Mac ecs6.2021h

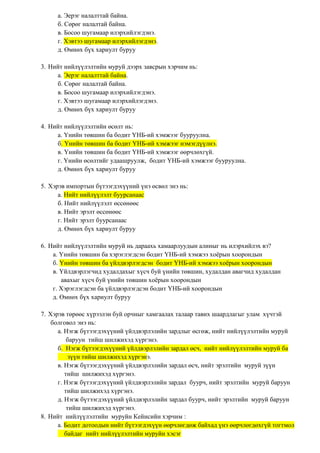

- 1. ąØąśąÖąó ąØąśąÖąøę«ę«ąøąŁąøąó I. ę«ąĮ菹Į / ąźčāą┤ą░ą╗ ąöąŠąŠčĆčģ ą░čüčāčāą┤ą╗čāčāą┤čŗąĮ 껹Į菹Į, čģčāą┤ą╗čŗą│ ąĮčÅą│čéą╗ą░ąĮ čéčāąĮą│ą░ą░ąČ, čģą░čĆąĖčāą╗čé ė®ą│ 1. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī čüąŠąĮą│ąŠą┤ąŠą│ čģčŹčĆčćąĖą╝ ą┤čŹčŹčĆčŹčŹ čģ菹▓čéčŹčŹ ą▒ą░ą╣ąĮą░. ąź 2. ąĪąŠąĮą│ąŠą┤ąŠą│ ą▒ą░ ą║ąĄą╣ąĮčüąĖą╣ąĮ čüčāčĆą│čāčāą╗ąĖą╣ąĮ ą░ą╗čī ą░ą╗čī ąĮčī č鹊ąŠčåąŠčģą┤ąŠąŠ čāčĆčé čģčāą│ą░čåą░ą░ąĮą┤ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī ą▒ąŠčüąŠąŠ ą▒ą░ą╣ąĮą░ ą│čŹąČ ę»ąĘą┤菹│. ę« 3. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ė®čüė®ą╗čé ąĮčī čé菹Įčåą▓čŹčĆčé 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čé껹▓čłąĖąĮ ą▒ą░ ą▒ę»čĆ菹Į ą░ąČąĖą╗ čŹčĆčģą╗菹╗čéąĖą╣ąĮ 껹Ą ą┤čŹčģ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čé껹▓čłąĖąĮą│ ąĮ菹╝菹│ą┤ę»ę»ą╗ąĮčŹ. ę« 4. ąśą╗ę»ę»ą┤菹╗ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģę»čćąĖąĮ čćą░ą┤ą╗čŗąĮ ą▒čāčāčĆą░ą╗čé ąĮčī ą║ą░ą┐ąĖčéą░ą╗čŗąĮ ė®čüė®ą╗čéąĖą╣ą│ čāą┤ą░ą░čłčĆčāčāą╗ąČ, ąĖąĮą│čŹčüąĮčŹčŹčĆčŹčŹ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ą│ ą▒ą░ą│ą░čüą│ą░ą┤ą░ą│. ąź 5. ę«ą╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģę»čćąĖąĮ ąĘ껹╣ą╗čüąĖą╣ąĮ ąĘą░čģ ąĘčŹčŹą╗ ą┤čŹčŹčĆčģ ą╝ąŠąĮąŠą┐ąŠą╗čī čģą░ąĮą┤ą╗ą░ą│čŗąĮ ė®čüė®ą╗čé ąĮčī 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą░ą╗ą┤ ąĮė®ą╗ė®ė®ą╗ąČ ą▒ąŠą╗ąŠčģ ą▒ą░ ąĖąĮą│čŹčüąĮčŹčŹčĆčŹčŹ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ė®ė®čĆčćą╗ė®ą╗čéė®ą┤ ąĮė®ą╗ė®ė®ą╗ąĮė®. ę« 6. ąĪąŠąĮą│ąŠą┤ąŠą│ ą║ąŠąĮčåąĄą┐čåąĖą╣ąĮ čæčüąŠąŠčĆ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī čÅą╝ą░čĆ čć ąĮė®čģčåė®ą╗ą┤ ąĘę»ę»ąĮ ą▒ą░ ą▒ą░čĆčāčāąĮ ą░ą╗čī čć ąĘ껹│čé čģė®ą┤ą╗ė®ąČ čćą░ą┤ą░čģą│껹╣ ą▒ą░ čāčćąĖčĆ ąĮčī ą╝čāčĆčāą╣ ą▒ąŠčüąŠąŠ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤čü菹Į ą▒ą░ą╣ąĮą░. ąź 7. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ ąĘą░ą▓čüčĆčŗąĮ čģčŹčĆčćąĖą╝ ą┤čŹčŹčĆ ę»ąĮčŹ ą▒ą░ ą▒ąŠą┤ąĖčé ąöąØąæ čāčĆą▓čāčā čģą░ą╝ą░ą░čĆą░ą╗čéą░ą╣. ąź 8. ąÜąĄą╣ąĮčüąĖą╣ąĮ čüčāčĆą│čāčāą╗ąĖą╣ąĮ 菹┤ąĖą╣ąĮ ąĘą░čüą░ą│čćą┤čŗąĮ 껹Ę菹╗ ą▒ąŠą┤ą╗ąŠąŠčĆ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī ą▒ę»čéčŹčŹą│ą┤čģę»ę»ąĮąĖą╣ ą▒ąŠą╗ąŠą╝ąČąĖčé ą│ą░čĆčåčŗą│ ąĘė®ą▓čģė®ąĮ čāčĆčé čģčāą│ą░čåą░ą░ąĮą┤ ąĖą╗čŹčĆčģąĖą╣ą╗ąĮčŹ. ę« 9. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą▒ąŠčüąŠąŠ čģčŹčĆčćąĖą╝ ą│菹┤菹│ ąĮčī ą▒ąŠą┤ąĖčé 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ą▒ąŠą╗ąŠą╝ąČąĖą╣ąĮ čģąĖą╗ čģčÅąĘą│ą░ą░čĆčŗąĮ čģčÅą╗ą▒ą░čĆčłčāčāą╗čüą░ąĮ ą┤ę»čĆčüą╗菹╗ ą▒ė®ą│ė®ė®ą┤ čāčćąĖčĆ ąĮčī ą┤čāčĆčŗąĮ 菹┤ąĖą╣ąĮ ąĘą░čüą░ą│ 菹ĮčŹ čģčŹčĆčćąĖą╝ ą┤čŹčŹčĆčŹčŹ čć ė®čüė®ą╗čéąĖą╣ą│ čģą░ąĮą│ą░čģ ą▒ą░ą│ą░čģą░ąĮ čģ菹╝ąČčŹčŹąĮąĖą╣ ąĮė®ė®čåąĖą╣ą│ čÅą╝ą░ą│čé ą░ą│čāčāą╗čüą░ąĮ ą▒ą░ą╣ą┤ą░ą│. ę« 10. ąŚą░čüą▓čĆčŗąĮ čģčŹčĆčćąĖą╝ ąĮčī 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ą░čłąĖą│ą╗ą░ą╗čéą│껹╣ ąĮė®ė®čå čģę»čćąĖąĮ čćą░ą┤ą░ą╗ ė®ąĮą┤ė®čĆčé菹╣ 菹┤ąĖą╣ąĮ ąĘą░čüą│ą░ą░čü čģė®ą┤ė®ą╗ą╝ė®čĆ ą▒ę»čĆ菹Į čŹčĆčģą╗菹╗čé 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģę»čćąĖąĮ čćą░ą┤ą╗čŗąĮ ą▒ę»čĆ菹Į ą┤ę»ę»čĆ菹Į ą░čłąĖą│ą╗ą░ą╗čéčéą░ą╣ 菹┤ąĖą╣ąĮ ąĘą░čüą░ą│čé čłąĖą╗ąČąĖčģ čłąĖą╗ąČąĖą╗čéąĖą╣ąĮ 껹ĄąĖą╣ąĮ ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ą│ ąĖą╗čŹčĆčģąĖą╣ą╗ąĮčŹ ę« 11. ąĪąŠąĮą│ąŠą┤ąŠą│ čģčŹčĆčćąĖą╝ ąĮčī 菹┤ąĖą╣ąĮ ąĘą░čüą░ą│ ą▒ę»čĆ菹Į čģę»čćąĖąĮ čćą░ą┤ą╗ą░ą░čĆą░ą░ ą░ąČąĖą╗ą╗ą░ąČ ą▒ą░ą╣ą│ą░ą░ ą▒čāčÄčā ą║ą░ą┐ąĖčéą░ą╗ čģė®ą┤ė®ą╗ą╝ė®čĆąĖą╣ąĮ ąĮė®ė®čåąĖą╣ąĮ ą▒ę»čĆ菹Į ą┤ę»ę»čĆ菹Į čłą░ą▓čģą░ąĮ ą░čłąĖą│ą╗ą░čüą░ąĮ 껹ĄąĖą╣ąĮ ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ą│ ąĖą╗čŹčĆčģąĖą╣ą╗ąĮčŹ. ę« 12. ę«ą╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģę»čćąĖąĮ ąĘ껹╣ą╗ąĖą╣ąĮ 껹ĮčŹ ąĮ菹╝菹│ą┤ą▓菹╗ ąĮ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ ąĘą░čĆą┤ą░ą╗ ąĮ菹╝菹│ą┤čŹąČ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖąĮčŹ. ąź 13. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ąĮčī ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ ą▒ąŠą┤ąĖčé čģ菹╝ąČčŹčŹą│ ąĖą╗čŹčĆčģąĖą╣ą╗čŹčģ ą▒čāčÄčā čāą╗čü ąŠčĆąĮčŗ 菹┤ąĖą╣ąĮ ąĘą░čüą│ąĖą╣ąĮ čüąĖčüč鹥ą╝ąĖą╣ąĮ čģ菹╝ąČčŹčŹąĮą┤ 껹╣ą╗ą┤ą▓čŹčĆą╗菹│ą┤čü菹Į ą┤ąŠč鹊ąŠą┤čŗąĮ ąĮąĖą╣čé ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ ą▒ąŠą┤ąĖčé čģ菹╝ąČčŹčŹ ą▒ą░ą╣ąĮą░ ę« 14. ąæąŠą┤ąĖčé 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ ą┐ąŠč鹥ąĮčåąĖą░ą╗ ąöąØąæ-čŹčŹčü ą▒ą░ą│ą░ čŹčüą▓菹╗ ąĖčģ ą▒ą░ą╣čģ 껹ĄąĖą╣ą│ ą╝ą░ą║čĆąŠčŹą║ąŠąĮąŠą╝ąĖą║čüčé čāčĆčé čģčāą│ą░čåą░ą░ ą│菹ĮčŹ ąź 15. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ čłąĖą╗ąČąĖą╗čé ąĮčī ė®ą│ė®ą│ą┤čüė®ąĮ 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮą┤ čģę»čćąĖąĮ ąĘ껹╣ą╗čüąĖą╣ąĮ 껹ĮčŹ, čŹčüą▓菹╗ čģę»čćąĖąĮ ąĘ껹╣ą╗čüąĖą╣ąĮ čģ菹╝ąČčŹčŹ ė®ė®čĆčćą╗ė®ą│ą┤ė®čģė®ą┤ ą▒ąĖą╣ ą▒ąŠą╗ą┤ąŠą│. ę« II.ąóąĄčüčé ąŚė®ą▓ čģą░čĆąĖčāą╗čéčŗąĮ ė®ą╝ąĮė®čģ ę»čüą│ąĖą╣ą│ ą┤čāą│čāą╣ą╗ąĮą░ čāčā. 1. ę«ąĮčŹ ė®čüčć, 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģ菹╝ąČčŹčŹ ą▒čāčāčĆą░čģ ąĮčī ą┤ą░čĆą░ą░čģ čłą░ą╗čéą│ą░ą░ąĮčéą░ą╣ čģąŠą╗ą▒ąŠąŠč鹊ą╣ ą░. ąØąĖą╣čé čŹčĆ菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČčü菹Įčé菹╣ ą▒. ąØąĖą╣čé čŹčĆ菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĘę»ę»ąĮ čéąĖą╣čł čłąĖą╗ąČčü菹Įčé菹╣ ą▓. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĘę»ę»ąĮ čéąĖą╣čł čłąĖą╗ąČčü菹Įčé菹╣ ą│. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČčü菹Įčé菹╣ ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 2. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą┤čŹčŹčĆčģ ąÜąĄą╣ąĮčüąĖą╣ąĮ čģčŹčĆčćąĖą╝ ąĮčī:

- 2. ą░. ąŁąĄčĆ菹│ ąĮą░ą╗ą░ą╗čéčéą░ą╣ ą▒ą░ą╣ąĮą░. ą▒. ąĪė®čĆė®ą│ ąĮą░ą╗ą░ą╗čéą░ą╣ ą▒ą░ą╣ąĮą░. ą▓. ąæąŠčüąŠąŠ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ. ą│. ąźčŹą▓čéčŹčŹ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ. ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 3. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą┤čŹčŹčĆčģ ąĘą░ą▓čüčĆčŗąĮ čģčŹčĆčćąĖą╝ ąĮčī: ą░. ąŁąĄčĆ菹│ ąĮą░ą╗ą░ą╗čéčéą░ą╣ ą▒ą░ą╣ąĮą░. ą▒. ąĪė®čĆė®ą│ ąĮą░ą╗ą░ą╗čéą░ą╣ ą▒ą░ą╣ąĮą░. ą▓. ąæąŠčüąŠąŠ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ. ą│. ąźčŹą▓čéčŹčŹ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ. ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 4. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ė®čüė®ą╗čé ąĮčī: ą░. ę«ąĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ ą▒ą░ ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹą│ ą▒čāčāčĆčāčāą╗ąĮą░. ą▒. ę«ąĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ ą▒ą░ ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹą│ ąĮ菹╝菹│ą┤ę»ę»ą╗ąĮčŹ. ą▓. ę«ąĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ ą▒ą░ ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹą│ ė®ė®čĆčćą╗ė®čģą│껹╣. ą│. ę«ąĮąĖą╣ąĮ ė®čüė®ą╗čéąĖą╣ą│ čāą┤ą░ą░čłčĆčāčāą╗ąČ, ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹą│ ą▒čāčāčĆčāčāą╗ąĮą░. ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 5. ąźčŹčĆ菹▓ ąĖą╝ą┐ąŠčĆčéčŗąĮ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹ĮčŹ ė®čüą▓ė®ą╗ 菹ĮčŹ ąĮčī: ą░. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ą▒čāčāčĆčüą░ąĮą░ą░čü ą▒. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ė®čüčüė®ąĮė®ė®čü ą▓. ąØąĖą╣čé čŹčĆ菹╗čé ė®čüčüė®ąĮė®ė®čü ą│. ąØąĖą╣čé čŹčĆ菹╗čé ą▒čāčāčĆčüą░ąĮą░ą░čü ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 6. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī ą┤ą░čĆą░ą░čģčī čģą░ą╝ą░ą░čĆą╗čāčāą┤čŗąĮ ą░ą╗ąĖąĮčŗą│ ąĮčī ąĖą╗čŹčĆčģąĖą╣ą╗čŹčģ ą▓čŹ? ą░. ę«ąĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ ą▒ą░ čģčŹčĆ菹│ą╗菹│ą┤čü菹Į ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą▒. ę«ąĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ ą▒ą░ 껹╣ą╗ą┤ą▓čŹčĆą╗菹│ą┤čü菹Į ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģ菹╝ąČčŹčŹ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą▓. ę«ą╣ą╗ą┤ą▓čŹčĆą╗菹│čćąĖą┤ čģčāą┤ą░ą╗ą┤ą░čģčŗą│ čģę»čüčć ą▒čāą╣ 껹ĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ, čģčāą┤ą░ą╗ą┤ą░ąĮ ą░ą▓ą░ą│čćąĖą┤ čģčāą┤ą░ą╗ą┤ą░ąĮ ą░ą▓ą░čģčŗą│ čģę»čüčć ą▒čāą╣ 껹ĮąĖą╣ąĮ čéė®ą▓čłąĖąĮ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą│. ąźčŹčĆ菹│ą╗菹│ą┤čü菹Į ą▒ą░ 껹╣ą╗ą┤ą▓čŹčĆą╗菹│ą┤čü菹Į ą▒ąŠą┤ąĖčé ę«ąØąæ-ąĖą╣ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą┤. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 7. ąźčŹčĆ菹▓ čéė®čĆė®ė®čü čģę»čĆčŹčŹą╗菹Į ą▒čāą╣ ąŠčĆčćąĮčŗą│ čģą░ą╝ą│ą░ą░ą╗ą░čģ čéą░ą╗ą░ą░čĆ čéą░ą▓ąĖčģ čłą░ą░čĆą┤ą╗ą░ą│čŗą│ čāą╗ą░ą╝ čģę»čćčé菹╣ ą▒ąŠą╗ą│ąŠą▓ąŠą╗ 菹ĮčŹ ąĮčī: ą░. ąØ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą╗čŗą│ ė®čüą│ė®ąČ, ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ菹┤ čģę»čĆą│菹ĮčŹ. ą▒. ąØ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą░ą╗ ė®čüčć, ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░ ąĘę»ę»ąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ菹┤ čģę»čĆą│菹ĮčŹ. ą▓. ąØ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą░ą╗ ė®čüčć, ąĮąĖą╣čé čŹčĆ菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ąĘę»ę»ąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ菹┤ čģę»čĆą│菹ĮčŹ. ą│. ąØ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą░ą╗ ą▒čāčāčĆčć, ąĮąĖą╣čé čŹčĆ菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ菹┤ čģę»čĆą│菹ĮčŹ. ą┤. ąØ菹│ąČ ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ ąĘą░čĆą┤ą░ą╗ ą▒čāčāčĆčć, ąĮąĖą╣čé čŹčĆ菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ菹┤ čģę»čĆą│菹ĮčŹ. 8. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ ąÜąĄą╣ąĮčüąĖą╣ąĮ čģčŹčĆčćąĖą╝ : ą░. ąæąŠą┤ąĖčé ą┤ąŠč鹊ąŠą┤čŗąĮ ąĮąĖą╣čé ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮ ė®ė®čĆčćą╗ė®ą│ą┤ė®ąČ ą▒ą░ą╣čģą░ą┤ 껹ĮčŹ ė®ė®čĆčćą╗ė®ą│ą┤ė®čģą│껹╣ č鹊ą│čéą╝ąŠą╗ ą▒ą░ą╣ą┤ą░ą│ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ čģčŹčü菹│

- 3. ą▒. ąæę»čĆ菹Į ą░ąČąĖą╗ čŹčĆčģą╗菹╗čéąĖą╣ąĮ 껹Ą ą┤čŹčģ 菹┤ąĖą╣ąĮ ąĘą░čüą│ąĖą╣ąĮ ąĮė®čģčåė®ą╗ ą▒ą░ą╣ą┤ą░ą╗čéą░ą╣ č鹊čģąĖčĆčć ą▒ą░ą╣ą┤ą░ą│ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ ą▒ąŠčüąŠąŠ čģčŹčü菹│ ą▓. ą»ąĮąĘ ą▒ę»čĆąĖą╣ąĮ 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮą┤ ąŠą╗ąČ ą░ą▓ą░čģčŗą│ čŹčĆą╝菹╗ąĘčŹąČ ą▒čāą╣ ą▒ą░čĆą░ą░ 껹╣ą╗čćąĖą╗ą│čŹčŹąĮąĖą╣ č鹊ąŠ čģ菹╝ąČčŹčŹ ą│. ąÉą╗ąĖąĮ čć ą▒ąĖčł 9 . ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ ąĪąŠąĮą│ąŠą┤ąŠą│ čģčŹčĆčćąĖą╝ ą░. ąæę»čĆ菹Į ą░ąČąĖą╗ čŹčĆčģą╗菹╗čéąĖą╣ąĮ 껹Ą ą┤čŹčģ 菹┤ąĖą╣ąĮ ąĘą░čüą│ąĖą╣ąĮ ąĮė®čģčåė®ą╗ ą▒ą░ą╣ą┤ą░ą╗čéą░ą╣ č鹊čģąĖčĆčć ą▒ą░ą╣ą┤ą░ą│ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ ą▒ąŠčüąŠąŠ čģčŹčü菹│ ą▒. ąæąŠą┤ąĖčé ą┤ąŠč鹊ąŠą┤čŗąĮ ąĮąĖą╣čé ą▒ę»čéčŹčŹą│ą┤čŹčģę»ę»ąĮ ė®ė®čĆčćą╗ė®ą│ą┤ė®ąČ ą▒ą░ą╣čģą░ą┤ 껹ĮčŹ ė®ė®čĆčćą╗ė®ą│ą┤ė®čģą│껹╣ č鹊ą│čéą╝ąŠą╗ ą▒ą░ą╣ą┤ą░ą│ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ąĮ čģčŹčü菹│ ą▓. ą»ąĮąĘ ą▒ę»čĆąĖą╣ąĮ 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮą┤ ąŠą╗ąČ ą░ą▓ą░čģčŗą│ čŹčĆą╝菹╗ąĘčŹąČ ą▒čāą╣ ą▒ą░čĆą░ą░ 껹╣ą╗čćąĖą╗ą│čŹčŹąĮąĖą╣ č鹊ąŠ čģ菹╝ąČčŹčŹ ą│. ąæ껹│ą┤ ą▒čāčĆčāčā 10. AS ŌĆōąĖą╣ąĮ ą╝čāčĆčāą╣ ą┤ą░čĆą░ą░čģ čģą░ą╝ą░ą░čĆą╗čāčāą┤čŗąĮ ą░ą╗ąĖą╣ą│ ąĮčī ąĖą╗čŹčĆčģąĖą╣ą╗čŹčģ ą▓čŹ ? ą░. ę«ąĮąĖą╣ąĮ čé껹▓čłąĖąĮ ą▒ą░ 껹╣ą╗ą┤ą▓čŹčĆą╗菹│ą┤čü菹Į ąöąØąæ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą▒ . ę«ąĮąĖą╣ąĮ čé껹▓čłąĖąĮ ą▒ą░ čģčŹčĆ菹│ą╗菹│ą┤čü菹Į ąöąØąæ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą▓. ę«ą╣ą╗ą┤ą▓čŹčĆą╗菹│ą┤čü菹Į ą▒ą░ čģčŹčĆ菹│ą╗菹│ą┤čü菹Į ąöąØąæ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ ą│. ąźčāą┤ą░ą╗ą┤ą░čģ ą▒ą░ čģčāą┤ą░ą╗ą┤ą░ąĮ ą░ą▓ą░čģ 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮ čģąŠčæčĆčŗąĮ čģąŠąŠčĆąŠąĮą┤čŗąĮ 11. AS ŌĆōąĖą╣ąĮ ą╝čāčĆčāą╣ ąĮčī čģčŹčé ą▒ąŠą│ąĖąĮąŠ čģčāą│ą░čåą░ą░ąĮą┤ ą░. ąŁąĄčĆ菹│ ąĮą░ą╗ą░ą╗čéčéą░ą╣ ą▒. ąĪė®čĆė®ą│ ąĮą░ą╗ą░ą╗čéčéą░ą╣ ą▓. ąæąŠčüąŠąŠ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ ą│. ąźčŹą▓čéčŹčŹ čłčāą│ą░ą╝ą░ą░čĆ ąĖą╗čŹčĆčģąĖą╣ą╗菹│ą┤菹ĮčŹ 12 ą»ą╝ą░čĆ ę»ąĄą┤ AS ą╝čāčĆčāą╣ ą▒ąŠčüąŠąŠ čłčāą│ą░ą╝ą░ą░čĆ ą┤ę»čĆčüą╗菹│ą┤čŹčģ ą▓čŹ ? ą░. ąØė®ė®čåąĖą╣ąĮ čģę»čćąĖąĮ čćą░ą┤ą╗čŗąĮ ą┤čāčéčāčā ą░čłąĖą│ą╗ą░ą╗čéčéą░ą╣ 껹Ąą┤ ą▒. ąØė®ė®čåąĖą╣ąĮ čģę»čćąĖąĮ čćą░ą┤ą╗čŗąĮ ą▒ę»čĆ菹Į ą░čłąĖą│ą╗ą░ą╗čéčéą░ą╣ 껹Ąą┤ ą▓. ąŚą░ą▓čüčĆčŗąĮ 껹Ąą┤ ą│. ąÉą╗ąĖąĮ čć ą▒ąĖčł 13. ą£ą░ą║čĆąŠčŹą║ąŠąĮąŠą╝ąĖą║čüčé ą▒ąŠą│ąĖąĮąŠ čģčāą│ą░čåą░ą░ ą│菹┤菹│ ąĮčī ą░. ąæąŠą┤ąĖčé ąöąØąæ ą┐ąŠč鹥ąĮčåąĖą░ą╗ ąöąØąæ - čé菹╣ čé菹Įčåę»ę» ą▒. ąæąŠą┤ąĖčé ąöąØąæ ą┐ąŠč鹥ąĮčåąĖą░ą╗ ąöąØąæ - čŹčŹčü ą▒ą░ą│ą░ čŹčüą▓菹╗ ąĖčģ ą▒ą░ą╣čģ ą▓. ąæę»čĆ菹Į ą░ąČąĖą╗ čŹčĆčģą╗菹╗čéčé菹╣ 껹Ąą┤ ą┐ąŠč鹥ąĮčåąĖą░ą╗ ąöąØąæ ą│. ąØ菹│ ąČąĖą╗čŹčŹčü ą▒ą░ą│ą░ čģčāą│ą░čåą░ą░ 14. ąźčāą┤ą░ą╗ą┤ą░ą░ąĮčŗ čģčÅąĘą│ą░ą░čĆą╗ą░ą╗čé, čģąŠčĆąĖą│čāčāą┤ ą▒ą░ą│ą░čüą░čģ ąĮčī ą░. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ą│ ą▒čāčāčĆčāčāą╗ąĮą░ ą▒. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗ąĖą╣ą│ ąĮ菹╝菹│ą┤ę»ę»ą╗ąĮčŹ ą▓. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé菹┤ ąĮė®ą╗ė®ė® 껹Ęę»ę»ą╗čŹčģą│껹╣ ą│. ė©ą╝ąĮė®čģ ą▒ę»čģ čģą░čĆąĖčāą╗čé ą▒čāčĆčāčā 15. ą»ą╝ą░čĆ č鹊čģąĖąŠą╗ą┤ąŠą╗ą┤ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖčģ ą▓čŹ ? ą░. ąæę»čĆ菹Į ą░ąČąĖą╗ čŹčĆčģą╗菹╗čéčé菹╣ 껹ĄąĖą╣ąĮ čģė®ą┤ė®ą╗ą╝ė®čĆąĖą╣ąĮ č鹊ąŠ čģ菹╝ąČčŹčŹ ė®ė®čĆčćą╗ė®ą│ą┤ė®čģ ą▒. ąÜą░ą┐ąĖčéą░ą╗čŗąĮ č鹊ąŠ čģ菹╝ąČčŹčŹ ė®ė®čĆčćą╗ė®ą│ą┤ė®čģ ą▓. ąóąĄčģąĮąŠą╗ąŠą│ąĖą╣ąĮ čłąĖąĮčŹčćą╗菹╗, ą┤菹▓čłąĖą╗ ą▒ąĖą╣ ą▒ąŠą╗ąŠčģ ą│. ąöčŹčŹčĆčģ ą▒껹│ą┤ III. ąæąŠą┤ą╗ąŠą│ąŠ

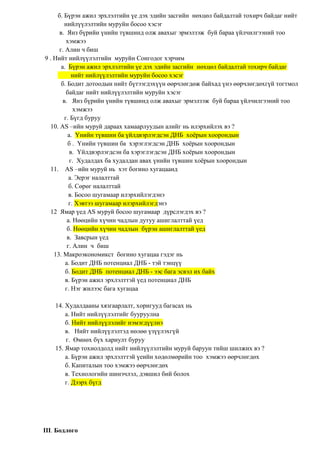

- 4. 1. ąöą░čĆą░ą░čģ ė®ė®čĆčćą╗ė®ą╗čéąĖą╣ąĮ ę»čĆ ą┤껹Įą┤ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé čģčŹčĆčģ菹Į ė®ė®čĆčćą╗ė®ą│ą┤ė®čģąĖą╣ą│ ąĘčāčĆą│ą░ą░čĆ čģą░čĆčāčāą╗. ą░. ąØąöą© ąĮ菹╝菹│ą┤čŹčģ菹┤ ą▒. ą×čĆą╗ąŠą│čŗąĮ čéą░čéą▓ą░čĆ ą▒čāčāčĆą░čģą░ą┤ ą▓. ąöąŠą╗ą╗ą░čĆčŗąĮ čģą░ąĮčł čāąĮą░čģą░ą┤ ą│. ą£ė®ąĮą│ė®ąĮąĖą╣ ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ąĮ菹╝菹│ą┤čŹčģ菹┤ ą┤. ąóą░čéą▓ą░čĆčŗąĮ čģčāą▓čī ą▒čāčāčĆą░čģą░ą┤ ąĄ. ą”čŹčĆ菹│ ą┤ą░ą╣ąĮčŗ ąĘą░čĆą┤ą░ą╗ ė®čüė®čģė®ą┤ ąæąŠą┤ąŠą╗čé : 1. ą░, ąĄ č鹊čģąĖąŠą╗ą┤ąŠą╗ą┤ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ą▒čāčāčĆčć, ąĘę»ę»ąĮ čéąĖą╣čł čłąĖą╗ąČąĖą╗čé čģąĖą╣ąĮčŹ. 2. ą▒, ą▓, ą│, ą┤ č鹊čģąĖąŠą╗ą┤ąŠą╗ą┤ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé ė®čüė®ąČ , ą▒ą░čĆčāčāąĮ čéąĖą╣čł čłąĖą╗ąČąĖą╗čé čģąĖą╣ąĮčŹ 2. ąØąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ čéą░ą╗ą░ą░čĆčģ ą╝菹┤čŹčŹą╗菹╗ čģę»čüąĮ菹│čé菹┤ ė®ą│ė®ą│ą┤ąČčŹčŹ. ąæąŠą┤ąĖčé ąöąØąæ-ąĖą╣ ąĮąĖą╣ą╗ę»ę»ą╗菹╗čé (ąóčŹčĆą▒čāą╝ $) ę«ąĮąĖą╣ąĮ čé껹▓čłąĖąĮ(ę«ąĮąĖą╣ąĮ ąĖąĮą┤ąĄą║čü) 400 300 400 250 300 200 200 150 100 150 ė©ą│ė®ą│ą┤ą╗ąĖą╣ą│ ą░čłąĖą│ą╗ą░ąĮ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ą│ ą▒ą░ą╣ą│čāčāą╗ą░ąĮ čģčŹčé ą▒ąŠą│ąĖąĮąŠ čģčāą│ą░čåą░ą░ąĮčŗ, ą▒ąŠą│ąĖąĮąŠ čģčāą│ą░čåą░ą░ąĮčŗ, čāčĆčé čģčāą│ą░čåą░ą░ąĮčŗ čģčŹčĆčćą╝ę»ę»ą┤ąĖą╣ą│ čģą░čĆčāčāą╗ąĮą░ čāčā. 3. ę«ąĮąĖą╣ąĮ čé껹▓čłąĖąĮą│ąĖą╣ąĮ ė®čüė®ą╗čéą│껹╣ą│čŹčŹčĆ ąöąØąæą▒ ŌĆō čģ菹╝ąČčŹčŹą│ 270 ŌĆōčü 280 čüą░čÅ $ ą▒ąŠą╗ą│ąŠčģ ą▒ąŠą╗ąŠą╝ąČč鹊ą╣ ą▒ą░ą╣ą│ą░ą░ ą▒ąŠą╗

- 5. 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮą│ąĖą╣ąĮ ė®čüė®ą╗čéą│껹╣ą│čŹčŹčĆ ąöąØąæ ŌĆō čģ菹╝ąČčŹčŹą│: ą░.240 ŌĆō 250 čüą░čÅ $ ą▒.300 - 310 čüą░čÅ $ čģę»čĆą│čŹąČ ą▒ąŠą╗ąŠčģ čāčā ? 4. ąźę»čüąĮ菹│čéąĮąĖą╣ ė®ą│ė®ą│ą┤ą╗ąĖą╣ą│ ą░čłąĖą│ą╗ą░ąĮ ąĮąĖą╣čé ąĮąĖą╣ą╗ę»ę»ą╗菹╗čéąĖą╣ąĮ ą╝čāčĆčāą╣ą│ ą│ą░čĆą│ą░ąČ ą┤ą░čĆą░ą░čģčī ą░čüčāčāą╗čéą░ąĮą┤ čģą░čĆąĖčāą╗ąĮą░ čāčā? ą░. ąæąŠą╗ąŠą╝ąČąĖčé ąöąØąæ ŌĆōąĮąĖą╣ čģ菹╝ąČčŹčŹą│ ąŠą╗ąĮąŠ čāčā? ą▒. P1 - 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮ ą▓. P2 - 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮ ą│. ę«ąĮą┤čŹčüąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģ菹╝ąČčŹčŹ Y- ą│ č鹊ą┤ąŠčĆčģąŠą╣ą╗ąĮąŠ čāčā ? P 1.6 1.8 2.2 1.6 2.4 P1 P2 1.7 AS 30 40 50 20 50 10 42 Y

- 6. ą░. ąæąŠą╗ąŠą╝ąČąĖčé ąöąØąæ ŌĆōąĮąĖą╣ čģ菹╝ąČčŹčŹą│ ąŠą╗ąĮąŠ čāčā? - 50 ą▒. P1 - 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮ - 1.6 ą▓. P2 - 껹ĮąĖą╣ąĮ čé껹▓čłąĖąĮ - 1.9 ą│. ę«ąĮą┤čŹčüąĮąĖą╣ 껹╣ą╗ą┤ą▓čŹčĆą╗菹╗ąĖą╣ąĮ čģ菹╝ąČčŹčŹ Y- ą│ č鹊ą┤ąŠčĆčģąŠą╣ą╗ąĮąŠ čāčā ? - 35