Pan card correction

3 likes5,477 views

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT.

1 of 7

Download to read offline

Recommended

HÆ°áŧng dášŦn váš― bÃĄnh rÄng trÊn phᚧn máŧm Catia

HÆ°áŧng dášŦn váš― bÃĄnh rÄng trÊn phᚧn máŧm Catia Cáŧa Hà ng Vášt TÆ°

Ėý

HÆ°áŧng dášŦn váš― bÃĄnh rÄng trÊn phᚧn máŧm Catia

Download nhanh tà i liáŧu:

http://technicalvndoc.com/huong-dan-ve-banh-rang-tren-phan-mem-catia/Six stroke Engine by Harish Kushwaha

Six stroke Engine by Harish KushwahaHARISH KUSHWAHA

Ėý

The document discusses the six-stroke engine, which adds an additional power stroke compared to traditional four-stroke engines. It provides a brief history, describing how the concept was introduced in 1883 but the design did not fit automobiles until more recent inventions like the Bajulaz engine in 1989. The key features of six-stroke engines are described as increased efficiency, torque, and reduction in fuel consumption and pollution compared to four-stroke engines. Examples of different six-stroke engine types and designs are provided, along with their advantages and potential applications, particularly for automobiles where it could significantly reduce fuel use and emissions.TÃnh toÃĄn báŧ tháŧ háŧ tháŧng treo theo dao Äáŧng cÆ°áŧĄng báŧĐc loᚥi tang tráŧng cho xe...

TÃnh toÃĄn báŧ tháŧ háŧ tháŧng treo theo dao Äáŧng cÆ°áŧĄng báŧĐc loᚥi tang tráŧng cho xe...Antonietta Davis

Ėý

1, CÃīng dáŧĨng:

Háŧ tháŧng treo là háŧ tháŧng liÊn kášŋt giáŧŊa bÃĄnh xe và khung xe hoáš·c váŧ xe.

Máŧi liÊn kášŋt cáŧ§a treo cáŧ§a xe là máŧi liÊn kášŋt Äà n háŧi. háŧ tháŧng treo cÃģ cÃĄc

cháŧĐc nÄng chÃnh sau ÄÃĒy:

+GiášĢm va Äášp sinh ra trong khi Ãī tÃī chuyáŧn Äáŧng, là m Êm dáŧu khi Äi qua

cÃĄc máš·t ÄÆ°áŧng gáŧ gháŧ khÃīng bášąng phášģng.

+Truyáŧn láŧąc và mÃī men giáŧŊa bÃĄnh xe và khung xe.

Sáŧą liÊn kášŋt giáŧŊa bÃĄnh xe và khung xe cᚧn thiášŋt phášĢi máŧm, nhÆ°ng cÅĐng phášĢi

Äáŧ§ khášĢ nÄng Äáŧ truyáŧn láŧąc.

2, PhÃĒn loᚥi.

Viáŧc phÃĒn loᚥi háŧ tháŧng treo dáŧąa theo cÃĄc cÄn cáŧĐ sau:

- theo báŧ phášn ÄÃ n háŧi chia ra:

+ Loᚥi bášąng kim loᚥi (nhÃp lÃĄ ,lÃē xo,thanh xoášŊn ).

+ Loᚥi khà (loᚥi báŧc bášąng cao su-sáŧĢi, mà ng,loᚥi áŧng).

+ Loᚥi thuáŧ· láŧąc ( loᚥi áŧng ).

+ Loᚥi cao su.

-Theo báŧ phášn dášŦn hÆ°áŧng chia ra:

+ Loᚥi pháŧĨ thuáŧc váŧi cᚧu liáŧn (loᚥi riÊng, loᚥi thÄng bášąng).

+ Loᚥi Äáŧc lášp ( máŧt ÄÃēn,hai ÄÃēn ).

https://lop4.com/4.3.1. thiášŋt kášŋ chášŋ tᚥo khuÃīn ÃĐp nháŧąa cho chi tiášŋt váŧ máŧ hà n

4.3.1. thiášŋt kášŋ chášŋ tᚥo khuÃīn ÃĐp nháŧąa cho chi tiášŋt váŧ máŧ hà nhttps://www.facebook.com/garmentspace

Ėý

Äáŧ xem full tà i liáŧu Xin vui long liÊn háŧ page Äáŧ ÄÆ°áŧĢc háŧ tráŧĢ

: https://www.facebook.com/thuvienluanvan01

HOášķC

https://www.facebook.com/garmentspace/

https://www.facebook.com/thuvienluanvan01

https://www.facebook.com/thuvienluanvan01

tai lieu tong hop, thu vien luan van, luan van tong hop, do an chuyen nganh

Äáŧ ÃĄN mÃīn chi tiášŋt mÃĄy thiášŋt kášŋ trᚥm dášŦn Äáŧng xÃch tášĢi

Äáŧ ÃĄN mÃīn chi tiášŋt mÃĄy thiášŋt kášŋ trᚥm dášŦn Äáŧng xÃch tášĢihttps://www.facebook.com/garmentspace

Ėý

Äáŧ xem full tà i liáŧu Xin vui long liÊn háŧ page Äáŧ ÄÆ°áŧĢc háŧ tráŧĢ

: https://www.facebook.com/thuvienluanvan01

HOášķC

https://www.facebook.com/garmentspace/

https://www.facebook.com/thuvienluanvan01

https://www.facebook.com/thuvienluanvan01

tai lieu tong hop, thu vien luan van, luan van tong hop, do an chuyen nganh

Seminar on six stroke engine

Seminar on six stroke engineshivam verma

Ėý

This document is a report on a six-stroke engine by student Madhvendra Verma. It defines a six-stroke engine as having two additional strokes compared to a four-stroke engine, making it more efficient and reducing emissions. It describes the main types of six-stroke engines, their basic components and workings, and compares six-stroke engines to four-stroke engines, noting advantages like higher thermal efficiency and lower fuel consumption, but also disadvantages like increased complexity and weight.M.Ed Advanced Psychology's Topic-Techniques of Creativity -Attribute Listing

M.Ed Advanced Psychology's Topic-Techniques of Creativity -Attribute Listingfatima roshan

Ėý

This document discusses creativity techniques and the Attribute Technique for generating new ideas. It defines creativity as thinking of something new and useful. Creativity techniques include coming up with new ideas, thinking outside the box, and building on others' ideas. The Attribute Technique systematically changes or substitutes attributes of a product, service, or process to identify problems or improvements. It involves listing attributes, considering their value, and modifying them to examine problems individually.Six Stroke Engine

Six Stroke Enginevibhor_shah

Ėý

The document discusses a six-stroke engine, which adds two additional strokes to the traditional four-stroke internal combustion engine. The Crower six-stroke engine injects water into the combustion chamber on the fifth stroke, where it is turned to steam to power an additional downstroke. This provides a second power stroke and cools the engine. Potential advantages include 40% reduced fuel consumption and lower emissions. Limitations include risks of damage from injecting cold water and additional system complexities. Improvements could involve pre-heating water and reusing condensed water to address these issues.Request for-new-pan-card-or-and-changes-or-correction-in-pan-data-form

Request for-new-pan-card-or-and-changes-or-correction-in-pan-data-formSRI TECHNOLOGICAL SOLUTIONS

Ėý

This document is a request form for a new PAN card or changes/corrections to an existing PAN card. It requests information such as the applicant's name, date of birth, gender, address, phone number, email, and Aadhaar number. It provides instructions on how to fill out the form correctly, such as writing the applicant's full name without abbreviations, providing the father's name for individual applicants, and including country and area codes for phone numbers. The applicant must sign and date the form and may submit supporting documents for proposed changes.Form_49A.PDF

Form_49A.PDFsambhubiswal1

Ėý

This document is an application form for an allotment of a Permanent Account Number (PAN) in India.

It requests basic identifying information such as name, date of birth, gender, address, father's name, mother's name, and contact details. It also asks for documentation to prove identity, address, and date of birth. The applicant declares that the information provided is true to the best of their knowledge. Instructions are provided on how to correctly fill out the form, including guidelines for name format, abbreviations, and other details.Form_49A of Income Tax for Individuals companies

Form_49A of Income Tax for Individuals companiesBiswajitDatta19

Ėý

This document is an application form for an allotment of a Permanent Account Number (PAN) in India. It requests basic identifying information such as name, date of birth, gender, address, father's name, mother's name, and contact details. It also asks for documentation to prove identity, address, and date of birth. The applicant must declare that the information provided is true and sign the form, which includes placing their signature or thumbprint on a photo affixed to the form. Instructions are provided on how to fill out the form correctly, such as writing names clearly without abbreviations and providing the correct Assessing Officer codes for the local tax office.Form49 a july 1, 2017

Form49 a july 1, 2017Amit Kumar

Ėý

This document is an application form for allotment of a Permanent Account Number (PAN) in India. It requests individual/entity details such as name, gender, date of birth/incorporation, address, father's name, photograph, income sources, and documents for identity, address and date of birth proof. Instructions are provided on accurately filling name fields like using full names without abbreviations, and address details like country/PIN codes. Applicants are advised to provide contact details and Aadhaar/Enrolment ID number as per Indian tax laws.Form49 a

Form49 azillowapi7

Ėý

This document contains an application form for an individual or entity to apply for a Permanent Account Number (PAN) from the Indian Income Tax department.

The form requests information such as the applicant's full name, father's name, date of birth/incorporation, gender, address, phone number, email, status, registration number if applicable, Aadhaar number if available, source of income, representative assessee details if any, and documents submitted as proof of identity, address and date of birth.

Instructions are provided on how to fill in each field correctly, such as using block letters and leaving one space between each word, providing passport size photographs, and ensuring dates, names and addresses areForm49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...

Form49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...Khanna Asssociates

Ėý

KHANNA & ASSOCIATES is a 70 year old taxation lawyer and chartered accountant firm .It includes Company Secretary , MBA s, Taxation Lawyers and Chartered Accountant. We are an international law firm . We provide various services legal to finance .

KHANNA & ASSOCIATES is a full service Law Firm handling all legal matters on Civil, Criminal, Business, Commercial, Corporate, Arbitration , Labor & Service subjects in law, in all courts as well as Tribunals. An individualized service by members with decades of experience ensures total satisfaction to the clients.

We Provide services are:

âĒ Accounting Services

âĒ Auditing & Assurance Services

âĒ Advisory Services

âĒ Business Services

âĒ Corporate Services

âĒ International Services

âĒ Financial & Corporate Services

âĒ Foriegn Exchange Services

âĒ STPI Services

âĒ Taxation Services

âĒ Trademark & Copyright Related Services

âĒ NRI Related Services

âĒ Corporate Governance Services

âĒ Service Tax

Strat up/stand up india service

Contact Us:

âĒ www.khannaandassociates.com

âĒ www.cafirm.khannaandassociates.com

âĒ www.bestdivorcelawyer.in

âĒ www.domesticviolence.co.in

IN-+91-946160007

US-+1-80151-20200

âĒ info@khannaandassociates.com

âĒ cafirm.khannaandassociates@gmail.com

Pancard

PancardMohammed Al Qureshi

Ėý

This document appears to be an application form for an allotment of a Permanent Account Number (PAN) in India. It requests information such as the applicant's name, gender, date of birth, address, phone number, email, occupation, income source, identification documents, and signature. The form notes that photographs and signatures are required, and that the applicant declares that the information provided is true to the best of their knowledge. It also has sections to provide details about parents and a representative assessee if applicable.49 a form_updated

49 a form_updatedRitesh Jain

Ėý

1. This document appears to be an application form for an Allotment of Permanent Account Number (PAN) in India.

2. The form requests information such as name, gender, date of birth, address, father's name, income source and documents for identity, address and date of birth proof.

3. The applicant declares that the information provided is true and correct to the best of their knowledge.Pancard Form 49 A

Pancard Form 49 Amutual_funds_new_application_forms

Ėý

1. This document appears to be an application form for an Allotment of Permanent Account Number (PAN) in India.

2. The form requests information such as name, gender, date of birth, address, father's name, contact details, income source and documents for identity, address, and date of birth proof.

3. The applicant declares that the information provided is true and correct to the best of their knowledge.PAN appl Nri Poi oci 49aa

PAN appl Nri Poi oci 49aaPAN Card Service for Indian Origins / OCI / NRI / POI

Ėý

This document is an application form for an individual or entity to apply for a Permanent Account Number (PAN) from the Indian Income Tax Department.

The form requests information such as the applicant's name, gender, date of birth/incorporation, father's name, addresses, phone number, email, citizenship details, income sources, and documents submitted as proof of identity and address.

It provides instructions on how to fill out the form correctly, such as writing names without abbreviations or titles, specifying dates in the format DDMMYYYY, and including country codes for phone numbers. Applicants must ensure all mandatory fields are completed accurately for their application to be processed.Forms 49a

Forms 49akrishnahariyani

Ėý

This document appears to be an application form for allotment of a Permanent Account Number (PAN) in India. It requests basic personal and contact details such as name, date of birth, address, father's name, contact numbers and email. It also requests details about source of income and documents submitted as proof of identity and address. Guidelines are provided at the end on how to correctly fill the form.Form_49A_Newpancard.pdf

Form_49A_Newpancard.pdfPAN Card Apply Online

Ėý

Download PAN Card Forms & Annexures

Relevent Forms and Annexure (Annexure applicable for certain cases only)

Form 49A

Application for Allotment of Permanent Account Number

[In the case of Indian Citizens/Indian Companies/Entities incorporated in India/Unincorporated entities formed in India]Employment Application Form

Employment Application FormSatish Kumar

Ėý

This 5-page document is an application for employment at XYZ LTD. It requests information about the applicant's personal details, education history, employment history, salary, health, references, and includes a declaration. The applicant is asked to provide personal information like name, address, contact details, religion, marital status, as well as employment details including organizations worked for, designations, durations, salaries. Educational qualifications from highest to lowest are also to be included. The applicant must declare that all information provided is true to the best of their knowledge.Employment Application Form

Employment Application FormSatish Kumar

Ėý

Employment Application Form is a bit comprehensive but it very much useful. It covers most of the crucial information hence It should be used for selected candidates only. It is an open file hence you may make any changes. The company,s name and logo can also be changed. Hope it will be helpful to you. If you like it click on "like symbol" -Thanks, Satish KumarPan application form 49 a for indian citizens

Pan application form 49 a for indian citizensVINOD ARORA

Ėý

1. The document is an application form for allotment of a Permanent Account Number (PAN) under section 139A of the Indian Income Tax Act of 1961.

2. It requests personal details such as name, gender, date of birth, address, father's name, contact information, status, income sources, and proof of identity and address.

3. Instructions are provided on correctly filling out the form, including examples for writing names, acceptable identity and address proofs, and business/profession codes for source of income.Aadhar

AadharPsb Bay

Ėý

The document provides instructions for filling out an Aadhaar enrolment or correction form. It states that Aadhaar enrolment is free and voluntary, and corrections made within 96 hours of enrolment are also free. It lists the fields to be filled in the form, including personal details, address, relationship details, and documents to be presented. It also provides lists of valid identity, address, relationship and date of birth documents that can be submitted.Enrolmentform

EnrolmentformSanjay Shah

Ėý

The document is an Aadhaar enrolment/correction form with instructions. It provides information on how to enroll or correct information for an Aadhaar identity number. Enrolment is free and corrections within 96 hours are also free. The form collects personal details like name, address, date of birth and relationships. It explains the verification process and lists valid documents for identity, address, date of birth and relationships. Instructions are provided on filling out each field of the form.Pan card duplicate 1

Pan card duplicate 1mongia_yp

Ėý

This document is a request form for individuals to apply for a new PAN card or make changes/corrections to their existing PAN data. It requests information such as name, father's name, date of birth, gender, address, contact details, and other PAN numbers held. The applicant must declare that the information provided is true to the best of their knowledge and sign the form, enclosing the relevant supporting documents.Pan card-correction-form

Pan card-correction-formALOK RAJ

Ėý

This document is a request form for individuals to apply for a new PAN card or make changes/corrections to their existing PAN data. It requests information such as name, father's name, date of birth, gender, address, contact details, other PAN numbers held, and a declaration signed and dated by the applicant. Supporting documents should also be enclosed with the application form.Enrolment form

Enrolment formAMAR051206

Ėý

The document provides instructions for filling out an Aadhaar enrolment or correction form. It notes that Aadhaar enrolment is free and voluntary, and corrections made within 96 hours of enrolment are also free. It lists the various fields to be filled out on the form, including pre-enrolment ID, name, gender, address, relationship details, consent for information sharing, and bank account information if the applicant wishes to link an account. It provides lists of valid identity, address, date of birth, and relationship documents that can be presented during enrolment or correction. Instructions are given for filling out fields depending on the verification method chosen - document, introducer, or head of familyGoa Value Added Tax

Goa Value Added Tax Subramanya Bhat

Ėý

DEFINITIONS: Business, Dealer, Goods, Declared Goods, Input Tax, Manufacture, Out Put Tax, Person, Sale, Sale Price, Turnover, Works-Contract, Taxable Turnover.Gst tax refund

Gst tax refundSubramanya Bhat

Ėý

Tax refund includes refund of tax on goods and/or services exported out of India or on inputs or input services used in the goods and/or services which are exported outside India, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilized input tax credit as provided under section 38(2).More Related Content

Similar to Pan card correction (20)

Request for-new-pan-card-or-and-changes-or-correction-in-pan-data-form

Request for-new-pan-card-or-and-changes-or-correction-in-pan-data-formSRI TECHNOLOGICAL SOLUTIONS

Ėý

This document is a request form for a new PAN card or changes/corrections to an existing PAN card. It requests information such as the applicant's name, date of birth, gender, address, phone number, email, and Aadhaar number. It provides instructions on how to fill out the form correctly, such as writing the applicant's full name without abbreviations, providing the father's name for individual applicants, and including country and area codes for phone numbers. The applicant must sign and date the form and may submit supporting documents for proposed changes.Form_49A.PDF

Form_49A.PDFsambhubiswal1

Ėý

This document is an application form for an allotment of a Permanent Account Number (PAN) in India.

It requests basic identifying information such as name, date of birth, gender, address, father's name, mother's name, and contact details. It also asks for documentation to prove identity, address, and date of birth. The applicant declares that the information provided is true to the best of their knowledge. Instructions are provided on how to correctly fill out the form, including guidelines for name format, abbreviations, and other details.Form_49A of Income Tax for Individuals companies

Form_49A of Income Tax for Individuals companiesBiswajitDatta19

Ėý

This document is an application form for an allotment of a Permanent Account Number (PAN) in India. It requests basic identifying information such as name, date of birth, gender, address, father's name, mother's name, and contact details. It also asks for documentation to prove identity, address, and date of birth. The applicant must declare that the information provided is true and sign the form, which includes placing their signature or thumbprint on a photo affixed to the form. Instructions are provided on how to fill out the form correctly, such as writing names clearly without abbreviations and providing the correct Assessing Officer codes for the local tax office.Form49 a july 1, 2017

Form49 a july 1, 2017Amit Kumar

Ėý

This document is an application form for allotment of a Permanent Account Number (PAN) in India. It requests individual/entity details such as name, gender, date of birth/incorporation, address, father's name, photograph, income sources, and documents for identity, address and date of birth proof. Instructions are provided on accurately filling name fields like using full names without abbreviations, and address details like country/PIN codes. Applicants are advised to provide contact details and Aadhaar/Enrolment ID number as per Indian tax laws.Form49 a

Form49 azillowapi7

Ėý

This document contains an application form for an individual or entity to apply for a Permanent Account Number (PAN) from the Indian Income Tax department.

The form requests information such as the applicant's full name, father's name, date of birth/incorporation, gender, address, phone number, email, status, registration number if applicable, Aadhaar number if available, source of income, representative assessee details if any, and documents submitted as proof of identity, address and date of birth.

Instructions are provided on how to fill in each field correctly, such as using block letters and leaving one space between each word, providing passport size photographs, and ensuring dates, names and addresses areForm49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...

Form49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...Khanna Asssociates

Ėý

KHANNA & ASSOCIATES is a 70 year old taxation lawyer and chartered accountant firm .It includes Company Secretary , MBA s, Taxation Lawyers and Chartered Accountant. We are an international law firm . We provide various services legal to finance .

KHANNA & ASSOCIATES is a full service Law Firm handling all legal matters on Civil, Criminal, Business, Commercial, Corporate, Arbitration , Labor & Service subjects in law, in all courts as well as Tribunals. An individualized service by members with decades of experience ensures total satisfaction to the clients.

We Provide services are:

âĒ Accounting Services

âĒ Auditing & Assurance Services

âĒ Advisory Services

âĒ Business Services

âĒ Corporate Services

âĒ International Services

âĒ Financial & Corporate Services

âĒ Foriegn Exchange Services

âĒ STPI Services

âĒ Taxation Services

âĒ Trademark & Copyright Related Services

âĒ NRI Related Services

âĒ Corporate Governance Services

âĒ Service Tax

Strat up/stand up india service

Contact Us:

âĒ www.khannaandassociates.com

âĒ www.cafirm.khannaandassociates.com

âĒ www.bestdivorcelawyer.in

âĒ www.domesticviolence.co.in

IN-+91-946160007

US-+1-80151-20200

âĒ info@khannaandassociates.com

âĒ cafirm.khannaandassociates@gmail.com

Pancard

PancardMohammed Al Qureshi

Ėý

This document appears to be an application form for an allotment of a Permanent Account Number (PAN) in India. It requests information such as the applicant's name, gender, date of birth, address, phone number, email, occupation, income source, identification documents, and signature. The form notes that photographs and signatures are required, and that the applicant declares that the information provided is true to the best of their knowledge. It also has sections to provide details about parents and a representative assessee if applicable.49 a form_updated

49 a form_updatedRitesh Jain

Ėý

1. This document appears to be an application form for an Allotment of Permanent Account Number (PAN) in India.

2. The form requests information such as name, gender, date of birth, address, father's name, income source and documents for identity, address and date of birth proof.

3. The applicant declares that the information provided is true and correct to the best of their knowledge.Pancard Form 49 A

Pancard Form 49 Amutual_funds_new_application_forms

Ėý

1. This document appears to be an application form for an Allotment of Permanent Account Number (PAN) in India.

2. The form requests information such as name, gender, date of birth, address, father's name, contact details, income source and documents for identity, address, and date of birth proof.

3. The applicant declares that the information provided is true and correct to the best of their knowledge.PAN appl Nri Poi oci 49aa

PAN appl Nri Poi oci 49aaPAN Card Service for Indian Origins / OCI / NRI / POI

Ėý

This document is an application form for an individual or entity to apply for a Permanent Account Number (PAN) from the Indian Income Tax Department.

The form requests information such as the applicant's name, gender, date of birth/incorporation, father's name, addresses, phone number, email, citizenship details, income sources, and documents submitted as proof of identity and address.

It provides instructions on how to fill out the form correctly, such as writing names without abbreviations or titles, specifying dates in the format DDMMYYYY, and including country codes for phone numbers. Applicants must ensure all mandatory fields are completed accurately for their application to be processed.Forms 49a

Forms 49akrishnahariyani

Ėý

This document appears to be an application form for allotment of a Permanent Account Number (PAN) in India. It requests basic personal and contact details such as name, date of birth, address, father's name, contact numbers and email. It also requests details about source of income and documents submitted as proof of identity and address. Guidelines are provided at the end on how to correctly fill the form.Form_49A_Newpancard.pdf

Form_49A_Newpancard.pdfPAN Card Apply Online

Ėý

Download PAN Card Forms & Annexures

Relevent Forms and Annexure (Annexure applicable for certain cases only)

Form 49A

Application for Allotment of Permanent Account Number

[In the case of Indian Citizens/Indian Companies/Entities incorporated in India/Unincorporated entities formed in India]Employment Application Form

Employment Application FormSatish Kumar

Ėý

This 5-page document is an application for employment at XYZ LTD. It requests information about the applicant's personal details, education history, employment history, salary, health, references, and includes a declaration. The applicant is asked to provide personal information like name, address, contact details, religion, marital status, as well as employment details including organizations worked for, designations, durations, salaries. Educational qualifications from highest to lowest are also to be included. The applicant must declare that all information provided is true to the best of their knowledge.Employment Application Form

Employment Application FormSatish Kumar

Ėý

Employment Application Form is a bit comprehensive but it very much useful. It covers most of the crucial information hence It should be used for selected candidates only. It is an open file hence you may make any changes. The company,s name and logo can also be changed. Hope it will be helpful to you. If you like it click on "like symbol" -Thanks, Satish KumarPan application form 49 a for indian citizens

Pan application form 49 a for indian citizensVINOD ARORA

Ėý

1. The document is an application form for allotment of a Permanent Account Number (PAN) under section 139A of the Indian Income Tax Act of 1961.

2. It requests personal details such as name, gender, date of birth, address, father's name, contact information, status, income sources, and proof of identity and address.

3. Instructions are provided on correctly filling out the form, including examples for writing names, acceptable identity and address proofs, and business/profession codes for source of income.Aadhar

AadharPsb Bay

Ėý

The document provides instructions for filling out an Aadhaar enrolment or correction form. It states that Aadhaar enrolment is free and voluntary, and corrections made within 96 hours of enrolment are also free. It lists the fields to be filled in the form, including personal details, address, relationship details, and documents to be presented. It also provides lists of valid identity, address, relationship and date of birth documents that can be submitted.Enrolmentform

EnrolmentformSanjay Shah

Ėý

The document is an Aadhaar enrolment/correction form with instructions. It provides information on how to enroll or correct information for an Aadhaar identity number. Enrolment is free and corrections within 96 hours are also free. The form collects personal details like name, address, date of birth and relationships. It explains the verification process and lists valid documents for identity, address, date of birth and relationships. Instructions are provided on filling out each field of the form.Pan card duplicate 1

Pan card duplicate 1mongia_yp

Ėý

This document is a request form for individuals to apply for a new PAN card or make changes/corrections to their existing PAN data. It requests information such as name, father's name, date of birth, gender, address, contact details, and other PAN numbers held. The applicant must declare that the information provided is true to the best of their knowledge and sign the form, enclosing the relevant supporting documents.Pan card-correction-form

Pan card-correction-formALOK RAJ

Ėý

This document is a request form for individuals to apply for a new PAN card or make changes/corrections to their existing PAN data. It requests information such as name, father's name, date of birth, gender, address, contact details, other PAN numbers held, and a declaration signed and dated by the applicant. Supporting documents should also be enclosed with the application form.Enrolment form

Enrolment formAMAR051206

Ėý

The document provides instructions for filling out an Aadhaar enrolment or correction form. It notes that Aadhaar enrolment is free and voluntary, and corrections made within 96 hours of enrolment are also free. It lists the various fields to be filled out on the form, including pre-enrolment ID, name, gender, address, relationship details, consent for information sharing, and bank account information if the applicant wishes to link an account. It provides lists of valid identity, address, date of birth, and relationship documents that can be presented during enrolment or correction. Instructions are given for filling out fields depending on the verification method chosen - document, introducer, or head of familyForm49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...

Form49A Application for Allotment of Permanent Account Number (PAN)-Khanna & ...Khanna Asssociates

Ėý

More from Subramanya Bhat (15)

Goa Value Added Tax

Goa Value Added Tax Subramanya Bhat

Ėý

DEFINITIONS: Business, Dealer, Goods, Declared Goods, Input Tax, Manufacture, Out Put Tax, Person, Sale, Sale Price, Turnover, Works-Contract, Taxable Turnover.Gst tax refund

Gst tax refundSubramanya Bhat

Ėý

Tax refund includes refund of tax on goods and/or services exported out of India or on inputs or input services used in the goods and/or services which are exported outside India, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilized input tax credit as provided under section 38(2).1 highlights of income tax provisions in budget 2018

1 highlights of income tax provisions in budget 2018Subramanya Bhat

Ėý

The document summarizes key changes to India's income tax provisions in the 2018 budget. Some key points:

- Long-term capital gains (LTCG) over Rs. 1 lakh from listed equity shares will now be taxed at 10%. All LTCG until January 31, 2018 will be exempt.

- Standard deduction of Rs. 40,000 introduced for salaried employees in lieu of transport/medical exemptions.

- Deduction limits for senior citizens increased for interest income, health insurance premiums, and medical expenditure.

- Corporate tax rate reduced to 25% for domestic companies with turnover up to Rs. 250 crores.Gst faq

Gst faqSubramanya Bhat

Ėý

GST frequently asked questions CENTRAL BOARD OF EXCISE & CUSTOMS. NEW DELHI. FREQUENTLY ASKED QUESTIONS. (FAQs). ON. GOODS AND SERVICES TAX (GST).Income tax assessment year 2018 19

Income tax assessment year 2018 19Subramanya Bhat

Ėý

- Income Tax Return (ITR) is a document filed with the Indian Income Tax Department by taxpayers annually detailing their earnings and taxes paid for the year. It must be filed by all Indian citizens earning a taxable income.

- The due date for individual ITR filing for financial year 2018-2019 was July 31, 2018. The date is extended for individuals requiring tax audit. Late filers may face penalties.

- The Indian income tax system levies tax on both earned and unearned incomes based on multiple tax slabs ranging from 0-30% depending on the amount of total annual income. Tax rates are lower for senior citizens.Revolution in indian tax system goods and

Revolution in indian tax system goods andSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT.

Union budget 2013 analysis of direct taxes

Union budget 2013 analysis of direct taxesSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT.

Revenue impact vat in goa

Revenue impact vat in goaSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT.

Depreciation accounting

Depreciation accounting Subramanya Bhat

Ėý

This document discusses depreciation accounting and various depreciation methods. It begins by defining depreciation as the reduction in value of an asset due to factors like usage, passage of time, wear and tear, etc. Depreciation is allocated over the useful life of an asset using methods like straight line, reducing balance, etc. The document then discusses various depreciation methods in detail like sinking fund method, insurance policy method, annuity method, and machine hour rate method. It also discusses accounting standard 6 related to depreciation accounting.Itr 3

Itr 3Subramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT.

Itr 2 a

Itr 2 aSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT Itr 2

Itr 2Subramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION. STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENEFIT. Itr 1

Itr 1Subramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION.

STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED . FOR PRACTITIONERS ALSO WILL BENIFITGst and its implications

Gst and its implicationsSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION.

STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED .Generally accepted accounting principles

Generally accepted accounting principlesSubramanya Bhat

Ėý

VARIOUS FORMS OF INCOME TAX ,BASIC KNOWLEDGE OF GST PPT WHICH REQUIRED FOR A STUDENT TO UNDERSTAND DIRECT AND INDIRECT TAXATION.

STUDENTS STUDYING B.COM AND M.COM WILL BE BENEFITED .Recently uploaded (20)

TLE 7 - 3rd Topic - Hand Tools, Power Tools, Instruments, and Equipment Used ...

TLE 7 - 3rd Topic - Hand Tools, Power Tools, Instruments, and Equipment Used ...RizaBedayo

Ėý

Hand Tools, Power Tools, and Equipment in Industrial ArtsEssentials of a Good PMO, presented by Aalok Sonawala

Essentials of a Good PMO, presented by Aalok SonawalaAssociation for Project Management

Ėý

APM event hosted by the South Wales and West of England Network (SWWE Network)

Speaker: Aalok Sonawala

The SWWE Regional Network were very pleased to welcome Aalok Sonawala, Head of PMO, National Programmes, Rider Levett Bucknall on 26 February, to BAWA for our first face to face event of 2025. Aalok is a member of APMâs Thames Valley Regional Network and also speaks to members of APMâs PMO Interest Network, which aims to facilitate collaboration and learning, offer unbiased advice and guidance.

Tonight, Aalok planned to discuss the importance of a PMO within project-based organisations, the different types of PMO and their key elements, PMO governance and centres of excellence.

PMOâs within an organisation can be centralised, hub and spoke with a central PMO with satellite PMOs globally, or embedded within projects. The appropriate structure will be determined by the specific business needs of the organisation. The PMO sits above PM delivery and the supply chain delivery teams.

For further information about the event please click here.A PPT Presentation on The Princess and the God: A tale of ancient India by A...

A PPT Presentation on The Princess and the God: A tale of ancient India by A...Beena E S

Ėý

A PPT Presentation on The Princess and the God: A tale of ancient India by Aaron ShepardHow to Configure Restaurants in Odoo 17 Point of Sale

How to Configure Restaurants in Odoo 17 Point of SaleCeline George

Ėý

Odoo, a versatile and integrated business management software, excels with its robust Point of Sale (POS) module. This guide delves into the intricacies of configuring restaurants in Odoo 17 POS, unlocking numerous possibilities for streamlined operations and enhanced customer experiences.Useful environment methods in Odoo 18 - Odoo šÝšÝßĢs

Useful environment methods in Odoo 18 - Odoo šÝšÝßĢsCeline George

Ėý

In this slide weâll discuss on the useful environment methods in Odoo 18. In Odoo 18, environment methods play a crucial role in simplifying model interactions and enhancing data processing within the ORM framework.EDL 290F Week 3 - Mountaintop Views (2025).pdf

EDL 290F Week 3 - Mountaintop Views (2025).pdfLiz Walsh-Trevino

Ėý

EDL 290F Week 3 - Mountaintop Views (2025).pdfKaun TALHA quiz Prelims - El Dorado 2025

Kaun TALHA quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ėý

Prelims of Kaun TALHA : a Travel, Architecture, Lifestyle, Heritage and Activism quiz, organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. Database population in Odoo 18 - Odoo slides

Database population in Odoo 18 - Odoo slidesCeline George

Ėý

In this slide, weâll discuss the database population in Odoo 18. In Odoo, performance analysis of the source code is more important. Database population is one of the methods used to analyze the performance of our code. APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...Association for Project Management

Ėý

APM People Interest Network Conference 2025

- Autonomy, Teams and Tension

- Oliver Randall & David Bovis

- Own Your Autonomy

Oliver Randall

Consultant, Tribe365

Oliver is a career project professional since 2011 and started volunteering with APM in 2016 and has since chaired the People Interest Network and the North East Regional Network. Oliver has been consulting in culture, leadership and behaviours since 2019 and co-developed HPTMÂŪâŊan off the shelf high performance framework for teams and organisations and is currently working with SAS (Stellenbosch Academy for Sport) developing the culture, leadership and behaviours framework for future elite sportspeople whilst also holding down work as a project manager in the NHS at North Tees and Hartlepool Foundation Trust.

David Bovis

Consultant, Duxinaroe

A Leadership and Culture Change expert, David is the originator of BTFAâĒ and The Dux Model.

With a Masters in Applied Neuroscience from the Institute of Organisational Neuroscience, he is widely regarded as the âGo-Toâ expert in the field, recognised as an inspiring keynote speaker and change strategist.

He has an industrial engineering background, majoring in TPS / Lean. David worked his way up from his apprenticeship to earn his seat at the C-suite table. His career spans several industries, including Automotive, Aerospace, Defence, Space, Heavy Industries and Elec-Mech / polymer contract manufacture.

Published in Londonâs Evening Standard quarterly business supplement, James Caanâs âYour businessâ Magazine, âQuality Worldâ, the Lean Management Journal and Cambridge Universities âPMAâ, he works as comfortably with leaders from FTSE and Fortune 100 companies as he does owner-managers in SMEâs. He is passionate about helping leaders understand the neurological root cause of a high-performance culture and sustainable change, in business.

Session | Own Your Autonomy â The Importance of Autonomy in Project Management

#OwnYourAutonomy is aiming to be a global APM initiative to position everyone to take a more conscious role in their decision making process leading to increased outcomes for everyone and contribute to âa world in which all projects succeedâ.

We want everyone to join the journey.

#OwnYourAutonomy is the culmination of 3 years of collaborative exploration within the Leadership Focus Group which is part of the APM People Interest Network. The work has been pulled together using the 5 HPTMÂŪ Systems and the BTFA neuroscience leadership programme.

https://www.linkedin.com/showcase/apm-people-network/about/QuickBooks Desktop to QuickBooks Online How to Make the Move

QuickBooks Desktop to QuickBooks Online How to Make the MoveTechSoup

Ėý

If you use QuickBooks Desktop and are stressing about moving to QuickBooks Online, in this webinar, get your questions answered and learn tips and tricks to make the process easier for you.

Key Questions:

* When is the best time to make the shift to QuickBooks Online?

* Will my current version of QuickBooks Desktop stop working?

* I have a really old version of QuickBooks. What should I do?

* I run my payroll in QuickBooks Desktop now. How is that affected?

*Does it bring over all my historical data? Are there things that don't come over?

* What are the main differences between QuickBooks Desktop and QuickBooks Online?

* And moreComputer Network Unit IV - Lecture Notes - Network Layer

Computer Network Unit IV - Lecture Notes - Network LayerMurugan146644

Ėý

Title:

Lecture Notes - Unit IV - The Network Layer

Description:

Welcome to the comprehensive guide on Computer Network concepts, tailored for final year B.Sc. Computer Science students affiliated with Alagappa University. This document covers fundamental principles and advanced topics in Computer Network. PDF content is prepared from the text book Computer Network by Andrew S. Tenanbaum

Key Topics Covered:

Main Topic : The Network Layer

Sub-Topic : Network Layer Design Issues (Store and forward packet switching , service provided to the transport layer, implementation of connection less service, implementation of connection oriented service, Comparision of virtual circuit and datagram subnet), Routing algorithms (Shortest path routing, Flooding , Distance Vector routing algorithm, Link state routing algorithm , hierarchical routing algorithm, broadcast routing, multicast routing algorithm)

Other Link :

1.Introduction to computer network - /slideshow/lecture-notes-introduction-to-computer-network/274183454

2. Physical Layer - /slideshow/lecture-notes-unit-ii-the-physical-layer/274747125

3. Data Link Layer Part 1 : /slideshow/lecture-notes-unit-iii-the-datalink-layer/275288798

Target Audience:

Final year B.Sc. Computer Science students at Alagappa University seeking a solid foundation in Computer Network principles for academic.

About the Author:

Dr. S. Murugan is Associate Professor at Alagappa Government Arts College, Karaikudi. With 23 years of teaching experience in the field of Computer Science, Dr. S. Murugan has a passion for simplifying complex concepts in Computer Network

Disclaimer:

This document is intended for educational purposes only. The content presented here reflects the authorâs understanding in the field of Computer NetworkHow to Modify Existing Web Pages in Odoo 18

How to Modify Existing Web Pages in Odoo 18Celine George

Ėý

In this slide, weâll discuss on how to modify existing web pages in Odoo 18. Web pages in Odoo 18 can also gather user data through user-friendly forms, encourage interaction through engaging features. Research & Research Methods: Basic Concepts and Types.pptx

Research & Research Methods: Basic Concepts and Types.pptxDr. Sarita Anand

Ėý

This ppt has been made for the students pursuing PG in social science and humanities like M.Ed., M.A. (Education), Ph.D. Scholars. It will be also beneficial for the teachers and other faculty members interested in research and teaching research concepts.FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptx

FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptxDanmarieMuli1

Ėý

Sinulog Festival of Cebu City, and Thingyan Festival of Myanmar.The Story Behind the Abney Park Restoration Project by Tom Walker

The Story Behind the Abney Park Restoration Project by Tom WalkerHistory of Stoke Newington

Ėý

Presented at the 24th Stoke Newington History Talks event on 27th Feb 2025

https://stokenewingtonhistory.com/stoke-newington-history-talks/Kaun TALHA quiz Prelims - El Dorado 2025

Kaun TALHA quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ėý

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...Association for Project Management

Ėý

Pan card correction

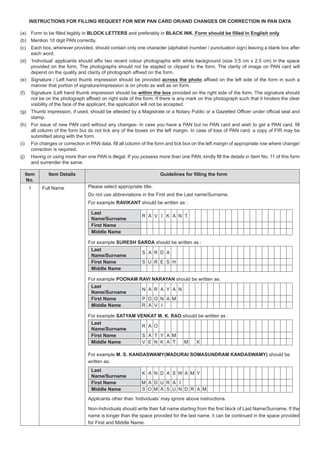

- 1. Request For New PAN Card Or/ And Changes Or Correction in PAN Data Permanent Account Number (PAN) Please read Instructions âhâ & âiâ for selecting boxes on left margin of this form. 1 Full Name (Full expanded name to be mentioned as appearing in proof of identity/address documents: initials are not permitted) Please select title, as applicable Shri Smt Kumari M/s Last Name / Surname First Name Middle Name Name you would like it printed on the PAN card 2 Details of Parents (applicable only for Individual applicants) Last Name / Surname First Name Middle Name Motherâs Name (optional) Last Name / Surname First Name Middle Name Select the name of either father or mother which you may like to be printed on PAN card (Select one only) (In case no option is provided then PAN card will be issued with fatherâs name) Fatherâs Name Motherâs Name (Please tick as applicable) 3 Date of Birth/Incorporation/Agreement/Partnership/Trust Deed/ Formation of Body of individuals or Association of Persons Day Month Year 4 Gender (for âIndividualâ applicant only) Male Female (Please tick as applicable) 5 Photo Mismatch 6 Signature Mismatch 7 Address for Communication Residence (Please tick as applicable) Flat/Room/ Door / Block No. Name of Premises/ Building/Village Pincode / Zip code 8 If you desire to update your other address also, give required details In additional sheet. 9 Telephone Number & Email ID details Country code Area/STD Code Telephone / Mobile number Email ID 10 AADHAAR number (if allotted) Name as per AADHAAR letter/card 11 Mention other Permanent Account Numbers (PANs) inadvertently allotted to you PAN 1 PAN 2 PAN 3 PAN 4 12 Verification I/We , the applicant, in the capacity of do hereby declare that what is stated above is true to the best of my/our information and belief. I/We have enclosed (number of documents) in support of proposed changes / corrections. Place D D M M Y Y Y Y Date Signature / Left thumb impression recent photographrecent photograph Signature / Left thumb impression across this photo

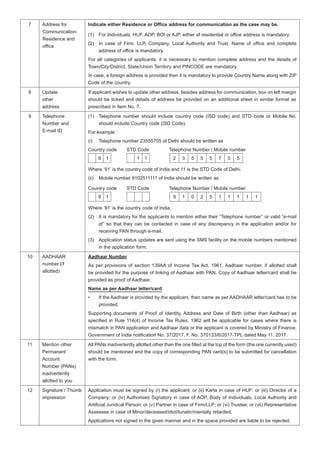

- 2. INSTRUCTIONS FOR FILLING REQUEST FOR NEW PAN CARD OR/AND CHANGES OR CORRECTION IN PAN DATA BLOCK LETTERS BLACK INK. Form should be filled in English only across the photo affixed on the left side of the form in such a within the box stamp. correction is required. and surrender the same. Item No. Item Details Guidelines for filling the form Full Name Please select appropriate title. For example RAVIKANT Last Name/Surname R A V I K A N First Name Middle Name For example SURESH SARDA Last Name/Surname S A R D A First Name S U R S H Middle Name For example POONAM RAVI NARAYAN Last Name/Surname N A R A Y A N First Name P O O N A M Middle Name R A V I For example SATYAM VENKAT M. K. RAO Last Name/Surname R A O First Name S A Y A M Middle Name V N K A M K For example M. S. KANDASWAMY(MADURAI SOMASUNDRAM KANDASWAMY) should be Last Name/Surname K A N D A S W A M Y First Name M A D U R A I Middle Name S O M A S U N D R A M for First and Middle Name.

- 3. For example XYZ DATA CORPORATION (INDIA) PRIVATE LIMITED Last Name/Surname X Y Z D A A O R P O R A I O N ( I N D First Name I A P R I V A L I M I D Middle Name For example MANOJ MAFATLAL DAVE (HUF) Last Name/Surname M A N O J M A F A L A L D A V ( H U F First Name Middle Name full name to be printed on the PAN card SATYAM VENKAT M. K. RAO Last Name/Surname R A O First Name S A Y A M Middle Name V N K A M K 2 Details of Parents (Applicable to Fatherâs Name Motherâs Name Appropriate flag should be selected to indicate the name (out of the fatherâs name and motherâs 3 Date of Birth/ Incorporation/ Agreement/ Partnership or Deed/Formation Association of Persons D D M M Y Y Y Y 2 8 5 4 5 & 6 Photo/signature Mismatch the left margin.

- 4. Address for Residence and office Indicate either Residence or Office address for communication as the case may be. 8 Update other address Number and 2 3 5 5 5 5 2 5 in the application form. AADHAAR number (if Aadhaar Number Name as per Aadhaar letter/card Mention other Permanent Account impression

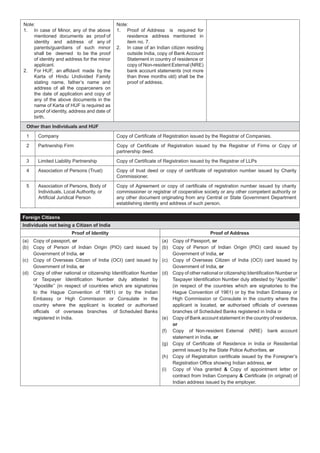

- 5. GENERAL INFORMATION FOR APPLICANTS (www.incometaxindia.gov.in) (www.utiitsl.com) (www.tin-nsdl.com). ` outside India then additional dispatch charge of ` Document acceptable as proof of identity, address and date of birth as per Rule 114 of Income Tax Rules, 1962 Proof of Identity Proof of Address Proof of date of birth Indian Citizens (including those located outside India) Individuals & HUF (i) Copy of (ii) in Original (iii) Bank certificate in Original on letter name and stamp of the issuing photograph and bank account number of the applicant (i) Copy of i. Allotment letter of accommodation (ii) Copy of following documents of not more than three months old or (iii) in Original (iv) in original. Copy of the following documents if they bear the name, date, month and year of birth of the applicant, namely:- or Undertaking or State Public Sector stating the date of birth.

- 6. mentioned documents as proof of parents/guardians of such minor shall be deemed to be the proof applicant. address of all the coparceners on name of Karta of HUF is required as birth. residence address mentioned in bank account statements (not more proof of address. Other than Individuals and HUF 2 Partnership Firm partnership deed. 3 4 5 Artificial Juridical Person Foreign Citizens Individuals not being a Citizen of India Proof of Identity Proof of Address or or or registered in India. or or or or branches of Scheduled Banks registered in India or or or or or & &

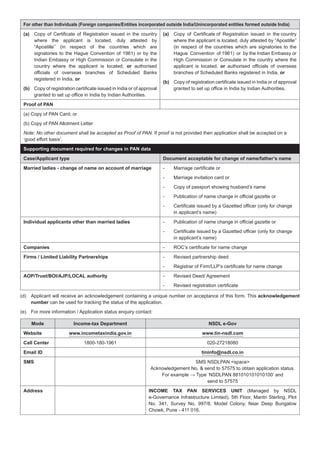

- 7. For other than Individuals (Foreign companies/Entities incorporated outside India/Unincorporated entities formed outside India) (a) or authorised or (b) (a) or or (b) Proof of PAN Note: No other document shall be accepted as Proof of PAN. âgood effort basisâ. Supporting document required for changes in PAN data Case/Applicant type Document acceptable for change of name/fatherâs name Married ladies - change of name on account of marriage Individual applicants other than married ladies Companies Firms / Limited Liability Partnerships AOP/Trust/BOI/AJP/LOCAL authority acknowledgement number can be used for tracking the status of the application. Mode Income-tax Department NSDL e-Gov Website www.incometaxindia.gov.in www.tin-nsdl.com Call Center Email ID tininfo@nsdl.co.in SMS SMS NSDLPAN <space> For example Address INCOME TAX PAN SERVICES UNIT