ã˝

A mutual fund is a professionally managed pool of money that allows investors to buy into a diversified portfolio. Key benefits include professional management, diversification, and liquidity, with options including equity funds, debt funds, and hybrid funds. The document is authored by Harshit Goyal as part of a bachelor's program in financial markets.Warren Buffett's Wager

Warren Buffett's WagerKobus Jansen van Vuuren

Ã˝

Warren Buffett, CEO of Berkshire Hathaway, won a wager asserting that U.S. equities would outperform hedge funds over a decade, resulting in a $2.2 million charity donation. He emphasizes that equities can outperform bonds in the long run despite short-term volatility, but this strategy requires an investor to have emotional stamina and financial stability. The document discusses the role of hedge funds as a complementary investment to equities to enhance portfolio diversification, especially for investors unable to fully commit to equities.Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11

Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11Proactive Advisor Magazine

Ã˝

This magazine article discusses various topics covered in the June 19, 2014 issue:

1) It discusses how different active investment strategies can be tailored to match different client personalities and risk tolerances.

2) It profiles investment advisor Carla Zevnik-Seufzer who emphasizes understanding each client's values and risk profile to develop customized plans using various active management approaches.

3) The article also briefly summarizes other pieces in the issue on rising oil prices and their potential economic impact, and how relying on outdated asset allocation models may not adequately address today's investment environment.Planning beyond 2020 - Russell Investments

Planning beyond 2020 - Russell InvestmentsnetwealthInvest

Ã˝

This document provides an overview of Russell Investments' global practice management perspective and insights. It discusses four fatal assumptions that advisers often make and four characteristics of winning advisers. It also examines how investor behavior leads to buying high and selling low. Additionally, it explores topics like the value of an adviser, disruptions from demographic shifts and technology, and taking an outcome-oriented approach to portfolio selection aligned with a client's goals. The document offers guidance to help advisers plan beyond 2020.Open Offers

Open Offersperfectresearch

Ã˝

The document discusses various investment opportunities arising from corporate events termed 'special situations,' encompassing activities such as mergers, spinoffs, and open offers. It highlights the potential for profit through calculated risks, liquidity, and short holding periods, while also detailing the regulatory landscape surrounding open offers in India. Additionally, it provides insights into the refractory industry and specific companies, emphasizing the appeal of strategic acquisitions and the market's growth potential.Portfolio Construction Today

Portfolio Construction TodayLondon Business School

Ã˝

The document discusses challenges in portfolio construction due to low expected returns on traditional assets and stresses the importance of diversification across various return sources. It highlights the significance of sticking with a well-constructed portfolio despite market fluctuations and outlines different investment strategies and risk factors. Additionally, it contains warnings about the limitations of hypothetical performance results and the potential risks of investing.How to become a winning adviser in the new world - Russell Investments

How to become a winning adviser in the new world - Russell InvestmentsnetwealthInvest

Ã˝

This document discusses planning for financial advisers beyond 2020. It covers several topics to help advisers succeed, including focusing on efficiency, measuring success, valuing the role of an adviser, addressing investor behavior gaps, and adapting to demographic and regulatory changes. The value of segmentation and delivering the right client experience is also discussed. Disruptions from technology are addressed as well as moving to an outcome-oriented approach.Muthoot Finance Ratio Analysis

Muthoot Finance Ratio AnalysisHarshit Goyal

Ã˝

Muthoot Finance is an Indian NBFC and the largest gold loan company in India. It has over 4,400 branches across India and also operates in the UK, US, and UAE. The company provides gold loans starting from ‚Çπ1500 with no maximum limit. Key ratios show Muthoot Finance has a P/E ratio and dividend yield higher than its sector averages, but a lower P/B ratio, indicating it may be undervalued relative to peers. Profitability ratios like return on assets and return on equity are also strong at 6.18% and 27.8% respectively. The target market includes small businesses, farmers, and salaried individuals seeking affordable loans.December 2017 Investment Commentary & Performance

December 2017 Investment Commentary & PerformanceAnthony A. Lombardi, CFA

Ã˝

1. The document discusses the author's views on investments in December 2017 and their investment process over nearly three decades of focusing on a 3-5 year horizon.

2. It describes how the author analyzes macroeconomic factors, market psychology, and company fundamentals to identify undervalued investment opportunities. The author focuses on traditionally cyclical sectors offering compelling valuations.

3. The author explains that their large cap value portfolio remains fully exposed to all market sectors but with a focus on cyclical areas they view as undervalued based on factors like price, balance sheet strength, and cash flows over a 3-5 year time horizon.Kotakbank

Kotakbankchoice broking

Ã˝

Kotak Mahindra Bank is one of India's leading financial services conglomerates, established in 1985. In 2003, Kotak Mahindra Finance received a banking license from the RBI, becoming the first non-banking finance company in India to convert to a bank. Kotak Mahindra Bank is currently the fourth largest private sector bank in India by market capitalization, headquartered in Mumbai. The document then provides a technical analysis of Kotak Mahindra Bank stock, recommending it as a buy between Rs. 1420-1440, with a price potential of Rs. 1600-1650 and stop loss of Rs. 1340.India Equity Strategy

India Equity StrategyKarvy Private Wealth

Ã˝

The document provides a bullish outlook for the Indian stock market, specifically the Sensex, over the next few years. It predicts that economic reforms by the new Indian government will revive growth to around 6% by fiscal year 2015. This will lead to high double-digit returns in equities and a Sensex target of 38,500 by March 2017. Midcap stocks are also expected to outperform the broader market and potentially double over the next three years due to undervaluation and stronger earnings momentum as the investment cycle revives.Why Creating a SPAC

Why Creating a SPACboblau55

Ã˝

This document introduces SPACs (special purpose acquisition companies) and discusses their benefits. It explains that a SPAC is a "blank check" company formed to raise capital through an IPO to acquire a private company. The sponsor works with an investment bank to create and list the SPAC on an exchange like Nasdaq. Investors can then invest in the SPAC and the sponsor will use the funds to acquire a target company within 2 years. This allows pre-IPO companies to go public through an acquisition while providing investors with liquidity. The document outlines the costs and process of creating a SPAC and compares it to a traditional IPO.why standard valuation matrix is not the best way to value great businesses

why standard valuation matrix is not the best way to value great businessesperfectresearch

Ã˝

The document discusses alternative valuation methods for great businesses, emphasizing the importance of understanding economic moats, growth rates, and company management. It critiques traditional valuation matrices, suggesting that they can lead to missed investment opportunities by focusing too much on price rather than potential for long-term growth and quality. The author presents a framework for evaluating businesses based on their capacity to reinvest, management quality, and resilience in tough market conditions.k1t-investor-pres-TS18_final 2016 enhance

k1t-investor-pres-TS18_final 2016 enhancesimon wajcenberg

Ã˝

K1T Capital is a systematic quant hedge fund that aims to deliver consistent excess returns within predetermined risk limits using algorithms designed to capitalize on cyclical patterns in financial markets. The presentation provides an overview of K1T Capital's investment strategy, trading system, backtested performance showing returns over 27% on average annually over 17 years, and experienced team. It highlights the energy sector as an area of focus in Q1 2016 given long term buy signals generated.Clash group white paper 2013

Clash group white paper 2013 simon wajcenberg

Ã˝

This white paper outlines various mobile marketing strategies, including rich media, location-based, in-app advertising, retargeted ads, mobile video ads, and mobile-specific affiliate networks, emphasizing the need for businesses to engage with a growing smartphone user base. Despite the availability of effective mobile advertising options, many companies lack a mobile marketing strategy to capitalize on the vast potential for customer engagement and ROI. The paper aims to guide marketers in choosing appropriate mobile strategies to enhance their advertising effectiveness and achieve higher conversion rates.More Related Content

What's hot (20)

September 2018 Investment Commentary & Performance

September 2018 Investment Commentary & PerformanceAnthony A. Lombardi, CFA

Ã˝

The document provides commentary on investments for the third quarter of 2018. Key points include:

- Markets reached numerous highs in the quarter despite trade tensions and upcoming midterm elections.

- The portfolio manager made several changes to the portfolio, including selling two positions, adding two new positions, and adjusting target sector weightings and cash levels.

- The portfolio generated a return of 7.03% for the quarter, outperforming the benchmark. Performance was driven by security selection and modest allocation effects.Morning tea 22 12-2016

Morning tea 22 12-2016Choice Equity

Ã˝

The document summarizes key developments in US and Asian stock markets, Indian corporate actions and results calendar, and provides technical analysis recommendations for buying/selling two stocks - EDELWEISS and INFRATEL. US stocks fell on concerns about valuations following recent gains. Asian shares were mixed with Japan's Nikkei falling. The Indian market is expected to open flat to negative. Key corporate actions and an earnings announcement calendar are provided. Technical analysis indicates buying EDELWEISS with a target price of Rs. 99.50 and selling INFRATEL with a target price of Rs. 320.Pick of the Week: LIC Housing Finance Ltd.

Pick of the Week: LIC Housing Finance Ltd.choice broking

Ã˝

This document provides information on LIC Housing Finance Ltd (LICHF), including that it is one of the largest housing finance companies in India. It was incorporated in 1989 and went public in 1994. The main objective of LICHF is to provide long-term financing to individuals for housing and real estate purposes. The company has an extensive network across India and representative offices in Dubai and Kuwait to serve Non-Resident Indians. The document also provides a technical analysis of LICHF stock and recommends it as a buy, with a price target of Rs. 460 based on the analysis.Morning tea 13 01-2017

Morning tea 13 01-2017Choice Equity

Ã˝

The US and Asian stock markets closed lower as investors awaited corporate earnings reports and details on Trump's economic policies. In India, the equity market is expected to open flat to positive tracking Asian indices. Two stocks, Torntpower and Crompton Greaves, are recommended as buy opportunities based on technical analysis showing breakouts and rising momentum. The document also provides a corporate action calendar and details of bulk deals by various investors.Ladder Capital - Investor Presentation (November 2019)

Ladder Capital - Investor Presentation (November 2019)David Merkur

Ã˝

Ladder Capital Corp is a commercial mortgage REIT that invests in commercial real estate loans, securities, and equity. It has a $6.6 billion portfolio of CRE assets focused on the middle market. Ladder utilizes a fully integrated in-house team to originate, underwrite, and manage its primarily senior secured loan portfolio. The company has a consistent track record of profitability through multiple market cycles and maintains a conservative leverage profile and dividend payout.Ladder Capital - Investor Presentation (November 2019)

Ladder Capital - Investor Presentation (November 2019)David Merkur

Ã˝

Ladder Capital Corp is a leading commercial mortgage REIT with $6.6 billion in CRE debt and equity assets. It has a multi-cylinder platform focused on CRE credit underwriting and generates industry-leading returns through loans, securities, and equity investments, with 79% of assets in senior secured products. The company has a cycle-tested management team with a track record of profitability and strong shareholder alignment.Introduction to Mutual Funds

Introduction to Mutual FundsHarshit Goyal

Ã˝

Mutual funds allow investors to pool their money for professional management across various assets like stocks and bonds, making them accessible even for small investors. These funds operate under regulatory frameworks, primarily governed by India's Securities and Exchange Board (SEBI), which ensures transparency and protection for investors. Advantages include diversification, professional management, liquidity, and potential tax benefits, while disadvantages may involve management costs, lock-in periods, and risk of dilution.Introduction to Mutual Funds

Introduction to Mutual FundsHarshit Goyal

Ã˝

A mutual fund is a professionally managed pool of money that allows investors to buy into a diversified portfolio. Key benefits include professional management, diversification, and liquidity, with options including equity funds, debt funds, and hybrid funds. The document is authored by Harshit Goyal as part of a bachelor's program in financial markets.Warren Buffett's Wager

Warren Buffett's WagerKobus Jansen van Vuuren

Ã˝

Warren Buffett, CEO of Berkshire Hathaway, won a wager asserting that U.S. equities would outperform hedge funds over a decade, resulting in a $2.2 million charity donation. He emphasizes that equities can outperform bonds in the long run despite short-term volatility, but this strategy requires an investor to have emotional stamina and financial stability. The document discusses the role of hedge funds as a complementary investment to equities to enhance portfolio diversification, especially for investors unable to fully commit to equities.Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11

Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11Proactive Advisor Magazine

Ã˝

This magazine article discusses various topics covered in the June 19, 2014 issue:

1) It discusses how different active investment strategies can be tailored to match different client personalities and risk tolerances.

2) It profiles investment advisor Carla Zevnik-Seufzer who emphasizes understanding each client's values and risk profile to develop customized plans using various active management approaches.

3) The article also briefly summarizes other pieces in the issue on rising oil prices and their potential economic impact, and how relying on outdated asset allocation models may not adequately address today's investment environment.Planning beyond 2020 - Russell Investments

Planning beyond 2020 - Russell InvestmentsnetwealthInvest

Ã˝

This document provides an overview of Russell Investments' global practice management perspective and insights. It discusses four fatal assumptions that advisers often make and four characteristics of winning advisers. It also examines how investor behavior leads to buying high and selling low. Additionally, it explores topics like the value of an adviser, disruptions from demographic shifts and technology, and taking an outcome-oriented approach to portfolio selection aligned with a client's goals. The document offers guidance to help advisers plan beyond 2020.Open Offers

Open Offersperfectresearch

Ã˝

The document discusses various investment opportunities arising from corporate events termed 'special situations,' encompassing activities such as mergers, spinoffs, and open offers. It highlights the potential for profit through calculated risks, liquidity, and short holding periods, while also detailing the regulatory landscape surrounding open offers in India. Additionally, it provides insights into the refractory industry and specific companies, emphasizing the appeal of strategic acquisitions and the market's growth potential.Portfolio Construction Today

Portfolio Construction TodayLondon Business School

Ã˝

The document discusses challenges in portfolio construction due to low expected returns on traditional assets and stresses the importance of diversification across various return sources. It highlights the significance of sticking with a well-constructed portfolio despite market fluctuations and outlines different investment strategies and risk factors. Additionally, it contains warnings about the limitations of hypothetical performance results and the potential risks of investing.How to become a winning adviser in the new world - Russell Investments

How to become a winning adviser in the new world - Russell InvestmentsnetwealthInvest

Ã˝

This document discusses planning for financial advisers beyond 2020. It covers several topics to help advisers succeed, including focusing on efficiency, measuring success, valuing the role of an adviser, addressing investor behavior gaps, and adapting to demographic and regulatory changes. The value of segmentation and delivering the right client experience is also discussed. Disruptions from technology are addressed as well as moving to an outcome-oriented approach.Muthoot Finance Ratio Analysis

Muthoot Finance Ratio AnalysisHarshit Goyal

Ã˝

Muthoot Finance is an Indian NBFC and the largest gold loan company in India. It has over 4,400 branches across India and also operates in the UK, US, and UAE. The company provides gold loans starting from ‚Çπ1500 with no maximum limit. Key ratios show Muthoot Finance has a P/E ratio and dividend yield higher than its sector averages, but a lower P/B ratio, indicating it may be undervalued relative to peers. Profitability ratios like return on assets and return on equity are also strong at 6.18% and 27.8% respectively. The target market includes small businesses, farmers, and salaried individuals seeking affordable loans.December 2017 Investment Commentary & Performance

December 2017 Investment Commentary & PerformanceAnthony A. Lombardi, CFA

Ã˝

1. The document discusses the author's views on investments in December 2017 and their investment process over nearly three decades of focusing on a 3-5 year horizon.

2. It describes how the author analyzes macroeconomic factors, market psychology, and company fundamentals to identify undervalued investment opportunities. The author focuses on traditionally cyclical sectors offering compelling valuations.

3. The author explains that their large cap value portfolio remains fully exposed to all market sectors but with a focus on cyclical areas they view as undervalued based on factors like price, balance sheet strength, and cash flows over a 3-5 year time horizon.Kotakbank

Kotakbankchoice broking

Ã˝

Kotak Mahindra Bank is one of India's leading financial services conglomerates, established in 1985. In 2003, Kotak Mahindra Finance received a banking license from the RBI, becoming the first non-banking finance company in India to convert to a bank. Kotak Mahindra Bank is currently the fourth largest private sector bank in India by market capitalization, headquartered in Mumbai. The document then provides a technical analysis of Kotak Mahindra Bank stock, recommending it as a buy between Rs. 1420-1440, with a price potential of Rs. 1600-1650 and stop loss of Rs. 1340.India Equity Strategy

India Equity StrategyKarvy Private Wealth

Ã˝

The document provides a bullish outlook for the Indian stock market, specifically the Sensex, over the next few years. It predicts that economic reforms by the new Indian government will revive growth to around 6% by fiscal year 2015. This will lead to high double-digit returns in equities and a Sensex target of 38,500 by March 2017. Midcap stocks are also expected to outperform the broader market and potentially double over the next three years due to undervaluation and stronger earnings momentum as the investment cycle revives.Why Creating a SPAC

Why Creating a SPACboblau55

Ã˝

This document introduces SPACs (special purpose acquisition companies) and discusses their benefits. It explains that a SPAC is a "blank check" company formed to raise capital through an IPO to acquire a private company. The sponsor works with an investment bank to create and list the SPAC on an exchange like Nasdaq. Investors can then invest in the SPAC and the sponsor will use the funds to acquire a target company within 2 years. This allows pre-IPO companies to go public through an acquisition while providing investors with liquidity. The document outlines the costs and process of creating a SPAC and compares it to a traditional IPO.why standard valuation matrix is not the best way to value great businesses

why standard valuation matrix is not the best way to value great businessesperfectresearch

Ã˝

The document discusses alternative valuation methods for great businesses, emphasizing the importance of understanding economic moats, growth rates, and company management. It critiques traditional valuation matrices, suggesting that they can lead to missed investment opportunities by focusing too much on price rather than potential for long-term growth and quality. The author presents a framework for evaluating businesses based on their capacity to reinvest, management quality, and resilience in tough market conditions.Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11

Carla Zevnik-Seufzer – Proactive Advisor Magazine – Volume 2, Issue 11Proactive Advisor Magazine

Ã˝

More from simon wajcenberg (7)

k1t-investor-pres-TS18_final 2016 enhance

k1t-investor-pres-TS18_final 2016 enhancesimon wajcenberg

Ã˝

K1T Capital is a systematic quant hedge fund that aims to deliver consistent excess returns within predetermined risk limits using algorithms designed to capitalize on cyclical patterns in financial markets. The presentation provides an overview of K1T Capital's investment strategy, trading system, backtested performance showing returns over 27% on average annually over 17 years, and experienced team. It highlights the energy sector as an area of focus in Q1 2016 given long term buy signals generated.Clash group white paper 2013

Clash group white paper 2013 simon wajcenberg

Ã˝

This white paper outlines various mobile marketing strategies, including rich media, location-based, in-app advertising, retargeted ads, mobile video ads, and mobile-specific affiliate networks, emphasizing the need for businesses to engage with a growing smartphone user base. Despite the availability of effective mobile advertising options, many companies lack a mobile marketing strategy to capitalize on the vast potential for customer engagement and ROI. The paper aims to guide marketers in choosing appropriate mobile strategies to enhance their advertising effectiveness and achieve higher conversion rates.Strike Ad Key Developments In Mobile Advertising

Strike Ad Key Developments In Mobile Advertisingsimon wajcenberg

Ã˝

The document summarizes the results of a survey of 46 advertising agencies about their mobile advertising campaigns and spending in 2010 and projections for 2011. Some key findings include:

- About 33% of agencies expect over 30% of client campaigns to include mobile elements in 2011.

- In 2010, most agency mobile ad spending was below £50,000, with 28.3% spending less than £10,000 and 32.6% spending £20,001-£50,000.

- Agencies projecting higher mobile spending increases in 2011 generally spent more (£20,000-£50,000) on mobile in 2010.Strike Ad White Paper

Strike Ad White Papersimon wajcenberg

Ã˝

This document discusses how to simplify mobile media planning and buying by overcoming the inherent complexities. It identifies that dedicated Mobile Demand Side Platforms can dramatically reduce workload for agencies by eliminating manual processes. These platforms allow agencies to plan, book, execute and optimize mobile campaigns through a single interface in real-time. The emergence of these platforms marks an end to large inefficiencies that have prevented many agencies from considering mobile as a viable advertising channel.StrikeAd Mobile Demand Side Platform

StrikeAd Mobile Demand Side Platformsimon wajcenberg

Ã˝

StrikeAd Fusion is a proprietary mobile demand side platform (DSP) created to help media agencies and advertisers effectively manage their mobile advertising campaigns through a single interface. It allows planning, executing, and evaluating multiple mobile campaigns simultaneously on a global scale. Through optimization, tracking, insights and analytics, StrikeAd Fusion provides agencies unprecedented efficiency and visibility into their mobile campaigns to drive real returns on investment.Clash Overview Presentation 1 10 09

Clash Overview Presentation 1 10 09simon wajcenberg

Ã˝

Clash-Media is a lead generation company formed in 2006 that has experienced significant growth. It operates in 9 countries with offices in the UK, US, Germany, France and Scandinavia. The company has raised over £5 million in funding and has an experienced management team. While Clash-Media has aggressively expanded over the past few years, it is now profitable and expects continued strong growth over the next two years as it works to become the market leader in Europe for lead generation.Online Lead Generation B2 C Report 2009

Online Lead Generation B2 C Report 2009simon wajcenberg

Ã˝

This document summarizes the key findings of the 2009 Online Lead Generation (B2C) Report published by Econsultancy in association with Clash-Media. The report is based on a survey of over 600 respondents regarding their use of online lead generation. Some of the main findings include: 1) Online lead generation is becoming more important for growing businesses, with 65% increasing its use in the last year; 2) The top perceived benefit is increasing prospects and customers; and 3) Surprisingly, over half of companies increased their overall marketing budgets despite the recession. However, under half feel they are effectively using online lead generation.Ad

K1T_Aug_2016_Report_V1

- 1. K1t Capital is an Appointed Representative of Linear Investments Limited, w hich is Authorised and Regulated by the Financial Conduct Authority (FCA) FRN: 537389 TRADING SUMMARY FOR AUGUST 2016 In the eye of the storm… In August we were ready to place large positions shorting the US market, but despite several close calls, the required target levels were not hit, leaving us on the sidelines. In fact, the range bound trading noted in our July report continued, with the S&P Mid (the 400 largest stocks after the S&P 500) reading in its tightest 30-day range on record. We recorded a slight loss on the month of 75bps. Analysis of historical data shows that volatility often follows periods of calm, which we will take advantage of in the months ahead. K1T FUND BENCHMARK PERFORMANCE In our first year (ending June 2016) the K1T fund made a compound return of 24.25%. In the first two months of Year 2 we’re showing a compound % return of 6.59%. PRODUCED 06 SEPTEMBER 2016 K1T APPROACH We’re an algorithmic, systematic hedge fund trading in the US listed securities. Our premise is the existence of cycles at all degrees of scale. We take short term and longer term positions, and are constantly developing and enhancing our strategy, while staying faithful to our proprietary K1T algo. Net risk never exceeds 3.5x AUM and we typically have a long bias. “Market volatility often follows periods of calm, which we hope to take advantage of in the months ahead” said Simon Wajcenberg, CEO K1TCapital K1T CAPITAL QUANT FUND 1 SP FACT SHEET FOR AUGUST 2016

- 2. K1t Capital is an Appointed Representative of Linear Investments Limited, which is Authorised and Regulated by the Financial Conduct Authority (FCA) FRN: 537389 Produced 06 september 2016 ABOUT K1TCAPITAL The team, key partnerships and regulatory environment Based in London, K1T Capital Limited as an Alternative Investment Manager that manages the K1T Capital Quant Fund 1 SP The fund itself is listed in the Cayman Islands. Our fund administrator is Apex Fund Services London. Our management team includes Simon Wajcenberg CEO (former E&Y Entrepreneur of the year), Ben Heaton (CIO), David Furse-Roberts FCA (CTO) and Peter Coveney FCA (CFO). K1t’s advisory board is made up of Craig Morgan (ex Morgan Stanley), James Hogbin (ex Royal Bank of Scotland) and Kapil Khandelwal (MD of EquNev Capital India). K1T’S PERFORMANCE VS THE SP500 The yellow line in the chart to the left shows the cumulative performance of K1T since launch on July 21st 2015, and compares with the SP500 over same period (red line). These are compound returns.

- 3. K1t Capital is an Appointed Representative of Linear Investments Limited, which is Authorised and Regulated by the Financial Conduct Authority (FCA) FRN: 537389 Produced 06 september 2016 ABOUT THE K1T SHARPE RATIO Using the month end price of the K1T Fund the Sharpe Ratio for the first 14 months of trading is 1.18. We expect the ratio to move back towards 2.0 over the longer term. Our historical backtest for the last 20 years generated a Sharpe Ratio from monthly data of 2.0. What kind of performance does a Sharpe Ratio of 2 imply? One way to think about it is in terms of the probability of positive % returns in the next month. A Sharpe ratio of 2.0 says there is a 72% chance of next month being positive. It’s worth noting that the Sharpe ratio of the SP500 for the last 20 years is 0.47. The Sharpe ratio of 0.47 means that we can calculate (with the help of the normal distribution) that the probability of a negative year for the SP500 is 31%. K1T Capital Limited is an appointed representative of Linear Investments Limited, which is authorised and regulated by the Financial Conduct Authority (‘FCA’) FRN: 537389. This material is for the exclusive use of the person to whom it has been delivered, is confidential, and may n ot be copied, distributed, or otherwise given or disclosed to any person. This material was prepared exclusively for information and discussion purposes only and to indicate preliminarily the feasibility of a possible investment opportunity. This material is not meant to be, nor shall it be construed as, an attempt to define all terms and conditions of any transaction or to contain all information that is, or maybe, material to an investor. K1T Capital Limited is not soliciting any action based upon this material, and this material is not meant to be, nor shall it be construed as, an offer or solicitation of an offer for the purchase or sale of any security or advisory or other service. If in the future any security or services is offered or sold, such offer or sale shall occur only pursuant to, and a decision to invest therein should be made solely on the basis of, a definitive disclosure document, and shall be made exclusively to qualified investors in a private offering exempt from registration under all applicable securities and other laws. Any such disclosure document shall contain material information not contained herein, and shall supplement, amend, and/or supersede in its entirety the information referred to herein. This document Wikipedia: “…the Sharpe ratio characterizes how well the return of an asset compensates the investor for the risk taken. When comparing two assets versus a common benchmark, the one with a higher Sharpe ratio provides better return for the same risk...”

- 4. K1t Capital is an Appointed Representative of Linear Investments Limited, which is Authorised and Regulated by the Financial Conduct Authority (FCA) FRN: 537389 Produced 06 september 2016 is made available to persons who would fall within the definition of a Professional Client or Eligible Counterparty in accordance with the rules of the Financial Conduct Authority.