Ratio analysis of rani ltd

0 likes851 views

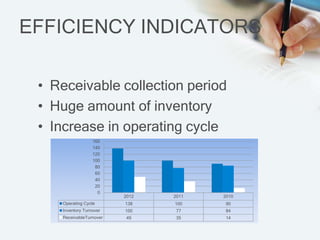

The document analyzes the ratio performance of Rani Ltd over three years from 2010-2012. It finds that while sales have increased, net profit margins have fallen due to rising costs of sales. Liquidity ratios like the current ratio are up but the quick ratio is alarming, indicating a working capital management problem. Receivable collection periods and inventory levels are high, extending the operating cycle. Suggestions include improving debt collection, inventory turnover, avoiding overtrading and better working capital management to secure the company's financial position.

1 of 12

Ad

Recommended

Pp slidecast

Pp slidecastsoldierfront69

?

Duvel Moortgat was founded in 1871 and has since become a market leader in quality beer with exports to over 40 countries. The document provides key financial information for Duvel Moortgat from 2005-2011, including increasing dividend per share, rising turnover and net profit figures, and concludes that there remains high demand for their quality beer.Delhaize group

Delhaize groupsaradeno

?

This document analyzes key financial ratios for Delhaize Group from 2008-2012. It examines liquidity ratios like the current and quick ratios, solvency ratios like the degree of debts, and profitability ratios such as the net profit margin. Overall, the ratios indicate Delhaize Group is a healthy company with relatively good financial performance. The document concludes with sources for the financial data.Presentation Stan Vermeersch

Presentation Stan Vermeerschstanverm

?

This document discusses Barco's stock price and financial performance in 2011 and 2012. It provides information on the company's turnover, which increased 27.9% to €34 billion in 2012. Net earnings per share also rose 27.5% from €2.84 in 2011 to €3.62 in 2012. The document examines factors that affected Barco's stock price, and provides an outlook on expectations for the stock price.Fa case4 4

Fa case4 4Pratik Jain

?

The document analyzes the financial structures and income statements of 8 small businesses owned by Ram and his friends. It breaks down the key components of their balance sheets including inventory levels, assets, liabilities and owners' equity. It then analyzes differences between the businesses in terms of their income, expenses, profits and factors affecting their financial performance.Ratio Analysis of Gati Travel

Ratio Analysis of Gati TravelShubham Ahirwar

?

The document analyzes the financial performance of Gati, an Indian express distribution and supply chain company, over three years (2016-2018), highlighting key income statement, balance sheet, and cash flow statement metrics. It discusses liquidity, profitability, turnover, coverage, and solvency ratios, indicating areas of improvement and compliance with policies. The analysis concludes that Gati has significant network coverage and geographic reach while identifying weaknesses that need addressing.Report

ReportTalha Hasan

?

This report analyzes the financial performance of Rani Ltd over 2010-2012. It finds that while revenue has increased slightly, net profit margins have declined significantly from 13.9% in 2010 to 10.43% in 2012 due to rising cost of goods sold. Liquidity ratios are satisfactory but the quick ratio is low at 0.64. Inventory and receivables levels have increased substantially, worsening the operating cycle from 90 to 138 days. Earnings per share have fallen 17% from 2010-2012. The report recommends improving inventory turnover and receivables collection to enhance profitability and liquidity.Dams or no dams97

Dams or no dams97Talha Hasan

?

The document presents information about dams, including why they are built, their types and uses, statistics on dams, and their impacts. It discusses how dams provide water storage and control, lists the main types of dams as gravity, arch, buttress, and embankment, and outlines their direct uses like irrigation, industrial, and hydroelectric power generation, as well as indirect uses such as flood control. It also provides some global statistics on dams and discusses their environmental, social, and economic impacts.Ford presetation

Ford presetationgiaosunobita

?

Ford Motor Company is an American automaker headquartered in Michigan. It has experienced declining revenues and profits since 2007 due to the economic recession. However, Ford implemented a successful cost control program starting in 2006 that helped improve profits. Looking forward, Ford should continue cost control efforts and focus on developing more fuel efficient and electric vehicles to adapt to changing market demands and environmental regulations. Diversifying into new markets like Africa also provides opportunities for future growth.Accor Hospitality financial analysis

Accor Hospitality financial analysisMTM IULM

?

Accor is a leading global hotel operator with a strong market presence in Europe and ongoing projects focused on expansion and asset management. The company has shown stable revenues from 2010 to 2012, with a notable shift towards an asset-light strategy that has led to improved financial performance despite high debt levels. Future suggestions include bolstering the asset-light strategy and enhancing brand recognition through institutional marketing.Fauji Fertilizer and Fatima Fertilizer Annual Reports Analysis

Fauji Fertilizer and Fatima Fertilizer Annual Reports AnalysisSahir Moiz

?

The document compares the financial performance and position of Fatima Fertilizer and Fauji Fertilizer over the years 2008-2011. Key metrics analyzed include working capital, current ratio, quick ratio, various turnover ratios, profitability ratios, debt ratios, and total debt to equity ratio. The analysis shows that while both companies have faced financial challenges, Fauji Fertilizer's position and ratios are generally better than Fatima Fertilizer's over this period, indicating Fauji may be the better investment option based on stronger short-term financial stability and profitability.Financial Statement Analysis - 2009 presentation

Financial Statement Analysis - 2009 presentationFelix Yamasato

?

The document discusses financial statement analysis and ratio analysis. It provides examples of key financial ratios used to analyze companies, such as current ratio, quick ratio, debt-to-equity ratio, and profit margins. It also discusses how to use ratio analysis to identify signs of potential financial distress, including issues with revenue and profit recognition or discrepancies between financing needs and uses. Practical examples are given comparing the financial ratios of three companies over multiple years.Cashflow statement(1)12

Cashflow statement(1)12Bharati Singh

?

The cash flow statement summarizes the inflows and outflows of cash and cash equivalents over a period of time. It has three sections - operating, investing, and financing activities. The operating section deals with cash from core business operations. The investing section includes cash from the purchase and sale of long-term assets. The financing section includes cash from activities related to changes in a company's capital structure and borrowing arrangements.U nilever

U nileverZeeshan Azam

?

This presentation summarizes the financial performance of Unilever Pakistan Limited for the year 2012-2013. It includes an introduction to the company, an overview of financial highlights for the year which show increases in sales, gross profit, and net income. A financial analysis of the company's balance sheet, income statement, cash flows, and key financial ratios is also presented. The analysis finds that the company is efficiently managing its assets and liabilities. While facing challenges in the operating environment, the presentation concludes that Unilever Pakistan Limited is well positioned to continue growing in the future through innovation and strength in emerging markets.Financial Analysis Valeo SA

Financial Analysis Valeo SAChristophe Vervynck

?

Valeo SA is a French automotive parts manufacturer with 74,800 employees and 125 production sites. The company's sales volume and net profit have shown growth from 2010 to 2013, with a current ratio indicating good liquidity. Overall, Valeo is a healthy company with a growing stock value and a commitment to corporate social responsibility.Ogdcl equity analysis

Ogdcl equity analysisSanakhawan Syed

?

OGDCL is the largest exploration and production company in Pakistan. It has market leadership with over 50% of Pakistan's oil reserves and gas production. The stock is recommended as a buy due to its impressive financial performance, attractive valuation, and positive sector outlook. However, the investment is subject to commodity price risk, exchange rate risk, and security concerns related to exploration activities.Working capital management at TCIL

Working capital management at TCILSreoshi Bera

?

The document analyzes the working capital management and ratio analysis of Tinplate Company of India Limited over several years. It finds that the company had negative working capital in 2008 and 2012 due to its parent company's policies, though negative working capital does not necessarily indicate a poor market position. Various ratios like current ratio, quick ratio, and debtors turnover ratio are calculated from the company's financial statements. Recommendations include growing gross working capital in line with production, paying sufficient dividends, and enhancing marketing strategy. In conclusion, the company has maintained good liquidity and paid liabilities and dividends on time.Financial planning and_forecasting

Financial planning and_forecastinglove_a123

?

The document provides an overview of financial planning and forecasting. It discusses key components like sales forecasting, creating pro forma profit and loss statements and balance sheets using historical averages or percentages of sales. It also covers calculating external financing requirements based on projected growth rates, current assets/liabilities, profit margins and dividends. The document includes an example of forecasting the income statement, balance sheet and external funds needed.Gull ahmad.pptx

Gull ahmad.pptx Sameera Khan

?

This document analyzes the financial statements of Gul Ahmed Textile Mills Ltd from 2010-2013. It includes various liquidity, leverage, activity, and profitability ratios calculated from the company's balance sheets and income statements. The liquidity ratios show the company has a current ratio close to 1 and low quick ratios, indicating insufficient short-term assets to cover debts. Leverage ratios like debt-to-total assets of around 75% suggest high reliance on debt. Activity ratios show inventory turnover improving but average collection periods remaining high. Profitability ratios demonstrate fluctuating net profit margins and returns on assets and equity.Financial Statment Analysis of Icici Bank

Financial Statment Analysis of Icici BankAnil Nandyala

?

This document provides an analysis of the financial statements of ICICI Bank for the years 2010 and 2011. It summarizes the bank's timeline since 1994. It outlines key points from the Board of Directors' report such as changes in interest rates and loans. It describes significant accounting policies and analyzes ratios related to liquidity, profits, operations, and performance compared to other banks. It also tracks some announcements that impacted the bank's stock price.Billerud Interim Report Q2 2012 presentation

Billerud Interim Report Q2 2012 presentationBillerudKorsn?s

?

The interim report summarizes BillerudKorsn?s' financial and operational performance for the first half of 2012. Key highlights include an increase in net sales and operating profit compared to the first quarter, driven by higher sales volumes. All three business areas (packaging & speciality paper, packaging boards, and market pulp) saw increased operating profits compared to Q1. The report also discusses market conditions, financial results, and an outlook for the remainder of 2012. BillerudKorsn?s announced plans to combine with Korsn?s, which is expected to generate annual synergies of MSEK 300.2011_Replanning_Your Business

2011_Replanning_Your Businessmguckin

?

The document outlines 6 steps business owners can take to improve their business, including properly planning goals and actions, monitoring financial metrics, managing cash flow, organizing operations, managing growth, and planning for transition. It then discusses each of these steps in more detail, providing advice on tasks like establishing a vision and measurable goals, regularly reviewing financial statements and key ratios, using cash flow forecasts to manage cash needs, and periodically evaluating the business for improvement opportunities. The overall message is that business owners should follow a structured process to effectively operate and grow their company over time.MTM - Financial Analysis of Club Med

MTM - Financial Analysis of Club MedMarco Lancellotti

?

Club Med is a leader in the leisure village market. Its strategy focuses on low capital investment and flexible capacity. Villages are owned by others and managed by Club Med for a fee. Club Med's financial statements from 2008-2010 show declining revenues but improved operating income and productivity ratios by 2010. Liquidity ratios are acceptable despite high long-term assets, but solvency ratios show the firm is highly leveraged. To improve performance, Club Med could focus on increasing customer numbers through special offers while reducing costs from villages.Financial Accounting Presentation from ABA Annual Meeting

Financial Accounting Presentation from ABA Annual MeetingMark Stoneman

?

The document discusses financial accounting provisions in private acquisition agreements, emphasizing the critical interactions between lawyers, appraisers, and accountants. It elaborates on valuation methods, including market-based and income approaches, and highlights the importance of accurate financial representations and materiality in mergers and acquisitions. The conclusion stresses the necessity for tailored financial statement representations and collaboration among professionals involved in the valuation process.Presentation of Swedbank's Year-End Report 2012

Presentation of Swedbank's Year-End Report 2012Swedbank

?

1) Swedbank reported strong fourth quarter and full year 2012 results, with profits up year-over-year driven by higher market-related income and continued stable asset quality.

2) The bank will focus on improving customer service and efficiency through IT investments in 2013.

3) Capital levels remained high and Swedbank intends to increase dividends to 75% of annual profits going forward based on a strong capital position and efficiency focus.Presentation unilever 2012_silkecoussement_2af02

Presentation unilever 2012_silkecoussement_2af02silkcous

?

The document summarizes key financial metrics and performance indicators for Unilever over several years. It shows that Unilever's turnover has generally increased each year from 2005 to 2011. It also discusses Unilever's performance in the third quarter of 2012, with turnover increasing 10% compared to the prior year. Additionally, it provides details on Unilever's current ratio, debt to equity ratio, and dividend payout. The conclusion states that 2011 was a strong year for Unilever and that the company has been able to profit during economic crises while maintaining good debt and liquidity ratios as well as an attractive, growing dividend.Tullio Cofrancesco - AGM 2015 - CFO Address - Office Brands Limited

Tullio Cofrancesco - AGM 2015 - CFO Address - Office Brands LimitedTullio Cofrancesco CA

?

The 2015 annual general meeting document reported on Office Brands Limited's financial results for 2014-2015. Key results included record distributions to licensees of over $1.28 million and total rebate distributions over $6.3 million. The company also declared a special dividend of $2.10 per share. Financially, the company strengthened its balance sheet with net equity increasing to over $1.7 million and net assets per share reaching $18.06. Revenues grew 4% while earnings per share were $3.26.financial perfomense analysis

financial perfomense analysisHaneesha Hakkim

?

ITC is an Indian conglomerate founded in 1910 as Imperial Tobacco Company of India. It has diversified into various business segments including tobacco, hotels, paper, packaging, agri-business, food, IT, apparel, personal care, and home products. The presentation analyzes ITC's financial performance over 2010-2014 through balance sheets, profit and loss statements, and cash flow analysis. It shows that ITC has grown its revenue, reserves, and investments over the years while effectively managing costs.RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUSTimccci

?

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

More Related Content

Similar to Ratio analysis of rani ltd (20)

Ford presetation

Ford presetationgiaosunobita

?

Ford Motor Company is an American automaker headquartered in Michigan. It has experienced declining revenues and profits since 2007 due to the economic recession. However, Ford implemented a successful cost control program starting in 2006 that helped improve profits. Looking forward, Ford should continue cost control efforts and focus on developing more fuel efficient and electric vehicles to adapt to changing market demands and environmental regulations. Diversifying into new markets like Africa also provides opportunities for future growth.Accor Hospitality financial analysis

Accor Hospitality financial analysisMTM IULM

?

Accor is a leading global hotel operator with a strong market presence in Europe and ongoing projects focused on expansion and asset management. The company has shown stable revenues from 2010 to 2012, with a notable shift towards an asset-light strategy that has led to improved financial performance despite high debt levels. Future suggestions include bolstering the asset-light strategy and enhancing brand recognition through institutional marketing.Fauji Fertilizer and Fatima Fertilizer Annual Reports Analysis

Fauji Fertilizer and Fatima Fertilizer Annual Reports AnalysisSahir Moiz

?

The document compares the financial performance and position of Fatima Fertilizer and Fauji Fertilizer over the years 2008-2011. Key metrics analyzed include working capital, current ratio, quick ratio, various turnover ratios, profitability ratios, debt ratios, and total debt to equity ratio. The analysis shows that while both companies have faced financial challenges, Fauji Fertilizer's position and ratios are generally better than Fatima Fertilizer's over this period, indicating Fauji may be the better investment option based on stronger short-term financial stability and profitability.Financial Statement Analysis - 2009 presentation

Financial Statement Analysis - 2009 presentationFelix Yamasato

?

The document discusses financial statement analysis and ratio analysis. It provides examples of key financial ratios used to analyze companies, such as current ratio, quick ratio, debt-to-equity ratio, and profit margins. It also discusses how to use ratio analysis to identify signs of potential financial distress, including issues with revenue and profit recognition or discrepancies between financing needs and uses. Practical examples are given comparing the financial ratios of three companies over multiple years.Cashflow statement(1)12

Cashflow statement(1)12Bharati Singh

?

The cash flow statement summarizes the inflows and outflows of cash and cash equivalents over a period of time. It has three sections - operating, investing, and financing activities. The operating section deals with cash from core business operations. The investing section includes cash from the purchase and sale of long-term assets. The financing section includes cash from activities related to changes in a company's capital structure and borrowing arrangements.U nilever

U nileverZeeshan Azam

?

This presentation summarizes the financial performance of Unilever Pakistan Limited for the year 2012-2013. It includes an introduction to the company, an overview of financial highlights for the year which show increases in sales, gross profit, and net income. A financial analysis of the company's balance sheet, income statement, cash flows, and key financial ratios is also presented. The analysis finds that the company is efficiently managing its assets and liabilities. While facing challenges in the operating environment, the presentation concludes that Unilever Pakistan Limited is well positioned to continue growing in the future through innovation and strength in emerging markets.Financial Analysis Valeo SA

Financial Analysis Valeo SAChristophe Vervynck

?

Valeo SA is a French automotive parts manufacturer with 74,800 employees and 125 production sites. The company's sales volume and net profit have shown growth from 2010 to 2013, with a current ratio indicating good liquidity. Overall, Valeo is a healthy company with a growing stock value and a commitment to corporate social responsibility.Ogdcl equity analysis

Ogdcl equity analysisSanakhawan Syed

?

OGDCL is the largest exploration and production company in Pakistan. It has market leadership with over 50% of Pakistan's oil reserves and gas production. The stock is recommended as a buy due to its impressive financial performance, attractive valuation, and positive sector outlook. However, the investment is subject to commodity price risk, exchange rate risk, and security concerns related to exploration activities.Working capital management at TCIL

Working capital management at TCILSreoshi Bera

?

The document analyzes the working capital management and ratio analysis of Tinplate Company of India Limited over several years. It finds that the company had negative working capital in 2008 and 2012 due to its parent company's policies, though negative working capital does not necessarily indicate a poor market position. Various ratios like current ratio, quick ratio, and debtors turnover ratio are calculated from the company's financial statements. Recommendations include growing gross working capital in line with production, paying sufficient dividends, and enhancing marketing strategy. In conclusion, the company has maintained good liquidity and paid liabilities and dividends on time.Financial planning and_forecasting

Financial planning and_forecastinglove_a123

?

The document provides an overview of financial planning and forecasting. It discusses key components like sales forecasting, creating pro forma profit and loss statements and balance sheets using historical averages or percentages of sales. It also covers calculating external financing requirements based on projected growth rates, current assets/liabilities, profit margins and dividends. The document includes an example of forecasting the income statement, balance sheet and external funds needed.Gull ahmad.pptx

Gull ahmad.pptx Sameera Khan

?

This document analyzes the financial statements of Gul Ahmed Textile Mills Ltd from 2010-2013. It includes various liquidity, leverage, activity, and profitability ratios calculated from the company's balance sheets and income statements. The liquidity ratios show the company has a current ratio close to 1 and low quick ratios, indicating insufficient short-term assets to cover debts. Leverage ratios like debt-to-total assets of around 75% suggest high reliance on debt. Activity ratios show inventory turnover improving but average collection periods remaining high. Profitability ratios demonstrate fluctuating net profit margins and returns on assets and equity.Financial Statment Analysis of Icici Bank

Financial Statment Analysis of Icici BankAnil Nandyala

?

This document provides an analysis of the financial statements of ICICI Bank for the years 2010 and 2011. It summarizes the bank's timeline since 1994. It outlines key points from the Board of Directors' report such as changes in interest rates and loans. It describes significant accounting policies and analyzes ratios related to liquidity, profits, operations, and performance compared to other banks. It also tracks some announcements that impacted the bank's stock price.Billerud Interim Report Q2 2012 presentation

Billerud Interim Report Q2 2012 presentationBillerudKorsn?s

?

The interim report summarizes BillerudKorsn?s' financial and operational performance for the first half of 2012. Key highlights include an increase in net sales and operating profit compared to the first quarter, driven by higher sales volumes. All three business areas (packaging & speciality paper, packaging boards, and market pulp) saw increased operating profits compared to Q1. The report also discusses market conditions, financial results, and an outlook for the remainder of 2012. BillerudKorsn?s announced plans to combine with Korsn?s, which is expected to generate annual synergies of MSEK 300.2011_Replanning_Your Business

2011_Replanning_Your Businessmguckin

?

The document outlines 6 steps business owners can take to improve their business, including properly planning goals and actions, monitoring financial metrics, managing cash flow, organizing operations, managing growth, and planning for transition. It then discusses each of these steps in more detail, providing advice on tasks like establishing a vision and measurable goals, regularly reviewing financial statements and key ratios, using cash flow forecasts to manage cash needs, and periodically evaluating the business for improvement opportunities. The overall message is that business owners should follow a structured process to effectively operate and grow their company over time.MTM - Financial Analysis of Club Med

MTM - Financial Analysis of Club MedMarco Lancellotti

?

Club Med is a leader in the leisure village market. Its strategy focuses on low capital investment and flexible capacity. Villages are owned by others and managed by Club Med for a fee. Club Med's financial statements from 2008-2010 show declining revenues but improved operating income and productivity ratios by 2010. Liquidity ratios are acceptable despite high long-term assets, but solvency ratios show the firm is highly leveraged. To improve performance, Club Med could focus on increasing customer numbers through special offers while reducing costs from villages.Financial Accounting Presentation from ABA Annual Meeting

Financial Accounting Presentation from ABA Annual MeetingMark Stoneman

?

The document discusses financial accounting provisions in private acquisition agreements, emphasizing the critical interactions between lawyers, appraisers, and accountants. It elaborates on valuation methods, including market-based and income approaches, and highlights the importance of accurate financial representations and materiality in mergers and acquisitions. The conclusion stresses the necessity for tailored financial statement representations and collaboration among professionals involved in the valuation process.Presentation of Swedbank's Year-End Report 2012

Presentation of Swedbank's Year-End Report 2012Swedbank

?

1) Swedbank reported strong fourth quarter and full year 2012 results, with profits up year-over-year driven by higher market-related income and continued stable asset quality.

2) The bank will focus on improving customer service and efficiency through IT investments in 2013.

3) Capital levels remained high and Swedbank intends to increase dividends to 75% of annual profits going forward based on a strong capital position and efficiency focus.Presentation unilever 2012_silkecoussement_2af02

Presentation unilever 2012_silkecoussement_2af02silkcous

?

The document summarizes key financial metrics and performance indicators for Unilever over several years. It shows that Unilever's turnover has generally increased each year from 2005 to 2011. It also discusses Unilever's performance in the third quarter of 2012, with turnover increasing 10% compared to the prior year. Additionally, it provides details on Unilever's current ratio, debt to equity ratio, and dividend payout. The conclusion states that 2011 was a strong year for Unilever and that the company has been able to profit during economic crises while maintaining good debt and liquidity ratios as well as an attractive, growing dividend.Tullio Cofrancesco - AGM 2015 - CFO Address - Office Brands Limited

Tullio Cofrancesco - AGM 2015 - CFO Address - Office Brands LimitedTullio Cofrancesco CA

?

The 2015 annual general meeting document reported on Office Brands Limited's financial results for 2014-2015. Key results included record distributions to licensees of over $1.28 million and total rebate distributions over $6.3 million. The company also declared a special dividend of $2.10 per share. Financially, the company strengthened its balance sheet with net equity increasing to over $1.7 million and net assets per share reaching $18.06. Revenues grew 4% while earnings per share were $3.26.financial perfomense analysis

financial perfomense analysisHaneesha Hakkim

?

ITC is an Indian conglomerate founded in 1910 as Imperial Tobacco Company of India. It has diversified into various business segments including tobacco, hotels, paper, packaging, agri-business, food, IT, apparel, personal care, and home products. The presentation analyzes ITC's financial performance over 2010-2014 through balance sheets, profit and loss statements, and cash flow analysis. It shows that ITC has grown its revenue, reserves, and investments over the years while effectively managing costs.Recently uploaded (20)

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUSTimccci

?

RECENT DEVELOPMENT IN TAXATION OF CHARITABLE TRUST

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

?

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehtaimccci

?

Issues of Trust Returns-ITR 7 CA. Ashok D. Mehta

SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)

SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Ride the Market Waves ¨C Swing Trading Course by FinanceWorld.io

Discover the smart way to profit from market ups and downs with FinanceWorld.io¡¯s comprehensive Swing Trading Course. This detailed PDF guide is perfect for those seeking a flexible, effective trading style that fits busy schedules, providing you with the strategies and confidence to capture short- to medium-term gains.

What¡¯s Inside This Course:

Introduction to swing trading and how it compares to day and long-term trading

Understanding market cycles and spotting profitable opportunities

Tools and platforms for successful swing trading

Technical analysis: identifying trends, support & resistance, and reversal patterns

Fundamental factors that influence price swings

Entry and exit timing techniques for maximum profit

Position sizing and risk management essentials

Swing trading psychology and staying disciplined

Case studies, real-world trade examples, and practical tips

Who Should Download This PDF?

Aspiring traders seeking a balance between day trading and investing

Busy professionals who want to trade without monitoring markets all day

Anyone looking to improve their trading results with proven, actionable strategies

Why FinanceWorld.io?

Our clear, step-by-step guidance and expert insights make swing trading accessible to all, from beginners to those wanting to refine their approach. FinanceWorld.io gives you the knowledge and confidence to trade smarter, not harder.STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)

STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Unlock the Power of the Stock Market ¨C Stock Trading Course by FinanceWorld.io (PDF)

Take your first step towards financial independence with FinanceWorld.io¡¯s in-depth Stock Trading Course. This easy-to-follow PDF guide demystifies the stock market, providing you with all the essential tools and knowledge to begin trading with confidence.

What¡¯s Included in This Course:

Introduction to stocks and the stock market ecosystem

Understanding shares, indices, and different market sectors

How to open a brokerage account and place your first trades

Fundamental analysis: reading financial statements and news

Technical analysis: chart patterns, trends, and indicators

Time-tested strategies for beginners and experienced traders

Essential risk management techniques to protect your capital

Trading psychology: mastering emotions and staying disciplined

Real-world examples, practice exercises, and actionable tips

Who Is This PDF For?

New investors looking to enter the world of stock trading

Current traders wanting to refine their approach and strategy

Anyone seeking to build wealth through the stock market

Why Choose FinanceWorld.io?

Our expert-written guides strip away the jargon and focus on practical, real-world trading skills. With FinanceWorld.io, you gain clarity, confidence, and a proven roadmap to succeed in the markets.The Economics of Dravidian Model- Equity and Social Justice

The Economics of Dravidian Model- Equity and Social JusticeCentre for Social Initiative and Management

?

This is a presentation on The Economics of Dravidian Model. It provides information on how this model has helped people of Tamil Nadu to achieve greater GDP Growth, better social justice and equity. How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...Ratiobox Limited

?

Zenko Properties, a dynamic and fast-growing real estate agency based in the UK, faced mounting operational challenges as its portfolio and client base expanded. Managing financial workflows across multiple property types, client accounts, and compliance requirements had become increasingly complex. Manual bookkeeping, fragmented systems, and limited in-house financial oversight were slowing down growth and exposing the company to potential compliance risks.

Recognising the need for a scalable, technology-driven solution, Zenko Properties partnered with Ratiobox to transform its financial operations. This case study explores how Ratiobox enabled Zenko to achieve greater operational efficiency, compliance assurance, and real-time financial clarity ¡ª all without the burden of maintaining a full in-house finance team.

Through a tailored combination of outsourced accounting services, automated bookkeeping, and integrated reporting tools, Ratiobox provided Zenko Properties with an end-to-end financial management solution. Our team began by conducting a deep-dive assessment of Zenko¡¯s legacy accounting practices, identifying critical inefficiencies and opportunities for automation. We then implemented a streamlined accounting framework using cloud-based platforms such as Xero, integrated with Zenko¡¯s CRM and property management systems.

Key improvements included:

Automated transaction processing, eliminating manual errors and reducing month-end closing time by over 50%.

Real-time financial dashboards, giving directors clear visibility into cash flow, revenue streams, and liabilities.

Fully managed payroll and HMRC submissions, ensuring Zenko stayed compliant and up to date with the latest tax regulations.

Scalable support for property acquisitions, enabling the finance function to grow in lockstep with Zenko¡¯s portfolio.

Beyond day-to-day accounting, Ratiobox also delivered strategic insights through periodic reporting and advisory input, helping Zenko's leadership make data-backed decisions on expansion, cost control, and investment timing.

As a result, Zenko Properties not only improved operational efficiency but also gained a future-proof financial infrastructure that supports long-term growth. With fewer internal resources tied up in routine tasks, the team was free to focus on delivering exceptional service to clients and exploring new market opportunities.

HUMAN BEHAVIOR cultural intelligence and global leadeership.pptx

HUMAN BEHAVIOR cultural intelligence and global leadeership.pptxzeriannebochorno

?

human behavior organizationINVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

?

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with ?50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.Issues pertaining to Penalty, Prosecution and Compounding procedures under TD...

Issues pertaining to Penalty, Prosecution and Compounding procedures under TD...imccci

?

Issues pertaining to Penalty, Prosecution and Compounding procedures under TDS/TCS regime

Business sentiment stabilized in May, but exporters¡¯ anxiety and labor shorta...

Business sentiment stabilized in May, but exporters¡¯ anxiety and labor shorta...?§ß§ã§ä§Ú§ä§å§ä §Ö§Ü§à§ß§à§Ş?§é§ß§Ú§ç §Õ§à§ã§İ?§Õ§Ø§Ö§ß§î §ä§Ñ §á§à§İ?§ä§Ú§é§ß§Ú§ç §Ü§à§ß§ã§å§İ§î§ä§Ñ§è?§Û

?

Key points:

? The highest uncertainty in the 3-month perspective was recorded among exporters, 20.7%

? The share of enterprises planning to scale down operations over a 2-year horizon rose to 5%, but 95% do not expect a decline or foresee growth

? Labor shortages remain the main obstacle ¡ª 63% of businesses noted this issue

? The second most common obstacles were safety risks and rising prices

? Power outages remain a relatively minor issue ¡ª only 7% mentioned it

Most key indicators of business sentiment remained stable in May. The Business Activity Recovery Index remained unchanged from April at 0.13. The aggregated indicator of industrial prospects, which reflects short-term expectations, slightly declined to 0.11 from 0.12 in March¨CApril.

These are the findings of the 37th monthly survey conducted by the IER among 474 industrial enterprises.

Uncertainty in the three-month outlook remained unchanged primarily for key production indicators.

¡°However, we recorded the highest level of three-month uncertainty among exporters. Every fifth exporter ¡ª 20.7% ¡ª currently does not know what their export dynamics will be over the next 3¨C4 months,¡± said IER Executive Director Oksana Kuziakiv.

Uncertainty decreased over longer horizons ¡ª 6-month and 2-year periods. Currently, only 28.7% of respondents find it difficult to predict their activities two years in advance. This is the lowest share since at least October 2022, when 42.3% of businesses reported uncertainty.

¡°In May, the share of those planning to reduce their enterprise¡¯s activity over two years increased to 5%. This is still a small number, though higher than April¡¯s 1.4%. Nearly 80% don¡¯t foresee major changes. In fact, 95% of respondents indicate that they will either remain unchanged or experience slight growth. Considering the instability, security, and economic challenges Ukraine faces, this is a very good result,¡± said Oksana Kuziakiv.

The share of enterprises that increased production in May fell from 26.2% to 19.5%, while the share of those that reduced output grew from 10% to 13.5%. The share of businesses planning to increase production in the next 3¨C4 months slightly declined, from 40.8% to 39.9%.

The total share of enterprises operating at full or near-full production capacity slightly increased in May, from 62% to 63%.

¡°In January this year, the share of those operating at over 75% of capacity rose significantly. Since then, it has remained relatively unchanged. For example, in May, 53% of companies were in this category,¡± noted Oksana Kuziakiv.

Expectations for new orders remain cautious: the share of companies with order portfolios longer than a year slightly decreased, from 16% to 15%. On average, the duration of new orders increased from 4.9 to 5 months.

¡°This happened because the share of those with orders for just one to two months declined from 33% to 24%. Likely, these orders were redistributed: some now work ¡®on the fly,¡¯ others shifted into the three-to-five month category,Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Discover why thriving restaurants outsource accounting: navigate compliance, manage diverse revenue from platforms, and master financial strategies for success.

https://www.pacificabs.com/knowledge-center/blog/restaurant-accounting-services-why-owners-never-touch-their-books/C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...imccci

?

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 2025-26

The Ultimate Guide to Buy Verified LinkedIn Accounts.docx

The Ultimate Guide to Buy Verified LinkedIn Accounts.docxBuy Verified Linkedin Accounts

?

Now, We providing verified LinkedIn accounts designed for businesses and professionals aiming to enhance their online presence and networking capabilities. These accounts are fully verified, secure, and perfect for marketing, recruitment, or expanding your professional network. The Economics of Dravidian Model- Equity and Social Justice

The Economics of Dravidian Model- Equity and Social JusticeCentre for Social Initiative and Management

?

Business sentiment stabilized in May, but exporters¡¯ anxiety and labor shorta...

Business sentiment stabilized in May, but exporters¡¯ anxiety and labor shorta...?§ß§ã§ä§Ú§ä§å§ä §Ö§Ü§à§ß§à§Ş?§é§ß§Ú§ç §Õ§à§ã§İ?§Õ§Ø§Ö§ß§î §ä§Ñ §á§à§İ?§ä§Ú§é§ß§Ú§ç §Ü§à§ß§ã§å§İ§î§ä§Ñ§è?§Û

?

Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Ad

Ratio analysis of rani ltd

- 1. RATIO ANALYSIS OF RANI LTD. Prepared For : BOD (Raja Ltd) Prepared By : Management Accountant

- 2. STRUCTURE ? Background ? Profitability of the company ? Liquidity position ? Efficiency indicators ? Investment perspective ? Trends of ratios & percentages ? Suggestions ? Conclusion ? Questions & Answers

- 3. BACKGROUND ? Current economic situation ? Nature & type of company ? Data limitations

- 4. PROFITABILITY OF RANI LTD ? Increase in sales ? Increase in cost of sales ? Falling net profit margin 25000 20000 15000 10000 5000 0 2012 2011 2010 Sales 20440 19467 18540 Cost Of Sales 12247 10650 10753 Net Profit 2132 2650 2578

- 5. LIQUIDITY POSITION ? Increase in current ratio ? Quick ratio at alarming rate ? Mismanagement of working capital 2 1.5 1 0.5 0 2012 2011 2010 Current Ratio 1.43 1.21 1.26 Quick Ratio 0.64 0.56 0.57

- 6. EFFICIENCY INDICATORS ? Receivable collection period ? Huge amount of inventory ? Increase in operating cycle 160 140 120 100 80 60 40 20 0 2012 2011 2010 Operating Cycle 138 100 90 Inventory Turnover 100 77 84 ReceivableTurnover 49 35 14

- 7. INVESTMENT PERSPECTIVE ? Earning per share ? Dividend per share

- 8. TRENDS OF RATIOS ? Current Ratio ? Net Profit Margin ? Quick Ratio ? Gross Profit ? Working Capital ? Return on Assets ? Receivable Turnover ? ROCE ? Inventory Turnover ? ROSE ? Operating Cycles ? EPS ? Sales ? Cost of Sales ? Dividend Per Share

- 9. CONCLUSION ? Unsecure financial position ? Deteriorating results ? Acute working capital management problem ? Overtrading ? Declining Profits ? Increasing Cash conversion cycle

- 10. SUGGESTION ? Comparison with other companies ? Improving the average collection period for trade debtors ? Improving the Inventory turnover ? Avoiding unnecessary overtrading ? Working capital management policy ? Acquisition of synergies

- 11. THANK YOU